Unit 1 - Business Management SL

1/106

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

107 Terms

Private Sector

Part of economy owned and controlled by private individuals and business. Profit based.

Public Sector

Part of economy under the ownership of the government. Traditionally provide essential goods and services that would be under-provided or inefficiently provided by the private sector.

State-owned Enterprise

Organizations owned wholly by the government.

Sole trader

A self-employed individual who runs and controls the business and is held responsible for its success and failure.

Benefits of Sole Trader

Easier control and decision making.

Quick and easy to set up.

Financial privacy

Close customer relationship, competitive advantage.

Flexibility.

Drawbacks of Sole Trader

Compete against established business

Stress

Owners do all roles in the business

Limited capital

Limited expansion opportunities

Unlimited liability

Lack of continuity (no investments)

Unlimited Liability

Feature for sole traders and ordinary partnerships who are legally bound/liable for all the money owed to their creditor.

Limited Liability

Restriction on the amount of money that owners can lose if their business goes bankrupt. Which essentially means owner can only lose what they have put in, and they don’t have to compensate with their own private property.

Partnership

Are a type of private sector business owned by 2-20 people.

Some has more share than others.

Deed of Partnership

Is a legal contract signed by the owners of a partnership.

Advantages of Partnership

Different skills → allocate to different roles.

More expertise

Greater stability, low risk

Partner can help when on is unavailable.

Disadvantage of Partnerships

Unlimited liability

Less access to loans than corporation.

1 partner doesn’t have complete control

Profit have to be shared

Disagreement

Company/Corporation

A business that is owned by shareholders. Issued a certificate of incorporation, separate legal identity from its owner.

Incorporated

Legal difference between the owners of a company and business itself

Two Documents Must Be Produced and Submitted to Authority

Memorandum of association - brief document outlining fundamental details

Articles of Association - a longer document, stipulating the internal regulations and procedures of the company.

Advantages of Companies/ Corporations

Limited liability

Easier access to finance

Expansion possibilities

Established organizational structure

Disadvantages of Companies/Corporations

Takes time and money to set up

Selling shares

Loss of control (shareholders taking control)

Privacy loss

A company has no control over the stock market

No control over share ownership

Private Limited Company

Is a business owned by shareholders with limited liability but shares cannot be bought by or sold to the general public.

Public Limited Company

Incorporated business that allows the general public to buy and shares in the company via the stock exchange.

Initial Public Offering (IPO)

Occurs when a business sells or part of its business to shareholders on the stock exchange for the first time.

Stock Exchange

Marketplace for trading stocks and shares of public limited companies.

Business vs Company

Companies are owned by shareholders, which can be private or public companies.

Business covers other form of ownership such as sole traders and partnerships.

For Profit Social Enterprise

Social enterprise

Social purpose

Improve human, social, or environmental well-being.

Social Enterprise

Revenue generation business with social goals at the core of their operations. They are organizations that engage in business activities but set goals important goals in terms of improving a social cause. Can be organized as for-profit business, non-profit organizations, cooperatives.

Private For-Profit Social Enterprises

Aim for surplus (profit) instead of relying on donations to achieve social aims

Triple bottom line framework for ethical business practices

Public For-Profit Social Enterprises

State-owned enterprises to operate in a commercial way

Help in raising government revenues to provide services to society that might be inefficient or undesirable if left to the private sector to deal with.

Cooperatives

A form of partnership with more than than 20 people. Each member participates in running the business and have equal say. A for-profit social enterprise that is set up, owned and run by members who can be employees or customers.

Advantages of For-Profit Social Enterprises

Favorable Legal Status

Strong Community Identity

Benefits to the stakeholder community

Disadvantages of For-Profit Social Enterprises

Complex decision making

Insufficient capital for growth and financial strength

Non-Profit Social Enterprises

Aim to fund a social purpose using surplus.

Non-Governmental Organizations

Private sector not-for-profit enterprises that operate for the benefit of others rather than aimed at making profit however still using business strategies to generate revenue and achieve financial stability.

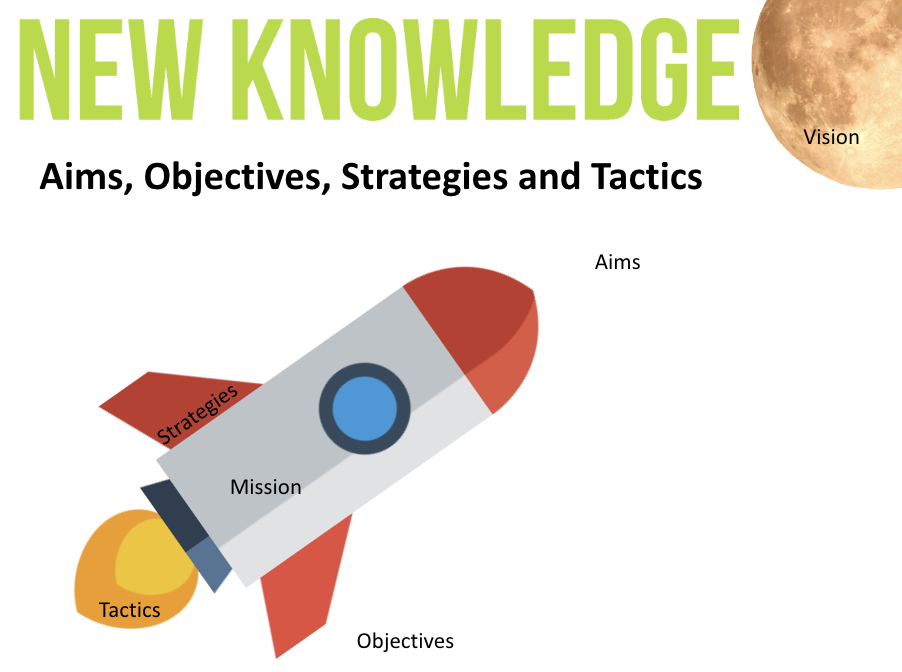

Vision Statement

A written expression of an organization’s long-term ambitions that it hopes to achieve in the future. It is often an optimistic view of what the organization want to accomplish.

Mission Statement

A declaration of the organization’s overall purpose, forming the foundation for setting the business’ objectives. The mission can be seen as ways of accomplishing the organization’s vision.

Steps to Set Mission Statement

Define the organization e.g what it is

Outline the what the organization aspire to be (vision statement)

Limited enough to exclude risky goals

Broad enough to allow innovative and creative growth

Distinguish organization from others.

Use to evaluate current business activities

Phrase clearly to be understood

Aims

General and long-term goal of a business, often vague and unquantifiable statements. Often expressed in the firm’s mission statement

Objectives

Short-to-medium and specific targets an organization sets in order to achieve its aims. Often expressed as SMART objectives.

SMART

Specific, Measurable, Achievable, Realistic and Time Constrained

Types of Objectives

Strategic, Tactical, Operational

Strategic (global) Objectives

Medium to long term objectives made by senior management.

Tactical Objectives

Medium to short term objectives set by middle managers.

Operational Objectives

Daily objectives set by floor managers.

Issues to meet Objectives

Culture clash - difference in culture

Financial constraints - money

Conflict

Business Strategy

Plans/approachs/scheme of action that businesses use to achieve their targets. Generally, strategies involve important decisions that may be risky and are done by senior mana

Business Tactic

Short-term plans of action that firms use to achieve their objectives. A tactic is an approach or scheme to achieve aim or objective. Tactic, compare to strategies, involve less resources and risk. They may not require senior management because they can be easily modified or reverse.

Internal Environment Factors Affecting Objectives

Leadership

HR

Organization (merger/acquisition)

Product

Finance

Operations

External Environmental Factor Affecting Objective

Technological

Social

Economic

Ethical

Political

Legal

Ecological

Why organizations set ethical objectives?

Build customer loyalty

Create a positive image

Develop positive work environment

Reduce risk of legal redness

Satisfying customers’ higher expectation

Increase profit

Impacts from Implementing Ethical Objectives

The business itself

Competitors

Suppliers

Customers

Local community

Government

Ethical Objectives Vs Corporate Social Responsibility

Ethical objectives are just 1 element of CSR

CSR is the concept that a business is obligated to operate in a way that have a positive impact on society.

Corporate Social Responsibility (CSR)

The conscientious considerations of ethical and environmental practices related to business activity.

Ethics

Moral principles that guide decision-making and strategy.

Ethical code of Practice

Documented beliefs and philosophies of an enterprise.

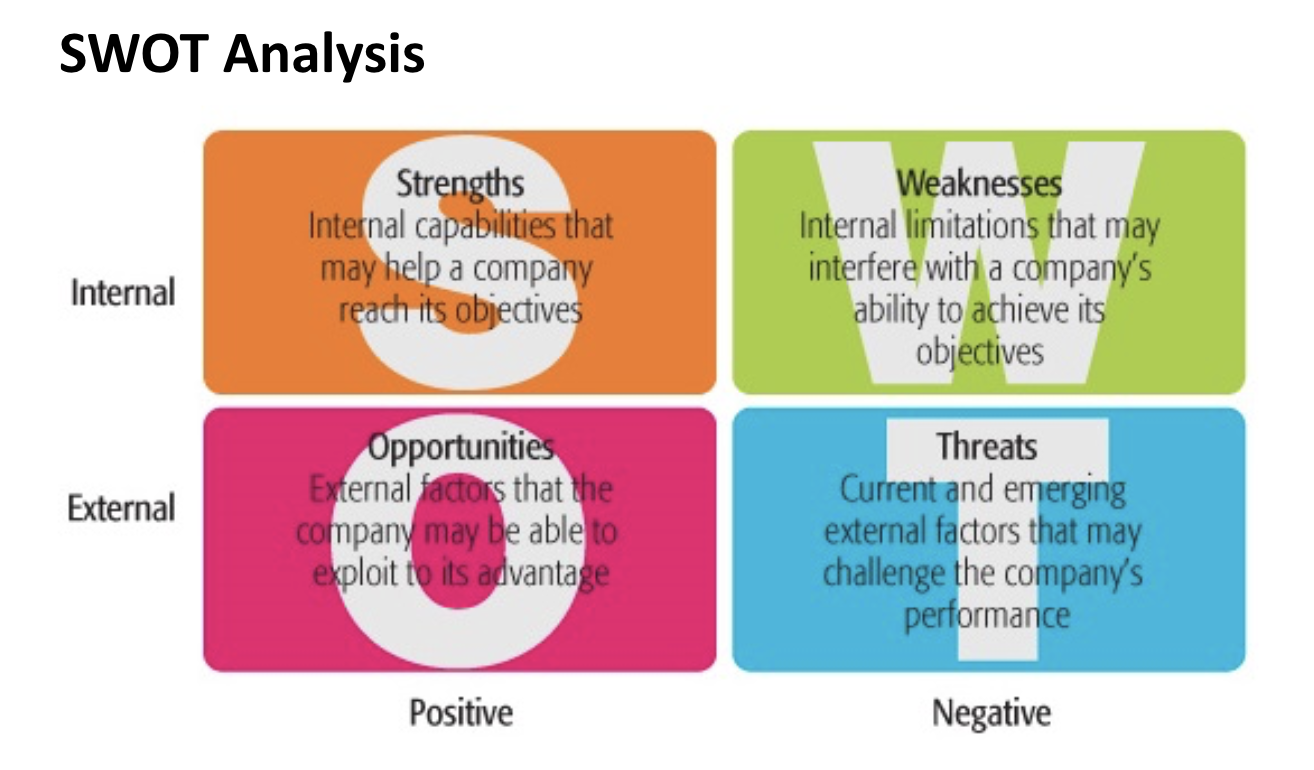

SWOT Analysis

An analytical tool used to assess the internal strengths and weaknesses, external opportunities and threads of a business decision, issue or problem.

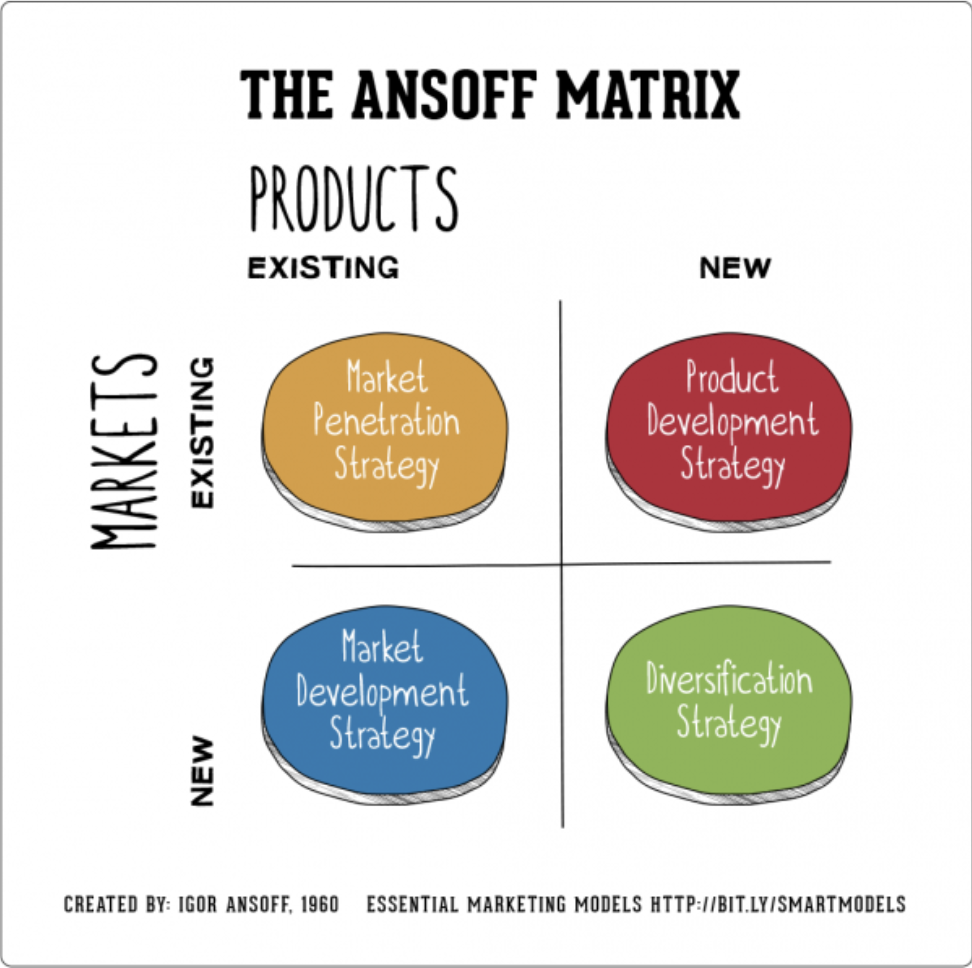

Ansoff Matrix

An analytical tool to devise various products and market growth strategies, depending on whether the business want to market new or existing products in either new or existing markets.

Advantages of using the Ansoff matrix

Provides analytical framework for strategic marketing decisions

Highlights the various risk degrees associated with strategic direction of marketing

An identified quadrant points to the marketing tactic that can be used.

Disadvantages of using Ansoff Matrix

It is only a tool and can be misused.

It simplifies a complex problem, can be too much.

Cannot predict actual events and thus, can be misleading.

Stakeholders

Individuals and organizations with a direct interest in the activities and performance of the business. It is a group that affects an organization or is affected by it.

Shareholders

Owners of a limited liability company.

Internal Stakeholders

Members of an organization but have a direct interest in its activities and performance.

External stakeholders

Individuals and organizations not part of the organization but have direct interest in its activities and performance.

Stakeholders includes (examples):

Owners/shareholders

Managers

Workers

Customers

Suppliers

Government

Local community

Financiers

Pressure groups

Media

Internal Stakeholder Interest

Shareholder - Return on investment

Workers - good pay and work conditions

Managers - meeting objectives, ensure job security

External Stakeholder Examples

Government - employ people, pay taxes

Suppliers - stable relationship

Customers/consumer - want the best product at the best price

Local community - effect of the business

Pressure groups

Pressure Groups

Consist of individuals with a common concern and seek to place demands on organizations to act a particular way.

Stakeholder Conflict

Refers to situations where stakeholders have disagreements on certain matters due to differences in their opinions and objectives.

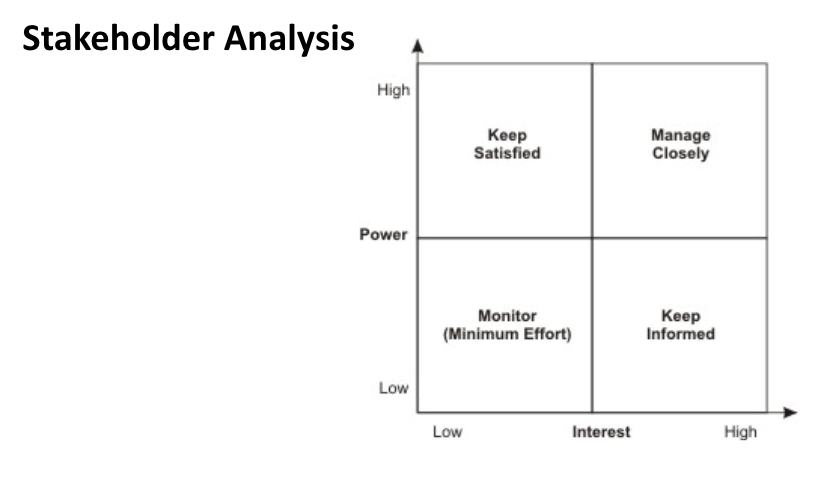

Stakeholder Analysis

A process used to asses and categorize stakeholders in a project, policy, or decision. This analysis helps organizations understand the various stakeholders' interests, influence, and participation levels, allowing for effective engagement strategies.

Variable Cost

Cost that vary with production

Fixed costs

Remain the same no matter how much or little you make.

Total Cost Formula

Fixed costs + Variable costs

Average Cost

Cost per unit of output (cost to make a product)

Average Cost = Total Cost/ Quantity of Output

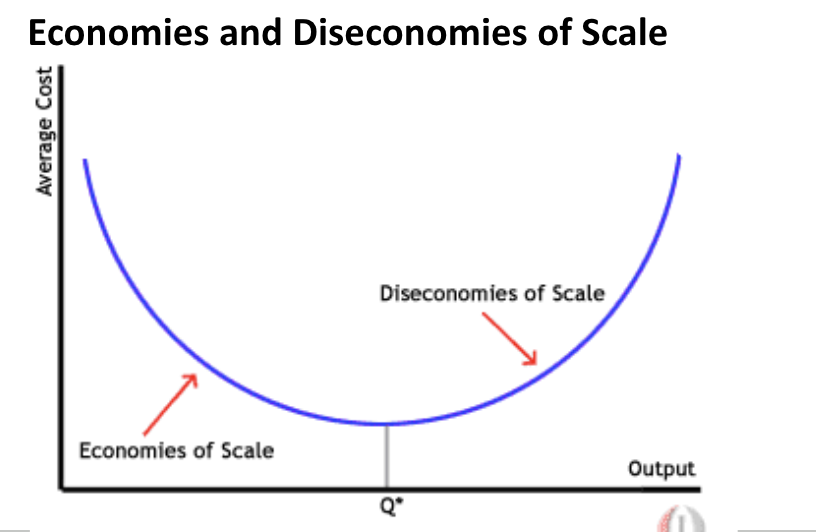

Economies of Scale (EOS)

Refers to lower average cost of production as a firm operates on a larger scale due to gains in productive efficiency.

Diseconomies of Scale

The cost disadvantages of growth. Unit costs are likely to eventually rise as a firm grows.

Internal Economies of Scale (efficiencies)

Technical

Managerial

Financial

Marketing

Purchasing

Risk Bearing

External Economies of Scale

Technical progress

Improved transportation networks

Skilled labour force

Regional specialization

Economies and Diseconomies of Scale Graph

Internal DIS-economies of Scale (inefficiencies)

Managerial - Lack of control

Poor working relationships

Disadvantages of specialization

Bureaucracy

Complacency (too satisfied to notice risks or danger)

External Diseconomies of Ccale

Increased market rents

Higher wages and financial rewards - retain workers

Traffic congestion

Optimal level of output

The most efficient scale of operation for a business which occurs at the level of output where the average costs of production are minimized.

Ways to Measure a Firm’s Size

Market share - a firm’s sales revenue as a percentage of the industry’s total revenue.

Total revenue - the value of a firm’s annual sales turnover per time period.

Size of a workforce - the total number of employees hired by the business.

Profit - the value of a firm’s profit over a time period

Capital employed - the value of the firm’s capital investment for the business to work.

Larger Business Benefits

Brand recognition

Brand reputation

Value added services - more resources to provide a range of services.

Lower price - offer greater price due to economies of scale

Greater choice - more choice

Customer loyalty - customers remaining loyal due to perceived trust and value for money.

Smaller Business Benefits

Personalized services - more time to devote to individual customers.

Flexibility - more flexible and adaptive to change, large businesses have larger financial commitments

Small market size - no large firm will compete with it hence allowing it to thrive

Cost control - no dilution of control (shareholders), less chance to face diseconomies of scale

Financial risk - Smaller business have less finance hence better control.

Government aid - Grants and subsidies can be offered to small business by government.

Local monopoly power - Can enjoy being the only firm in a location.

Why firms want to grow

To have benefits of larger scale production (economies of scale)

Gain larger market share and power. Allow charging higher prices.

Growth for survival, grow to compete with rivals who are also growing.

To spread risks by diversifying. If one market is at risk, having operations in other markets help ensure firm’s survival.

Internal Growth (organic)

Using the business own capabilities and resources to increase scale of operation and revenue.

Ways Business and Grow Internally

Changing price

Good promotion

Producing better products

Sell through a better distribution network

Offer preferential credit

Increase capital expenditure (investment)

Improved training and development

Providing overall value for money

Advantages to Internal Growth

Better control and coordination

Easier to control internal factors

Inexpensive

No interest in paid on retained profit (reinvestment in the company)

Less risky

Builds on the strength of business.

Disadvantages of Internal Growth

Diseconomies of scale

Higher unit costs of production and result from internal growth.

Restructure need

Sole trader can control the business easily, if it grows into a multinational company then structure has to change.

Dilution of control and ownership

Firm grows can change from sole trader to a plc, which then owners have to share decision-making with shareholders.

Slow growth

Internal growth is slower than external growth

External Growth

Happens when a business grows by collaborating with, buying or merging with another firm.

Benefits of External Growth

Faster way to grow

Quick way to reduce competition

Greater market share and power

Sharing of ideas with other businesses

Help a firm evolve and spreading risks across different markets.

Disadvantages of External Growth

The main disadvantage of external growth is the huge costs which can be higher than internal growth.

Mergers

2 business merge to form a new business

Acquisition (takeover)

When one business buys a controlling interesting in another business.

Hostile takeover is when the acquisition is done without the consent of the target company’s management.

Why firms become targets for takeovers

Growth potential but lacks sufficient funding for growth

Seen as small rival with growth potential

Widely recognized branding but are facing financial crisis.

Vulnerability

Forward Vertical Integration

Growth strategy that occurs with the amalgamation of a firm operating at a later stage in the production process.

Backward Vertical Integration

Growth strategy that happens when a firm amalgamates with a firm operating at an earlier stage in the production process.

Conglomerates

Businesses that provide a diverse range of products and operate in multiple industries.

Advantages of M&As (Merger and Acquisitions)

Greater market share

Economies of scale

Synergy - access to other’s resources

Survival - a bigger company, more change of survival

Diversification

Disadvantages of M&As

Redundancies - when a role is no longer necessary in a company, hence the need to terminate employees

Conflict

Culture class - things need to adapt to the culture of a newly formed organization.

Loss of control - more people have the say in decision-making

Diseconomies of scale

Regulatory problems - governments are concerned with M&As, preventing them due to the risk of monopolies.

Joint Ventures

Growth strategy that combines the contributions and responsibilities of two different organization in a shared project by forming a separate legal enterprise (no rebranding or a new organization, just a project)

Strategic Alliances

Similar to join ventures but:

More than 2 businesses

No new businesses is created

Individual businesses in the alliance can stay independent

More fluid than Joint Ventures

Franchise

Right given by one business to another to sell goods and service using its name and branding. (this is a right, a franchise). An agreement where franchisor to sell the rights to another business, to sell products under its name.