Equity Valuation

1/63

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

64 Terms

How attractive is the industry ?

Porter 5 forces

Pestel

What is the company position in the industry (Business model) ?

Cost Leadership

Differentiation

Focus

How well was the strategy executed ?

How the financials reflect the strategy

How to analyse the cost structure

Profit Margin

High proportion of accrual in earnings

Low quality earning

Research Format report

Table of content

Executive summary

Business summary

Risks

Valuation

Historical & ProForma table

When to apply a DDM

The company pays dividends

There is a dividend policy

The investor takes a no control perspective

When to Use Free Cash Flow models

No/Unstable dividends

Easy to forecast

The investor takes a control perspective

Present Value of Growth opportunity in DDM

Vo = E1/R + PVGO or P/E = 1/r + PVGO/E1

Forward P/E

P/E = Payout ratio / (r-g)

H model DDM

Vo = (D0(1+g1) + DoH(g0-G1)) / (r-Gg1)

growth rate of dividends

g = Retention ratio x ROE

Free Cash Flow To Firm general formula

FCFF = NI + NCC + Int(1-t) - CAPEX - Change in WC

Free Cash Flow to firm from CF Statement

CFO + Int (1-t) - CAPEX

From FCFF to FCFE

FCFE = FCFF - Int(1-t) + net borrowing

FCFF from EBIT

EBIT(1-t) + D&A - Change in WC - CAPEX

FCFF from EBITDA

EBITDA(1-t) + D&A(t) - change in NWC - CAPEX

What to do in Non operating assets

Do FCFF calculation on operating and add back non operating asset at market value

Normalised EPS

EPS adjusted for cyclicality

2 methods for normalised EPS

Historical average over full cycle

average ROE x BVPS

Earning Yield

E/P

Prdicted PE factors

Growth rate in earning

payout ratio

standard deviation of earning

PEG

P/E / Growth rate of earning

Own Historical P/E

Justified price = (Benchmark Value of historical P/E) x Most recent EPS

Tangible BVPS

Shareholder Equity - intangible

Justified Forward P/E

Payout Ratio /r-g

Justified Trailing P/E

Payout ratio x (1+g) / (r-g)

Justified P/B Ratio

1+ (ROE - r) / r-g

Justified P/S Based on forecast

Po/S1 = (E1/S1)*Payout ratio / (r-g)

Justified Trailing P/S ratio

Po/So = (Eo/So) x payout ration x (1+g)/r-g

growth rate in P/S ratio

g = retention rate x Dupont decomposition

Scaled earning surprised

EPS surprise/ SD(EPS surpise)

how to average multiple

Use the harmonic mean

Residual income

Residual remaining income after deduction of cost of capital

2 approaches for residual income

Nopat - Capital Charge

Net income - Equity charge

Economic Value Added Formula

NOPAT x (C% x TC)

NOPAT adjustment in EVA Calculation

R&D is added back to earning

Charge for capital can be suspended

deferred tax are eliminated

LIFO reserve is added back to capital

Operating lease are treted as capital lease

Market Value Added

Market Value - Book Value

Residual income model

Book Value + Discounted residual income

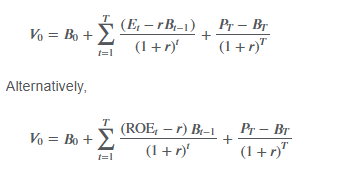

RIM Formula

Bo + Somme(Et -rBt-1)/(1+r)^t

Excess earning method

Bo + Somme(( ROEt - r) Bt-1)/ (1+r)^t

Single stage dividend model for residual income

Vo = Bo + (ROE- r)/(r-g) x Bo

Tobin s q

Market Value of debt and equity / Replacement cost of asset

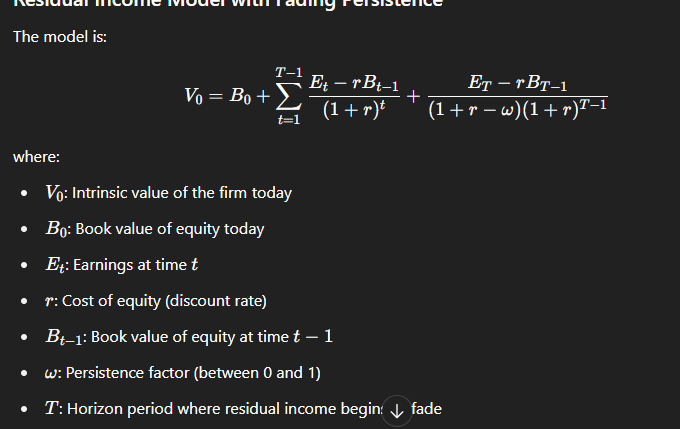

Multistage residual income valuation

Residual income with fading persistence

When to use a RMI model

A company do not pay dividends

FCF are negtive

Uncertainty around the terminal value

3 important topics in private valuation

Normalised earnings

Discount rate

Valuation Discount/Premium

expanded CAPM

An adaptation of the CAPM that adds to the CAPM a premium for small size and company-specific risk.

Discount for lack of control

1 - (1/1+control premium)

Discount for lack of marketability

At the money put option premium as a % of the stock

Total discount for DLOC ant DLOM

(1 - (1-DLOC) x (1- DLOM))

Re investment rate

g / WACC

Firm Value for private company from NOPAT

EBIT (1-t) (1-RIR) / (WACC - g)

Excess earning method for private company

DDM but D= Normalised income - WC x cost WX - Fixed asset x cost of fic=xed assets

Unlevering Beta

Bu = Bl / (1 + (1-t) x D/E)