Macroeconomic Objectives- Low and stable rate of inflation

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

38 Terms

Inflation

the sustained (continual) rise in the average price level in an economy over time

the costs of living rises because households and firms need to spend more money to buy the same amount of goods and services as before. That is, inflation reduces the purchasing power of money

At a global level, inflation reduces a country’s international competitiveness

Measuring the inflation rate: the Consumer Price Index (CPI)

The consumer price index is a weighted index of the average consumer prices of goods and services over time.

It is the most common method used to measure inflation (and therefore changes in the cost of living) for the typical or average household in the economy

Calculating changes in the value of the CPI gives the rate of inflation

How does the CPI function?

A base year, with an assigned index number of 100, is used as the starting period when calculating CPI.

A price index of 115.2 means that prices have increased by an average of 15.2% since the base year

If prices rise by another 5% in the following year, the price index becomes 120.96 (115.2 × 1.05.) This means that prices have increased by an average of 20.96% since the base year

The CPI uses statistical weights to reflect the relative importance of household spending on each of the items of expenditure in the representative lists of goods and services. There are two ways to apply these weights to the CPI:

Volumes of quantities purchased: It is assumed that the more times and the greater the quanities purchased

How does the CPI create its basket of goods and services?

Volumes of quantities purchased- It is assumed that the more times and the greater the quantities purchased, the more important the item is to the average household. The weights are therefore based on quantities purchased per month

Value of quantities purchased- Similarly, it can be assumed that the more money an average family spends on a product as a proportion of its overall spending, the more important that product is to the family. Hence. such products would have a larger statistical weight applied in the calculation of the CPI

The statistical weights in the CPI are revised periodically to reflect changes and trends in the expenditure of a typical household in the economy

Limitations of the CPI in measuring inflation

Atypical households

Regional and international disparities

Difference in income earners

Changes in product quality

Different patterns of consumption over time

Time lags

Volume or value of quantities purchased

Atypical households (CPI Limitations)

The CPI only takes an average measure, without considering what it means in multicultural and diverse societies in the real world. It may have minimal relevance for atypical households, and expatriate families in an overseas country

Regional and International Disparities (CPI Limitations)

The CPI does not reflect regional differences and disparities in prices and the cost of living. Prices can vary between economies, making comparisons difficult. For example, housing costs are extremely high in HK and Singapore but far more affordable in Hungary and Scotland

Difference in income earners (CPI Limitations)

Different individuals on different levels of income can experience a different rate of inflation because of their pattern of expenditure is not necessarily or accurately reflected by the CPI owing to different consumption patterns between, high, middle and low-income earners

Changes in product quality (CPI limitations)

AS a price index, the CPI ignores changes in the quality of goods and services over time. So, while some products increase in price, the CPI ignores the higher specifications and build quality that are not reflected in the calculation

Different patterns in consumption over time (CPI Limitations)

Consumption patterns change over time, thereby affecting average price levels. Although each product in the CPI is weighted, as the popularity of most goods and services change over time, these needs to be reflected in the CPI calculations. This makes historical comparisons of inflation misleading/inaccurate

Time lags (CPI Limitations)

Calculations may not accurately reflect changes in consumption patterns due to time lags in collecting data to compile the CPI.

Given the huge amount of data collection and reporting needed to construct the CPI, the data may well be out of date or inaccurate by the time of publication

Volume or value of quantities purchased (CPI limitations)

The calculation of the CPI by using quantities purchased as weights (rather than the percentage of income spent on the items) is also a limitation.

For example, a typical household might spend $80 on refuelling the family car every two weeks (so makes only two purchases per month), whereas the same family might buy eight loaves of bread in the same time period.

Hence, while applying a weight in the CPI based on the quantities purchased is quite simple, it is also somewhat trivial.

Causes of inflation

demand-pull inflation

cost-push inflation

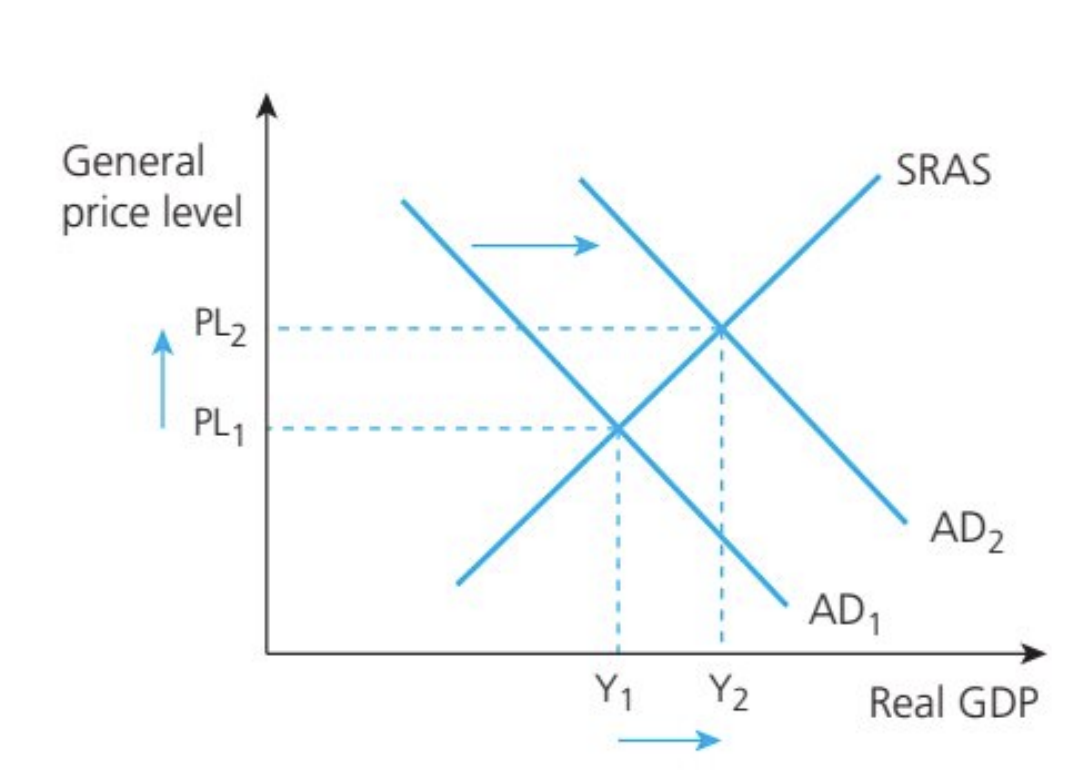

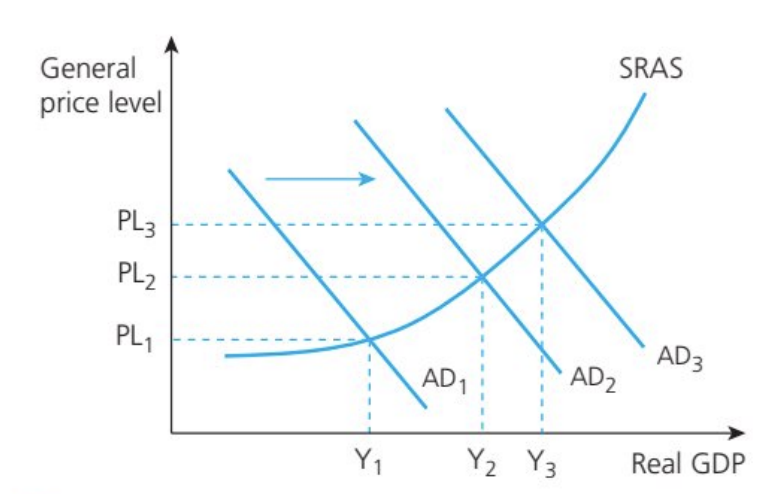

Demand-pull inflation

triggered by higher levels of AD in the economy, which drives up the general price level, Diagrammatically, this is shown by a rightwards shift of the AD curve.

It is caused by excessive aggregate demand, that is, AD increasing at a faster rate than AS, thereby forcing up the average price level

An increase in any component of AD (consumption, investment, government spending and net exports) will tend to cause demand-pull inflation

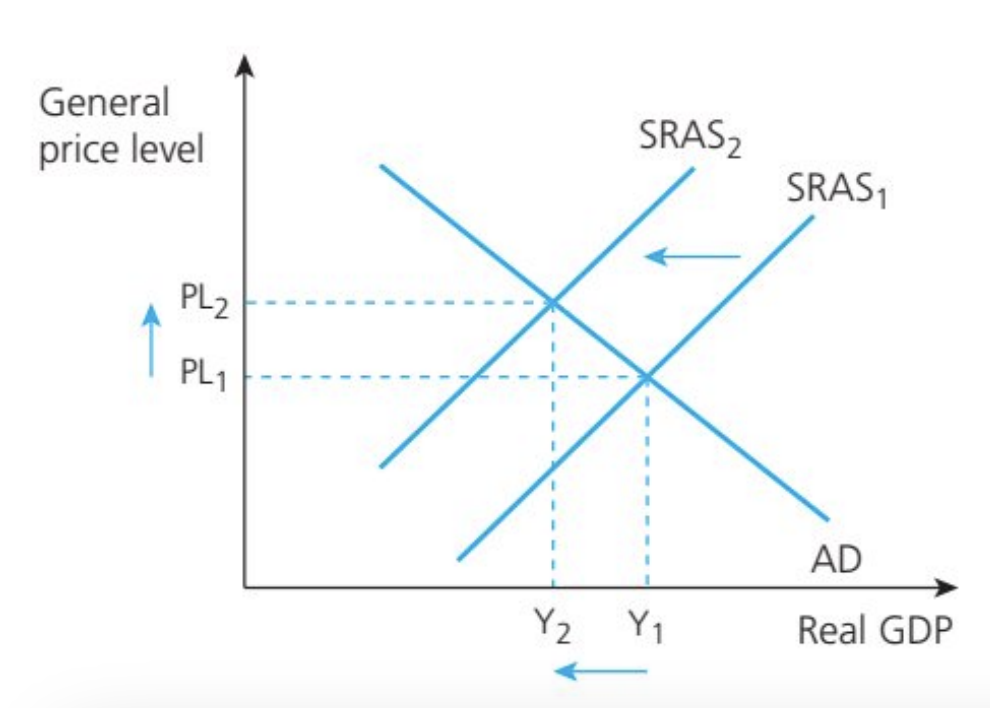

Cost-push inflation

refers to inflation caused by higher costs of production, such as higher rents or raw material prices

these shifts shift the SRAS curve to the left and forces up the average prices

Higher production costs push firms to raise their prices in order to maintain their profit margins. Diagrammatically, this is shown by a leftwards shift of the SRAS curve

Causes of cost-push inflation

higher imported prices of raw materials, semi-finished goods and finished goods for sale

higher labour costs in the economy

increased corporation taxes

escalating rents on commercial properties

Costs of a high inflation rate

Uncertainty

Redistributive effects

The effects on saving

Damage to export competitiveness

The impact on economic growth

Inefficient resource allocation

Costs of a high inflation rate- Uncertainty

Inflation lowers the spending power of households and firms in the economy. This creates uncertainty, especially when the inflation rate is extremely high, rand reduces both consumer and business confidence. The uncertainty can lead to lower economic growth over the long term.

Costs of a high inflation rate- Redistributive effects

The effects of inflation are not distributed evenly among different stakeholders in the economy.

Especially prevalent when the prices of essential goods and services (water, gas, electricity) rise at a rapid rate, which has a larger impact on low-income households and small-sized firms as they are most vulnerable to rising costs of living and costs of production

Costs of a high inflation rate- The effects on saving

Savers tend to lose from high inflation because it reduces the real rate of return for savers.

For example, if banks pay 0.5% interest on people’s savings accounts but the inflation rate is 1.5%, then the real interest rate is -1.0%.

Hence, high inflation discourages savings as money becomes less effective as a store of value

Costs of a high inflation rate- Damage to export competitiveness

Higher inflation rates cause exports to be less price competitive, leading to a fall in exports and a deterioration in the country’s current account on the balance of payments. By contrast, imports become cheaper for domestic consumers and firms, so they may choose to subsitute domestic products for imported ones. Overall, this reduces the export sales and profitability of domestic firms, which slows or reduces economic growh and causes higher unemployment.

Costs of a high inflation rate- The impact on economic growth

The combination of uncertainty and the lower expected real rates of return on capital investments (due to the higher costs of production) tends to lower the amount of planned investment in the economy.

In the long run, a lack of investment expenditure and international competitiveness (due to higher average prices) is harmful to the economy’s economic growth

Costs of a high inflation rate- Inefficient resource allocation

High inflation can cause inefficiencies as higher prices can distort resource allocation and prevent the economy from operating at Yfe. Unemployment itself, caused by the harmful effects of inflation, represents allocative inefficiencies.

Deflation

the persistent fall in the general price level in an economy over time. This can mean the inflation rate is negative

Causes of deflation

Can be caused by a continual decline in AD or an increase in the SRAS.

SRAS shifting out is known as benign inflation, while AD declining is known as malign inflation

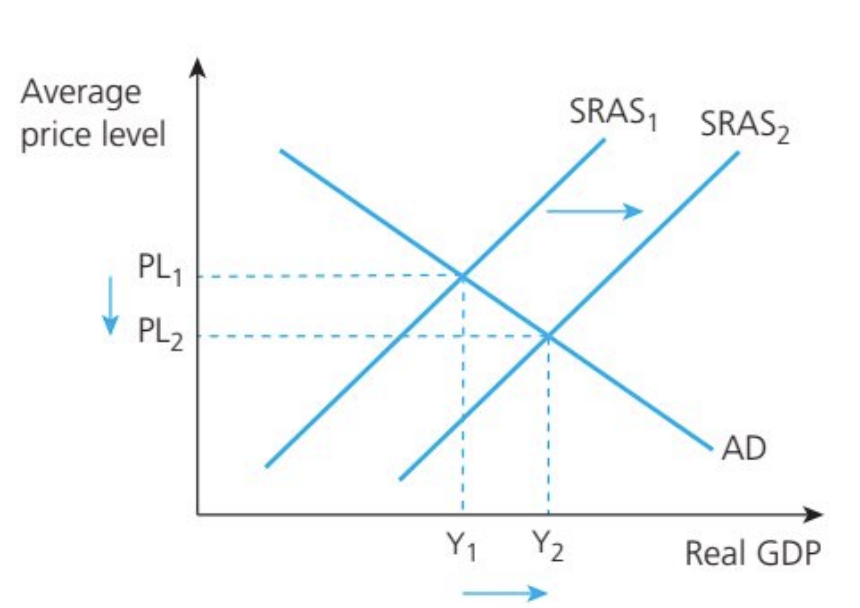

benign deflation

Deflation caused by an outwards shift of the SRAS curve

Generally positive in the economy, as they are able to produce more, thereby boosting real GDP and employment, without an increase in the general price level

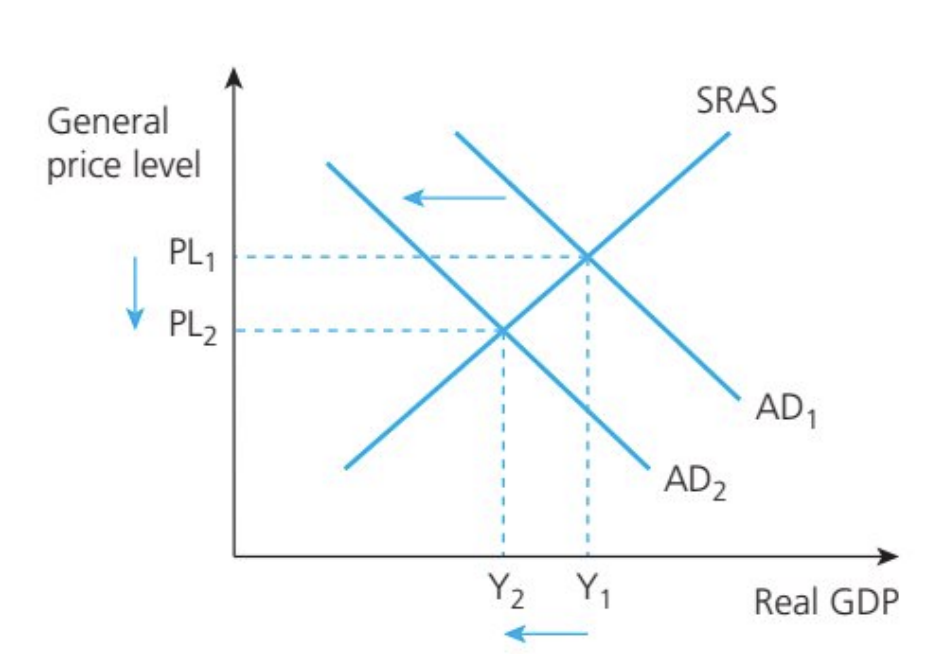

malign deflation

harmful deflation due to a decline in aggregate demand for goods and services in the economy

It is usually associated with economic recession and rising levels of unemployment

Disinflation

occurs when there is a fall in the rate of inflation, that is, prices are still rising, but at a slower pace. The rate of inflation remains positive

Disinflation can lead to deflation if not controlled effectively, with negative consequences for the economy and a fall in the standards of living in the country

Diagrammatically, disinflation is shown by a small proportional increase in average prices

Costs of deflation

Uncertainty

Redistributive effects

Deferred consumption

Association with high levels of cyclical unemployment and bankruptcies

Increase in the real value of debt

Inefficient resource allocation

Policy ineffectiveness

Costs of deflation- Uncertainty

Deflation causes uncertainty in the ecoomy, such as an increase in the real value of debts, so this reduces both consumer and buisness confidence levels. Uncertainties add further economic problems, such as deferred consumption and investment expenditure. Hence, uncertainties can have detrimental impacts on economic growth and employment

Costs of deflation- Redistributive effects

Deflation causes a fall in the value of assets and household wealth as incomes, profits and asset values (such as share prices) fall. Deflation also leads to a redistribution of income and wealth from borrowers to lenders as the real value of debt increases

Costs of deflation- Deferred consumption

causes consumption to be postponed as consumers wait in anticipation of further falls in the prices of goods and services, and because consumer confidence is low. Hence, deferred consumption slows down the level of economic activity, causing a fall in business profits and incentives, and possibly prolonging an economic recession

Costs of deflation- Association with high levels of cyclical unemployment and bankruptcies

A fall in AD causes a fall in the derived demand for labour in the economy, that is, deflation can cause cyclical unemployment and therefore mass job losses throughout the economy

Costs of deflation- Increase in the real value of debt

The real costs of debts (borrowing) increase when there is deflation because interest rates rise when the price level falls, ceteris paribus.

For example, if interest rates average 0.5% but the inflation rate is -1.0%, then the real interest rate is approximately 1.5%. This means that deflation makes it more difficult for borrowers to pay off their debts at a time when firms earn less revenue and consumers earn lower wages.

Costs of deflation- Inefficient resource allocation

Deflation is usually caused by a weak economy, that is, a significant fall in the level of AD and real GDP that leads firms to cut their prices.

The damaging effects of deflation also causes market distortions, such as greater uncertainty, deferred consumption and investment expenditure, bankruptcies, cyclical unemployment, and an increase in the real value of debt.

Costs of deflation- Policy ineffectiveness

Policy measures adopted by the government to achieve macroeconomic goals like economic growth and low unemployment become less effective when the economy faces deflation.

Given the weak economy, governments would ordinarily lower interest rates to raise AD, but nominal interest rates cannot fall below zero so monetary policy becomes ineffective.

Such policy ineffectiveness can also lead to lower growth and higher unemployment in the economy

The costs of unemployment vs the costs of inflation

Costs of unemployment | Costs of inflation |

Psychological costs | Increases the cost of living |

Social problems | Deferred consumption and investment |

Loss of household incomes (earnings) | Decline in international competitiveness |

Higher government borrowing | Savings eroded |

Slower economic growth | Uncertainty |

Rising wealth and income inequalities | Higher costs of production |

Dealing with unemployment versus inflation

Unemployment and inflation are interlinked, where governments often struggle to decide which macroeconomic objective to pursue as a priority

Government priorities change over time, and contexts are lasso important to consider. E.g during COVID-19, lower unemployment became the key macromic objective, even if it led to demand-pull inflation

In deciding which macroeconomic objective to pursue as a priority, policymakers consider the breadth and severity of the relative costs of unemployment and inflation. They also need to consider the magnitude of inflation and unemployment rates in the economy.