SL Economics - Unit 2

5.0(1)

5.0(1)

Card Sorting

1/107

Earn XP

Description and Tags

Study Analytics

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

108 Terms

1

New cards

Competitive Market

Where buyers and sellers carry out an independent exchange where no one individual has market power

2

New cards

Good vs Service

Goods are tangible. Services are not tangible

3

New cards

Demand

Quantities consumer is willing/able to buy at different prices

4

New cards

Law of Demand

higher price = lower demand (etc)

5

New cards

Increase Demand Graph

6

New cards

Decrease Demand Graph

7

New cards

Aggregate vs Market

Aggregate = whole economy. Market = 1 industry

8

New cards

Non-Price Determinants of Demand

Income (normal goods↑↑/inferior goods↑↓), preferences and tastes↑↑, price of substitute goods↑↑, price of complementary goods↑↓, population↑↑

9

New cards

Increase Quantity Demand vs Increase Demand

Increase quantity demand is a movement along demand curve (has to do with price). Increase demand is a shift.

10

New cards

Supply

Quantity producer willing/able to supply at different prices

11

New cards

Law of Supply

Increase price = increase supply

12

New cards

Increase Supply Graph

13

New cards

Decrease Supply Graph

14

New cards

Non-Price Determinants of Supply

Prices of related goods (joint supply↑↑/competitive supply↑↓), government intervention (tax↑↓/subsidy↑↑), cost of resource prices ↑↓, changes in technology↑↑, price of complementary goods↑↑, producer price expectations↑↓, number of suppliers↑↑, unpredictable events↑↓

15

New cards

Market equilibrium

The intersection between demand and supply

16

New cards

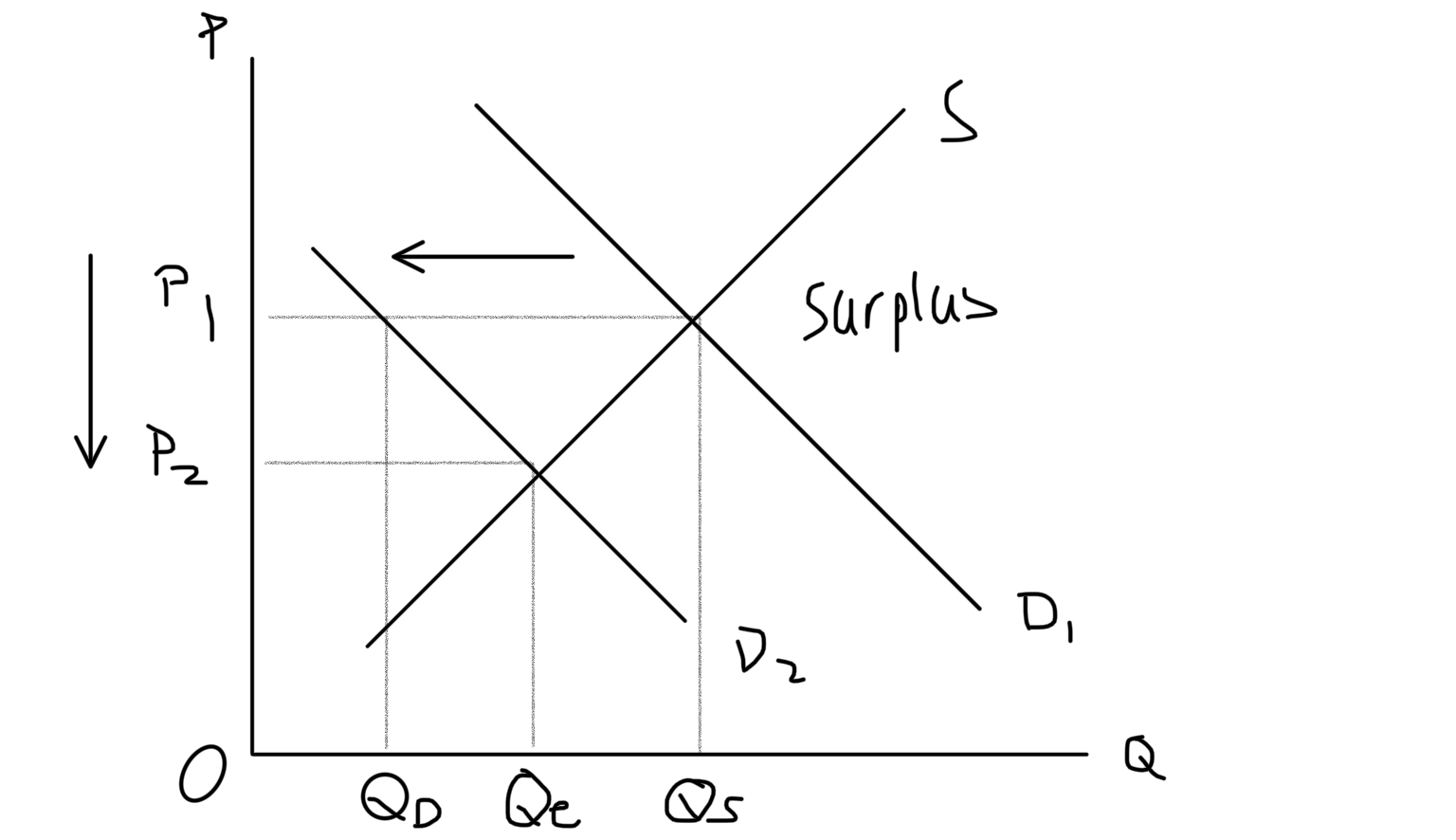

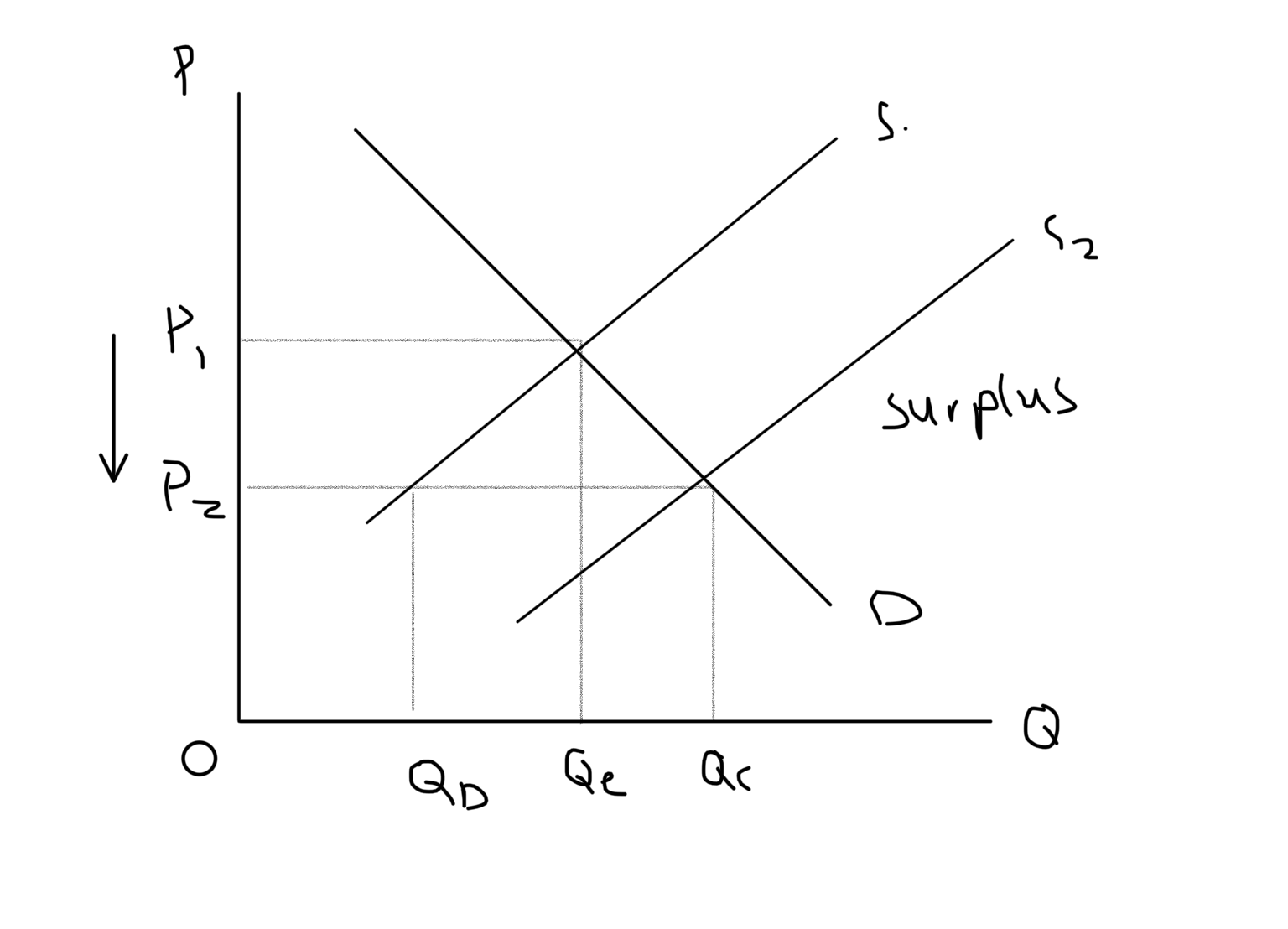

Surplus

QD > QS. P > Pe. Price often drops with surplus

17

New cards

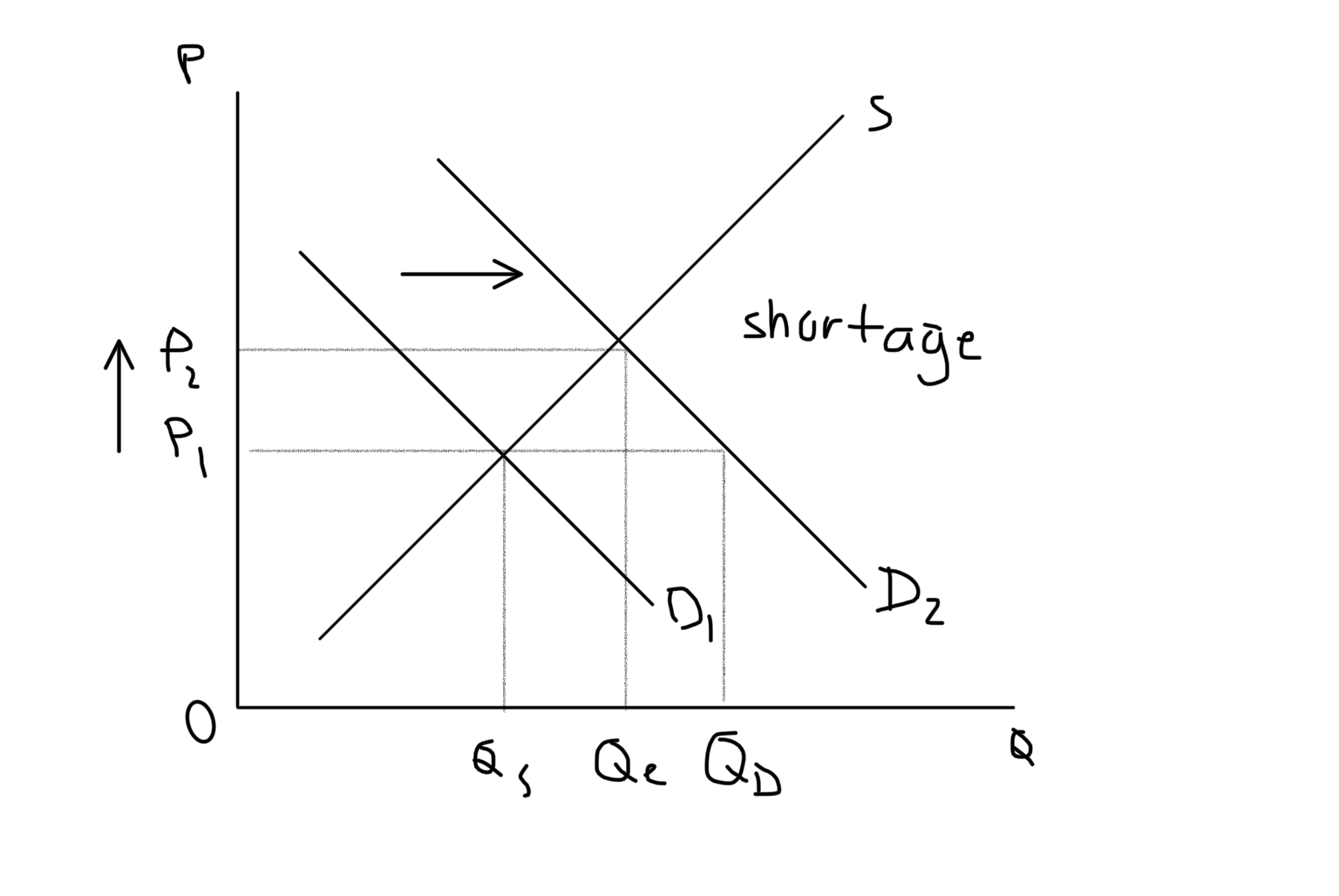

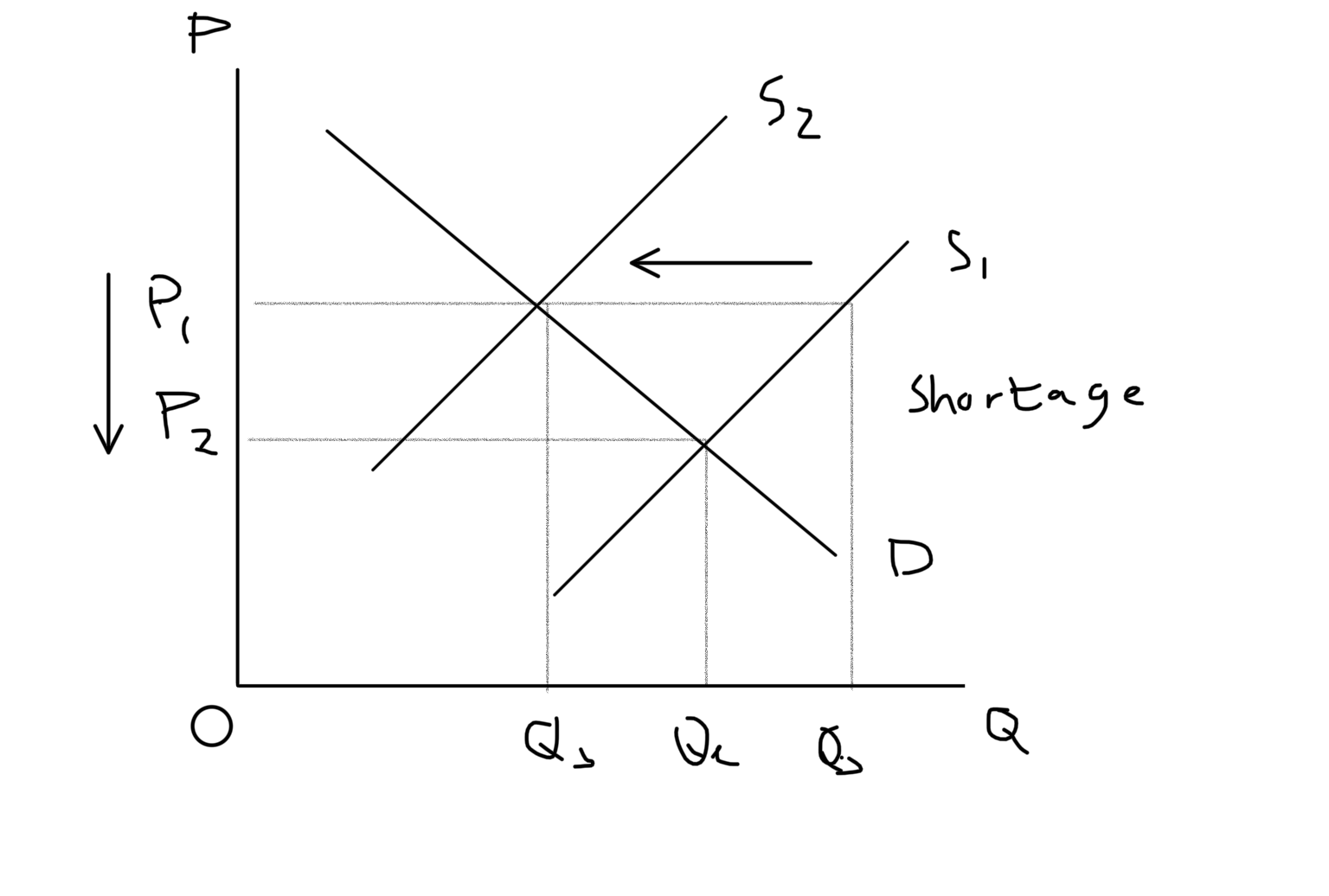

Shortage

QD < QS. P < Pe. Price often increase with shortage

18

New cards

Price Elasticity of Demand (PED)

Measures how much QD responds to change in price

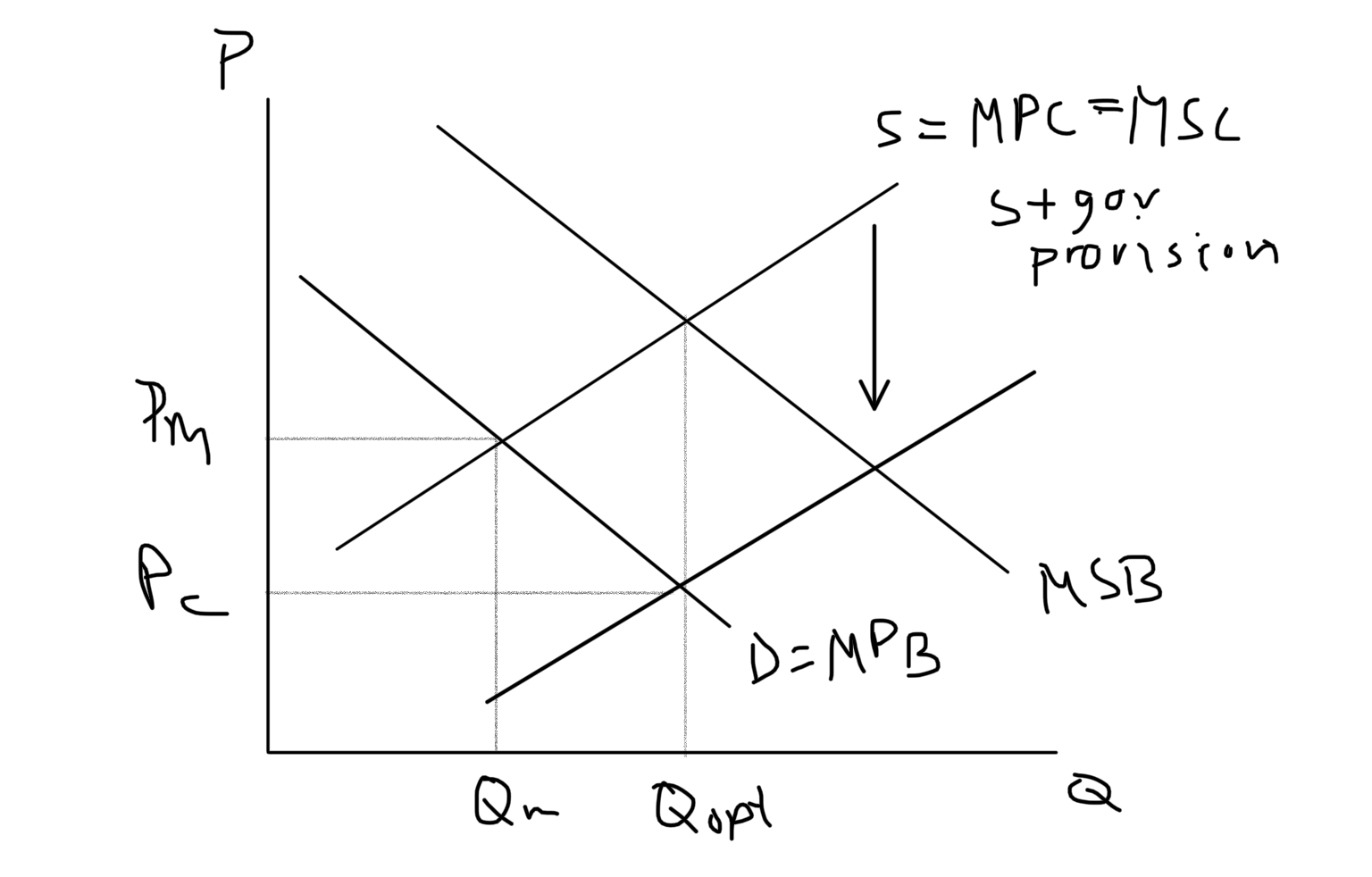

19

New cards

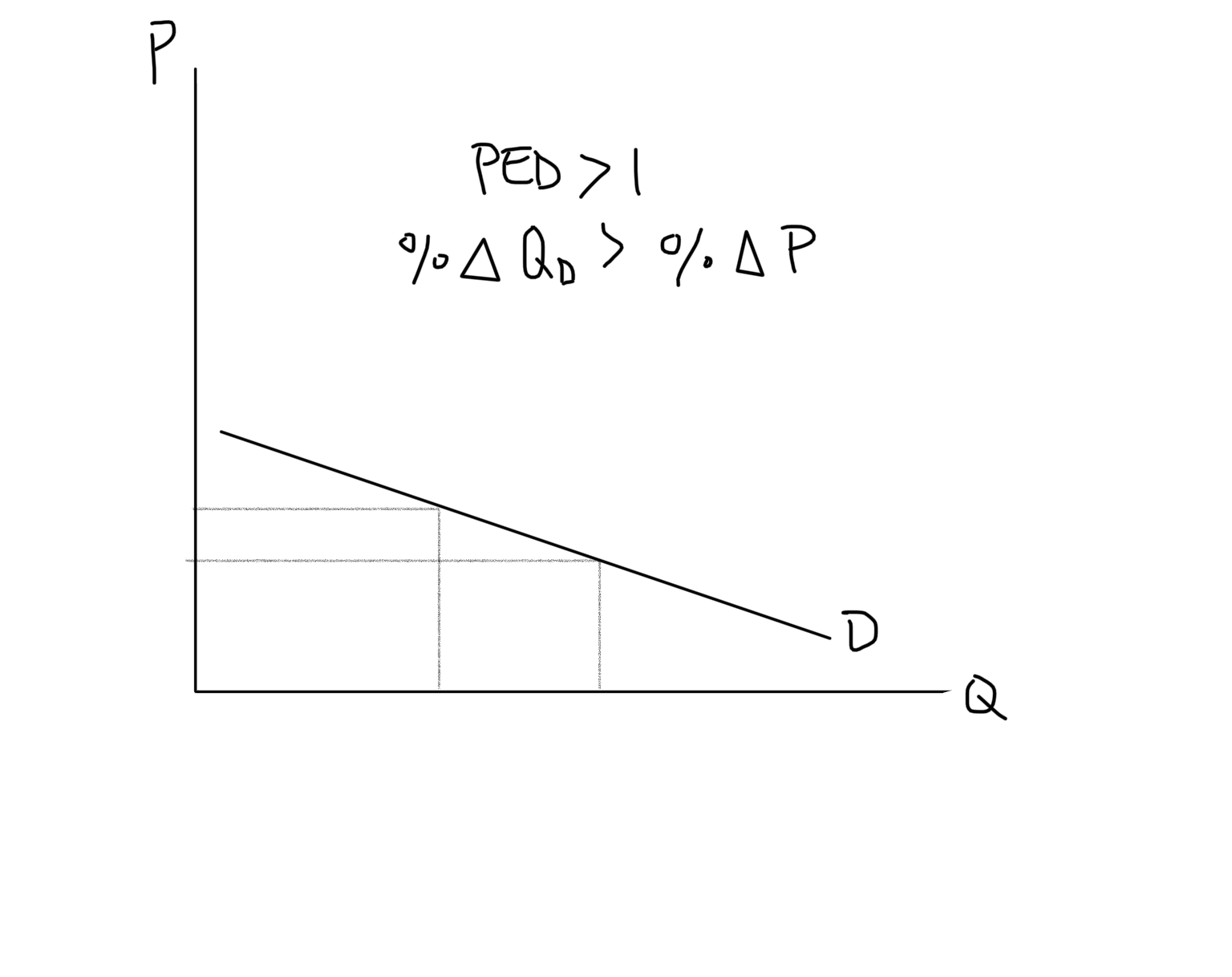

Price Elastic (Demand)

Demand is highly responsive to change in price (PED > 1)

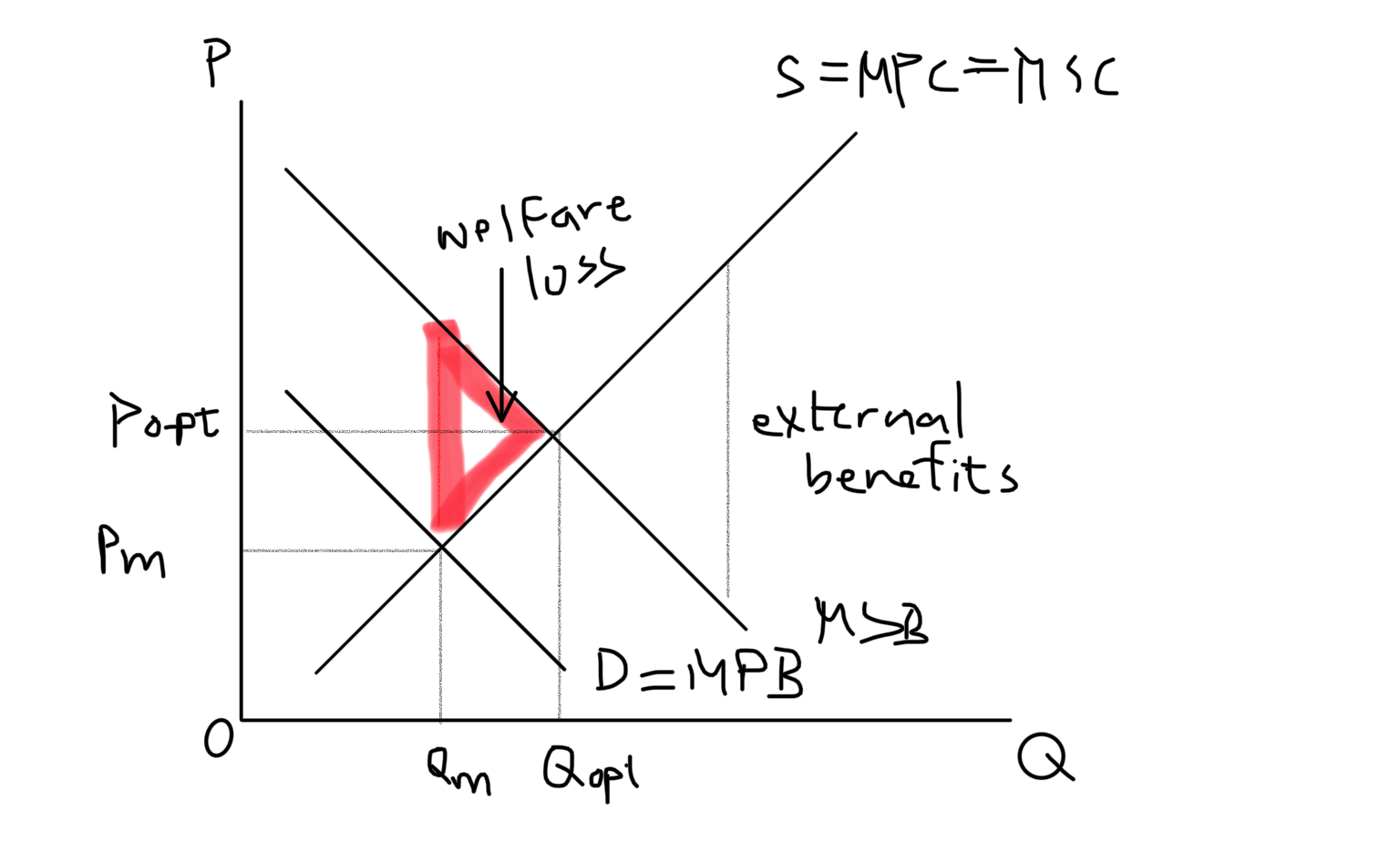

20

New cards

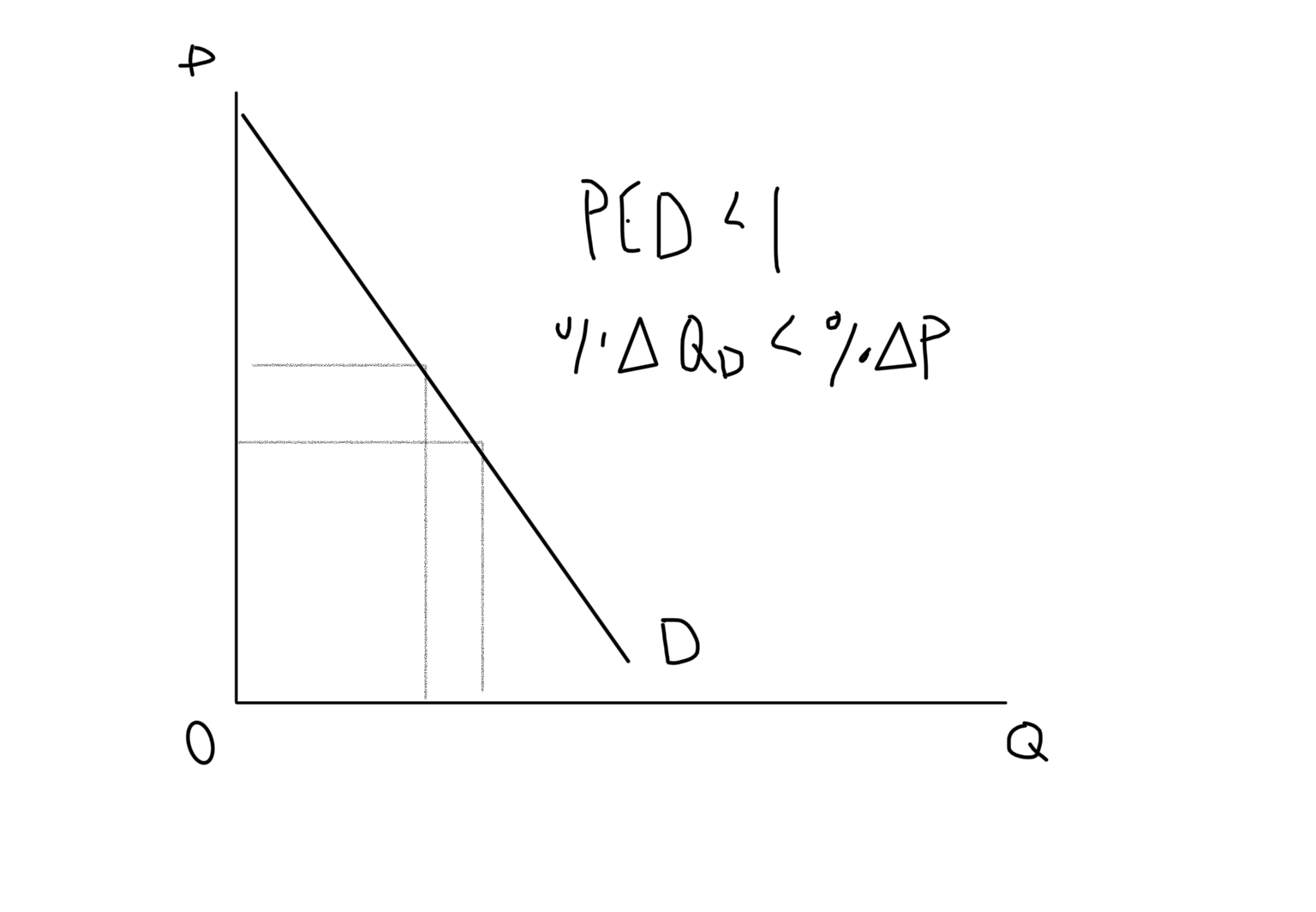

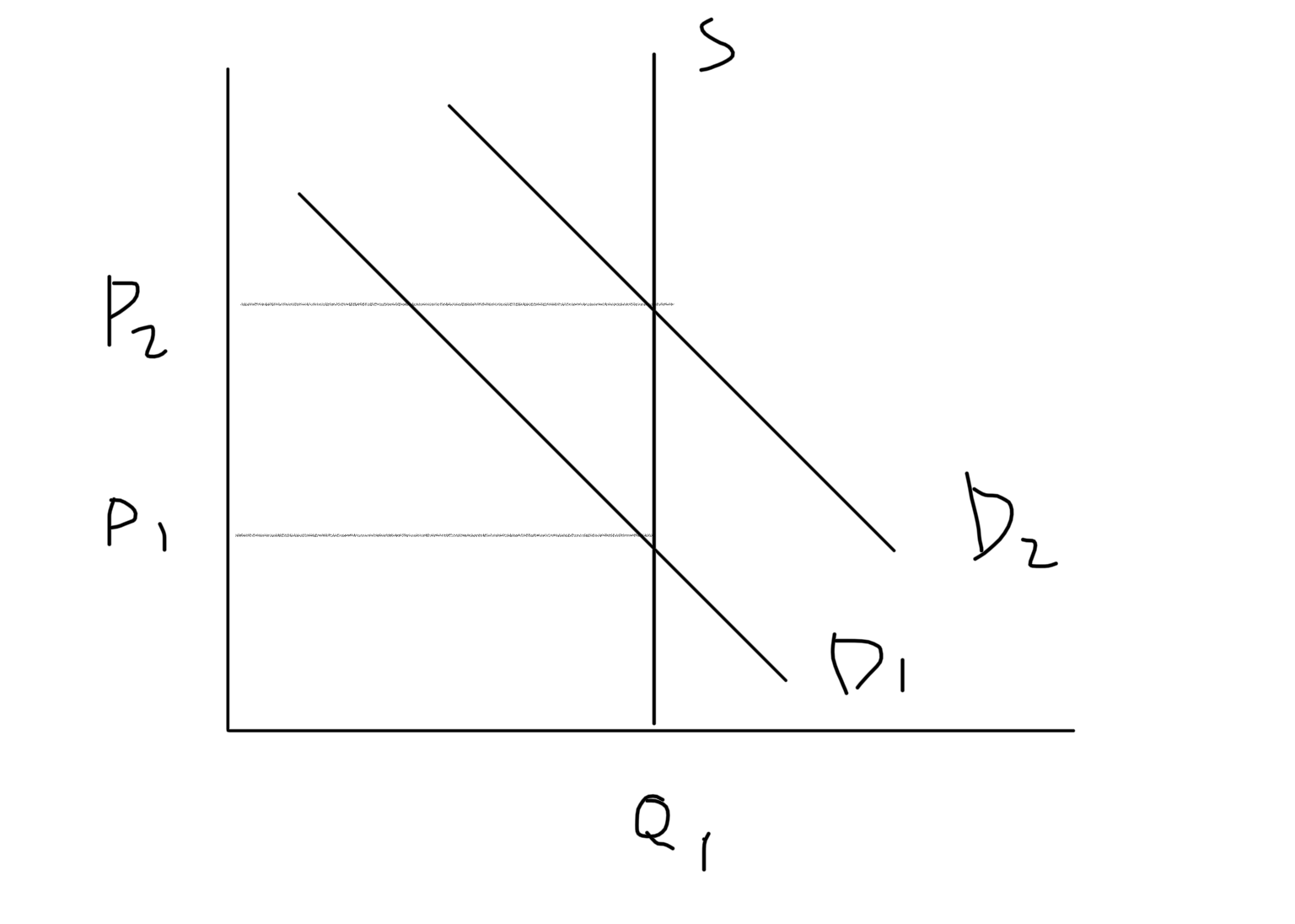

Price Inelastic (Demand)

Demand not very responsive to change in price (PED < 1)

21

New cards

PED Formula

| (Qf-Qi / Qi) / (Pf-Pi / Pi) | or | %ΔQD / %ΔP|

22

New cards

Price Elastic Demand Graph

\

23

New cards

Price Inelastic Demand Graph

24

New cards

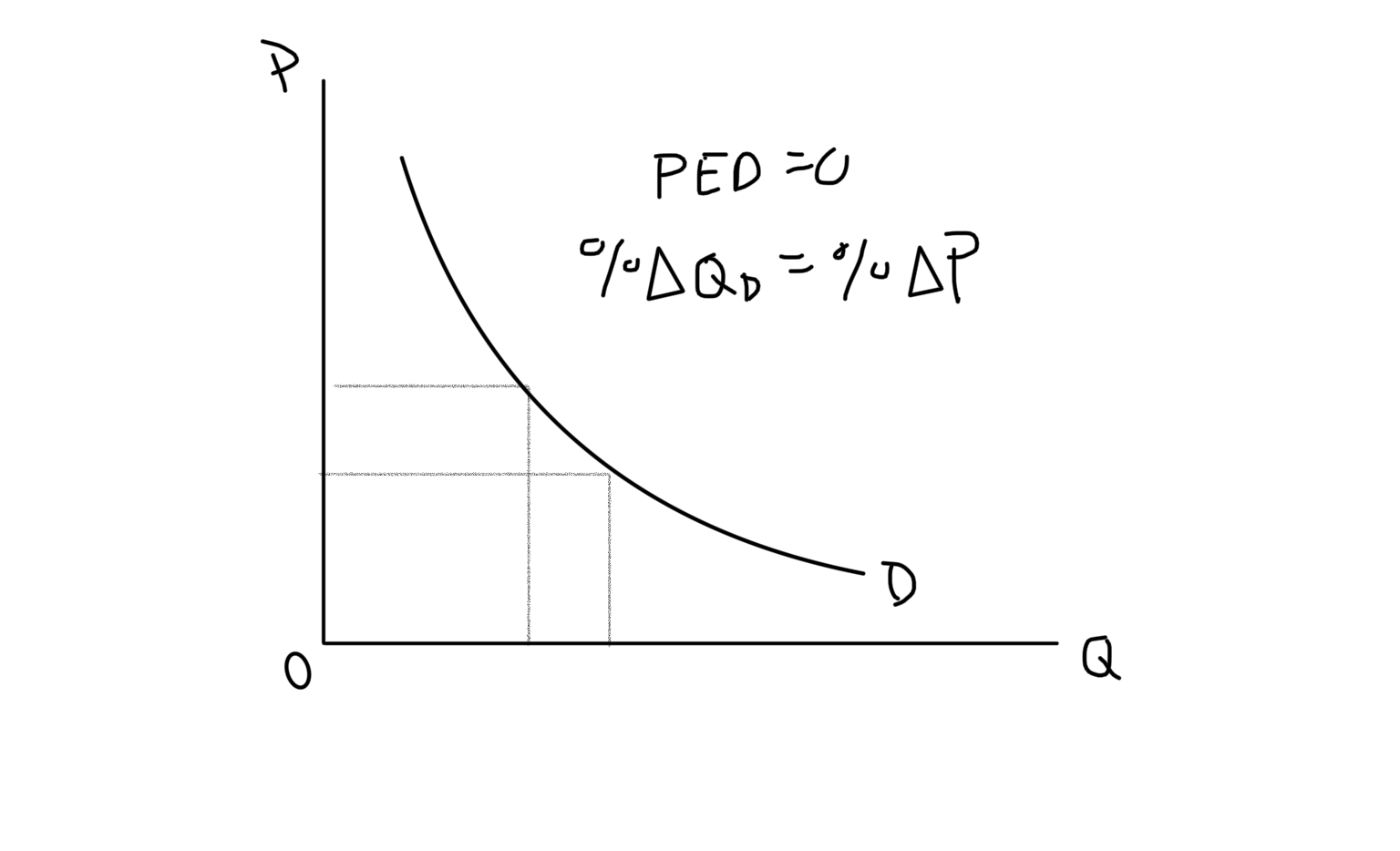

Unit Elastic Demand Graph

25

New cards

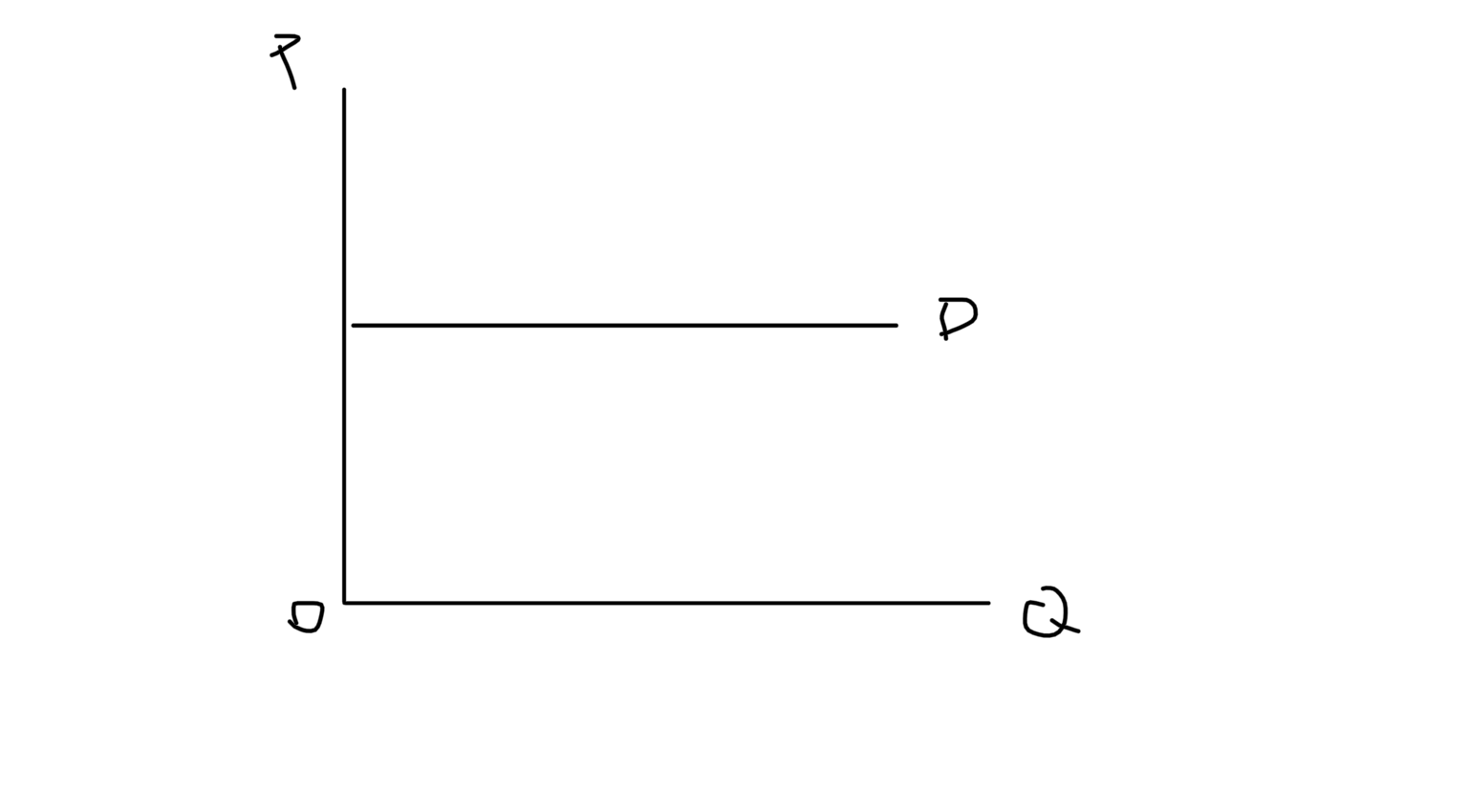

Perfectly Elastic Demand Graph

26

New cards

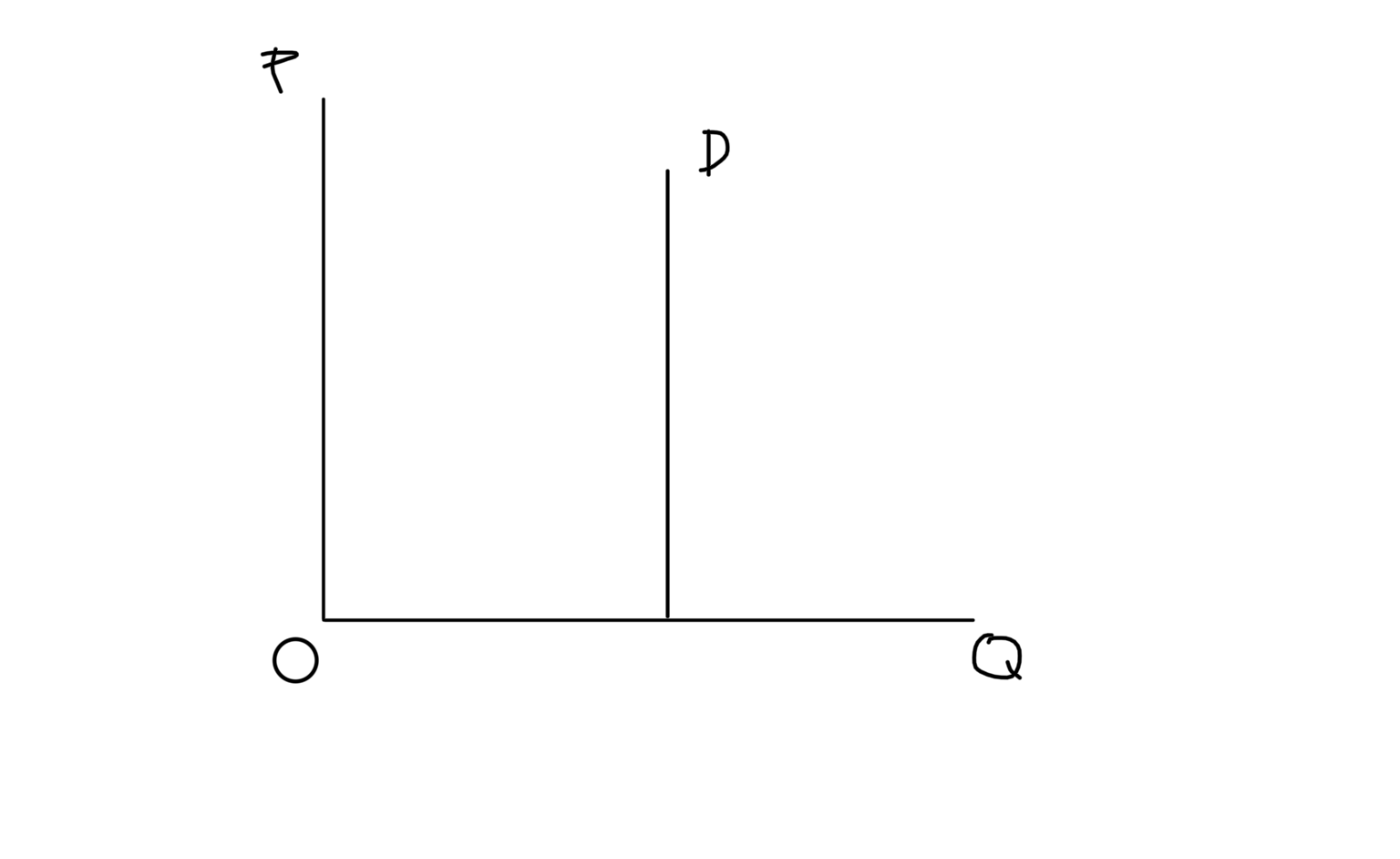

Perfectly Inelastic Demand Graph

27

New cards

Determinants of PED

Number of substitutes, closeness of substitutes, necessities vs luxuries, length of time, proportion of income spent

28

New cards

Calculate total revenue

TR = QS x QD

29

New cards

Income Elasticity of Demand (YED)

How much demand responds to change in income

30

New cards

YED Formula

(Df-Di / Di) / (Yf-Yi / Yi) or | %ΔQD / %ΔY|

31

New cards

YED > 0 (positivie)

Demand for normal good

32

New cards

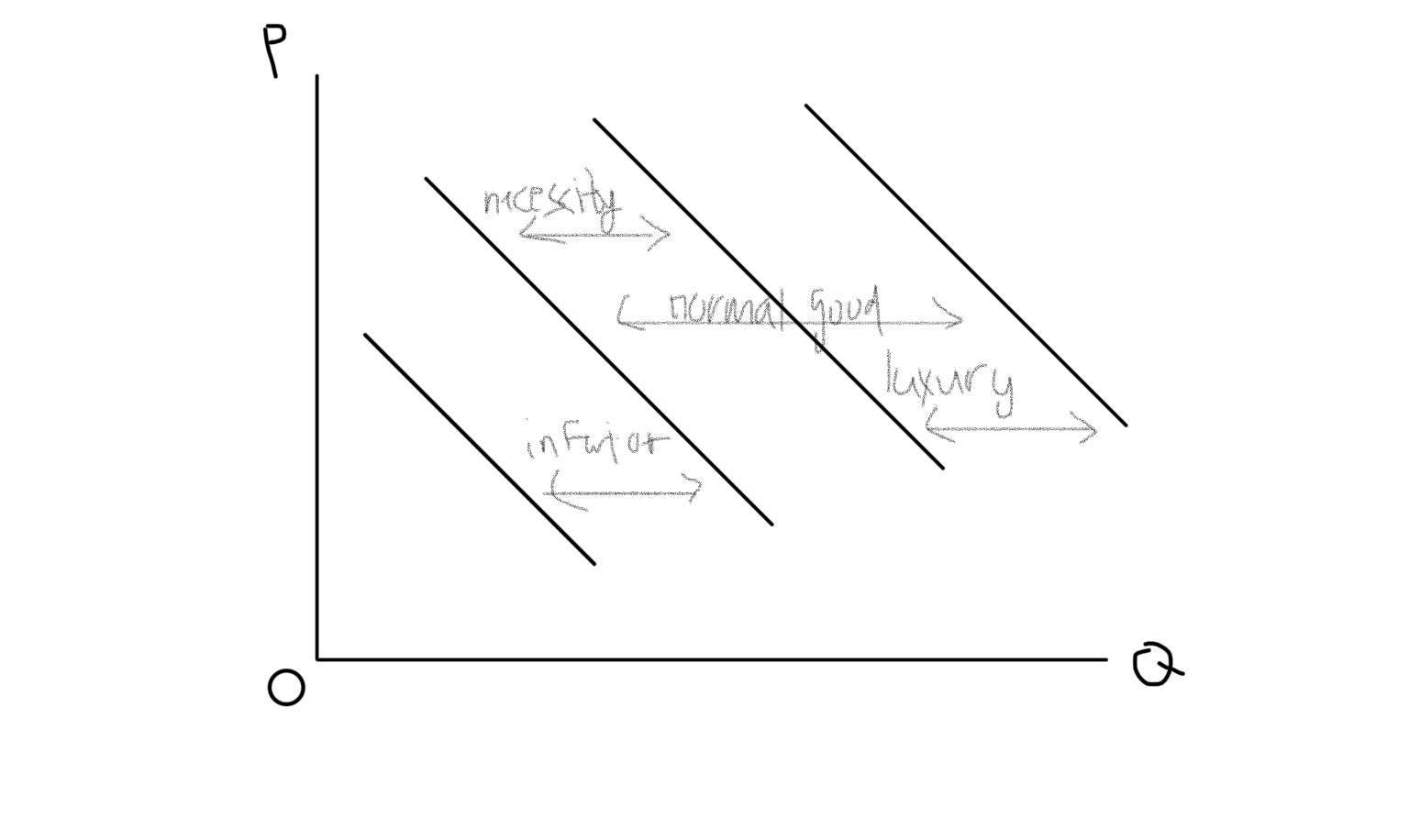

YED < 0 (negative)

Demand for inferior good

33

New cards

0 < YED

Income elastic demand (necessities)

34

New cards

YED > 1

income inelastic demand (luxuries)

35

New cards

YED Shifts in Demand Graph

36

New cards

Engel Curve

As you get rich, changes in income don’t affect you as much. Graph looks like a spiral

37

New cards

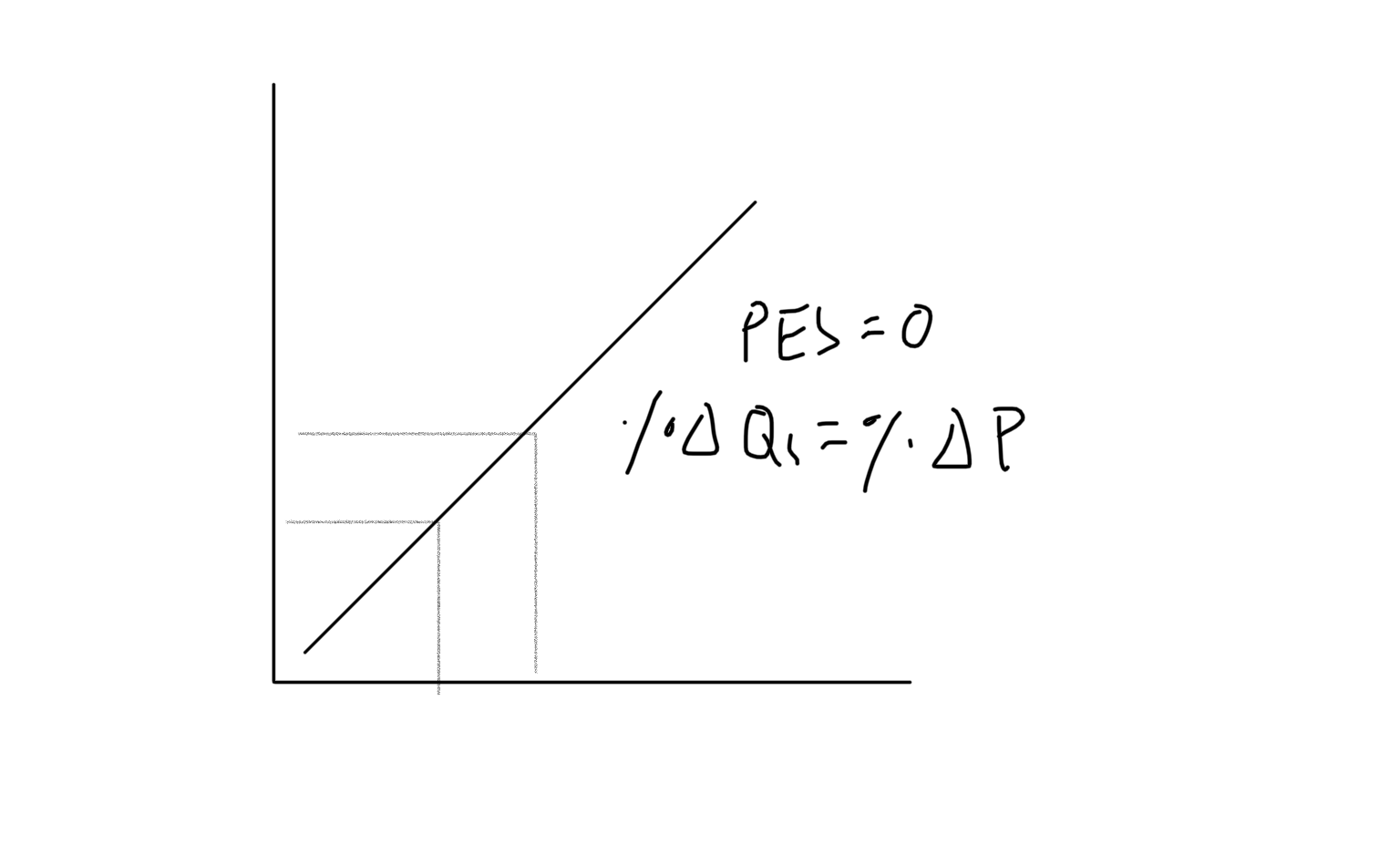

Price Elasticity of Supply (PES)

How much quantity supplied responds to change in price

38

New cards

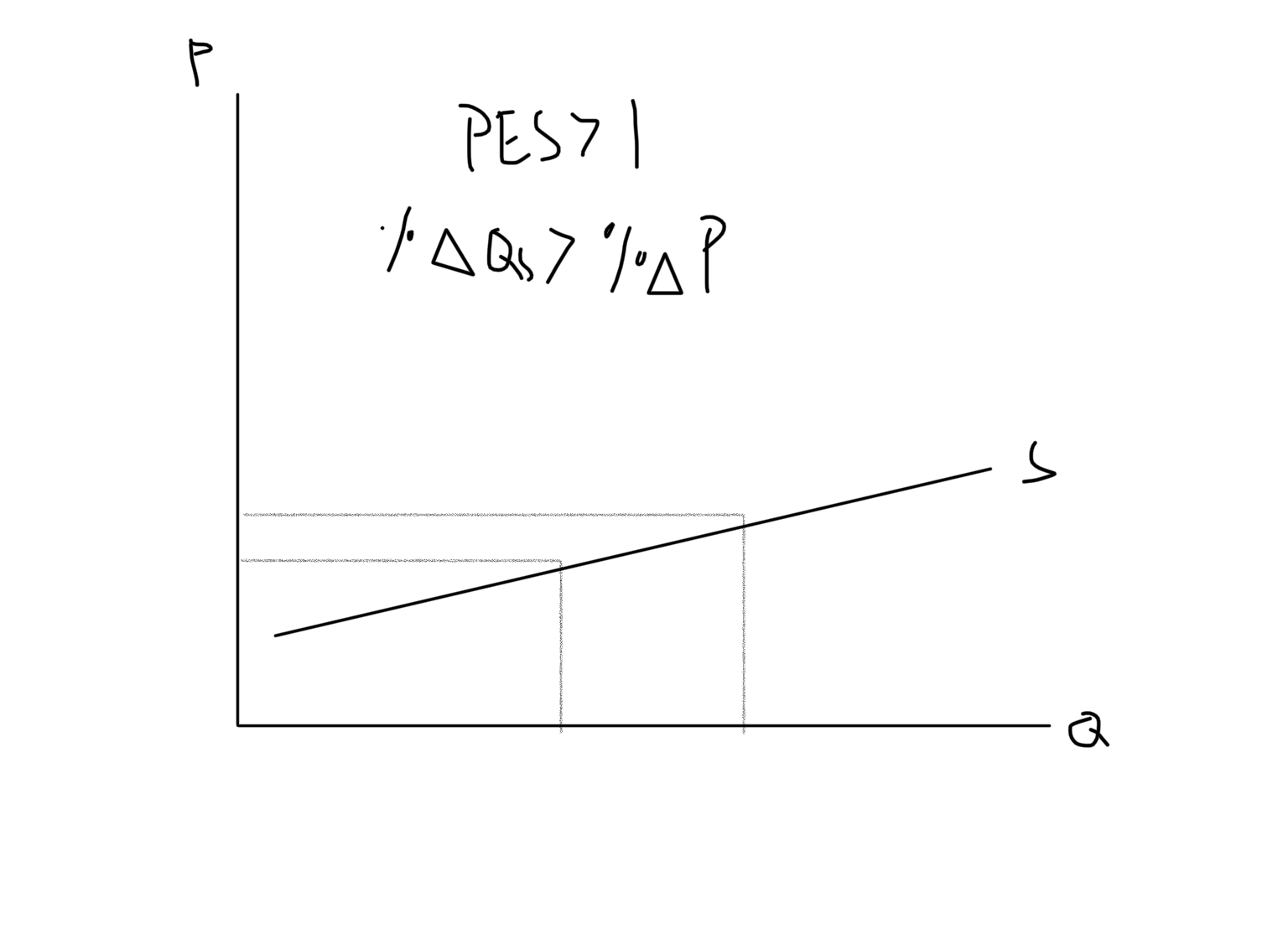

Price Elastic (Supply)

Supply is highly responsive to change in price (PES > 1)

39

New cards

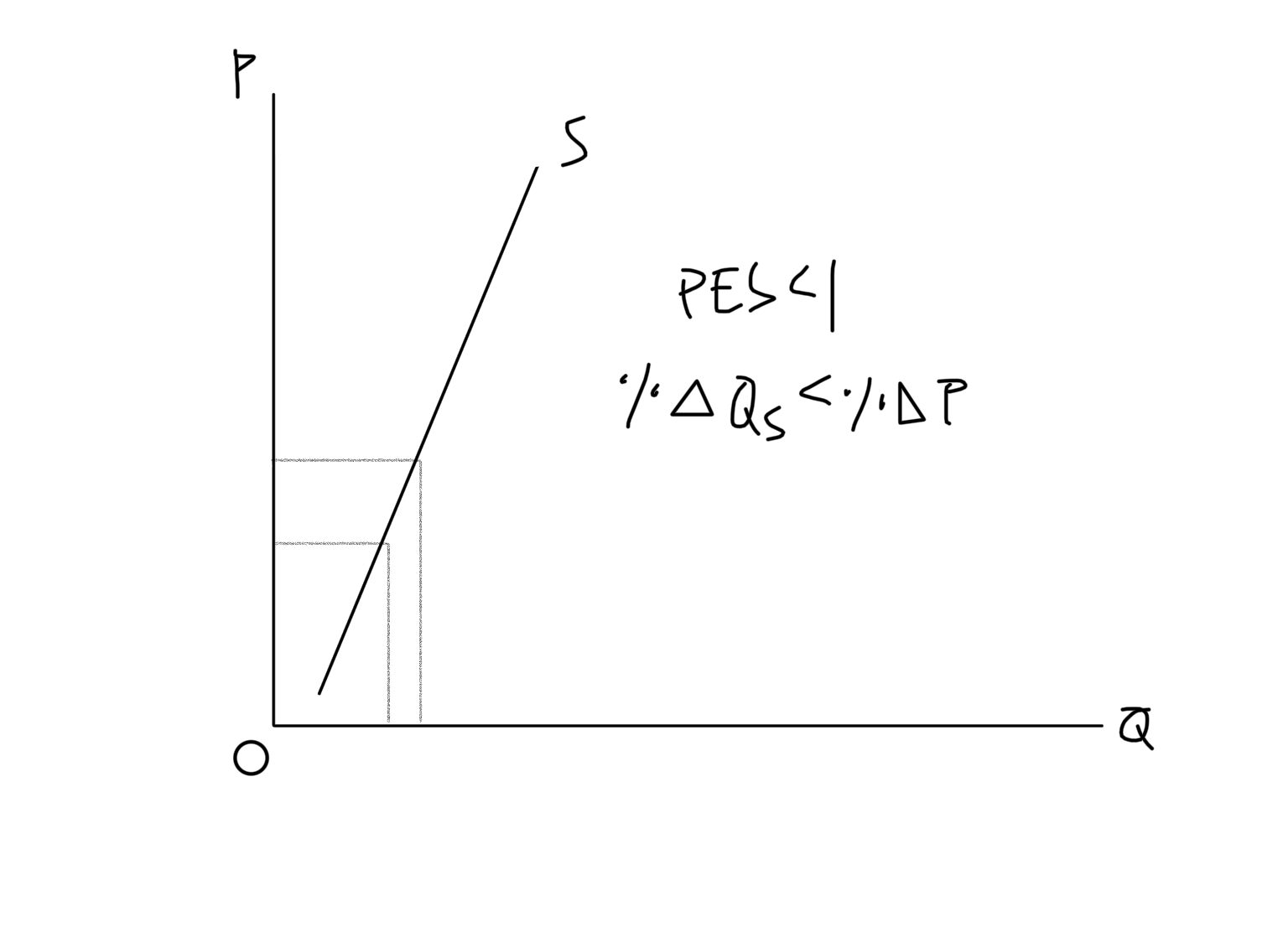

Price Inelastic

Supply is not very responsive to change in price (PES < 1)

40

New cards

PES Formula

(Qf-Qi / Qi) / (Pf-Pi / Pi) or or %ΔQD / %ΔP

41

New cards

Price Inelastic Supply Graph

\

42

New cards

Price Elastic Supply Graph

43

New cards

Unit Elastic Supply Graph

44

New cards

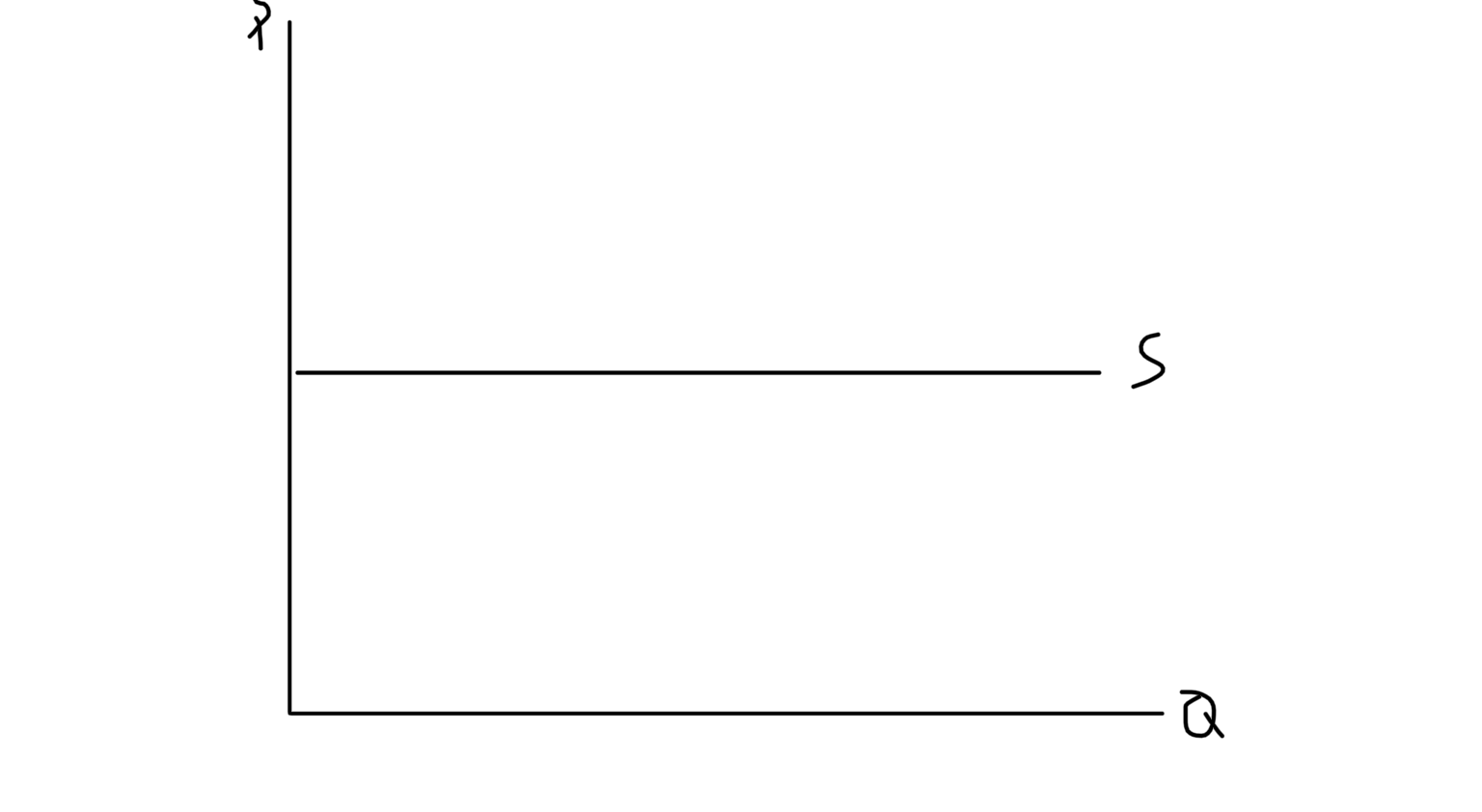

Perfectly Elastic Supply

45

New cards

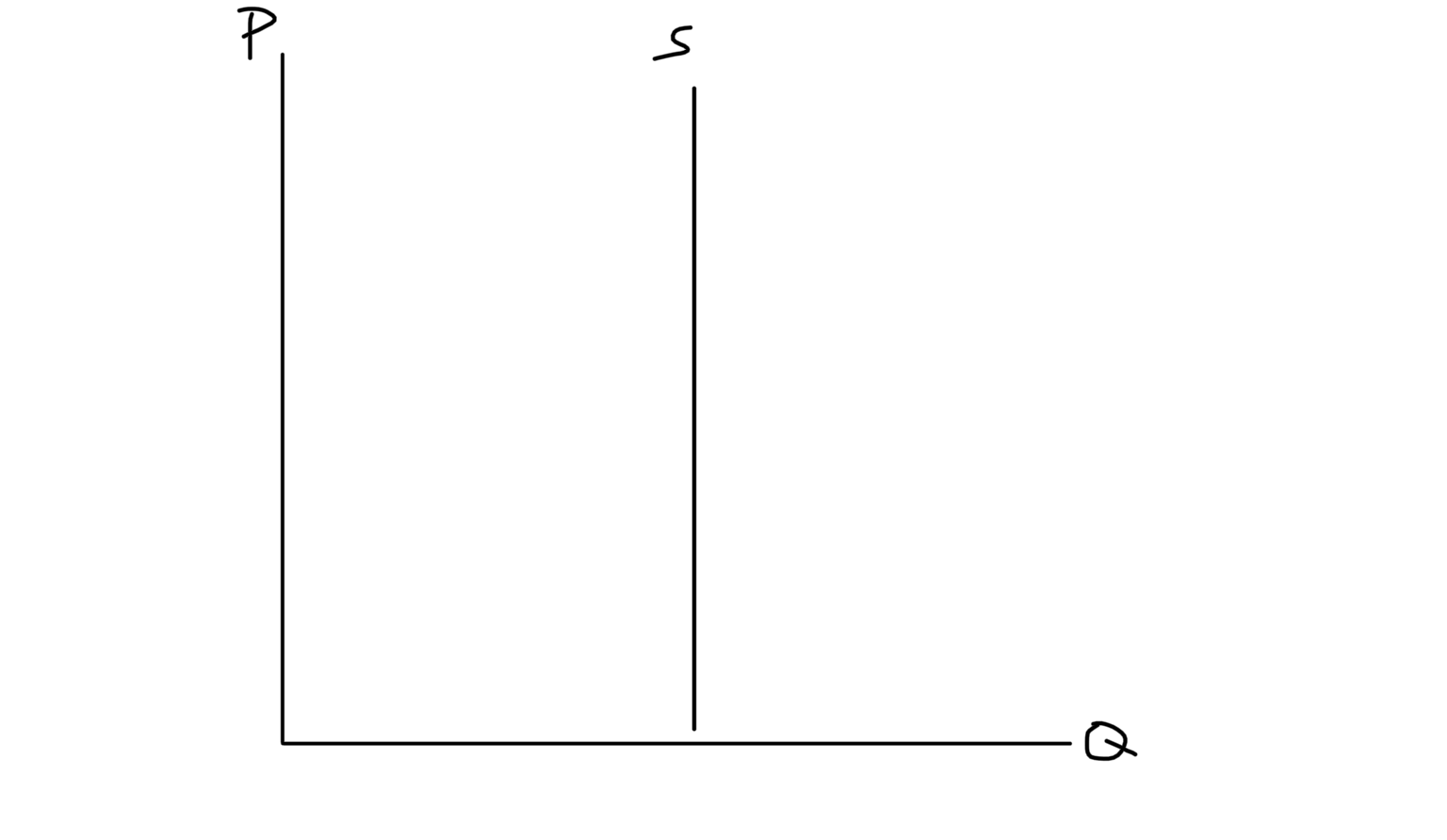

Perfectly Inelastic

46

New cards

Determinants of PES

Length of time↑↑, mobility of factors of production ↑↑, spare capacity of firms↑↑, Access to inventory ↑↑, rate at which costs increase, ↑↓

47

New cards

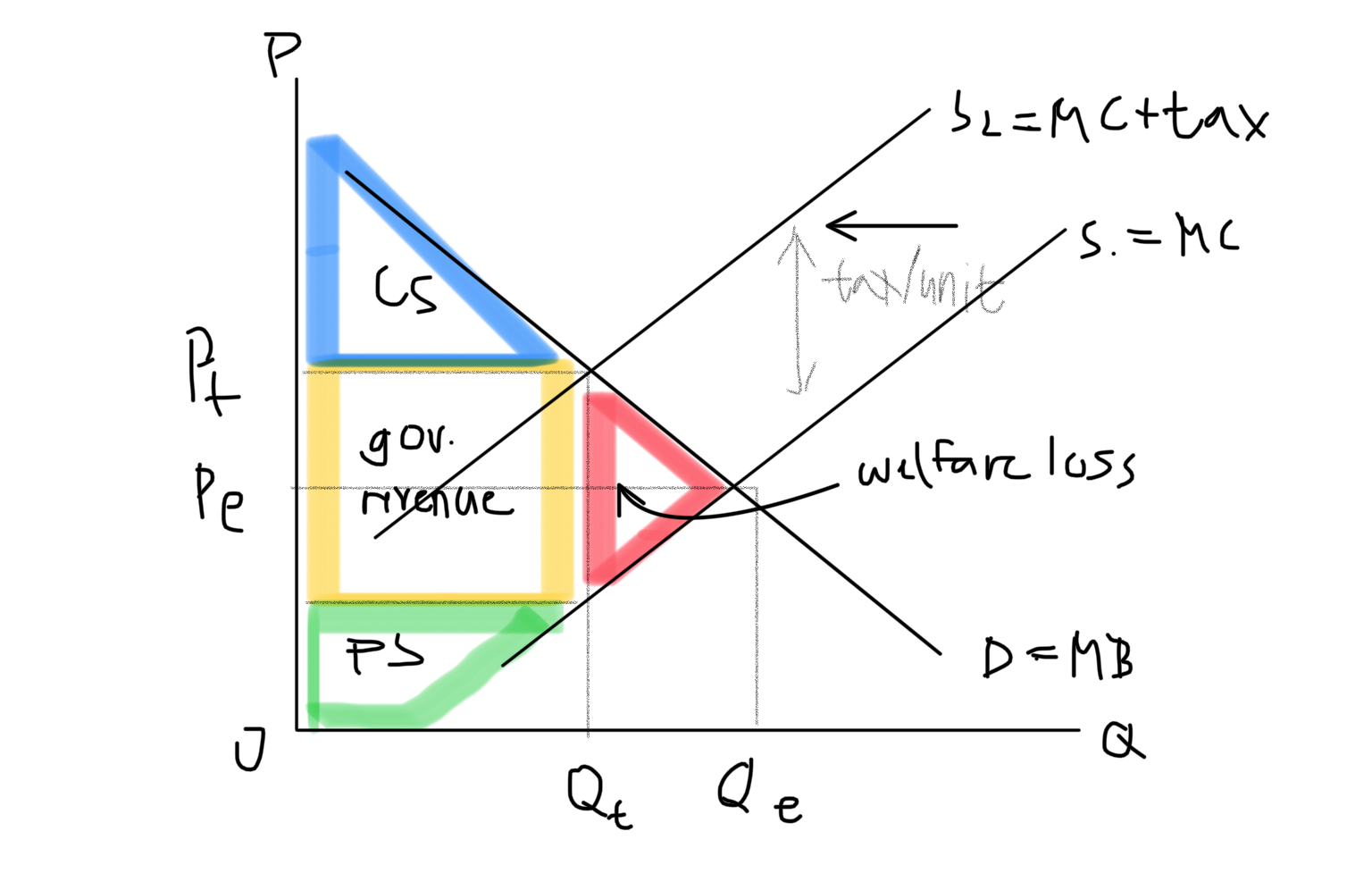

Indirect Tax Graph

48

New cards

Government Legislation Graph

Same as indirect tax

49

New cards

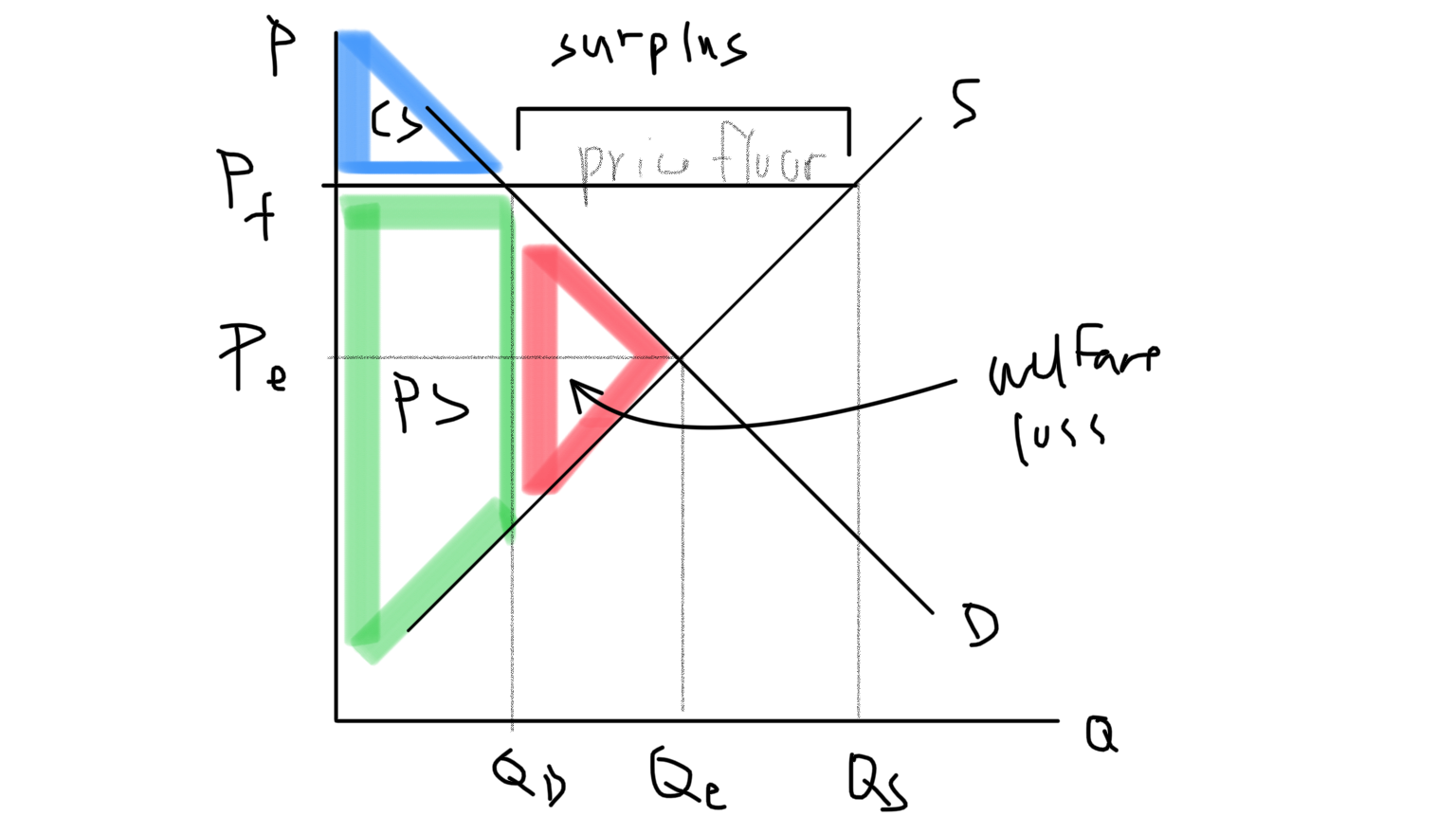

Price Floor Graph

50

New cards

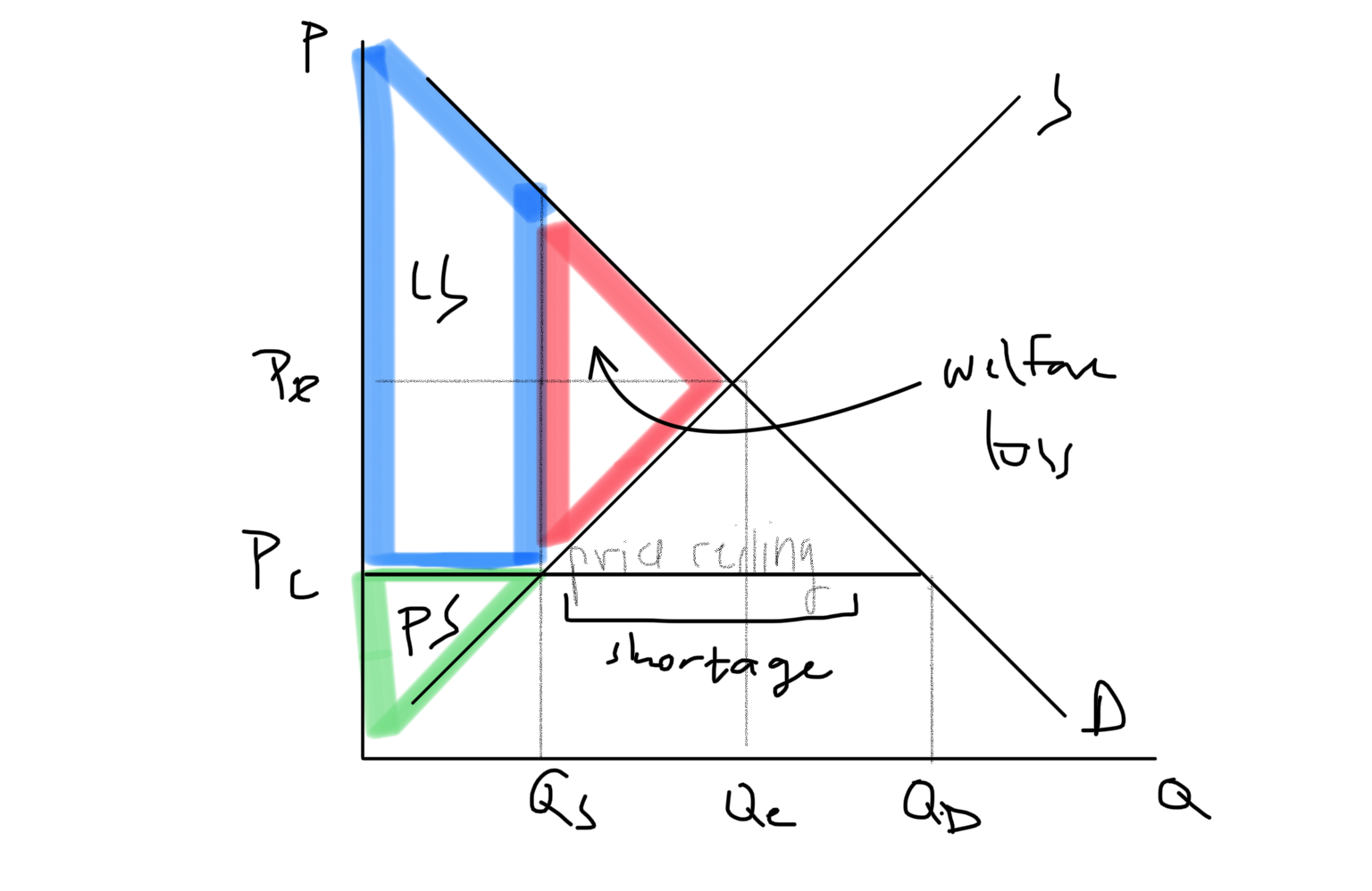

Price Ceiling Graph

51

New cards

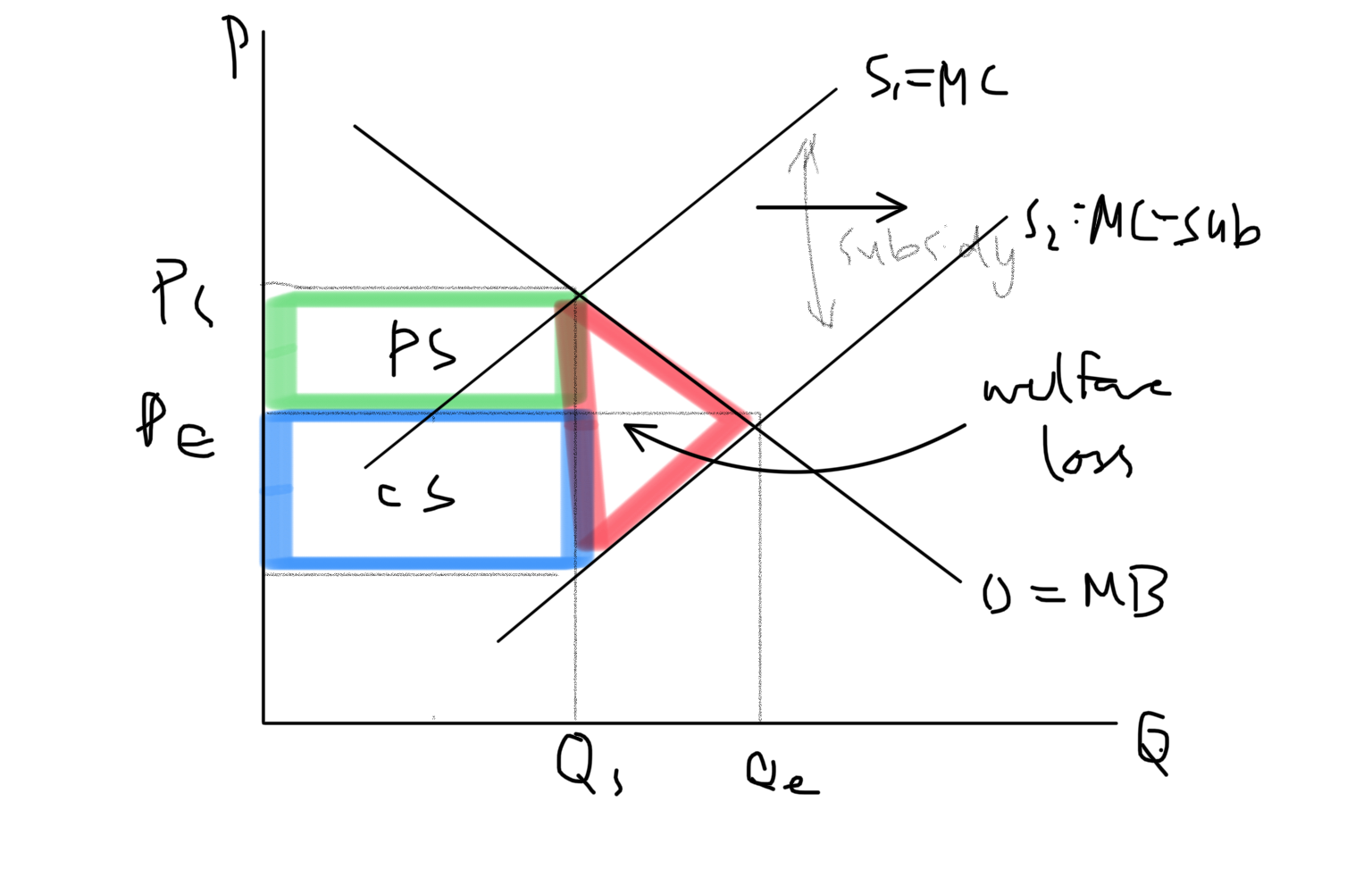

Subsidies Graph

52

New cards

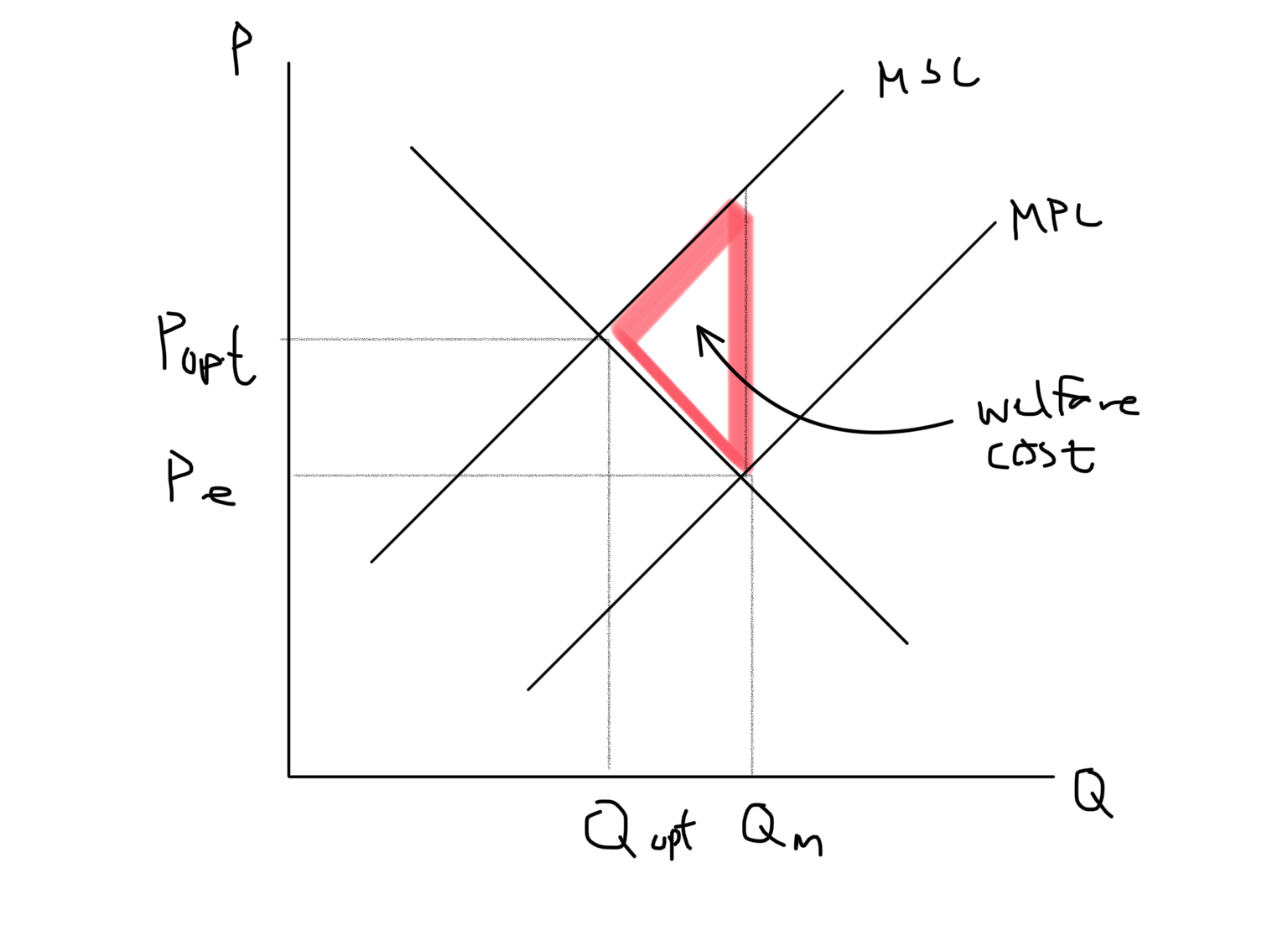

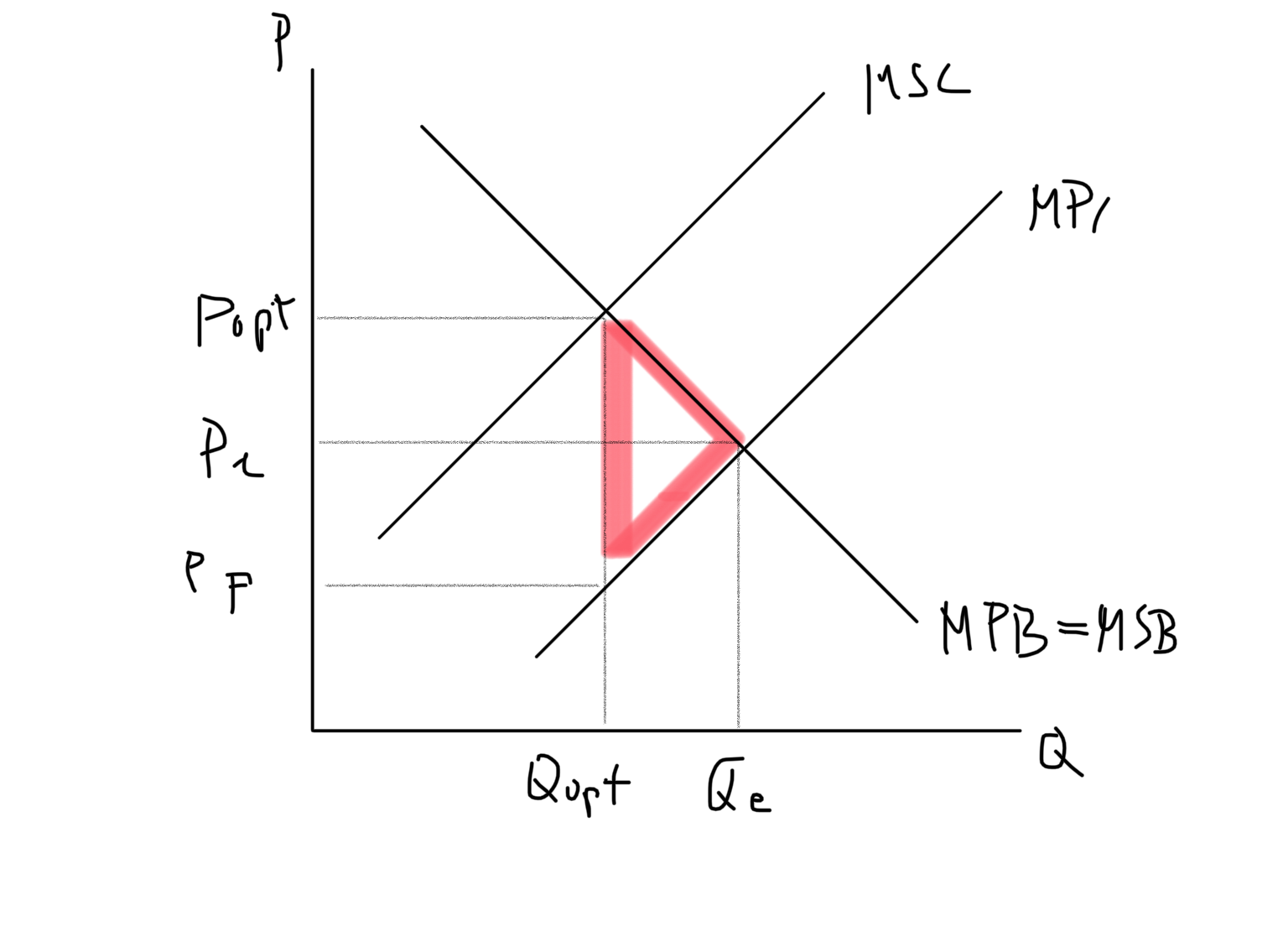

Negative Production Externality Graph

53

New cards

Indirect Tax Externality Graph

54

New cards

Carbon Tax Graph

55

New cards

Traceable Permits Graph

56

New cards

Common pool resource

Resources not owned by anyone. Rivalrous (If I take some, less for you) and non-excludable. Examples: air, river, forest

57

New cards

Tragedy of the commons

Herders share field for cattle. As herd grows, grass decreases. Eventually there is no more grass.

58

New cards

Marginal cost (MC)

Cost to producers of producing goods.

59

New cards

2 Types of marginal cost

Marginal private cost (MPC): cost to private firm/producers

Marginal social cost (MSC): cost to society

Marginal social cost (MSC): cost to society

60

New cards

Marginal benefit (MB)

Benefit to consumers for consuming goods

61

New cards

2 Types of marginal benefit

Marginal private benefit (MPB): benefits go to private individuals

Marginal societal benefit (MSB): benefits for society

Marginal societal benefit (MSB): benefits for society

62

New cards

Social surplus

Sum of consumer and consumer surplus

63

New cards

Externality

When actions of consumers/producers causes positive/negative side effects to third parties

64

New cards

2 types of positive externalities

Positive production externality: external benefit created by producers (research, new tech)

Positive consumption externality: external benefits created by consumers (education)

Positive consumption externality: external benefits created by consumers (education)

65

New cards

2 types of negative externalities

Negative production externality: external costs created by producers (pollution)

Negative consumption externality: external costs created by consumers (smoking)

Negative consumption externality: external costs created by consumers (smoking)

66

New cards

Carbon tax

Tax per unit of carbon emissions of fossil fuels

67

New cards

Tradable permits

Permits to pollute issued by gov. which can be bought and traded

68

New cards

Collective self-governance

Solution to common pool resources where consumers choose to use sustainably

69

New cards

Market failure

Overallocation/provision: QS > QD

Under-allocation/provision: QS > QD

Not always bad as it signals areas to be corrected

Under-allocation/provision: QS > QD

Not always bad as it signals areas to be corrected

70

New cards

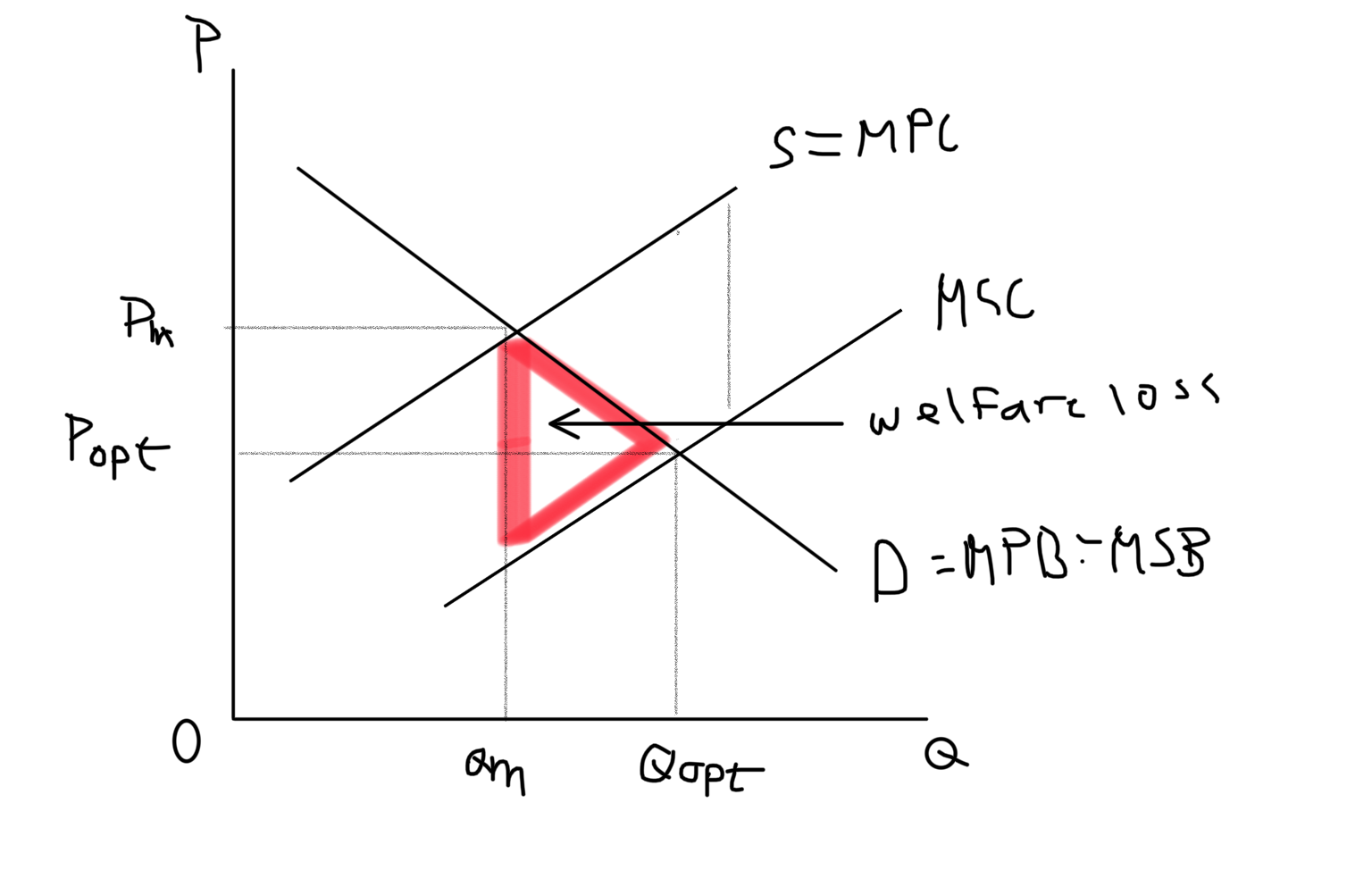

Policies to correct negative production externality

Indirect taxes, carbon taxes, tradable permits, gov. legislation/regulation, education and awareness creation, collective self-governance

71

New cards

Advantages of market-based policies

* Can internalize externalities where costs are covered by producers and consumers

* Taxation on emission = less pollution/cost

* Taxation on emission = less pollution/cost

72

New cards

Disadvantages of market-based policies

* May be impractical (calculating amount of emission is hard)

* Technical limitations

* Technical limitations

73

New cards

Advantages of government legislation and regulations

* Easier to implement

* Can avoid technical difficulties

* Highly effective

* Can avoid technical difficulties

* Highly effective

74

New cards

Disadvantages of government legislation and regulations

* More costly as no gov. revenue

* Can still face technical difficulties

* Cost involving monitoring regulations

* Can still face technical difficulties

* Cost involving monitoring regulations

75

New cards

Advantages of self-governance

* Sustainability without private or government ownership

76

New cards

Disadvantages of self-governance

* Unlikely

* Much communication needed

* Much communication needed

77

New cards

Education and awareness creation advantages

* Part of “natural” free market system

78

New cards

Education and awareness creation disadvantages

* May not be effective

* Difficult to measure

* Difficult to measure

79

New cards

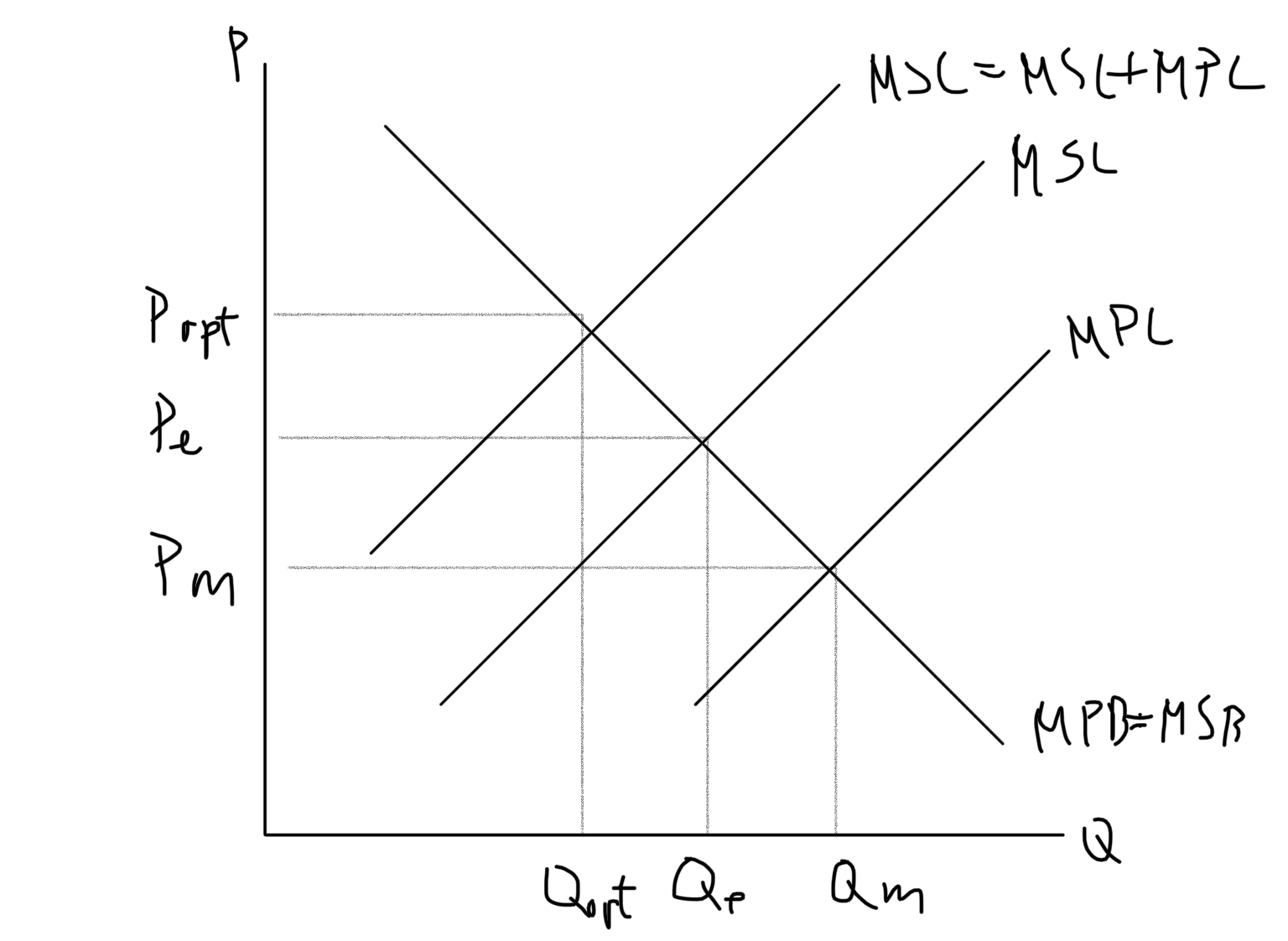

Positive production externality and graph

* External benefits created by producers

* MSC < MPC

* MPC – MSC = external benefit

* MSC < MPC

* MPC – MSC = external benefit

80

New cards

Direct government provision externality

* Positive production externality

* Direct government provision to producers to continue to continue to produce goods/services

* Can be capital or resources

* Direct government provision to producers to continue to continue to produce goods/services

* Can be capital or resources

81

New cards

Direct government provision externality graph?????

82

New cards

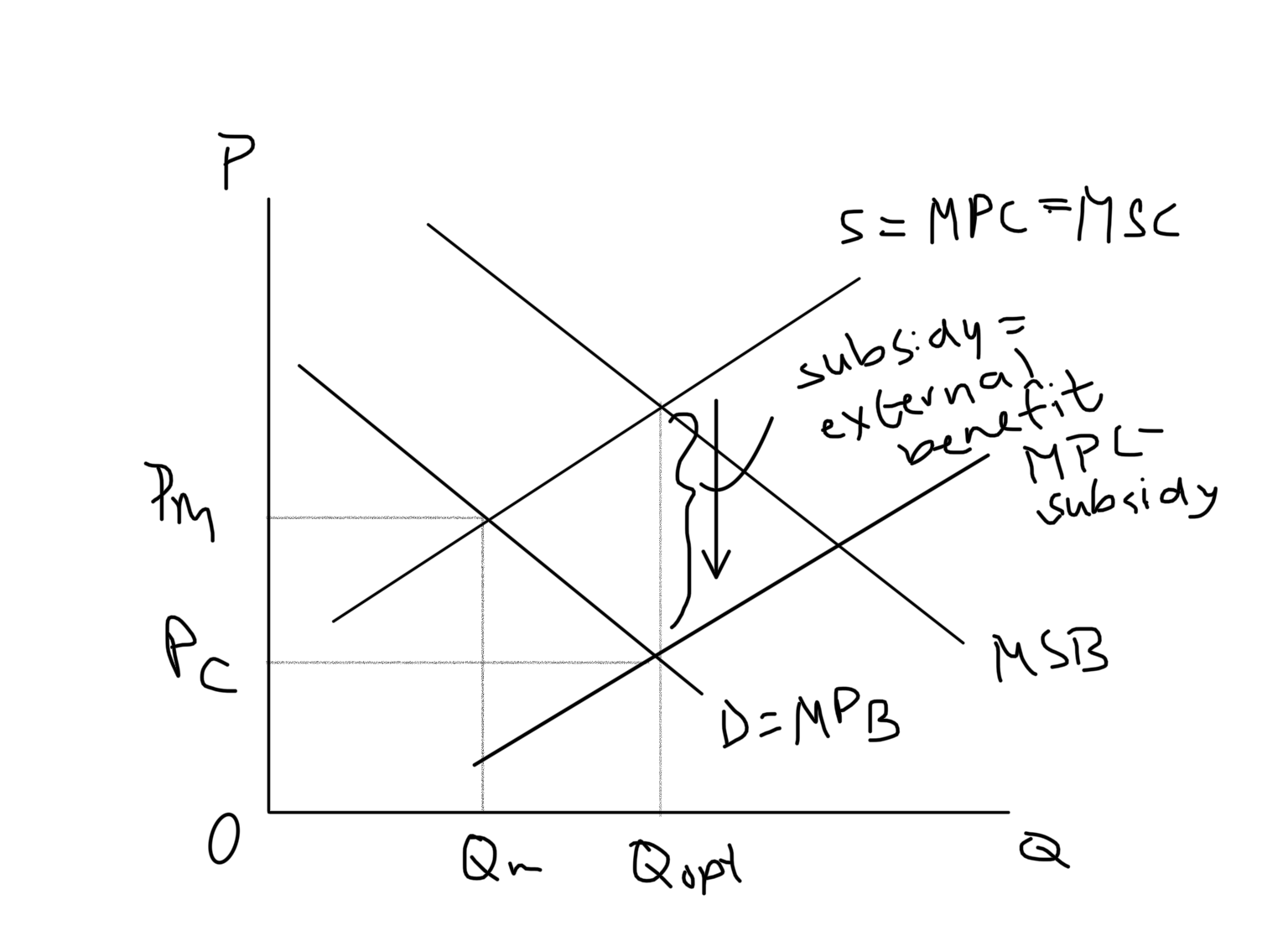

Subsides external benefit

* Positive production externality

* Subsidy to a firm per unit of the good provided = external benefit

* Subsidy to a firm per unit of the good provided = external benefit

83

New cards

Subsides external benefit graph??????

84

New cards

Positive consumption externality and graph

* External benefits created by consumers

* Often caused by consumption of merit goods

* MSB > MPB

* MSB –MPB = external benefit

* Often caused by consumption of merit goods

* MSB > MPB

* MSB –MPB = external benefit

85

New cards

Government legislation and regulation

* Positive consumption externality

* Regulations to promote greater consumption of goods with positive externalities

* Regulations to promote greater consumption of goods with positive externalities

86

New cards

Education and awareness creation

* Influencing consumer taste and preference to directly influence consumption choices (increase the demand)

87

New cards

Indirect tax

Is imposed on one person or group (like manufacturers), then shifted to a different payer, usually the consumer. (Taxes are put on goods, not consumers)

88

New cards

4 types of indirect taxes

Excise taxes, Specific taxes, Ad Valorem taxes, General sales taxes

89

New cards

Excise taxes

Are imposed on a particular goods and services

90

New cards

Specific taxes

A fixed amount of tax per unit of goods/service sold

91

New cards

Ad Valorem taxes

A fixed % of the price of the good/service (price up → tax up)

92

New cards

Direct tax

(Paid to the government by taxpayers. Suppliers →gov) income tax, business tax, property tax

93

New cards

Effects of indirect taxes (increase the price)

reduces consumer spending on taxed goods (QD decreases), signal producers to produce less (QS decreases)

94

New cards

Effects of indirect taxes (changes allocative efficiency)

Economy with a high degree of allocative efficiency → allocative efficiency goes down, welfare loss goes up. Economy with a low degree of allocative efficiency → allocative efficiency goes up (potentially)

95

New cards

Reasons for imposing indirect taxes

Indirect taxes → source of gov revenue. Indirect taxes are a method to discourage consumption of demerit goods. Indirect taxes can be used to redistribute income (by taking luxury goods) Indirect taxes are a method to improve the allocation of resources

96

New cards

Price ceiling

A gov setting a legal maximum price for a good. These are usually set to make certain goods more affordable to people on low incomes. Price ceiling must be below equilibrium price. AFFORDABILITY IS IMPORTANT. Creates a shortage.

97

New cards

Possible consequences of price ceilings

Non-price rationing (distribution of goods determined not solely by price). Underground (parallel) markets (black market) (unrecorded transaction involving markup on goods with price ceiling). Under-allocation of resources (allocative inefficiency), creates shortage. Negative welfare impacts (due to disequilibrium, max social surplus not reached; there is welfare loss)

98

New cards

A legal minimum price; sellers can’t charge less than this price. Must be above market equilibrium price. It creates a surplus

price floor

99

New cards

Creates surplus (QD

Possible consequences of price floor

100

New cards

Subsidies

A payment made to the firm by the gov (opposite of tax), to lower production cost. Right supply shift.