Economics- 2.5: The UK Economy; Performance and Policies

0.0(0)

0.0(0)

Card Sorting

1/39

Earn XP

Description and Tags

Last updated 12:03 PM on 11/9/22

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

40 Terms

1

New cards

Economic Growth

The increase in productive capacity of an economy (GDP) over a period of time.

2

New cards

Government Growth Targets

2-3%

3

New cards

Unstable Growth concequences

Risk of Recession due to over confidence leading to environmental problems, bottle necks in supply, insifficient infastructure and inequality.

4

New cards

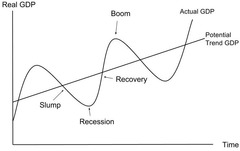

Actual Growth

Economic growth as measured by recorded changes in RGDP over time.

5

New cards

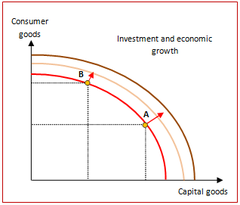

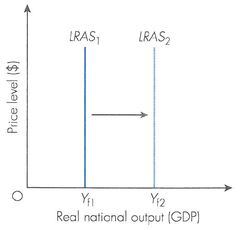

Potential Growth

Economic growth as measured by the changes in the productive potential (capacity) of the economy over time.

6

New cards

Fluctuations of GDP

-Boom = RGDP rise

-Recession = RGDP falls

-Slowdown = RGDP may rise below trend of fall

-Recession = RGDP falls

-Slowdown = RGDP may rise below trend of fall

7

New cards

Factors of Economic Growth

Land, Labour, Capital, Enterpirse. Components of Aggregate Demand

8

New cards

Land Growth

- New Resources: E.g Oil allowing cheaper energy prices and rise production of goods + services. Less reliant on foreign resources.

- Land purchased to build factories (Capital) and new labour demand causes rise in growth.

- Land purchased to build factories (Capital) and new labour demand causes rise in growth.

9

New cards

Labour

- Size: Immigration, Age, Participation. = More can be produced

- Quality: Education, Skills = Increased Efficiency

- Quality: Education, Skills = Increased Efficiency

10

New cards

Capital

- Sustained Investment (Foreign or Domestic) = New Technology to improve Productivity

- Improved Technology means lower COP as less labour is needed and more is produced.

- Improved Technology means lower COP as less labour is needed and more is produced.

11

New cards

Enterprise

- Development of jobs and products increases growth. Lead to more investment and more capital, labour or land.

- Lack of Credit or Capital leads to lack of investment. Lowering productivity but costs remain high.

E.g: High Interest rates, Lack of banking.

- Lack of Credit or Capital leads to lack of investment. Lowering productivity but costs remain high.

E.g: High Interest rates, Lack of banking.

12

New cards

Corruption and Instability

- Asymmetric Information in Credit: Lenders charge higher interest to cover risk. (Afforded by corrupt borrowers) = Missing Market, no equilibrium price of credit/ interest

- Incompitent Government = Decreased Investment, War diverts funds

- Fiscal Deficit = Cannot spend to grow

- Unstable Currency

- Incompitent Government = Decreased Investment, War diverts funds

- Fiscal Deficit = Cannot spend to grow

- Unstable Currency

13

New cards

Efficiency

Resources are allocated to serve each person in the best way possible, minimising waste and inefficiency.

14

New cards

Efficiency and Growth Relation

- Competition: Producers forced to lower prices or Increase Quality = Increase output or value

- Solid Credit markets to allow expansion.

- Solid Credit markets to allow expansion.

15

New cards

International Trade

Exchanging goods and services between countries

16

New cards

International Trade Benefits

- Prevents BOP deficit/ poor

- Increases competition = Forces increase in efficiency

- Increases investment into labour or capital to meet demand.

- Increases competition = Forces increase in efficiency

- Increases investment into labour or capital to meet demand.

17

New cards

Output Gaps

The difference between actual and potential GDP or growth in GDP.

18

New cards

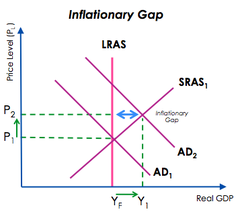

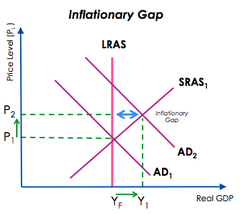

Positive Output Gap

The level of RGDP in the economy is greater than the Trend output level

19

New cards

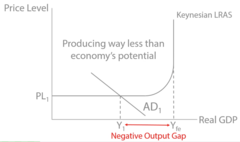

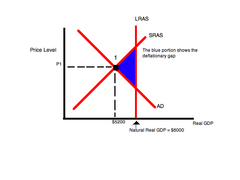

Negative Output Gap

The level of Actual RGDP in the economy is lower than the Trend output level or Potential GDP

20

New cards

Difficulties of Output Gap

- Very Difficult to measure as exact position of LRAS is unknown.

- RGDP estimates are inaccurate.

- Invalid to use in economic policy due to inaccuracy.

- RGDP estimates are inaccurate.

- Invalid to use in economic policy due to inaccuracy.

21

New cards

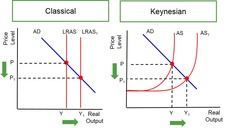

Classical View: Output Gap

Output Gaps cannot occur in the Long-run as Full employment is fixed

22

New cards

Productivity

Measure of the efficient use of FOP

23

New cards

Productivity effect on Economic Growth

- Increases national output/ GDP

- Inflation increases

-Economic Growth

- Inflation increases

-Economic Growth

24

New cards

Productivity on employment

-Unemployment increases in short- run but decreases in long-run because price levels decrease and exports increase

25

New cards

Productivity gap

Difference between labour productivity in the UK and in other developed economies

26

New cards

Producvitity Gap causes

- Lack of Technology

- Lack of skilled workers

- Entrepreneaurship

- Lack of skilled workers

- Entrepreneaurship

27

New cards

Trade Cycle

The pattern of economic growth which changes from booms or recovery and recessions or slow growth in a fairly regular pattern. Measured by a change in RGDP

28

New cards

Mild Trade Cycle

RGDP does not fall but growth is lower than the trend

29

New cards

Extreme Trade Cycle

Cycle where RGDP falls.

- Normally caused by demand and supply shock.

- Normally caused by demand and supply shock.

30

New cards

Trend Explanation

Keynes: Due to 'Animal Spirit'- speculative action from rise and fall in output or asset prices

- Change in capital which exacerbate change in output

- Change in capital which exacerbate change in output

31

New cards

Characteristics of Boom

-High rates of economic growth

-Near full capacity or positive output gaps

-Unemployment Falls

-Demand pull inflation

-High consumer/firm confidence

-Government budget improves (more tax revenue and less spending on welfare)

-Interest Rates Increase

-Imports increase

-Standard of Living Increases

-Near full capacity or positive output gaps

-Unemployment Falls

-Demand pull inflation

-High consumer/firm confidence

-Government budget improves (more tax revenue and less spending on welfare)

-Interest Rates Increase

-Imports increase

-Standard of Living Increases

32

New cards

Characteristics of Recession

-Negative economic growth

-Spare capacity and negative output gaps

-Demand-deficient unemployment

-Low inflation rates

-Government budgets worsen due to more spending on welfare payments and lower tax revenues

-Less confidence amongst consumers and firms, which leads to less spending and investment

-Interest Rates decrease: to increase investment.

-Imports decrease.

-Standard of Living Falls

-Spare capacity and negative output gaps

-Demand-deficient unemployment

-Low inflation rates

-Government budgets worsen due to more spending on welfare payments and lower tax revenues

-Less confidence amongst consumers and firms, which leads to less spending and investment

-Interest Rates decrease: to increase investment.

-Imports decrease.

-Standard of Living Falls

33

New cards

Benefits of Economic Growth: Consumers

-Income and Wealth rise

-Increase saving for future consumption

-Increased Confidence = More spending on consumer durables

-Increased Employment and opportunities

-Increase saving for future consumption

-Increased Confidence = More spending on consumer durables

-Increased Employment and opportunities

34

New cards

Costs of Economic Growth: Consumers

-Increased inequality: Unwaged and Unskilled less likely to benefit from growth, Incomes of some accelerate faster those on low wages affected by inflation + tax.

-Long term Unemployment with inflexible labour markets.

-Long term Unemployment with inflexible labour markets.

35

New cards

Benefits of Economic Growth: Firms

-Increased Profit

-Increased sales due to increased consumption

-More workers and Investments = Future growth

-FDI increases

-Multiplier and Accelerator effect

-Invest into cleaner technology to boost brand image.

-Increased sales due to increased consumption

-More workers and Investments = Future growth

-FDI increases

-Multiplier and Accelerator effect

-Invest into cleaner technology to boost brand image.

36

New cards

Costs of Economic Growth: Firms

-Environmental problems/ Negative externalities

-Depletion of natural resources and external costs

-May have tight labour markets = Less suitable workers available and higher skilled more competitive.

-Inflation

-Depletion of natural resources and external costs

-May have tight labour markets = Less suitable workers available and higher skilled more competitive.

-Inflation

37

New cards

Benefits of Economic Growth: Government

-Increased tax revenue from: VAT, Income, Corporation

-Fewer demands to pay welfare = better fiscal position. (Gov Spending decreases)

-Standard of Living rises and total incomes rise as long as Cost of living does not rise at same rate

-More Gov Spending on areas to increase SOL

-Wealth/ Asset increases.

-Fewer demands to pay welfare = better fiscal position. (Gov Spending decreases)

-Standard of Living rises and total incomes rise as long as Cost of living does not rise at same rate

-More Gov Spending on areas to increase SOL

-Wealth/ Asset increases.

38

New cards

Costs of Economic Growth: Government

-Balance of Payments deficit/ decrease: Consumers have higher incomes and spend more on imports and less incentive for firms to export

-Bottleneck: Little spare capacity = Increase price for energy, skilled labour = COP increases

-Monopoly power develops = Barrier to entry developed

-Social Dislocation and Stress = Increase spending and social pressure may result in more household debt

-Decreased Productivity: More travels, less hours worked due to high income, retire

-Bottleneck: Little spare capacity = Increase price for energy, skilled labour = COP increases

-Monopoly power develops = Barrier to entry developed

-Social Dislocation and Stress = Increase spending and social pressure may result in more household debt

-Decreased Productivity: More travels, less hours worked due to high income, retire

39

New cards

Rapid Growth Problems

-Short term spikes/ inflation

-Bad planning/ Corner Cutting

-Poor income distribution

-Volatility in economic cycle (deeper recession)

-Bad planning/ Corner Cutting

-Poor income distribution

-Volatility in economic cycle (deeper recession)

40

New cards

Growth pessimists

Those who question long-term sustainability of growth.

-Renewable energy will be depleted due to concept of the Tragedy of the Commons: public good means no one will look after it and quality decreases.

-Increased environmental threats putting pressure on scarce land and over-population.

-Renewable energy will be depleted due to concept of the Tragedy of the Commons: public good means no one will look after it and quality decreases.

-Increased environmental threats putting pressure on scarce land and over-population.