Final Exam #2

1/35

Earn XP

Description and Tags

Weeks 5-11

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

Financial Tools to help analyse project risk

Sensitivity analysis

Break-even analysis

Simulation analysis

Sensitivity Analysis

How changes in input factors (like price, interest rates, or costs) affect the outcome (like profit, investment return, or system behavior).

Estimate NPV using optimistic variables

Estimate NPV using pessimistic variable

Calculate range

Repeat

Scenario Analysis

A specific form of sensitivity analysis

Imagine a scenario – for example when best (worst) values are simultaneously realised for all variables of interest

Compute the NPV under the imagined scenario

Break-even Analysis

Shows the point where a project or business neither makes a profit nor a loss—i.e., where NPV = 0.

Fixed costs / Selling price - Variable Cost

Simulation Analysis

simulation changes many variables at once, using random values within realistic ranges

Decision Tree Analysis

A visual way to map out choices, risks, and outcomes in uncertain situations

Rectangle = decision point

Circle = denotes a probabilistic event where something will happen with some probability

Benefits:

Makes you think beyond just “today”—you have to connect today’s decision with future choices.

Limitations:

Can get very complex fast

Uncertainty with discount rates: By using the same discount rate (I.e. cost of equity) for everything, we’re assuming that all the cash flows have the same level of risk and that the risk doesn’t change over time.

Payoff from a Call Option

A call option is a contract that gives you the right (but not the obligation) to buy an asset (like a stock) at a set strike price before a certain date.

→ You use a call when you think the price will go up.

Payoff from a Put Option

A put option is a contract that gives you the right (but not the obligation) to sell an asset at a set strike price before a certain date.

→ You use a put when you think the price will go down.

Motivation for Real Options

Real options are choices a company has inside a real project — like the option to wait, expand, shrink, abandon, or change the project later, depending on how things turn out.

They are opportunities, not obligations (the company doesn’t have to act if it doesn’t want to).

Standard NPV vs Real Option Analysis

• Standard NPV analysis is static

• Real option analysis is dynamic

Two issues with Real Options

Identification

First, you have to spot if there are any real options hidden in the project.

Valuation

After finding the options, you need to figure out how much they’re worth

Four types of real options

1. Option to delay making an investment (a timing option)

2. Option to expand operations by making follow-up investments (a growth option)

3. Option to abandon the project (an exit option)

4. Option to vary the output or production methods (a flexibility option)

Importance of Real Options

Real Options Analysis (ROA) is more important when:

There is lots of uncertainty about the future (like prices, costs, demand, etc.).

Managers can change their decisions later based on new information

Long-term

Industry is fast-changing

Types of takeovers

Horizontal takeovers: Target and acquirer are in the same industry

Vertical takeovers: Target’s industry buys from or sells to acquirer’s industry

Conglomerate takeovers: Target and acquirer operate in unrelated industries

Friendly takeovers: approved by target’s management

Hostile takeovers: not approved

Reverse takeovers: A private company acquires a public company

Financing a Takeover / Stylised Facts

Cash bid: Pays cash to the target’s shareholders for their shares

Adv: Certain and clearly understood by the target management and shareholders

Disadv: Raising the necessary cash can be difficult for the bidder if the target is large, bidder’s debt rating will go down if it borrows more to fund

Share bid ("script bid): Acquiring company proposes to exchange its own shares for the target’s shares

Adv: Avoids strain on the cash position of the bidder

Disadv: Equity issue is an expensive way of raising capital

Stylised Facts

Takeovers happen in "waves"

Takeover waves usually focus on just a few industries at a time.

When a takeover is announced:

Shareholders of the target company usually gain

Shareholders of the acquiring company often lose a little

Reasons for Takeovers

Sensible Reasons

Operating synergies (decrease cost, increase revenues)

-Economies of scales/scope

Replace poor current target management

Market Power (big competitor means less competition)

Tax Savings

Dubious (hesitant) Reasons

Diversification: owning different kinds of businesses (shareholders can do this on their own - unnecessary, expensive)

Managerial Motives (Empire-building, Overconfidence)

Valuation Techniques

Market Capitalisation (Market Cap)

– The value of a company’s equity (shares).

Enterprise Value (EV)

– The total value of the whole company (both debt and equity).

Intrinsic valuation (DCF analysis): Estimates a firm’s intrinsic value that is determined by its fundamentals – cash flows, growth, and risk

Providing a benchmark to assess whether the takeover price is fair

Forecast Period – Project cash flows for the next 5–10 years

Terminal Value – Estimate the value of the business beyond the forecast period

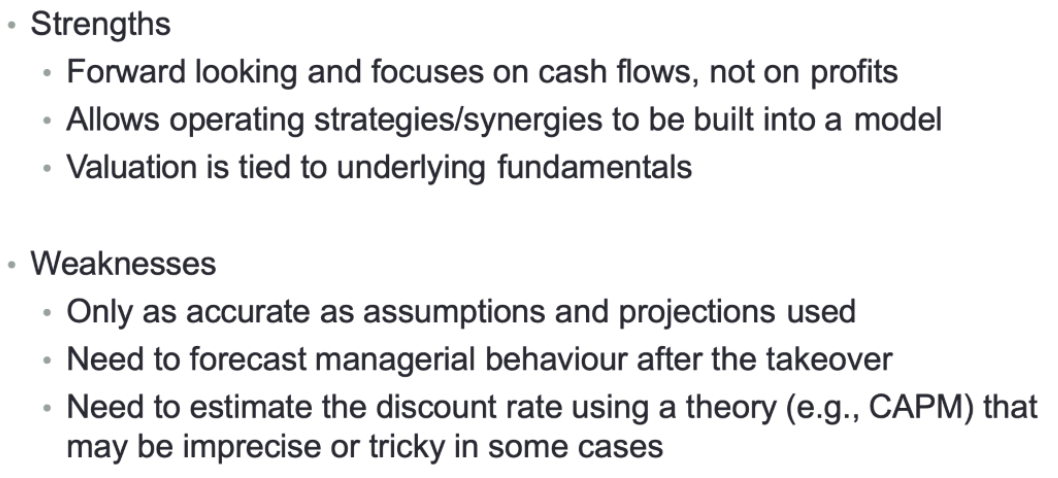

Pros and Cons – DCF Method

Relative valuation

Comparable Companies Market Multiples Method

Estimates a firm’s market value by comparing with similar publicly traded comparable companies, using certain ratios

Based on the idea that similar businesses should be worth similar amounts

Adv: common, convenient

Disadv:

Comparable Transactions Method

Looks at past takeover deals for similar companies to estimate a target’s value.

shows the actual prices paid in real acquisitions

Economic Evaluation of Takeovers

Synergy value is the extra value created when two companies merge

Acquisition premium is the extra amount paid above the target company’s value before the offer (usually based on its stock price).

A takeover only makes financial sense if the synergy value is greater than the premium paid.

Paying with stock

Fixed Shares:

The number of shares is fixed, but their value can change with the market.

Fixed Value:

The dollar amount is fixed, but the number of shares changes based on the buyer's share price before closing.

Collars, Floors, and Ceilings

These are built-in protections in stock deals to avoid one side getting too much or too little if share prices change.

EPS bootstrapping refers to where an acquirer buys a company with a low PRICE/EARNINGS RATIO through a STOCK SWAP in order to boost the post acquisition EARNINGS PER SHARE (EPS) of the newlyformed group and create a rise in the stock price.

Regulatory Issues in Takeovers

Merger activity is influenced by local laws and regulations.

Key Regulatory Areas to Consider:

Anti-monopoly

Foreign investment

Employment protection

Special industry protection

State protection

The ACCC (Australian Competition and Consumer Commission) monitors mergers to prevent reduced competition in markets or monopolies

Mergers that reshape markets or reduce competitive pressure may face regulatory challenges.

Corporate Restructuring

Reorganizing the legal, ownership, operational, financial or other structures of a company for the purpose of making it more profitable, or better organized for its present needs

Three distinct groups of activities:

• Business (or operational) restructuring

• Financial restructuring

• Organizational restructuring

Types of Restructuring

Business (or operational) restructuring

Changes in the mix of assets owned by a firm or the lines of business (mergers, acquisitions, spin-offs, etc.)

Financial restructuring

Improvements in the capital structure and/or ownership/control of the firm

Leveraged transactions (LBO/MBOs) and debt restructuring

Organizational restructuring

Significant changes in the organizational structure of the firm

Divisional redesign and employment downsizing

Restructuring motivations:

Align shareholder and manager interests (solve agency problem)

Transfer assets to more efficient owners

Sharpen management focus when lacking diverse skillsets

Bad past acquisitions causing losses (negative synergy)

Breaking up firms can "unlock" hidden value, known as addressing the diversification discount

Business (or Operational) Restructuring

Divestitures (Asset Sales)

Selling a business unit or asset to another company

Seller retains the funds but loses all control over the sold asset

Spin-offs

A company splits off part of its business into a new, separate listed company

Existing shareholders get shares in the new company pro-rata (based on what they already own)

No cash/fund is received by the parent company

Equity Carve-outs

Similar to a spin-off, but instead of giving shares to existing shareholders, the parent sells a portion of a subsidiary’s shares to the public (via IPO)

The parent company keeps a majority stake and receives cash (retains funds) from the sale

Ownership of shareholders are unaffected and they benefit from subsidiary

Financial Restructuring

Leveraged Transactions (LBOs/MBOs)

What is a Leveraged Transaction?

A small group of investors buys a company using mostly borrowed money (debt) and a small amount of their own (equity). The assets of the company being acquired, along with those of the acquiring company, are often used as collateral for the loans.

The company often goes private (temporarily).

Two types:

LBO (Leveraged Buyout) – led by private equity (PE) firms

MBO (Management Buyout) – led by existing management

Debt Restructuring

A company reorganizes its debt when it's struggling to make payments (i.e., in financial distress) → Debt settlement, Debt-for-equity swap, Modified debt terms (Lower interest, Extended repayment period)

Goal:

Help the company survive

Avoid costly legal proceedings like bankruptcy

Allow creditors to recover at least part of their money

Overoptimism

Overoptimism means overestimating the chances of good outcomes or underestimating bad ones.

Entrepreneurs often overestimate how successful they’ll be.

Insolvency

Stock-based insolvency: The company's total assets are worth less than its total debts.

Flow-based insolvency: The company’s cash flow isn’t enough to make required payments on time.

Investment Distortions When a Firm Is Close to Bankruptcy

Excessive Risk-Taking (Asset Substitution)

Debt Overhang (Underinvestment)

Companies have several ways to manage distress, including:

-Selling major assets to raise cash.

-Merging with another company.

-Issuing new shares or bonds.

Liquidation vs. Reorganization

When a firm can't pay its debts, it has two main choices:

-Liquidation: Shuts down the company and sells its assets.

Absolute Priority Rule (APR)

Sets the order in which claims are paid in liquidation:

-Secured creditors (backed by collateral) are paid first, from the sale of that collateral.

-Reorganization: Tries to keep the company running by restructuring its finances.

Corporate risk

exposure of a company's earnings, cash flows, or market value to uncertain external factors or events

Types of Corporate risk

Market risks:

• Price movements in financial markets (e.g. interest rate, exchange rate, and commodity price risks)

• Managed using financial derivatives or other financial contracts

Commercial (or operational) risks:

Risks from running the business caused by internal processes or unexpected competitor actions.

Managed by company as they partly control these risks.

Can't be hedged with financial tools like derivatives

External event risks:

• Stem from non-market events such as natural catastrophes or changes in tax or regulatory policies

• Managed using insurance products

What is Risk Management?

Risk management = reducing uncertainty in future business outcomes.

Goal: remove bad outcomes, keep good ones.

Works like options: can limit losses (future payoff can’t go below zero), but still allows gains.

Risk management can add value in real (imperfect) markets via cash flow by:

Tax savings (due to tax non-linearity)

Risk management that stabilizes income can reduce or eliminate taxes, especially when tax preferences (like carry-forwards) are involved

Lower bankruptcy costs

Avoiding underinvestment (protects future projects)

Better monitoring and reduced managerial risk-taking

Also improves WACC by managing debt/equity more efficiently

Risk Management Tools

Derivatives: contracts whose value depends on (or “derives from”) the price of an underlying asset

Derivatives help manage risk by cutting losses, like options.

Common derivatives: forwards, futures, options, swaps.

Hedging: strategy used to reduce or eliminate the risk of adverse price movements in an asset. It’s like buying insurance to protect yourself from financial losses

Hedging is costly, so firms hedge only net exposure, not everything.

Natural hedges occur by matching revenues and costs in same currency or location.

Example: Making goods in Australia to sell in Germany → open factory in Germany, borrow in euros → reduces currency risk naturally, less hedging needed.

Valuation of Takeover - STEPS

1. Calculate Free Cash Flows in forecast period (t=1,...T) - FCF formula

2. Terminal value (estimating the value after the forecast period, using perpetuity/TV formula)

3. Discount all cash flows to Present Value

Take all the projected FCFs (from forecast years and terminal value) and discount them back to today using the WACC (Weighted Average Cost of Capital).

This gives you the present value of the entire firm — the Enterprise Value.