4.1.6 restrictions on free trade

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

43 Terms

reasons for restrictions on free trade

protect new firms

being reliant on other countries for energy,defence,agriculture creates vulnerabilities

protect jobs

to protect against dumping

correct imbalances in balance of payments

ban certian goods

raise tax revenue

response to recession/low AD

arguement against recession

risk of retaliation

market distortions

higher price for consumers

regressive effect on income inequality

bypassing import controls

higher costs for exporters

dumping

occurs when foreign frims sell products at unfairly low prices in foreign markets

what are type of restrictions on trade

tariffs

quotas

subsidies to domestic producers

non-tariff barriers

protectionism

any attempt to impose restrictions on trade in goods and services

effect of the trade war between USA and the rest of the world

decrease stock markets as low business confidence

long term is beneficial for us production so high economic growth

decrease consumption as increased prices as higher costs due to tariffs so decrease in standard of lving

decrease FDI

structural and cyclical unemployment

what is a tariff

tax on imported goods/services

how do tariffs work

Domestic producers/retailers have to pay the tariff when the good/service crosses the border into the country

This raises the cost of production for domestic firms

Firms often pass on the increased costs to consumers in the form of higher prices

These higher prices allow some domestic firms to increase their output (law of supply)

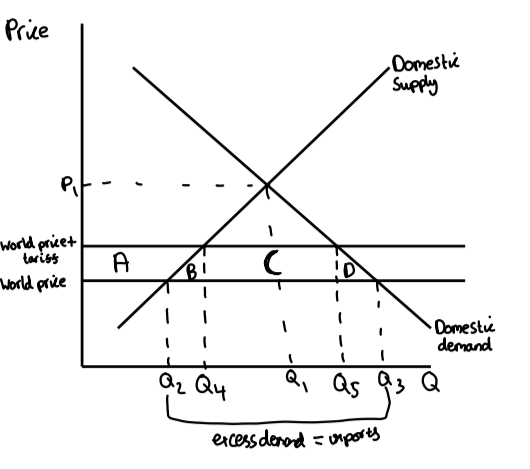

tariff diagram

closed economy (p1 Q1)

open economy - lower price(world price),fall in DS Q1 to Q2 rise in DD Q1 to Q3

increase imports Q1 to Q3

tariff increases domestic supply but decreases domestic demand so less imports

A= increase in producer surplus

ABCD loss in consumer surplus

B and D deadweight welfare loss

C gov revenue from tariff

quota

quantitative limit on the number of imports

what is the effect of a quota

creates excess demand for imports for a givene level of domestic demand

the quota pushes up the market prices

this incentives dometic producers to increase their supply

uk quota example

in June 2022 the UK extended their quota on steel imports for a further two years in order to protect employment in the domestic steel industry

japan quota example

quota on 770,000 tonnes of rice per year imported tariff free and any more are subject to high tariffs

domestic subsidy

any form of financial help given to domestic producers to lower their costs and help them compete in international markets

how domestic subsidies help

subsidy given to domestic suppliers causes a right shift in the domestic supply

the extent of the reduction in costs depends on the size of subsidy

They can increase output and lower prices

With lower prices their goods/services are more competitive internationally

The level of exports increases

The increased output may result in increased domestic employment

non tariff barriers

health and safety regulation

product specifications

environmental regulations

intellectual property laws-patents,copyright

preferential state procurement policies-government favour local producers when finalising contracts for state spending

financial-banks favourdomestic firms to loan

managed exchnage rates

example of health and safety regulation

in 2017 the EU put a new health regulation in place regarding the permitted level of aflotoxins in nuts. Aflotoxin levels are naturally higher in southern hemisphere countries and it effectively blocked the import of southern hemisphere nuts

example of environmental regualtion

in November 2021 new regulations were put in place in the EU and the USA to limit the amount of imports of 'dirty steel' - predominantly this is steel produced using coal fired power stations which are prevalent in China

impact of tariff on domestic producers

lead to higher prices for imported foods so will supply more and receive more demand

but other industries may have higher costs as imports more expensive

impact of tariff on domestic consumers

higher prices so less consumption

impact of tariff for foreign producers

lead to higher costs so have to charge higher prices and so lower demand

but could become more efficient as try to lower costs

impact of tariff for government

igher tax revenus

impact of tariff on standard of living

The standards of living for consumers worsen as the value of their income is eroded as they are paying higher prices

Domestic firms who benefit from increased production may increase employees' wages

This would increase the standard of living for employees

impact of tariff on equality

Workers in industries that have been experiencing structural unemployment due to foreign competition will feel that the tariff results in them being treated more fairly

impact of quota on domestic producers

Increases their output

Raises the selling price

Increases their revenue

but it may encourage domesitc firms to be less productively efficient,may be affected by scarce supply of higher quality overseas imports

impact of quota on foreign producers

Decreases their output

Compared to a tariff, those firms who manage to export in the quota receive a higher price for their sales

impact of quota on consumers

Results in higher prices and less choice

but consumers who work for domestic firms may benefit from higher employment and import cap might stimulte icreased investment

impact of quota on government

they do not receive any tariff revenue (as there is no tariff)

They may receive higher tax revenue at the end of the financial year when domestic firms pay their corporation tax

improved external balance from the reduction in imports and an expansion of GDP from the increase in domestic proudction

impact of quota on standard of living

Reduces for consumers as higher prices erode the purchasing power of their income

impact of quota on equality

Improves for domestic firms but worsens for foreign firm

impact of subsidies on domestic producers

Decreases costs of production

Increases output

Increases international competitiveness

but risk of dependency culture

impact of subsidies on foreign producers

Makes it harder for them to compete with domestic firms

impact of subsidies on consumers

lowers prices but may face higher taxes

impact of subsidies on government

This costs the government the amount of the subsidy

There is an opportunity cost associated with every subsidy provided

impact of subsidies on standard of living

Improves for consumers as they benefit from lower prices - their income goes further

impact of subsidies on equality

Domestic firms can compete more equally

impact of non tariff barriers on domestic producers

Limits foreign competition

Protects levels of outputs

May increase selling price and revenue

impact of non tariff barriers on foreign prodcuers

Acts as a disincentive to sell into foreign markets

Costs of meeting the non-tariff barriers may significantly reduce profit margins

impact of non tariff barriers on consumers

May reduce choice/variety in a market

impact of non tariff barriers on government

They may lose some credibility with the WTO

Enforcing the non-tariff barriers may be difficult or expensive

impact of non tariff barriers on standards of living

Less choice and higher prices erode standards of living

Product labelling information may improve decision making and quality of life

impact of non tariff barriers on equality

May help improve equality e.g. environmental standards help create equal production inputs which results in equality in the costs of production

examle of tarriffs and quotas

In many cases, tariffs and quotas arise from geopolitical factors between countries. For example, the World Trade Organisation (WTO), an intergovernmental organisation that regulates international trade, settled a decade-long argument between the EU and America regarding subsidies. The US was accused of illegal subsidies to Boeing, an American aerospace corporation. By providing subsidies, the firm’s costs of production were reduced, which meant they were able to lower prices to consumers. This had adverse impacts for the competitiveness of Airbus, the European-owned counterpart to the aviation duopoly. The EU therefore took the issue up with the WTO, and was permitted to add tariffs to $4 billion worth of US imports to compensate for the loss of profits to Airbus