HW 5: Chapter 28: Monetary Policy and Banking Regulations

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

45 Terms

Of the following, who sets the discount rate?

The Board of Governors of the Federal Reserve System sets the discount rate.

Which of the following define the term bank capital?

It is the difference between a bank's assets and its liabilities.

It is a bank's net worth.

Bank capital is the difference between a bank's assets and its liabilities. It is also called net worth. Regulation requires banks to have positive net worth so that they remain solvent.

Small Bank holds reserves of $50 million. The Fed sells Small Bank $20 million in bonds. What will Small Bank do if it wants to maintain reserves of $50 million?

(Hint: Recall that both reserves and bond holdings are entered on the Assets side of a bank's balance sheet.)

Small Bank will halt loans or slow down the rate of new loans until the desired reserve level is attained.

When the Fed sells $20 million in bonds to Small Bank, Small's reserves decrease from $50 million to $30 million. To restore the reserve level to the desired $50 million, Small Bank will halt or slow the rate of new loans and add the stream of payments being made on prior loans to its reserves.

Which of the following is not true of the U.S. Federal Reserve System?

The Fed is a part of the U.S. government.

The purpose of the long and staggered terms is to insulate the Board of Governors as much as possible from political pressure so that governors can make policy decisions based only on their economic merits. Additionally, except when filling an unfinished term, each member only serves one term, further insulating decision-making from politics. The Fed's policy decisions do not require congressional approval, and the President cannot ask for a Federal Reserve Governor to resign as the President can with cabinet positions.

True or false?

In recent decades, the Federal Reserve has often made discount loans.

False

In recent decades, the Federal Reserve has made relatively few discount loans. Before a bank borrows from the Federal Reserve to fill out its required reserves, the bank is expected to first borrow from other available sources, like other banks. This is encouraged by the Fed charging a higher discount rate than the rate of federal funds.

True or false?

The federal funds rate is a long-term interest rate.

False

The federal funds rate is the interest rate at which one bank lends funds to another bank overnight; therefore, it is a short-term interest rate.

What is the most important bank regulation, from the customer's point of view?

deposit insurance

From a customer's point of view, the most important form of regulation comes in the form of deposit insurance. For commercial banks, this insurance is provided by the Federal Deposit Insurance Corporation (FDIC). If a commercial bank fails, the FDIC guarantees to reimburse depositors up to $250,000 per insured bank, for each account ownership category. From a depositor's point of view, therefore, it is not necessary to worry about a bank's safety.

Who runs the regional Federal Reserve Banks in each district?

the member commercial banks of the district

The Fed includes 12 regional Federal Reserve banks, each of which is responsible for supporting the commercial banks and economy generally in its district. The commercial banks in each district elect a Board of Directors for each regional Federal Reserve bank, and that board chooses a president for each regional Federal Reserve district.

What are some reasons that banks are highly regulated?

All of the above.

Banks are regulated in part to protect individual depositors against corrupt business practices. Banks are also susceptible to crises of confidence. Because their reserves equal only a fraction of their deposit liabilities, an effort by customers to get all their cash out of a bank could force it to fail. A few poorly managed banks could create such a crisis, leading people to try to withdraw their funds from well-managed banks. Another reason for the high degree of regulation is that variations in the quantity of money have important effects on the economy as a whole, and banks are the institutions through which money is created.

True or false?

If the central bank raises the discount rate, then commercial banks will reduce their borrowing of reserves from the Fed, and instead call in loans to replace those reserves.

True

If the central bank raises the discount rate, then commercial banks will reduce their borrowing of reserves from the Fed, and instead call in loans to replace those reserves. When their quantity of outstanding loans decrease, the money supply falls and market interest rates rise. If the central bank lowers the discount rate it charges to banks, the process works in reverse: the money supply rises and market interest rates fall.

True or false?

The Federal Open Market Committee is composed of seven members of the Board of Governors and 4 publicly elected members of Congress.

False

The FOMC is composed of the seven members of the Board of Governors, the president of the New York Federal Reserve Bank, and four regional Federal Reserve bank presidents who serve on a rotating basis.

Which of the following is an institution that provides short-term emergency loans in conditions of financial crisis?

lender of last resort

A lender of last resort is an institution that provides short-term emergency loans in conditions of financial crisis.

Which of the following best describes the primary functions of a central bank?

A central bank is an institution that conducts a nation's monetary policy and regulates its banking system.

Of the following, which is the most commonly used tool of monetary policy in the United States?

open market operations

Over the last few decades, open market operations have been the Fed's most commonly used tool of monetary policy. These take place when the central bank sells or buys U.S. Treasury bonds in order to influence the quantity of bank reserves and the level of interest rates.

Which of the following best defines the term deposit insurance?

Deposit insurance is a system that makes sure depositors in a bank do not lose their money, even if the bank goes bankrupt.

Which of the following progressions is correct?

The Fed buys government bonds, money is injected into the market, there is an increase in the money supply, and the Federal Funds rate decreases.

Think of the Fed as external from the market. When the Fed purchases government bonds, it is removing bonds from the market and injecting money in place of the bonds. This injection increases the money supply in the market, and therefore, the federal funds rate will decrease because there is a lower demand for reserves among banks.

What term is best defined as an institution that conducts a nation's monetary policy and regulates its banking system?

A central bank is an institution that conducts a nation's monetary policy and regulates its banking system.

Loosening requirements too much would create a danger of banks being unable to meet the demand for withdrawals.

A sudden demand that all banks increase their reserves would be extremely disruptive and difficult to comply with.

Changes in reserve requirements have large impacts on banks. Loosening requirements too much would create a danger of banks being unable to meet the demand for withdrawals, because the temptation would be to loan out too much money, and the oversupply of cash that results could cause inflation.

seven members of the Board of Governors

the president of the New York Federal Reserve Bank

The Federal Open Market Committee (FOMC) makes the decisions regarding these open market operations. The FOMC comprises seven members of the Federal Reserve’s Board of Governors. It also includes five voting members who the Board draws, on a rotating basis, from the regional Federal Reserve Banks. The New York district president is a permanent FOMC voting member and the Board fills other four spots on a rotating, annual basis, from the other 11 districts.

In open market operations, the selling of bonds by the central bank __________.

decreases the amount of loans and money supply in an economy

When a central bank buys bonds, money is flowing from the central bank to individual banks in the economy, increasing the money supply in circulation and available loans. When a central bank sells bonds, then money from individual banks in the economy is flowing into the central bank—reducing the quantity of money in the economy.

Which description best fits the definition of bank run?

A bank run is a situation in which depositors race to the bank to withdraw their deposits for fear that otherwise those deposits would be lost.

True or false?

The federal funds rate is a long-term interest rate.

False

The federal funds rate is the interest rate at which one bank lends funds to another bank overnight; therefore, it is a short-term interest rate.

Which of the following is not a function of central banks?

to make loans to small businesses

The Federal Reserve, like most central banks, is designed to perform three important functions:

To conduct monetary policy

to promote stability of the financial system

To provide banking services to commercial banks and other depository institutions and to provide banking services to the federal government

However, making loans to small businesses is not a function of the Federal Reserve system.

To prevent excessively risky behavior by banks

To prevent bank runs

The purpose of bank regulation is to prevent bank runs, financial crisis, and the loss of depositors' money, as well as to protect the integrity of the financial system and to prevent excessively risky bank behavior.

True or false?

The Federal Open Market Committee is composed of seven members of the Board of Governors and 4 publicly elected members of Congress.

False

The FOMC is composed of the seven members of the Board of Governors, the president of the New York Federal Reserve Bank, and four regional Federal Reserve bank presidents who serve on a rotating basis.

Which of the following best defines the term bank capital?

Bank capital is a bank's net worth.

Bank capital is the difference between a bank’s assets and its liabilities. In other words, it is a bank’s net worth. A bank must have positive net worth; otherwise it is insolvent or bankrupt, meaning it would not have enough assets to pay back its liabilities. Regulation requires that banks maintain a minimum net worth, usually expressed as a percent of their assets, to protect their depositors and other creditors.

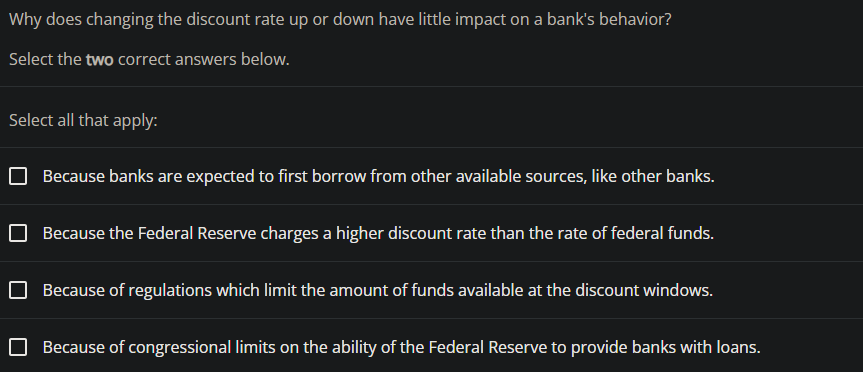

Because banks are expected to first borrow from other available sources, like other banks.

Because the Federal Reserve charges a higher discount rate than the rate of federal funds.

In recent decades, the Federal Reserve has made relatively few discount loans. Before a bank borrows from the Federal Reserve to fill out its required reserves, the bank is expected to first borrow from other available sources, like other banks. This is encouraged by the Fed charging a higher discount rate than the rate of federal funds. Given that it is rare for banks to borrow from the Fed, changing the discount rate up or down has little impact on bank's behavior. More importantly, the Fed has found from experience that open market operations are a more precise and powerful means of executing any desired monetary policy.

Suppose the Fed sells $25,000 in bonds to Luna Corporation. Luna pays for the bonds with a check drawn on Fifth Third Bank, which the Fed deposits. Which of the following happen when Fifth Third Bank pays the check?

Fifth Third Bank's reserves in the Fed are decreased by $25,000 and the reserves in the entire banking system are decreased by $25,000.

When the Fed sells bonds, money flows from the buyers of the bonds (Luna bank) to the Fed. This process reduces the commercial bank's reserve balance with the Fed and reduces the reserves in the entire banking community.

What is not true about the reserve requirement?

Banks have less money to lend out if the reserve requirement is lowered.

The reserve requirement is the percentage of reserves that a bank must keep. Raising it would require that banks keep more reserves, so less money is available to lend out, decreasing the money supply. Lowering the reserve requirement would have the opposite effect. Small changes to the reserve requirement are made each year, but large changes are rarely made because they would make banking operations difficult.

True or false?

Bank regulation is used to prevent excessively risky behavior by banks.

True

The purpose of bank regulation is to prevent bank runs, financial crisis, and the loss of depositors' money, as well as to protect the integrity of the financial system and to prevent excessively risky bank behavior.

Of the following, who makes up the Federal Open Market Committee?

seven members of the Board of Governors

The president of the New York Federal Reserve Bank

The Federal Open Market Committee (FOMC) makes the decisions regarding these open market operations. The FOMC comprises seven members of the Federal Reserve’s Board of Governors. It also includes five voting members who the Board draws, on a rotating basis, from the regional Federal Reserve Banks. The New York district president is a permanent FOMC voting member and the Board fills other four spots on a rotating, annual basis, from the other 11 districts.

Big Bank is initially holding $20 million in reserves, which is exactly the quantity of reserves it wants to hold. The Fed buys $10 million in bonds from Big Bank. What will Big Bank do to again hold exactly $20 million in reserves?

Big Bank will make loans that total $10 million.

When the Fed buys $10 million in bonds from Big Bank, Big Bank's reserves increase from $20 million to $30 million. To revert to the $20 million in desired reserves, Big Bank will loan out the extra $10 million.

A bank currently meets its required reserves when the Federal Reserve announces that required reserves will increase. What effect will this have on amount of loanable funds?

If banks are required to hold a greater amount in reserves, they have less money available to lend out.

If banks are required to keep larger amounts in reserves, this will decrease excess reserves of banks. This decrease in excess reserves will subtract from the assets banks have to make loans, decrease the amount of loanable funds.

Of the following, which is the most commonly used tool of monetary policy in the United States?

open market operations

Over the last few decades, open market operations have been the Fed's most commonly used tool of monetary policy. These take place when the central bank sells or buys U.S. Treasury bonds in order to influence the quantity of bank reserves and the level of interest rates.

As a firm becomes more established, who will be more likely to provide financial capital to the firm?

both bondholders and shareholders

When a firm becomes at least somewhat established, other outside investors who do not know the managers personally, like bondholders and shareholders, are more willing to provide financial capital to the firm.

What is the most important bank regulation, from the customer's point of view?

What is the most important bank regulation, from the customer's point of view?

deposit insurance

From a customer's point of view, the most important form of regulation comes in the form of deposit insurance. For commercial banks, this insurance is provided by the Federal Deposit Insurance Corporation (FDIC). If a commercial bank fails, the FDIC guarantees to reimburse depositors up to $250,000 per insured bank, for each account ownership category. From a depositor's point of view, therefore, it is not necessary to worry about a bank's safety.

Which of the following is not true of the U.S. Federal Reserve System?

The Fed is a part of the U.S. government.

The purpose of the long and staggered terms is to insulate the Board of Governors as much as possible from political pressure so that governors can make policy decisions based only on their economic merits. Additionally, except when filling an unfinished term, each member only serves one term, further insulating decision-making from politics. The Fed's policy decisions do not require congressional approval, and the President cannot ask for a Federal Reserve Governor to resign as the President can with cabinet positions.

Which of the following is the specific interest rate targeted in open market operations?

federal funds rate

The specific interest rate targeted in open market operations is the federal funds rate. The name is a bit of a misnomer since the federal funds rate is the interest rate that commercial banks charge making overnight loans to other banks. As such, it is a very short term interest rate, but one that reflects credit conditions in financial markets very well.

Which of the following is an institution that provides short-term emergency loans in conditions of financial crisis?

A lender of last resort is an institution that provides short-term emergency loans in conditions of financial crisis.

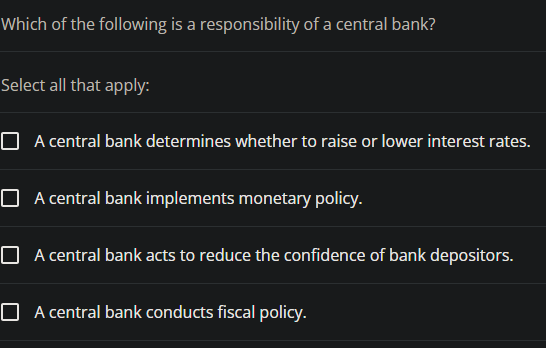

A central bank determines whether to raise or lower interest rates.

A central bank implements monetary policy.

The Federal Reserve, like most central banks, is designed to perform three important functions:

conduct monetary policy

promote stability of the financial system and

provide banking services to commercial banks and other depository institutions, and to the federal government.

Which of the following is not a result of raising the discount rate?

Banks extend more loans to individuals and firms.

When the discount rate is raised, banks decrease their borrowing of reserves from the Fed because funds are more expensive. Thus, less money is available to lend. As a result, the money supply will decrease, and interest rates will increase.

True or false?

The federal funds rate is a long-term interest rate.

False

The federal funds rate is the interest rate at which one bank lends funds to another bank overnight; therefore, it is a short-term interest rate.

When the Federal Reserve purchases bonds from Bank XYZ, where does it get the money to do so?

The money is created by the Fed.

A central bank has the power to create money. When buying government bonds, the Fed writes a check to the seller, and the seller's commercial bank has that amount credited to its account with the Federal Reserve.