MGMT 4513 Midterm Exam

1/106

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

107 Terms

Strategic management

The study of why some firms outperform others

Analysis

Strategic goals (vision, mission, strategic objectives)

Internal and external environment of the firm

Strategic decisions

Where to compete?

How to compete?

When to compete?

Energizing actions

Vision, leadership, problem solving process, people development, organizational infrastructure, communications, performance measurement

Strategic direction

Mission, vision, strategy

Mission

Statement explaining why a company exists

- Provides context for all decisions within the organization

- Describes an enduring reality

- Is capable of infinite fulfillment (no time frame)

- Useful for both internal and external audiences

Vision

Crystalization of what leaders want firms to be

- Guides development of strategy and organization

- Describes an inspiring new reality

- Is achievable within a specific time period

- Primarily useful internally (slogans can be used externally)

Strategy plan

How to beat present and potential competitors

- Lists set of actions to provide products or services that create more value than their cost

- Constantly changes in response to analysis, customer experience, trial and error

- For internal use

2 approaches for evaluating firm performance

- Financial ratio analysis

- Stakeholder perspective

Stakeholders

Individuals and groups who can affect, and are affected by, the strategic outcomes achieved and who have enforceable claims on a firm's performance

External environments

General, industry, competitor

Attractive industry

- High entry barriers

- Suppliers and buyers have weak positions

- Few threats from substitute products

- Moderate rivalry among competitors

Unattractive industries

- Low barriers to entry

- Strong supplier and buyer bargaining power

- Strong threat from substitutes

- Intense rivalry

- Low profit potential

- No two firms are totally different

- No two firms are exactly the same

2 unassailable assumptions in industry analysis

Claims

Enforced by the stakeholder's ability to withhold essential participation

The 3 stakeholder groups

- Capital market stakeholders

- Product market stakeholders

- Organizational stakeholders

Capital market stakeholders

- Shareholders and lenders expect the firm to preserve and enhance the wealth they have entrusted to it

- Returns should be commensurate with the degree of risk to the shareholder (shareholders major suppliers of capital (e.g., banks)

Product market stakeholders

Primary customers, suppliers, host communities, union officials

Primary customers

Demand reliable products at low prices

Suppliers

Seek loyal customers willing to pay highest sustainable prices for goods and services

Host communities

Want companies willing to be long-term employers and providers of tax revenues while minimizing demands on public support services

Union officials

Want secure jobs and desirable working conditions

Organizational stakeholders

Employees, managers, nonmanagers

Employees

- Expect a dynamic, stimulating and rewarding work environment

- Are satisfied by a company that is growing and actively developing their skills

Two issues affect the extent of stakeholder involvement in the firm

- How to divide returns to keep stakeholders involved?

- How to increase returns so everyone has more to share?

Corporate governance

The relationships among various participants in determining the direction and performance corporations

- Shareholders

- Management (led by the CEO)

- Board of directors

The firm

- Goals and values

- Resources and capabilities

- Structure and systems

The industry environment

- Competitors

- Customers

- Suppliers

Strategic competitiveness

When a firm successfully formulates and implements a value-creating strategy

Sustainable competitive advantage

When competitors are unable to duplicate a company's value-creating strategy

Strategic management process

The full set of commitments, decisions, and actions required for a firm to achieve strategic competitiveness and earn above-average returns

Risk

An investor's uncertainty about the economic gains or losses that will result from a particular investment

Average returns

Returns equal to those an investor expects to earn from other investments with a similar amount of risk

Above-average returns

Returns in excess of what an investor expects tp earn from other investments with a similar amount of risk

Alternative views of "outperform others"

- The economic value model

- Objectives other than wealth creation

- Stakeholder surplus model

The economic value model

Strategy objective is to maximize shareholder wealth

Objectives other than wealth creation

Objectives that are used as surrogates for eventual wealth or the fulfillment of a mission

Stakeholder surplus model

Defines beneficiary group and maximizes wealth for total group

- To replace assets a firm must earn return on capital in excess of cost of capital

- To survive acquisition, firm must achieve stock market value in excess of break-up value

How do we know if a company is performing well at the minimum?

A comprehensive value metrics framework

1. Value drivers

2. Financial indicators

3. Intrinsic value

4. Shareholder value

Value drivers sources

- Market share

- Scale economies

- Innovation

- Brands

Financial indicators measures

- Return on capital growth (of revenues and operating profits)

- Economic profit (EVA)

Intrinsic value measures

- Discounted cash flows

- Real option values

Shareholder value measures

- Market value of the firm

- Market value added (MVA)

- Return to shareholders

Relationship of economic value to share price

Internal views, external views, and the translation process

Internal views

- Economic value

- Changes in financial efficiency

- Value of additional operating options

- → Economic value of strategy

External views

- → Share value (present strategy)

- → Alternate owners and uses of assets

- → Share price

Translation process

- Generic preference and credibility → market view

- Market view and communication → ____________

Mission statements, vision statements, strategic objectives

The hierarchy of organizational goals is in this order (least specific to most specific)

False

(T/F) Some excellent examples of mission statements are: "To be the happiest place on earth" (Disney) and "restoring patients to full life" (Medtronic)

False

(T/F) Organizational goals and objectives should be vague in order to allow changes in strategy

Economic value

Present operations and balance sheet

Financial ratio analysis

- Balance sheet

- Income statement

Stakeholder perspective

- Employees

- Customers

- Owners

General environment

Focused on the future

Industry environment

Focused on factors and conditions influencing a firm's profitability within an industry

Industry

A group of firms producing products thar are close substitutes

- Firms that influence one another

- Includes a rich mix of competitive strategies that companies use in pursuing strategic competitiveness and above-average returns

Competitive environment

Focused on predicting the dynamics of competitors’ actions, responses and intentions

- Sometimes called the task or industry environment

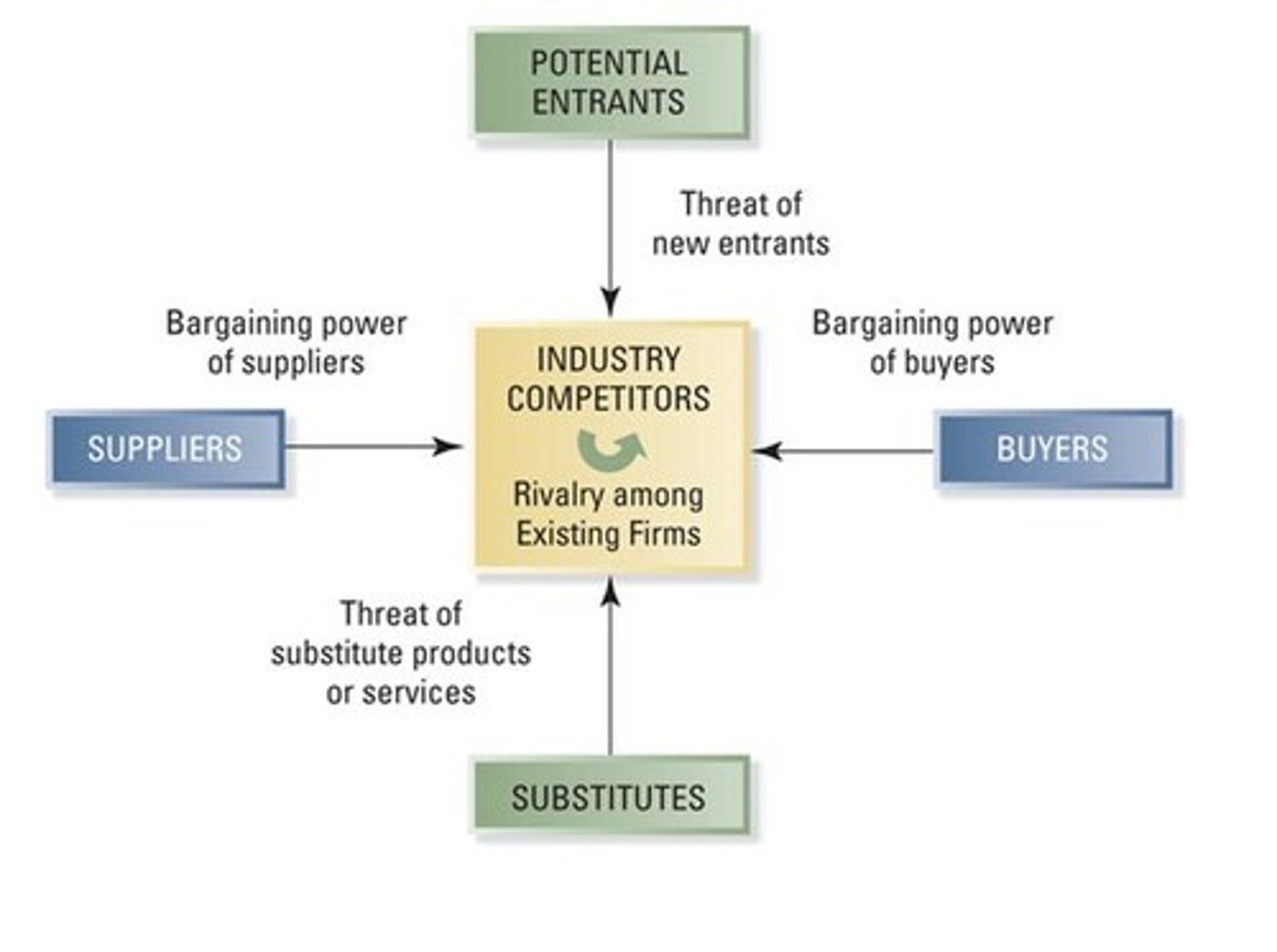

Porter's Five Forces Model

Potential Entrants

Substitutes

Suppliers

Competitors

Attractive Industry

Sociocultural changes

Increasingly larger numbers of women entering the work force since the early 1970s is an example of

An industry is defined as

A group of firms producing products that are close substitutes

Increase in demand for any given price

Shifts in a "textbook" demand curve:

- Price of substitutes rises

- Price of complements decreases

- Income rises

- Increase in desirable product attributes

- Shift in consumer preferences/demographics toward good

Decrease in demand for any given price

Shifts in a "textbook" demand curve:

- Price of substitutes decreases

- Price of complements rises

- Income decreases

- Decrease in desirable product attributes

- Shift in consumer preferences/demographics away from good

Switching price

Price at which product value equals the value of next best alternative for that customer or segment

- Must be for a particular product, given other products in the market

Demand curve

Summarizes relative value to each segment

"Textbook" smooth demand curve

Just approximation of underlying "kinked" demand curve defined by different switching prices for different customer segments

The threat of new entrants

Profits of established firms in the industry may be eroded by new competitors

Reduces threat of new entrants

High barriers of entry

- Economies of scale

- Product differentiation

- Capital requirements

- Switching costs

- Access to distribution channels

- Cost disadvantages independent of scale

- Government policy

- Expected retaliation

Economies of scale

Marginal improvements in efficiency that a firm experiences as it incrementally increases its size

Product differentiation

- Unique products

- Customer loyalty

- Products at competitive prices

Capital requirements

- Physical facilities

- Inventories

- Marketing activities

- Availability of capital

Switching costs

- One-time costs customers incur when they buy from a different supplier

- New equipment

- Retraining employees

- Psychic costs of ending a relationship

Access to distribution channels

- Stocking or shelf space

- Price breaks

- Cooperative advertising allowances

Cost disadvantages independent of scale

- Proprietary product technology

- Favorable access to raw materials

- Desirable locations

Government policy

- Licensing and permit requirements

- Deregulation of industries

Expected retaliation

Responses by existing competitors may depend on a firm's present stake in the industry (available business options)

Rivalry among competing firms

Which is considered a force in the "Five Forces" model?

Increases the threat of new entrants

Because the internet lowers barriers to entry in most industries, it

Bargaining power of suppliers

Which of the following is NOT an entry barrier to an industry?

True

(T/F) Industries characterized by high economies of scale typically attract fewer new entrants

A competitor to your product where a high switching cost exists

Which of the following firms would likely pose the least competitive threat?

Dominance by a few suppliers

The bargaining power of suppliers is enhanced under the following market condition:

The cost of the marble will be expensive because of the bargaining power of the supplier

A certain marble quarry provides a unique type of marble that is richly colored and strikingly veined. It has been used for churches and public buildings throughout the world. The architect of a new headquarters for a prestigious Fortune 500 firms has specified the use of this marble, and this marble only, for this project. which of the following statements is most likely to be true?

Strategic groups

Cluster of firms that share similar strategies

Strategic dimensions

- Extent of technological leadership

- Product quality

- Pricing policies

- Distribution channels/type of distribution system

- Customer service

- Breadth of product and geographic scope

- Degree of vertical integration

Analysis of resources, capabilities, and core competencies

If you believed in a pure five forces model of above-average returns, which of the following things is LEAST important?

Industry B; Industry B

Industry A is characterized by high advertising and R&D expenses (as a proportion of revenues) or, said differently, high differentiation. Industry B has a low advertising and R&D expenses. Which industry would tend to have a higher threat of new entrants? Higher degree of rivalry?

Business-level strategies

Are intended to create differences between the firm's position relative to those of its rivals

Broad scope

The firm competes in many customer segments

Narrow scope

The firm selects a segment or group of segments in the industry and tailors its strategy to serving them at the exclusion of others

Cost leadership strategy

An integrated set of actions taken to produce goods or services with features that are acceptable to customers at the lowest cost, relative to that of competitors with features that are acceptable to customers

A manufacturing business pursuing cost leadership will likely

Rely on experience effects to raise efficiency

Overall cost leadership

Convincing rivals not to enter a price war, protection from customer pressure to lower prices, and the ability to better withstand cost increases from suppliers characterize which type of competitive strategy?

Differentiation strategy

An integrated set of actions taken to produce goods or services (at an acceptable cost) that customers perceive as being different in ways that are important to them

Focus strategies

An integrated set of actions taken to produce goods or services that serve the needs of a particular competitive segment

Decreased emphasis on competition based on price

High product differentiation is generally accompanied by

Offering lower prices to frequent customers

A firm can achieve differentiation through all of the following means except

If several competitors pursue similar differentiation tactics, they may all be perceived as equals in the mind of the consumer

Which statement regarding competitive advantages is true?

Broadly-defined target market is to a cost leadership strategy

A narrow market focus is to a differentiation-based strategy as a

False

(T/F) To generate above average returns, a firm following an overall cost leadership position should not be concerned with attaining parity or proximity on the basis of differentiation relative to its peers