eco3203 chap 12 & 13

1/14

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

15 Terms

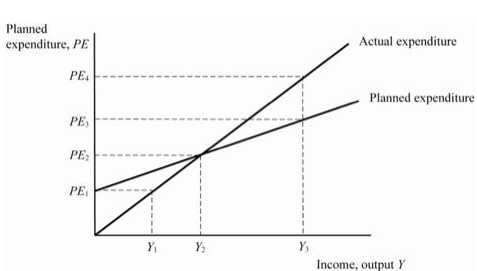

the keynesian cross

simple closed-economy model in which income is determined by expenditure

notation:

I = planned investment

PE = C + I + G = planned expenditure

Y = real GDP = actual expenditure

actual - planned expenditure = unplanned inventory investment

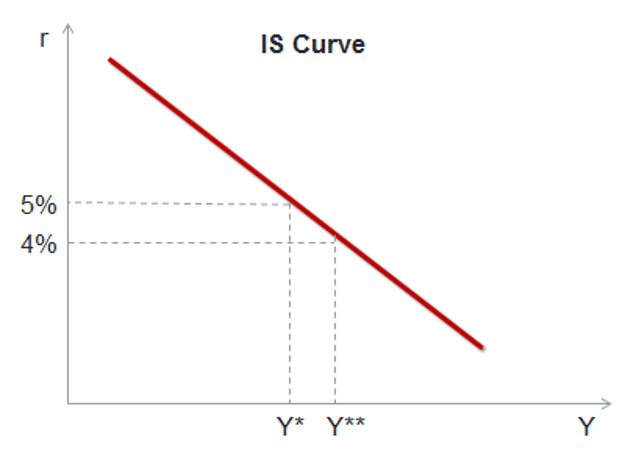

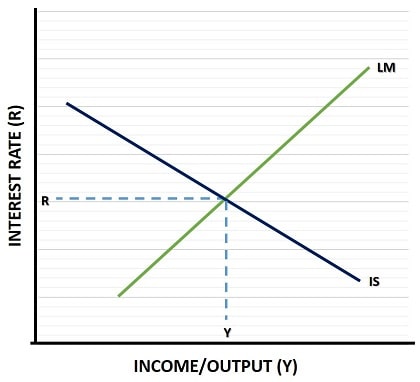

IS curve

relationship between income and the interest rate

shows combinations of interest rates and output where the goods market is in equilibrium

Y = C(Y - T bar) + I(r) + G bar

shift:

ΔY = (-mpc / 1 - mpc) * ΔT

ΔT works better in calculations

variable y

Y = C + I + G (equilibrium condition)

ΔG = ΔY * (1 - mpc)

solving for Δy:

ΔY = (1/1 - mpc) * ΔG

ΔY / ΔG = 1 / 1 - mpc

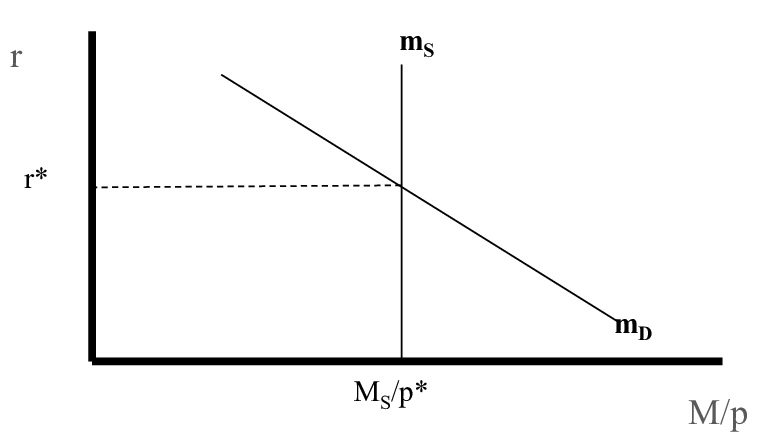

money market model and money demand

money demand equation: (M / P)^d = L(r)

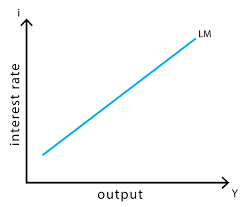

LM curve

shows the changes in the money market’s equilibrium

IS-LM graph

IS shocks

exogenous changes in demand

crowding out

increase in government spending leads to less investment in the private sector

2001 recession

2.1 million jobs lost

unemployment rate rose from 3.9% to 5.8%

GDP growth slowed to 0.8%

federal funds rate

the interest rate banks charge one another

the Fed targets this particular interest rate

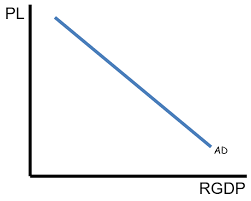

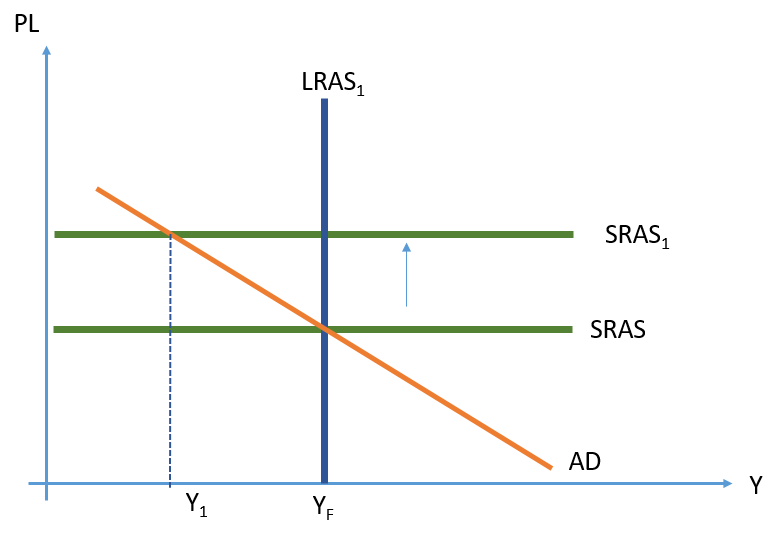

AD curve

AD-AS model

great depression

stock market crash (1929, 1933)

investment decreased

due to: overbuilding in ‘20s; government spending increased while output/income decreased; widespread bank failures

another depression unlikely

effects of borrowing on inflation

if inflation goes down, the real cost of borrowing increases (and vice versa)

2008/2009 financial crisis

bursting house price bubble

foreclosure rates increased

mortgage crisis

declining consumer confidence, less investment and spending on consumer durables

falling stock prices

failing financial institutions

2009: real GDP falls, unemployment rate ~10%