Inflation and deflation (money supply)

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

Money

Object accepted for goods, services, and debts.

Functions of Money

Roles include exchange, saving, accounting, and payment.

Money Supply

Total money available in the economy at a time.

Narrow Money (M0)

Physical money: notes and coins in circulation.

Broad Money (M4)

Includes M0 plus private sector bank deposits.

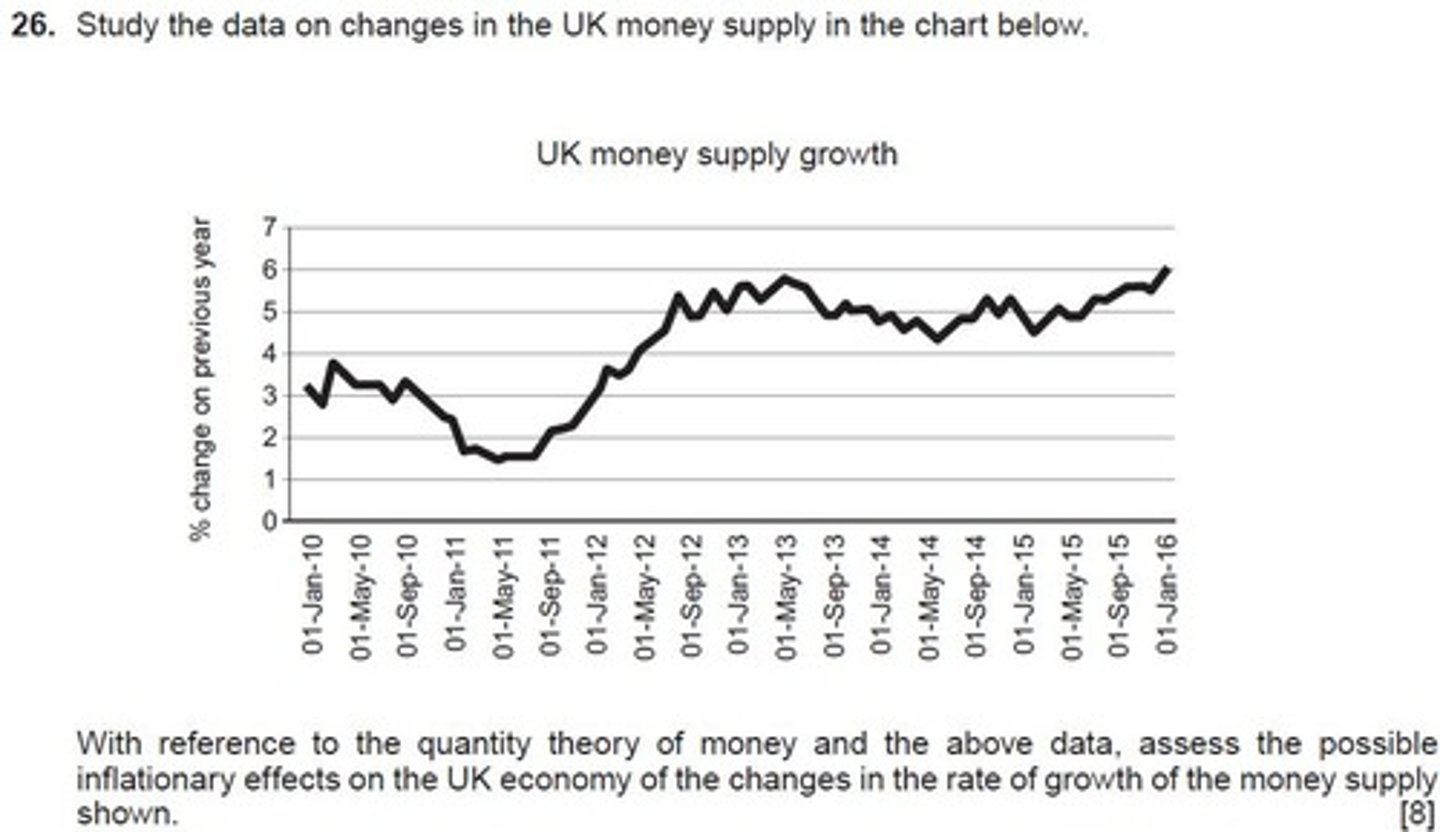

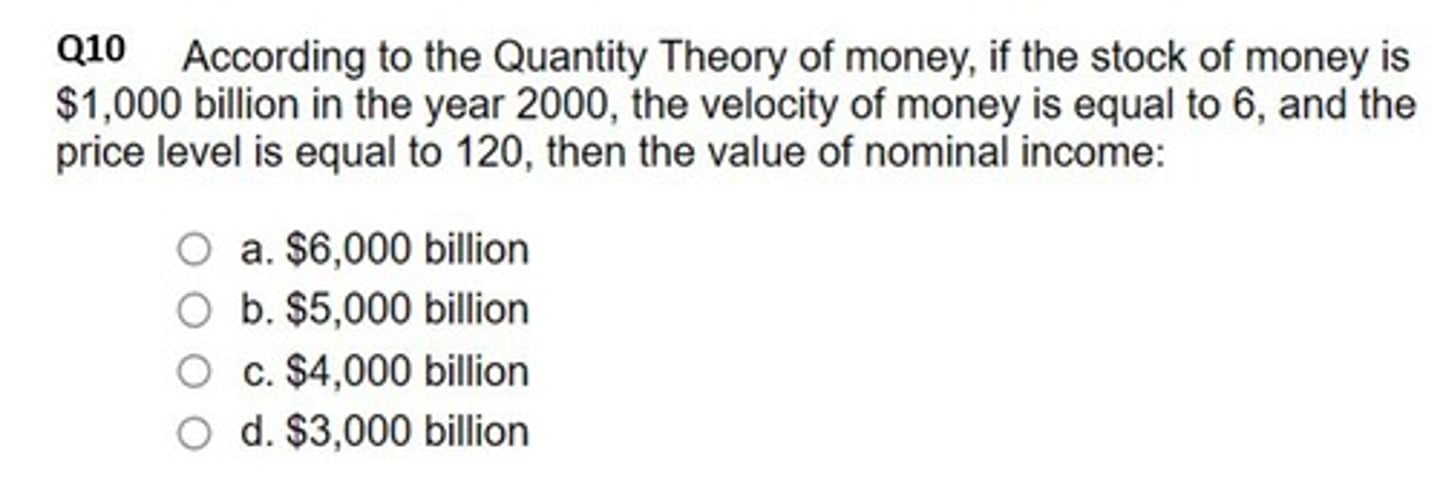

Quantity Theory of Money

Inflation linked to money supply increase.

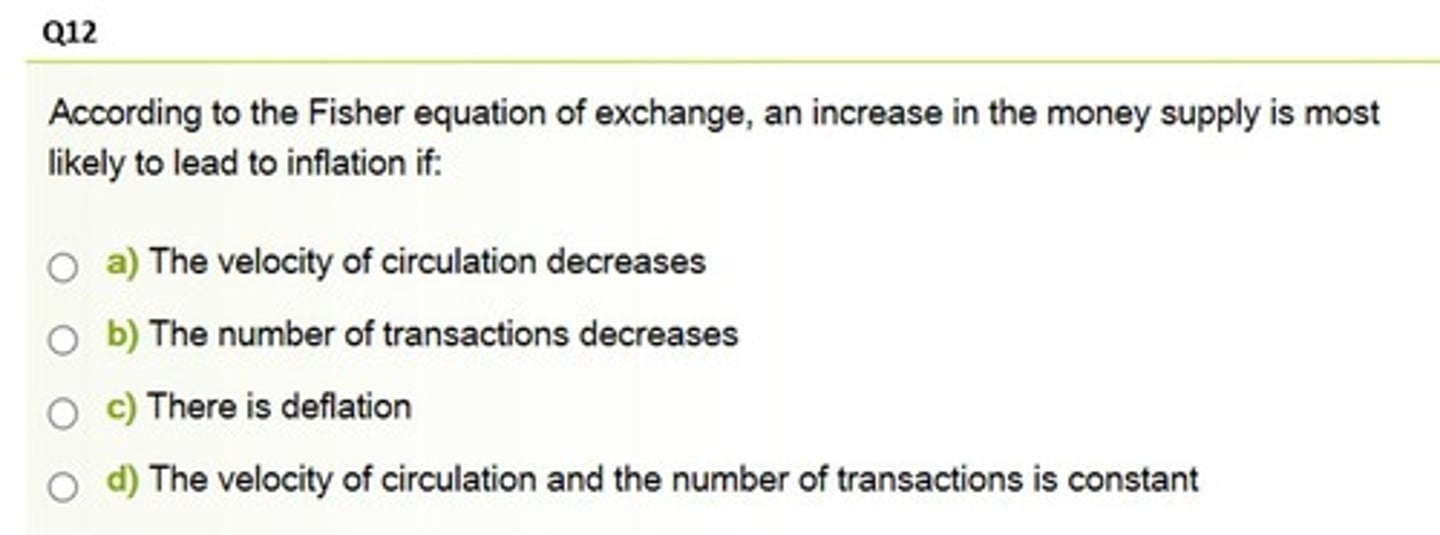

Fisher Equation of Exchange

M x V = P x T; money transactions identity.

Velocity of Circulation (V)

Average times money changes hands in a period.

Average Price Level (P)

Mean price of goods/services in an economy.

Number of Transactions (T)

Total buying/selling events in a time frame.

Inflation

General increase in prices over time.

Deflation

General decrease in prices over time.

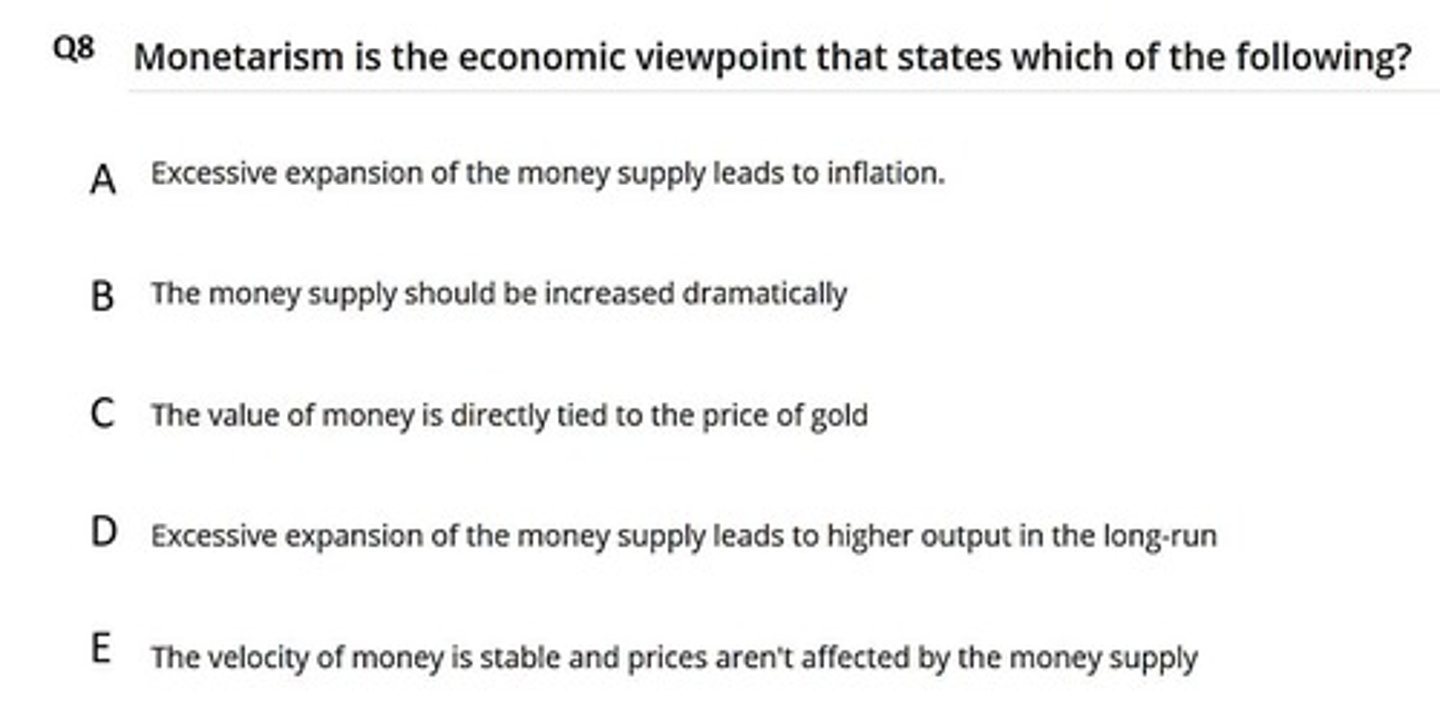

Monetarism

Economic theory emphasizing money supply control.

Milton Friedman

Economist asserting inflation is a monetary phenomenon.

Classical View

Focus on long-term economic growth and stability.

Keynesian View

Emphasizes demand-side factors for economic output.

Long-Run Aggregate Supply (LRAS)

Represents economy's maximum sustainable output.

Demand-Pull Inflation

Inflation caused by increased demand for goods.

Supply-Side Policies

Strategies to enhance production capacity and efficiency.

Economic Models

Simplified representations of economic processes.

Inflationary Expectations

Public's anticipation of future inflation rates.

Bank Weakness

Financial instability affecting money supply confidence.

Money Substitutes

Alternative payment methods like credit cards.

Venezuela Case Study

Example of extreme inflation linked to money supply.

Consumer Prices Index

Measure of average price changes over time.

Transaction Frequency

Rate at which transactions occur in an economy.

Economic Output (Y)

Total value of goods/services produced in an economy.

Percentage Change in Money Supply

Rate of increase or decrease in money supply.