4.1 Perfect Competition

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

Perfect competition

A form of market structure that produces allocative and productive efficiency in long-run equilibrium

Allocative efficiency

Achieved when p=mc

Productive efficiency

Achieved when quantity produced/sold is such that the average total cost is minimised (lowest point on LRAC curve)

P = AC (normal profit)

Features of perfect competition

Many sellers (all firms are price takers - take the price as given)

Product is very homogenous (all very similar/nearly identical/perfect substitutes)

No barriers to entering/exiting the market (Whenever there is profit to be made, in the long run new firms can enter the market)

Perfect information (Consumers know the prices that all firms are charging and can easily find the lowest possible price to buy from the cheapest supplier)

The minimum efficient scale is very small

Firms produce at profit maximising quantity (MR = MC)

Typical industries: Agriculture/Forestry/Fishery Hotels/Restaurants

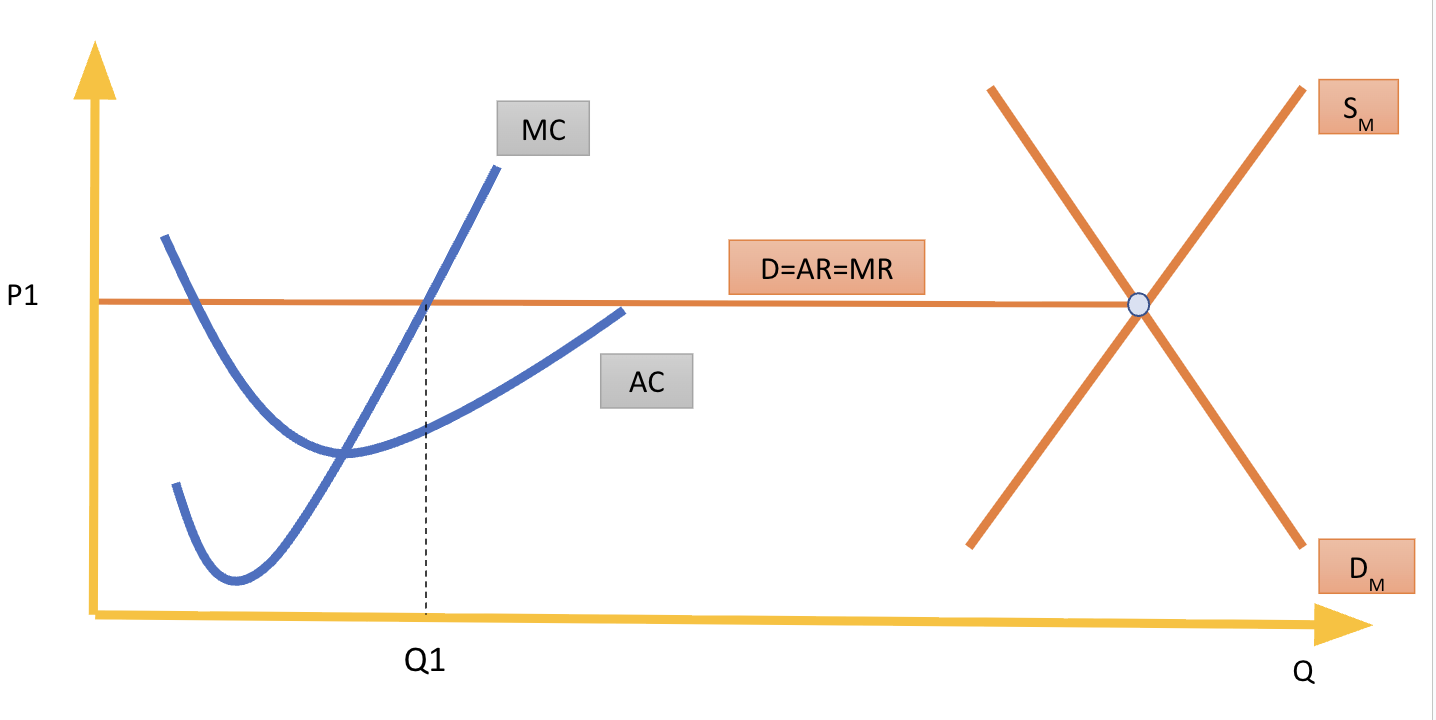

Perfect Competition in the short-run

Each individual firm is a price taker in a perfectly competitive market

“Price taker” means that each firm faces an infinitely elastic demand curve

Because the Demand faced by each individual firm is horizontal D = MR, D is also = AR (as with any demand curve)

With horizontal demand MR = P, max profit condition becomes MR = P = MC

Not productively efficient as there can be supernormal/sub-normal profits

Achieves allocative efficiency as P = MC

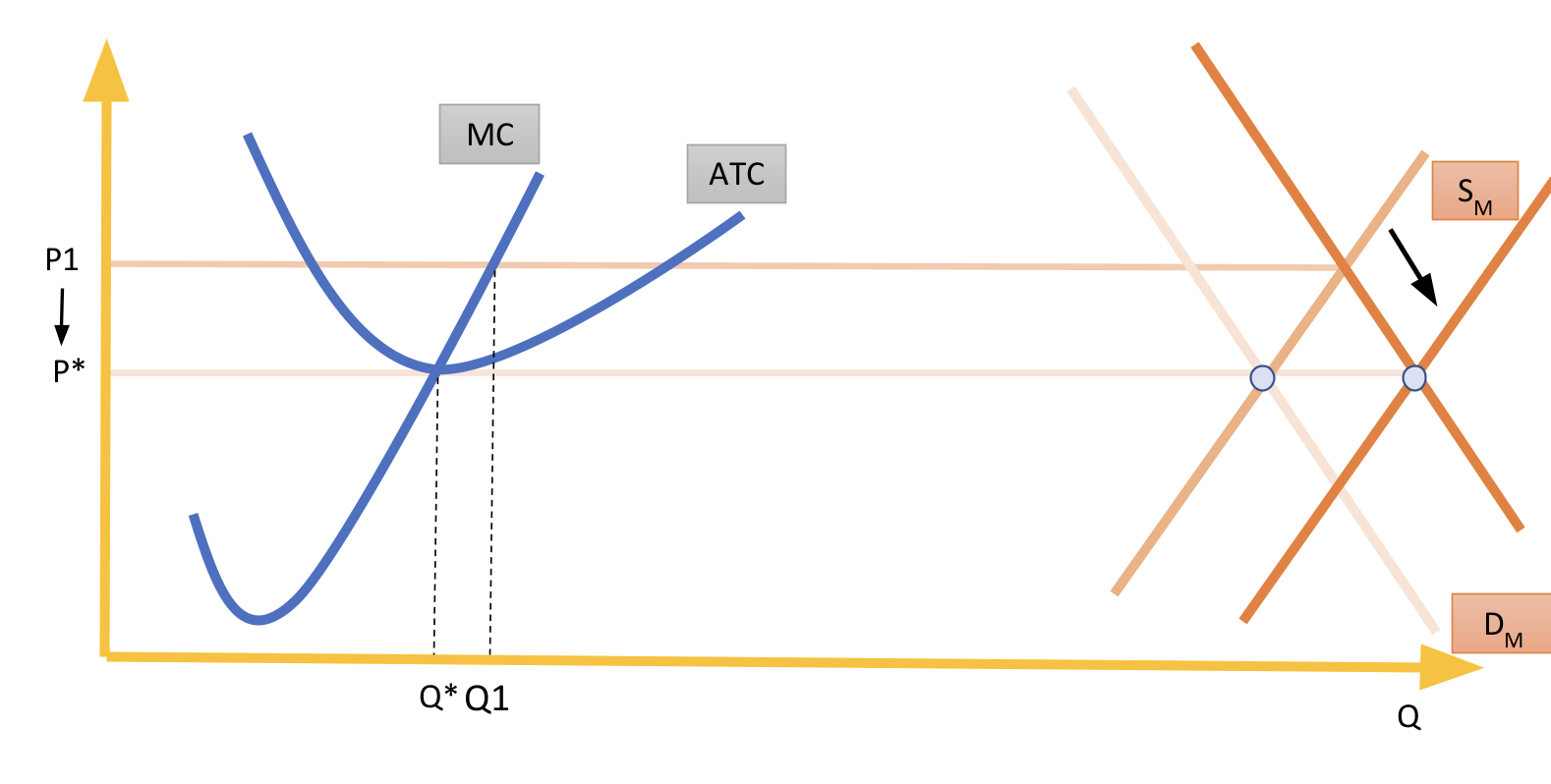

Profits/Losses in the long run

Profits will attract new firms in the market so SM (market supply) will increase

Losses will drive firms out of the market so SM will decrease

When does SM stop shifting rightward

When Super-Normal Profits are equal to 0 (as zero supernormal profits will stop attracting firms to enter the market)

This is also when MC = AC = P (P = AC is only possible in the long run)

Perfect Competition in the long-run

Allocative efficiency achieved as P = MC

Productive efficiency achieved as P = AC

New firms enter the market, the industry expands, the market price falls until supernormal profits become 0. This brings the price back to P*

Dynamic efficiency when there is perfect competition

Not achieved in competitive markets

This is because firms operate in a very competitive market with low profit margins (normal profits) just sufficient to recover explicit costs and opportunity costs.

In order to achieve dynamic efficiency, firms need to either make supernormal profits or be able to access additional resources

In order to innovate, firms should invest profits in research and development to increase future efficiency