final accounts / balance sheet / depreciation

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

40 Terms

statement of profit / loss is also known as

Income statement

statement of financial position is also known as a

balance sheet

The Statement of Profit or Loss shows

the income and expenditure of a business over a period of time - usually a year - and calculates the amount of profit made

the statement of profit loss is divided into three parts called the….

The trading account

The profit and loss account

The appropriation account

the trading account in a statement of profit/loss is where…

the cost of sales is deducted from sales revenue to calculate the gross profit

the profit and loss account in a statement shows …

expenses

profit before interest and tax

interest

profit before tax

tax

profit for period

the appropriations account in a statement of profit/loss shows

the dividens

retained profit

why are shareholder interested in P/L acc

Interested in revenues, costs and profits earned, business growth and dividend payments

may use ratio analysis tools to identify profit margins and returns on investment

why are employees interested in P/L acc

Interested in profits earned and the potential for wage increases and job stability

__ may look at notes to the accounts that detail levels of executive pay

why are Managers and directors interested in the P/L acc

Interested in performance data such as an improvement in sales revenue and net profit

This data can aid business decision making

Financial data can provide evidence to support the payment of bonuses

why are suppliers interested in the P/L acc

Interested in the continued success of the company they are supplying and this information is also used by ______ to determine the level of trade credit offered to businesses

why is the government interested in the P/L acc

Used to determine how much tax is payable

The Statement of Profit or Loss can provide an insight into whether the business will continue to provide employment, place orders with other businesses and supply goods and services to the public sector

The Statement of Financial Position ( balance sheet) shows …

the financial structure of a business at a specific point in time , It records the business assets and liabilities and specifies the capital (equity) used to fund the business

Statement of Financial Position is also known as the Balance Sheet bc the _______ should equal ______

net assets , total equity

statement of financial position / balance sheet has ….

non current assets

current assets

total assets

current liabilities

non current liabilities

total liabilities

net assets

equity

non current assets are

items that are owned by the business in the long term such as : machinery , buildings , vehicles

current assets are

items that are converted into cash quickly usually within 12 months , the main types are cash , debtors and stock

total assets are

non current assets + current assets

current liabilities are

money owed by a business that will fall due within 12 months ex: bank overdrafts and creditors

non current liabilities is:

money owed by the business that does not need to be payed back for at least 12 months ex: bank loans mortgages

total liabilities =

current liabilities + non current liabilities

net assets =

total assets - total liabilities

equity/ capital employed shows

how the net assets of a business are funded

how do shareholders use a balance sheet

Used to identify the asset structure of the business and how their investment has been put to use

Used to calculate the working capital of the business and determine its solvency

Used to determine the rough value of a business which helps a judgement on whether their investment is growing

how do managers and directors use a balance sheet

Used to identify the financial position of the business at a given point in time

Useful to assess the working capital position of the business and determine if there are enough liquid current assets to pay its bills

Provides information on the capital structure of the business which helps guide decisions on whether to raise further funds through borrowing or via other means (e.g. share issue)

how do suppliers and creditors use a balance sheet

Used to judge the solvency of the business to determine the risk when offering firms trade credit

Businesses with low levels of working capital may find it difficult to pay short-term debts and so ____ may offer trade credit, but with stricter terms

how do employees use the balance sheet

Used to answer questions such as:

Is the business financially stable or are jobs at risk?

Has the businesses performance improved or worsened?

What is the business spending its money on?

How much are senior executives paid?

How much tax is the business paying?

intangible assets

are non-physical and cannot be held

Businesses need to account for ______ _____

in their annual reports as it adds to the value of the business

intellectual property includes

patents, trademarks, patents and copyrights which protect unique ideas, inventions, artistic works, and brand names

brand value

The reputation and recognition associated with a brand has a value

It includes the brand name, logo, slogans, and customer loyalty to the brand

customer relationship

Long-term ______ ______ including customer lists, contracts, and customer loyalty programs

These relationships can provide recurring revenue and a competitive advantage

licenses and permits

___________ and regulatory approvals that grant exclusive rights or access to certain markets or resources, often issued by governments

depreciation is

an accounting technique which recognises that the value of fixed (non-current) assets falls over time

It reflects wear and tear, the reduction in an asset's value as it ages or obsolescence

what are the two common methods of calculating depreciation

Straight line depreciation

Units of production depreciation

historic cost

original cost of purchasing an asset or item

straight line method of depreciation

reduces the value of an asset by the same value each year of its useful life

the three key variables to calculate this are

Life expectancy

The number of years it is expected to be used before it will need to be replaced

Residual value

The scrap value of the asset at the end of its useful life

Historic cost

The initial cost of purchasing the asset

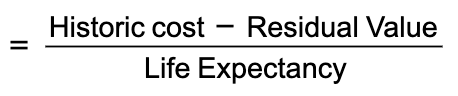

formula of annual rate of depreciation

units of production depreciation

The ________ depreciates an asset based on its usage or production output during an accounting period (usually a year)

It is commonly used for assets that wear out based on the number of units produced or hours of operation rather than the passage of time

Vehicles commonly lose value as their mileage increases

Machinery wears out as it is used in production

depreciation per unit formula

step 1 = (historic cost - residual value) / expected units over an assets lifetime = depreciation per unit

step 2= depreciation per unit x number of units produced

once depreciation is calculated its recorded as:

an expense on the income statement AND The value of the asset is reduced by this amount in the balance sheet and is recorded as its book value