Chapter 5: Master Budgets

1/43

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

44 Terms

budget

a financial “plan” that managers use to coordinate a business’s activities

managers use budgets to:

develop strategies

plan and budget for specific actions to achieve goals

implement plans

take corrective action

budgeting objectives

develop strategies

plan

direct

control

budgeting “benefits”

requires managers to plan for the company’s future

coordinates a company’s activities

provides a benchmark that motivates employees and helps managers evaluate performance

facilitates coordination and communication

provide a benchmark that motivates employees and helps managers evaluate performance

benchmarking

the practice of comparing a company with its prior performance or with best practices from other companies

Participative budget

a budgeting process where those individuals who are directly impacted by a budget are involved in the development of the budget (bottom-up approach)

these budgets tend to be achievable because those who are directly impacted by the budget help to create the plan

managers must:

support the budget

show employees how budgets can help them achieve better results

require that employees participate in developing the budget

budgetary games:

budgetary slack

“spend it or lose it”

budgetary slack

occurs when managers intentionally understate expected revenues or overstate expected expenses

zero-based budget (ZBB)

all revenues and expenses must be justified for each new period

previous year’s actual results are ignored under this approach

strategic budget

a long-term financial plan used to coordinate the activities needed to achieve the long-term goals of the company

operational budget

a short-term financial plan used to coordinate the activities needed to achieve the short-term goals of the company

continuous budget

a type of operational budget that involves continuously adding one additional month as each month goes by

static budget

a budget prepared for only one level of sales volume

flexible budget

a budget prepared for various levels of sales volume

master budget

a set of budgeted financial statements and supporting schedules for an entire organization

three types of budgets included in the master budget:

the operating budget

the capital budget

the financial budget

operating budget

a set of budgets that projects sales revenue, cost of goods sold, and selling and administrative expenses, all of which feed into the cash budget and then the budgeted financial statements

capital expenditures budget

presents a company’s plan for purchasing long-term assets

financial budget

includes the cash budget and the budgeted financial statements

cash budget

details how the business expects to go from the beginning cash balance to the desired ending cash balances

master budget includes the following budgets:

sales budget

production budget

direct materials budget

direct labor budget

manufacturing overhead budget

cost of goods sold budget

selling and administrative expense budget

sales budget

the forecast of sales revenue is the “cornerstone” of the master budget

production budget

the basis for product costs budgets: direct materials budget, direct labor budgets, and manufacturing overhead budgets

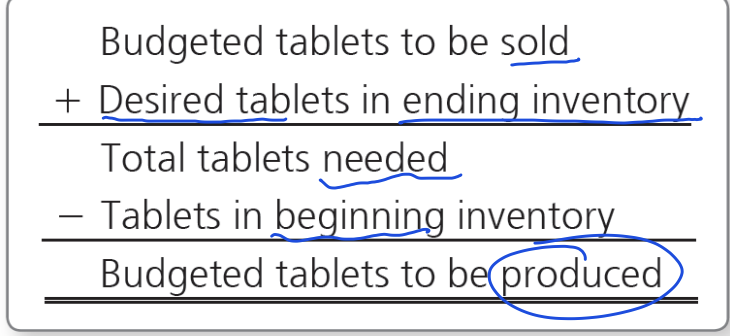

production budget calculation

direct material budget

estimates the amount of materials to purchase to meet the company’s production needs

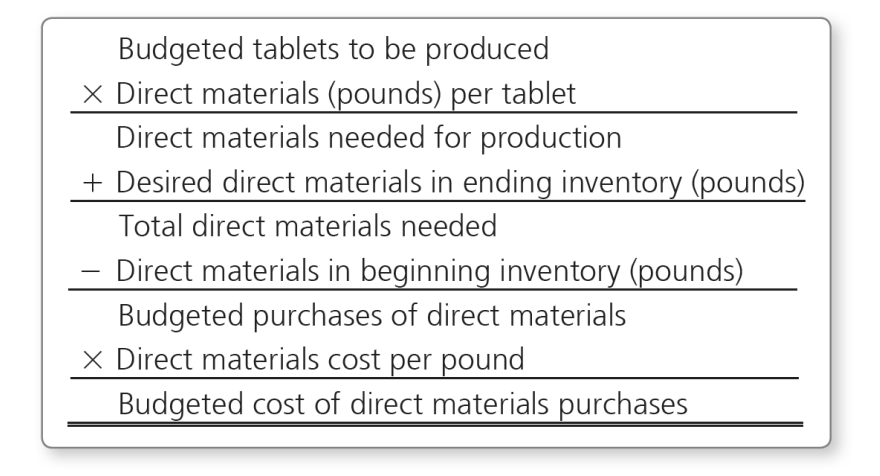

direct materials budget calculation

direct labor budget

estimates the direct labor hours and related cost needed to support the production budget

manufacturing overhead budget

estimates the variable and fixed manufacturing overhead deeded to meet the company’s production needs

predetermined overhead allocation rate =

total estimated overhead costs / total estimated quantity of the overhead allocation base

cost of goods sold budget

estimates the cost of goods sold based on the company’s projected sales

the cost accountant works with the office and sales managers to develop the ___________

selling and administrative expense budget

selling and administrative expense budget

estimates the selling and administrative expenses needed to meet the company’s projected sales

financial budgets include:

the cash budget

the budgeted financial statements

budgeted income statement

budgeted balance sheet

budgeted statement of cash flows

Capital expenditures budget (CAPEX)

the purchase of long-term assets is part of a strategic plan

capital expenditures are purchases of long-term assets, such as:

delivery trucks

computer systems

office furniture

manufacturing equipment

land

cash budget

pulls information from the other budgets previously prepared

cash budget has three sections:

cash receipts

cash payments

short-term financing

cash payments

capital expenditures

product costs

direct materials purchases

direct labor costs

manufacturing overhead costs

selling and administrative expenses

inventory, purchases, and cost of goods sold budget

the cost of goods sold computation shows the relationship between inventory, purchases, and ending inventory:

beginning merchandise inventory + purchases - ending merchandise inventory = COGS

the equation can be rearranged to find the amount of purchases required:

purchases = COGS + desired ending merchandise inventory - beginning merchandise inventory

budgets for a merchandising company include:

capital expenditures budget

cash budget

budgeted income statement

budgeted balance sheet

short-term financing

companies often borrow funds to maintain a minimum cash balance

sensitivity analysis

technology can make it more cost effective to conduct sensitivity analysis

sensitivity analysis is a “what if” technique that asks what a result will be if a predicted amount is not achieved or if an underlying assumption changes

sensitivity analysis provides a better understanding of how changes in sales and costs are likely to affect the company’s bottom line

examples of how companies use data analytics:

help with sales forecasting and financial planning

drive growth and operational efficiency

establish budgets and monitor them against actual results