unit 5 business

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

functions of financial department

records transactions

forecasts cash flow

prepares accounting information

prepares financial accounts

makes financial decisions

start up capital definition

financial sources needed by an entrepreneur when first starting a business to buy fixed and current assets

assets definition

items of value which are owned by the business

Intangible assets definition

assets that do not exist physically but can have value

e.g brand name, patent, copyright

working capital definition

finance needed by business to pay its day-to-day costs which do not involve the purchase of long-term, fixed assets

e.g wages, bills, materials

capital expenditure definition

spending by a business on fixed assets which will last for more than one year

Used during start-up or during expansion

product development, R&D, takeovers

revenue expenditure definition

money spent by a business on day-to-day expenses which don’t involve purchase of long-term assets, such as wages or rent

short term finance definition

loans or debts used to overcome cash-flow problems and the business expects to pay them back within one year

short term bank loans, overdraft

long term finance definition

loans or debts to finance purchases of fixed assets or business expansion and the business expects to pay them back in 5 years or longer

internal sources of finance

owners savings

retained profit

sale of unwanted fixed assets

sale of inventories

sale and leaseback

use of working capital

owners savings internal sources of finance advantages + disadvantages

advantages - no interest is paid, should be quickly available

disadvantages - savings may be too low, increases risk taken by owners which have unlimited liability

retained profit definition

profit remaining after all expenses, tax and dividends have been paid out, and which is reinvested back into the business

retained profit internal sources of finance advantages + disadvantages

advantages - does not have to be repaid, no interest

disadvantages - new business has no retained profit, small firms → don’t have enough retained profit to finance expansion, lower dividends → investors invest into other businesses

sale of unwanted fixed assets internal sources of finance advantages + disadvantages

advantages - makes better use of the capital tied up in the business, does not increase debts of a business, land + buildings often raise a lot of money

disadvantages - may take time to sell assets, not available to new businesses as they dont have any unwanted fixed assets to sell

sale of inventories internal sources of finance advantages + disadvantages

advantage - reduces opportunity cost + storage cost of high inventory levels

disadvantage - must be done carefully - if too many inventories are sold → customers disappointed since not enough goods a kept in inventory

external sources of finance

short term -

overdrafts

debt factoring

trade credit

long term -

bank loans

mortgage

debenture

leasing

share issue

hire purchase

overdraft external source of finance

Agreement with a bank that allows a business to spend more money than it has in its account up to an agreed limit. The loan must be repaid within 12 months

able to take at short notice → flexible for business

high interest rate → only used in case of short term cash flow problems

trade credit external source of finance

agreement between a business and its supplier that the business can pay for the supplied materials at an agreed time in the future

almost interest free

Regular delayed payments → risk of demanding payment upfront

no further deliveries until old ones are paid

any discount will be lost

debt factoring external sources of finance

selling trade receivables to improve business liquidity

immediate cash for the business

risk of collecting the debt becomes the factoring businesses problem

business does not receive 100% of the value of the debts

trade receivables definition

Amount owed to a business by its customers who bought goods on credit.

mortgage external source of finance

long term loan used to buy land or buildings

interest is paid every year

similar to bank loan

debenture external sources of finance

bond issued by a company to raise long term finance usually at fixed rate of interest

used to raise large sums of money

owner of bond receives interest + full price upon maturity date

leasing external sources of finance

using a fixed asset by paying a fixed amount per time period for a fixed period of time.

ownership remains with leasing company

used with machines

no big one time payment needed

high interest rates

hire purchase external source of finance

purchase of an asset by paying a fixed repayment amount per time period over an agreed period of time.

The asset is owned by the financing firm

until the final repayment.

purchasing firm responsible for maintenance + repairs

higher interest rates

no big one time payment needed

Bank loan external source of finance

finance provided by a bank which the business will repay with interest over an agreed period of time

share issue external source of finance

source of permanent capital available to limited liability companies after they sell their shares

capital does not have to be repaid however shareholders expect dividends

no interest

risk of takeover

authorised share capital definition

maximum amount of shares a business is allowed to sell

government grants source of finance

often offered to startups/small/medium sized businesses

do not have to be repaid

often with strings attached e.g business has to relocate

crowd funding source of finance

Financing a business idea by obtaining small amounts of capital from a large number of people, most often using internet and social medias

include how investors benefit after enough money is raised

if total amount is not raised finance has to be repaid

can be a fast way to raise large sums

micro funding source of finance

Small amounts of capital loaned to entrepreneurs in less developed countries where finance is often difficult to obtain.

These loans are usually repaid after a relatively short period of time

factors influencing source of finance

amount of finance required

length of time when finance is needed

size + legal form of business

existing borrowing

profitability of business

desire to keep ownership of business

will banks lend ?

is cashflow forecast available?

is business plan available?

is a forecasted income statement available?

will the loan be secured?

why is the loan needed?

will shareholders invest ?

are the future prospects for a company good?

how do company dividends differ from other companies

how has the companies share price level varied?

cash inflow

sums of money received by a business during a period of time

e.g sales revenues, payment by debtors, borrowing, sales of assets, investments

cash outflow

sums of money paid out by a business during a period of time

e.g Expenditures to buy materials, paying wages & bills, paying off debts, buying fixed assets

cash flow

cash inflows and cash outflows over a period of time

net cash flow, positive cash flow, negative cash flow

net cash flow - cash inflow - cash outflows

positive cash flow - cash inflows > cash outflows

negative cash flow - cash inflows < cash outflows

cash flow management

Ensures that the business has enough cash whenever they need to pay their employees, suppliers, etc.

why are cashflow forecasts important

prevent negative cash flow

convince banks to provide loans

to help managers plan ahead

how to solve short term cash flow problems

hire purchase, leasing

bank loan

overdraft

all more expensive than delaying purchase by one month

ask customers to pay trade receivables quicker

negotiate longer trade credit with supplier

what is meant by liquidity of a business

ability of a business to pay its short term debts

how to measure business liquidity

working capital

Enough working capital to pay debts → business is liquid

working capital cycle definition

Time it takes from buying raw materials, making these into goods for sale, finding buyers for them and receiving payments from customers

factors that affect amount of working capital

level of inventories - less inventories → less working capital needed

trade credit terms - longer trade credit → less working capital needed

length of production process - short production process → less working capital

how quickly the business finds customers - quickly → less working capital

trade receivables terms - shorter credit sales → less working capital

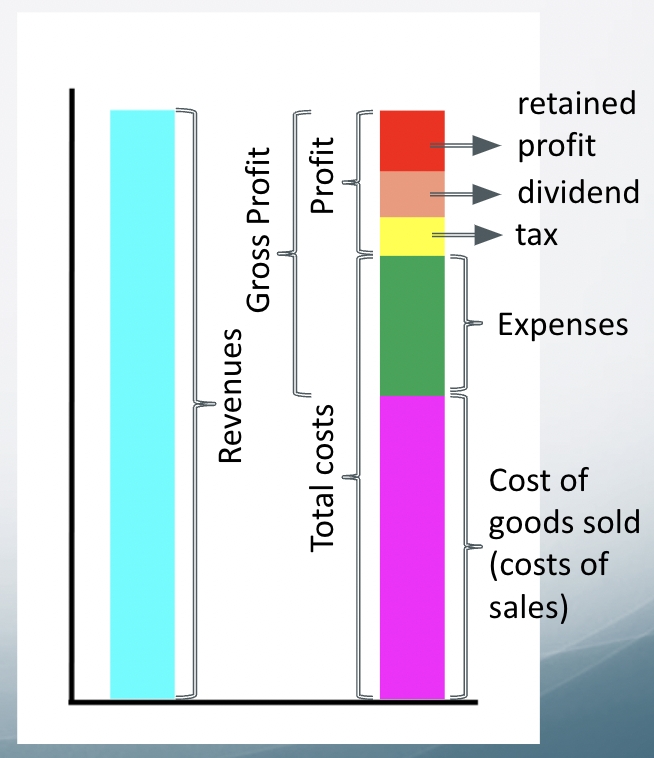

overhead costs

day-to-day operating expenses of a business, but not directly related to creating a product

e.g rent, insurance, marketing, wages of sales people

cost of goods sold

direct costs of producing the goods sold by a company: costs of material & production labor

e.g costs of flour, sugar to make a cake, baker’s wages

profit vs gross profit vs retained profit

profit - difference between total revenue and total costs

gross profit - difference between revenues and direct production costs.

retained profit - profit remaining after all expenses, tax and dividends have been paid, which is then reinvested back into the business”

dividends

payment, out of profit, to shareholders as reward for their investment

why is profit important

As a reward for business owners for the risk of investing into business

To attract investors who provide additional funs for business expansion

As a measure of success of a business & performance of managers

Source of finance: retained profit as an internal source of finance

To decide whether to continue making & selling a product or not

To decide if to expand the business / buy fixed assets

cash flow vs profit

cash flow - pays day to day expenses → important to business short term + long term

profit - measure of success of business → important long term

How do the following directly affect cash flow and profit?

Business takes a bank loan:

Business buys a new machine:

Business sold goods, but will receive money for it next month

1 - Cash increases, profit unchanged

2 - Cash decrease profit unchanged

3 - Cash unchanged, profit increased

how can a profitable business run out of cash

buy too many fixed assets at once

offer too long trade credit period

expanding too quickly

too many inventories

income statement

financial statement which records the revenue, costs and profits of a business for a given period of time (usually once a year)

necessary for strategic decision making

how is the income statement important for shareholders + lenders

shareholders - high profit → high dividends + increase in market price of shares

lenders - higher profit → safe to pay loans on time

how is the income statement important for managers + employees

managers - high profit → business done well + source of finance for expansion

employees - high profit + chance of bonuses

how is the income statement important for government + suppliers

government - higher profit → higher tax revenue

suppliers - higher profit → promise of future purchases of their supplies

balance sheet / statement of financial position definition

an accounting statement that records assets, liabilities and owner’s equity of a business at a particular date

needs to be done by incorporated businesses at the end of each financial year

owners equity

amount owed by business to its owners, including capital and retained profit

money invested by owners

net assets formula

total assets - total liabilities

= working capital

capital employed formula

non current liabilities + shareholders equity

a balance sheet shows

Assets that the business owns and their value

What the business is owed and its value

What the business owes and its value

How the business finances its activities

Amount of working capital

disadvantages of balance sheets

shows the financial position of a business for only one particular day

value of assets/liabilities can be changed quickly

does not show trends / flows

value of non current assets might not reflect the market value of them

not a good indicator of how much a business is worth

how do banks + share holders benefit from balance sheets

banks - know if it is risky to lend money

shareholders - see how much business is worth + if it is managed well

capital employed definition

shareholders equity + non current liabilities → the total long term and permanent capital invested in a business

profitability definition

the measurement of the profit made relative to either the value of sales achieved or the capital invested in the business

who is profitability important for

investors when deciding which business to invest into

directors + managers to assess if the business is becoming more/less successful overtime → might lead to changes in operations to improve profitability

how to measure profitability ?

gross profit margin

profit margin

return on capital employed

Gross profit margin, profit margin, return on capital employed formula

gross profit - (gross profit/revenue) x 100

profit - (profit/revenue) x 100

return on capital employed - (net profit/capital employed) x 100

higher gross profit margin means…

higher revenues without similar increase in cost of sales

keeping revenues and lowering costs of goods sold

good has more added value (added value = selling price - direct costs)

profit margin description

profit earned per 1$ revenue

affected by cost of goods sold + revenue + expenses

higher profit margin means …

higher revenues without similar increase in costs of sales, keeping revenues and lowering cost of goods sold

lower expenses (overheads)

what does the difference between profit and gross profit mean

difference = expenses

small difference → low expenses → costs controlled well

big difference → high expenses → costs controlled poorly

Analysis of return on capital employed

ROCE increases over time → business is getting more profitable

if ROCE of business A > ROCE business B → Business A = more profitable

ROCE high → business is using resources efficiently

how to measure liquidity - ratio

current ratio

acid test ratio

current ratio - formula + optimum value + limitation

current assets/current liabilities

optimum value → between 1.5 and 2

limitation → inventories are the least liquid form of current assets → including them can skew the current ratio significantly

analysis of current ratio

below 1.5 → risk of not having enough cash to pay short term debts → cash flow problems

more than 2 → business has too much cash in unprofitable assets → missing on potential gains

why are inventories less liquid

it takes time to sell finished goods

when goods are sold on credit → business needs to wait for customer to pay

Acid test ratio optimum value + formula

(current assets-inventories)/current liabilities

optimum value - 1

analysis of acid test ratio

if less than 1 - risk of not having enough cash to pay short term debts → cash flow problems

if more than 1 - business has too much cash in unprofitable assets → missing on potential gains

profitability vs liquidity

a lot of cash → increases liquidity but limits profitability as is not used to buy profit making assets

a lot of non current assets → limits liquidity in short run but increases profitability in long run

Benefits of ratio analysis

Stakeholders can compare ratios over time → can identify trends

No need to investigate all financial statements to get the information → information received quickly

Stakeholders can compare results with other businesses to see how well the business is doing

Limitations of ratio analysis

Ratios compare past data → does not predict the future

Ratios do not include all strengths & weaknesses that affect profitability (e.g. quality of human capital)

Financial statements prepared in different ways from company to company → harder to compare

Effect of external factors, (e.g. laws, exchange rates, economic factors, not considered)

Who cares about ratio analysis pt 1 - owners+shareholders, potential investors, lenders, managers

owners + shareholders - more profit → higher investment, business market value increases → wealth

Potential investors - comparing dividends between businesses

Lenders - high profit + liquidity → safe (lenders get back money + interest)

Managers - are financial objectives achieved? , more retained profit → can buy more technologies,

Who cares about ratio analysis pt 2 trade payables, government, employees, customers

trade payables - does business have enough working capital to pay goods on credit?,higher profits → chance of expansion → more need for raw materials → chance to increase supplier revenue

government - higher profit → more tax revenue, higher revenue + profit → higher employment → government spends less on unemployment

employees - more profit + revenues → job security + chance to negotiate higher wages

customers - higher profits + revenues → business will continue to producing goods + profit reinvested to increase the quality