Fiscal policy - overview

1/9

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

10 Terms

Fiscal policy: definition

The manipulation of govt. spending, taxation and borrowing to influence the level of economic activity

Macroeconomic functions of fiscal policy

Keep inflation on target (2%)

Stimulate economic growth and employment during times of recession

Maintain a stable economic cycle that minimises boom + bust.

What are the microeconomic functions of fiscal policy?

Can improve education, health and the redistribution of income.

What is expansionary fiscal policy?

If the government is trying to stimulate economic activity.

Methods of expansionary fiscal policy

1. Cutting taxes: Income tax - will give consumers more disposable income, raising consumption

Corporation tax - will increase available profits for firms, stimulating investment

2. Raising govt spending - may increase infrastructure spending or public sector pay

3. Increasing the budget deficit - an increase in borrowing, which must be repaid with interest

Contractionary fiscal policy - definition

To constrain aggregate demand, reduce debt or control inflation.

Methods of contractionary fiscal policy

1. Increasing taxes: will discourage spending

2. Cutting govt spending: if current levels are unaffordable or inflationary

3. Cutting the budget deficit: may stabilise economic growth as reduced debt repayments in future can be reinvested back into the economy.

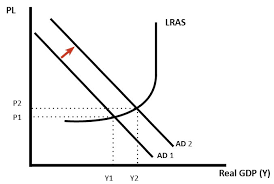

Expansionary fiscal policy - diagram

Assume the govt. would like to stimulate economic growth

May decide to cut taxes, which boosts AD to AD1 as consumption rises

RNO rises from Y to Y1

Creates employment

However, price level rises also, hampering inflation targets

If consumption is spent on imports, this will worsen balance of payments on current account

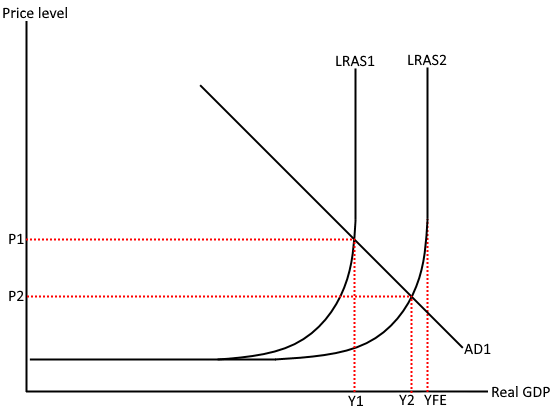

Expansionary fiscal policy - Aggregate Supply

Imagine the govt. would like to stimulate the supply side of the economy.

They may cut corporation tax in order to boost firms’ profits, which can then be reinvested into capital projects

LRAS will shift right to LRAS2

Productive capacity has increased and there’s been a fall in PL, softening inflationary pressure

However, if AD remains unchanged, spare capacity has also increase - a waste of economic resources.

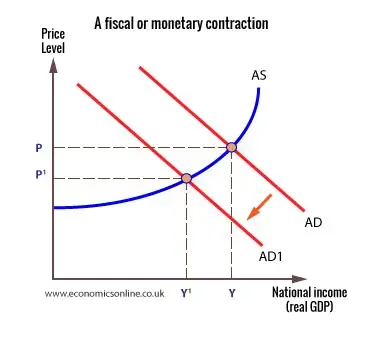

Contractionary fiscal policy diagram + chain of analysis

Assume the govt. would like to use fiscal policy to maintain its inflation target at 2%, as the economy is up against capacity constraints

It may decide to increase taxation, decreasing consumption, shifting AD to AD1

Reduces inflationary pressure, with price level falling to P1

Also improves balance of payments, as less income is spent on imports

But, this damages Real GDP as economic growth declines.

Also, falling consumption and lower Ad likely to increase cyclical unemployment