W4 Externalities

1/87

Earn XP

Description and Tags

Externalities

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

88 Terms

What is an externality?

When one economic agent makes another better or worse off without bearing the cost or receiving the benefit, creating a market failure.

Why do externalities cause market failure?

Because there’s a missing market for the external cost or benefit — no price signal reflects the impact on others

Which of these is an externality:

A steel plant pollutes a river used for recreation but doesn't pay the users of the river for it

A steel plant buying neighbouring land and prevents someone else from buying it

First one

What does the supply curve represent in externality theory?

Private Marginal Cost

What does the demand curve represent in externality theory?

Private Marginal Benefit

What is the social optimum condition in the presence of externalities?

Social marginal benefit (SMB) = Social marginal cost (SMC)

When does the First Welfare Theorem guarantee efficiency?

When SMB = PMB and SMC = PMC (i.e., no externalities)

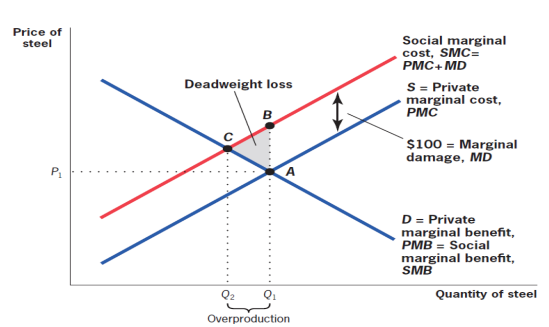

What is a negative production externality?

A cost (marginal damage, MD) imposed on others by production, not borne by the producer.

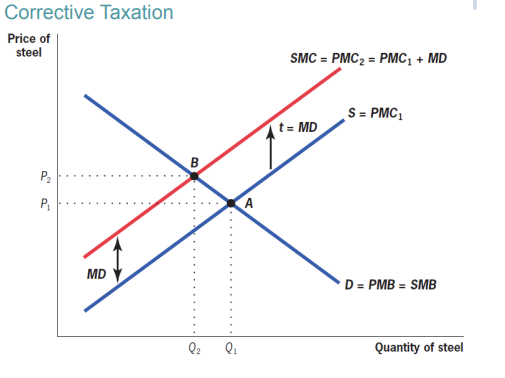

What is the relationship between SMC and PMC when there is a negative production externality?

SMC = PMC + MD

SMC > PMC

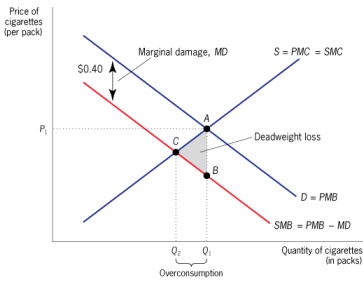

What is the relationship between SMB and PMB when there is a negative consumption externality?

SMB = PMB - MD

SMB < PMB

What is a negative consumption externality?

A cost from consumption not paid for by the consumer.

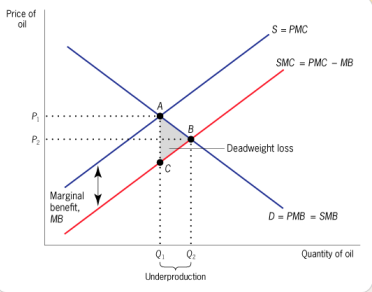

What is a positive production externality?

A benefit from production not paid for by others.

What is a positive consumption externality?

A benefit from consumption not received by the consumer.

What is the relationship between SMB and PMB when there is a positive consumption externality?

SMB = PMB + MB

SMB > PMB

What is the relationship between SMC and PMC when there is a positive production externality?

SMC = PMC - MC

SMC < PMC

What is the market equilibrium in the presence of externalities?

PMB = PMC

Do negative production externalities lead to over or under production?

Overproduction

Do positive production externalities lead to over or under production?

Underproduction

Do negative consumption externalities lead to over or under consumption?

Overconsumption

Do positive consumption externalities lead to over or under consumption?

Underconsumption

Is zero consumption/production optimal if externalities exist?

Not necessarily - most times social optimum still has some production/consumption of the good

What does the optimal quantity depend on? Is this easy to measure?

Slope of PMB, PMC, and MD (or MB)

Difficult to measure - private sector may not have incentives to reveal PMB and PMC and cannot use revealed preferences directly for MD

What does the Coase Theorem argue?

Under certain conditions (well-defined property rights and costless bargaining), externalities can be internalised by market participants without government intervention.

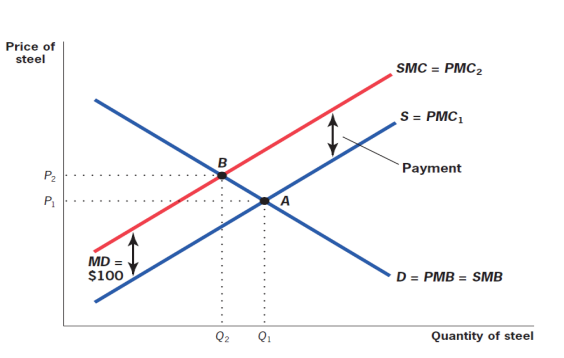

How does this demonstrate the Coase Theorem?

Firm compensates consumers amount equal to their external marginal damage so new PMC becomes PMC+MD which is equal to SMC

According to the Coase Theorem, what does the efficient solution to an externality not depend on?

The efficient solution to an externality does not depend on which party is assigned the property rights, as long as someone is assigned those rights.

E.g whether swimmers pay for river to swim in clean water or firms compensates swimmers leads to the same outcome

According to Coase Theorem, what must the government do? What happens when they do so?

Assign property rights to some parties

Create a space for parties to bargain costlessly (a ‘market’)

Then the parties will reach optimal quantity on their own

What is a key advantage of the Coase Theorem?

No need to know the optimal quantity or slopes of PMB, PMC and MD (or MB) as the market participants reach optimal outcome alone through bargaining

What is the limitation of Coase Theorem in practice?

High transaction costs and negotiation problems, especially with many parties.

When is the Coase Theorem more likely to work?

For small-scale, localised externalities with few affected parties and low bargaining costs.

Why can’t Coase Theorem solve global externalities like climate change?

Too many parties and coordination failures → need a government to aggregate and represent interests

What are the two main types of government policies?

Price policies

Quantity policies

What are price policies?

Government changes prices (using tax or subsidy) such that parties internalise the externality

What are quantity policies?

Government restricts quantity directly

What is a Pigouvian tax?

A tax equal to the marginal damage at the social optimum.

What are the limitations of price policies?

Government must know the exact marginal damage, which is difficult to estimate in practice. (also PMB and PMC)

Particularly difficult if marginal damage not constant

What does the "targeting principle" suggest?

Policies should directly target the externality itself rather than related markets (like the complement/substitute good).

What’s the problem with uniform quantity regulation?

Inefficient if firms have different marginal abatement costs.

What is cap-and-trade?

A quantity policy that allows trading of pollution permits to improve allocative efficiency.

What is mathematically the equilibrium outcome in a model with negative production externalities? How can we show that this is not efficient?

Market equilibrium (assuming perfect competition): when firms maximise profits and consumers maximise utility

Firms profit = px - c(x) so FOC with respect to x => c ′ (x) = p

Consumers maximise utility u(x) + Z - px so FOC => u ′ (x) = p

Market equilibrium: PMB = PMC ⇔ u′(xp) = c′(xp)

To prove inefficient:

Damage from externality = d(x)

Total social welfare is W(x)= u(x) - c(x) - d(x)

dW/dx = u′(xp) - c′(xp) - d′(xp) but we know u′(xp) = c′(xp) so

dW/dx = - d′(xp) which is < 0 so increasing x decreases welfare

What is mathematically the efficient outcome in a model with negative production externalities?

Efficient when no DWL so dW/dx = 0

dW/dx = u′(x*) - c′(x*) - d′(x*) = 0

u′(x*) = c′(x*) + d′(x*)

How do we mathematically show that a Pigouvian tax leads to the social optimum?

Tax is equal to external marginal damage so t = d′(x∗)

Firms profit = px - c(x) - tx so FOC with respect to x => c ′ (x) + t = p

Consumers maximise utility u(x) + Z - px so FOC => u ′ (x) = p

Market equilibrium: PMB = PMC ⇔ u′(xp) = c′(xp) + t

Since t = d′(x∗) we get u′(x*) = c′(x*) + d′(x*) which is social optimum

How do we mathematically show that a Pigouvian subsidy leads to the social optimum?

Subsidy is equal to external marginal damage so s = d′(x∗)

Firms profit = px - c(x) + s(xp - x) so FOC with respect to x => c ′ (x) + s = p

Consumers maximise utility u(x) + Z - px so FOC => u ′ (x) = p

Market equilibrium: PMB = PMC ⇔ u′(xs) = c′(xs) + s

Since s = d′(x∗) we get u′(x*) = c′(x*) + d′(x*) which is social optimum

What does a Pigouvian tax look like on a marginal benefit/cost diagram?

What are the limitations of quantity policies?

Same as price policies - need to know social optimum, and thus MD, PMB, and PMC (even if MD constant)

Is the outcome of quantity policies different to price policies if the government mandates the socially optimum quantity x*?

No, same outcome in terms of efficiency as price policies

In practice, are price and quantity policies equivalent? Why?

Not necessarily, because:

There could be heterogeneity in marginal cost of abatement (some firms can reduce pollution more cheaply than others)

There could also be uncertainty over these marginal costs (we might not how much it will cost firms to reduce pollution)

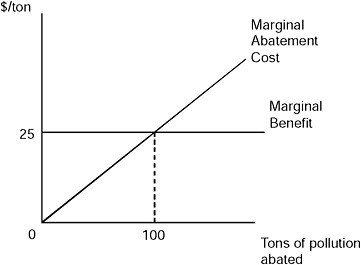

What is abatement?

Reduction in pollution from the unregulated market level

If pollution is unregulated (no tax/regulation), how much is abatement, q, equal to?

q=0

Firms do not abate

When do firms stop abating in terms of marginal cost and benefit?

Stop abating when marginal cost (MD=SMB) = marginal benefit (S=PMC=SMC).

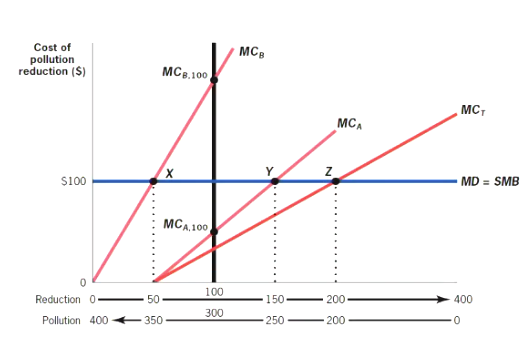

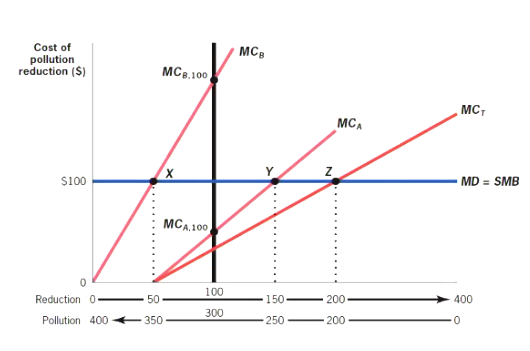

How much will two firms with the following abatement costs abate? Which firm abates more? What does this show about price and quantity policies?

cH(q) = q2

cL(q) = 1/3 q2

cH '(q) = 2q

cL’(q) = 2/3q

Social optimum when maximised W=100(qL + qH) - cL(qL) - cH(qH)

First, with respect to qL: cL’(qL) = 100 => 2/3qL = 100 so qL =150

Then with respect to qH: cH’(qH) = 100 => 2qH = 100 so qH = 50

Low cost firm abates more (150>50)

Highlights the point about the existence of heterogeneity in marginal costs of abatement so policies are not necessarily equivalent

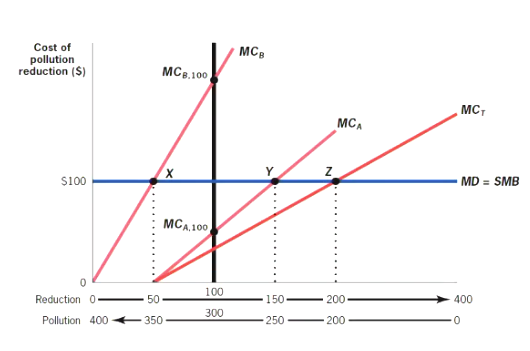

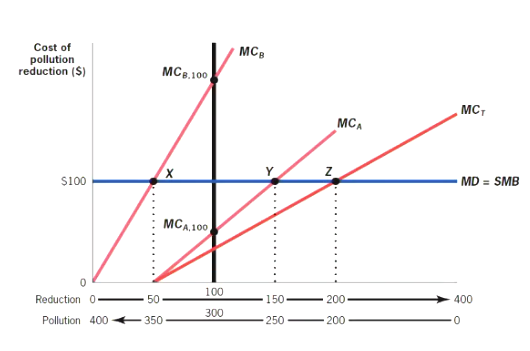

In this diagram what is MCT?

Marginal damage curve - sum of both MCA and MCB

What do points X, Y and Z show?

X= how much high cost firm abates (50)

Y = how much low cost firm abates (150)

Z = total abatement (150+50)

Is uniform quantity regulation at abatement of 100 efficient? Why?

It is inefficient:

Firm B (high cost firm) does too much abatement (it should do 50 but is doing 100)

Firm A (low cost firm) does too little abatement (it should do 150 but is doing 100)

So both would benefit if:

Firm L abated more

Firm H abated less

Total abatement would stay the same (at 200) but there would be a Pareto improvement

So the uniform quantity regulation leads to inefficiency

Is a tax of $100 efficient?

Yes because it helps reach social optimum where firm A abates 150 and firm B abates 50

What type of inefficiency would uniform quantity regulation lead to?

Allocative inefficiency - when resources are not distributed in a way that maximises total social welfare

How can uniform quantity regulation be efficient?

It must be firm specific - each firm should be assigned a different abatement target based on its own marginal abatement cost

How can allocative inefficiencies with quantity regulations be resolved?

Through flexible quantity policies like ‘cap-and-trade’ where they can trade abatement among themselves as long as total abatement = 200 (social optimum)

What are the benefits of using cap-and-trade?

It is efficient - doesn’t have allocative inefficiency like typical quantity regulations

Don’t need to know abatement costs for all firms

How does cap-and-trade work?

The government:

Sets a cap on total pollution (i.e., fixed total abatement)

Allocates or auctions pollution permits (e.g., each permit allows 1 unit of pollution)

Allows firms to trade permits with each other — creating a market for pollution/abatement

Why does it not matter where pollution is reduced in the case of climate change?

Because greenhouse gases mix globally in the atmosphere, so only the total global emissions matter, not the location.

What is the economic principle behind efficient pollution reduction globally?

Abate where marginal abatement cost (MAC) is lowest to minimize total global cost of pollution reduction

What is the Clean Development Mechanism (CDM)? Is it cost-effective?

A system allowing high-income countries to fund emission-reducing projects in countries without targets and count the reductions toward their own goals

It is cost effective since developing countries often have lower marginal abatement costs, allowing more emissions to be reduced per dollar spent

Higher income countries (high abatement cost) buys permits to avoid costly extra abatement

In a cap-and-trade system, if a high-cost firm abates 50 units and a low-cost firm abates 150 units (with a total target of 200 units), who pays whom and why?

Firm H buys permits to avoid costly extra abatement and Firm L sells permits and does extra abatement

What does Weitzman (1974) say about uncertainty in marginal abatement costs?

When marginal abatement costs are uncertain, price and quantity policies are no longer equivalent. The choice between a tax (price) and cap-and-trade (quantity) depends on the relative uncertainty and slope of marginal benefits vs. marginal costs.

What is the argument in favour of price policies (e.g., carbon tax) under uncertainty?

If abatement costs are higher than expected, price policies (like a carbon tax) allow firms to adjust how much they abate, keeping costs manageable. In contrast, cap-and-trade keeps total abatement fixed, making it potentially more expensive.

What is the argument in favour of quantity policies (e.g., cap-and-trade) under uncertainty?

When abatement costs are uncertain, so is the total amount of abatement that price policy achieves, so using cap-and-trade guarantees total amount of abatement

What is meant by flexible quantity policies?

Cap-and-trade policy

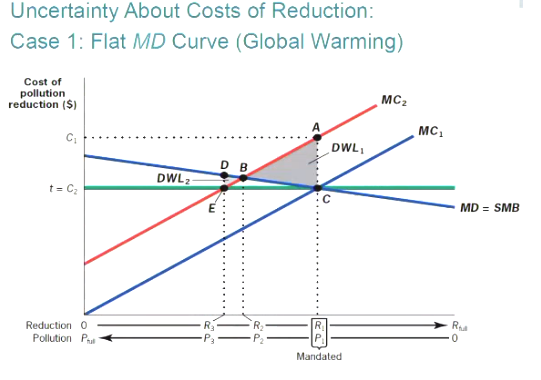

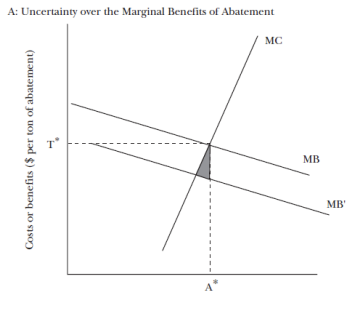

Explain this graph.

MD no longer constant (flat) now has a small negative slope

We are showing price and quantity policy

Taxation at level t=C2 leads to a much lower DWL2 than regulation R1 and DWL1

If costs are uncertain, taxes preferable when MD flat

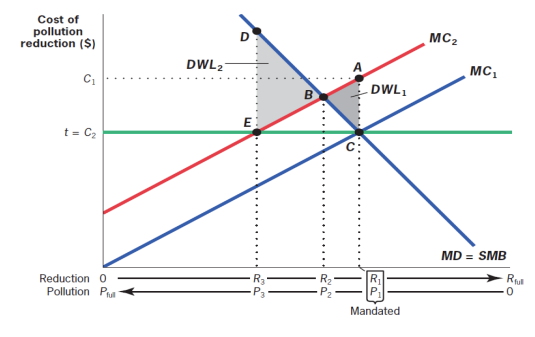

Explain this graph.

MD no longer constant (flat) now has a steep slope

We are showing price and quantity policy

Regulation R1 leads to a much lower DWL1 than Taxation at level t=C2 with DWL2

If costs are uncertain, regulation preferable when MD steep

Are taxes or tradeable permits preferred when MD curve is flat? What about steep?

If cost are uncertain:

Taxes preferable when MD curve is flat.

Tradable permits/regulation/cap-and-trade are preferable when MD curve is steep.

What do price and quantity regulations get right individually and how does this link to when they are preferable?

Quantity regulation gets the amount of pollution reduction right, regardless of cost, and so is more appropriate when marginal damage are steep

Price regulation through taxation gets the costs of pollution reduction right, regardless of quantity, so it is more appropriate when marginal damage are flat.

How does the COVID-19 pandemic illustrate the use of price vs. quantity policies to address externalities?

Uncertain Marginal Costs: It’s hard to measure the cost of reducing interpersonal interactions.

External Marginal Damage: Spread of disease depends on R (reproduction number) and very important to be below R=1

If R > 1: Quantity policies are better to keep R below 1 and prevent exponential spread.

If R ≤ 1: Price-like policies may be sufficient - the spread is under control, so the damage from one extra interaction is lower and not exponential.

Are Pigouvian taxes/subsidies and cap-and-trade equivalent when there is uncertainty over the marginal benefit of abatement?

Yes, both policies lead to the same total abatement and cost to firms

Both get the social optimum wrong to the same extent by targeting an abatement level A* based on incorrect marginal benefit estimates.

What are the three tools for governments to deal with externalities?

Facilitate Coasian solution among relevant parties (assign and enforce property rights, reduce bargaining costs)

Intervene through price-based policies (taxes and subsidies)

Intervene through quantity-based measures (direct regulation, cap-and-trade)

What 3 factors determine what government tool is most efficient?

Scale of the externality

Heterogeneity in costs of externality reduction (different abatement costs)

Uncertainty over costs of externality reduction (steepness)

Name 3 methods to value externalities.

Market-based (e.g., financial (health) costs from pollution)

Survey-based (contingent valuation, WTP/WTA)

Revealed preferences (e.g., travel costs, housing prices)

To implement public-sector solutions to correct externalities, it is necessary to put a monetary value on these externalities. What is meant by monetary value?

Example: necessary to measure the MD from a negative externality to know the optimal Pigouvian tax

Why is valuing externalities challenging?

Externalities are by definition outside the market: so typically no direct market value

What is contingent valuation?

Asking people how much they’d pay to protect something without a market price (e.g., endangered species).

What are the limitations of contingent valuation?

Limitations: (PIFIE)

Partial view: Budget allocation requires considering all causes simultaneously, which is a government role.

Information: People may not know their true value for unfamiliar goods

Framing effects: Responses can be influenced by question order/number.

Incentives: No incentive to answer truthfully.

Embedding effect: difficulty valuing 1 vs. multiple similar items

What are revealed preferences?

Use actual individual choices to infer valuation of non-market goods.

What is hedonic pricing or capitalisation?

Infer willingness to pay for non-market amenity using housing prices: how much more people pay to live in less-polluted area (infers value of environmental amenities)

What did Chay and Greenstone (2005) find in their study using hedonic pricing for air quality improvements in the US?

Studied effect of Total Suspended Particulates (TSP) on housing prices using a natural experiment from 1970s US pollution regulation.

Used difference-in-differences comparing counties mandated to reduce TSP (treatment) vs. those not (control).

Found that a 1µg/m³ reduction in TSP led to a 0.2–0.4% increase in property values.

Applying the 0.4% increase to US housing stock valued at $7.1 trillion (1997) implies a $32 billion gain in housing value from a 1µg/m³ TSP reduction.

What are the 4 limitations of the revealed preferences approach to valuing externalities?

Assumes people are rational and have perfect information.

Only captures valuation of those making the specific choices considered (marginal person ≠ average person).

Different behaviours may reflect multiple values (e.g., housing prices reflect pollution, productivity, recreation).

Ignores valuation by people not making related choices but who still care (existence value).

What are the additional issues that arise when valuing long-term externalities like climate change?

Society may adapt - marginal damages from our perspective may not capture damages for future generations. Adaptation affects damages and marginal abatement costs

Long-run social discounting - Many damages from climate change in the long run, but to compare current cost of abatement with marginal benefits of abatement, need to express future benefits in today’s value. PV depends on discount rate and needs to be ‘right’ and consider absolute discounting (people’s patience) and economic growth

What components make up the private investment discount rate r?

Absolute discounting (δ): preference for money now vs. future.

Economic growth (g): future generations expected to be richer, so each £1 means less to them.

Is the discount rate for social investments like climate change mitigation higher or lower than for private investments? Why?

Discount rate for social investments like climate change mitigation is lower than for private investments

Reasons:

Ethical concerns: not clear why we should value future generations less (absolute discounting).

Uncertainty about future economic growth; climate change may cause economic collapse, making future generations poorer, so g might be low or negative.

Why might governments subsidise green jobs or innovation despite the targeting principle? Does this contradict the targeting principle?

These policies address other market failures (positive externalities from innovation, liquidity constraints), so they fix other market failures that also matter alongside directly taxing emissions so they don’t contradict the targeting principle.