4. Monetary Policy

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

11 Terms

Fiat Money

Fiat money is currency that has no intrinsic value and is accepted as money because a government declares it legal tender.

Roles of Banks

Monopoly supplier of the currency;

Banker to the government and the bankers’ bank;

Lender of last resort;

Regulator and supervisor of the payments system;

Conductor of monetary policy; and

Supervisor of the banking system (not sole).

The Objectives of Monetary Policy

The mane objective of maintaining price stability (inflation).

Monetary Policy Tools

open market operations (via purchase and sale of government bonds);

the refinancing rate (through repurchase agreement – REPO);

reserve requirements.

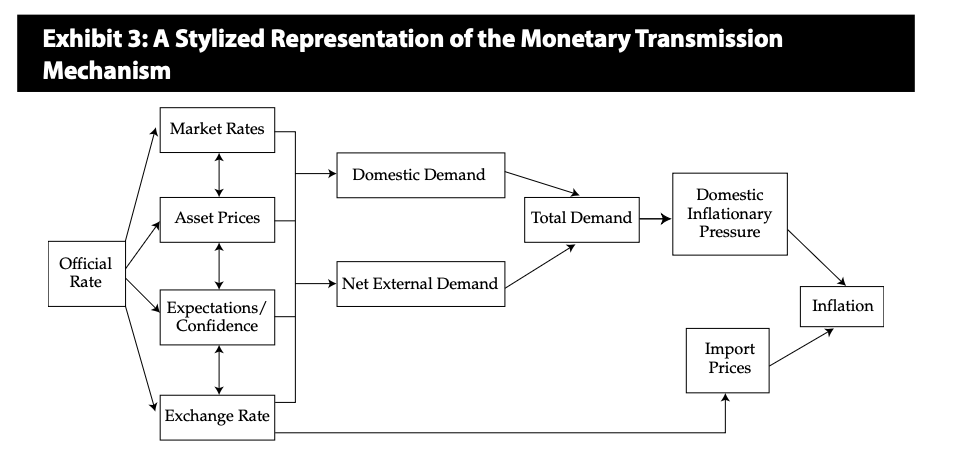

The Transmission Mechanism

To summarize, the central bank’s policy rate works through the economy via one

or more of the following interconnected channels:

Short-term interest rates;

Changes in the values of key asset prices;

The exchange rate; and

The expectations of economic agents.

Exchange Rate Targeting

1. Инфляция ↑ (в Стране А выше, чем в США):

Инфляция ↑

Центральный банк продаёт доллары → скупает свою валюту

Количество денег в экономике ↓

Процентные ставки ↑

Кредиты дороже → экономика охлаждается → инфляция ↓

2. Инфляция ↓ (в Стране А ниже, чем в США):

Инфляция ↓

Центральный банк покупает доллары → выпускает свою валюту

Количество денег в экономике ↑

Процентные ставки ↓

Кредиты дешевле → экономика разгоняется → инфляция ↑

Neutral Rate

Neutral rate = Trend growth + Inflation target

Expansionary < Neutral rate < Contractionary

Demand & Supply Shocks

1. Шок спроса (рост потребления и инвестиций)

→ спрос ↑

→ инфляция ↑

→ ЦБ повышает ставки

→ кредиты дороже → спрос ↓

→ инфляция ↓

2. Шок предложения (рост цен на нефть и издержки)

→ издержки ↑ (например, цена на топливо)

→ цены ↑ → инфляция ↑

→ прибыль компаний ↓, потребление ↓

→ безработица ↑, экономика тормозит

→ если ЦБ ещё поднимет ставки → спад усиливается → позже инфляция резко ↓

Liquidity trap

Liquidity trap – a situation when interest rates are near zero and people hoard money instead of spending or investing, making monetary policy ineffective.

Quantitative Easing

Quantitative easing (QE) – an unconventional monetary policy where a central bank buys large amounts of financial assets to inject money into the economy and stimulate growth when interest rates are near zero.

Fundamental limitation of monetary policy

Central bankers do not control the decisions of individuals and banks that can influence the money creation process.