Unit 4: Measures of Economic Performance

1/29

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

30 Terms

economic growth

an increase in real GDP

real GDP

measures output of goods & services produced in a nation adjusted for inflation

C + I + G + Xn

real GDP per capita

a better indication of a nation’s standard of living for its people

standard of living

measures how much stuff people have; the higher the GDP per capita, the more stuff people have

production possibilities curve (PPC)

maximum potential output a country can produce, given its efficient use of all of its resources

factors:

increase of quantity of resources in a nation

improvements in quality of the resources

relationship between PPC & AD-AS model

both PPC & AD-AS model are used to show economic growth in an economy; both show shifts as results of the change in quantity and quality of production

economist focus

use real GDP as the most common data point to define growth in a nation

GDP doesn’t tell us anything about many factors of well-being (ex: education, health, life expectancy, quality of life, environmental consequences, AND how income of a country is distributed — % of population in poverty)

3 main goals of an economy

economic growth, full employment, and low inflation rates

unemployment

people of legal working age who are willing and able to work, actively seeking employment, but are unable to find a job

underemployment

when someone works a part-time job AND wants a full-time job OR when someone works for a job that they are overqualified for

4 types of unemployment

frictional unemployment, structural unemployment, seasonal unemployment, and cyclical unemployment

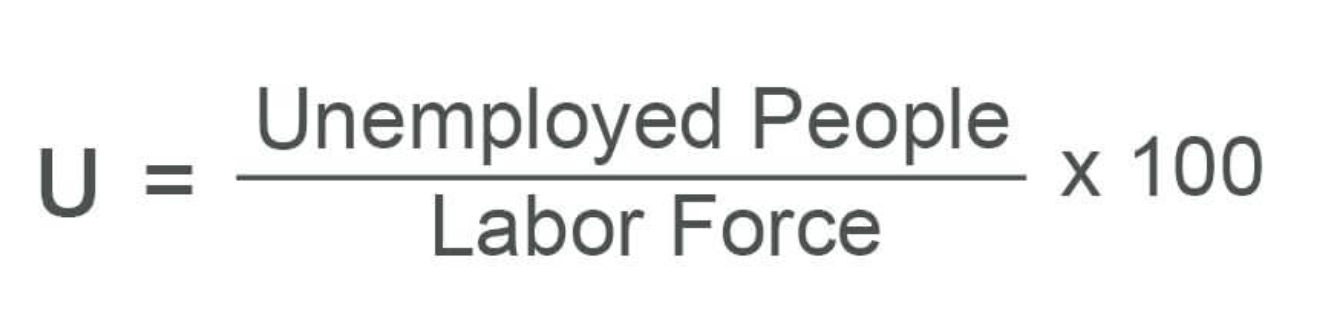

unemployment rate

labor force = employed + unemployed

consequences of unemployment

decreases household incomes

increases in poverty & crime rates

negative effects of unemployment

downward pressure on wages

brain drain (educated/skilled move away to find employment bc they can’t find it in their current country)

decrease in consumption & GDP

more unemployment

budget deficit

Milton Friedman

famous economist who developed concept of natural rate of unemployment (NRU) based on theories on classical economics (in U.S. it’s 4-5%, but other countries have more generous unemployment benefits making it higher)

inflation

increase in the average price level of a nation’s goods & services

goal for countries is 2-3%

purchasing power of consumers decreases

some countries experience hyperinflation

consequences of inflation

low wages become constant

people with fixed incomes are hurt (fixed cannot increase based on prices increasing)

people with cash are hurt (value of currency decreases)

people with savings are hurt (interest rates when put into bank stay the same, but prices of general goods increase so ppl technically lose money)

real IR

nominal IR - inflation rate

deflation

decrease in the average price level of goods & services

first glance seems great, but long term not really

caused by a decrease in aggregate demand

disinflation

decrease in inflation rate

consumer price index (CPI)

measures how much money it costs for a typical household in the country to live

value of basket in specific year/value of the same basket in base year all multiplied by 100

main issue with CPI

not every country will buy the same basket of goods (high income will buy more expensive — diff basket of goods than low income earners in the same country); also does not account for regional/cultural differences, substitute goods people may buy, or new items introduced into the basket

overstates inflation: does not take into account that many shoppers use discount stores

fixed market of basket of goods & services

measures the average amount of money spent by consumers on a fixed set of goods & services in a year (value is calculated over time and is compared to price of the basket in the base year)

value = quantity * price

total value = base value + new value

shrinkflation

when a product becomes low in quality for the same price

core rate of inflation

calculated with market basket which excludes food & energy; problem: they can have big fluctuations in price causing skewed inflation rate

producer price index

another measure to calculate inflation

uses market basket of goods & services used by producers

different indices created for prices of resources, intermediate goods, wholesale goods, & resale goods

good predictor of consumer inflation in the CPI as producers will pass on increase in price of production to consumers

demand-pull inflation

increase in AD causes this

cost push-inflation

decrease in SRAS causes this

SRAS will decrease due to increases in costs of production or due to supply shocks

phillips’ curve

illustrates the relationship between unemployment and inflation

A.W. Phillips argued that there is a tradeoff between the economics of low inflation and low unemployment (not possible to have both simultaneously)

lower rate of inflation = higher rate of unemployment and vice versa

SRAS shifts right then SRPC shifts right and vice versa

LRPC

inflation and unemployment are unrelated, therefore this curve is vertical at the natural rate of unemployment