A-level Economics Theme 2

1/117

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

118 Terms

Macroeconomics

The study of the economy as a whole, including inflation, growth and unemployment.

What is meant by GDP?

The output of an economy

Quantity/value of all goods/services produced in an economy in a 1 year period.

What is the difference between the expenditure and income approach when measuring GDP?

Expenditure: adds up value of all expenditure in economy

Income: adds up rewards for FOP used e.g wages from labour, rent from land etc

What is nominal GDP?

Actual value of all goods/services produced in an economy in a 1 year period NOT adjusted for inflation

What is real GDP?

Value of all goods/services produced in an economy in a 1 year period and it is adjusted for inflation.

What is the concept of Purchasing power parities?

Calculates relative purchasing power of different countries.

Shows number of units of a country’s currency needed to buy a product in the local economy

Makes a more accurate standard of living comparison

Aggregate demand

The total demand for all goods/services in an economy at any given average price level.

What are the 4 components of AD?

Consumption(C) + Investment(I) + Government spending(G) + Exports-Imports(X-M).

What are the % of each component that make up AD in the UK?

Consumption: 60%, Investment: 14%, Gov spending: 25%, Net exports: 1%.

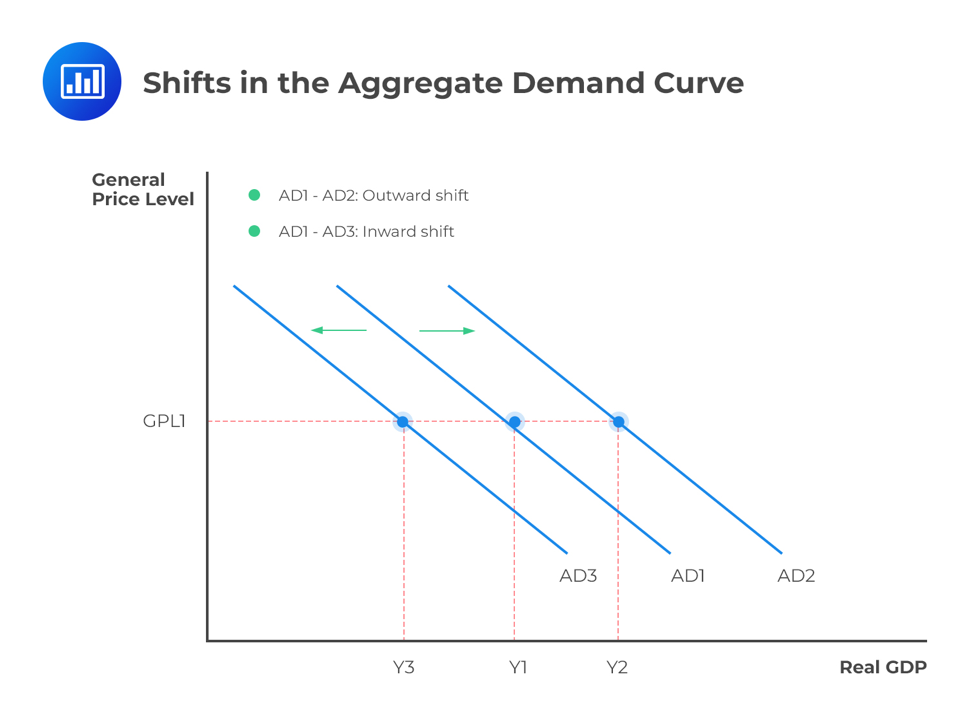

Aggregate demand curve

Shows the relationship between average price level and the total output in an economy.

What causes shifts in the AD curve?

Any changes to the components of AD.

Basic concept of consumption?

Consumption increases as disposable income does and vice versa

e.g wages, transfer payments(benefits) increase = increase in disposable income

Formula for Marginal propensity to consume?

MPC = Change in consumption/Change in income

Formula for Average propensity to consume?

APC = Consumption/Income

What are the 5 determinants of consumption?

Interest rates

Changes to consumer confidence

Changes to wealth

Composition of households

Inflation & expectancy of inflation

What is investment?

The total spending on capital goods by firms.

What are the 7 determinants of investment?

Interest rates

Rate of economic growth

Business confidence

Demand for exports

Access to credit

Influence of government & regulations

Keynes & animal spirits

What is meant by net trade balance(X-M)

Difference between the value of exports and imports (X-M)

How does UK real income affect the net trade balance?

Increase = little effect on exports but effect on imports (Trade balance weakens)

How does increase in real income abroad affect net trade?

Increase = effect on exports but little effect on imports (Trade balance strengthens)

How does appreciation/depreciation of UK £ affect net trade?

Appreciation = exports decrease but imports increase (Trade balance weakens)

Depreciation = exports increase but imports decrease (Trade balance strengthens)

How does protectionism affect the net trade balance?

Decrease = imports likely to rise and exports to increase (Trade balance weakens)

Increase = decreased demand for imports

What is inflation?

It is the sustained increase in the average price level of goods/services

APL measured checking prices of a basket of goods/services that an average household will pruchase each month(CPI)

The UK has an inflation target rate of 2% per annum

What is deflation?

Occurs when there is a fall in the average price level of goods/services in an econ

Only occurs when the % change in prices falls below 0%

What is disinflation?

Occurs when the average price level is still rising but at a lower rate than before e.g Y1 = 5%, Y2 = 4%

How is the inflation rate measured?

Calculated using an index with 100 as the base year

If the index is 100 in year 1 and 107 in year 2 then the inflation rate is 7%

Formula for CPI?

Cost of basket in year X/Cost of basket in base year x 100

The percentage diff in CPI between the 2 years is the inflation rate for that period. new-old/old x 100

What and how is the Retail price index calculated?

Same way as CPI but there are goods excluded from CPI that are in RPI e.g council tax, mortgage

What are the 4 causes of inflation?

Demand pull, cost push, increase in money supply and an increase in wages.

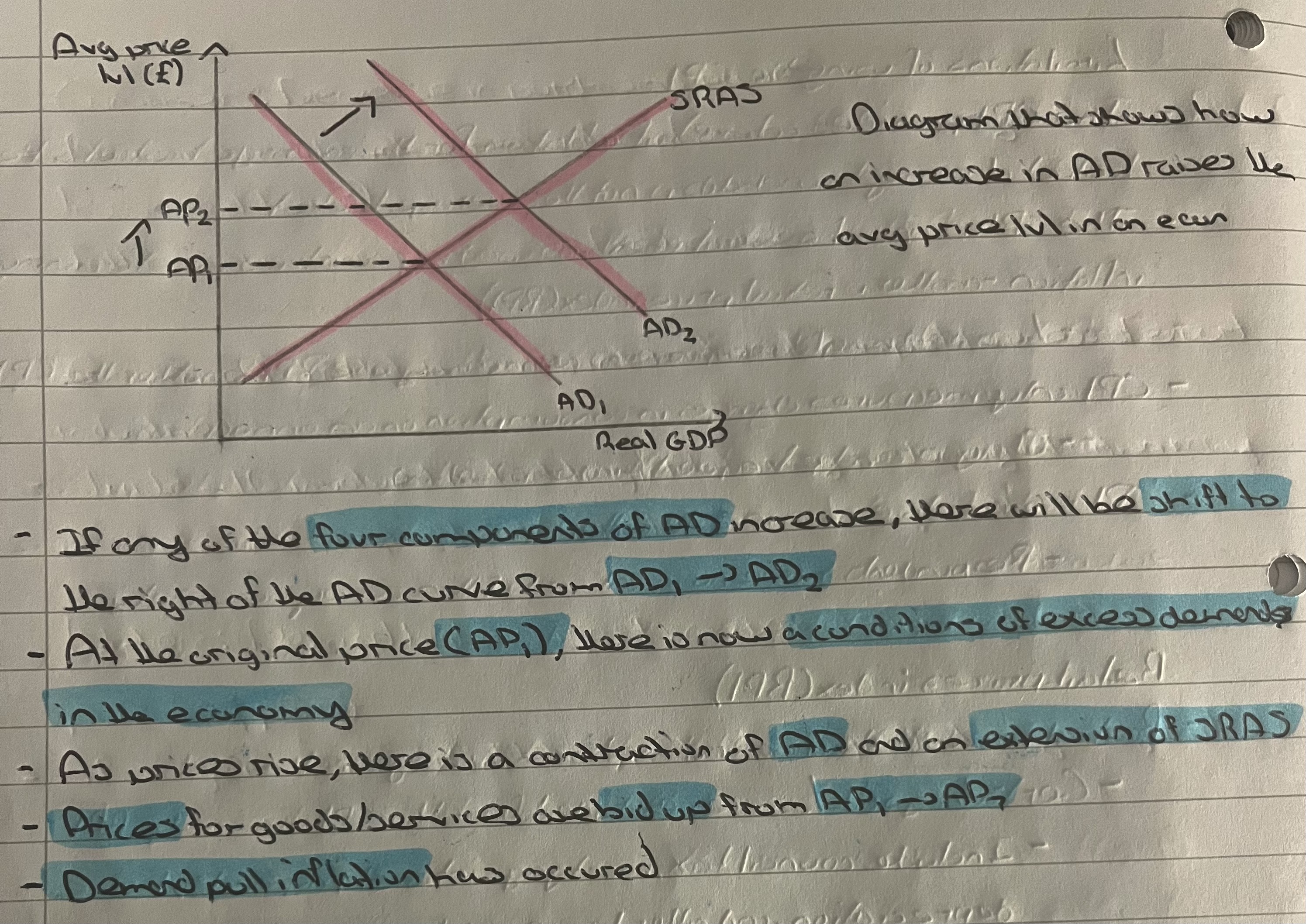

What is demand pull inflation?

Price rises caused by excess demand in the economy.

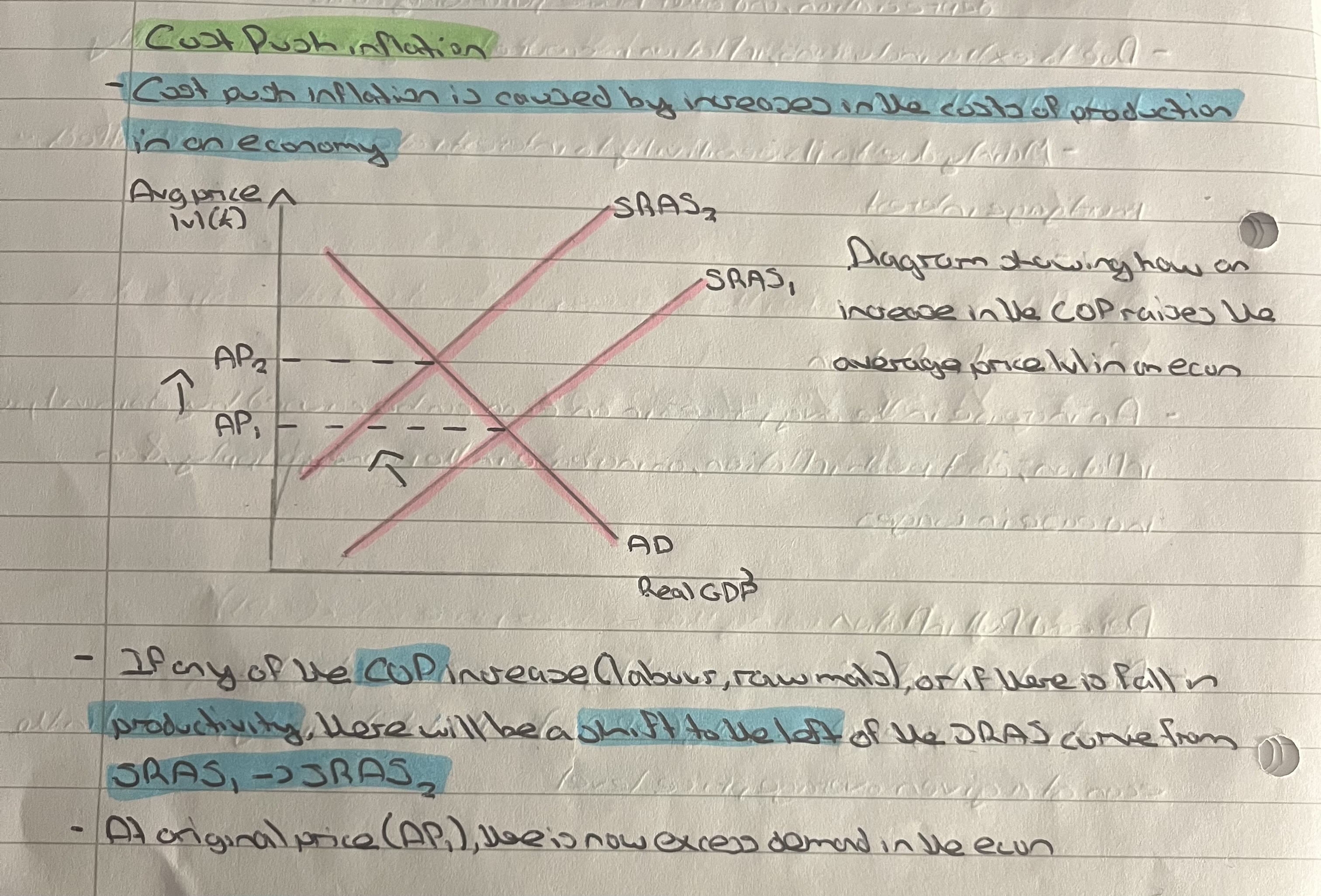

What is cost push inflation?

Price rises due to increases in COP in an economy.

What are changes to money supply?

If bank lowers interest rate = more borrowing by consumers and firms = increased consumption = demand pull inflation

What is meant by changes to wages?

Increased AD = demand pull inflation = workers now feel less well off as wages no longer have strong purchasing power = demand wage increases to compensate for higher prices = wage increases form of cost push inflation (rise in COP) = leads to even higher prices

What is unemployment?

Someone not working but actively seeking work

Who makes up the labour force?

Those actively working and the unemployed, usually between ages 16-65.

Who makes up the non labour force?

Those not actively seeking work e.g stay at home parents, pensioners, school children

What is meant when someone is “underemployed”?

They want to work more hours than they currently do.

Working in a job that requires lower skills than they have.

Often a result of cyclical/structural unemployment.

What is meant by economically inactive?

Those between 16-65 and not working/seeking work

Causes/types of unemployment

Structural unemployment

Cyclical/demand deficient unemployment

Seasonal unemployment

Frictional unemployment

Real wage unemployment

What is meant by structural unemployment?

Occurs when there is a mismatch between jobs & skills in an econ

What is meant by cyclical/demand deficient unemployment?

During e.g recession, fall in demand resukts in less need for labour and thus, less jobs

What is meant by balance of payments?

Countrys record of all financial transactions that occur between it and rest of world

What is a current account deficit?

Value of outflows greater than value of inflows

e.g imports > exports

What is the effect of a current account deficit?

A lack of exports harms AD as it is component but could raise tarrfis

Thus, firms who rely on imports = high cop = higher cost and passed onto consumer in form of higher price

comes at expense of inflation

Aggregate supply

Quantity of goods/services that producers in an economy are willing and able to supply at a given level of prices at a given time

Short-run aggregate supply curve

Influenced by changes in COP or productivity

Long-run aggregate supply curve

Influenced by a change in the productive capacity of the economy

Changed by changes to the quantity/quality of the FOP

Supply-side shocks

Factors such as changes in wage rates or commodity prices which cause the short run aggregate supply curve to shift.

What factors influence SRAS?

Change in cost of raw mats

Business taxes, subsidies, regulations

Supply shocks

Changes in exchange rates

Changes in tax rates

Explain changes in cost of raw mats

As price of input costs rise, fewer goods/services can be produced w same amount of money and vice versa

Explain changs in exchange rates

Appreciation: Firms who buy from abroad can import more at cheaper price = lower COP

Depreciation: Firms who buy from abroad face higher import costs = high COP = less output

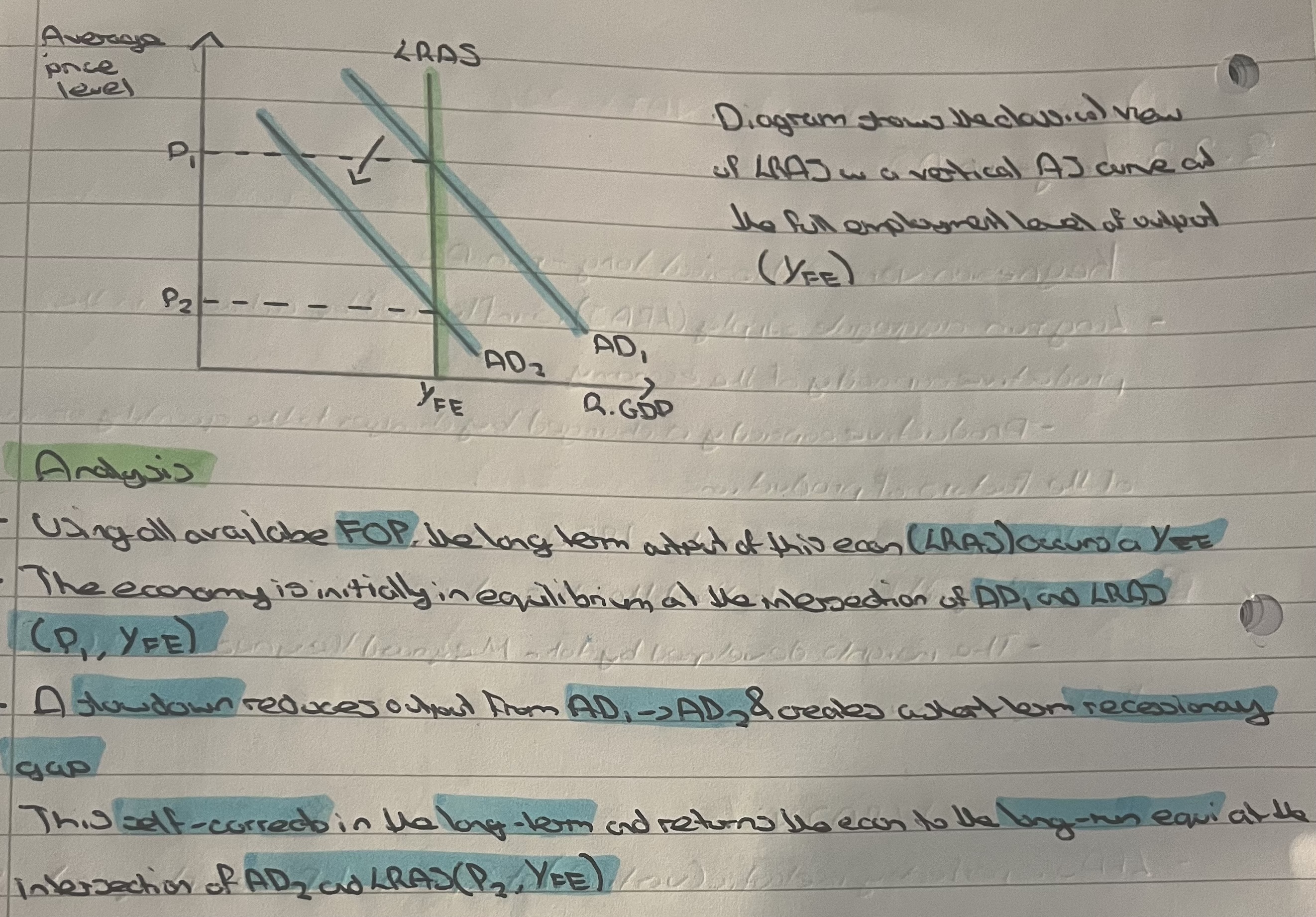

What is the classical LRAS view?

LRAS is inelastic at a point of ful employment of all available resources

View believes that in long run, economy will always return to this full employment lvl of output

What is the keynesian LRAS view?

Curve is more L shaped

Supply is elastic at lower levels of output due to spare production capacity

Supply is inelastic at a point of full employment (Yfe) of all available resources.

What factors influence LRAS?

Technological advances

Changes in relative productivity

Changes in education & skills, increases quality of labour

Changes in government regulations

Demographic changes and migration

Competition policy

Circular flow of income

Economic model that illustrates money flows in an economy

Role of households

Households own the wealth in the economy (these are the FOP)

Households receive rent for land, wages for labour, interest for capital and profit for enterprise

With this income, they buy goods/services from firms

Role of firms

Firms purchase FOP from households

They use these resources to produce goods/services

They sell the goods/services to households & receive sales revenue

What is meant by national income

Value of the output of an economy over a period of time

Injections

Injections add money into the circular flow of income & increase its size.

Increased gov spending

Increased investment

Increased exports

Withdrawals or leakages

Money removed from the circular of income & reduce its size

Increased imports

Increased saving

Increased taxation by the gov

What is the impact of injections > withdrawals

Economic growth

What is the concept of the multiplier effect?

One individuals spending is another persons income.

Name an example of the multiplier process?

Consumer confidence increase has led to more spending

Thus, higher consumption

This shifts AD1 outwards to form AD2

Businesses receive more revenue/profit from increased consumer spending

Thus, will REINVEST into business e.g. capital goods

Investment will cause SECONDARY shift outwards from AD2 TO AD3

Same applies to negative multiplier effect

Marginal propensity to import (MPM)

Proportion of additional income that is spent on imports

MPM = % change in imports/% change in income

Marginal propensity to save (MPS)

Proportion of additional income that is saved

MPS = % change in savings/% change in income

Marginal propensity to tax (MPT)

Proportion of additional income that goes towards tax

MPT = % change in tax/% change in income

Marginal propensity to consume (MPC)

Proportion of additional income that is spent

MPC = % change in consumption/% change in income

Marginal propensity to withdraw (MPW)

The increase in withdrawals from the circular flow (S + T + M) divided by the increase in income that caused them (i.e. change in W / change in Y); this is the same as the sum of the marginal propensity to save, tax and import (MPS + MPT + MPM).

Significance of the multiplier in shifting AD

Greater withdrawals = smaller value of the multiplier and vice versa

Any factor that affects disposable income will change MPC and thus, the multiplier

E.g. increase in taxes/interest rates, lower multiplier

E.g. consumer confidence increase = MPC increase and thus, greater multiplier

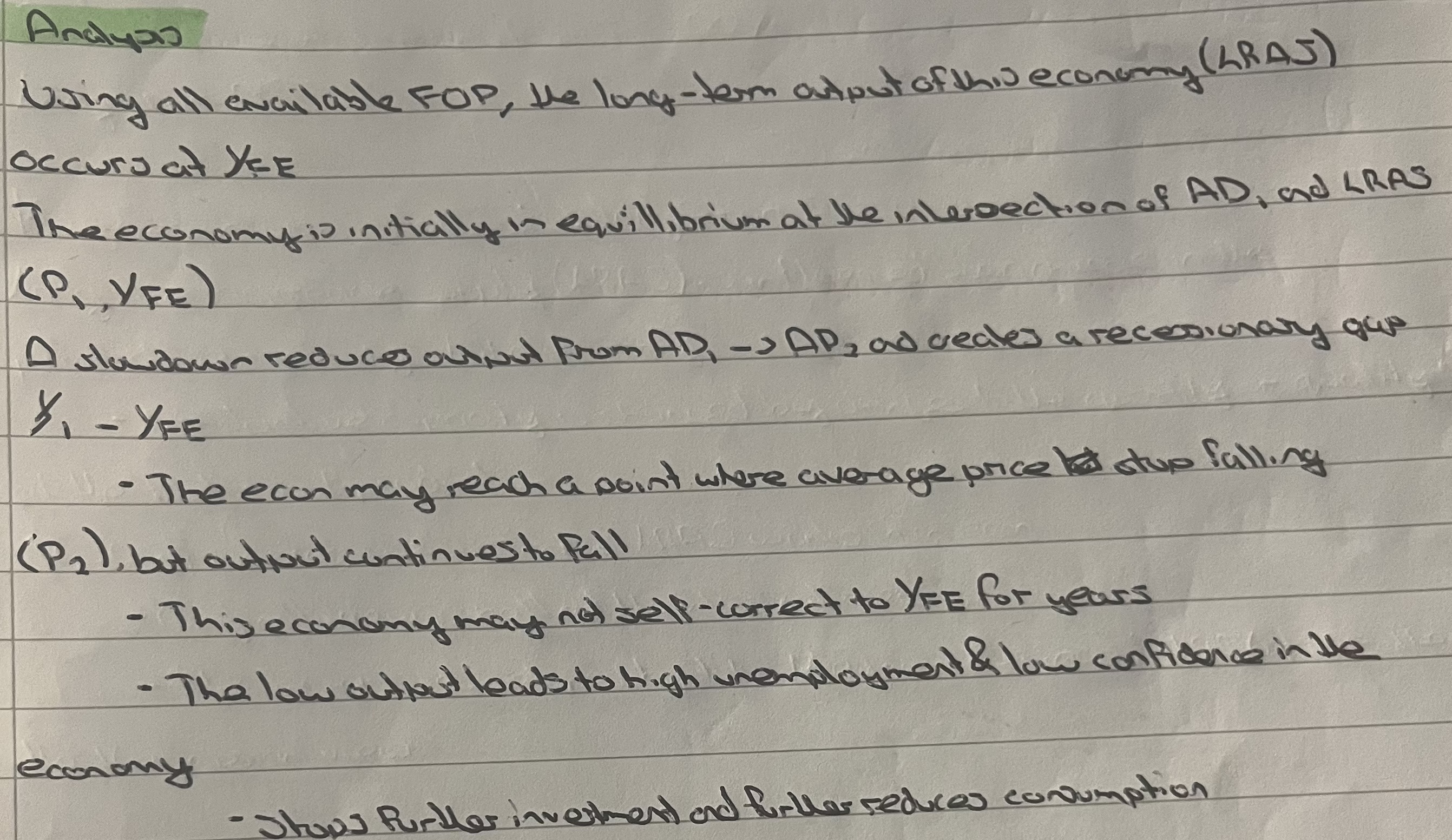

What is meant by short run economic growth?

Changes to any of the components of AD will cause short term econ growth

Shown by outward shift in AD

Shown by moving from a point inside PPF closer to curve

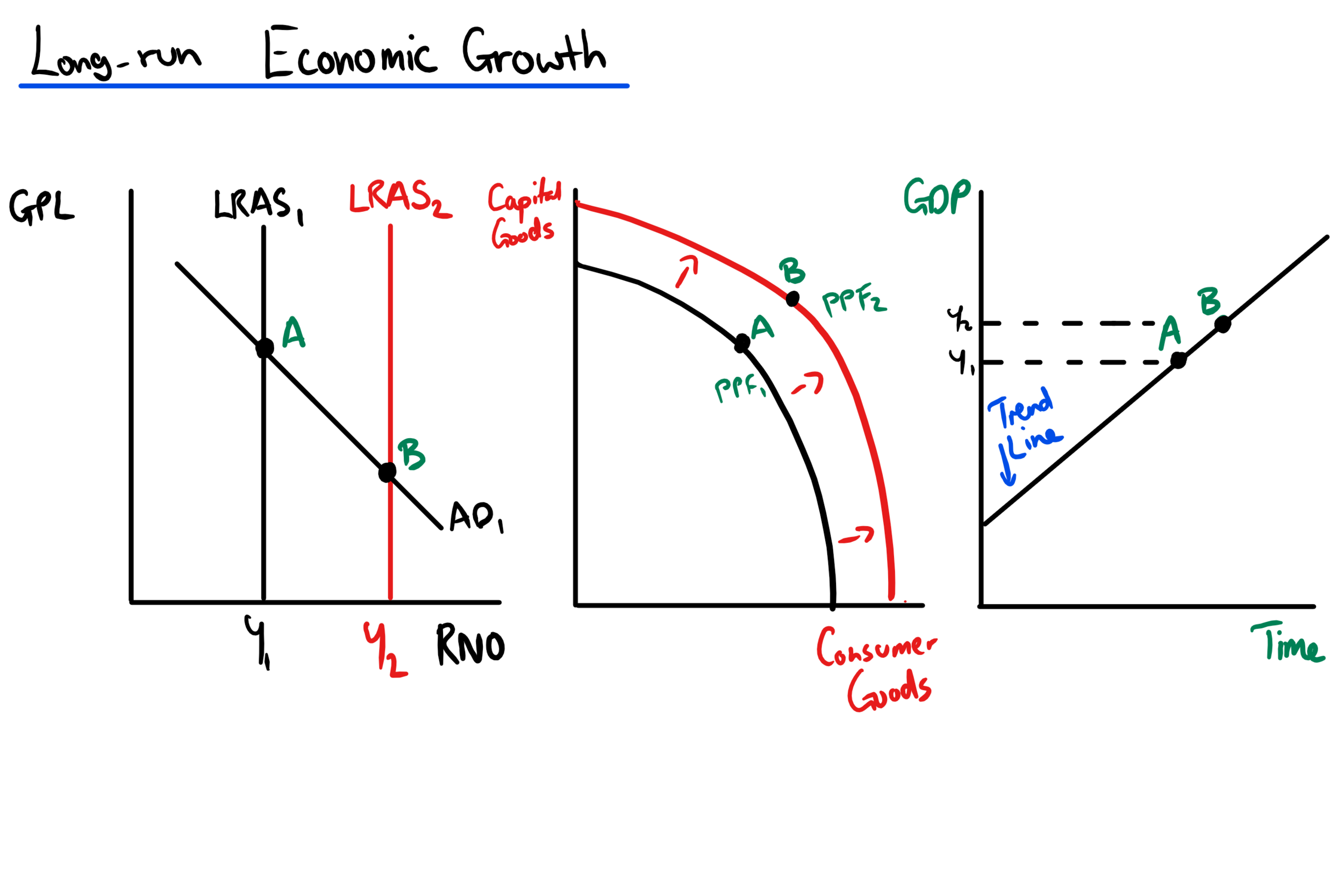

What is meant by long run economic growth?

Caused by any improvements to quality/quantity of the FOP

Factors include determinants of LRAS

Actual growth?

Occurs when there is an increase in the quantity of goods/services produced in an economy in a given time period

Potential growth?

Is the increase in the productive potential of an economy shown by outward shift of PPF or LRAS

What are the 4 recognisable points in a trade cycle

Peak/Boom

Slowdown/downturn

Recession

Recovery

Characteristics of a recession

Defined as two consecutive quarters or more of negative econ growth

High unemployment

Spare production capacity

Low confidence for firms/households

Low inflation

Increased government expenditure

Characteristics of a boom

Decreasing unemployment and increasing job vacancies

Spare capacity reduced

High confidence in firms/households

Demand pull inflation

Improvement in gov budget as tax rev rises and expenditure falls

Benefits of econ growth

Increased incomes = better standard of living

Higher sales revenue

Increased investment increases potential output

Reduced expenditure by gov and higher tax rev due to income and business tax

Increased employment

Cons of economic growth

Rising AD = demand pull inflation = less purchasing power

Lack of equity e.g. rich get richer and poor get poorer

Increased inflation can harm export sales

Increased income = consumption of demerit goods

Increased price level = higher wages demanded = COP

What are the 7 macroeconomic objectives?

Economic growth

Low & stable rate of inflation

Low unemployment

Balanced government budget

Environmental sustainability

Balance of payments equilibrium on current account

Greater income equality

Economic growth

UK/nations have an annual rate of 2-3%

Low unemployment

Target rate for the UK is 4-5%

Low & stable rate of inflation

UK has target inflation rate of 2% using CPI

Demand side policies ease demand pull inflation

Supply side policies ease cost push inflation

Balance of payments

Aim to run at a small current account deficit

Balanced gov budget

UK aims to run at a balanced budget

If expenditure > revenue there is budget deficit

Has to be financed through public sector borrowing which adds to public sector debt

May have to raise taxes in long run

Reducing deficit can be bad

Cutting public sector pay, raising taxes, reduced spending on public & merit goods, reducing unemployment benefits

Environmental protection

Aim to reduce emissions by 72% by 2035

Reduce negative externalities of production

Causes of fiscal budget deficit

Recession causing unemployment

Decrease consumer spending & profits meaning less tax

Increase in welfare benefits

Increase in interest rate affecting public sector debt

Justification for budget deficit

Rise in borrowing to fund extra gov spending can boost AD

Demand side policy

Shift AD

What is fiscal policy?

Use of gov spending and taxation to influence AD

What is monetary policy?

Use of interest rates & money supply to influence AD - Bank of England sets

Adjustments to interest(not more than 0.25%)

Quantitative easing(increase supply of money in econ)

Exchange rates

Budget deficit

Expenditure > revenue

Budget surplus

Revenue > expenditure

What are direct taxes

Taxes imposed on income and profit

e.g. income tax, corporation tax, national insurance

What are indirect taxes

Imposed on spending

What is meant by expansionary demand side policies

Demand side policies that aim to shift AD outwards

e.g. expansionary fiscal/monetary policy

Examples of expansionary demand side policies?

Reducing taxes, increasing gov spending, decreasing interest rates

What is meant by contractionary demand side policies

Demand side policies that aim to shift AD inwards

e.g. Contractionary fiscal/monetary policies

Examples of contractionary demand side policies?

Increasing taxation, Reducing gov spending, Increasing interest rates

Strength and weakness of fiscal policy

S: Short time lag, increased consumption of merit/public good

W: Increased gov spending = budget deficit = debt for future = austerity, Conflicts between objectives e.g. cutting taxes = inflation

Strength and weakness of monetary policy

S: Considers long term, Targets inflation

W: Time lags of up to 2 years, conflicting objectives