ACA BST

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

What are the four key components of a mission statement?

Purpose, Values, Policies, Strategy

What is the definition of strategy?

Long-term direction and scope to achieve a competitive advantage through the configuration of resources to meet the needs of the markets and fulfil stakeholder expectations.

What makes planning strategic?

Longer term, considers whole organisation, considers resources and external environment, considers all stakeholders, looks at gaining a sustainable competitive advantage

Rational approach to strategic planning

formal and systematic, identify goals and select strategies to achieve them

Merits of strategic planning

Provides a framework.

Encourages long-term

planning.

Goal congruence.

Considers the needs of stakeholders.

Optimised use of resources.

Considers changes in the business environment. Monitors progress

Demerits of strategic planning

Lack of evidence to prove that it leads to success. Businesses may need to be more dynamic and react to problems as they occur.

Formal planning reduces initiative and innovative thinking.

Political infighting can disrupt the process

What are emergent strategies (aka bottom up approach)?

Behaviours adopted that have a strategic impact, emerge over time in response to the environment

Suitability of the emergent approach

Dynamic environments and require quick decision making

Have flexible, decentralised structures, managers can make decisions

Different grades of strategy (Mintzberg)

Intended strategy - conscious decision

Deliberate strategy - put into practice

Realised strategy - resultant energy

Unrealised strategy - strategy not implemented

Emergent strategies - develop over time

Resource-based (inside-out) strategic advantage

focus on developing internal competencies and resources that are hard to imitate and find or create markets to exploit these strengths

Risks of resource-based strategic advantage

may fail to react to long-term industry trends,

may find their resources and competencies are no longer valued by the customer

Positioning (outside-in) strategic advantage

analyse the external environment to identify customer needs and adapting to meet those needs

Risk of positioning strategic advantage

forced to constantly evolve and develop new competencies as customer's needs are ever changing

Influences on planning horizons

Nature of ownership - quick returns vs long term provision

Capital structure - banks may expect returns over a long period of time

Nature of industry - high level of capita; expect returns generated over a long period of time

Nature of Business Environment - dynamic industry, may be better to plan short term and react to current market

Nature of Management - need time and skill to master long-term planning

What is a mission statement?

Brief statement set out in general terms which doesn't include a timeframe or commercial terms, written to internal and external stakeholders.

Rational approach - mission at the start point of strategy formulation

Advantages of a mission statement

Help resolve stakeholder conflict

Set the direction of the organisation and so help formulate strategy

Help communicate the values and direction of the organisation to stakeholders

Criticisms of mission statements

Often full of meaningless terms, give staff little idea of what to aim at

Often ignored by managers

Often considered to be just a PR exercise

Objectives should be SMART

Specific, Measurable, Achievable, Realistic, Time-bound

Objectives of profit-making entities

Primary - maximise shareholder wealth

Secondary - e.g. customer satisfaction, social responsibility, innovation, meaningful employment

Objectives of not-for-profit entities

Primary - maximise benefit to target stakeholder

Secondary - e.g. investing in staff, minimal impact on the local environment, economy, efficiency, effectiveness

Issues with the objectives of NFPs

Often have multiple objectives to consider

Difficult to measure as success is typically non-financial

Stakeholder conflicts more difficult to resolve as they usually have a wide range of influential stakeholders

Financial constraints may limit the amount that they can achieve

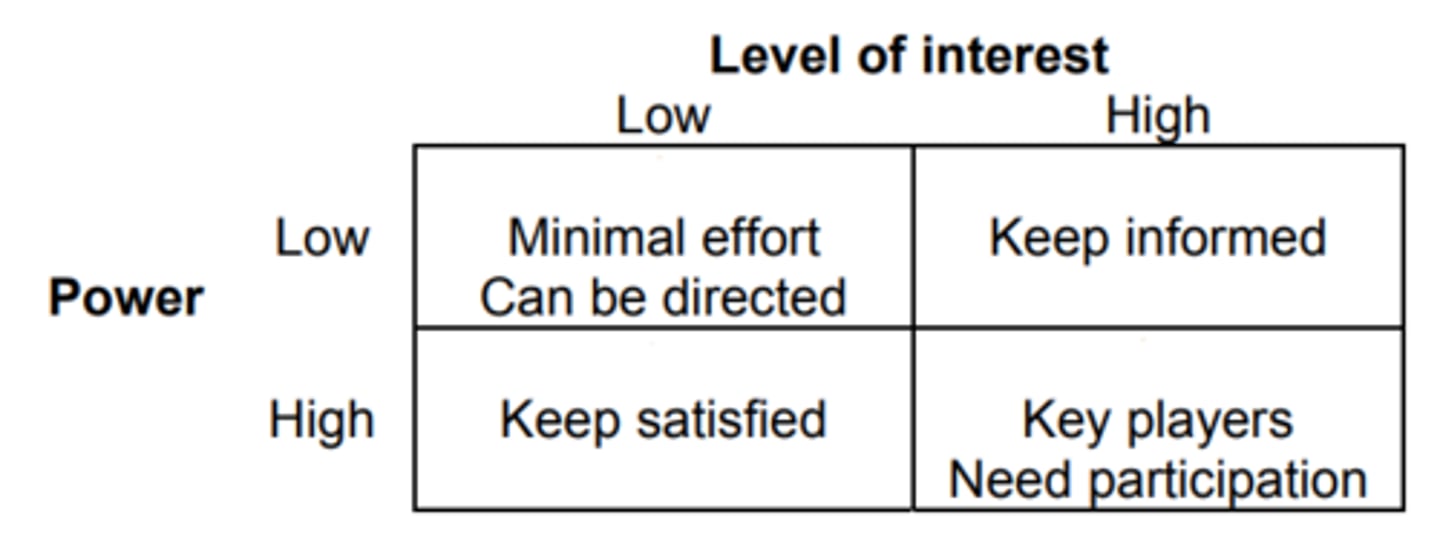

Mendelow's Matrix for stakeholder mapping

Interest - Power

L-L - minimal effort directed

L-H - keep satisfied

H-L - keep informed

H-H - key player needs participation

What is a stakeholder?

Any group or individual with an interest in what the organisation does

What are the 3 business environments?

Internal Environment -> Industry -> Macro

To analyse: industry - 5 forces

macro - PESTEL

Macro Environment

Consists of external factors that effect the overall environment that the business operates in

Industry Environment

Consists of external factors affecting the competitiveness of the industry that the business operates in

Internal Environment (Internal Capabilities)

Consists of the organisation's own internal resources and capabilities

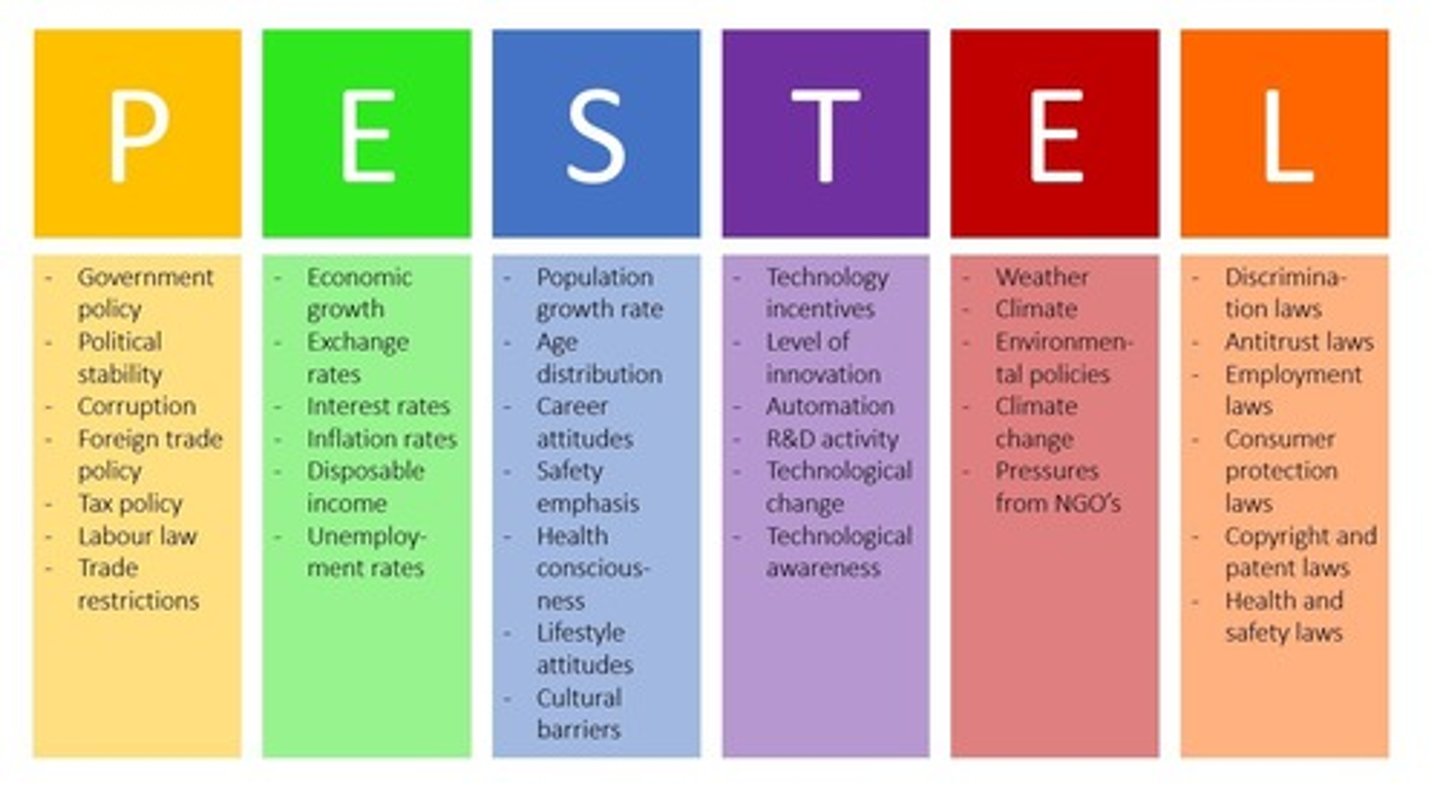

PESTEL Analysis

Political

Economic

Social

Technological

Ecological

Legal

Scenario Planning

Concerns the development of pictures of potential futures for the purpose of managerial learning and the development of strategic responses

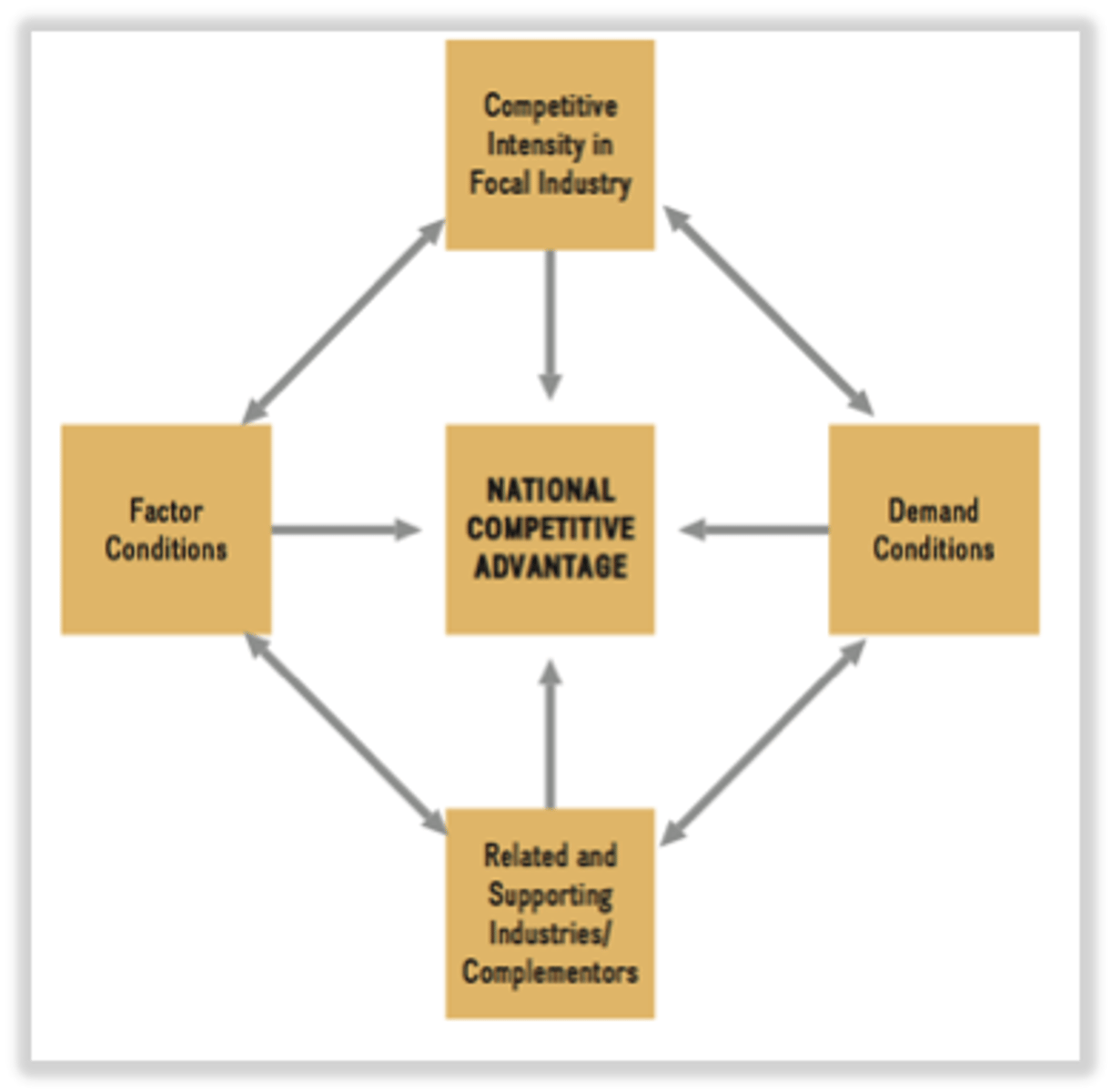

Porter's Diamond

4 key determinants of national competitive advantage

Demand conditions

Strategy, structure and rivalry

Related and supporting industry

Factor Conditions

Porter's Diamond - Factor Conditions

Supply side

availability of the factors of production e.g. HR physical resources, infrastructure, capital, knowledge

Porter's Diamond - Demand Conditions

demanding local consumers force firms to become more innovative

trend setting local consumers help local producers to anticipate future global trends

Porter's diamond - Related and Supporting Industries

proximity leads to:

easy access to components, with reduced lead times and carriage costs

encourages knowledge sharing which increases innovation

Porter's Diamond - Strategy, Structure and Rivalry

Strong domestic rivalry forces local firms to become more efficient to survive

The strategies or structures that have become prevalent in a particular nation may give advantages in particular industries

What is an industry?

Group of organisations supplying a market offering similar products using similar technologies to provide customer benefits

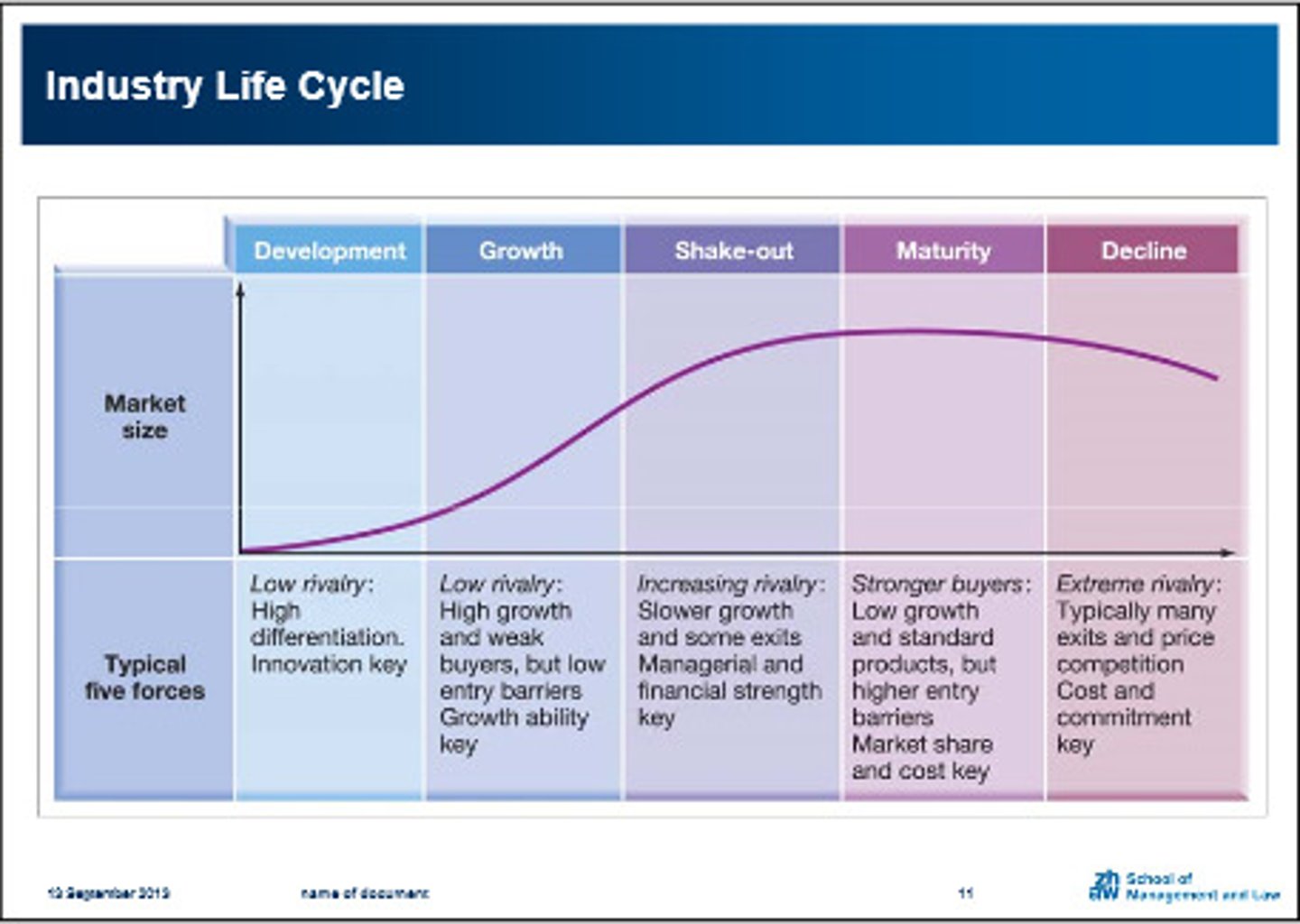

Industry Life Cycle

Introduction

Growth

Shakeout

Maturity

Decline

Key stages of industry life cycle - introduction

new product or service invented

can be significant first mover advantage for the first firms in the market (reputation and experience)

Key stages of industry life cycle - growth

rapid growth

market becomes attractive to new entrants

competitive rivalry is relatively low as firms are experiencing growth without having to increase market share

Key stages of industry life cycle - shakeout

market growth begins to slow

weaker players are forced to leave the industry or merge with another company

Key stages of industry life cycle - maturity

stable period of low growth

competition intensifies and smaller competitors (who lack scale economies) are shook-out of the industry

Key stages of industry life cycle - decline

sales volumes start to fall as demand declines

firms leave the industry and eventually it ceases to exist

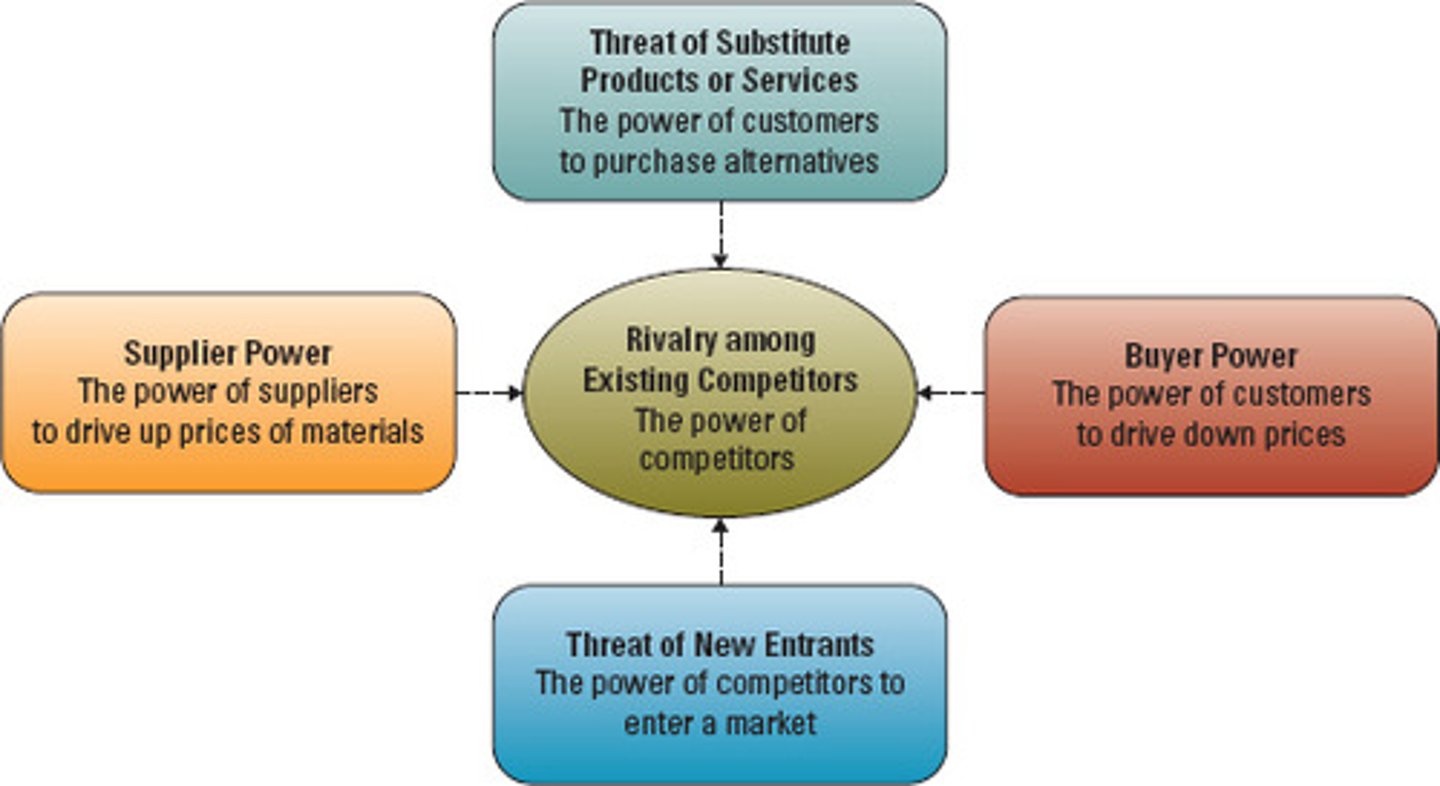

Porter's Five Forces

Determine the level of competition and therefore profitability of the industry

Threat of new entrants

Bargaining power of customers

Bargaining power of suppliers

Threat of substitutes

Competitive rivalry

Porter's 5 Forces - threat of new entrants

Market Attractiveness:

high industry growth, high profit margins, few existing competitors, easy customer switching

Barriers to entry:

economies of scale, brand loyalty, capital requirements, access to distribution, patents, government subsidies

Porter's 5 Forces - competitive rivalry

Higher if there are:

large number of existing competitors

high levels of fixed costs

low industry growth

low switching costs

high exit barriers

high strategic importance

Porter's 5 Forces - threat of substitutes

Availability of substitutes:

from different industries e.g. rail vs bus

from sub-industries e.g. CD vs MP3

Increased likelihood:

price of substitute is low

relative performance of the substitute is comparable

customers can switch easily

Porter's 5 Forces - power of customers

Higher if there are:

small numbers of large customers

large number of competitors

low levels of product differentiation

low switching costs

the customers own profitability is low

high degree of price transparency in the market

Porter's 5 Forces - power of suppliers

Bargaining power will be increased if:

few large suppliers

supplier's products are differentiated

high switching costs for the customers

the supplier has other buyers they can sell to instead

Different types of suppliers:

providers of raw materials

service providers and outsourced services

employees and hire workers

What are critical success factors (CSFs)?

a small number of key goals vital to the success of the organisation

What product features are valued by customers and where must the organisation excel? What resources and competencies will enable them to achieve its CSFs?

What are threshold resources?

Basic resources needed by all firms in the market

What are unique resources?

Resources which are better than those of the competition and difficult to replicate, giving the firm a sustainable competitive advantage

9Ms Model

Checklist when performing a resource audit

Men (HR) - number, skills, potential etc

Machines - premises, location, capacity, age

Money - existing finance, access to future funding

Materials - relations with suppliers, access to inputs

Markets - existing customers, locals, distribution syst

Management - quality, skills, leadership style

Methods - activities and processes adopted

Management Information Systems - quality to assist in marketing, production, R&D

Make-up - attitudes, culture, structure

Human Capital

considers the collective attributes of an organisation's HR E.g. capabilities, creativity, skills and knowledge of the workforce and how these combine to create economic value

Programmes to enhance the value of the workforce

Education and training

Allowing creativity

Infrastructure

Recognising the intellectual property

Motivation

Competition

Participation in activities

Flexible workplace arrangements

Home working

Improvements in technology e.g. cloud computing

Core competencies

critical activities and processes which enable the the firm to meet the CSFs and therefore achieve a sustainable competitive advantage

Kay's Core Competencies Model

Reputation - reason customers are attracted

Competitive architecture - network of relationships - internal (employees), external (suppliers, customers, intermediaries), network (collaborating businesses)

Innovative ability - ability to develop new products and services

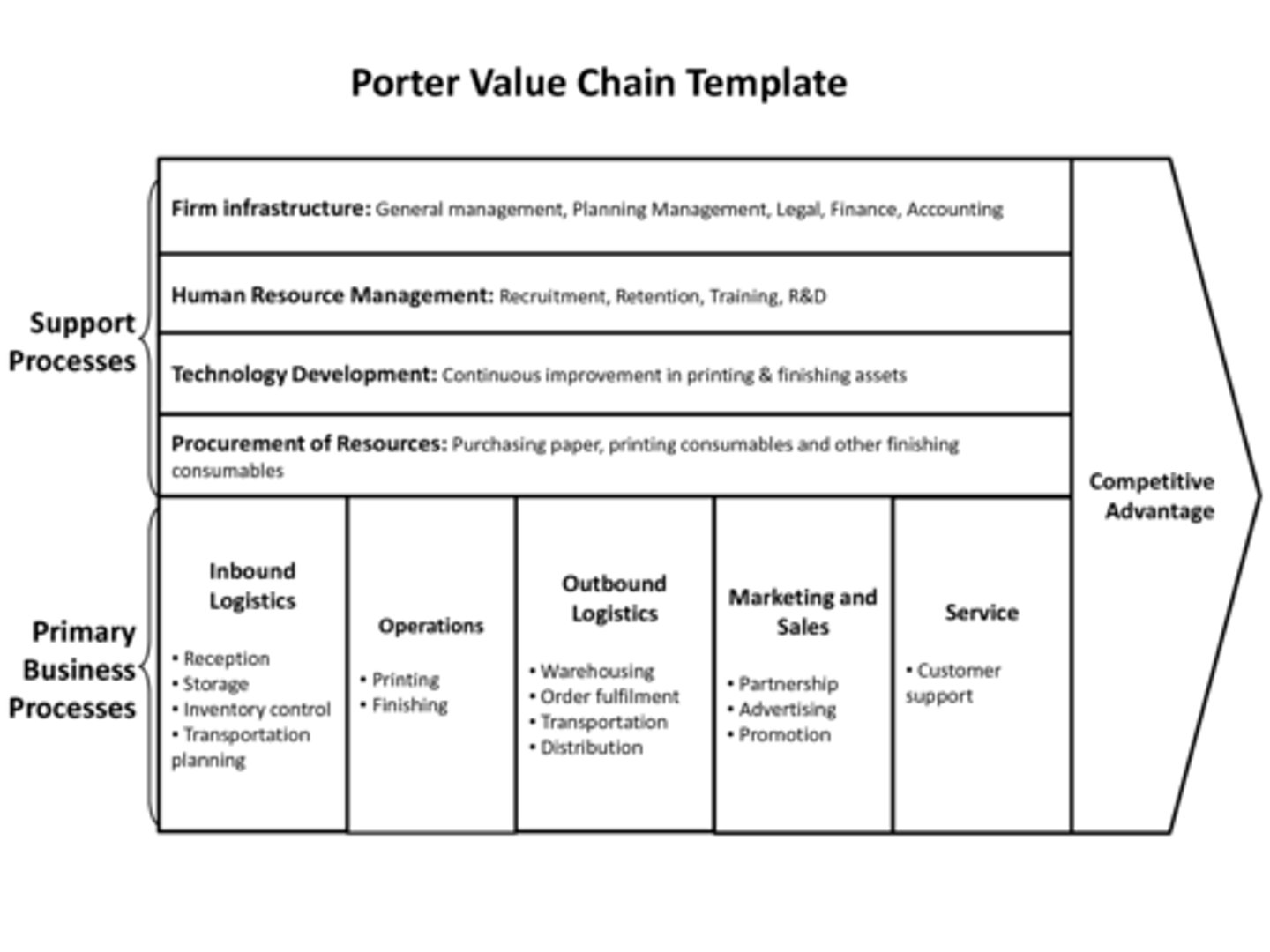

What is a value chain?

Identifies the relationships between the company's resources, activities and processes that link the business together and create a profit margin

Porter's Value Chain Analysis

value is measured by the difference between the cost of the activities and sales revenue created by sales to customers

non-value adding activities can be identified and reduced or eliminated

Performing a value chain analysis

1. Identify the generic strategy

Cost leadership - seeking to be the lowest cost producer in the industry - should seek cost advantages throughout the value chain

Differentiation - creating tangible and intangible product features that the customer is willing to pay more for - should seek quality advantages throughout the value chain

Cost drivers

factors that cause costs to be incurred. Important for a cost leader who is trying to reduce costs

Value drivers

Potential sources of value. Important for differentiators who are trying to generate quality advantages in their value chain

Value chain analysis - Primary Activities

Inbound logistics - receiving, storing and distributing inputs of the products

Operations - transform inputs into final product

Outbound logistics - collecting, storing and distributing the final product

Marketing and Sales - informing, persuading and enabling to buy product

Service - after sales services e.g. installation, repair, training and customer service

Value chain analysis - Supporting activities

Procurement - processes for acquiring the various resource inputs to the primary activities

Technology development

HR management - recruiting, managing, training, developing and rewarding internally

Infrastructure - systems of planning; finance, QC, info management, structures and routines to sustain the culture of the organisation

Linkages in the value chain

Internally - two or more activities in the chain impact each other. 2 types:

co-ordination - consistent with each other and work together

optimisation - strength in one area can lead to committing fewer resources to another

Externally - internal should be consistent with customer's and supplier's chains

Strengthening the value chain

Outsourcing - external providing performing traditionally in-house activities

Automation - equipment to replace a process

Shared service centres - number of internal activities brought together into one site

Harmon's process-strategy matrix

Low importance low complexity - automate/outsource - processes are simple and straightforward

High importance and low complexity - automate - processes important to the organisation but simple to perform

Low importance and high complexity - outsource - processes add little value, but are too complex for automation

High importance and high complexity - improve - processes are a core competence and should be improved as much as possible

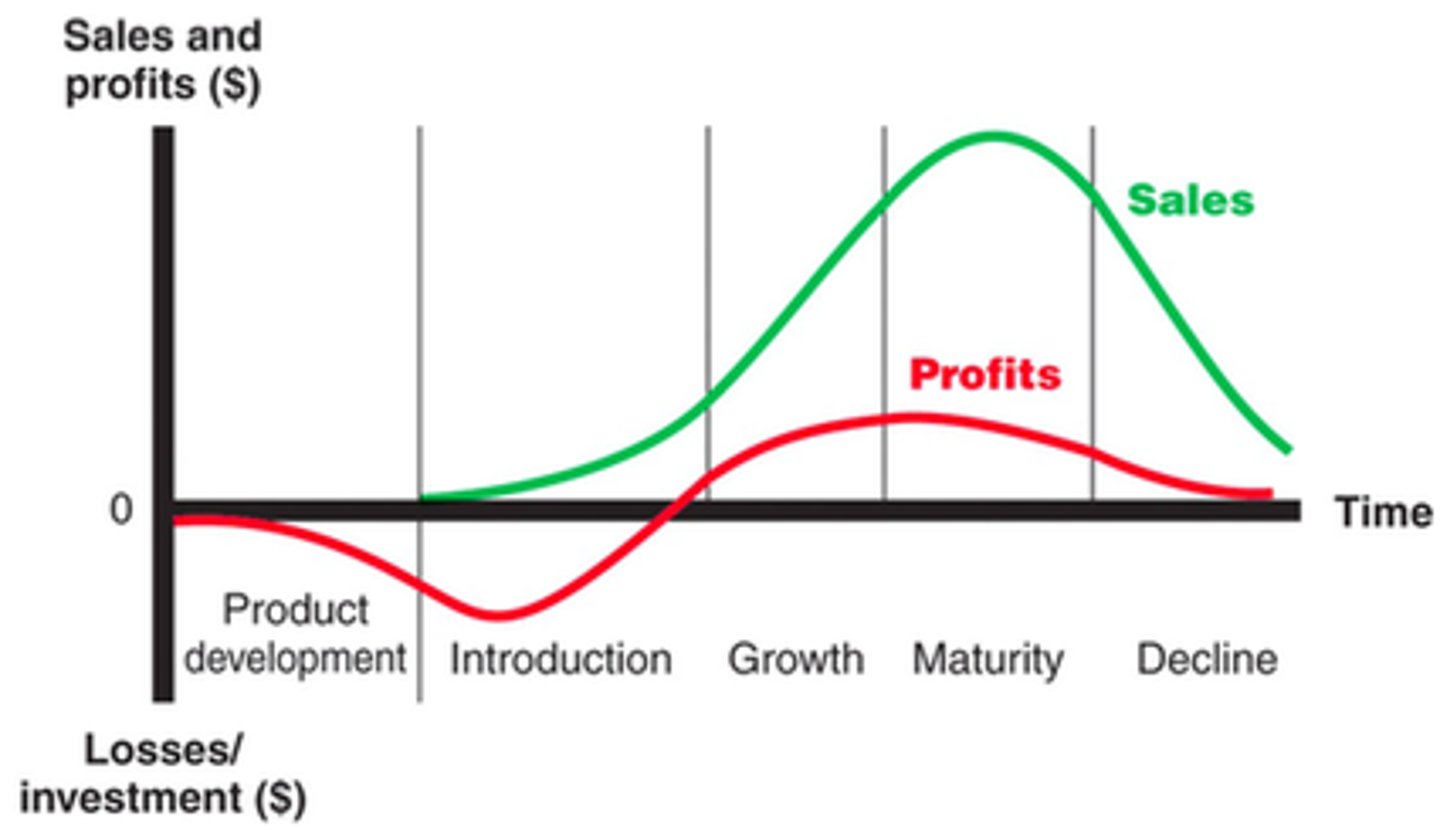

Product Life Cycle

application of life cycle theory to product or services

Development-Introduction-Growth-Maturity-Decline

Stages of the product life cycle

Development - negative cashflows (investment in R&D and initial marketing), market research

Introduction - continued cash outflow (high marketing>initial sales), initial demand (will determine pricing policy)

Growth - new competition (quality improvements to compete), economies of scale (emerge through mass production)

Maturity - critical mass (leads to cost efficiencies), positive cashflows (max sales, min marketing)

Decline - heavy price discounting (utilise spare capacity and cover overheads), brand loyalty (may be key to retain customers)

Too many products in one phase can cause problems e.g. cash flows

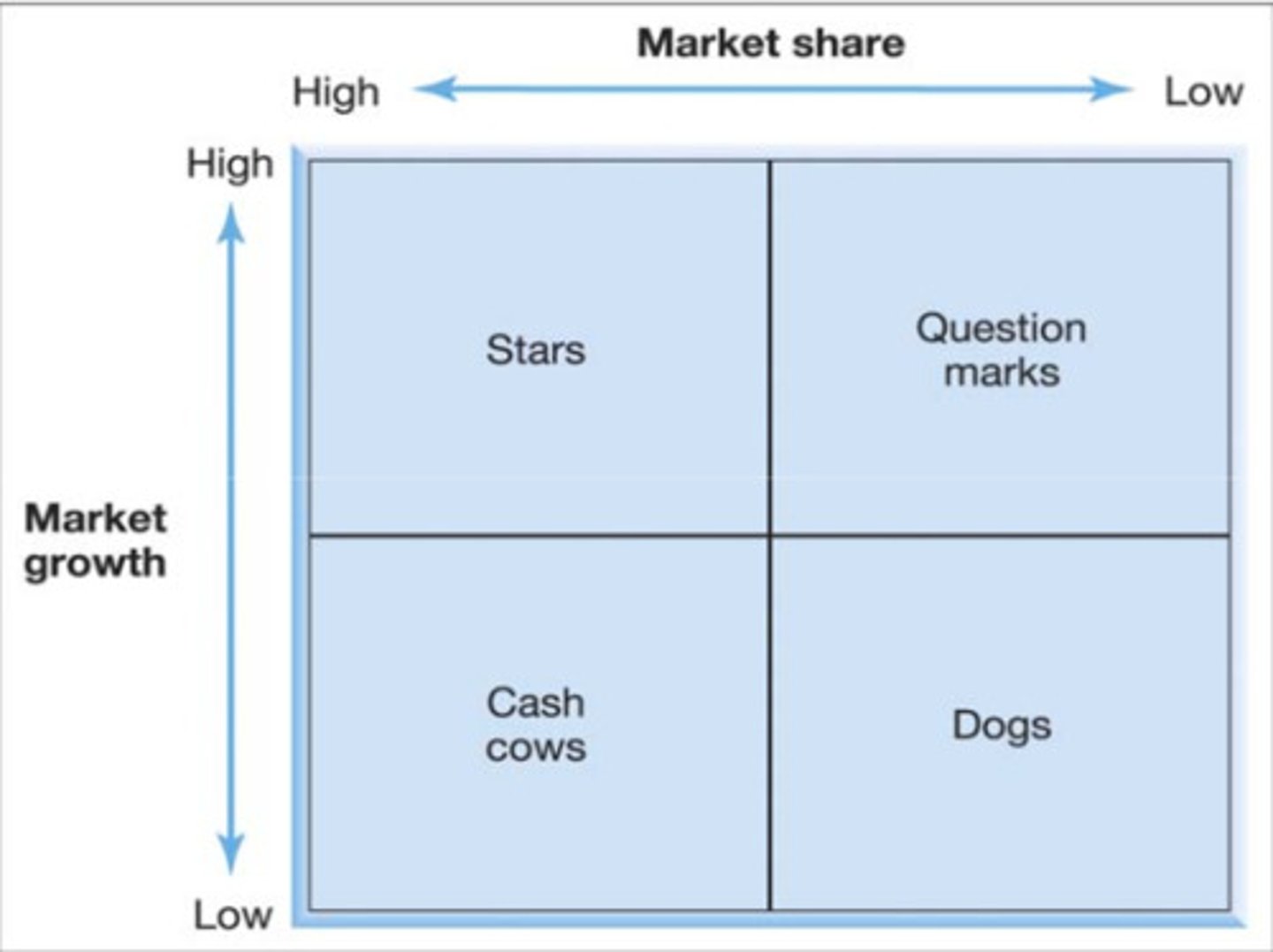

BCG Matrix

Help decide where to allocate resources

Market attractiveness - measured by market growth

Competitive strength - measured by relative market share RMS = sales/largest competitor's sales

BCG Matrix - Problem Child

Definition - attractive market but don't have the market share to be competitive

Implications - lack of economies of scale limit cash flow

Decisions - should the company invest further to gain market share?

BCG Matrix - Star

Definition - Dominant position in an attractive market

Implications - high threat of new entrants requires the company to continue to invest to defend market share

Decisions - consolidate current position or invest further to seek additional growth?

BCG Matrix - Cash Cow

Definition - dominant position in a low growth market

Implications - competitors will decide not to attack out market share as the market does not warrant the investment, large positive cash flows can be achieved

Decisions - 'milk the cow' and enjoy cash flows accepting market share may fall

BCG Matrix - Dog

Definition - low share of an unattractive market

Implications - product may lack economies of scale but the market is not attractive enough to seek growth

Decisions - when should the company 'put the dog down' and divest from this product?

SWOT Analysis

Internal and external analysis used to perform a corporate appraisal to evaluate the strategic position of the organisation

Strategic Impact of SWOT analysis

can strength match opportunities?

address weaknesses before pursuing opportunities

sufficient strengths to minimise threats?

can weaknesses be converted into strengths?

can threats be converted into opportunities?

gap analysis

comparison between entity's ultimate objective and the expected performance from projects

Why does the gap exist?

Strategies to close the gap?

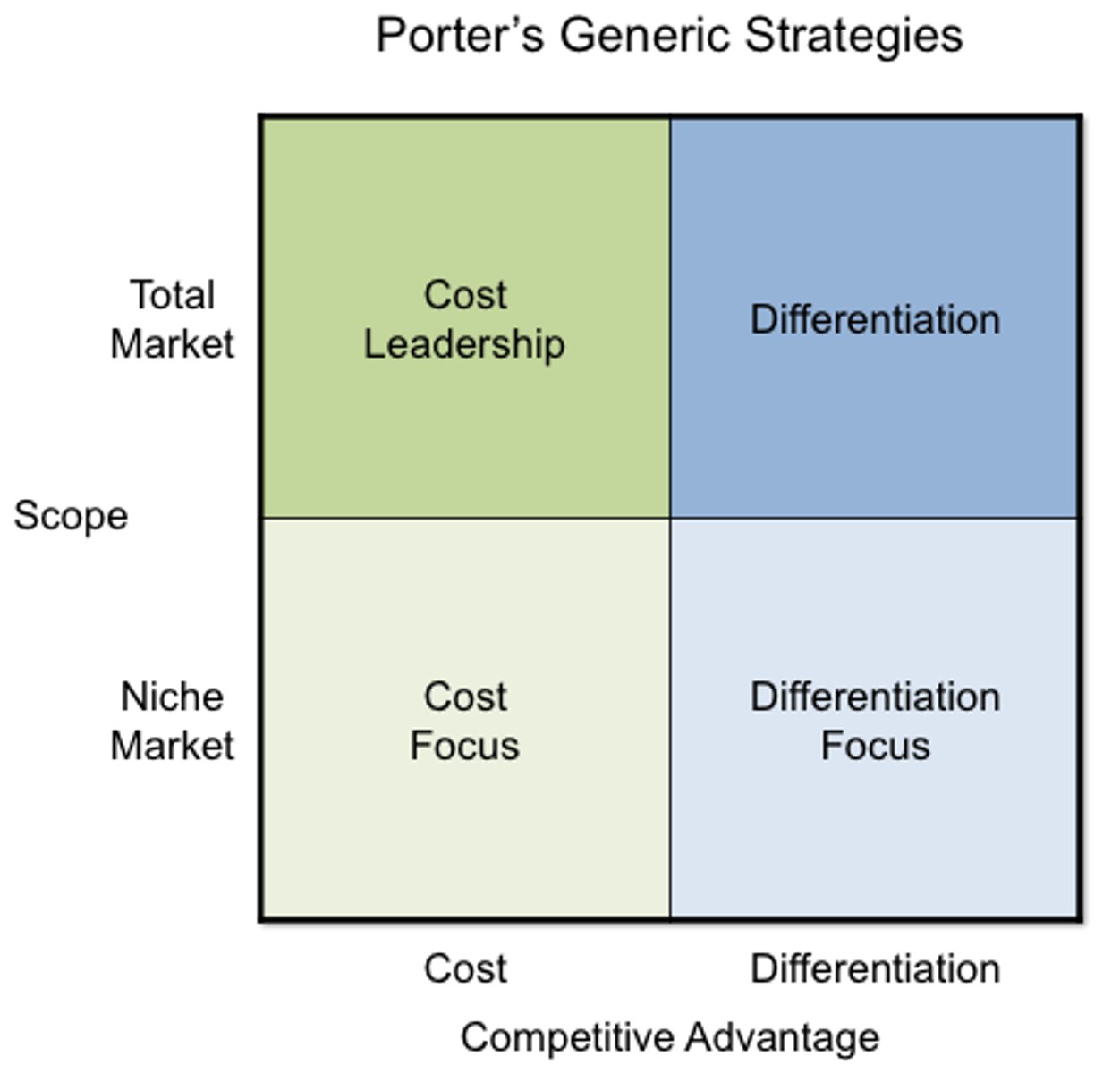

Porter's Generic Strategies

To obtain a sustainable competitive advantage, generic strategy which best fits the organisation's environment (5 forces) and then organising value-adding activities (Value chain analysis) to support the chosen strategy

Cost leadership - lowest cost producer

Differentiation - tangible and intangible features customer willing to pay for

Focus - utilising either in a narrow profile of market segments (niching)

Porter's Generic Strategies - Cost leadership strategies

To achieve: economies of scale, seek cheaper sources of supply, reduced labour cost, use value chain to identify non-key activities

Potential benefits: can earn higher profits by charging same price as competitors, remain profitable in price war, economies of scale create barrier entires

Risks: only room for one cost leader, cost advantage may be lost because of inflation, movements in exchange rates, competitors using cheap overseas labour etc, customers may pay extra for better product

Porter's Generic Strategies - Differentiation Strategies

Based on product features (actual) or altering consumer perception

To achieve: strong branding, product innovation, quality, product performance

Potential benefits: products command a premium price so higher margins, fewer perceived substitutes due to uniqueness and brand loyalty - demand less price sensitive, less direct competition

Risks: cheap copies, being out-differentiated, customers unwilling to pay the extra, differentiating factors no longer valued by customer

Porter's Generic Strategies - Focus/Niche Strategy

Focus on segment of market rather than whole market

To achieve: identify segment of customers/consumers with similar needs, choose differentiation or cost-focus, develop products to meet the needs of the segment, develop a marketing strategy to specifically target chosen segment

Potential Benefits: smaller segment so smaller investment in marketing/production to develop competitive advantage, less competition, entry is cheaper and easier

Risk: if segment too small, difficult to achieve sufficient sales, if too large then large players may become interested

Ansoff's Matrix

Existing products, existing markets - market penetration (more sales of existing products to existing markets)

New products, existing markets - product development (developing new products for existing markets)

Existing products, new markets - market development (finding new markets for existing products)

New products, new markets - diversification (developing new products for new markets)

Ansoff's Matrix - Market Penetration

To achieve: competitive pricing, advertising or sales promotion, improving competitive advantage through adjustments in the value chain

Potential Implications: greater market strength and economies of scale, lack of diversification

Ansoff's Matrix - Product Development

To achieve: invest in R&D

Potential implication: the business should already have good knowledge of their customers, product failure may damage the brand

Ansoff's matrix - Market Development

To achieve: new geographical markets or market segments, using new distribution channels

Potential implications: market research may be needed to overcome lack of market knowledge, customer's awareness may need to be generated in the new market

Ansoff's Matrix - Diversification

seeks growth in new markets with new products

Related diversification (concentric)

Unrelated diversification (conglomerate)