Micro Please Save Me

1/127

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

128 Terms

A tariff / quota has two effects

Increase in domestic production, decrease in domestic consumption

Less is consumed, leading to lower gains for trade

Tariffs for ya bitch ass

The tariff reduces consumer surplus, increases producer surplus, creates new

government revenue, and creates deadweight loss (areas B and D). Area D shows

that some mutually beneficial trades go unexploited. Area B shows that tariffs

cause some of the economy’s resources to be wasted on inefficient production.

For Swaziland to become an importer of carbonated beverages,

the world-market price must be lower than the domestic market price.

Suppose the world price of cheese is $6 per pound and that a $2 import tariff is imposed

$6 + $2 is $8. Price raises to $8

In the aggregate international trade is beneficial

True

If New York can produce more avocados than California, we know for sure that:

New York has an absolute advantage in avocado production. (we would need to know opportunity costs for the answer to be comparative advantage)

According to the Heckscher–Ohlin model, a country has a comparative advantage in producing a good:

if that good's production is intensive in factors that are abundant in that country.

Accounting profit

Total revenue - explicit costs

Economic profit

Total revenue - explicit costs - implicit costs

Normal profit

When economic profit is zero

The implicit cost of Capital

the opportunity cost of the use of one’s

own capital; that is, the income earned if the capital had been employed

in its next best alternative use

Marginal cost

of producing a good or service is the additional cost

incurred by producing one more unit of that good or service.

Marginal cost formula

Change in tc / change in q

Marginal benefit

the additional benefit derived from producing one

more unit of a good or service

decreasing marginal benefit from an activity

when each additional unit of the activity yields less benefit than the previous unit

marginal benefit curve

shows how the benefit from producing one

more unit depends on the quantity that has already been produced.

Marginal analysis optimal point

Where MB and MC intersect

Sunk cost

a cost that has already been incurred and is not recoverable

Neoclassical Economics

An approach to economics that

relates supply and demand to an individual's rationality and his or her

ability to maximize utility or profit.

Behavioral Economics

The study of psychology as it relates to the economic decision-making

processes of individuals and institutions. The two most important

questions in this field are:

1. Focusing on the mental process behind decisions

2. Improving outcomes by improving decision-making.

Bounded rationality

Making a choice that is close to but not exactly the one that gives you the best payoff—the “good enough” method of decision making.

Choosing the best option requires mental effort, and if it’s too costly, it might

make sense to choose a “good enough” option

Framing bias

the tendency to make a decision based on how the

choices are presented

Status quo bias

the tendency to avoid making a decision altogether.

Neoclassical economics expanded:

People are “good” at MOSTLY everything.

Good at being rational

Good at having stable preferences

Good at being accurate calculators

Good at assessing the future

Good at resisting temptation

People are only bad at TWO things:

People are entirely self interested; people are bad at selflessness

People don’t care about fairness; people are bad at being fair

Behavioral economics

People are “bad” at MOSTLY everything.

Bad at being rational

Bad at having stable preferences

Bad at being accurate calculators

Bad at assessing the future

Bad at resisting temptation

People are only GOOD at TWO things:

People are generous; people are GOOD at selflessness

People care about fairness; people are GOOD at being fair

Any rational producer would stop producing at the point where

marginal cost exceeds marginal benefit

Behavioral economics was motivated by an attempt to understand:

how people actually choose among economic alternatives.

Tonya is considering leaving work early to go to a baseball game. A ticket costs $30, and it costs $5 to park at the stadium. Tonya will miss three hours of work, where she is paid $20 an hour. What is Tonya's total implicit cost of going to the game?

$60

Bounded rationality implies that the decision maker:

will make a choice that is good enough even if it is not completely optimal.

Krista sets up a business selling coffee from a coffee cart. She earns $12,000 in revenue a month. She incurs costs of $3,000 per month in supplies (coffee cups, creamer, sugar, pastries, napkins, and so on). She used to earn $3,500 per month as a barista. The coffee cart is very specialized and has no other uses. What is Krista's implicit cost of capital per month?

$0

Graph with just marginal benefit

You can add marginal benefit to get total benefit

Investors who are reluctant to sell a stock that has dropped in value are exhibiting:

loss aversion.

Samuel owns a small retail shop with several different brands of clothing, including a brand that he makes himself. Over the last two years, his clothing brand has not sold well, and he continues to lose money making his own brand. If Samuel stops making his own brand because he sees how much it is hurting his business, this is an example of _____

reacting to market forces

Excludable

People who don’t pay can be easily prevented from using a good.

Rival in consumption:

The same unit of the good cannot be consumed by more than one person at a time (or at all)

Nonexcludable

People who don’t pay cannot be easily prevented from using a good.

Nonrival:

More than one person can consume the same unit of the good at the same time.

Private goods

are excludable and rival in consumption, like wheat.

Public goods

are nonexcludable and nonrival in consumption, like a public sewer system

Common resources

are goods that are nonexcludable but rival in

consumption, like water in a river

Artificially scarce goods

are excludable but nonrival in consumption, like

on-demand movies on Amazon Prime

Pigouvian tax:

is a tax imposed

on activities that generate

negative externalities

The Tragedy of the Commons

Is a situation in a shared-resource system where individual users, acting

independently according to their own self-interest, behave contrary to the

common good of all users by depleting or spoiling the shared resource

through their collective action.

Toilet paper is a rival good because:

if one person uses several sheets of toilet paper, no one else can

If the government provides the public good, how much should it produce?

Produce the quantity where marginal social benefit of a public good equal's marginal cost of producing it.

The marginal social benefit curve of

a public good equals the vertical

sum of individual marginal benefit

curves.

The marginal social benefit curve of

a public good equals the vertical

sum of individual marginal benefit

curves.

The rise of the internet and file sharing has turned media such as movies and music into public goods. How?

It has made those goods nonexcludable

London recently started charging a fee to drive in certain parts of the city during peak traffic times to address the problem of traffic congestion. It has worked! This fee has

a) encouraged consumers to drive less than they otherwise would.

b) encouraged consumers to drive at times when traffic congestion is less of

a problem.

c) made a common resource excludable: those who pay for the right to

drive can drive, and those unwilling to pay must forgo driving.

ANSWER: (a), (b), and (c) are all true.

Negative Externalities

Example – Pollution

• Supply side market failures

• External Costs that are past on to society

• Supplier does not bare responsibility for these costs

Supply-side market failures

•Occurs when a firm does not pay the full cost of producing its output

•External costs of producing the good are not reflected in supply

•Private Marginal Cost < Social Marginal Cost

The market for which good will not produce the efficient quantity?

video games

Which good is MOST likely to be underproduced in a market economy?

clean air

Production of which good is likely to be inefficiently low in a market economy?

fish stocks in a public lake

The efficient price of subscriptions is $_____.

$0

The optimal quantity of city beautification projects is the point where the marginal social benefit curve intersects the marginal social cost curve, or three projects.

The optimal quantity of city beautification projects is the point where the marginal social benefit curve intersects the marginal social cost curve, or three projects.

Utility:

Is the value or satisfaction from consumption.

Consumption bundle

Is the collection of all the goods and services consumed by that

individual.

Utility function:

The total utility generated by their consumption bundle.

Assume that the marginal utilities for the first three units of a good consumed are 200, 150, and 125, respectively. The total utility when two units are consumed is:

$350

The optimal consumption bundle

is the one that maximizes a consumer’s total utility

given their budget constraint

Utility Maximizing Rule

Consumer allocates his or her income so that

the last dollar spent on each product yields the same amount of extra

(marginal) utility.

MU / P = MU / P

An increase in the price of good X while holding income and the price of good Y constant will

a) increase the marginal utility provided by good X.

b) increase the marginal utility per dollar spent on good Y.

c) decrease the marginal utility per dollar spent on good X.

d) reduce the individual’s preference for good X

The substitution effect of a good

....of a change in the price of a good is the change in the quantity consumed of that good as the consumer substitutes the good that has become relatively more expensive for the good

that has become relatively less expensive.

The income effect of a good

...of a change in the price of a good is the change in the quantity consumed of a good that results from a change in the consumer’s purchasing power (or real income) due to the change in the price of the good

Giffen good

A very rare inferior good for which the income effect outweighs the substitution effect, and the demand curve slopes upward.

An increase in the price of good X while holding

income and the price of good Y constant will:

have a negative substitution effect, leading the consumer to decrease consumption of good X because of the decrease in the marginal utility per dollar spent on good X

The table shows Lin's total utility from consuming cowboy hats and suntan lotion. Lin has $24 to spend. Hats cost $12 each and a bottle of suntan lotion costs $6.

Quantity of cowboy hats | Utility from cowboy hats | Quantity of tanning lotion | Utility from tanning lotion |

0 | 0 | 0 | 0 |

1 | 240 | 1 | 300 |

2 | 360 | 2 | 420 |

3 | 460 | 3 | 520 |

4 | 520 | 4 | 580 |

Which consumption bundle is her optimal consumption bundle?

First Step:

Calculate MU of each product

Second Step:

Calculate MU / P of each product

Third Step:

Allocate budget accordingly

Lin has $24. The goal is to allocate her budget to get the most utility per dollar spent.

First, buy 1 cowboy hat (cost = $12) and 1 bottle of suntan lotion (cost = $6). This leaves her with $6.

With the remaining $6, she should buy another bottle of suntan lotion (since it provides the next highest MU per dollar, which is 20).

When total utility is at a maximum, marginal utility would be:

zero.

Answer in pic

When the price of a normal good increases, consumers will decrease their consumption of that good because the good has become more expensive relative to other goods

This effect, called the substitution effect, holds for inferior goods, as well.

Physical capital:

often referred to simply as “capital”—consists of manufactured productive resources such as equipment, buildings, tools, and machines

Human capital:

the improvement in labor produced by education and knowledge that is embodied in the workforce

The cost of employing that extra worker is the wage rate, W.

The cost of employing that extra worker is the wage rate, W

VMPL

P * MPL

VMPL = W

Optimal choice

Suppose the marginal cost of hiring an additional unit of labor is $10 and the value of the marginal product from hiring this additional unit of labor is $12. To maximize profit, this firm should hire

more labor

The equilibrium wage rate is $18. A perfectly competitive firm sells widgets for $8. Suppose the marginal product of the sixth unit of labor is three widgets and the marginal product of the ninth unit of labor is two widgets. This firm should hire:

more than six but fewer than nine units of labor.

Three main causes of shifts in the

factor demand curves:

1. changes in prices of output

2. changes in supply of other factors

3. changes in technology

Efficiency wages

Refer to employers paying higher than the minimum wage to retain

skilled workers, increase productivity, or ensure loyalty

A type of incentive scheme to motivate workers to work hard and

to reduce worker turnover.

The substitution effect:

A rise in the wage rate raises the opportunity cost

of leisure. There is an incentive to work more, because leisure is relatively

more expensive than working or consumption.

The income effect:

A rise in the wage rate makes you richer. There is an incentive to work less and buy yourself more leisure, because leisure is a normal good

When an individual’s labor supply curve is downward-sloping, this implies that the individual’s income effect is:

stronger than the individual’s substitution effect.

Asymmetric Information

A situation where one party to a market transaction has much more information

about a product or service than the other. The result may be an under- or over-

allocation of resources

Asymmetric Information ex

Hiring

Banks Underwriting Loans

Health Insurance

Securities Industry

Adverse selection

When information known by the first party to a contract or agreement is not known by the second and, as a result, the second party incurs major costs

How to Mitigate Adverse Selection

Screening: describes the efforts of the less informed party (insurance

company, employer) to gather information about the more informed

party (consumers, employee)

Signaling: Describes the efforts of the more informed parties

(consumers, employees) to reveal information about themselves to

the less informed party (insurance company, employer

Moral hazard

The moral hazard problem is the tendency of one party to a contract or

agreement to alter her or his behavior, after the contract is signed, in ways that

could be costly to the other party.

Moral hazard ex

Private firms that go public

Too big to Fail

Car insurance

State Budgets

SOLUTIONS FOR MORAL HAZARD

Deductible: a sum that the insured individual must pay before

being compensated for a claim.

Insurance companies deal with moral hazard by requiring a

deductible: they compensate for losses only above a certain amount,

so that coverage is always less than 100 percent

How many workers to employ?

Pick the last VMPL that exceeds wage

Efficiency wage

Above equilibrium

A positive change in technology

firms will increase their demand for high‑skill labor

For a country to become an importer

World-market price must be LOWER than the domestic market price

On a graph that means the line is below equilibrium

This means the price decreases, but so does the quantity produced

Opportunity Cost:

Explicit Costs + Implicit Costs

What you must give up in order to get something

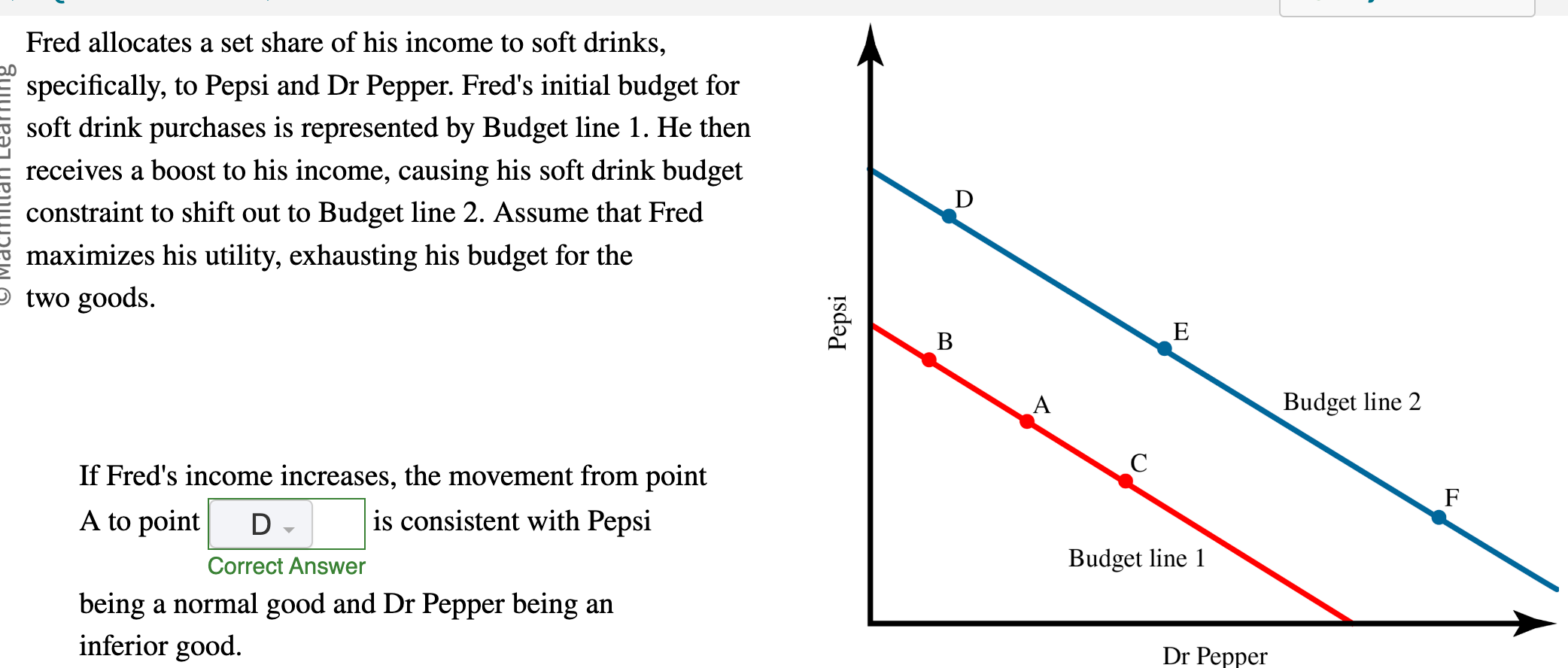

Normal Good:

Demand increases when income increases

Example: steak

Inferior Good

Demand decreases when income increases

Instant noodles

Complements

If a decrease in price of one good leads to an increase in the demand for the other

Substitutes:

If a decrease in the price of one good leads to a decrease in the demand for the other

Price Above Equilibrium:

Creates a surplus

Price Below Equilibrium

Creates a shortage