Lecture 9 + 11 + 12

1/27

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

28 Terms

What does it mean when we say there is a bubble?

when house prices are unreasonably high and keep increasing

cause: faulty credit markets.

6 facts about real estate cycles

Heterogeneity in boom-busts across space

Implies that only some cities grow more astronomically.

Boom bust of 1980s looks a lot like 2000s

Local housing markets have different timing of their cycles

Largest booms and busts are clustered (coastal MSAs + Florida)

Cross-section variation in house price changes is larger in booms than busts

Patterns hold if you control for demand factors (rents, incomes, employment)

Economic boom

Labour market shifts out,

Equilibrium residents/ workers increase

Housing market demand shifts out, house prices up

Economic Bust

Shifts in labour demand

Labour market shifts in

Equilibrium residents and workers down

Housing demand shifts in, prices down

what determines the response of prices to changes in economic activity

elasticity of supply

elastic supply: home prices will not increase as much even if demand shifts out

inelastic supply: home prices will increase a lot due to shift in demand as more pressure on prices.

What happens in a housing bubble?

expected capital gains increase

this decrease the user cost of capital (i + h + d + m - g) —> causes demand to shift out —> prices up —> capital gains up —> cycle again.

if prices are increasing more than rents, there is likely a bubble.

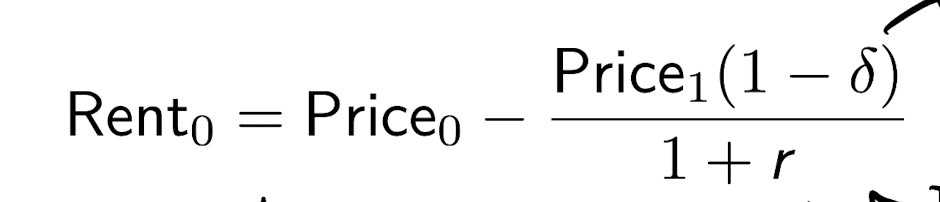

What should rent be?

rent should be the cost of holding a house for 1 year and selling it after.

if prices grow more, rent goes down.

if interest rates go down, rent goes down

if depreciation goes down, rent goes down.

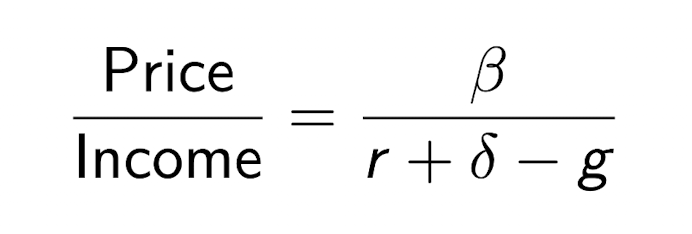

Price-to-rent ratio

represents the value of an asset relative to the income stream it generates, similar to a price-earnings ratio.

if r increase, price rent goes down

if g increases, price rent goes up,

if the ratio is very high, there is likely a bubble.

Issues with price to rent ratios?

tends to be higher in high-cost markets

issue with measuring quality

hard to compare similar owned and rented homes

as such, it is better to look at trends in the ratio as compared to the ratio itself.

Price-to-income ratio

is a measure of bubbliness and affordability

tells how many years of income would take to buy a home.

annual rent is B*income where B is proption of income spent on housing

B

Can increase if income decreases or if housing becomes more expensive, causing the price/income ratio to increase

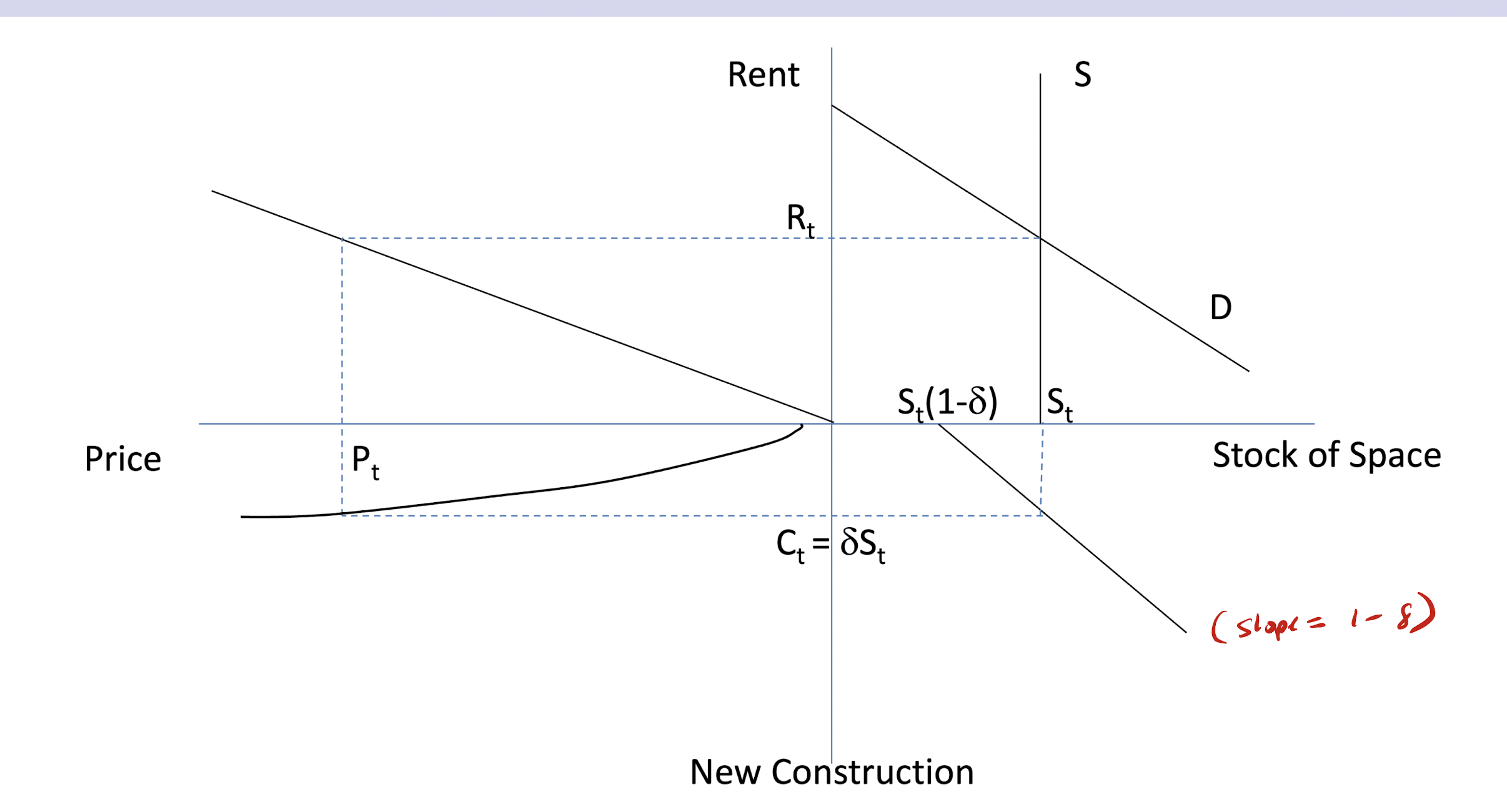

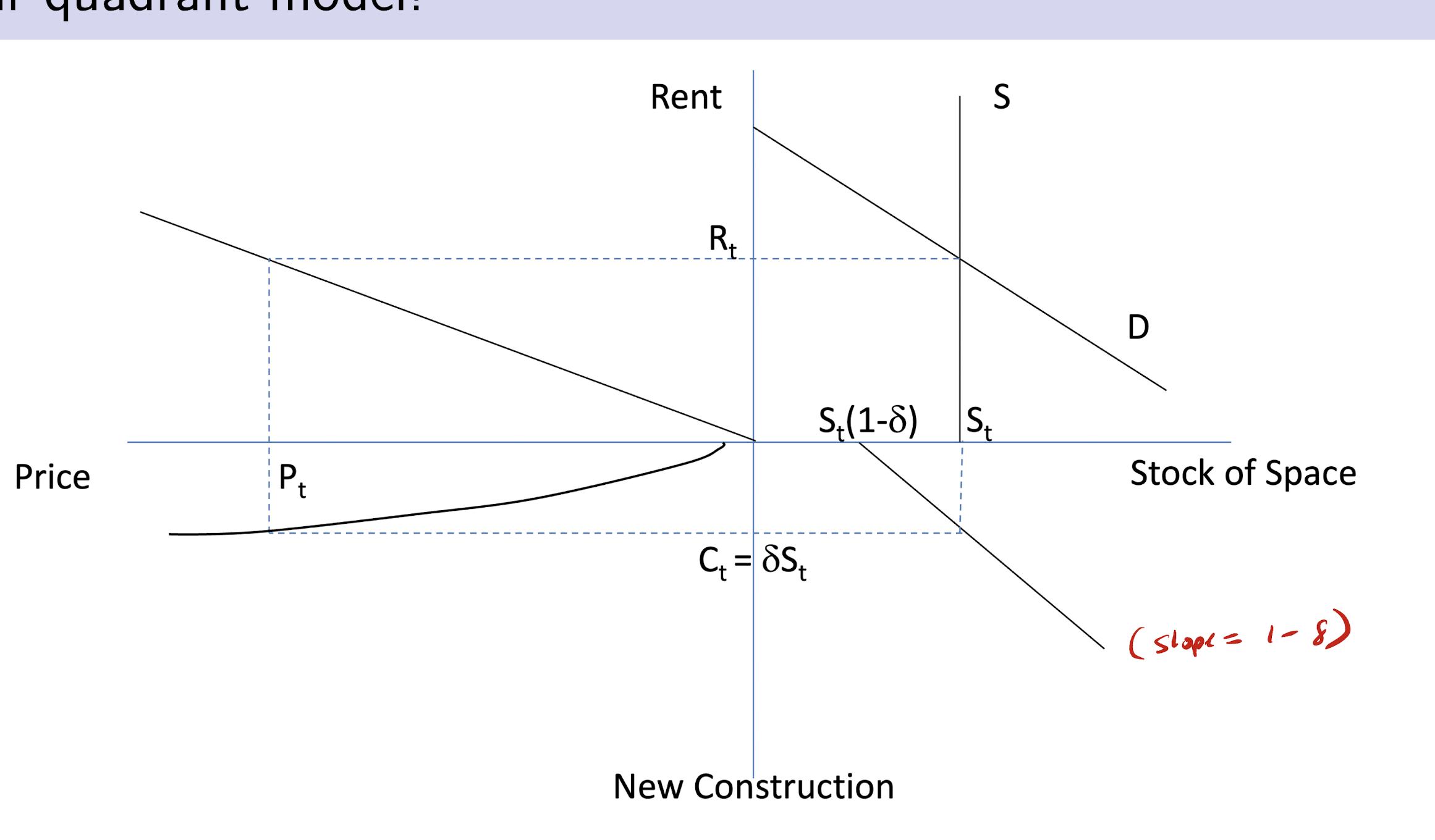

The four quadrant model

shocks have low adjustment because of

1) construction lags

2) slow depreciation of stock

Types of shocks in 4 quad model?

1) demand shocks (impact space market)

2) cap rate shocks (changes to i, g, or d) impact asset market

3) supply/construction costs (impact construction market)

4 markets that determine real estate activity

1) space market clearing (UR

2) asset market clearing (UL)

3) construction market (LL)

4) stock market (LR)

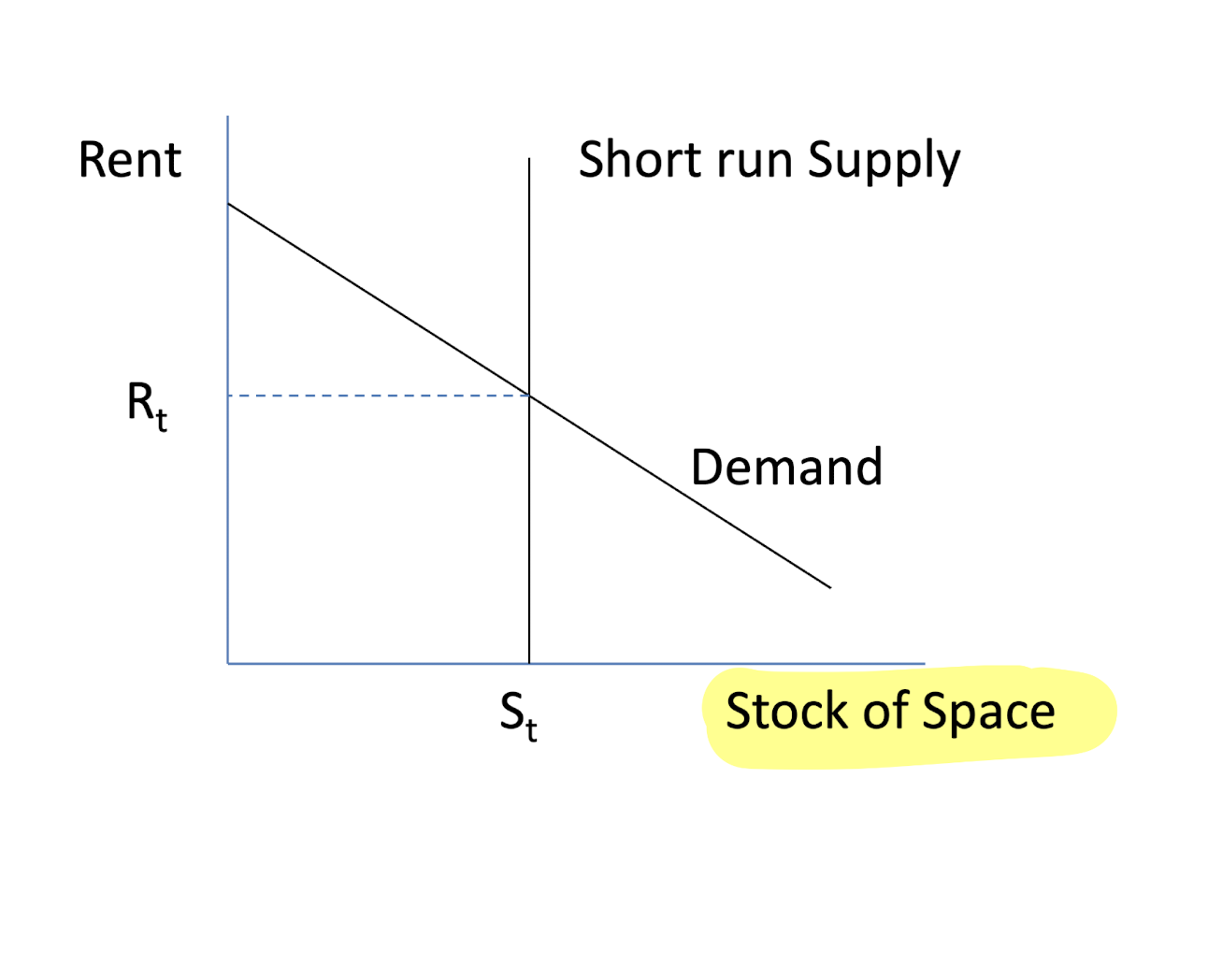

upper right quadrant (space market)

rents are determined by Q(s) = Q(D)

supply is perfectly inelastic in the short run

x-axis: stock of space

y-axis: rent

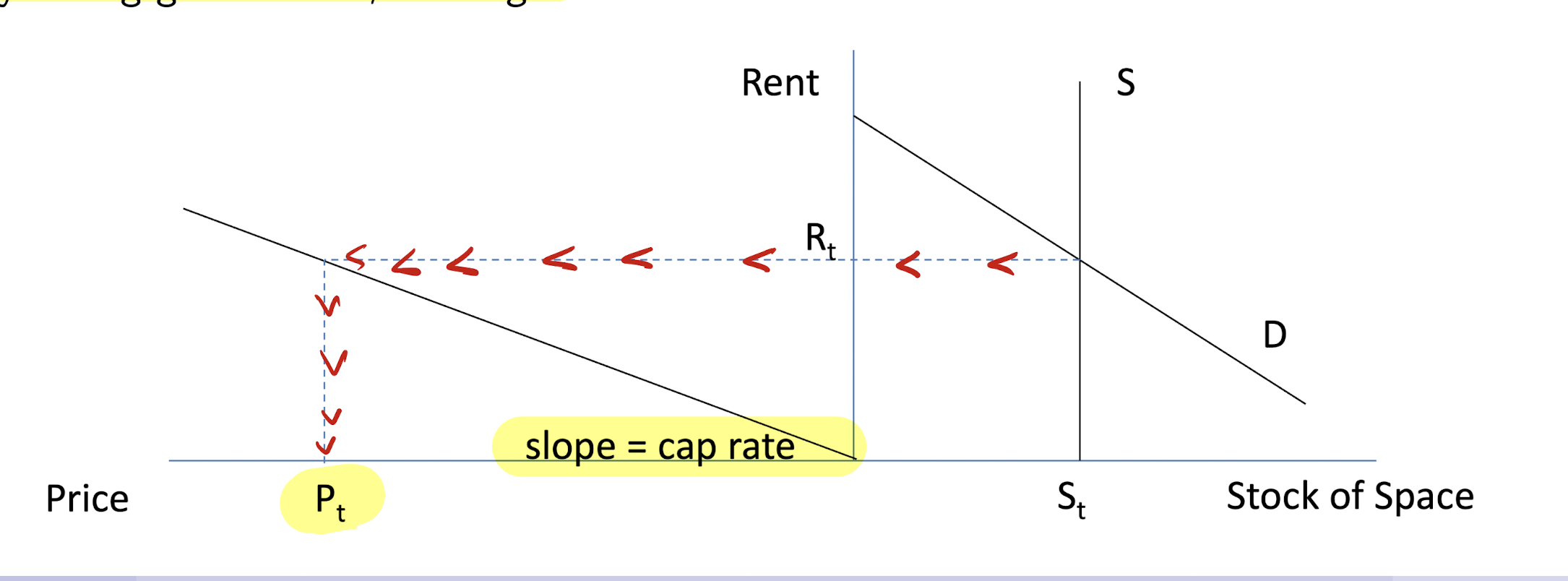

upper left quadrent (asset market)

developers want to know how much market rent converts into sales price

formula : price = rent/cap rate

X-axis: price

y-axis: rent

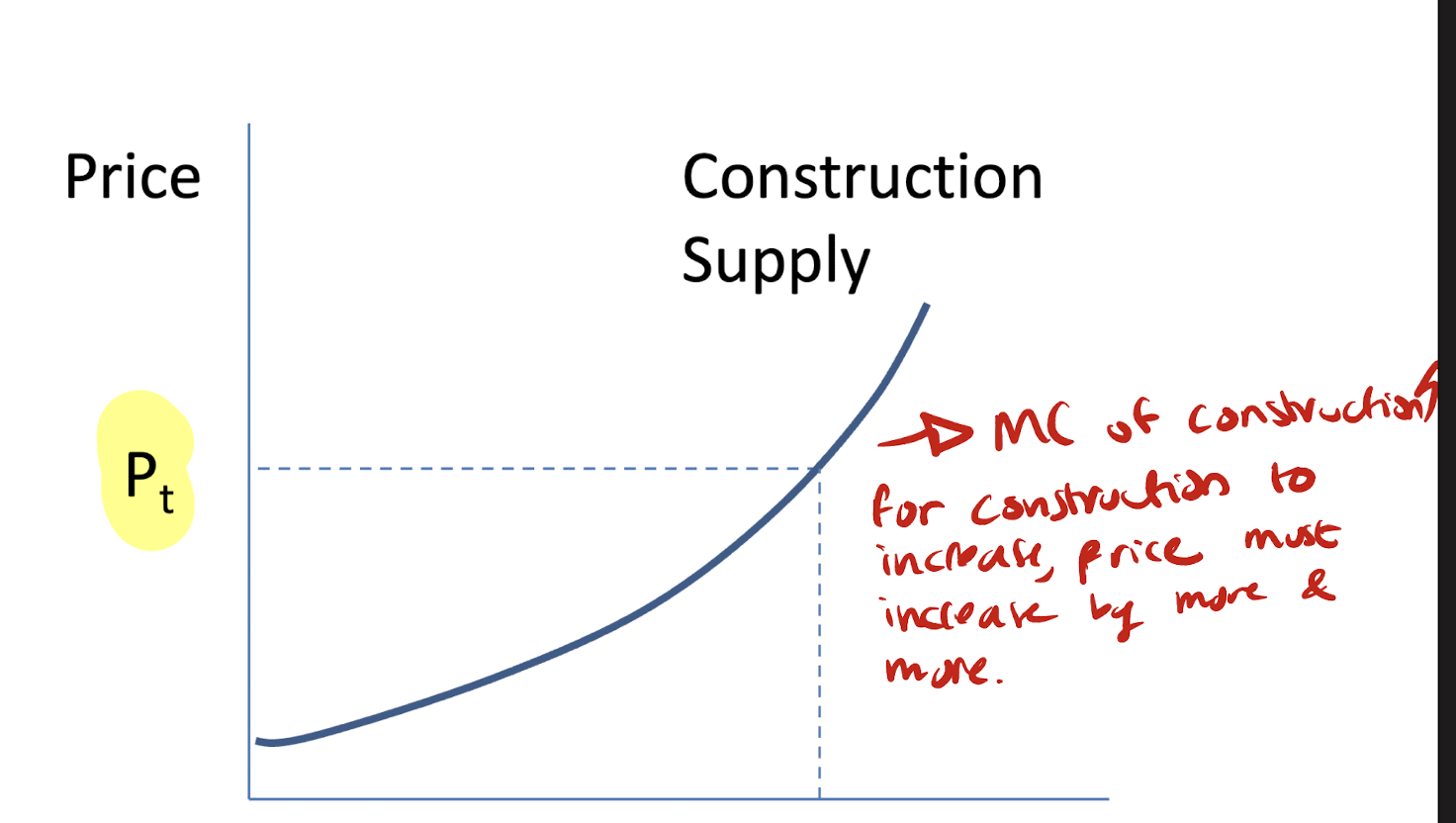

lower left quadrant (construction market)

new construction depends on price — developers build more if price is higher

slope: MC of construction —> increasing due to regulations/limited land availability/ higher tech with building taller buildings

x-axis: price

y-axis: newconstruction

lower right quadrant (stock market)

stable equilirbrium: C = D(s) s.t. change in stock is zero.

x-axis: stock of space

y-axis: new construction

slope : 1-d

Securitization

buying mortgages off bank balance sheets and selling to investors as canada mortage bonds

mortgages in canada terms

25-30 years amortization in 5 -year terms

why did the financial crisis occuer?

before 2000, lending was prime and 20% deposit

in 2000s, lending standards relaxes, lending to subprime with no downpayments or proper income verificiation

as home prices rose, banks believed that even if borrowers defaulted, they could sell the house to recover the money

however, as home prices began to fall, borrowers defaulted and this started the crsis.

Mian and Sufi study

collected equafix data on subprime lending based on zip codes

data showed negative relationship between income growth and subprime mortgages

data showed increase in mortgage debt relative to other non-mortgage debt

data showed increase in default rates

data showed increase in investors buying subprime MBS.

data showed reduction in denial rate for subprime borrowers relative to prime

What is a brokerage system

brokerage system connects buyers with sellers

why are agents needed?

1) connect buyers and sellers

2) have expertise in pricing and valuations

3) manage all the transaction logistics

Issuers of agents

1) market power

2) moral hazad

3) adverse selection

market power

commisions are high in real estate market

entry of more agents has not lowered commisions

listing on MLS requires a broker

brokerage fee is a % while all other selling costs are usually fixed

steering effect: agents can steer buyers towards high-commision homes.

moral hazard

are agents acting in the best interest of their clients

are they acting just as clients would if they were fully informed?

the incentives of both parties are not aligned

agents

agents have an incentive to do more deals rather than get a better price for clients.

adverse selection

can clients tell if agents are good or bad?

the commision structure makes it easy for amatures to enter the market

unobserved agent traits impact the clients experience,