PE05 - AREI - Past Exam - WS2223 - For now just Multiple Choice Part

1/11

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

12 Terms

lost on og document

Question 2

Which of the following statements regarding the property cycle is incorrect? (4 credits)

a) In Recovery period, property prices begin to increase.

b) In Expansion period, yields fall.

c) In Hyper Supply period, rent growth stagnates or rents fall.

d) In Recession period, the completion of building stock decreases.

Correct answer: d) In Recession period, the completion of building stock decreases.

Question 3

Real Estate Cycle: What accompanies the transition from decreasing expected yields / increasing rents / decreasing vacancy rates to high LTV ratios / high property prices / high volume of transaction with respect to financial conditions? (4 credits)

a) Tightening financial conditions.

b) Falling leverage effect.

c) Easing financial conditions.

d) Rising leverage effect.

Correct answer: d) Rising leverage effect

The question describes a typical late-expansion phase of the real estate cycle:

Decreasing yields

Increasing rents

Decreasing vacancy rates

High LTV ratios (loan-to-value)

High property prices

High transaction volume

These signs are associated with:

Investor optimism

Greater willingness of lenders to provide debt

Higher property prices being financed with increasing amounts of debt

→ This is a rising leverage effect

b)

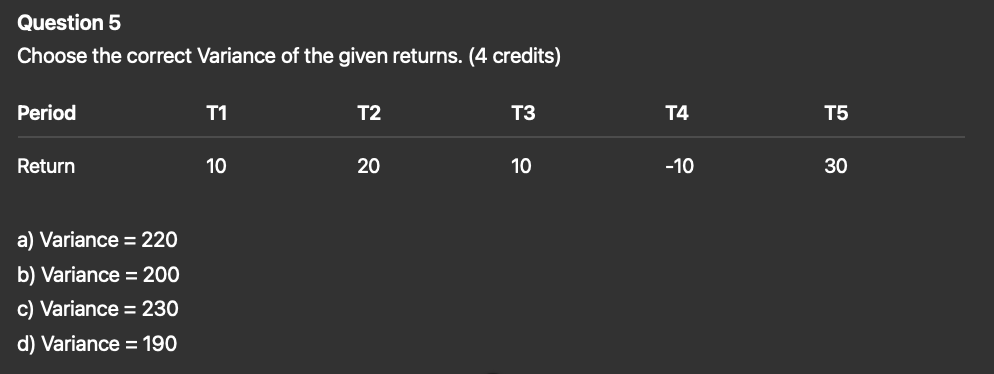

Correct answer: a) Variance = 220

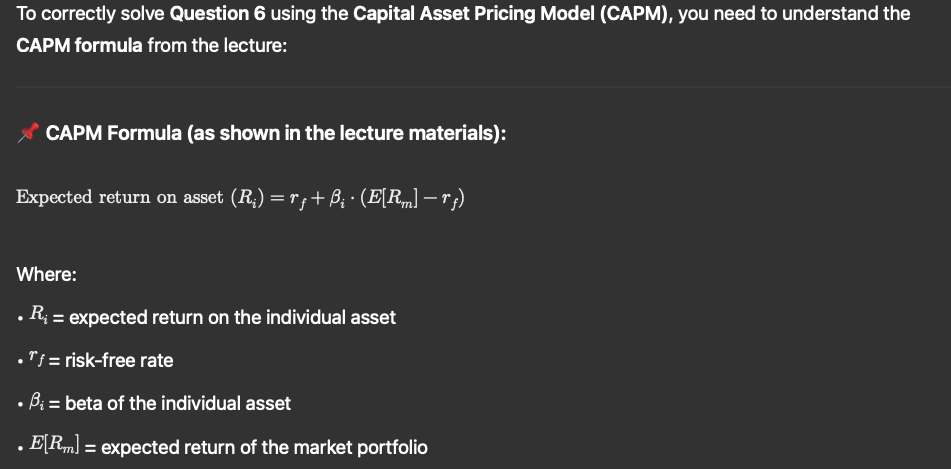

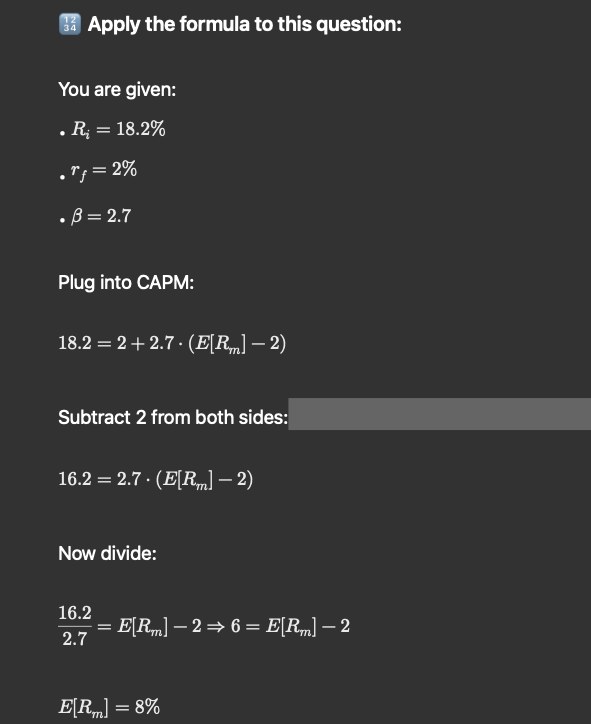

Question 6

Taking the capital asset pricing model (CAPM) as a basis, which of the following statements is correct, if: (4 credits)

The risk free rate is 2%, the expected return on the individual asset is 18.2%, and the beta is 2.7.

a) The expected return of the market portfolio is 7%.

b) The expected return of the market portfolio is 8%.

c) The expected return of the market portfolio is 9%.

d) The expected return of the market portfolio is 10%.

Correct answer: b) The expected return of the market portfolio is 8%.

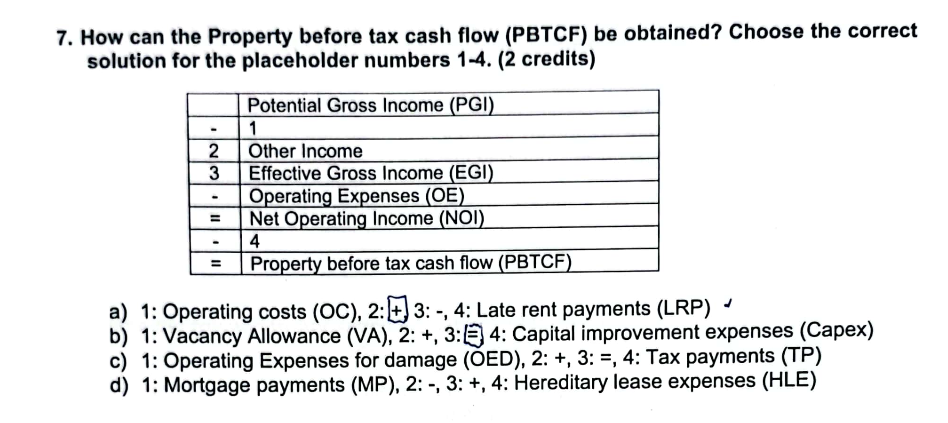

Question 7

Security Market Line: The slope of the security market line is equal to… (4 credits)

a) … the risk free rate.

b) … the expected return of the market portfolio.

c) … the amount of systematic risk.

d) … the market risk premium.

Correct answer: d) … the market risk premium.

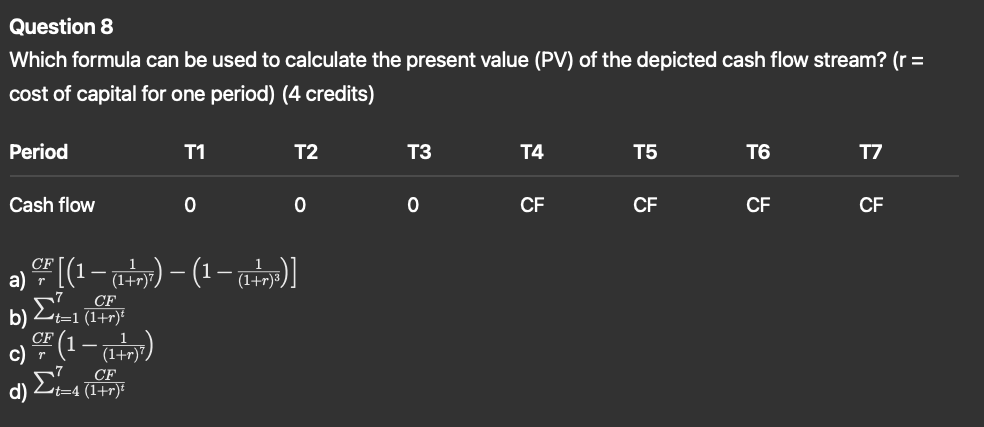

Correct answer: a)

Question 9

Internal Rate of Return (IRR): Which of the following statements concerning the IRR is not correct? (4 credits)

a) The IRR is the rate of return of a project which makes the net present value (NPV) = 0.

b) The IRR is the return of per dollar investment, taking into account the time value of money.

c) The IRR is usually expressed as % per year.

d) A project should be accepted if the IRR is higher than the required rate of return.

Correct answer: a) The IRR is the rate of return of a project which makes the net present value (NPV) = 0.

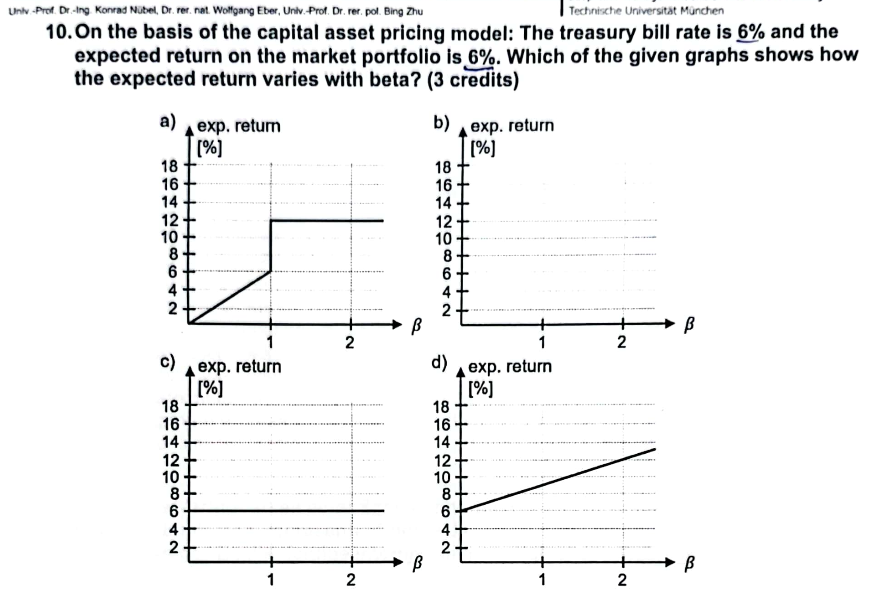

Question 10

Which of the following statements is correct? (4 credits)

a) Private markets are more liquid than public markets and thus are more informationally efficient.

b) Public markets are usually for transactions involving “whole” assets rather than shares of assets (like stocks) as we typically see in private markets.

c) Equity assets give their owners the rights to the cash flows generated by an underlying asset before other claim holders (including debtors) have been paid.

d) Debt assets give their owners the rights to future cash flows to be paid by borrowers on loans.

Correct answer: d) Debt assets give their owners the rights to future cash flows to be paid by borrowers on loans.

Question 11

Systematic Risk is diversifiable. Is that statement correct? (2 credits)

a) Yes, the statement is correct.

b) No, the statement is not correct.

c) The statement is only correct for European markets.

d) The statement is only correct for the US market.

Correct answer: b) No, the statement is not correct.

c)