the financial sector chap 37-39

1/112

Earn XP

Description and Tags

money and interest rates, the financial sector, the central bank and financial regulation

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

113 Terms

money

any item or medium of exchange that is widely accepted as payment for goods and services and debts

what are the four roles of money

medium of exchange, store of value, unit of account, standard of deferred payment

explain money as a medium of exchange

money can be used in transactions

explain money as a store of value

money is an asset that retains value for future transactions

explain money as a unit of account

goods and services can be placed a value determined by money

explain money as a standard of deffered payment

debts can be payed in the future due to the financial value placed upon them

what are some qualities of money

must be portable, divisible, acceptable, scarce, durable and have stability in its value

money supply

quantity of money in circulation within an economy

what process controls the money supply, what are the two types

monetary policy, expansionary and deflationary

what does expansionary monetary policy aim to do

aims to reduce the levels of the real interest rate, expands the banking systems, depreciates the exchange rate

what does deflationary monetary policy aim to do

increases interest rates on loans and savings, tightens the credit supply and makes getting loans more difficult, appreciation of the exchange rate

barter system

process of market transactions when money is not in place, where people trade goods rather than using money

double coincidence of wants

issue within the barter system, transactions can only take place when both parties want the opposites good

who issues all physical cash within an economy

its central bank

liquidity

the ease of converting an asset in the short term and the owner not incurring any costs

what do different forms of assets vary in

liquidity

what are the most liquid forms of financial worth

bank notes and coins

near money

assets that are close to being money and are not cash eg savings accounts, certificates of deposits

commodity money

money that always physically has intrinsic value such as gold coins

fiat money

government issues currency that is not commodity backed and can erode in value such as bank notes

what is the symbol for narrow money and what is it

M0, measure of the money supply that includes the most liquid assets which are notes, coins and bank deposits

what is the symbol for broad money and what is it

M4, broad money which is narrow money and near money assets that can be accessed within a five year period such as bonds, retail deposits, arguably the most inclusive definition of money

credit creation

process whereby banks can influence the money supply through giving out loans and taking deposits

how does the cycle of credit creation take place

people put deposits into banks, banks reserve an amount as liquid cash (usually 10%) and loan the rest out as credit, loans create expenditure and the money goes back into the banking system

how does the credit creation cycle result in the credit multiplier

increase in the amount of credit in the economy fuels expenditure which means more money circulating the economy and then more deposits which increases the amount of credit a bank can load out and therefore the credit multiplier

what is the value of the credit multiplier

1 / the cash ratio banks decide to hold as a decimal ie a liquid reserve of 25% sees a credit multiplier of 4 (1/0.25)

what is the general view that classical economist hold about the money supply and the price level

there is a closer relationship between the money supply and the general price level, price will only increase with more money in the supply

what does the fisher equation outline

the relationship between the money supply, velocity of circulation, general price level and real income

velocity of circulation

speed at which money changes hands, calculated through volume of transactions over the money supply

how is the volume of transactions calculated

real income x general price level

what is the fisher equation

MV=PY (money supply x velocity of circulation = price level x income)

what figures in the fisher equation represent the nominal gdp value

either MV or PY

explain the use of the fisher equation in terms of aggregate demand and aggregate supply

as the money supply increases, households have more disposable income so spend more which shifts AD out, households have more income to save so will force interest rates down and further force AD out, neoclassical LRAS has vertical supply so equilibrium regaining forces an increase in price (inflation)

represent the effect of the fisher equation on the neoclassical lras diagram

upwards shift of ad on a constant real gdp of yf

how do you calculate the real interest rate and what is it

interest that accounts for inflation, nominal interest rate - inflation rate

what is the general assumptions when using the fisher equation

the velocity of circulation is constant and real output tends to the natural rate

how do neo-classical economists evaluate the fisher equation

say that there is a close relationship between demand stability and the velocity of circulation and that the economy quickly goes to equilibrium so the fisher equation is true

how do Keynesian economists evaluate the fisher equation

say that there is no close or valid relationship between the demand for money and circulation, economy doesn’t easily return to equilibrium so fisher equation doesn’t really work

what is a general evaluation of the use of the fisher equation

difficult to identify the size of the money supply so its hard to see relationships and connections with other variables

what are there three main motives for holding money as stated by keynes

transactional demand for money, pre-cautionary demand for money, speculative demand for money

explain the transactional demand for money and its relevance to interest rates

people choose to hold money to spend it, amount is determined by income level, not much relevancy according to interest rates as income is more relevant

explain the pre-cautionary demand for money and its relevance to interest rates

people want liquid assets (savings) for emergency payments or to take advantage of future spending opportunities, links to investments, interest rate plays a bigger role as people will save with a higher rate

explain the speculative demand for money and its relevance to interest rates

bond and share prices effect whether a firm will hold financial assets in cash or bonds depending on the interest rate, high rate and high return may incentivise bonds to be purchased, bonds may be sold when prices are anticipated to fall

who thought of liquidity preference

keynes

what is liquidity preference

theory developed by keynes that describes the supply and demand for money being dictated by interest rates, high rates means that people choose to hold financial assets in bonds and low rates mean people choose to hold assets in cash

how can the central bank influence interest rates according to keynes

as liquidity preference is dictated by interest rates which is dictated by money supply, increasing the money supply lowers interest rates (more liquid assets) and decreasing the money supply raises interest rates (more non-liquid assets)

why is liquidity preference important

shapes monetary policy and signals whether the central bank should increase or decrease the money supply

how is the money supply changed

the central bank can alter credit that is loaned out to citizens by reducing or increasing the amount of required reserves commercial banks must hold

what is the base rate and how does the central bank use it

general rate of interest that is set by the MPC, sets the standard for the country and commercial banks use the rate as a guide for what to offer customers both saving and loans wise

what is the market for loanable funds

the buying and selling of credit based financial products such as loans, bonds and stocks determines the equilibrium interest rate

for a firm, how can interest rates affect their interaction with the market for loanable funds

if interest rates are high it increases the firms opportunity cost when taking out a loan for investment, may choose to use past profits or finance investment in a different way

for a household, how can interest rates affect their interaction with the market for loanable funds

may choose to save more when interest rates are high and spend more when they are low

link the circular flow of income with the market for loanable funds

as households save more and spend less (leakage), banks have a larger yield of loanable funds to offer to firms for investment expenditure (injection)

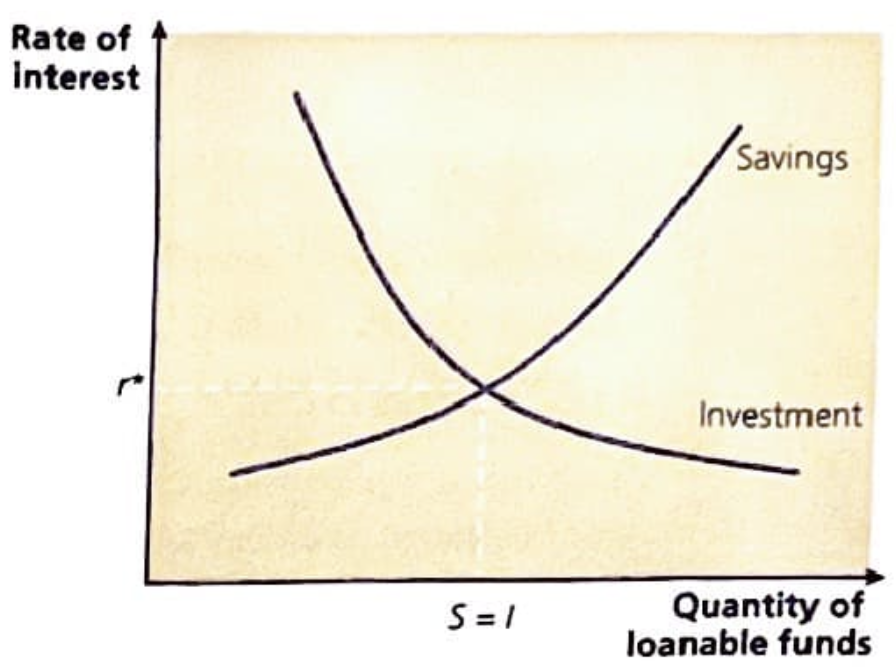

sketch the diagram for the market of loanable funds

generic supply and demand curve with savings representing the supply and investment representing the demand, interest rate sits at the equilibrium

what did keynes say about the market of loanable funds

rejected the idea that it affects interest rates because he argued interest rates are determined by the demand for money not the demand for savings and investment, ignores the fact that people may hoard cash and not all investment is interest rate driven rather by business confidence and growth

what are the five main roles of the financial sector

facilitating saving, facilitating borrowing, market of exchange of goods and services, forward markets, market for equities

what is a market for equities

market where stocks and shares can be bought and sold

what is a forward market

an agreeable contract that allows for commodities to have a stable price, setting a price for future delivery

why may the financial sector not run as smoothly in a developing economy as a developed economy

due to provision of informal markets, weak property rights, lack of a stable financial sector, asymmetric information, monopolised local finance schemes, lack of collateral

what does investment do to an ADAS diagram to show growth

cause supply to shift outwards as the production process has improved

what is the situation called when developing economies fail to stimulate investment, explain it

low level equilibrium situation where a shortage in capital leads to low per capita incomes and low savings which leads to low investment, repeating the cycle

what two processes does the potential of an economy rely on

the quantity of the factors of production available and the efficiency to which the factors of production are utilised towards production

what is the basic outline of the Harrod - Domar model

savings are crucial within an economy to boost investment

how can savings benefit an economy according to the Harrod - Domar model

more savings = more investment = more capital = more output = more revenue = more investment

why is it hard to access savings within a developing country

poor financial markets lead to a lack of savings as most of the household savings will be under the bed, loansharks are common meaning most generated income is paid back in interest, households will focus more on consumption and maintaining education and health than saving

how do developing economies face a foreign exchange gap

have to rely on imported capital as they dont have the knowledge or funds to access it themselves, therefore need foreign currency but this is in shortage due to little funds to begin with so cant access capital and face a gap

what do developing economies prioritise on importing

food, medicine etc which diminishes their ability to invest in / purchase capital

capital flight

process of FDI generated savings within a developing country being repatriated which restricts the growth and development within the developing country

how may capital flight be worse for a developing economy receiving FDI

if the FDI comes from MNCs who are more likely to repatriate their profits overseas

why are modern developing economies better off than previous economies

they have more knowledgeable strings of aid such as countries that have made mistakes in the past, they have forms of income that they can use to benefit their economy ie FDI and loans, availability of convergence with developed economies to aid development

why has convergence not occurred

developing countries cant benefit from capital provision from convergence because their human capital isn’t strong enough, need to improve education and healthcare to get an efficient working population

what is micro-finance

small scale financial loans that dont require collateral aiming to improve the economic development of an area, typically rural

why are rural areas the target for micro finance

more likely to have informal sector investment which is high in interest payments and monopolisation, small businesses have extremely low profit margins and poverty is maintained, usually low collateral as property rights are very weak

if collateral isn’t needed for micro-finance, how are loans repaid?

over time through joint liability, usually small groups based on social trust that are all responsible for repaying their loans, if they all successfully repay then they can qualify for bigger loans

what is an A02 example of the origins of micro-finance

Professor Yunus in Bangladesh launched Grameen bank which in trounced micro-finance post famine as there was an influx of low revenue small businesses in urban bangladesh, many loaners were women and loan repayment was very successful, ended up in 97% of Bangladeshi villages and significantly reduced credit exploitation from informal markets, got nobel peace prize 2006

why is the financial sector so important when it comes to economic development (eval)

means people can save money and invest into the economy (harrod-domar), eradicates the informal sector of loans, allows more money to be put into social infrastructure, benefits physical and human capital, regulation and centralisation of the financial sector reduces monopolisation

can countries develop without a stable financial sector, why

no, it underpins the whole of development whether it be through physical capital or human capital

what are the main functions of a central bank

issuing notes and coins, being a banker to the government and commercial banks, managing foreign exchange reserves, managing government borrowing, influencing interest rates and regulating financial systems

why is the central bank key in developing economies

aims to restore confidence in the banking system and set more people up with current accounts as systems are poor (sub-saharan africa 20% have accounts)

what are some additional objectives of a central bank

adhering to other government objectives, may be cultural such as bank of pakistan adhering to islamic banking where interest rates are prohibited (use of profit sharing or cost plus margins)

what functions does the uks central bank have, what is it called

bank of england, controls gov tax revenues and expenditures, issues narrow money, withholds deposits for liquidity reserves, charges banks for not adhering to practices, ranges foreign exchange and gold reserves

what is the pre 2009 banking regime that aimed to regulate the amount of liquidity within the economy

the reserves averaging regime - financial institutions would have to hold a certain amount of money every day in the central bank, penalised for funds being below and remunerated for funds being higher, aimed to maintain bank rate

what are the three main goals of the bank of England, what do these goals mean

maintaining monetary and financial stability (monetary is the price of goods and services to prevent inflation, financial is maintaining a sufficient flow of liquidity within the economy to facilitate transactions ) and being a lender of last resort (emergency loans to finance ill institutions)

how can the UKs central bank target inflation and when did this first take place

Labour 1997 brought power to the BOE to change the interest rates rather than the government so that credibility of the government is higher and rates are focused for long term efficiency rather than short term aid

what group sets the base rate and how does it work

Monetary Policy Committee- meet once a month to discuss the setting of the base rate which banks will use to set their own rates for loans and savings, also take into consideration things like unemployment and growth

what type of policy do central banks focus on

monetary policy

how can the central bank intervene in the short term to adjust interest rates and what does this help

open market operations where they buy and sell financial assets such as bonds, improves the financial stability of the economy (flow of liquidity)

what is the main form of open market operations in the UK economy

quantitative easing

what happened to the structure of the interbank market following the 2008 financial crisis

central bank moved from reserves averaging regimes to quantitative easing to buy and sell financial assets such as government bonds from commercial banks in order to improve liquidity, commercial banks were purchased from and the base rate didn’t affect the level of borrowing

how did financial regulation change following the 2008 financial crisis

realisation that old regulatory framework couldn’t keep up with changing globalised structure of the national and global financial market, changed the UKs regulation process as a result

how did globalisation contribute towards the 2008 financial crisis

development of technology and new financial assets (bonds, stocks, investments) saw institutions aiming to maximise their profits through investing in markets such as subprime mortgages, when such investments which large institutions relied on fell through, banks and companies crashed which led to recession

what regulatory bodies did the government introduce post financial crisis

the PRA, FCA, FPC

who are the PRA, what do they do and where are they based

prudential regulation authority based within the bank of england, responsible for microprudential regulation (focusing on supervising financial institutions on a firm level such as through asset valuation, capital ratios etc)

who are the FPC, what do they do and where are they based

financial policy committee based in the bank of england, responsible for macroprudential regulation (mitigating the risk of the financial system as a whole), support government policies and work with them closely

who are the FCA, what do they do and where are they based

Financial conducts authority, separate to the bank of england and regulate financial services such as financial advisers, hedge funds, broker dealers

what two groups have a secondary responsibility of supporting the governments economic policy

the MPC (monetary policy committee) and the FPC (financial policy committee)

how does the structure of financial regulation take place

the financial policy committee analyse the economy and suggest action for the financial conducts authority and prudential regulations authority to take, they either comply or suggest why the change wouldn’t be effective, FPC also define what acts and institutions need to be regulated depending on the risks associated

what two things can they financial policy committee do to mitigate the risks of a financial institution

counter cyclical capital buffers (financial institutions having a minimum amount of liquid capital to fall back on) and sectoral capital requirements (additional capital that firms require to fall back on if identified as high risk)

what does globalisation of financial institutions also require

global regulation

evaluate the 2008 financial crisis and its outcomes such as quantitative easing and improved regulation

caused high levels of public debt due to bailing out banks, showed importance of financial stability regardless of interest rates and inflation targets, poor regulation caused unemployment and a recession so key to have new regulation