Oligopoly and Monopolistic Competition

1/13

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

14 Terms

Oligopoly

a market with many buyers and few sellers

characterised by strategic interaction

e.g. firms compete by producing new products, but must incur significant costs to do so, while the projected return depends of the reactions of their rivals

Cartel

a group of independent market participants who collude with each other in order to improve their profits and dominate the market

usually illegal

Cartel Instability

Since rival firms in the same industry interact with one another repeatedly, it might seem that the tit-for-tat strategy would ensure widespread collusion to raise prices

However, they are still difficulties

One difficulty is that tit-for-tat effectiveness is greatly weakened if there are more than two players in the game

The other difficulty is that even if there are only two firms in an industry, these firms realise that other firms may enter their industry

Two Models for Oligopoly

The Cournot model

The Bertrand model

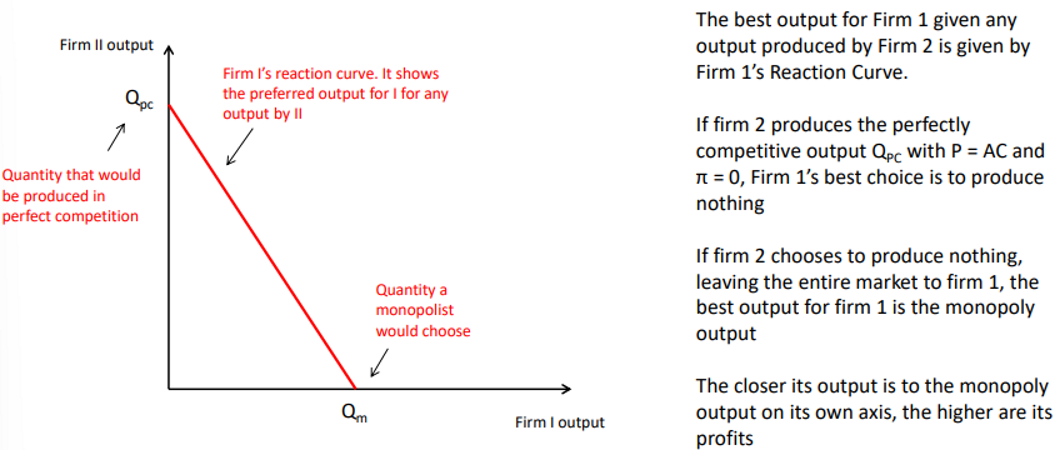

The Cournot Model

Consider two firms, each of which seeks to maximise its own profit under the assumption that the other firm’s output is given

Here, we focus on a duopoly:

Two producers

But the model can be generalised to more than two producers

Assume:

Highly substitutable products

Firms have the same technology and face the same input costs

Constant unit costs and straight line market demand curve

Reaction Function

The best response of a player is described as a reaction function

If firms maximise profits, the best response is the response that yields the highest profit

Cournot Equilibrium

each firm is setting MC equal to (residual) MR and so is producing to the left of the point at which AC reaches a minimum

industry output is below what a perfectly competitive industry would provide, but above what a monopolist would provide

there is allocative inefficiency

firms earn supernormal profit, but not as much as they could earn if they were to collude (thus effectively becoming a monopoly)

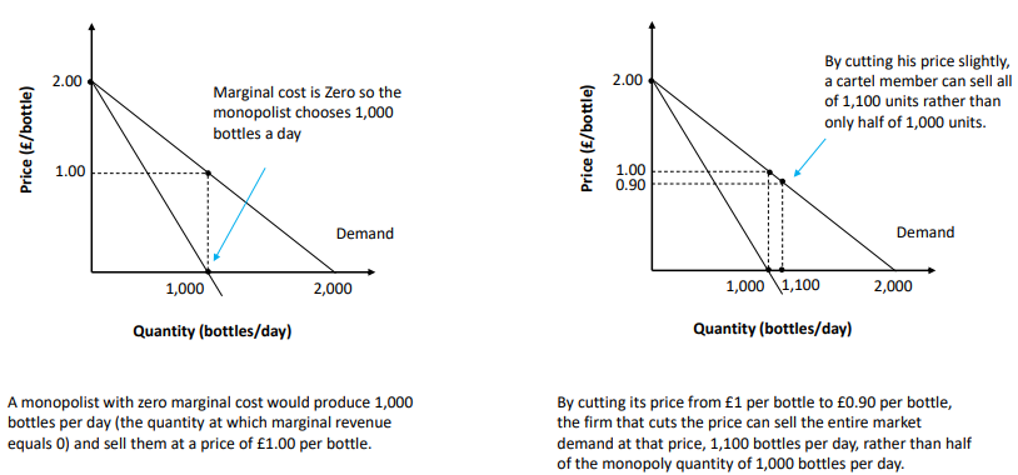

The Bertrand Model

Firms compete on price, allowing the market to determine the volume sold at that price. Each firm assumes the others will charge current prices:

Undercutting: Firms typically see opportunities with Bertrand pricing to just price below their rivals and steal the whole market…

Any firm can do this up so long as the price they set does not fall beneath their Marginal Cost (they would then be making a loss

Bertrand Paradox

For two similar firms producing a highly substitutable output, the Nash equilibrium in prices is P = MC

That is, as long as there are at least two players, the perfectly competitive price emerges

Why Bertrand Paradox?

Suppose MC < P1 < P2

Firm 1 earns (P1 - MC) on each unit sold, while Firm 2 earns nothing

Firm 2 has an incentive to slightly undercut Firm 1’s price to capture the entire market

Firm 1 then has an incentive to undercut Firm 2’s price. This undercutting continues until P1 = P2 = MC …

Reasons Why the Bertrand Paradox will not Hold

The firms have capacity constraints, and output cannot increase sufficiently for price to be driven down to cost

Product differentiation means that the firms’ products are not highly substitutable

The firms understand that the short-term gain from undercutting leads to falling profits in the longer term

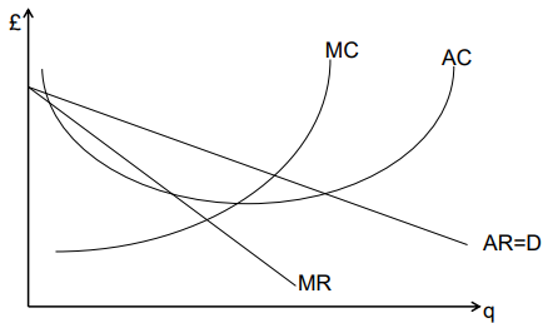

Monopolistic Competition

Occurs where there are many buyers and many sellers, and sellers can differentiate their products. This puts a downward slope on each firm’s demand curve

Profits may be earned in the short run, but these are competed away by entry so that in the long run equilibrium supernormal profits are zero. The equilibrium involves lower output and a higher price than under perfect competition

The 5 Sources of Market Power

Exclusive control over important inputs

Patents and copyrights

Government licences or franchises

Economies of scale (Natural monopolies)

Network economies

Market Structure

| Perfect Competition | Monopoly | Oligopoly | Monopolistic Competition |

Size and number of buyers | Many, none of which is large relative to the overall market | Many, none of which is large relative to the overall market | Many, none of which is large relative to the overall market | Many, none of which is large relative to the overall market |

Size and number of sellers | Many, none of which is large relative to the overall market | One | Few, each of which is large relative to the overall market | Many, none of which is large relative to the overall market |

Degree of substitutability of different sellers products | Homogeneous - all the same | No good substitutes | May or may not be differentiated | Heterogenous - diverse |

Extent to which buyers are informed about prices and available alternatives | Well informed | Well informed | May or may not be well informed | May or may not be well informed |

Conditions of entry | Neither technological nor legal barriers | Either technological or legal barriers completely block entry | Technological and legal barriers may or may not exist | Neither technological nor legal barriers |