PHAR4814 - Financial Management and Leadership - 4

1/101

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

102 Terms

Transaction Components

Every business transaction has a SOURCE and APPLICATION of money

Transaction Classifications

1) INCOME - money coming in

2) EXPENSE - money going out (Operating expenses, Non-operating expenses)

3) ASSET - things owned, accounting characteristics

4) LIABILITY - things owed against those assets

5) CAPITAL(aka OWNER'S EQUITY) = assets - liabilities

Types of Financial Reports

PROFIT AND LOSS REPORT - Statement of Financial Performance

BALANCE SHEET - Statement of Financial Position

BUDGET - planning tool

What is a Profit and Loss Report, and what is its significance in pharmacy

Statement of Financial Performance [over a period of time]

Includes: revenue, GP margin, expenses, net profit

A scoreboard that helps in...

1) Inventory Management - By analyzing COGS and revenue, an owner can identify the most and least profitable products. 2) Expense Management - lists all expenses, helping identify areas where costs could be cut or investments increased.

3) Budgeting and Forecasting - historical data in the report can help forecast future revenues and expenses, aiding in budget creation.

4) Performance Over Time - can track if pharmacy's financial health is improving or declining, and make necessary adjustments.

What is a Balance Sheet, and what is its significance in pharmacy

Statement of Financial Position

What you own and what you owe at a specific point in time, i.e. a SNAPSHOT of the NET WORTH of the business on a particular day (eg 30 June)

Includes: Assets, liabilities, capital (owner's equity)

1) Understand Liquidity - shows how much cash and other liquid assets are on hand to cover short-term liabilities.

2) Evaluate Solvency - shows proportion of debt to equity; providing info on long-term financial stability.

3) Track Financial Health - Over time, changes in balance sheet can reveal trends in business performance and financial health.

e.g. Can help an owner...

1) Make decisions about purchasing or upgrading equipment based on how much cash and other assets are readily available.

2) Evaluate whether they are in a position to take on more debt or whether they should focus on paying down existing liabilities.

3) Understand the equity in the business, which can be important for decisions about future financing or profit distribution.

Assets (accounting definition)

All the following MUST apply:

- Item will produce a future economic benefit

- The benefit arises from a transaction or event

- Business has an exclusive right to the item

- Must be able to reliably measure the value in money

Liabilities (accounting definition)

Claims of individuals and organisation (not the owner) against the assets of a business

Business supplied you goods, they claim the money owed to them (the liability) for supplying the goods (an asset)

Bank provides

Must be able to value it reliably

Gross Profit (GP)

Total profit before expenses for that financial year period

= sales - COGS

= selling price - cost price

Correct sales figure and COGS critical to getting correct GP

Net profit

= Total Revenue - Total Expenses

---> this is actually how much money you've made

DRIVERS OF PROFIT AND LOSS

1) Sales - turnover

2) GP margin - tells us if it is a highly competitive market, competing as a discounter, if it is providing goods/services with high margin like compounding, located in an area with no competition (eg rural)

3) Rent expense

4) Wages - how many staff? Skill level of staff?

5) Interest expense

Accrual accounting

Applies the Matching Principle - Report expenses on the profit and loss in the period when the related revenues are earned.

· records transactions when they occur, regardless of when the cash exchange happens

· revenue is recorded when it is earned, even if payment hasn't been received yet

Revenues and expenses are recorded when they are earned or incurred, regardless of when the cash is actually received or paid

More accurate and more consistent - allows for better comparisons of financial performance over time

Pharmacy and GST

Businesses pay GST to suppliers on almost all goods

Not ALL goods have GST charged to the customer - Prescriptions, Medicines, Feminine hygiene, Sunscreen, etc

This means a Pharmacy is ALWAYS owed money as the GST paid is more than has been collected from customers -- This is unique to pharmacy

Implications of GST in Pharmacy

Managing CASH FLOW

Paying suppliers

Having proper process in place for managing invoices

Proper auditing processes for Point of Sale computer systems

Bank accounts and borrowing money

Calculating correct prices to sell to customers

Types of Assets

CURRENT ASSET – money in the bank, stock on shelves, i.e. can be bought and sold, turned into money quickly short-term (liquid, 12 months)

NON-CURRENT ASSET – planned equipment, robot, building i.e. purchased for long-term benefit; can be sold and turned into money but not quickly

TANGIBLE ASSET – physical presence, can be measured, and are used in the operations of the business; i.e. building, land, machinery, inventory of drugs, cash

INTANGIBLE ASSET – don't have a physical existence, but still hold significant value for a business. Can potentially be converted into cash if sold, but value can be more subjective and harder to quantify. i.e. patents, trademarks, copyrights, goodwill, brand recognition.

Types of Liabilities

CURRENT - something that needs to be paid off short-term (within 12 months, e.g. monthly accounts for suppliers, short-term business loan over 6-12 months

NON-CURRENT - long-term business mortgage, long-term payment on equipment

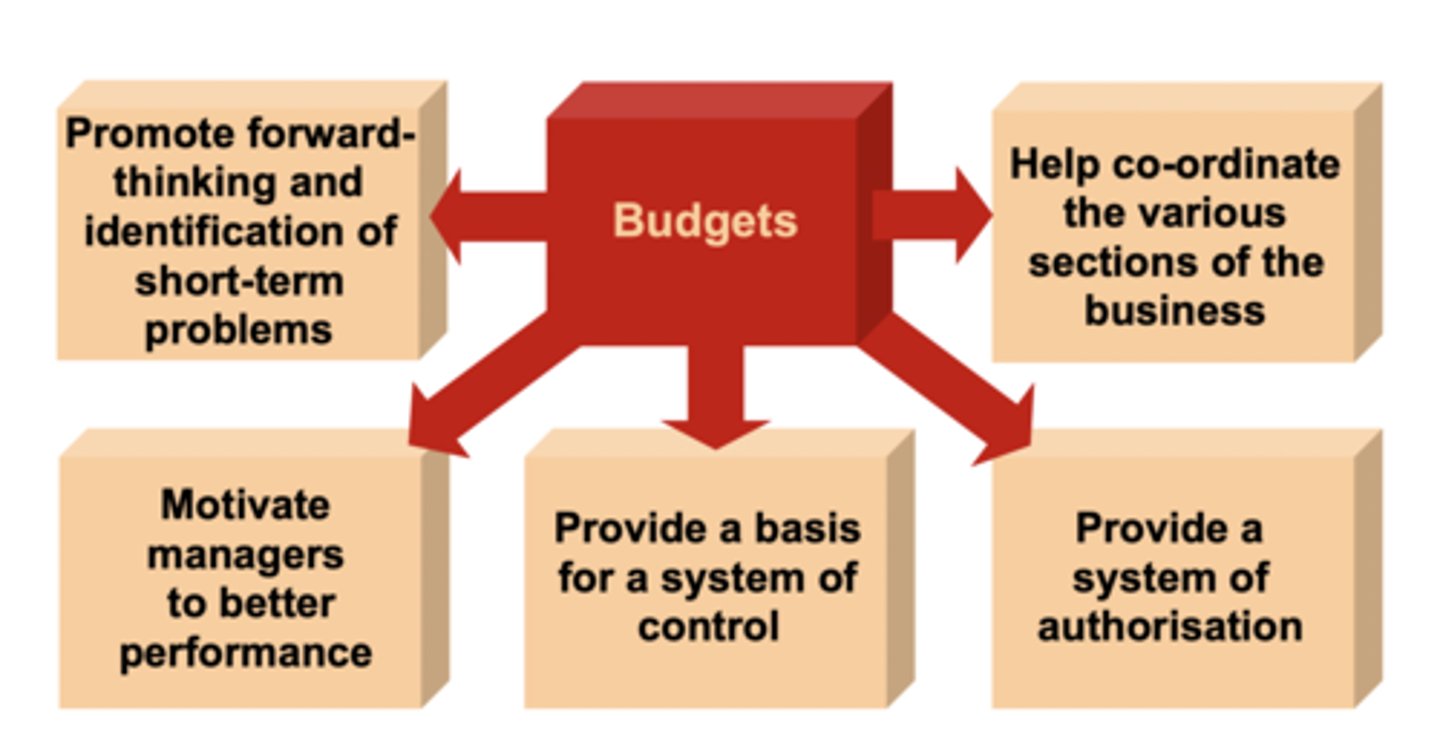

Budget

Type of Financial Report:

Planning tool - sets targets, gives a sense of control

Changes in different months, seasons, demographics (more competition? New doctors?), events (bushfires?)

Profit & Loss Budget - profitability (revenues exceeding expenses) or profit loss expected for a certain period (uses revenues and expenses)

Gives a picture of what the business has earned or lost in a specific timeframe

e.g. financial year budget - how much profit expected to make this year and can expect how much tax need to be paid on it.

matches income to expenses

Cash Flow Budget - liquidity (having enough cash to pay the bills)

projection of all cash inflows and outflows over a certain period of time.

determines whether business has enough cash to operate, or whether you need to make adjustments like getting a loan or injecting more owner's equity.

more detailed, considers when are we getting paid for stock and when do we have to pay for it (to wholesalers, loans, liabilities etc) - when did we pay for the item to wholesaler and when did we get paid by the PBS.

More about timing of when money enters and leaves a business account - a forecast of cash (not profit) that you expect to flow in and out of your business, showing you how much cash you'll have on hand at a given time.

considers timing issues and other inflows/outflows

times of the year that may require more careful budget consideration: end of financial year,

Every business needs a buffer

How often for Budget review

Introducing new service: weekly, monthly (varies based on enthusiasm and time of owner)

New business or high debt: more often, monthly

Long-term business used to peaks/troughs and with a larger buffer: 1-2x/year

Leader definition

Someone who has followers

Takes people where they would not have got by themselves

Leadership Definition

Ability to influence people towards the achievement of common goals

Ability to identify priorities, set a vision, mobilise actors and resources needed to achieve them

Why should leadership be viewed in context

Some characteristics are important in one context but not in another

Different settings need, seek and value different leadership characteristics A leader is not meant to be perfect - no leader ticks all boxes

Leaders vs Managers

Managers:

- Appointed to a role/title

- Have formal authority

- Get tasks done using their managerial authority

- Perform managerial functions

- Scope of work/role is defined

Leaders:

- Need not be appointed to a role

- Do not always have formal authority

- Get tasks done because people willingly want to do tasks the leader wants done

- Perform leadership functions

- Scope of work/role is not limited

Leadership in Health

Leadership can help the development of a profession

Leadership can improve reputation of a profession from public, HCP, and govt perspective

Leadership can influence patient outcomes

How can Leadership influence patient outcomes

Improved staff performance

Better teamwork

Better Organisational Culture

Better communication

Pareto Principle

Leaders are 80% made and 20% born

3 main points for BUILDING LEADERSHIP SKILLS

1) What is your Vision - What drives you

2) What are your Goals - What do you want to achieve

3) What Actions will you have to do to achieve your goals

LEADERSHIP THEORIES

Trait Theory

Behavioural Theories

Contingency Theory

Extensions of Contingency Theory

- PATH GOAL THEORY

- ATTRIBUTION THEORY

- TRANSFORMATIONAL LEADERSHIP

Trait Theory

Certain 'traits' define leaders

1) Drive

2) Desire to lead

3) Honesty and Integrity

4) Self-confidence

5) Intelligence (and emotional intelligence)

6) Job-relevant knowledge

Issues with Trait Theory

Traits not traditionally associated with leadership in studies may be the ones that differentiate between leaders and followers.

Situational context or leader-follower interaction is not accounted for.

Behavioural Theory

Certain 'behaviours' define leaders

1) Employee orientation

2) Productivity orientation

Balance between these two!!

Axis of concern for task (productivity focused) vs concern for people (relationship focused)

Good evidence that 'team management' approach is effective - high concern for people AND productivity

Issues with Behavioural Theory

Doesn't recognise that situational constraints affect leadership

Contingency Theory

Effective leadership depends on match between:

1) Leader's style of communication and interaction with those being led

2) Degree to which situation allows leaders to have control and influence

3) Structure of tasks

PATH GOAL THEORY

Extension of Contingency Theory

Allows those being led to achieve goals i.e. facilitate path to goal achievement by removing barriers

Axis of directive vs supportive behaviour: directing>coaching>supporting>delegating

4 styles moderated by environment and subordinate characteristics:

1) Directive

2) Supportive

3) Participative

4) Achievement oriented

ATTRIBUTION THEORY

Extension of Contingency Theory

Leadership is an 'attribution' that others make about a person

1) People will judge those with a relationship orientation as better leaders

2) Charismatic leadership correlates with performance/satisfaction of those being led

TRANSFORMATIONAL LEADERSHIP

Extension of Contingency Theory

Integrative style of leadership + a set of competencies

COMPETENCIES

1) Communication skills

2) Collaboration skills

3) Coaching skills

4) Emotional intelligence

5) Mentoring skills

LEADERSHIP STYLE -

1) Role model for followers

2) Challenges others to take ownership of their work

3) Move people to work towards their own goals

4) Create a shared vision and inspire others to achieve - Leaders & followers help each other to advance to higher morale/motivation

5) Provide intellectual stimulation

6) Catalyst for change

Country Club Leader

Behavioural Theory of Leadership

High concern for people

Low concern for productivity

Team Leader

Behavioural Theory of Leadership

High concern for people

High concern for productivity

Task Management

Behavioural Theory of Leadership

Low concern for people

High concern for productivity

Impoverished Leader

Behavioural Theory of Leadership

Low concern for people

Low concern for productivity

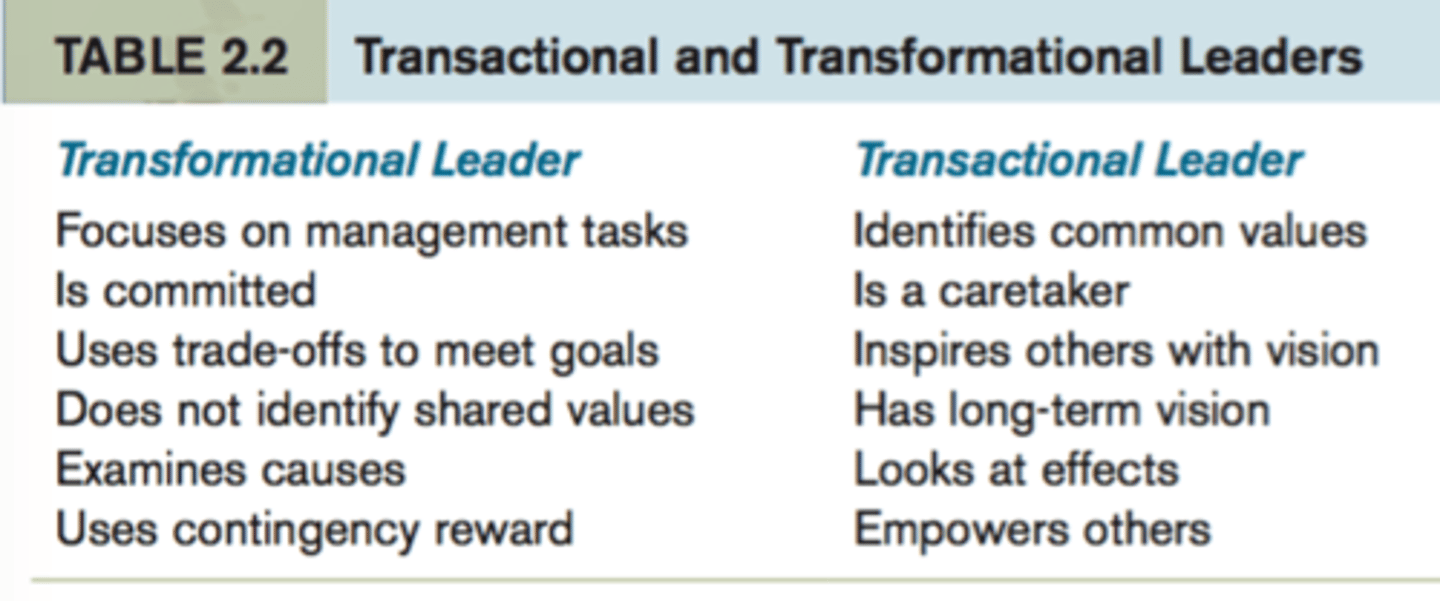

Transformational vs Transactional Leaders

Income Definition

All revenues received by the business

INCLUDES: PBS script income, PBS incentive income, PBS program income, Patient contribution, Service Fees, Retail Sales, Rent, Interest received, Consulting fees

Income from Front of Shop

Stock purchased from Wholesalers and a Mark-up applied to that cost price

Income from Dispensary

Stock purchased from wholesalers

- Non-PBS items - Dispensing fee + Markup

- PBS items - Dispensing fee + AHI fee added on a tiered basis

Expenses definition

All outgoing payments from the business (not goods)

KEY EXPENSES WHEN EVALUATING BUSINESS PERFORMANCE - Rent, Wages, Interest

Important to identify abnormally small or large (or missing) expenses as part of the analysis or management process.

Important when valuing a business as the expenses directly affect NET PROFIT - purchase price will be based on the Net Profit

Markup Definition + markup % calculation

Applying a percentage increase to the purchase price

Applying a markup to cost of goods generates a profit

MARKUP % = (Selling Price - Cost Price) / Cost Price*100%

- If GST is included, add 10% GST at the end AFTER adding the x% markup

Gross Profit Margin/% Definition + Calculation

Profit margin generated by applying a mark-up

Expressed as $ amount OR % of the sale price

% - difference between purchase and selling price as a % of selling price

GP % = (Selling Price - Cost Price)/Selling Price x100

Gross Profit % = gross profit $$/total income x100

***SALE PRICE DOES NOT INCLUDE GST AS THIS IS THE GOVT'S MONEY**

If GST included, first remove GST and use sale price excl GST

Calculating COGS

COGS = opening stock + purchases - closing stock

measures exactly how much stock was sold in the period

Gross Margin Return on Inventory (GMROI) + Calculation

Measurement of the efficiency of stock management

For every $ you spend on stock, how many $ come back to you

Measure of your ability to turn stock into cash, over an above the cost of the inventory

Most of use when analysing a product line, range or department.

Can be used for overall stock holding

GMROI = Gross Profit / Average Inventory Cost (SOH)

Note: GP = sales - COGS

A higher GMROI implies you're generating more GP for every dollar of inventory invested.

INFLUENCED BY: Stock turn; stock level; Margin %; Pricing; Buying; Mix of stock

GMROS (space)

Factors in relationship with stock and space i.e. rent

How well each square m of your pharmacy is contributing to your gross margin.

Allows you to see which areas of the pharmacy are most profitable >> can be helpful in planning store layout, deciding products to stock, determining how to allocate your space.

High GMROS: may indicate a particular area is generating a good return from the space it occupies --- products in that area are highly profitable, popular, or effectively marketed

Low GMROS: may indicate an area that isn't contributing much to gross margin relative to the space it occupies ---> reassess products stocked in that area or how that space is used.

GMROS = Gross Margin / Sales Area

HOW TO IMPROVE GMROI

1) Raise Prices - not always the best option as it may affect sales

2) Markdown poor performing stock (Quit stock) and use the money more effectively on better performing inventory

3) Analyse and identify top performers of which you should never be out of stock

4) Reduce cost of goods sold - Negotiate better supplier discounts, discounts for early payment, reduce shrinkage

5) Carry the appropriate amount of stock to satisfy demand

6) Staff training on "Solution selling" or "Add-on sales"

Methods of Valuing Inventory

1) Average cost - Most POS systems would use this method

- total cost of all items in inventory divided by total number of items >> determine an average cost per item

- simple, easier to calculate and maintain (beneficial for high volume pharmacies)

- may not reflect the true cost of inventory (if significant price fluctuations or if inventory has items of varying costs)

2) Actual cost - Sometimes used when manually counting for a valuation

- records specific cost of each individual item in inventory

- time-consuming, administratively demanding

- more accurate reflection of true cost of inventory

POS data is only as good as the person entering it - important to have regular rotating stocktakes

Full stock take at least once a year to ensure accurate opening and closing stock figures

KEY PERFORMANCE INDICATORS

SALES:

- GP$/Total Sales $

- Net Profit $ / Total Sales $

- Dispensary Sales $ / Total Sales $

- Average Sale: Total Sales $ / Total No. Customers

SCRIPTS

- Scripts per week/hours open per week

- Customers per week/month/annum

PROFIT

- EBIT

- Break even point

- ROI

EXPENSES

- Wages $ / Total Sales $

- Rent $ / Total Sales $

LIMITATIONS OF RATIO ANALYSIS

Shouldn't be used in isolation

Analyse several ratios to get a clearer picture

E.g. Measure Gross profit dollars PLUS:

- Average inventory during the year

- Stockturn

- Return on space

EBIT

Earnings before Interest and Tax

EBIT = Net profit - Operating Expenses

Operating expenses: COGS, wages, rent, utilities, Marketing and advertising, professional fees e.g. accounting fees, Depreciation

Represents OPERATING profit/income generated.

Shows profitability of the pharmacy's main business activities, independent of its tax and capital structure.

Higher EBIT: pharmacy is generating more profit from its main operations (i.e., selling pharmaceutical goods and services) - could influence Inventory Management, staffing, expansion

low EBIT might indicate that there are issues with the pharmacy's core operations - costs are too high, sales are too low, or both

EBITDA

Earnings before Interest and finance, Tax, Depreciation and Amortisation (non-cash expenses)

Represents CASH FLOWS generated

EBITDA = EBIT + depreciation + amortisation + leasing

= net profit + depreciation + amortisation + leasing

Measure of overall financial performance (/profitability) not influenced by financing decisions (interest), tax environments (taxes), and accounting decisions (depreciation and amortization).

Interest definition

Cost of borrowing money for business purposes

Finance definition

Can include leasing assets, sometimes called "Leasing" on a profit and loss

Depreciation definition

A tax deduction allowed to compensate for drop in value of an item

Used for tangible assets: buildings, equipment, vehicles

Amortisation definition

A tax deduction allowed to compensate for drop in value of an item

Used for intangible assets: patents, copyrights, trademarks, cost of borrowing money

Financial Return definition

Money made or lost over a period of time (usually a year)

Return on Investment (ROI) definition

money made relative to the cost of the investment

Stock Turn definition + Calculation

How many times are you turning over your stock

Stock Turn = COGS $/ Average SOH

- Lower stock turn = holding more stock, but tying up cash also

- Higher stock turn = may indicate stock levels are too low, may be missing out on sales or discounts on buying larger quantities

Valuation (aka Expected ROI, Market Value, Valuation, increase in value) + Calculation

Valuing provides a guide only

MOST COMMON METHOD IN PHARMACY: Capitalisation Method

Valuation = EBITDA / Capitalisation Rate

Essentially estimating how much business's core operational profitability (EBITDA) is worth when adjusted for the perceived risk (Cap Rate) of the business.

It gives an estimated value of the business based on its earnings and the risk associated with it.

Capitalisation rates ie CAP rate ie %ROI

Estimates investor's potential return on an investment (money made relative to the cost of the investment)

Determined by the market - ie supply and demand

Cap Rate = Net Operating Income (NOI) / Current Market Value

AFFECTED BY – interest, banks change risk profiles

Lower CAP rate - market perceives less risk with the investment, so is willing to accept a lower return

- business is seen as a safer investment, which could be due to factors like a strong location, steady market demand, solid financial performance, etc.

Higher CAP rate - may indicate riskier investment, requiring a higher return to entice investors.

- might suggest a riskier investment, which could be due to factors like a more uncertain market, weaker financial performance, etc. An investor might demand a higher potential CAP rate to compensate for taking on more risk.

An investor would be interested in the CAP rate as it gives them an estimate of the potential ROI.

A pharmacy that is growing and in a desirable area may attract a lower capitalisation rate (hence higher Value) than a business in a remote area that is not showing growth.

Benchmarking and Comparisons

One of best ways to assess performance is to measure yourself against other similar businesses

Businesses are grouped by similar characteristics to allow for better comparison (medical centre, regional strip shop, Metro shopping centre etc)

Commonly we compare KPI's

KPIs compared in benchmarking

· Wages to sales% 10-12%

· GMROI

· Stockturns - Ideal 8

· GP% range between 27-38%

· Rent%

· GMROS

· GMROL - Gross margin Return on Labour (per Full time equivalent)

Common Problem areas in pharmacies (post benchmarking)

Staff levels too high

Stockturns too low

GMROI too low → wrong stock mix, stock level too high

GMROS indicated that space could be better used or that you have too much space

Wages

WAGES ARE YOUR LARGEST CONTROLLABLE EXPENSE

- Effective and thoughtful rosters are a must

- Wages too low = service suffers, more opportunity for theft, reduced morale etc

- Wages too high = costly, law of diminishing returns applies, staff become inefficient, gains in sales from additional staff overtaken by increased wages

- Budgeting must account for the busy time of year and rosters need to reflect those budgeting factors

Cash Flow Management

Cash Flow Management aims to increase available cash in the working capital cycle

Monitoring cash flow can help identify potential shortages and manage finances proactively

POSSIBLE METHODS of Cash Flow Management

Forward charging of invoices

Increasing supplier trading terms eg 30 day or 60 day payment terms

Pay-on-time discounts

Efficient use of bank credit

Forward planning so you are aware of cash requirements eg tax

Personal drawings

Loan payments

Budgeting for Profit and Growth

Gives motivation to apply Marketing and HR Skills and align Marketing and HR plans to business goals

1) Constantly assess how stock is performing - regular best sellers/worst sellers reports

2) What new ranges could give better return

How could you market and promote better

3) What new services could attract new customers or better serve existing ones

- Assess new services by forecasting potential income and measuring against additional expenses

4) Consider performance against benchmarks

Cash Flow Activities

Operating Activities

Investing Activities

Financing Activities

Operating Activities

CASHFLOW ACTIVITY

Day-to-day activities that generate revenue: sales, inventory, bills, wages, collections

Positive cash flow = enough cash to cover expenses and invest in growth

= ongoing success

Investing Activities

CASHFLOW ACTIVITY

Acquiring long-term assets for future income or growth: Purchasing/selling property, investing in R&D, acquiring/selling businesses, buying/selling financial assets

Positive cash flow - generating more cash from investments than spending

Negative cash flow - spending > generating

= long-term growth & profitability

Financing Activities

CASHFLOW ACTIVITY

Raise capital from investors or creditors to fund operations and growth: Issuing or repurchasing shares, issuing or repaying debt, paying dividends to shareholders

Positive cash flow - raising more cash than it's using to fund operations and growth

= maintain financial stability

Cash Flow Principles

Reflects financial health, ability to meet obligations, and fund operations/growth

Critical for pharmacies to purchase inventory, pay suppliers, and meet financial obligations

Inadequate cash flow = lost sales and decreased profitability

FLUCTUATIONS may occur due to changes in insurance reimbursement rates, interest rates, regulations, or shifts in consumer behaviour

Cash Accounting vs Accrual Accounting

CASH ACCOUNTING

- Suits smaller businesses with mostly have cash transactions

- Gives a picture of how much money in till and bank accounts

- Doesn't show money owed to you or money you owe others

ACCURUAL ACCOUNTING

- Suits businesses that don't get paid straight away

- Helpful if you deal with lots of contracts or large sums

- Tracks true financial position by showing money owed to you and money you owe

- More complicated than cash accounting

ASSET RICH BUT CASH POOR (definition, challenges, solutions, importance)

Significant assets but limited cash for short-term financial obligations

Challenges: assets not easily converted into cash, limiting ability to meet financial obligations

Solutions: take on debt or sell assets to improve cash flow

Importance: balance between assets and cash reserves for financial stability

Managing Working Capital

Optimize inventory management

Negotiate payment terms with suppliers

Reduce waste and inefficiencies

Manage accounts receivable

Streamline accounts payable processes

Constructing a Budget

1) Determine your sources of income

2) Identify your expenses

3) Categorize your expenses

4) Estimate your income and expenses

5) Set financial goals

6) Create a budget

7) Track your expenses

Timing Issues when constructing a budget

- Seasonal

- Supplier trade terms

- Forward charge

- Sales COD vs account

- PBS

- Monthly rent, weekly wages, quarterly electricity, etc

- Personal requirements

- Loan repayments

- Income tax

- Consider timeline

Decision Making in the Budgeting Process

Profitability Targets

Anticipate peaks and troughs (cash flow)

Identify risk

Are you growing too fast?

Variance analysis

Revise future budgets

Working Capital Cycle

Cycle showing flow of cash to keep business running.

Cash at bank > order stock > pay suppliers > customer sales > collect PBS > repeat

The period of time between spending cash on the production process and receiving cash payments from customers.

The time length of the cycle varies between pharmacies.

Working Capital: Shows how much money will be left after paying upcoming expenses

Benefits of Budgets

Pharmacy Regulation (buying a pharmacy)

Restrictions on who can own a pharmacy

Restrictions on where pharmacies can operate

Approvals needed for the premises

Requirements to maintain registration as a pharmacist and the business

Pharmacy is treated differently with regards to renting premises

Steps to buy a pharmacy

Select a business > investigate the business > acquisition process > close the deal

Investigating a Pharmacy business before buying

Legal Due Diligence

- The Sale Contract

- Structure - Partnership Agreement, Service Company, Trust

- Lease & Premises

- Finance / securities required by lender

- Approval Number from pharmacy board

Accounting, Financial & Tax due diligence

- Profit and Loss, Balance Sheet

- Liabilities

- Financial commitments and funding of the business

Pharmacy Business Structures

Sole Proprietor

Unincorporated partnership

Pharmacist's Body Corporate

Trusts / Service Companies

Partnership or Shareholder Agreement

Unincorporated vs Incorporated partnership

Unincorporated partnership - corporation is not a separate legal entity from its owners; owners are personally responsible for the business's liabilities

Pharmacist's Body Corporate (ie incorporated) - Corporation is a separate legal entity from its owners. Corporation itself is responsible its liabilities, shareholders have limited liability

Acquisition Process in buying a pharmacy (step 3)

1) Arranging finance

2) Making an offer

3) Sale contract

4) Exchange of contracts

5) Conditions Precedent

6) Settlement

7) Completion

Pecuniary Interest can only be held by

A registered pharmacist

A partner in a pharmacist's partnership

A pharmacist's body corporate (nominee company)

A member of a pharmacist's body corporate

LIMIT - Pecuniary interest in 5 pharmacies

LEASE OPTIONS WHEN BUYING A PHARMACY

1) Grant of a new lease

2) Assign the current lease, either as it is, or with variations that can be negotiated

Retail Leases Act 1994 (RLA)

Retail Leases and associated requirements under the RLA 1994 (NSW)

RLA requirement for Landlords to provide Disclosure Statements will assist with highlighting some of these Key Terms. Tenants have recourse when a landlord fails to produce an LDS in time or provides information that is false, misleading or incomplete under the RLA.

Costs of Leasing

Finance - Bank loan and Fees, Security required by lenders.

Preparation and Negotiation - e.g. Solicitors costs; Landlord's reasonable costs, stamping & registration fees, stamp duty

Rent, Rent Increases

Outgoings - Water, Cleaning etc

Fit-Out

Make-Good - At the end a lease, putting everything back you way you found it

Security - Bank guarantee

Assigning the lease (taking over an existing lease)

1) current lease is a contract between landlord and the seller

2) with landlord's consent, seller assigns its rights and obligations under the lease to buyer

3) buyer takes seller's place and contract (lease) is then between the landlord and the buyer

The RLA allows the Landlord to withhold their consent (which should only be done reasonably) in certain circumstances - most notably "if the proposed assignee has financial resources or retailing skills that are inferior to those of the proposed assignor"

Obtaining consent is an important element in the transaction

Requirements during Assignment of a Lease

1) Landlord's Consent

2) Landlord's Mortgagee's Consent

3) Disclosure Statements

4) Your Bank (Mortgagee) will want a Mortgage over your Lease and Right of Entry Deeds

Exiting a lease

Renew or Extend

Exercise of an Option - Your right, not an obligation.

Termination for Breach - provisions entitling Landlord to terminate for Breach or Unconscionable Conduct

Termination by Notice

Expiry - The lease comes to an end without extension or renewal.

Transfer - You may wish to assign the lease yourself

Surrender- When a buyer takes over a new lease, or the property itself is acquired, you could surrender your lease: e.g. compulsory acquisition.

Capital

Capital (owner's equity) = Assets - liabilities

How does the Statement of Financial Performance link to the Statement of Financial Position

The statement of financial performance links the Statement of financial Position from the beginning of a period to that at the end of a period – the net profit generated during a period is added to the Capital on the balance sheet and represents the wealth generated in that period.

When selling to customers, no GST on...

Scheduled items (S2, S3, S4, etc)

Sunscreen (over 15+)

Folic acid as a single ingredient >400mcg

Feminine hygiene, contraceptives

When buying or selling, no GST charge by wholesalers or charged to customers on...

baby food