Government Accounting Pinnacle

1/50

Earn XP

Description and Tags

Flashcards on Government Accounting

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

51 Terms

Government Accounting

Encompasses the processes of analyzing, recording, classifying, summarizing, and communicating all transactions involving the receipt and disposition of government funds and property, and interpreting the results thereof.

Charged with government accounting Responsibility

Commission on Audit (COA)

Department of Budget and Management (DBM)

Bureau of Treasury (BTr)

Other government agencies.

Commission on Audit (COA)

Has the exclusive authority to promulgate accounting and auditing rules and regulations.

Keeps the general accounts of the government, supporting vouchers, and other documents.

Submits financial reports to the president and congress.

Department of Budget and Management (DBM)

Responsible for the formulation and implementation of the national budget with the goal of attaining the nation’s socio-economic objectives.

Bureau of Treasury (BTr)

Acts as cash custodian of the government.

Authorized to receive and keep national funds and manage and control the disbursements thereof

Maintains accounts of financial transactions of all national government offices, agencies and instrumentalities.

Government Agencies

Refers to any department, bureau or office of the national government, or any of its branches and instrumentalities, or any political subdivision, as well as any government owned or controlled corporation (GOCC), including its subsidiaries, or other self-government board or commission of the government.

National Budget

The government’s estimate of the sources and uses of government funds within a fiscal year.

The Budget Cycle

Budget Preparation

Budget Legislation

Budget Execution

Budget Accountability.

Budget call

The budget preparation starts when the Department of Budget and Management (DBM) issues this to all government agencies.

It contains, among other things, the next fiscal year’s targets, the agency’s budget ceiling and other guidelines in the completion and submission of agency budget proposals.

Budget hearing

The DBM deliberates on the budget proposals, makes recommendations, and consolidates the deliberated proposals into the National Expenditure Program (NEP) and Budget of Expenditures and Sources of Financing (BESF). The DBM then submits the proposed budget to the President

Preparation to the Office of the President

After the President approves the proposed budget, the DBM finalizes the budget documents to be submitted to the Congress. At this point, the proposed budget is referred to as the President’s Budget.

House Deliberations

The house of representatives conducts hearings to scrutinize the various agencies’ respective proposed programs and expenditures. Thereafter, the HOR will prepare General Appropriation Bill (GAB).

Senate Deliberation

The senate conducts its own deliberations on the GAB

Bicameral deliberations

This is formed to harmonize any conflicts between the representatives and senate versions of GAB. Thereafter, final GAB is submitted to the President for enactment.

President’s enactment

The president enacts the GAB and will now known as General Appropriations Act (GAA). The president, however, may exercise his veto power before his enactment of the bill.

Release guidelines and BEDs

The DBM issues guidelines on the release and utilization of funds while the various agencies submit their Budget Execution Documents (BEDs).

Allotment

Authorization issued by the DBM to government agencies to incur obligations for specified amounts contained in a legislative appropriation in the form of budget release documents.

Posted in the Registry of Appropriations and Allotments (RAPAL) and Registries of Allotments, Obligations, and Disbursements (RAOD).

Incurrence of obligations

Government agencies incur obligations which will be paid by the government.

Recorded in the Obligation Request and Status (ORS) documents and Registries of Allotments, Obligations, and Disbursements (RAOD)

Appropriation

Authorization by a legislative body to allocate funds for specified purposes.

Posted in the Registry of Appropriations and Allotments (RAPAL).

Obligation

Amount contracted by an authorized officer for which the government is held liable.

Disbursement

Actual amount paid out of the budgeted amount.

Budget accountability reports

It is required by the government agencies to submit.

Performance reviews

The DBM and COA perform periodic reviews of the agencies’ performance and budget accountability and report to the president.

Audit

The COA audits the agencies

Budget Registries

Registries of revenue and other receipts (RROR)

Registries of appropriations and allotment (RAPAL)

Registries of allotments, obligations and disbursements (RAOD)

Registries of budget, utilization, and disbursements (RBUD)

Registries of revenue and other receipts (RROR)

Used to monitor the budgeted amounts, actual collections and remittances of revenue and other receipts.

Registries of appropriations and allotments (RAPAL)

Used to monitor appropriations and allotments. This is to ensure that allotments will not exceed appropriations.

Registries of allotments, obligations and disbursements (RAOD)

Used to monitor the allotments received, obligations incurred against the corresponding allotment, and the actual disbursements made.

Personnel Services (PS)

Pertain to all types of employee benefits.

Maintenance and other operating expenses (MOOE)

Pertain to various operating expenses other than employee benefits and financial expenses.

Financial Expenses (FE)

Pertain to finance costs.

Capital Outlays (CO)

Pertain to capitalizable expenditures.

Registries of budget, utilization, and disbursement (RBUD)

Used to record the approved special budget and the corresponding utilizations and disbursements charged to retained income.

Budget Preparation

Budget Call

Budget Hearing

Preparation to the Office of the President

Budget Legislation

House Deliberations

Senate Deliberation

Bicameral Deliberations

President’s enactment

Budget Execution

Release guidelines and BEDs

Allotment

Incurrence of obligations

Disbursement authority

Disbursement authority

Appropriation

Allotment

Obligation

Disbursement

Budget Accountability

Budget accountability reports

Performance reviews

Audit

Journals

General journal

Cash receipts journal

Cash disbursements journal

Check disbursement journal

Ledgers

General ledgers

Subsidiary ledgers

Object of Expenditures

Personnel Services (PS)

Maintenance and other operating expenses (MOOE)

Financial Expenses (FE)

Capital Outlays (CO)

The Government Accounting Cycle

Appropriation

Allotment

Incurrence of obligation

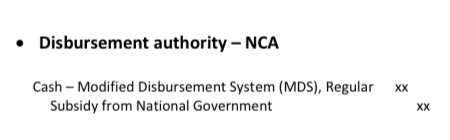

Disbursement authority – Notice of cash allocation (NCA)

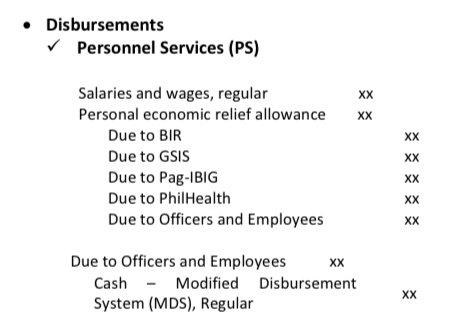

Disbursements

Billings, collections & remittances

Unadjusted trial balance

Adjusting entries

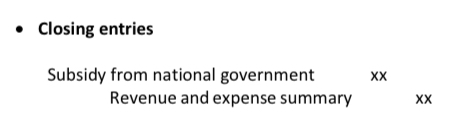

Closing entries

Preparation of financial statements

BOOKS OF ACCOUNTS AND REGISTRIES

Journals

Ledgers

Registries

Journal entry for Disbursement authority – NCA

Dr. Cash – Modified Disbursement System, Regular

Cr. Subsidy from National Government

Journal entry for Disbursement - Personnel Services

Dr. Salaries and wages, regular

Dr. Personal economic relief allowance

Cr. Due to BIR

Cr. Due to GSIS

Cr. Due to Pag-IBIG

Cr. Due to PhilHealth

Cr. Due to officers and employees

Dr. Due to officers and employees

Cr. Cash - Modified Disbursement System, Regular

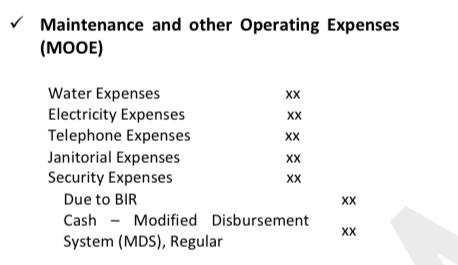

Journal entry for Disbursement - Maintenance and other Operating Expenses

Dr. Water Expenses

Dr. Electricity Expenses

Dr. Telephone Expenses

Dr. Janitorial Expenses

Dr. Security Expenses

Cr. Due to BIR

Cr. Cash - Modified Disbursement System, Regular

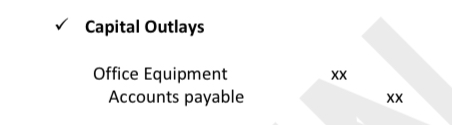

Journal entry for Disbursement - Capital outlays

Dr. Office Equipment

Cr. Accounts payable

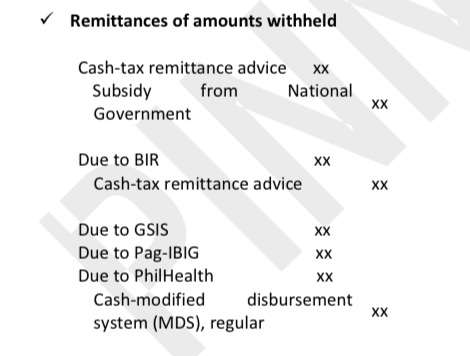

Journal entry for Disbursement - Remittances of amounts withheld

Dr. Cash-tax remittance advice

Cr. Subsidy from National Government

Dr. Due to BIR

Cr. Cash-tax remittance advice

Dr. Due to GSIS

Dr. Due to Pag-IBIG

Dr. Due to PhilHealth

Cr. Cash-modified disbursement system, regular

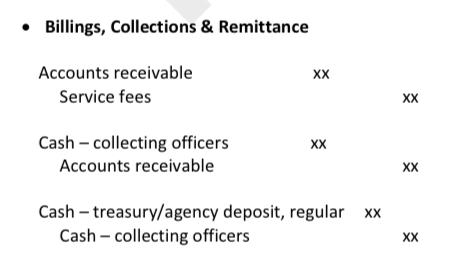

Journal entry for Billings, Collections & Remittance

Dr. Accounts receivable

Cr. Service fees

Dr. Cash-collecting officers

Cr. Accounts receivable

Dr. Cash-treasury/agency deposit, regular

Cr. Cash-collecting officers

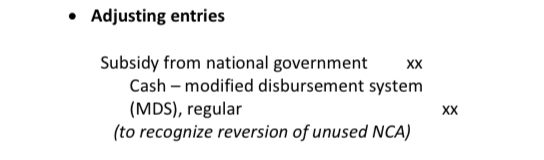

Adjusting entries to recognize the reversion of unused NCA

Dr. Subsidy from national government

Cr. Cash - modified disbursement system, regular

Journal entry for the closing entries in the government accounting cycle

Dr. Subsidy from national government

Cr. Revenue and expense summary