4. Monopoly, price discrimination and monopolistic competition

1/59

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

60 Terms

What is a monopoly?

a market with a single producer of a good

What is a monopolist?

the only supplier of a product for which there is no close substitute. e.g. only hotel in a town

price setter: can choose any price and sell the quantity demanded at that price or choose an output level and sell it at the market-clearing price

what does the a monopoly depend on?

how wide the sector and the geographical area considered are

Why might there be monopolies

patents

legal restrictions

economies of scale and scope (natural monopolies)

What is a monopoly constrained by?

the market demand curve

can only sell for the price given by demand curve

although normally it is easier to think in terms of inverse demand curve p(y)

What is a monopolist’s revenue given by

p (y) y

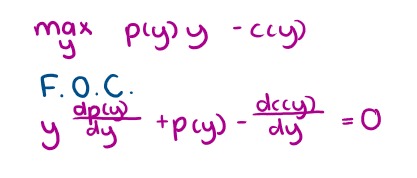

What is a monopolists profit maximisation problem?

How to solve the monopoly’s profit maximisation problem?

What does a monopoly’s profit maximisation problem teach us?

the first 2 terms of our F.o.C gives us Marginal Revenue, meaning the expression is equivalent to MC = MR

assuming downward sloping demand curve , dp(y)/dy <0 so MR>p → to sell more the firm must reduce its price on all units

they reduce revenue from all customers

set lower for all instead of only new not just existing

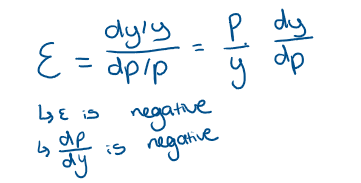

What does price elasticity of demand measure?

the responsiveness of demand to changes in price

What is the equation for elasticity

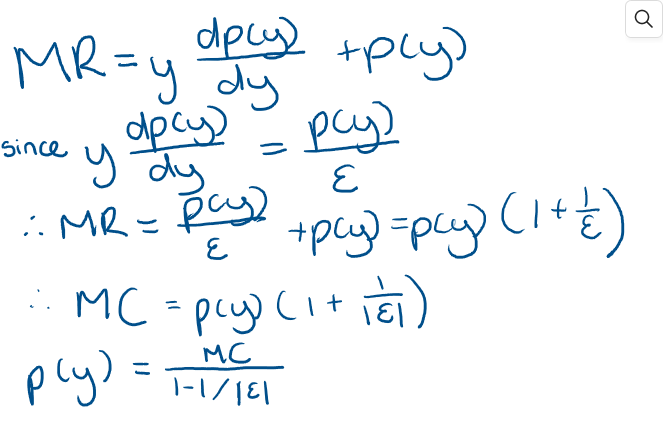

How do we get the equation for MR, and how can we use it to derive MC?

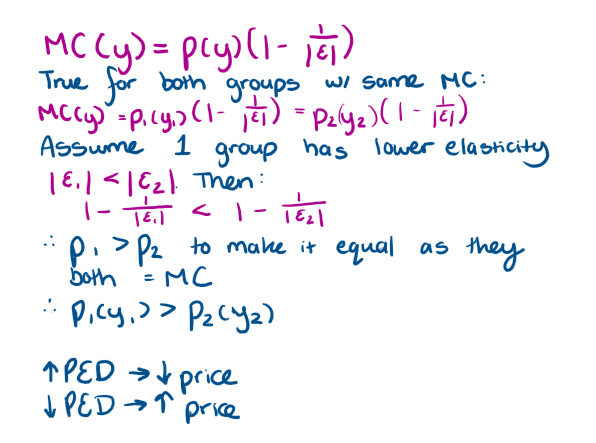

What is markup pricing?

‘inverse elasticity rule’

the price is a mark-up over MC that depends on the PED

the less elastic the demand, the greater the price

Why might elasticity work for a monopolist in comparison to a perfectly competitive firm?

Competitive firm

faces perfectly elastic demand→ horizontal demand curve at the market price → elasticity is infinite and denominator = 1

p(y) = MC (y)

Monopolist

faces downward-sloping demand curve → elasticity is finite and 1-1/|e| < 1

Monopolist sets p(y) > MC (y) with a mark up over marginal cost given by 1/(1-1/|e|)

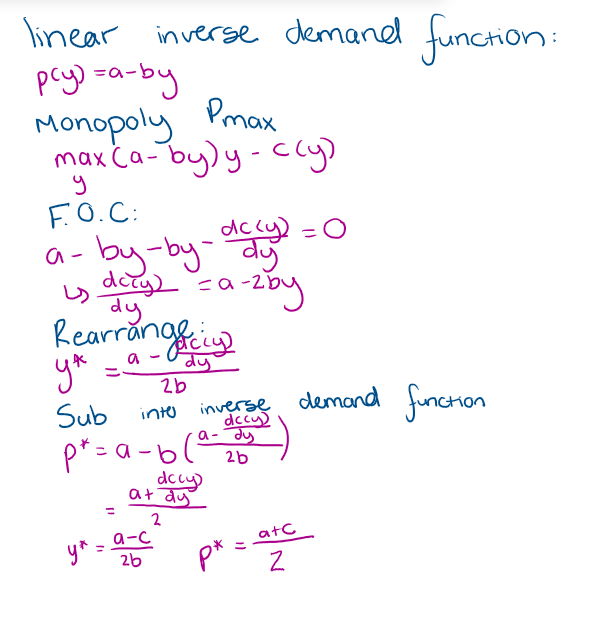

If a monopolist has a linear inverse demand function, what will be its price and output?

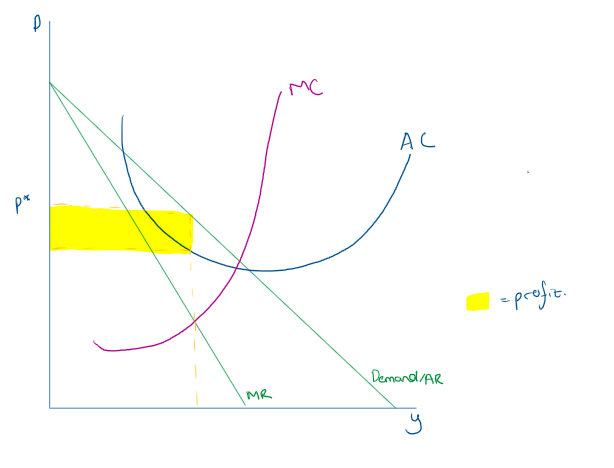

What does monopolists profit look like on a diagram?

To see the inefficiency of a monopoly what do we need to do?

compare a monopolist with a given Mc curve and a competitive industry with an industry supply curve given by the same MC curve

we believe that one firm producing the industry output would do it with the same costs as many firms combined

What does a competitive market need for MC?

price and output are determined by supply (MC) and demand

for LR equilibrium, this must correspond to the lowest point on firms’ LR AC curves

Where does a monopoly produce?

MC = MR

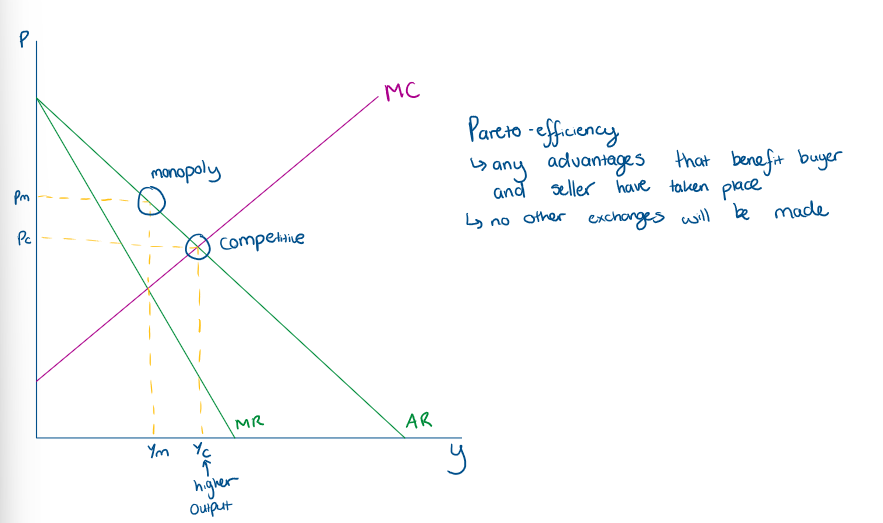

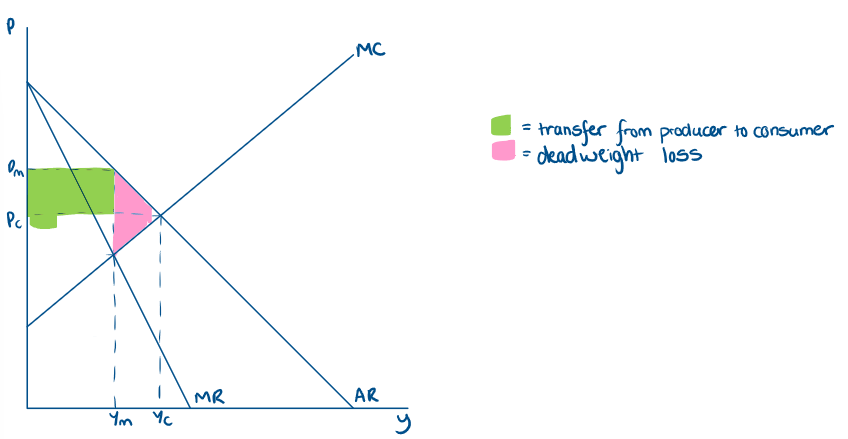

What does a comparison between monopoly and competitive look like diagrammatically?

btw ym and yc - consumers who would be willing to pay pc or more to buy the good → this is more than the cost of producing the good in this range

if this exchange was made there would be a pareto improvement

However, monopolist will not supply this customer bc doing so would mean reducing the price paid not just by the additional customer but by all customers → reduce monopolists profit

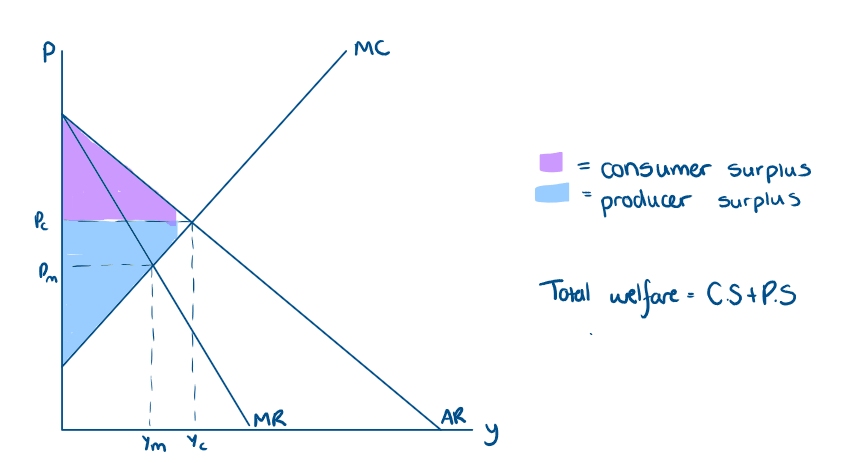

What can we use to compare welfare in monopoly and a competitive market?

producer and consumer surplus

What does consumer surplus measures?

difference btw the amount consumers would be willing to pay for a good and the amount they acc pay, and is given by the area above the price and below the demand curve

What does competitive market’s producer surplus and consumer surplus look like?

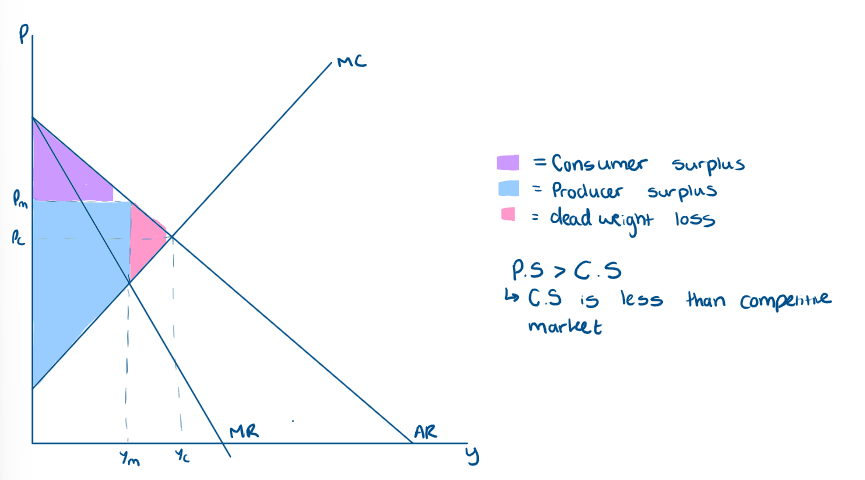

What does monopoly’s producer surplus and consumer surplus look like?

diagrammatically, what is the difference between competitive market and monopolies PS and CS?

What is the deadweight loss?

Lower quantity → output falls from yc → ym with an associated loss of welfare:

over the range of output from ym to yc the dead weight loss adds up the difference btw what ppl would be willing to pay and the cost of supplying the units which are not produced by the monopolist

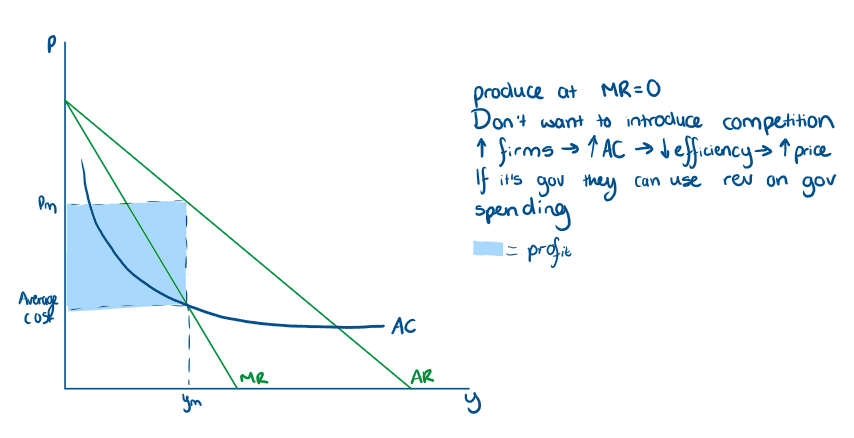

What happens if there is an increasing returns to scale across all levels of output?

AC curve will always be downward sloping → not U shaped

One firm produces a given output at lower average cost than 2 firms

Example: industry with high fixed costs like infrastructure costs for water supply

most significiant costs inc building the water treatment plant and installing a network of pipes

MC of providing water through pipes is relatively low

dont want large number of firms competing

simplify by assuming high fixed cost and 0 MC → AC = AVC

produces at MR = Mc = 0

What does a natural monopoly look like?

What is the problem with natural monopolies?

monopoly price may be seen as undesirable

Example: water controlled by government

gov can control supply it can choose supply at loss - covering loss through taxation, break even or earn a profit but will probably set a price below pm - sets the prices abit above AC

private supply could be regulated. firm will need to atleast to be able to break even so that regulated price is likely to be or slightly higher than the price at which AC cuts the D curve

What is the minimum efficient scale

Lowest level of output at which a firm exploits all economies of scale

meets at minimum AC

with a U-shaped AC curve → bottom of curve

What does minimum efficient scale look like?

For a competitive market to be possible, what do we need?

Minimum efficient scale to be relative to market demand - we need a large number of firms to all be producing at the minimum efficient scale.

What is price discrimination?

different consumers are charged different prices

What are the 3 categories of price discrimination?

First degree:

Seller can charge a different price for any unit to any consumer

Second degree:

Either every consumer who buys a second quantity pays the same price

or differences in price paid are a result of consumers’ choices - both apply to bulk discounts

CONSUMER CHOICE - everyone gets the same price for different wuantities

Third degree:

either different consumers pay different prices, but all units bought by a single consumer have the same price - different price from people doing the same thing- they decide if you are able to

seller charged consumers different prices according to their characteristics - student discount or senior citizem discounts

NO BULK DISCOUNT

What type of discrimination is the pink tax

considered 2nd degree

your choice - you could but male razors

If it is dependent on how much you buy then it becomes 3rd degree

What is another name for first degree price discrimination, and what does it allow?

‘Perfect price discrimination’

Allows the monopolist to receive consumers’ valuation for every unit sold

allows monopolist to sell each unit for the reservation price of the consumer - the maximum they would be willing to pay

What will a demand curve represent for first- degree price discrimination?

represents a series of consumers’ valuation of individual units of a good, starting with the highest valuation and working down.

Monopolist getting as much money out of consumer → denying consumer surplus

In first- degree price discrimination what is required for the monopolist to still supply units?

Will supply units as long as the amount they receive for each unit (given by the demand curve) is at least as high as the amount it costs to supply the unit

What is the results of first-degree price discrimination?

competitive output being replicated where MC cuts the demand curve

we dont have a single market price found where MC = Demand, as each consumer pays a price that reflects their own valuation

welfare effects are very different

What does first- degree price discrimination look like on a diagram?

Is first degree price discrimination realstic?

UNFEASABLE

the amount of info needed to achieve this outcome is likely to make first-degree price discrimination impossible in most circumstances

some specialist markets w/ small buyers and sellers negotiating prices may come close e.g. specialised antiques - not something most producers prefer

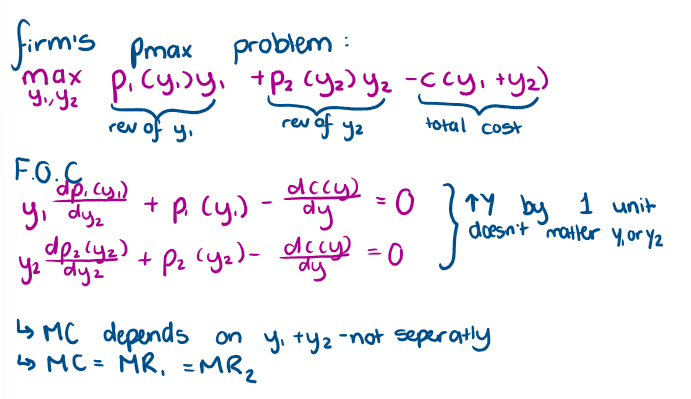

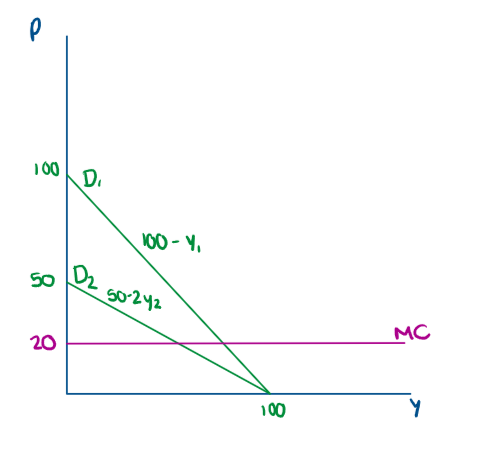

What are we assuming for third-degree price discrimination?

the monopolist can prevent resale, so no consumer can buy at a low price and sell to another consumer at a higher price

2 groups with different demand for a single product

group 1’s demand = D1 (p1), inverse demand = p1(y1)

Group 2’s demand = D2(p2), inverse demand = p2(y2)

Monopolists costs of producing output = c(y1 + y2)

What is a firm’s profit maximisation problem? and how is it solved

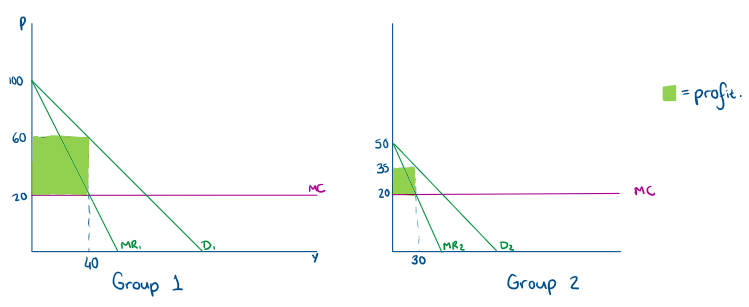

What happens to elasticity in third-degree price discrimination? And how does it tell us how much the consumer will pay

Comparison: how does profit compare between price discrimination and non- price discrimination?

profit is higher in price discrimination

if it was more profitable for the firm to sell at the same price for both groups → nothing to stop it from doing so when we solved the price discrimination case.

the fact that they chose to sell at different prices is because it is more profitable to do so

what will a MC, D graph look like for both individual firms groups?

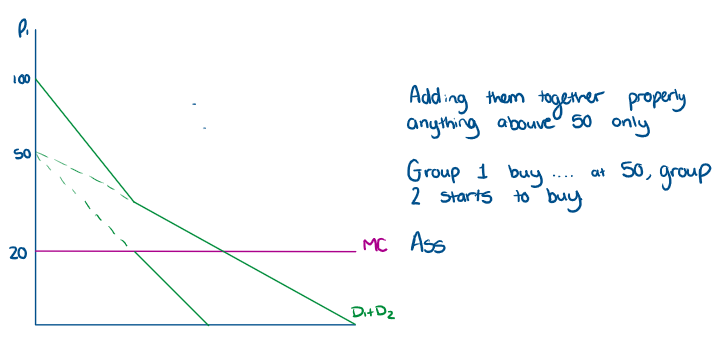

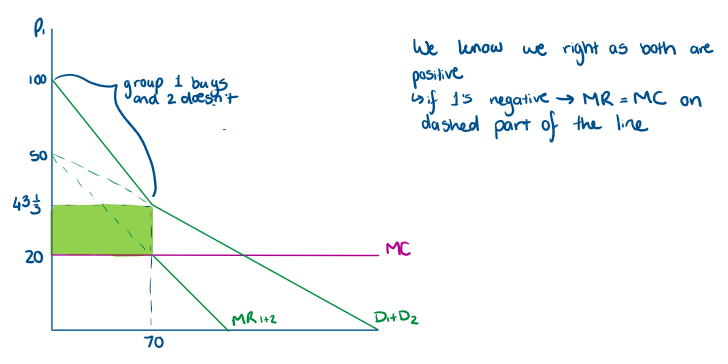

What does the Demand curve for both firms together look like?

What will profit maximisation look like for each group?

What does profit maximisation look like for both groups together?

What is monopolistic competition?

combines aspects of monopoly and a competitive market

competitive bc - firms are free to enter and exit → profits are driven down to 0

monopolistic bc/ - each firm produces a differentiated product rather than them being perfect substitutes they are imperfect substitutes → product differentiation

same level of concerns _ all similar quality

What is product differentiation?

feature of most industries w/ more than 1 firm competing

Any consumer may prefer one product to another not due to quality difference but simply personal preference

What are different forms of product differentiation?

difference in products

Difference in branding or advertising

What does product differentiation mean for firms if they want to raise their prices?

firm does not instantly lose all its sale

some consumers like the firm’s variety of the product enough to be willing to pay a higher price and still consume it, whil other consumer will switch to a different variety

firms increasing price → loses sakes relatively quickly but not immediately lose all sales

demand curve is flatter/more elastic

if only 1firm puts up their price up they lose alot but if everyone does they dont lose that much

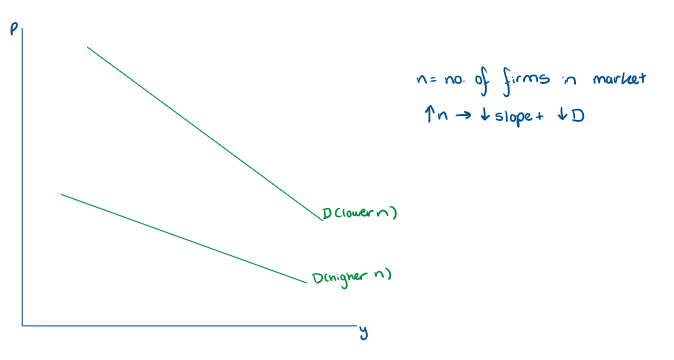

How is an individual firm’s demand curve affected by additional firms entering a monopolistic competition market?

2 effects

market is shared by more firms → individual firm has a smaller share + demand curve shifts inward

increased competition → consumers have more variety to choose from → easily lose sales to rivals if they raise their price → demand becomes more elastic (flatter)

If there are n firms in the market the effect of increasing n on an ind

What happens to a demand curve in monopolistic competition if firms enter the market

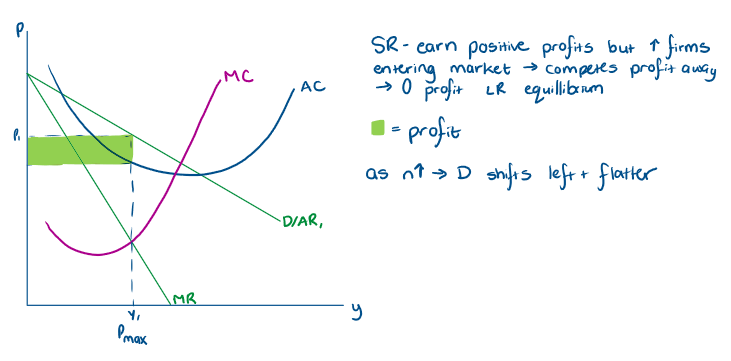

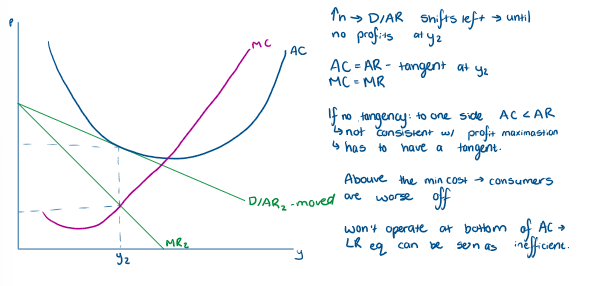

What must be true to get a long run equilibrium in a monopolistic competition?

each firm is maximising profit, so producing where MC = MR

Each firm is producing on its individual demand/AR curve

Profit for each firm is 0→ AR = AC

Only happens if there is a tangency between AR and AC at the level of output where MR = MC

What happens in the short run of a monopolistic competition, include a diagram?

What happens in the Long run of monopolistic competition, include a diagram?

Is monopolistic competition efficient?

compared to a competitive market → consumers are worse off:

a competitive market has a lower price → equivalent to bottom of AC curve + higher consumer surplus

however, consumers may like product variety → dont have in competitive market → for some products they may be better off even with higher price

depends on product and depends on market → could go either way, prices aren’t all that matters