2.3 AS aggregate supply

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

22 Terms

Aggregate supply

Volume of goods and services produced within the economy at a given price level.

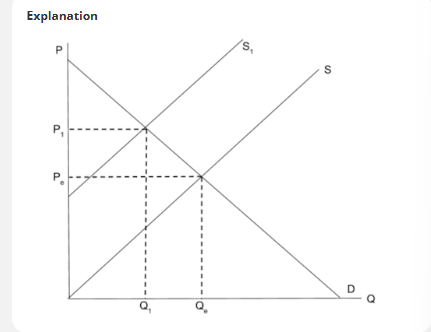

Normal supply curve

As prices increase, firms can make more profit by selling their goods at these higher prices. Therefore, they increase the quantity that they sell in order to profit maximise.

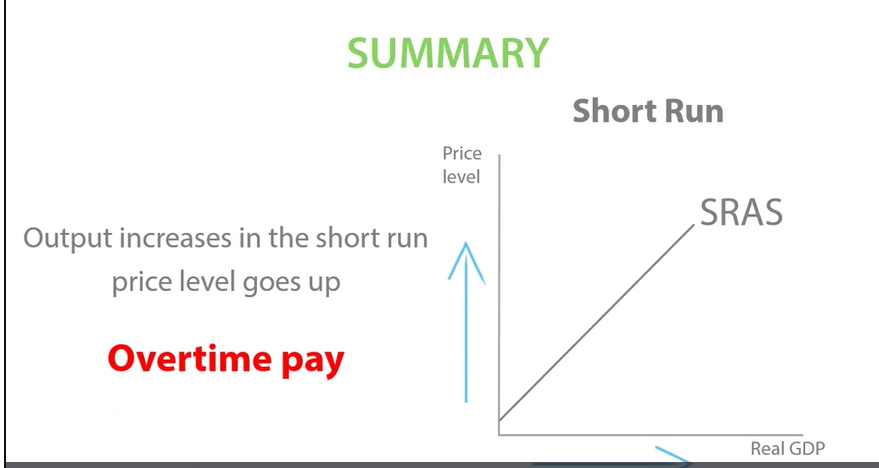

Why does short run aggregate supply curve slop upwards

If firms want to increase output in the short run, they don’t have time to hire new workers. They have to pay their current workers overtime pay. This will increase the firm’s costs and therefore forces them to increase their prices.

SRAS curve and LRAS curve shifts

WHEN COST CHANGES WE SHIFT SRAS.

WHEN QUANTITY/ PRODUCTIVITY CHANGE we shift LRAS.

In economics, short run is where at least one factor of production is fixed.

Long run- all factors of production are variable.

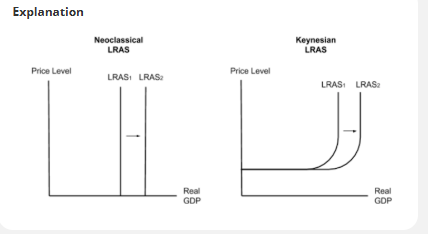

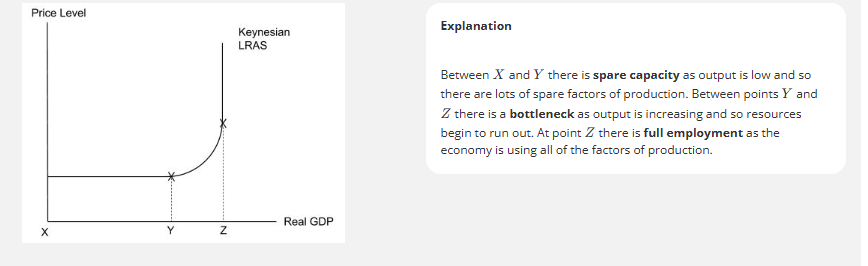

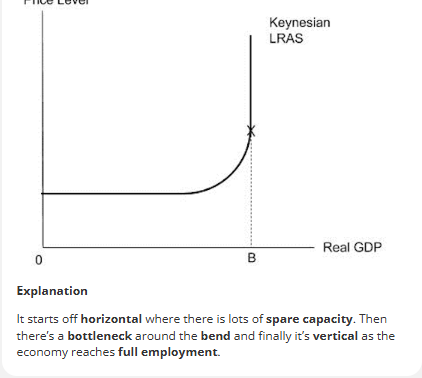

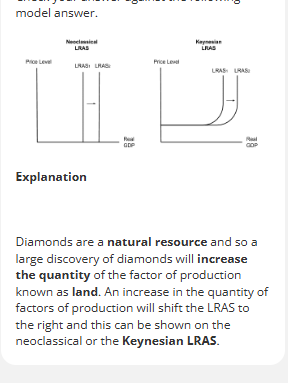

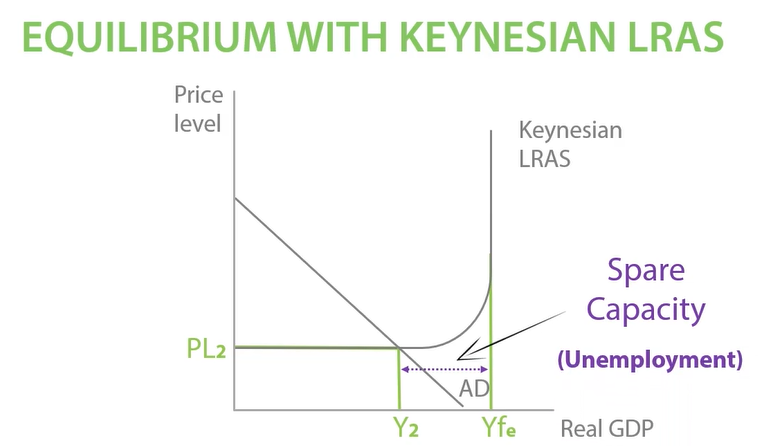

Keynesian LRAS curve

SPARE CAPACITY, BOTTLENECK, FULL EMPLOYMENT. SIT BACK FLIP

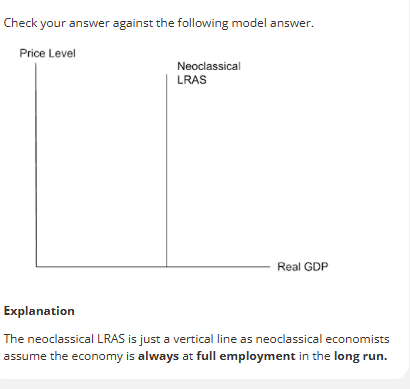

NEOCLASSICAL LRAS

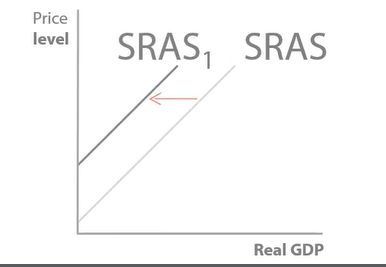

SRAS shifts

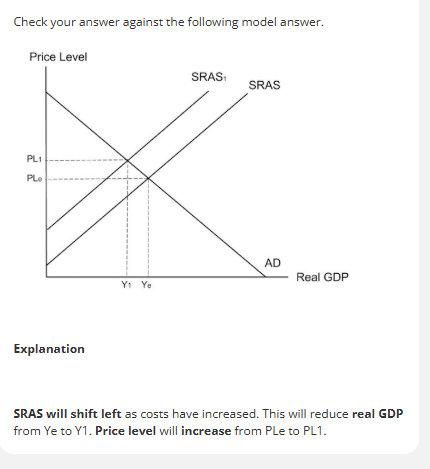

What will be the impact of a disruption in the supply of oil?

OIL prices are a key reason for changes in cost. SRAS shift

Quantity of oil decreases which leads to an increase in price.

Oil prices increase firms have to pay more for transport, plastic, production, when costs change we use SRAS.

Producers cant afford to produce as much so SRAS shift inwards, output will decrease.

commodities— used commonly.

When commodities increase price cost increase SRAS shift left

Reduction in oil prices will reduce costs for firms, this should be shown using outward shift of the SRAS curve.

Price level will decrease and real GDP will increase

SHIFTS IN AS

Draw an aggregate supply graph to show impact on diamond discovery.

new resources discovered increase quantity of factors of production pushing out LRAS

SHIFTS IN SRAS

Impact of increase in investment in American technology sector on the American aggregate supply curve.

LRAS shift right.

Increase in investment, more technology and and machines means more productive.

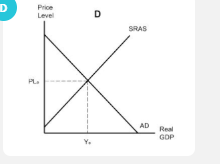

Equilibrium in short run

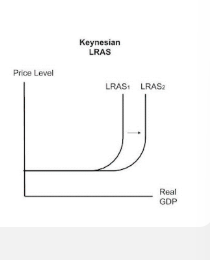

Equilibrium at Keynesian LRAS

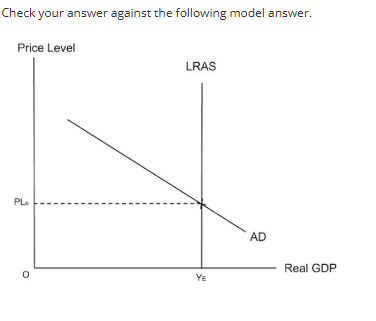

Equilibrium at neoclassical LRAS

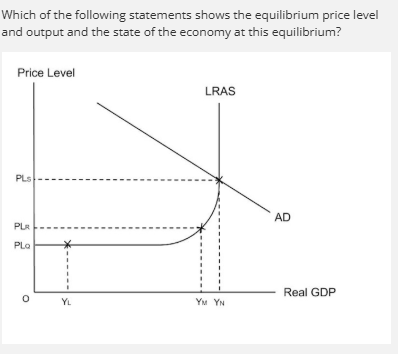

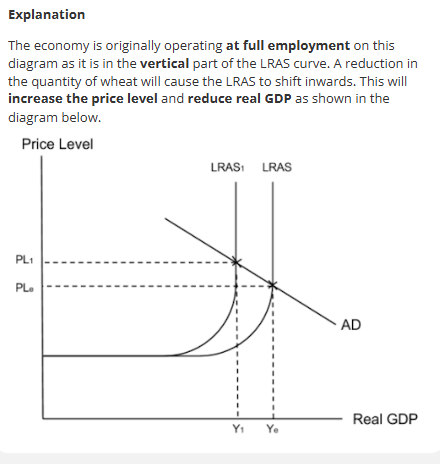

Following a decrease in the quantity of wheat, what would happen to the diagram?

Keynesian long run diagram. Price level increases, real GDP decreases

Reduction in wheat supply reduces economy potential output, LRAS shift left. The productive capacity of economy falls.

If AD intersects the flat (spare capacity) section of LRAS, the inward shift may not change equilibrium GDP or price level — output is demand-constrained, not supply-constrained.

If AD intersects the vertical section (full capacity), the LRAS shift will reduce real GDP and raise the price level (stagflation).

HOWEVER:

Depends on size of LRAS shift: small reduction in wheat supply may have little macro impact, a large global shock could be sever.

The main affect may be concentrated in food industries rather than whole economy.

In short run, substitution (importing wheat, alternatives) may cushion impact.

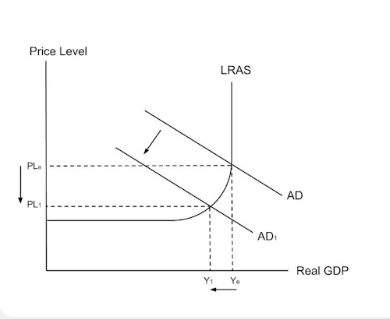

How could we show impact of a loss of jobs in the Welsh valleys using as AS-AD diagram?

Using a Keynesian LRAS to show a reduction in price level and a reduction in real GDP.

A REDUCTION IN AD FROM AD TO AD1 WILL REDUCE THE PRICE LEVEL AND REDUCE REAL

-closure of coal mines leads to large-scale job losses. This reduces household incomes in the local area. With lower disposable income, C falls. reduces revenue for firms, cut production, investment or lay off workers. creates further founds of falling income and spending.

Corporation tax, VAT tax, Income tax fall for government reducing spending. austerity cuts.

HOWEVER: if workers can transition into new industries the fall in AD may be less severe.

regional: at a national level effect on AD may be relatively small if other regions remain strong.

short run/long run: short run unemployment rises and AD falls. long run, workers may move into other industries AD increases.

Government intervention: government responds with regional development spending, subsidies, retraining programmes, negative AD reduced.

Elasticity of AD: size of fall in GDP depends on multiplier, if marginal propensity to consume if locally high, multiplier effect will make decline sharper. If households save more or imports rise, negative multiplier is weaker.

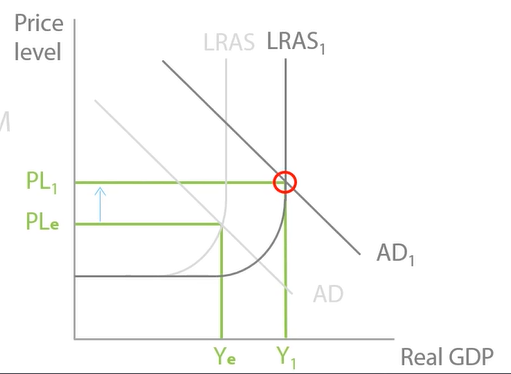

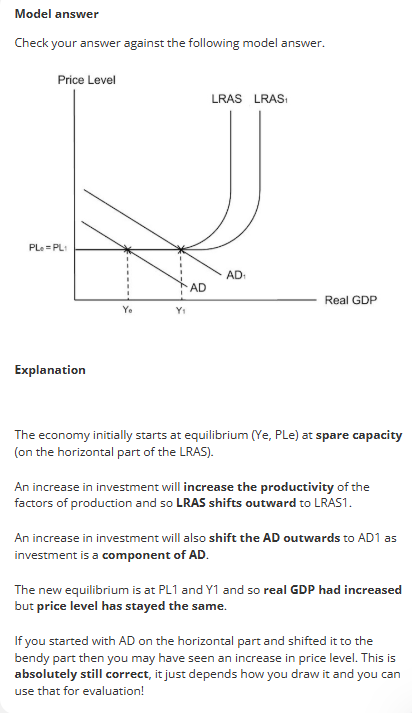

How would an increase in investment affect the economy?

Increase in investment would increase long run aggregate supply as factors of production will become more productive as we are investing in capital.

Increase in investment will also increase AS as investment is a component of AD. AD(C+I+G+(X-M)

animal spirits increase, investment increases AD increase

more investment, increase productivity of technology and machinery will increase economies productivity. Price level increase from PLE to PL1

Increase in investment with economy in equilibrium with spare capacity

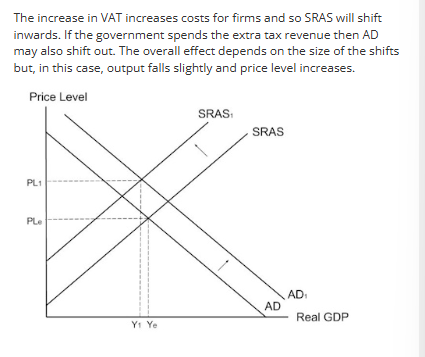

SRAS, VAT INCREASE

VAT is an indirect tax which is paid on goods at each stage of production or distribution

VAT increase costs, producers cant afford to produce as much, SRAS will shift inwards.

EVALUATION: with the increase in VAT, government can spend it on schools, education, benefits, police, doctors, teachers, subsidies, transport, pensions.

Exchange rate

How much of one currency can be exchanged for another

Use to calculate the price of foreign goods and services in our currency.

FACTORS INFLUENCING SRAS

-CHANGES IN COST OF RAW MATERIALS AND ENERGY

-CHANGE IN EXCHANGE RATES

-CHANGE IN TAX RATES

CHANGE IN COSTS OF RAW MATERIALS AND ENERGY

-if oil prices rise, firms production costs increases.

-SRAS shifts inwards, as firms supply less at every price less.

-This causes cost-push inflation (higher price level) and lower real GDP.

-The size of the shift depends on the economy’s dependence on imports e.g. UK imports most oil and gas

CHANGE IN EXCHANGE RATES

-Depreciation of the pound makes imports of raw materials and energy more expensive. Firms costs rise, so SRAS shifts left. Price level rises and real GDP falls.

-An appreciation makes imports cheaper, reducing costs.

-SRAS shifts right, lowering inflationary pressure.

Effect depends on how import dependent the economy is.

CHANGE IN TAX RATES

A rise in indirect taxes (VAT) raises production costs. SRAS shifts left, increasing prices and reducing output.

A cut in indirect tax lowers cost.

SRAS shifts right, reducing the price level and raising real GDP.

The effect depends on whether the tax change is temporary or long term structural VAT rate.

FACTORS INFLUECING LRAS

-TECHNOLOGICAL ADVANCES

-CHANGES IN RELATIVE PRODUCTIVITY

-CHANGES IN EDUCATION AND SKILLS

-DEMOGRAPHIC CHANGES AND MIGRATION

-COMPETITION POLICY

TECHNOLOGOCIAL ADVANCE.

-New technology increases efficiency and reduces production costs.

Firms can produce more output with the same resources, shifting LRAS right.

This raises potential growth, lowers long-run price pressures and improves competitiveness.

The effect depends on how quickly technology is adopted across industries.

CHANGES IN RELATIVE PRODUCTIVITY.

-If UK workers become more productive relative to competitors, unit labour costs fall.

-Firms become more competitive internationally, raising exports and output capacity.

-LRAS shifts right.

However productivity growth in the UK been weak since 2008, limiting LRAS growth. Gains may also be sector specific.

CHANGES IN EDUCATION AND SKILLS:

-Better education and training can improve human capital. Workers become more efficient raising labour productivity.

-LRAS shifts right as the economy can produce more with the same resources.

-Quality of education matters more than just spending levels. Also, skills must match labour market demand - otherwise underemployment persists.

DEMOGRAPHIC CHANGES AND MIGRATION

Rising working age population or inward migration increases labour supply, more workers shift LRAS right, raising potential output.

An ageing population reduces labour force participation. LRAS shifts left as productive capacity falls.

Migration effects depend on the skills of migrants- high skilled workers rise productivity more than low skilled labour.

COMPETITION POLICU

-Strong competition policy prevents monopolies, forcing firms to innovate and cut costs. This improves efficiency, increase output and shifts LRAS right.

-However, less competition can sometimes be beneficial if it encourages investment and innovation. e.g. copyright laws mean business ideas cant be copied, encourage them to do more research as they know theyll benefit with higher profits.

FACTORS INFLUENCING LRAS

CHANGES IN GOVERNMENT REGULATION

EXPANDING THE WORKFORCE

-regulations and policies can increase labour force participation.

E.G. free childcare for pre-school children encourages parents to return to work, raising the size of the active workface.

-stricter rules on welfare or reducing unemployment benefits can also incentivise job seeking.

-increasing retirement age expands the population.

-larger workforce increases the economy’s productive capacity, shifting LRAS right.

ENCOURAGE RESEARCH AND DEVELOPMENT

-the government can offer tax breaks or subsidies for firms that invest in innovation.

This makes R&D more attractive, encouraging firms to develop new technologies.

-Successful innovation improves productivity and efficiency, raising potential output. LRAS shifts right.

-reducing barriers to entry such as cutting corporation tax encourage start ups, more firms in the market create jobs, boost competition, raise output, strengthens efficiency and increase long-run capacity, shifting LRAS right.

-excessive regulation raises business costs and slows decision-making. strict planning delay infrastructure projects or housebuilding, shift LRAS left.