theme 2

1/177

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

178 Terms

What is Gross Domestic Product (GDP)?

The value of all goods/services produced in an economy.

When does economic growth occur + what does it lead to?

When there is a rise in GDP.

It leads to higher living standards + more employment opportunities.

How is GDP measured through?

Adding up all the expenditure in the economy, e.g. consumption, gov spending

Adding up the gains from factors of production, e.g. wages from labour, interest from capital

What is real GDP?

The value of GDP, adjusted for inflation.

e.g. , if the economy grew by 4% since last year, but inflation was 2%, real economic growth was 2%.

What is nominal GDP?

The value of GDP, not adjusted for inflation.

e.g. nominal economic growth is 4%, which can be misleading as it displays GDP has higher than it actually is

Nominal GDP formula

Volume of GDP x Price level

Real GDP formula

Real GDP = (Nominal GDP ÷ Price index) x 100

What is total GDP?

The combined monetary value of all goods and services produced within a country’s borders during a specific time period.

What is GDP per capita + what is it useful for?

Shows the mean wealth of each resident in a country

GDP ÷ population

✔ Useful for comparing the relative performance of countries.

What is GNI (Gross National Income)?

A measure of GDP, which is the total income earned by a country's people and businesses, no matter where they are in the world.

What is Gross National Product (GNP)?

A measure of GDP, which is the market value of all products produced in a year by labour and property supplied by citizens in a country.

Includes income earned from overseas assets

Includes products produced by citizens in a country, regardless of if they’re inside the border or not, which differs from the regular GDP calculation

What is Purchasing Power Parity (PPP) and what is it used for?

A conversion factor used for all GDP measures to calculate the relative purchasing power of different currencies.

It is used for a more accurate standard of living comparison between countries + economic performance comparison

What are limitations of GDP?

Doesn’t measure inequalities as GDP per capita is an average, so standards of living can be quite different

Doesn’t tell us about the quality of goods/services

Doesn’t count for the differences in hours worked

Doesn’t include unpaid/voluntary work

What is Gross National Happiness (GNH)?

National happiness and wellbeing being measured in the UK

Focuses on health, relationships, education, living conditions .etc

Presents normative data, only data from who they’re interested in

What is the relationship between real income and subjective happiness?

The higher the GDP per capita, the higher the average life satisfaction score.

However, The UK economy grew from 5% in GDP per capita between 2007-2014, but showed no change in life satisfaction.

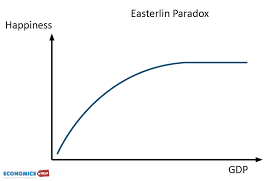

What is the Easterlin Paradox?

Happiness increases with income up to a certain point, where it stops increasing upwards

What is inflation + what is the UK inflation target?

Increase in average price level of goods/services in an economy

UK inflation target = 2%

If the level of inflation is 10%, what will £500 worth of goods in year 1 cost in year 2?

1.10 (110%) x 500 = £550

In year 2, £500 worth of goods will cost £550 with 10% inflation rate

How do you work out the cost of goods in the previous year?

Value in Year 1 = Value in Year 2 ÷ 1 + inflation

e.g. inflation = 10% + year 2 price = £550

550 ÷ 1 + 1.1 = £500

What is deflation?

Fall in average price level of goods/services in an economy

What is disinflation?

When average price levels are still rising, but at a slower rate than before

Indexes formula

(New figure / base figure) x 100

e.g. If the base year is 2005, work out the index of consumer spending for 2000

2000: consumer spending = 625.1

2005: consumer spending = 712.5

(625.1 / 712.5) x 100 = 87.73 index

What is Consumer Price Index (CPI) + how is it calculated and how is inflation rate calculated?

MEASURE OF INFLATION

Where average price levels are measured by checking the prices of a basket of goods and services that an average household purchases per month

Goods/services are weighted from the proportion of household spending (e.g. more money spent on food than shoes, shoes - lower weight)

Inflation rate is calculated by subtracting the index of year 1 and year 2 (BASE YEAR IS ALWAYS 100)

e.g. Year 1 - 100 (base), Year 2 - 107

107 - 100 = 7%

Inflation = 7%

What are the limitations of CPI?

It only looks at the average households, all households vary in what they consume

Ignores the quality of products in the basket

Measures changes only on an annual basis

What is Retail Price Index (RPI)?

MEASURE OF INFLATION

Measures average price levels also using a basket of goods but also includes council tax, mortgage payments + other house purchasing costs

Often has a higher value of inflation than CPI

What is demand pull inflation?

Inflation is caused by increase in aggregate demand in the economy.

Any factor that increases AD (C + I + G + [X-M]) causes demand-pull inflation.

![<p>Inflation is caused by <strong><em>increase in aggregate demand</em></strong> in the economy.</p><ul><li><p>Any factor that increases AD (C + I + G + [X-M]) causes demand-pull inflation.</p></li></ul><p></p>](https://knowt-user-attachments.s3.amazonaws.com/53523385-aa4f-4748-870d-e77cfa909773.png)

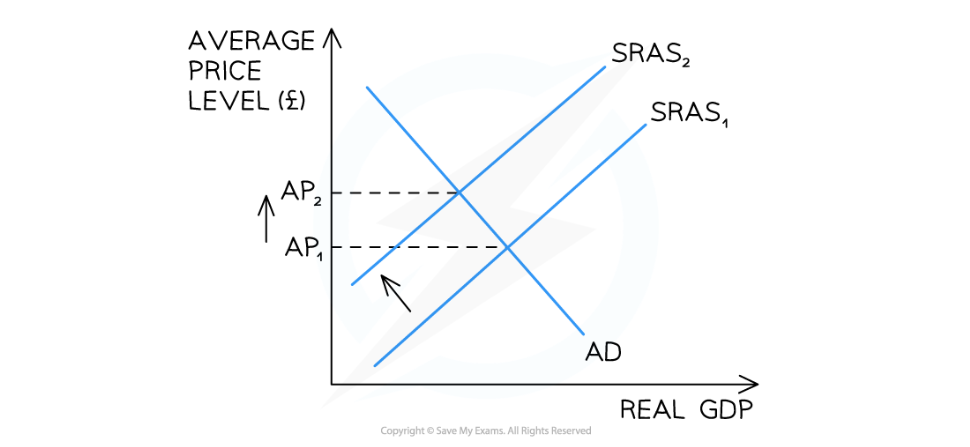

What is cost push inflation?

Inflation is caused by a decrease in aggregate supply in the economy.

Any factor that decreases AS leads to cost push inflation, e.g. increase in cost of production

What is change in money supply?

Inflation occurs from the increased borrowing from firms and consumers as a result of lowered interest rates from the Central Bank.

There can be too much money in the economy. If people have access to money and want to spend it but there isn’t any increase in amount of goods/services supplied, then prices must rise.

What is the impact of inflation on firms, consumers, governments and workers?

Firms

More uncertainty as there are price changes and delayed investments

Price changes force firms to change prices too, which can be expensive

Consumers

Decrease in purchasing power

Fall in real income for those on fixed income or pension

Governments

Less international competitiveness in export industries

Increased trade offs (choosing one thing to fund into, so you have to sacrifice another) to tackle inflation, e.g. increased unemployment

Workers

More demand for higher wages due to lower purchasing power

Motivation and productivity fall

What is unemployment?

When someone is not working but is actively seeking work.

They are in the population of working age + apart of the labour force, so they are economically active

Unemployment rate formula

No. of unemployed people ÷ No. of employed people + no. of unemployed people

What are the two measures of unemployment and what are they?

International Labour Organisation (ILO)

A survey (UK Labour Force Survey) is sent to a random sample of UK households every quarter

Respondents answer if they are unemployed through criteria, e.g. ready to work in 2 weeks, have looked for work in past month

ILO is used globally for international comparisons

Claimant count: the number of people receiving Job Seekers Allowance (JSA) for being unemployed.

What are the differences between Claimant Count and ILO?

Some people may not be included in the ILO measure but will be in the Claimant Count, e.g. those who fraudulently claim benefits

Some people may not be eligible for benefits but are still unemployed, meaning they would be classed as unemployed in the ILO but not the Claimant Count

What is underemployment?

Individuals that are in paid employment, but desire more hours and/or work in a job that is lower skilled than their ability.

What are some issues with measuring unemployment rates?

Both measures of unemployment don’t include people:

Working part time that want to work full time (underemployment)

Classed as sick or disabled

Those who aren’t actively looking for a job but would take one if offered or are in education as they can’t get a job

This is called the hidden figure of unemployment.

What is structural unemployment and when does this happen?

Unemployment occurs when there is a mismatch between jobs and skills in an economy.

Occurs when the structure of an economy changes and a type of worker is no longer needed

Can be due to increasing competition internationally or technology

What is cyclical unemployment and when does this happen?

Unemployment occurs due to a fall in aggregate (total) demand in an economy

Happens during a economic recession - negative economic growth due to business failures.

Output falls, so firms lay off workers

This is because there is a decrease in demand leading to businesses to cut employment to control costs + restore profitability

What is seasonal unemployment and what are examples of seasonal jobs?

When some people are unemployed during certain seasons, like summer or winter

e.g. tourists, fruit pickers

Hard to control in a free market economy

What is frictional unemployment and what type of unemployment is it?

Unemployment occurs when workers are switching between jobs

Short-term unemployment where they voluntarily left their previous job in search for another

What is real wage unemployment and how does this happen?

Unemployment occurs when real wages are above the equilibrium, causing an excess supply of labour.

It is illegal for firms to pay workers less than minimum wage, meaning people become unemployed as firms may not be able to pay this higher wage.

How do you expand output in an economy and how is this done via immigration?

Through increasing the amount of labour available.

Immigration allows for immigrants to fill in vacancies that local citizens cannot or will not fill

Often manual labour or low skilled jobs

This pushes down wages for low skilled jobs, which acts as an incentive for employers to hire more workers, increasing employment

Immigration also leads to job creation due to an increased population

What is the effect of unemployment on firms, governments, the economy and individuals?

Firms:

Loss of sales revenue

Loss of output

Changes in skill levels in the economy

Governments:

Less tax revenue

Increased spending on benefits

Economy:

Increased crime + anti social behaviour

Individuals:

Loss of income

Health issues

Mental instability

What is the balance of payments?

A record of all financial transactions that occurs between a country and the rest of the world

What are the two types of balance of payments and what are they?

Current account: records payments for the purchase and sale of goods and services

It records income and current transfers of wages, interest, profit or dividends

Financial + capital account: all transactions related to savings, investments .etc

What is credit and what is debit?

Credit: money flowing into a country (+)

Debit: money flowing out of a country (-)

What is a current account deficit?

Where imports are greater than exports.

There is more money going out of the country; the current account balance is negative (debit)

What is a current account surplus?

Where exports are greater than imports.

There is more money coming into the country; the current account balance is positive (credit)

What are the macroeconomic objectives?

Low unemployment

Low and stable inflation

Economic growth at a similar rate to other economies

Balance of payment equilibrium being met

Greater income equality

When there is higher economic growth, there are more imports from increased demand, leading to a current account deficit. But, when there is more unemployment in the economy, the deficit shrinks + improves.

Governments want export-led growth as it leads to economic growth, more employment and improves the current account balance.

Why is it difficult for the UK government to reduce the current account deficit?

The UK government find it difficult to reduce the imbalance to as close to equilibrium as possible due to increasing income and wealth, causing the value of imports to rise.

Often consumers enjoy a variety of goods abroad

What are the implications of a current account deficit and what can the government do to reduce it?

A current account deficit has a negative impact on aggregate demand as imports and exports are net negative (more goods imported)

To correct this, governments can:

Raise tariffs (taxes on imports + exports) - decreases the amount of imports bought by households + higher cost of production for firms that rely on import of raw materials

Currency devaluation - makes exports cheaper and imports more expensive

Supply-side policies - boosts domestic production + competitiveness, so goods and services domestically produced look more attractive to consumers so import levels fall

What are four ways that has led to the interconnectedness of economies + globalisation?

The amount of output from an economy that is traded internationally is growing

More people/companies own assets in other countries, e.g. shares, loans .etc

Increasing migration between countries

More technology being shared faster

Countries are becoming more interdependent, so one change in condition of the economy in one country affects another country as they rely on their exports/imports.

How did COVID-19 + UKRAINE WAR impact the interconnectedness of economies?

It showed how disruptions in one part of the world caused problems in others.

Many countries are dependent on imports that come from other countries, e.g. import of raw materials.

These restrictions on trade reduced output and ability to supply.

What is Aggregate Demand (AD)?

The total demand for all goods/services in an economy at any given price

What is the formula for aggregate demand?

AD = C + I + G + [X-M]

C = consumption (total spending of goods/services by consumers)

I = investment (total spending on capital goods by firms)

G = government spending (total spending by the gov, e.g. public sector salaries)

X-M = net exports (difference between revenue gained from selling goods abroad + expenditure from buying goods abroad)

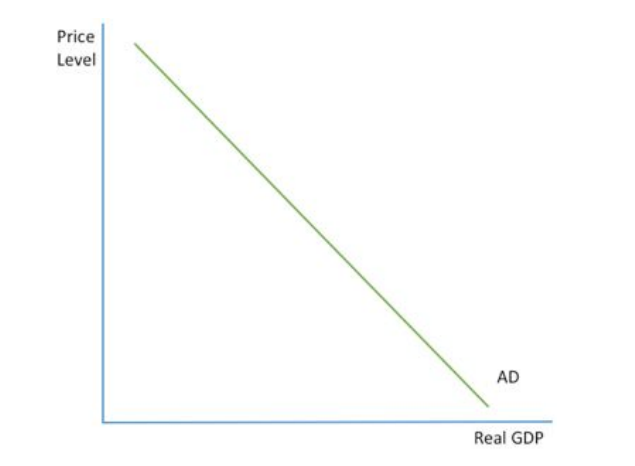

What does the AD curve look like and why is it downward sloping?

Reasons it is downward sloping:

Interest rate effect: at higher price levels, there are higher interest rates, which reduces investments + acts as an incentive for households to save

Wealth effect: as price levels increase, purchasing power of households decrease, so AD falls

The exchange rate effect: as price levels fall, interest rates fall, which lowers exchange rate. This makes goods/services more attractive abroad so exports increase + increasing real GDP

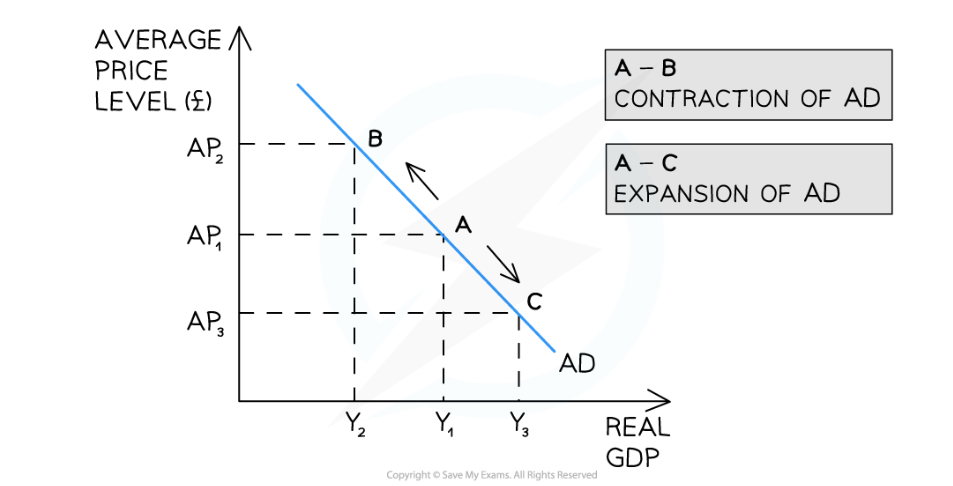

What happens when there is a movement in the AD curve?

There is a change in average price level

What happens when there is a shift in the AD curve?

There is a change in any of the components of AD (C + I + G + [X-M])

![<p>There is a <strong><em>change in any of the components of AD</em></strong> (C + I + G + [X-M])</p><p></p>](https://knowt-user-attachments.s3.amazonaws.com/e4c2a6ce-c816-4217-9de6-fe03b0a93c62.png)

What is disposable income and what happens when households have high + low disposable income?

Disposable income is the amount of money an individual/household has to spend or save after taxes are deducted.

High disposable income - households tend to spend more as there is more money available to buy goods + services [Higher consumption = INCREASES AD]

Low disposable income - households tend to save more as there is less money to spend and only buys necessities (essential goods) [Lowers consumption = DECREASES AD]

What are thefactors that disposable income and consumption are influenced by?

Marginal propensity to consume (MPC): proportion of additional income that households chose to spend rather than save

Consumer confidence: if households are uncertain for the future, e.g. due to economic instability, they could save more even with high disposable income, reducing impact on spending

Interest rates: increased interest = an incentive to save, lowered interest = incentive to spend + reduces cost of borrowing and increases disposable income

Wealth effects: a change of consumption following a change in wealth, experienced when real house prices rise as owners have more wealth and are more confident in spending.

Tastes and attitudes: a strong materialistic drive encourages people to have the newest and best products, therefore increasing spending.

What is investment and how does this impact the economy?

The total spending on capital goods by firms, which helps to increase the capacity of an economy and increase potential economic growth

What is depreciation?

A decrease in monetary value of a capital good overtime

What are the two types of investment?

Gross investment: the total amount of spending on capital goods

Replaces old capital goods + purchasing new capital goods

Net investment: gross investment - depreciation

Provides info on the new capital goods added to the economy; helps to better understand extra production possibilities

What are the factors that influence investment?

Rate of economic growth: increasing growth, shows that higher output = higher profits; the faster the economic growth, the greater urgency to invest

Interest rates: decreasing interest rates encourages investments as there is less to pay back whilst increasing interest reduces investments

Demand for exports: demand for exports increases, firms will invest to meet global demand

Demand for exports can increase if exchange rates depreciates, as goods are now cheaper to foreigners

Influence of governments and regulations: government intervention can increase investments, e.g. subsidies, whilst regulation can decrease investments (raising cost of production, lowering profits)

Business expectations and confidence: the longer a period of economic growth, the higher the consumer confidence. If economic growth slows, future expectations on profit decrease + investment decisions are harder

Keynes + animal spirits: Keynes believed firms have lots of optimism in the good times + take risks, which leads to less rational investment decisions through following the herd

Access to credit: the easier it is to take out a loan, the higher the level of investment

What is government spending mostly used on?

Government spending is mostly spent on welfare (social protection, e.g. pension), healthcare + education

What influences government expenditure?

Trade cycle: decisions of government spending may be to manage AD and to regulate the trade cycle. In a recession, governments may increase spending to stimulate demand, whilst in booms they decrease spending to reduce inflation.

Fiscal policy: some government spending is fixed from year to year, e.g. pension and school funding. They can however vary every year.

Age distribution of the population: an ageing population can lead to an increased expenditure on pensions, social care .etc, whilst a young population causes an increased expenditure on education.

What is the trade cycle, its features and how does the government tackle each part of the trade cycle?

Trade cycle: fluctuations in an economy overtime, measured by changes in Real GDP

Boom: high economic growth, low unemployment + rising consumer spending and inflation

Governments may reduce spending to avoid overheating, which worsens inflation

May put in policies that focus on reducing public debt from previous recessions

Slowdown: lowering economic growth, inflation can be high, demand slows which reduces profit

Governments can introduce stimulus measures, e.g. targeted spending on tax cuts to support lowering demand

Recession: negative economic growth, high unemployment + declining consumer spending + increased deflation

Governments increase spending (expansionary fiscal policy) to stimulate demand + support economy, e.g. infrastructure projects + unemployment benefits

Deficits may grow as governments borrow more

Recovery: GDP rises, unemployment falls, consumer + business confidence improves, investments increase

Government continue spending to ensure recovery is maintained

Once growth is stabilised, they may focus on reducing public debt + cut back on spending to avoid inflation

How can the 2008 FINANCIAL CRISIS + 2010-2015 RECOVERY be evidence of the trade cycle?

In the 2008 global financial crisis, UK governments had to increase expenditure on bank bailouts (to stabilise banks), infrastructures + welfare to counteract recession

In the 2010-2015 recovery, austerity (cutting back on gov spending) policies were introduced to reduce public debt from the crisis

What is a fiscal policy, what are they used for and what are the two types?

The way a government uses spending + taxation powers to influence economies

Used for managing economic growth, inflation + unemployment

Expansionary fiscal policy: when the government increases spending/cut taxes to stimulate the economy - boosts demand + creates jobs

e.g. if the economy is in recession, the government may increase spending on infrastructure projects/cut taxes for firms + individuals to spend and invest

Contractionary fiscal policy: when the government decreases spending/increases tax to slow down the economy + control inflation

e.g. if the economy is growing too fast and has high inflation, the government can reduce spending + interest rates

What is the net trade balance?

The difference between the value of exports and imports

What happens to trade balance when more exports are being bought + when more imports are being bought?

More exports being bought = strengthens the trade balance

More imports being bought = weakens the trade balance

What are the factors influencing exports + imports?

UK real income

Increases: consumers purchase more imports [WEAKENS]

Increases abroad: countries buy more exports [STRENGTHENS]

£ GBP

Appreciates: exports decrease as they’re more expensive, imports increase [WEAKENS]

Depreciates: exports increase as they are cheaper, imports decrease as they’re worth less [STRENGTHENS]

World economy

Boom: increased demand for exports [STRENGTHENS]

Slow: less demand for exports [WEAKENS]

Protectionism (gov policies that restrict international trade in order to protect domestic industries)

Increases: exports depend on measures from other countries, import demand decreases as they are more expensive [STRENGTHENS]

Decreases: increased exports + increased imports as they are cheaper [STRENGTHENS]

What is aggregate supply (AS)?

Aggregate supply (AS) is the total supply for all goods/services produced in an economy at a given price level

What does the SRAS curve look like and why is it upwards sloping?

It is upwards sloping because it is the combined supply of all individual supply curves + as real output increases, firms spend more to increase production and increases supply

What happens when there is a movement in the SRAS curve?

When there is a change in average price level

What happens when there is a shift in the SRAS curve?

When there is changes in the conditions of supply (e.g. cost of production)

What is short-run aggregate supply (SRAS) + what does short-run mean?

Supply is influenced by changes in the cost of production

Short-run: a time period where at least one factor of production is fixed

What is long-run aggregate supply (LRAS) + what is long-run?

Supply is influenced by the changes in productive capacity in the economy

Productive capacity changes when the quality or quantity of factors of production change - causing a shift inwards or outwards in the PPF curve

For long-term economic growth, productive capacity must increase

Long-run: a time period when all factors of production are variable

What are the factors that influence SRAS (short-run aggregate supply)?

Causes a shift

Cost of raw materials: increase in costs of raw materials increases cost of production, SRAS shifts left as it costs more to produce the same amount of output. Decrease = less to produce the same output, shifts right

Change in exchange rate: a weaker pound, increases the price of imports causing SRAS to shift left. A stronger pound, decreases the price of imports, causing SRAS to shift right.

Change in tax rates: taxes increase the cost of production, causing SRAS to shift left. Subsidies shift the SRAS right as they decrease costs.

Supply side shocks occur when there is a large change in these factors.

What is the classical view on LRAS?

The classical view believes the economy can’t produce more in the long-run because prices go up as output depends on factors of production.

They believe the economy is always at full employment in the long-run, meaning everyone can find a job in a long run.

If there are issues in the economy, e.g. unemployment, wages and prices will change to fix it on their own. So, there is no need for government intervention.

If we want the economy to grow, we should improve things like education, technology .etc - shifting SRAS right

What is the Keynesian view on LRAS?

The Keynesian view on LRAS has three parts:

Flat section - there is lots of spare resources (like unemployment), so output can increase without prices rising.

Upward sloping section - some resources are being used, so prices start to rise.

Vertical section - all resources are fully used, output can’t increases without causing inflation; full employment.

Keynesians believe the economy can get stuck with high employment and low output that won’t fit itself automatically.

Wages and prices can be sticky (can’t change easily), so issues like unemployment can last a long time without government help.

The government should adopt policies, like fiscal policies in order to support the economy.

How does the 2008 FINANCIAL CRISIS link to Keynesian view on LRAS?

Governments needed to intervene with significant expenditure in order to counteract the recession

What factors influence LRAS (long-run aggregate supply)?

Technology advances: improves the quality of factors of production, more goods will be produced at the same cost + at a faster output, shifts LRAS right.

Changes in relative productivity: the more productive the economy, the more goods produced at the same cost, which depends on factors like efficiency, skill of labour + technology, shifting LRAS right.

Changes in education + skills: a more skilled workforce will be more employable, allowing for efficiency in their jobs. Output increases, shifting LRAS right. Education reduces structural unemployment.

Changes in government regulation: can increase the size of the workforce by encouraging people to go back to work, shifting LRAS right. Policies can increase research and development offering tax break for those who invest in research, shifts LRAS right. High regulation would shift LRAS left as it increases cost + not time-effective.

Demographic changes and migration: if immigration is high, the population will grow + more workers, shifting LRAS right. Ageing population/young population and emigration will cause LRAS left.

Competition policy: the government can promote competition between businesses and markets, forcing them to improve quality of goods/lower prices. They do this by improving their efficiency, shifting LRAS right.

What is the definition of wealth?

A stock of assets, e.g. ownership of things like properties, savings, investments .etc

What is the definition of income?

A flow of money from wages, dividends (money gained from investments) + interests .etc

What is the circular flow of income, what does it look like and what does national income equal to?

An economic model showing how money flows in the economy

Households: owns all the wealth and factors of production in the economy in return for rent, wages, interest and profits from firms.

They use this money to buy goods produced by firms.

Firms: purchases factors of production from households + sells goods/services to them + earns revenue

National income = national expenditure = national output

How can the circular flow of income be criticised?

It is too simplified and doesn’t represent the actual economy through:

The government must be added, as they can take money out of the flow of income through taxation + increase the flow through spending

There are financial services that increase the flow through investment and decrease the flow through savings from when consumers + producers save

Foreign markets must be added as exports add money, foreigners buying British goods, to the flow whilst imports, British people buying foreign goods, take money away from the flow.

What are injections in the circular flow of income?

Additions in the circular flow of income

Investments - firms investing in capital goods

Gov spending - spending to provide goods/services, e.g. education

Exports - people/firms from outside the country purchasing domestically produced products

What are the effects of increasing injections on the economy?

Causes the multiplier effect: Increases economic growth as higher injections raise total spending, boosting output + income

It can lower unemployment as there is more investment + government spending, job creation and household spending

However, there is a risk of high inflation as if injections rise without output rising, demand-pull inflation may occur

What are withdrawals in the circular flow of income?

Leakages in the circular flow of income

Savings: choosing to save money rather than spend

Taxes: money flowing from firms + consumers to governments via direct and indirect taxes

Imports: when goods/services are bought from abroad + money leaves the country

What is the effects of changing withdrawals on the economy?

Slower economic growth: higher withdrawals lowers AD, lowering output + income

Higher unemployment: firms cut jobs due to demand pulls from high withdrawals

Lower inflation: more withdrawals can reduce demand-pull inflationary pressure as less goes into consumption

Trade balance: if withdrawals via imports fall, trade deficit may shrink

What does larger injections and larger withdrawals mean for the economy?

If the amount of injections are greater than leakages/withdrawals, the economy is growing.

If the amount of injections is smaller than leakages/withdrawals, the economy is shrinking.

When does real national output equilibrium occur?

When aggregate demand (AD) intersects with aggregate supply (AS)

The size of the change in real national output depends on the size of the shift + elasticity of the curve that hasn’t moved.

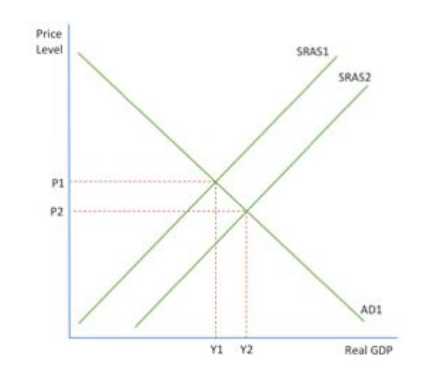

What happens when there is a shift in the SRAS curve to real national output equilibrium + what does the curve look like?

Factors that shift SRAS moves the real national output equilibrium.

An increase in SRAS leads to a fall in price level and increase in real GDP.

A decrease in SRAS leads to higher prices and lower real GDP.

What happens when there is shift in the LRAS curve to real national output equilibrium + what do the Keynesian and classical graphs look like?

Factors that shift the LRAS curve moves the real national output equilibrium.

Classical

Increases in AD increases price and output in the short-run. Overtime, prices will continue to rise as the economy moves back to the equilibrium in the long-run. Output hasn’t changed, but is just at a higher price.

Increase in LRAS leads to lower prices and higher output and moved to the new national output equilibrium at AD1 = LRAS2 at P2Y2 from the original equilibrium at AD1 = LRAS1

Keynesian

The impact of a shift in AD depends on the elasticity of the curve and whether the economy is at near or full employment

If the economy is producing at or near full employment, like AD1, a rise in LRAS will increase output and decrease price level. The equilibrium moves from P1Y1 to P2Y2.

However, if the economy is in a recession, like AD2, a rise in LRAS won’t have an effect on prices or output and the equilibrium doesn’t move.

What do classical economists prefer in rises in LRAS for the new equilibrium?

Classical economists prefer supply-side policies over demand management as even if there is a rise in AD, it only increases prices and not output. Whilst a rise in LRAS leads to lower prices and higher outputs.

What do Keynesian economists argue should be done when the government is in recession?

The government should work to increase AD as when the economy is in recession, a rise in LRAS doesn’t have an effect on prices, output or equilibrium and becomes stuck.

How does increasing AD and AS link?

A factor that affects AD can affect AS.

e.g. increase in investment increases AD and LRAS as firms produce more as they have more machines. This shifts the new national output equilibrium.

However, not all investment leads to increased production, as firms can invest and then go bankrupt, so LRAS won’t increase and the equilibrium won’t move.

The extent to which any factor shifts AD/AS increases output + lessens inflation depends on the rate of its returns.

What is the multiplier?

Shows how much a change in injections or withdrawals leads to a large change in national income.

e.g. if the UK government injected an additional £5 million into the economy through gov spending + this led to an increase in real income of £15 million. The value of the multiplier will be 3 (15 / 5 = 3)

Multiplier formulas

1 / (1 - MPC)

1 / MPW

e.g. MPC = 0.8

1 / (1 - 0.8) = 5

Total increase or decrease in GDP formula

Initial injection or withdrawal x Multiplier

e.g. total increase [Multiplier - 5, injection is 10M]

10m x 5 = £50 million