Macroeconomics textbook understanding

1/63

Earn XP

Description and Tags

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

64 Terms

What could cause an increase in potential economic growth?

An increase in the labour supply

An increase in investment

An increase in productivity

What is the difference between GDP and GNI

GNI is GDP plus net income paid into the country by other countries

How is net income calculated for GNI?

Profits and income earned overseas from locally owned firms MINUS profits and income that goes abroad from foreign-owned companies

What are the two ways an economy can grow?

To be a volume or value producer: sell more stuff at lower prices or sell less stuff at higher prices

What does an evaluation of economic growth figures depend on?

How well off the country is in the first place

How much of the output is self consumed (so doesn’t appear as GDP)

Methods of calculation and reliability of data

Composition of government spending (is money spent on warfare or on areas that directly impact quality of life e.g. education)

What are some limitations of using GDP to compare living standards between countries?

Subsistence, barter, and the hidden economy

The informal economy (e.g. growing your own fruit or volunteering at a shop)

Currency values (whether to use the exchange rate or the purchasing power)

Income distribution

Size of the public sector

Consumer and capital spending

Quality of life issues (e.g. more stress from working more hours)

Why do we use the consumer price index (CPI) to measure the general price level?

Using an index means that percentage changes can be shown easily, making effective comparisons possible

What are some problems associated with deflation?

The real payments will become larger for people with debts

It stops any firm from wanting to invest in a country from abroad as the value of output is likely to fall

It will likely cause AD to fall as people know that they can buy things for cheaper at a later date

How is inflation calculated?

First survey: the ONS collects data from self-reported diaries of all purchases from around 7000 households.

This determines the contents of a virtual basket of goods and services that households spend their money on, and weights are assigned based on the proportion spent on each

Second survey: an average from a selection of prices from high and low cost shops is gathered for each item.

Then, you can measure year on year the change in the general price index to see inflation

What are some issues with the CPI?

It doesn’t include housing costs such as mortgage interest repayments or rent (average mortgage payments cost 15-20% of income)

Measures the cost of living only for an average household. The top and bottom 4% income brackets are not included, and nor are pensioners

Sampling problems: In 2017, less than 50% of the households replied to the survey. Households may also not give accurate information

The list of 650 items is changed once a year, but tastes and fashions change much faster

Unrepresentative of someone with atypical spending patterns e.g. a vegetarian or someone who takes the rail to work

Sometimes the quality of the good changes. e.g. a new iphone might cost more this year, but it is because it is of higher quality than the last phone

What’s the main difference between CPI and CPIH?

CPIH includes changes in residential rents across the UK. It also includes council tax in its calculation

What is an advantage of the RPI?

More inclusive than the CPI as it includes housing costs

What are disadvantages of the RPI?

Not as reliable for international comparison as the statistical method of basing the data is unique to the UK

The RPI includes the cost of mortgage interest repayments and these will rise when interest rates are raised, any interest rate rise to tackle inflation will have a one-off effect of making inflation look worse and the policy-makers look incompetent

What effects does inflation have on consumers?

The real value of savings falls as prices rises

The purchasing power of those on fixed incomes falls as prices rise (for example, pensioners)

Those with high levels of personal debt benefit, as the real value of the debt falls

What effects does inflation have on firms?

Loss of international competitiveness - the balance of trade is likely to worsen

Loss of business confidence

Investment from abroad might decrease - why buy into a currency that is falling in value?

Increased prices might be a sign that firms can make more profits

A little inflation means that real wage differentials can be changed without actually cutting wages in nominal terms (workers will accept wage rises below the rate of inflation but never accept wage cuts)

What effects does inflation have on the government?

Inflation reduces the real interest rate, so the real value of the government’s debt falls

A little inflation provides a cushion against the perils of deflation

Fiscal drag may occur: people’s nominal wages rise so they’re drawn into a higher tax bracket, even though real income (Purchasing power) hasn’t increased. Businesses may also make higher profits so pay higher tax

What effect does inflation have on workers?

Some workers may expect an increase in their wages but firms don’t feel confident paying higher costs

What are the two parts of the working age (16-64) population?

The labour force / currently active population

The economically inactive

What is a problem of the ILO’s labour force survey?

The survey data are 6 weeks out of date by the time they are published

What are benefits and problems with the claimant count as a measure of unemployment?

Problems:

There is stigma attached so not everyone who is eligible claims it

The criteria for eligiblity are very tight

Benefits:

Quick and cheap to obtain the data

Give a useful measure of hardship

What factors affect the employment rate?

The school or compulsory training leaving age. In the short term, this would reduce the size of the workforce as anyone in education is not economically active, but in the longer term school leavers are likely to be more employable

Number of school leavers entering higher or further education

Number of people who continue to work beyond the state requirement age. The state pension in the UK is low relative to other developed economies

Level of net migration

Availability of jobs

Level of taxes and benefits - high income taxes and high out-of-work benefits are a disincentive to work

What is the classical view of unemployment?

There are only unemployed people who are not able and willing to work at the going wage rate

So, unemployment is just a short term problem and the best solution is laissez faire

If people accept lower wages, the cost of living will fall as firms dont need to cover high costs with high prices, so the lower wage will become acceptable

People who believe this think that out of work benefits should be cut, trade union power curtailed and there should be no minimum wage

What is the Keynsian view of unemployment?

If people spend too little and save too much (low AD), there will be less demand for goods and services, which will result in fewer job opportunities, which will lead to less spending… etc etc

Even if wages are cut, there will still not be more people employed - lower wages = less spending = even fewer people needed in employment

Other reasons include a lack of business confidence, an increase in the value of a currency, slow rates of productivity growth, and an economy undergoing structural change

How do the skills of the labour force affect structural unemployment?

The higher the level of skills in the labour force, the more flexible workers will be in there is a change in the requirements in the labour market

What are the effects of unemployment on consumers?

Lower incomes, therefore living standards will fall

People out of work may become demoralised and their skill sets will become obsolete

What are the effects of unemployment on firms?

People spend less, so they may have to lower prices and make less profit

However, people may be more willing to stay in their jobs for fear of unemployment

What are the effects of unemployment on workers?

Over time, workers might find their skills become obsolete/out of date

What are the effects of unemployment on the government?

The government has to pay more in social benefits

The government will recieve less in tax revenues from income tax and VAT

How has international trade affected countries?

Countries become interdependent, relying on each other for income (through exports) and resources (through imports). This means that if one country or area suffers this has a direct effect on other countries

Why is the AD curve downwards sloping?

NOT ‘people buy more when its cheaper’

Lower prices in an economy = increase in net exports = higher AD

Total expenditure by the economy remains much the same along the AD curve. When there is a fall in the price level, people spend ~the same amount but buy a large amount of goods/services. (the real balance effect)

At higher price levels, interest rates are likely to be raised by the monetary authorities. This means investment may fall and savings increase

What factors affect consumption?

Income (but at higher incomes people tend to save a higher proportion of income)

Consumer confidence

Interest rates

The housing market (wealth effect)

What factors affect investment?

Interest rates

Profits of businesses (many finance their investment from retained profits)

Corporation tax rate

Government policy

Exchange rate (more exports = more profit)

New technological developments (could increase productivity and decrease unit costs, so businesses will have a good incentive to invest)

Business confidence

What factors affect net exports?

Changes in real income

Changes in the exchange rate (but in the short run the PED for im/exports tends to be low

Changes in the global economy (in/deflation in different countries economies)

The degree of portectionism (e.g. USA imposes tarrifs on UK steel)

Non-price factors (e.g. quality)

What factors affect the LRAS?

Changes in relative productivity

Changes in education and skills

Demographic changes and migration

Health spending (Healthier workforce = less days off and active beyond retirement age. However this might be spent on the elderly, which arent economically active)

Technological advances (reduces costs for firms)

Changes in government regulation (deregulation leads to less costs for firms)

Reduction in barriers to international trade (increased competition drives down prices and inefficient domestic firms are overtaken by better overseas firms. increase in globalisation = increase in AD)

What causes shifts in the SRAS vs LRAS curve?

SRAS: short-run ‘supply-side’ shocks. This includes changes in the price of oil or exchange rates

LRAS: Changes in the quantity or quality of factors of production

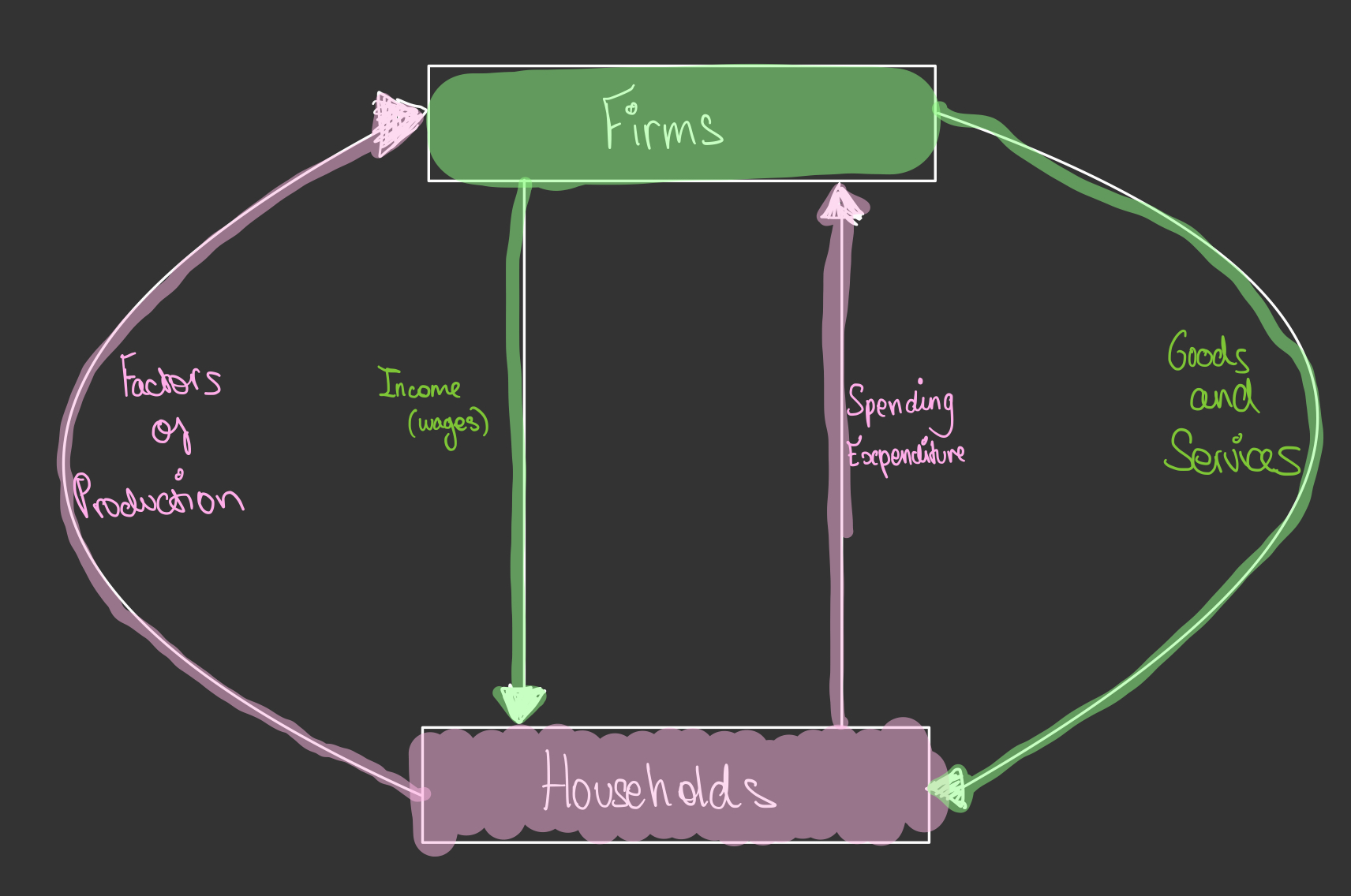

Draw the circular flow of income

What are the three injections into the circular flow of income?

Investment (an increase in the capital stock)

Government spending

Exports

What are the three withdrawals from the circular flow of income?

Savings

Tax

Imports

How is the multiplier calculated?

1 / MPW or 1 / (MPS + MPT + MPM) or 1 / (1-MPC)

What are some constraints on economic growth?

Labour market problems (developing countries have falling birth rates. They need to allow more immigration)

Interest rates (affect investment and consumption)

Deficiencies in infrastructure

External factors (e.g. global recession or trump’s tariffs)

What are some effects of a positive output gap, and what does it signify?

Tight labour markets

Wage pressures

Shortage of raw materials

Can be a sign that the economy is overheating and the inflationary pressures are likely to be evident

Interest rates are likely to be raised

Why is it hard to estimate the size of the output gap?

Not all unemployed resources would have the same impact on the economy if they were eventually employed

The non-use of resources makes them less useable in the future and the productive potential of the economy tends to fall when there is long-term unemployment

What are characteristics of a recession (opposite of boom)

Falling real incomes and consumption

An improvement in the balance of trade (less consumption = less imports)

Rising unemployment

Disinflation

Lower tax revenues for the government - an increasing budget deficit

How does economic growth benefit consumers?

Incomes and wealth rise

People can save money for future consumption

Consumer confidence rises

Wages might rise as firms try to keep hold of their workers

How does economic growth benefit firms?

More profit (due to more consumption)

Firms can take on more workers

Firms can invest more (increases future growth prospects)

They may be able to afford to use cleaner technology, improving their brand image and living standards

How does economic growth benefit governments?

When incomes and asset prices rise, people pay more in taxes. Firms will also pay more corporation tax

There will be less unemployment and social benefits to pay

What are some costs of economic growth?

Opportunity cost - in the short term, more funds on capital goods instead of consumer goods may lead to a fall in living standards. this will be fixed in the long term when PPF shifts out

Income inequality - the unwaged and unskilled are less likely to benefit from increased incomes

Environmental problems - depletion of natural resources and external costs such as carbon emissions. (However, the government can use increased tax revenue to help)

Balance of payments problems on the current account - if the growth wasn’t export-led, higher incomes = more imports. high domestic demand may = less exports, as firms don’t need to rely on exports as much

Inflation - little spare capacity in the economy may lead to shortages in factors of production e.g. skilled labour

Increased stress and social dislocation - e.g. working longer hours

What are the seven main macroeconomic objectives for governments?

Economic growth (rises in RGDP)

Reduction in unemployment

Control inflation

Equilibrium in the BOP on the current account

Balanced government budget

Protection of the environment

More equal income distribution

How does quantitative easing work?

The BOE makes large purchases of government bonds

This pushes up their price and lowers the interest rate (yields) on these bonds

The lower interest rates feed through the economy, reducing the cost of borrowing by firms and households

QE will also cause a rise in asset prices. This will lead to a wealth effect

How does quantitative tightening work?

Central banks sell bonds or other assets to the money markets

Reducing the demand for bonds, QT can lead to higher interest rates

What are the two types of fiscal policy, and what do they involve?

Expansionary policy - cutting tax or raising government spending

Contractionary policy - raising tax or reducing government spending

What type of inflation is monetary policy more suitable for, and why?

Demand-pull.

When there is cost-push inflation, higher interest rates raise the costs of production. At a time of rising commodity prices, the people who have to bear the brunt of this are people in debt

How effective is monetary policy?

Shorter lag time than fiscal policy

It’s a blunt tool that hits the whole economy. It affects both small and large firms, and interest rate rises usually worsen income distribution

Bad at dealing with cost-push inflation - more suited to demand-pull

How effective is fiscal policy?

Can only be implemented in the annual autumn budget, and there is also an implementation lag as many tax changes cannot be implemented until the start of the next fiscal year in April

Can cause crowding out

Resource crowding out: If a government builds a new hospital, there’s less scope for a private hospital in the vicinity

Financial crowding out: When the government runs a deficit, it stifles private investment

What are the two types of supply side policy?

Market based - increase the effectiveness of markets

Interventionist policies - governments getting involved in markets to reduce market deficiencies

Name some market-based methods of supply-side policies

Improving incentives

Increasing competition

Labour market reforms

Increasing price flexibility and signalling in a market

Name some interventionist methods of supply-side policies

Improving education and training

Improving infrastructure

Improving healthcare and introducing performance-related pay

How does the supply-side market-based method of improving incentives work?

Give higher rewards to workers e.g. through cutting income tax rates

Corporation taxes could also be cut. This would enable firms to keep more profit and so give them a greater incentive to take risks e.g. through increasing investment

How does the supply-side market-based method of increasing competition work?

Promoting the entry of small firms into the market

Privatisation

Deregulation (usually accompanies privatisation, so when a state monopoly is privatised, measures are taken to enable new firms to enter and compete with the newly privatised firm)

How does the supply-side market-based method of labour market reforms work?

Reducing unemployment benefits

Reducing minimum wages

Reducing the power of trade unions

How does the supply-side market-based method of increasing price flexibility and signalling in a market work?

If prices aren’t used to allocate resources effectively, there will be surpluses/deficits in the market.

e.g. price caps on electricity and gas might encourage over-consumption and so result in shortages

How does the supply-side interventionist method of improving education and training work?

e.g. increasing spending on pre-school education to offering firms subsidies to take on apprentices

However, these are expensive and have a huge time lag

How does the supply-side interventionist method of improving healthcare and introducing performance-related pay work?

Increase productivity = more output at any given price level

What’s the relation between the control of inflation and the balance of payments on the current account?

When the main goal is controlling inflation, interest rates may be higher than they would be otherwise. High interest rates = High exchange rate = High imports = worsening the current account

Low rate of inflation = international competitiveness of goods and services = improvement of balance of payments on the current account