AP Macro Graphs & Formulas

1/28

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

29 Terms

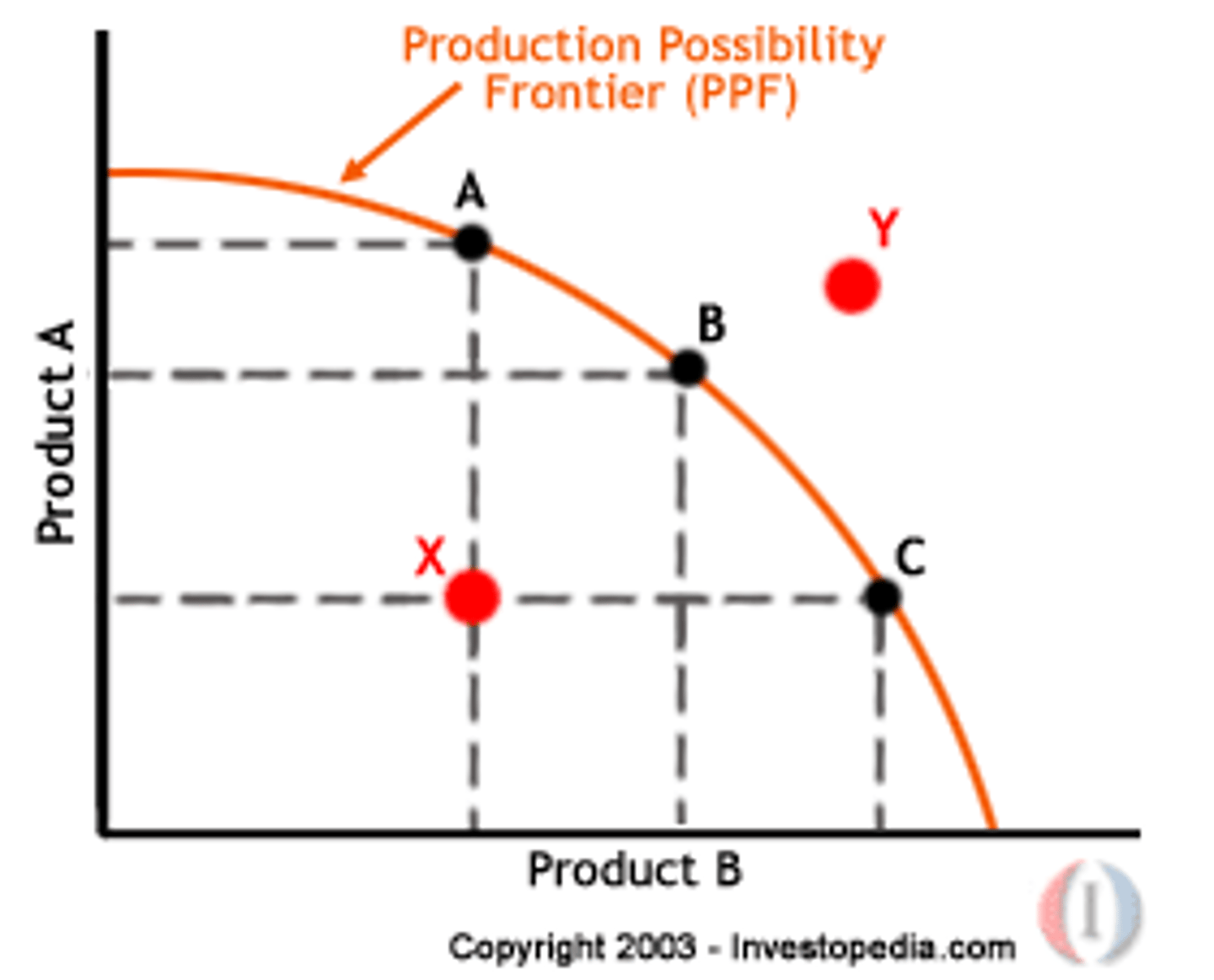

Production Possibilities Curve

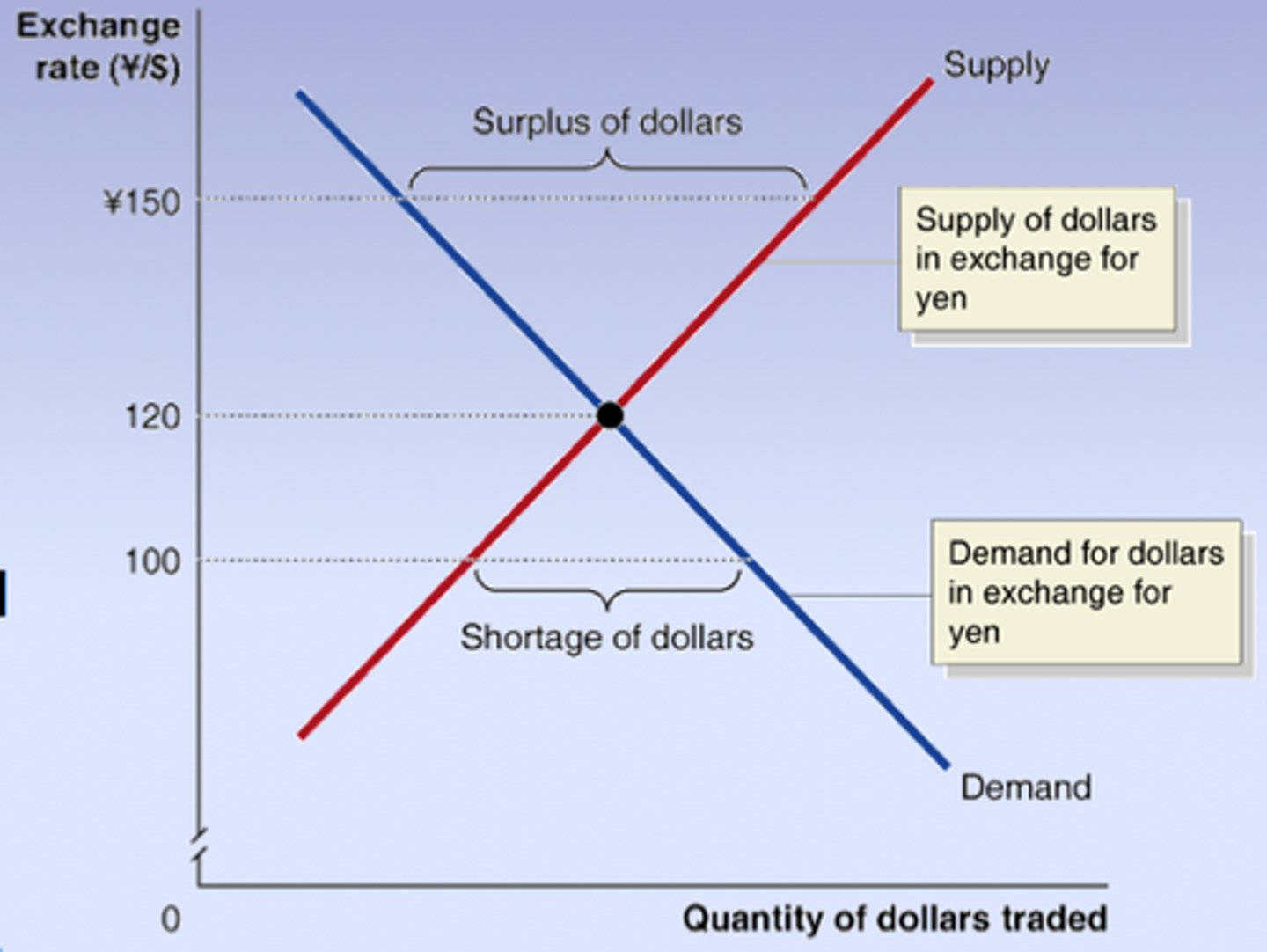

Foreign Exchange Market (FOREX)

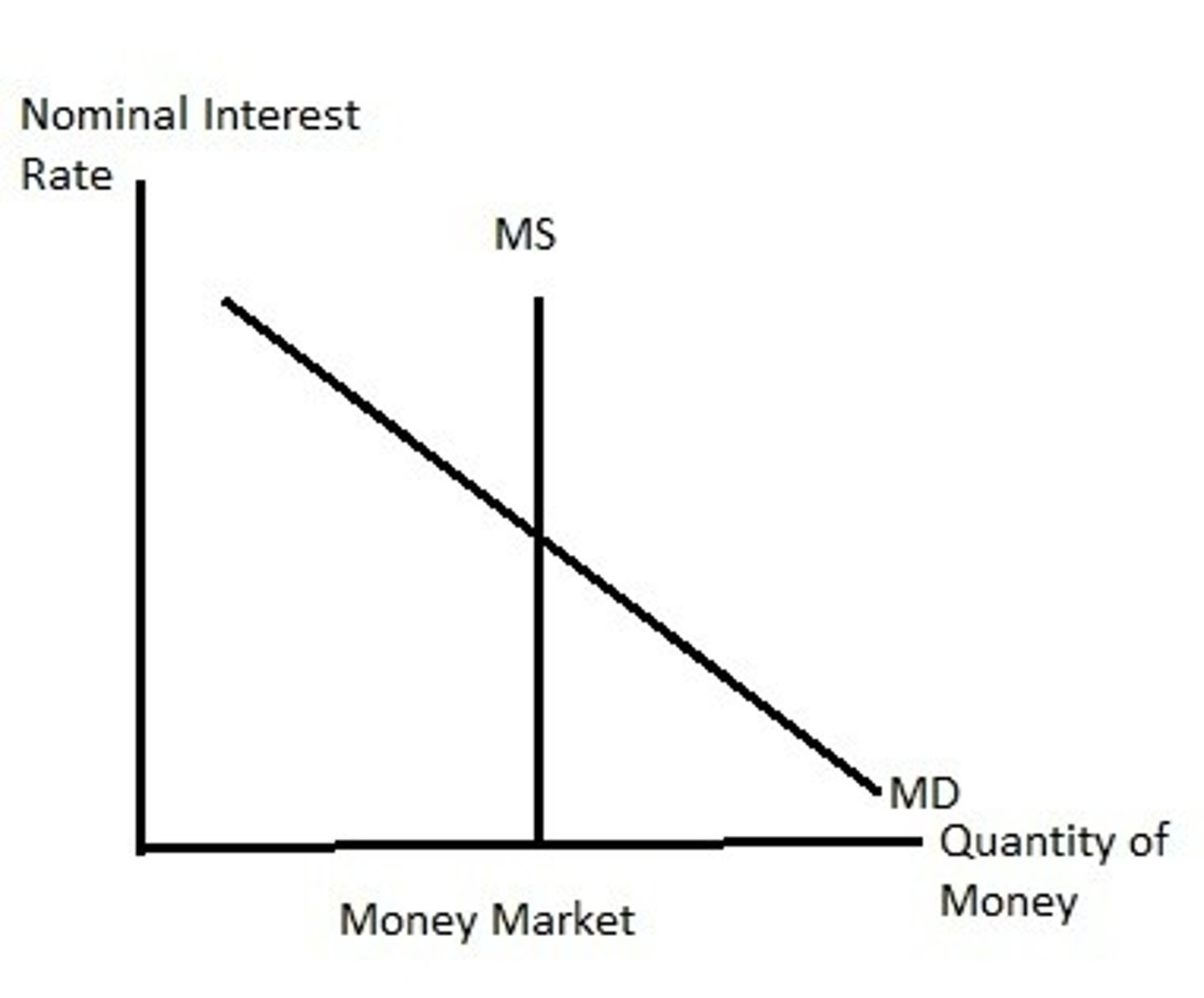

Money Market

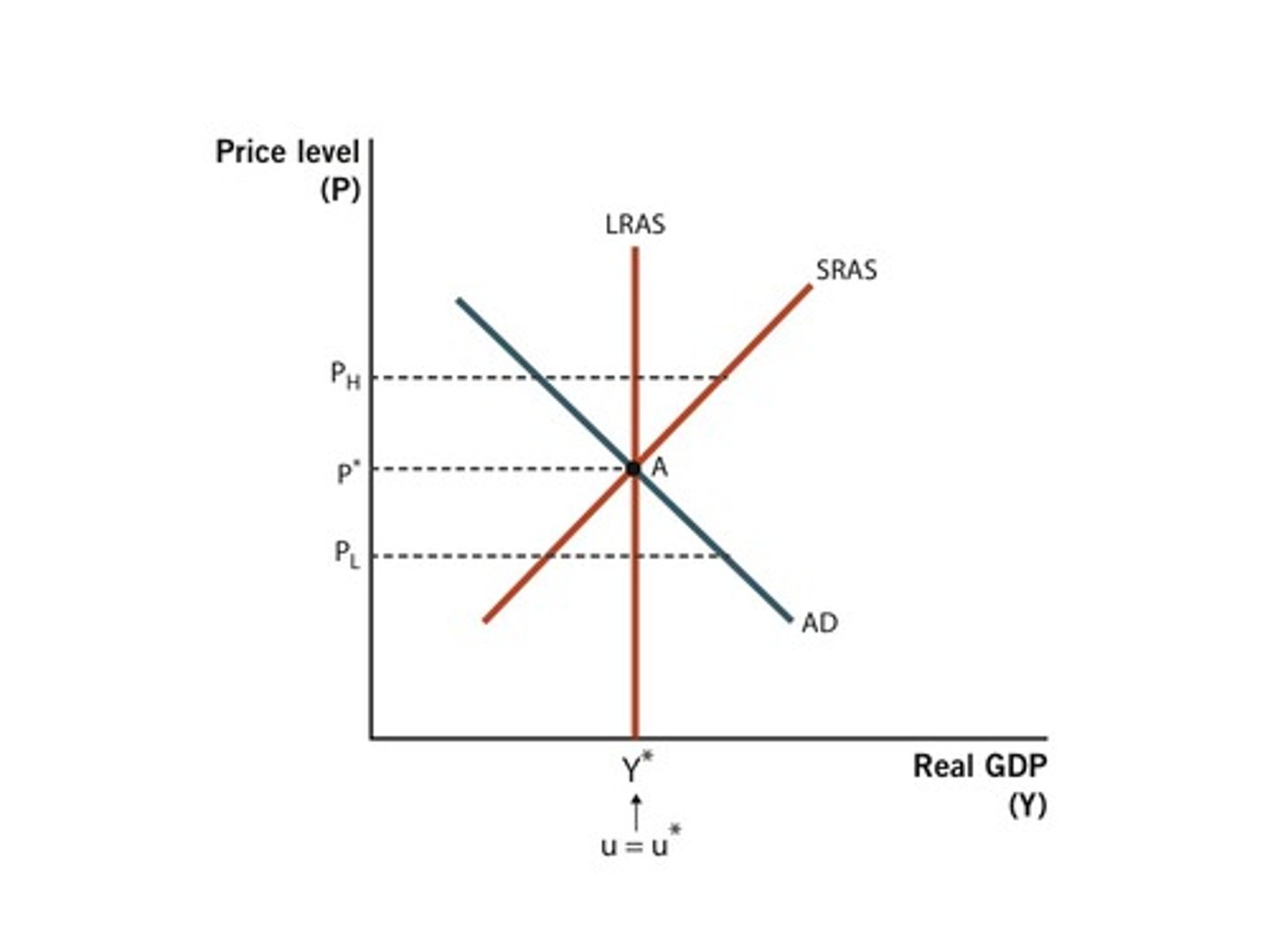

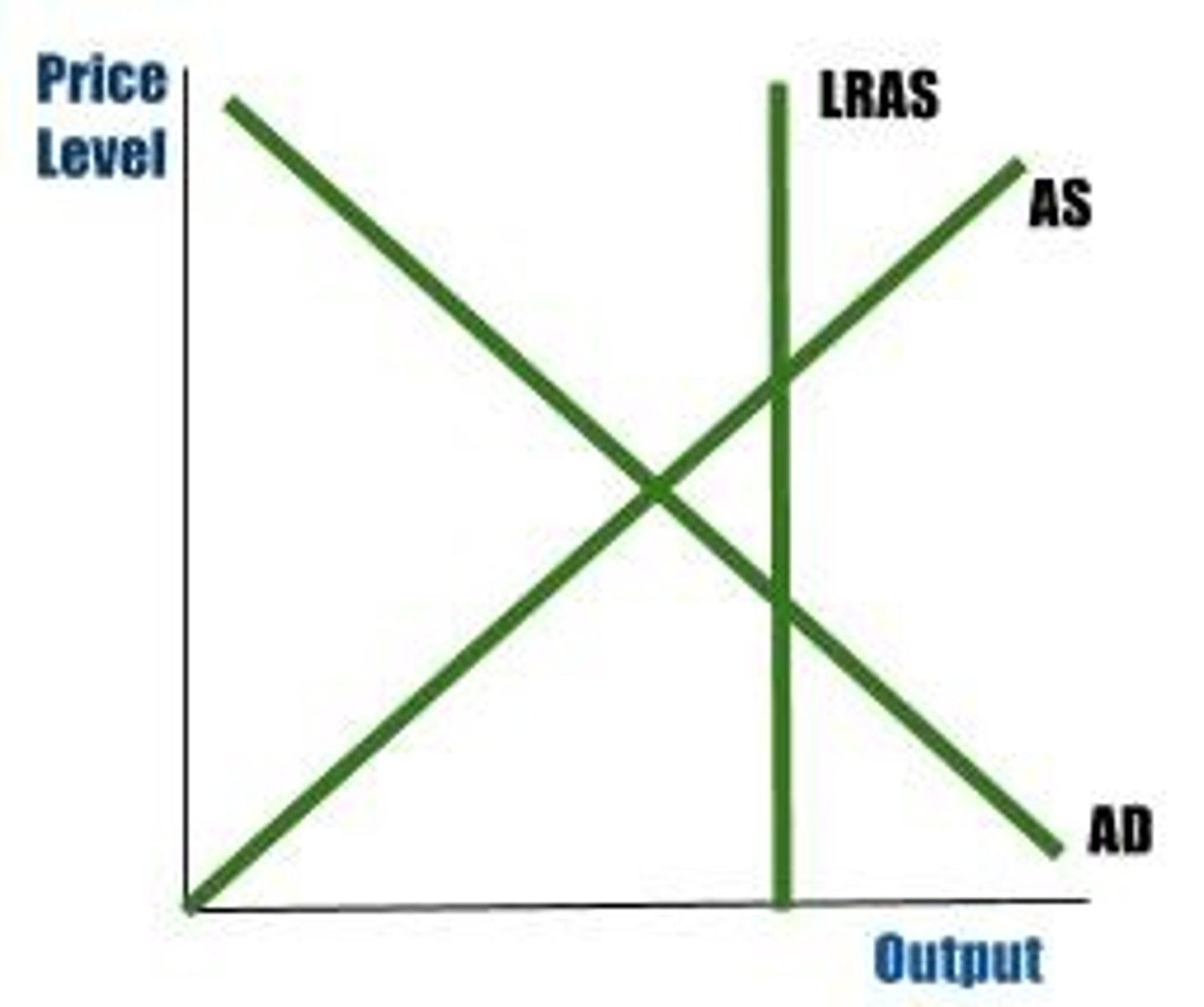

Aggregate Supply & Aggregate Demand Curve (AD/AS)

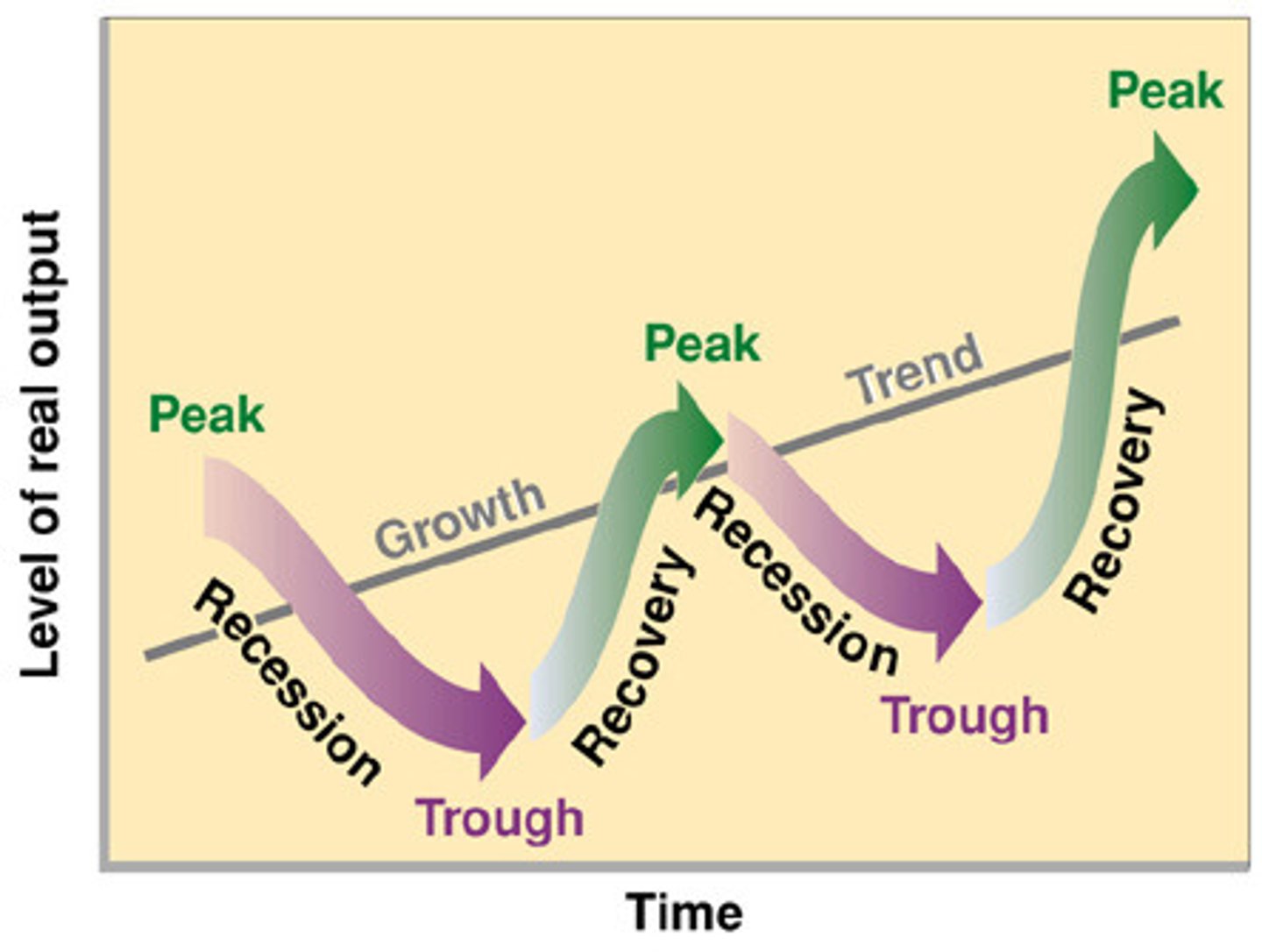

Business Cycle

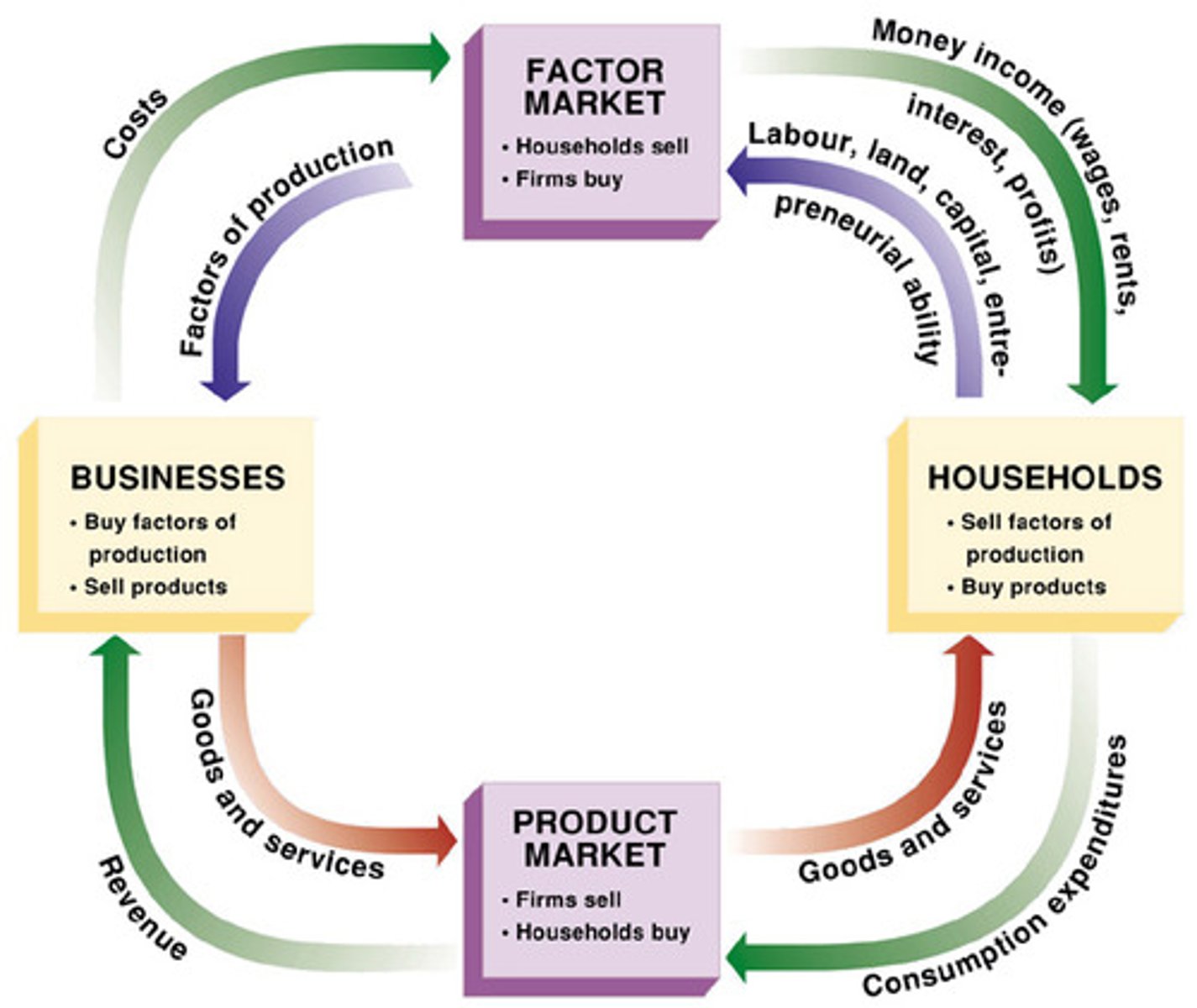

Circular Flow Diagram

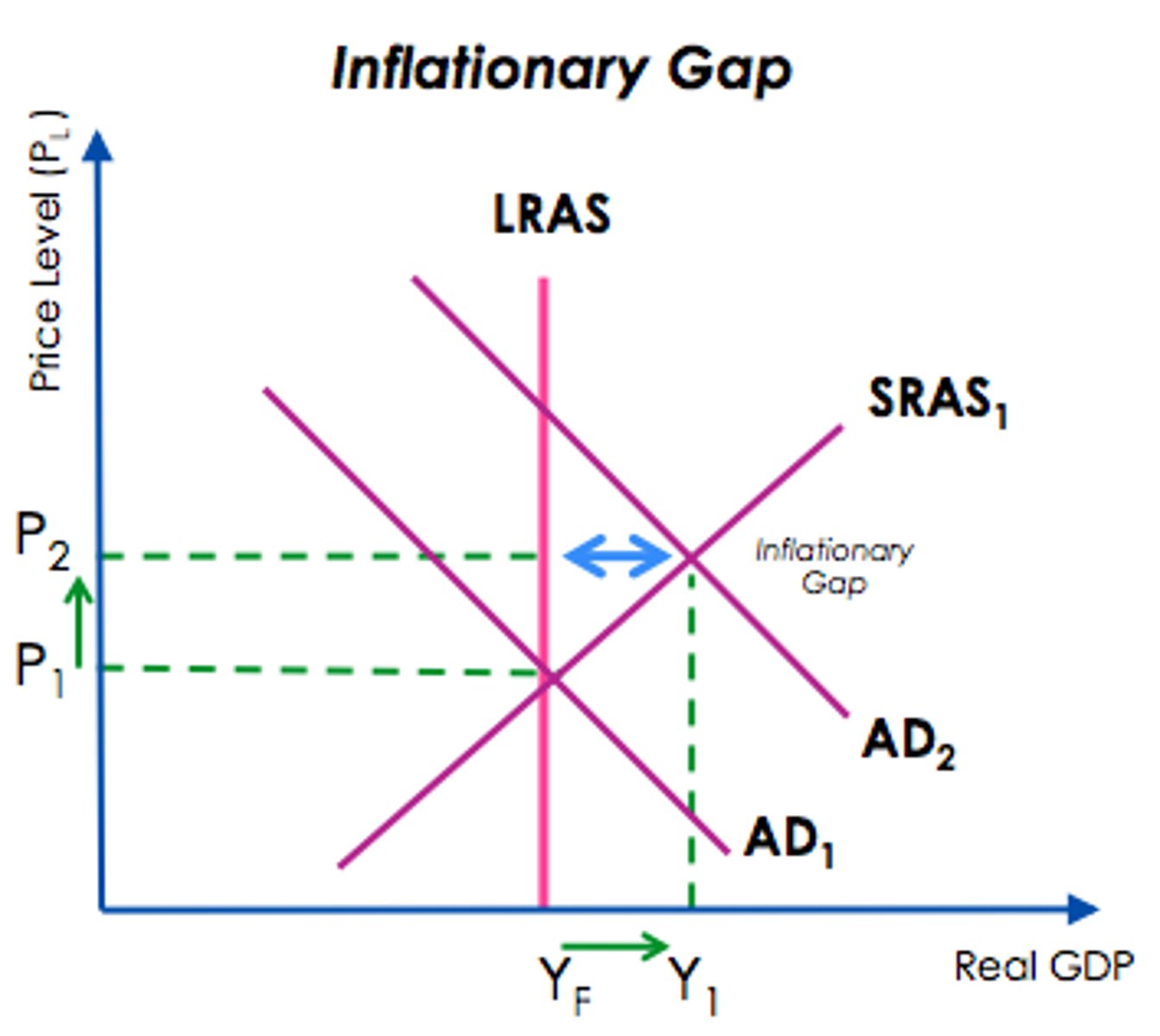

Inflationary Gap

Recessionary Gap

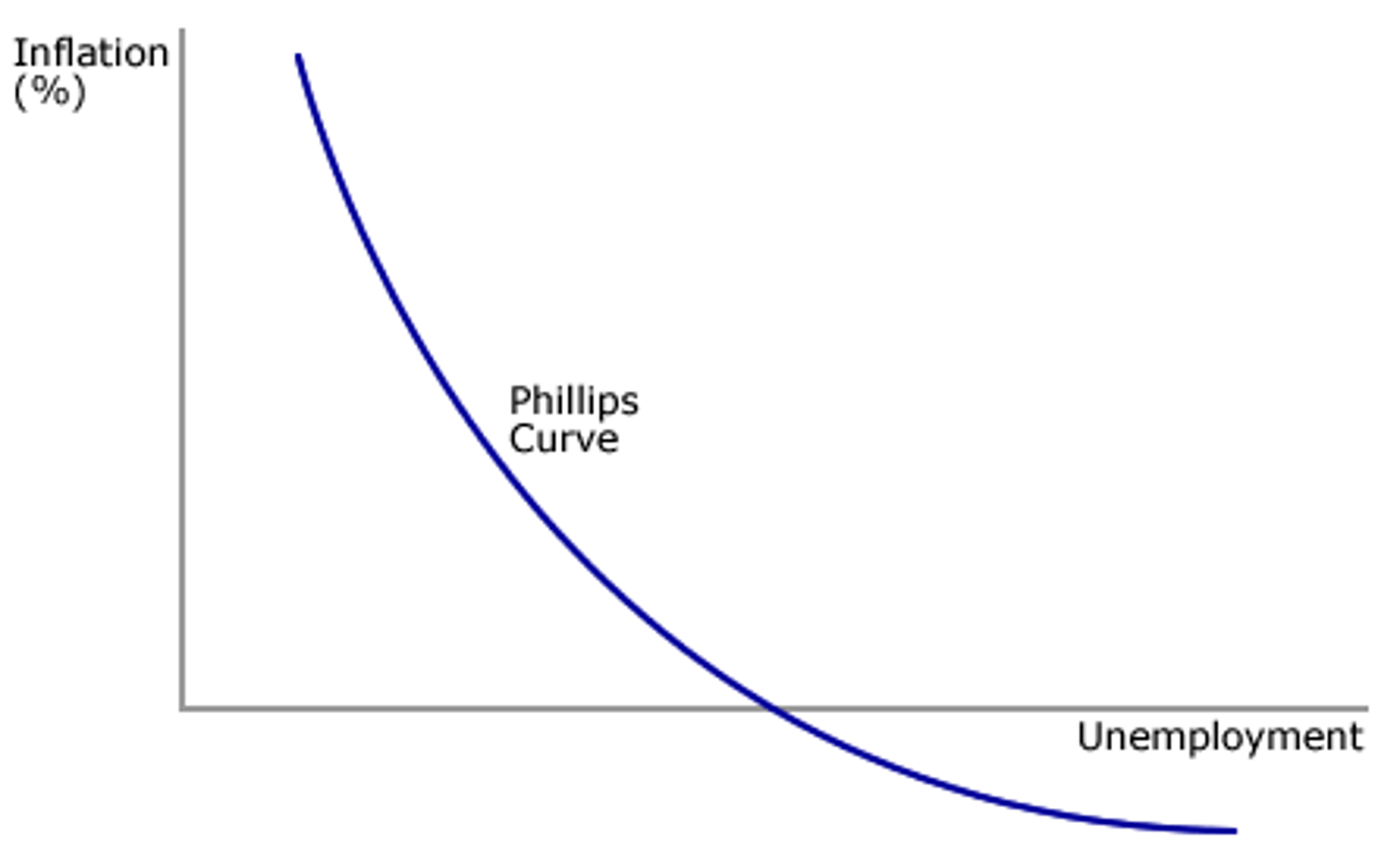

SR Phillips Curve

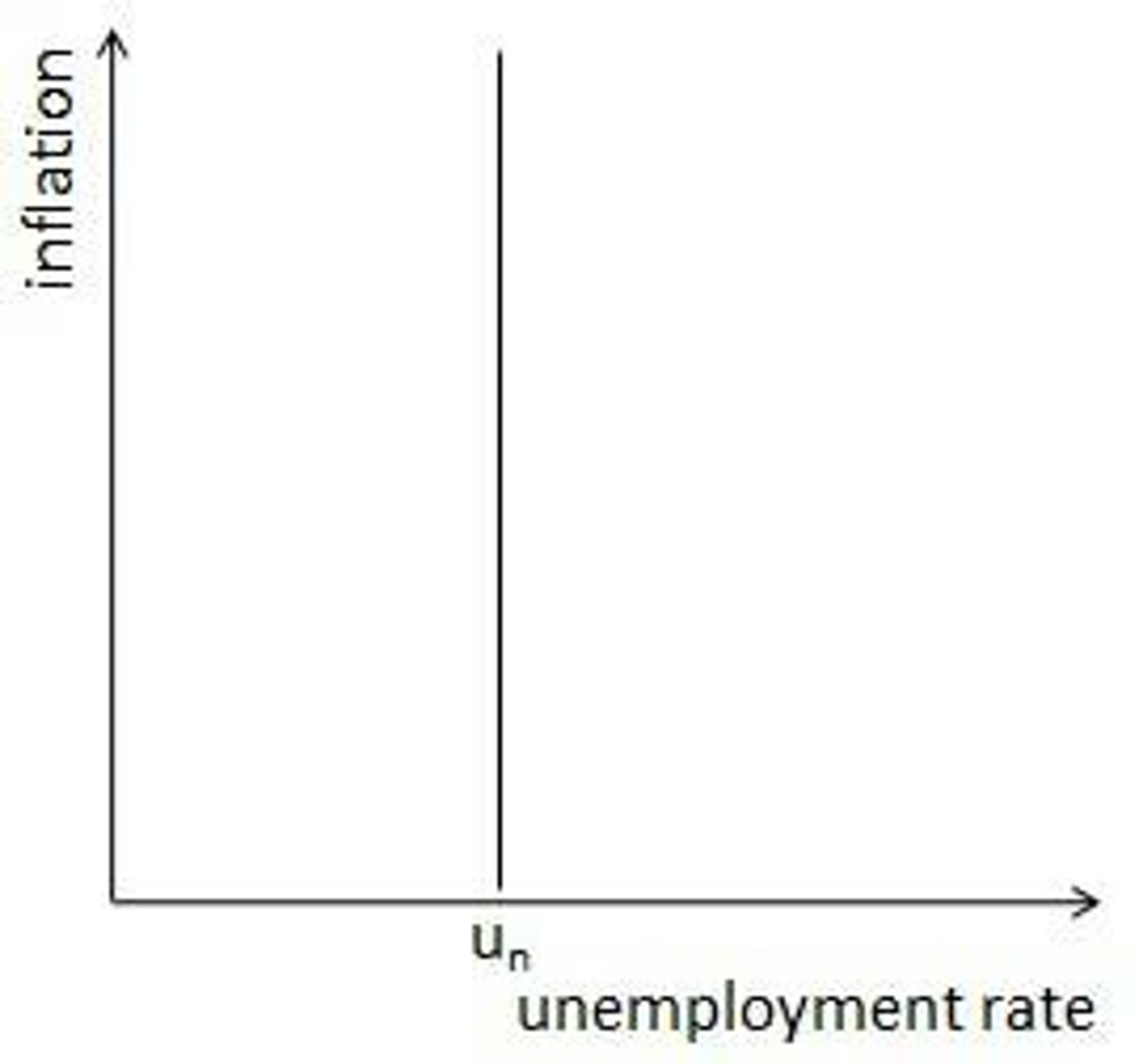

LR Phillips Curve

GDP Expenditure Approach

GDP = C + I + G + (X-M)

GDP Income Approach

Y = W + I + R + P (wages + interest payments + rent + profits)

GDP deflator

GDP Deflator = (Nominal GDP/Real GDP) x 100

Real GDP formula

Real GDP = (Nominal GDP/GDP deflator) x 100

GDP per capita

GDP/population

Net Exports

NX = exports (X) - imports (M)

Money Multiplier

1/required reserve ratio

Tax Multiplier

-MPC/MPS

Marginal Propensity to Consume (MPC)

MPC = change in consumption / change in income

MPC and MPS relationship

MPC + MPS = 1

Equation of Exchange

MV=PY

M is the money supply

V is the velocity of money

P is the price level

Y is the output of goods and services produced in an economy

CPI (Consumer Price Index)

CPI = (current price/base price) X 100

Marginal Propensity to Save (MPS)

MPS = change in saving / change in income

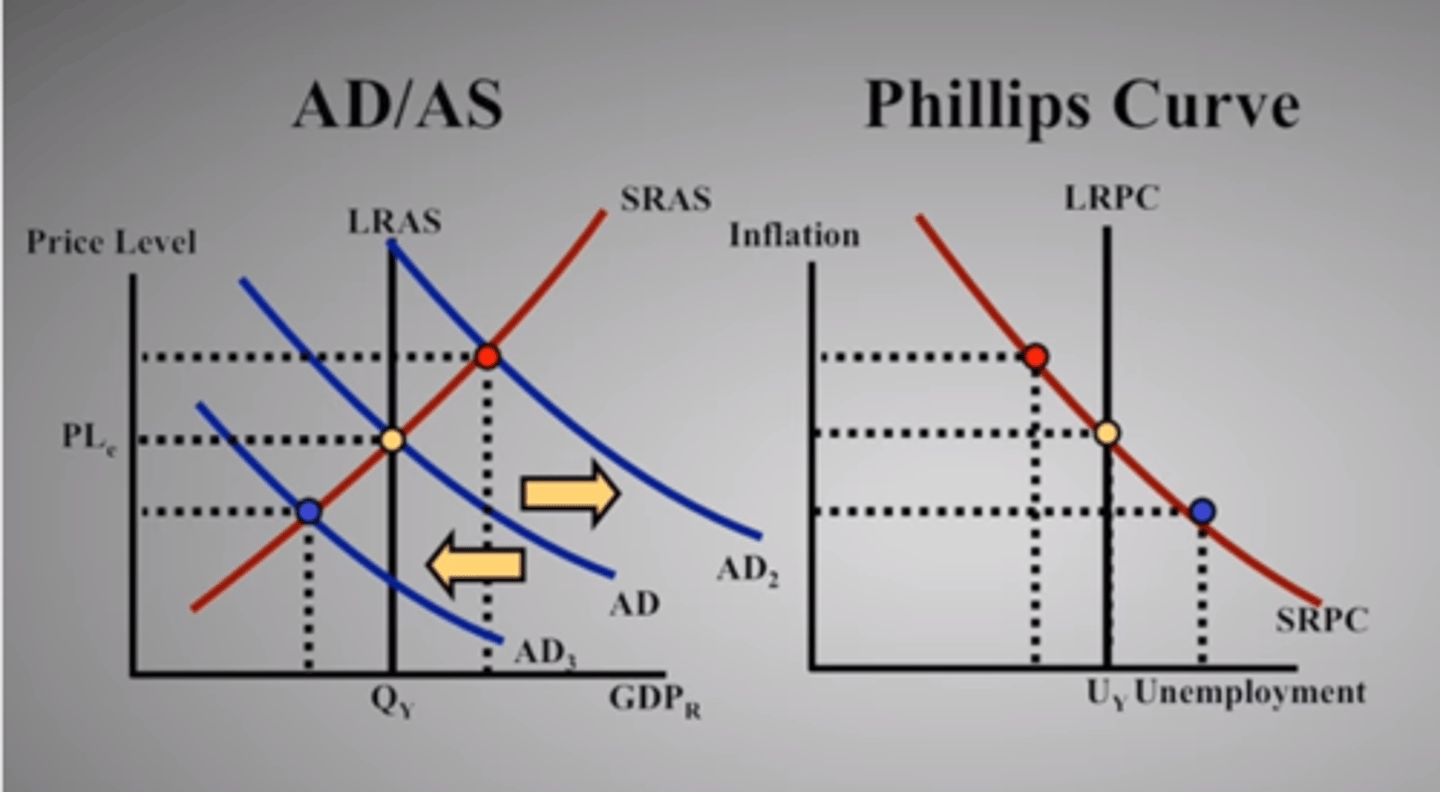

AD/AS (demand) relationship to Phillips Curve

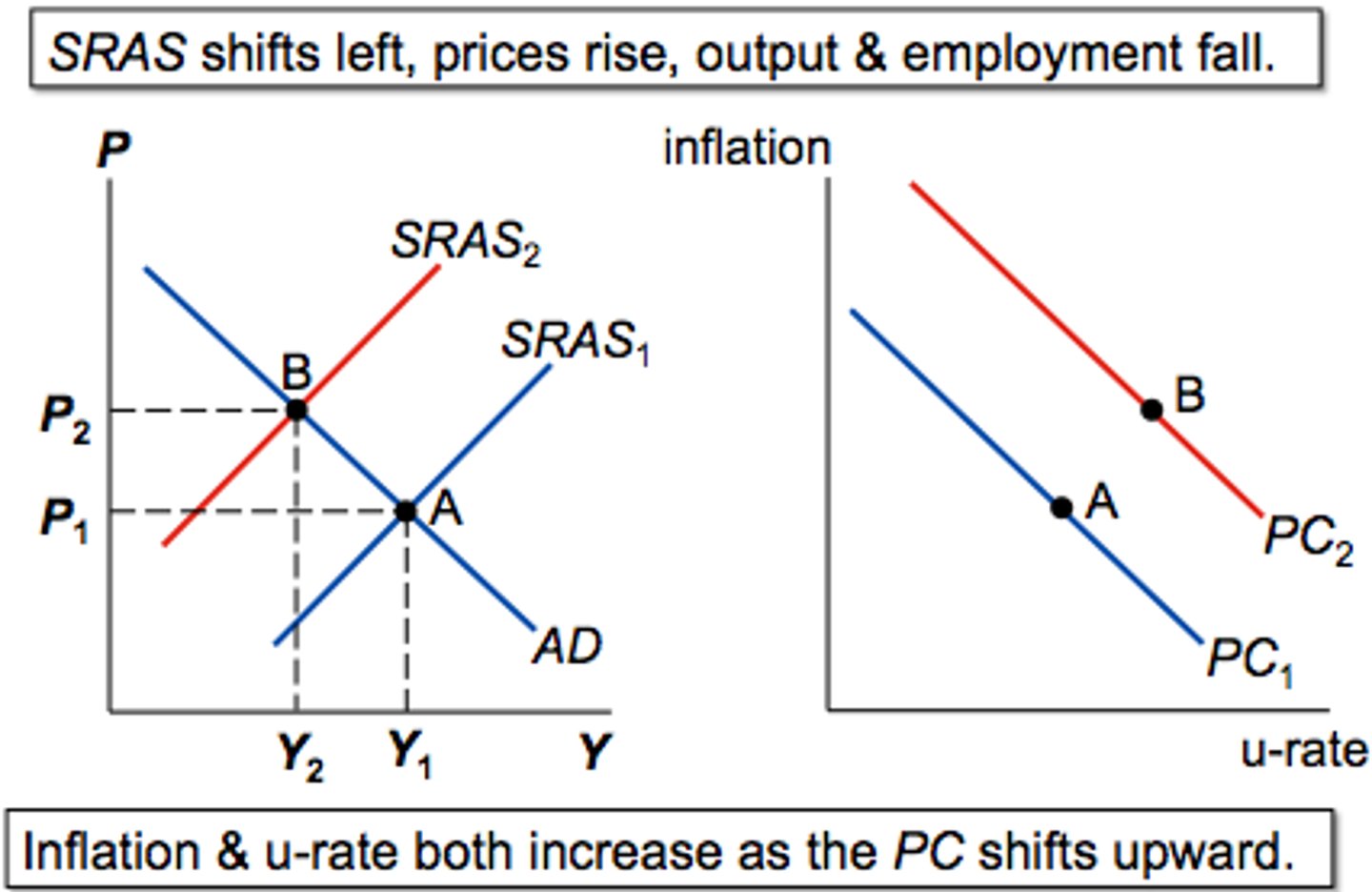

AD/AS (supply) relationship to Phillips Curve

Unemployment Rate

(# unemployed/# labor force) x 100

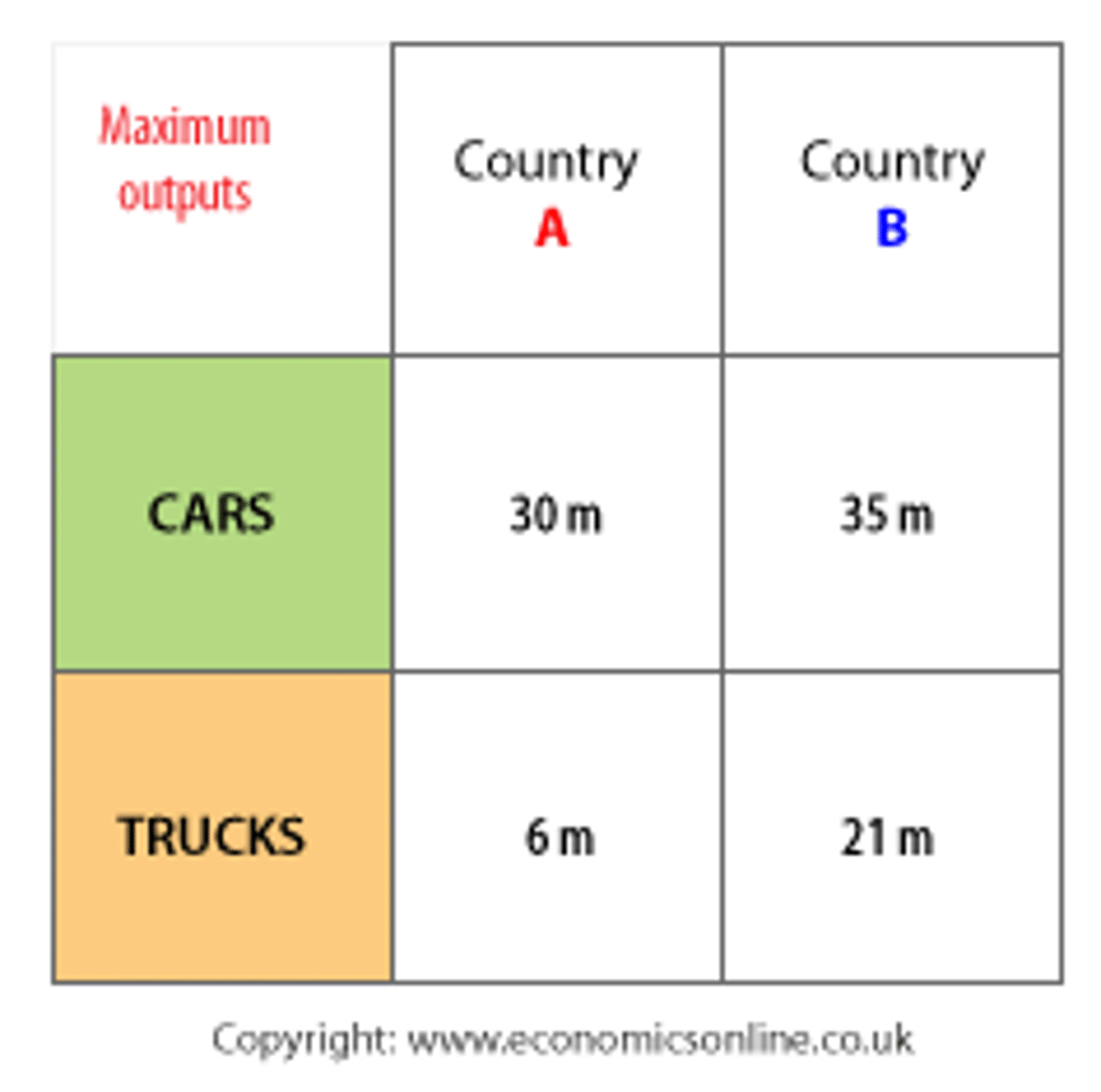

Comparative Advantage

OOO output other over

IOU input other under

Spending Multiplier

1/MPS or 1/1-MPC

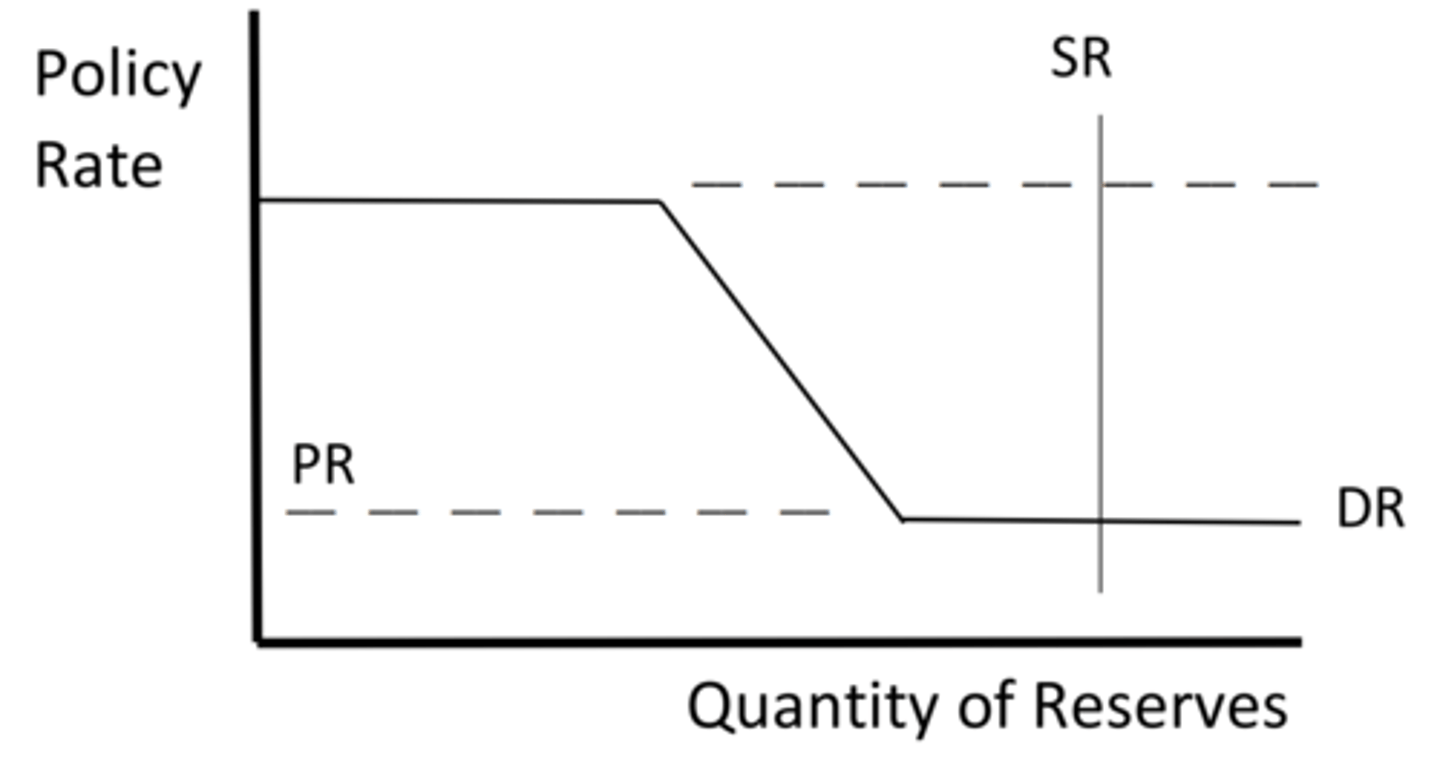

Reserve Market (ample)