Chapter 17: Tracking the Business Cycle

1/78

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

79 Terms

the level of output that occurs when all resources are fully employed

potential output

What we can sustainable produce given our current resources

potential output

in the short run, the economy may fail to meet its

potential output

short-term fluctuations in economic activity

Business cycle

cause actual output to deviate from potential output

business cycle

the business cycle causes the (BLANK) to rise and fall sharply

unemployment rate

Even decades later, people who graduated in a recession tend to earn (BLANK) than those who graduated in better economic times

less

the difference between actual and potential output, measured as a percentage of potential output

output gap

output gap =

((actual output - potential output)/potential output) x 100

the economy is producing less than it can (called a bust)

negative output gap

idle resources: workers can’t find jobs, storefronts are shuttered, etc.

negative output gap

the economy is producing more than its potential (called a boom)

positive output gap

This unsustainable intensity is possible only for a short while

positive output gap

Trough

Peak

Recession

Expansion

Real GDP

a high point in economic activity

peak

a low point in economic activity

trough

a period of declining economic activity

recession

runs from peak to trough

recession

a period of increasing economic activity

expansion

runs from trough to peak

expansion

Keep going until they’re killed by an adverse shock

expansion

Recessions create a lot of

unhappiness

Are the economy’s fluctuations rhythmic, reliable, or predictable

no

recessions are

not inevitable

GDP measures the (BLANK) of output

level

GDP growth is about

changes

No two business cycles are ever the same, but they do have some common features: Recessions are

short and sharp

No two business cycles are ever the same, but they do have some common features: Business cycles are

persistent

No two business cycles are ever the same, but they do have some common features: Expansions are

long and gradual

No two business cycles are ever the same, but they do have some common features: business cycles impact (BLANK) parts of the economy

many

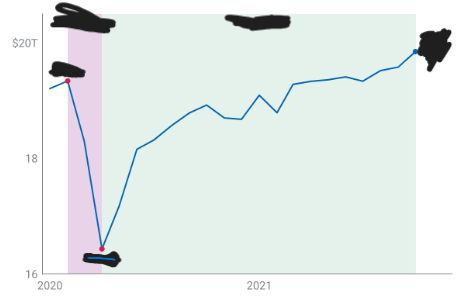

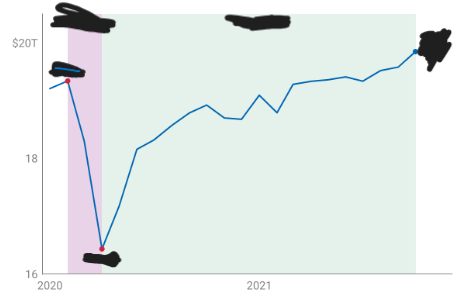

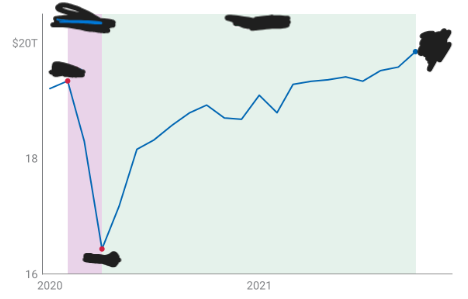

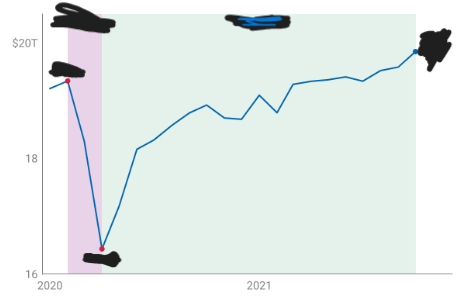

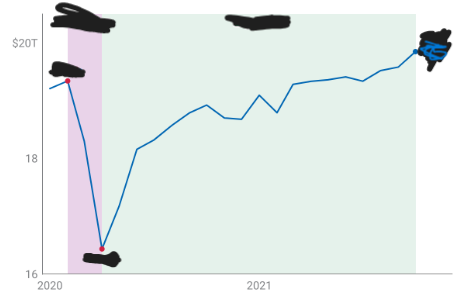

Rapid bounce-back following the coronavirus shutdowns

unusual expansion

The state of the economy this year is closely related to the conditions

next year

variables that move up and down together

comovement

If one part of the economy is doing well, then the other parts of the economy are probably doing

well

Creation of new businesses, housing construction, automobile sales, imports from

overseas, new investment projects, business profits, workers’ real wages, stock prices, inflation and interest rates

indicators that move together

industries that rise and fall together

goods-producing and private service-producing

industry that is usually more sensitive to the business cycle

goods-producing

variables that tend to predict the future path of the economy

leading indicators

tend to change first

leading indicators

business confidence, consumer confidence, the stock market

leading indicators

variables that tend to follow business cycle movements with a bit of a delay

lagging indicators

example of lagging indicator

unemployment

For every percentage point that actual output is less than potential output, the unemployment rate will be around half a percentage point higher

okun’s rule of thumb

If output gap declines from 0% to -4% then the unemployment rate will likely

rise by 2%

business cycles are not

cycles

data stripped of predictable seasonal patterns

seasonally adjusted

for easier comparison of date with different rates, use

annualized rates

data converted to the rate that would occur if the same rate had occurred throughout the year

annualized rates

data from a time period of less than a year converted into an annual rate

annualized rates

real variables are adjusted for

inflation

comparing quantities, holding prices constant

real data

chained 2012 dollars means

real data

makes it difficult to tell whether an increase reflects rising prices or rising quantities

nominal data

updates to earlier estimates are called

revisions

broadest measure of economic activity

real GDP

measures the total size of the economy

real GDP

What is the caution for real GDP?

incomplete when first released

acts as a useful cross-check on GDP

Real GDI

adds up total income

gross domestic income

GDP and GDI should be (BLANK), but often (BLANK)

equal, differ

early reports of (BLANK) are often more reliable than (BLANK)

GDI, GDP

tell you if the labor market is improving

nonfarm payrolls

tell you how many jobs are created each month by tracking the number of workers on businesses’ payrolls

nonfarm payrolls

indicator of excess capacity

unemployment rate

share of the labor force that wants a job but can’t find one

unemployment rate

how many people lost their jobs and applied for unemployment insurance during the previous week

initial unemployment claims

tells you want managers are planning

business confidence

tells you what consumers are thinking

consumer confidence

asks regular people how optimistic they are about the economy

consumer confidence

tells you what’s happening with prices

inflation rate

provides a sense of how much economy-wide prices are growing

consumer price index

tells you what’s happening with wages

employment cost index

how fast wages and benefits are rising

employment cost index

leading indicator of inflationary pressure

employment cost index

tells you about future expected profits of businesses

stock market