Economics - AS Levels

1/194

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

195 Terms

1 - Fundamental Economic Problem

- Scarce resources to satisfy unlimited needs and wants.

1 - Economic Goods

- Defined as a private good which is relatively scarce.

- Economic good = private good.

- Example = food, clothes, cars.

1 - Free Goods

- Scarcity doesnt apply.

- Enough quantity to satisfy demand.

- Unnecessary to involve an allocative mechanism (method where scarce resources are distributed).

- No cost involved in consumption of free goods, unlike economic or private goods.

- Example = sunshine, air, and sea water.

1 - Inevitability of a Choice

- Due to economic problem, decisions need to be made about allocation of scarce resources.

- Example = choosing between alternative uses of the scarce resources.

1 - Needs and Wants Definition

- Need = a good of vital importance that is demanded. e.g. food, clothes, water.

- Want = a good of less crucial importance that is demanded. e.g. new television, car, holiday.

1 - Opportunity Cost

- The loss of other alternatives when one alternative is chosen.

- Result of making a choice; when a decision is made to produce one product with a combination of resources, its clear what other products cannot be produced with those scarce resources.

- Applicable to both production and consumption decisions.

1 - Factors of Production

- Land = natural resources of an economy.

- Labour = labour force of an economy (physical and mental).

- Capital = Human-made aids to production, e.g. tools and machinery.

- Enterprise = Person/organisation who takes a risk to organise and combine the other three factors of production. Called an entrepreneur.

1 - Specialisation & Division of Labour

- Specialisation = encouraging individuals, firms, regions, and countries to concentrate on what they are the best at producing.

- Division of labour = process where workers specialise in or concentrate on particular tasks.

1 - Advantages of Division of Labour

- Saving time = takes a lot of time to move from one task to another. DOL reduces time wasting, and contributes to a reduction in costs.

- Easier application of technology = involves workers becoming specialists in particular tasks, making it easier to apply technology, e.g. machinery, to specific tasks.

- Increase in skill = workers concentrate on specific tasks, enabling them to become skilled in said tasks. Repeated practice enhances efficiency. Concentrating on what they do best will motivate the workers.

- Increased productivity = specialising in specific tasks results in increased productivity. This will lead to improved living standard of economies.

- Potential higher earnings = specialisation means the worker is exceptional at they're job, allowing them to earn more.

1 - Disadvantages of Division of Labour

- Dependency on others = process of production is divided into separate tasks. Potential danger of one group of workers being held back by another group at a different part of the production process.

- Dependency on technology = danger that technology will take over, and replace workers.

- Frustration, boredom and alienation = reduction in levels of motivation after completing repetitive tasks. Will have a negative effect on worker productivity.

- Over-concentration of particular skills = danger that focusing on certain skills is at the expense of other useful skills that aren't encouraged.

- Unemployment = specialisation is only useful as long as there is demand for their skillset. Danger that if the demand for those skills decreases, workers may be unemployed. Would be fine if workers found alternative employment (frictional unemployment), but if demand for skills applies to the whole industry then it would be difficult for them to find alternative employment.

1 - 3 Fundamental Questions of Production

- What will be produced?

- How will it be produced?

- For whom will it be produced?

1 - Decision-Making in Market Economies

- Market economy = where production and prices are determined by unrestricted competition between privately-owned businesses (not owned by government).

- Producers = main aim is to maximise profits.

- Consumers = main aim is to maximise satisfaction.

- Allocation of resources = determined by demand and supply.

- Very little to no state/government intervention.

1 - Advantages of Market Economies

- Resources allocated through market forces and price mechanism; no need for intervention, so the state can concentrate on other areas, e.g. international diplomacy.

- Producers profit motive = producers encouraged to be more innovative and cost-effective.

- If firms can become more cost-effective then this should lead to lower prices for consumers.

- Will maximise producer and consumer surplus.

1 - Disadvantages of Market Economies

- Public goods (good that is non-excludable and non-rivalrous, e.g. air, streetlights) wouldn't be provided in a market economy, e.g. provision of police and defence forces.

- Merit goods (commodity or service, e.g. education or health services, that serves the public) would be under-produced and under-consumed.

- Demerit goods would be over-produced and over-consumed in a market economy.

- Negative externalities in a market economy, e.g. noise and pollution.

1 - Decision Making in Planned/Command Economies

- Planned/Command Economy = where decisions about resource allocation are made by state or government agencies.

- State/government will own all/most economic resources.

- Prices determined by state rather than price mechanism.

- Aim of production = maximisation of social welfare rather than profit.

1 - Advantages of Planned/Command Economies

- State/government controls all/most economic resources, so decisions are in the interest of the whole society. e.g. more equitable distribution of income/wealth.

- State/government can decide which goods are going to be produced and to whom they are going to be supplied. e.g. banning demerit goods.

1 - Disadvantages of Planned/Command Economies

- System can become very inflexible and and unresponsive to changes in consumer demand.

- Less incentive for firms to be innovative. Profit motive becomes not as important as in a market economy, as a result variety of goods is restricted and products can be of poor quality.

- Majority of firms will be state owned and lack of competition means high level of inefficiency and low level of productivity.

1 - Decision-Making in Mixed Economies

- Mixed economies = economic system where allocation of resource decisions are made by public and private sector.

- Private sector = influenced by self interest.

- Public sector = influenced by public interest.

- Possible competition within the private sector. Public sector will intervene through taxation and regulation.

- Private sector allocation of resources determined by price mechanism.

- Public sector decisions taken by government.

1 - Issues of Transition from a Planned/Command Economy to a Mixed Economy

- Reduction in welfare services = Fall in quality of living due to a lower level of welfare provision, e.g. education, housing and health care.

- Markets = Specialised markets and services needed to be improved, e.g. banking and legal services.

- Inflation = state can no longer control prices in the way it did when it was a planned economy, which kept price levels low. Inflation could rise higher in mixed economy than planned economy. General price levels in an economy could fall, known as deflation.

- Industrial unrest = once state control is reduced, trade unions demand wage rises to match increases in price, backed up by strike action.

- International trade = transitional economies have greater freedom of which countries they wish to trade with. Although, this could imbalance exports/imports, leading to a deficit in the current account of the balance of payments.

- Employment = many workers unable to move from one form of employment to another, so employment increases significantly, leading to a decrease in income.

- Output = Many firms were supported by the government in planned economies, so when it transitioned a number of firms were unable to survive; consequently, output decreases.

1 - Economic Structure

- Primary Sector = extractive activities, e.g. fishing, agriculture, mining/

- Secondary Sector = manufacturing and construction, e.g. building airport runways, producing tv's.

- Tertiary Sector = services, e.g. education, health and financial services.

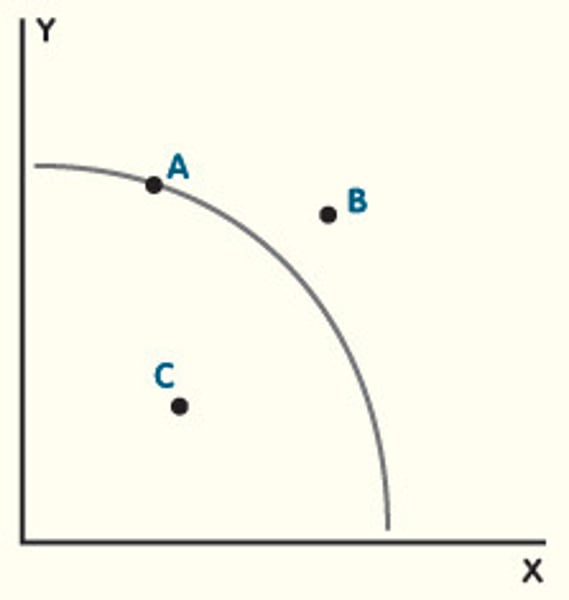

1 - Production Possibility Curves

- PPC joins together different combinations of products that can be produced over a period of time given the existing resources and technology available.

- Can be used to highlight choice and opportunity cost.

- To increase one products output, the other products output needs to decrease.

1 - PPC Diagram

- Origin = 'O'.

- OA (x) = 1 type of output (e.g. agricultural)

- OB (y) = 1 type of output (e.g. industrial)

- OC (x) = 1 type of output (e.g. agricultural)

- OD (y) = 1 type of output (e.g. industrial

1 - Choice Between Consumer Goods and Capital Goods

- Long run = economies need to allocate resources to capital goods, aka investing.

- Potential tradeoff between allocating resources to the production of consumer goods and capital goods = less of one when another is increased.

1 - Microeconomics and Macroeconomics PPC

- Macroeconomics = branch of economics concerned with large-scale or general economic factors, e.g. interest rates and national productivity.

- Microeconomics = branch of economics concerned with single factors and effects of individuals, households and firms decisions and allocation of resources, e.g. how a city decides to spend a government surplus.

- PPC can show extent of unemployment or economic growth within macroeconomics.

1 - Constant and Increasing Opportunity Costs PPC

- PPC's drawn as a curved line due to constant and increasing opportunity costs.

- Increasing amounts of one will need to be sacrificed to produce more of the other.

- If a country focuses more on the production of one good it has to use more resources.

1 - Draw a PPC regarding Industrial and Agricultural Output

1 - Shifts of a PPC

- Can shift to left or right, but the entire curve can also shift.

1 - Causes of a Shift of a PPC to the Right

- Improving technology = making greater use of machinery should enable an economy to produce more, contributing to an increase in labour productivity. Will increase production capacity.

- Introduction of new resources = enhance the possibility of an economy to produce more.

- Increase in supply of labour = increase potential quality of labour available for employment, and productivity.

- Improved management of resources = changes in system of production can increase output.

1 - Ceteris Paribus

- Means "all other things being equal", meaning other factors that could influence the relationship between two variables are assumed to remain constant.

1 - Money

- Anything which is a means of payment.

- Before money, barter was used.

- Barter = number of disadvantages, including it required a double coincidence of wants, difficult to compare value of goods and services exchanged, products may be indivisible.

- Disadvantages of barter brought about money.

1 - 4 Functions of Money

- Medium of exchange.

- Measure of value or unit of account.

- A standard for deferred payment.

- A store of value or wealth.

1 - Characteristics of Money

- Acceptability = needs to be generally accepted in an economy to exchange for goods and services.

- Divisibility = needs to be divided into smaller units so things can be bought and sold.

- Portability = needs to be easily transported for conveniency.

- Durability = needs to be durable if it is going to be accepted.

- Scarcity = needs to be scarce, as if it "grew on trees" it would be worthless.

- Stability of supply = over a long period of time.

- Recognisability = contributes to confidence in it.

- Uniformity = needs to have the same value.

- Stability of value = purchasing power needs to be relatively same, disregarding inflation.

1 - Private Goods

- A product that is both rival (when someone consumes a good its available quantity is decreased for others) & excludable (producer can exclude consumers from using a particular product by charging a price for it).

- Examples include = bike, piece of clothing or food.

1 - Public Goods

- Good that is non-rival and non-excludable.

1 - Free Rider Problem

- A person who has no incentive to pay for the use of a public good because there can be consumption without any payment being made.

- Example = a person standing in a store using their air con but not buying anything.

1 - Non-rejectability

- The idea that certain goods cannot be rejected, such as the police force or the armed forces of a country.

1 - Merit & Demerit Goods

- Merit Goods = products which have positive externalities, which are under-produced and under-consumed in a market economy as a result of imperfect information held by consumers. e.g. education and healthcare.

- Demerit Goods = A product which has negative externalities, and is over-produced and over-consumed in a market economy as a result of imperfect information held by consumers. e.g. cigarettes and alcohol.

1 - Positive and Normative Statements

- Positive = statement based on factual evidence. Objective rather than subjective.

- Normative = statement which involves making a value judgement. Opinion based upon a belief rather than factual evidence. Person expressing judgement has based it on particular norms or values. Subjective rather than objective.

1 - Nature of Economic Activity

- To produce goods and services to provide what we want and need.

- Aim is to become more efficient in order to maximise economic welfare and satisfaction.

1 - Role of Prices in a Free Market Economy

- Three key functions: incentivise, ration and signal.

- If prices rise, consumers ration, aka reduce the amount they are willing and able to buy. This acts as a signal to producers that there is an excess supply in the market (stock stays on the shelves), and thus incentivises suppliers to decrease supply.

1 - Cause of a PPC Shift to the Right

- New technology

- New resources, i.e. gold discovery

- Increased supply of labour, i.e. increased birth rate and migration

- Improved labour force, i.e. education and training

- Better use of labour, i.e. division of labour and specialisation.

- More entrepreneurship

2 - Individual/Effective Demand

- Individual demand for a good or service is the quantity they are willing and able to purchase over a range of prices over a period of time.

- Individual may desire a Ferrari, but because they do not have the money to buy one, they do not have a demand for it.

- Effective demand is the desire for a product backed up with the ability to pay for it.

2 - Market Demand

- Total demand for a particular product in the market.

2 - Law of Demand

- For most goods and services the quantity demanded varies inversely with its price (one decreases/increases as the other decreases/increases).

2 - Demand Curve

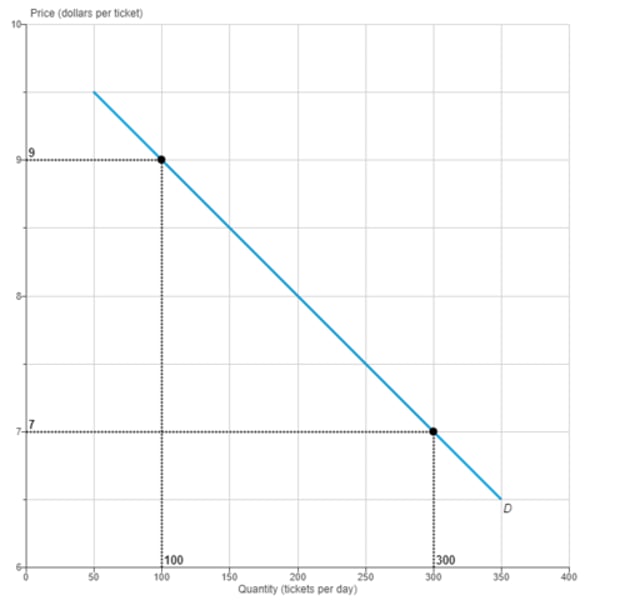

- Demand curve shows the relationship between changes in price and changes in quantity purchased.

2 - Movements of the Demand Curve

- If these change:

1. income

2. Price of other goods

3. Tastes

4. Expectations of future prices

5. Age and gender distribution of the population

6. Distribution of income

Then individuals will be able to purchase more or less at each and every price, causing the demand curve to shift.

2 - Normal and Inferior Goods

- Normal good = a good whose demand rises as income rises and decreases when income decreases. e.g. holidays

- Inferior good = a good whose demand falls as income rises and rises as income falls. e.g. low price 'value' brands.

2 - Substitutes and Complements

- Substitutes = goods that are alternatives for another. e.g. coffee and tea.

- Complements = goods that are consumed together. e.g. fuel and cars.

2 - Determinants of Supply

- Price rises = producers are willing to supply more because they'll gain more profit.

- Likely that cost of production will rise, so it'll be necessary to increase product prices to maintain profit margins.

2 - Law of Supply

- For most goods and services, the quantity supplied will increase as profit increases, and decrease as profit decreases.

2 - Shifts of Supply Curve

- If these change:

1. Costs of production

2. Availability of resources

3. Climate

4. Technology

5. Government regulation

6. Taxes and subsidies

7. Price of other goods that the producer could supply

Then producers are able to offer more or less for sale at each and every price.

- If change enables producers to offer more for sale then the supply curve will shift to the right.

- If they're able to offer less then the supply curve will shift to the left.

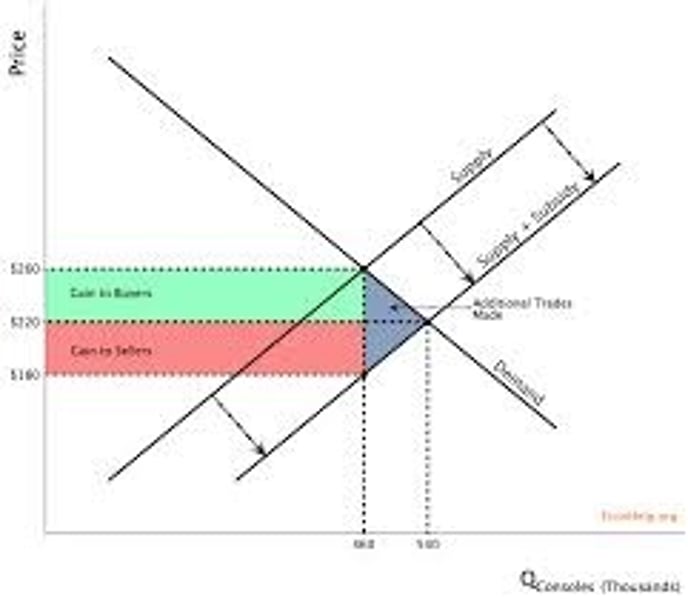

2 - Impact of Taxes and Subsidies on the Supply Curve

- Indirect taxes on subsidies, such as VAT and GST, initially paid by producers but can be passed onto consumers. Increase costs of production so reduce supply.

- Subsidies (payments made by the government to producers to reduce firms costs of production) enable producers to supply more at lower costs.

2 - Movements Along the Supply Curve

- Shows the relationship between price of a good/service and quantity supplied.

- Change in price will result in a movement along the curve.

3 - Market Equilibrium & Disequilibrium

- Equilibrium price and quantity demanded & supplied are given by the intersection of the demand and supply curve.

- If equilibrium is 15c, no price above 15c is an equilibrium because there will always be a surplus, and therefore a tendency for the price to fall. Same logic applies for prices below 15c.

3 - Market Equilibrium Definition

- Price from which there will be no tendency for change given existing conditions of market and supply. It is the price at which demand meets supply.

3 - Market Disequilibrium Definition

- Situation where demand does not equal supply, in which case there will be a tendency for the price to change: to rise if demand is greater than supply, and to fall if supply is greater than demand.

3 - Elasticity of Demand

- Elasticity = responsiveness of demand or supply to a change in one of its determinants.

- Identifies the impact that a change in one variable has on another.

- Relevant to firms deciding pricing policy and tax legislation.

3 - Draw Price Elasticity of Demand Graph

3 - Calculation of Price Elasticity of Demand

- Q1 - Q / Q divided by P1 - P / P

- Percentage change in quantity demanded / Percentage change in price.

3 - 3 Principal Elasticities of Demand

- Price elasticity = if price changes, how much Qd will change?

- Income elasticity = if income changes, how much Qd will change?

- Cross elasticity = if the price of good A changes, how much will Qd of good b change?

3 - Price Elasticity of Demand

- Price elasticity of demand = the responsiveness of demand for a product to a change in price.

- How much does Qd change when there is a change in price? Relevant as if a producer needs to get rid of excess stock they need to know how much he has to reduce his price by in order to increase the quantity demanded to sell surplus stock.

3 - Key Levels for PED

- 0 = Perfectly inelastic PED. Change in price has no effect on Qd. Revenue increases.

- 0-1 = Inelastic PED. Increase in price causes as increase in revenue.

- 1 = Unitary Elastic. Changes in Qd equal a change in price. A change in price causes no change in revenue.

- >1 = Elastic. Change in Qd leads to a change in price. An increase in price causes a fall in revenue.

- Infinity = Perfectly elastic. Fall in price leads to a huge amount bought. Increase in price leads to nothing being bought.

- Demand curve is vertical it looks like the letter I for inelastic.

- PED changes along a straight demand curve. It is usually elastic at the top, unitary in the middle and inelastic in bottom right.

3 - PED and Shifts of the Supply Curve

- Inward shift in supply curve leads to an increase in price for inelastic goods (e.g. petrol) where there are few substitutes.

- For elastic goods, the impact on price is less dramatic.

3 - Determinants of PED

- Availability of substitutes. e.g. PED of petrol is inelastic as there are limited alternatives in the short term.

- Time. e.g. could change power from oil to solar but this takes time.

- Luxury or necessity. Necessity has more elastic PED; luxury need not be purchased, resulting in more elastic PED.

- Proportion of income spent on an item. e.g. if a pen goes up by 20% you might not notice, but if a car did you would.

- Category of product. e.g. food is inelastic as it is a need, but any individual item of food is more elastic as it has substitutes.

3 - PED and the Incidence of Tax

- Incidence of tax = % tax rise that is passed onto the consumer.

- Need to consider: effect on price, quantity sold, tax revenues and employment.

- Tax rise is shown by the vertical distance between the supply curves at Q2, but change in price is the difference between P1 and 2.

3 - Incidence of Tax Effects

- Effect on price = if the change in price is much less than the tax rise, the incidence of tax is said to be low.

- Effect on quantity sold = with inelastic goods, e.g. pharmaceutical drugs, there is little impact on the quantity sold.

- If demand is more inelastic than supply = consumers will have greater incidence of taxation.

- If supply is more inelastic than demand = producers will have greater incidence of taxation.

- Impact on tax revenues = more inelastic PED leads to more tax revenues when taxes increase on the good.

- Impact on employment = more elastic PED leads to bigger fall in employment in those industries when prices rise.

3 - Income Elasticity of Demand (YED)

- Responsiveness of Qd to a change in income.

- YED = % change in Qd / % change in income.

- Usually positive (normal goods)

- Can be negative (inferior goods), e.g. branded goods.

- If >1 income is elastic.

- If <1 income is inelastic.

- With economic growth, elastic goods (travel) will grow more rapidly than income elastic goods.

3 - Cross Elasticity of Demand (XED)

- Responsiveness of changes in Qd for good A to a change in price of good B.

- % change in Qd for good A / % change in price for good B.

- >1 = elastic.

- If positive, goods are substitutes, and the higher the value, the closer they are as substitutes.

- If negative, they are complementary, and the higher the negative value, the more complementary they are.

3 - Price Elasticity of Supply

- Responsiveness of supply to changes in price level.

- % change in Qs / % change in price.

- >1 = elastic

- <1 = inelastic

3 - Factors Affecting PES

- Time = e.g. agricultural markets are inelastic in the short term as they need to plant crops. In the long run they are more elastic.

- Available resources = raw materials are inelastic.

- Availability of stock

- Spare capacity. If there is full capacity it is less elastic.

- Examples of perfectly inelastic supply = road space, building land in a city, seats in a sports venue.

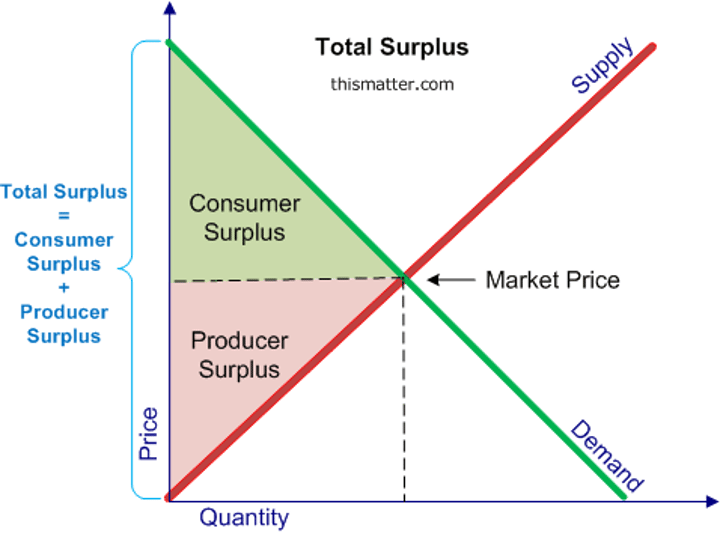

4 - Consumer Surplus

- The difference between the maximum price an individual would pay for a product and the price actually paid.

- Formula = (1/2) x Qd x P(rice)

4 - Consumer and Producer Surplus Graph

4 - Producer Surplus

- Difference between the minimum price a supplier is prepared to accept for a good and the price actually received.

- Way of examining satisfaction that a company gains from selling a good or service. A surplus meaning that they achieve satisfaction above what they would have been prepared to receive.

4 - Information Failure

- Situation where people do not have the full information needed to make informed decisions about their behaviour.

- Imperfection in a market means the product will be produced/consumed but not in the right quantities. e.g. merit/demerit goods. Therefore, there is a misallocation of resources in the market.

5 - Maximum and Minimum Price Controls

- Maximum Price Control = where a maximum price is established in a market below what would have been equilibrium price without government intervention. Make it so that prices aren't able to rise above a maximum price. May be applied to basic foods or rent.

- Minimum Price Control = where a minimum price is established in a market above what would have been equilibrium price without government intervention. Make it so that prices aren't able to fall below a minimum price. May be applied to wages.

5 - Why Taxes Are Used

- To redistribute income in response to circumstances where there is unequal distribution of income.

- To try and change consumer and/or producer behaviour. e.g. merit and demerit goods.

- To raise money to pay for things such as public goods.

5 - Direct Taxes

- Taxes on the income of individuals and firms. Also include taxes on inherited wealth. e.g. income tax, corporation tax and inheritance tax.

5 - Indirect Taxes

- Taxes on goods and services bought, therefore they're taxes on expenditure. e.g. Value Added Tax (VAT), Goods and Services Tax (GST).

5 - Impact and Incidence of Taxes

- Impact of a tax = refers to the person or company on which the tax is levied. i.e. someone will be legally responsible for paying the tax.

- Incidence of a tax = refers to the eventual burden of a tax. e.g. part of the tax could be passed onto the consumer to pay. The more inelastic of demand and the more elastic of supply, the greater the burden will be on the consumer.

5 - Specific and Valorem Taxes

- Indirect taxes take different forms, including:

1. Specific taxes = tax imposed on a product, e.g. petrol, alcohol, tobacco. A specific amount is required to pay in taxation.

2. Ad Valorem taxes = tax which places a percentage rate on a good or services rather than a fixed amount. e.g. sales tax might charge a 20% rate. This is the case with a tax such as VAT.

5 - Average and Marginal Rates of Taxation

- Average rates = refers to the average percentage of total income which is paid in taxation. Also known as the effective rate of tax or the average propensity to pay tax.

- Marginal rates = refers to the proportion of an increase in income that is taken in tax.

5 - Progressive and Regressive Taxes

- Progressive taxes = where the proportion of income paid in tax increases as income increases. It depends on the marginal rate of tax (MRT).

- Regressive = where the proportion of income paid in tax decreases as income increases. If the MRT decreases as income increases, the tax is regressive.

5 - Subsidies

- An amount of money paid by a government to a producer so that the price to the customer will be lower than it otherwise would have been.

- May be used to encourage suppliers to increase production.

5 - Subsidy Graph

5 - Public Goods

- Public goods = goods that, if left to the free market, would not be produced as there is no incentive for the market to allocate resources to their production. e.g. roads.

- Both non-rival (no less once consumed) and non-excludable (producers can't exclude people by charging money for it).

5 - Nationalisation

- Refers to the process by which private sector firms are transferred into public ownership and are owned and controlled in some way by the government.

- Takes place in order to discourage or encourage certain activities, e.g. discouraging indirect taxation and encouraging subsidies.

5 - Advantages of Nationalisation

- Nationalised industry can benefit from economies of scale (proportionate saving of costs gained by an increased level of production), lowering cost and possibly price.

- Can avoid wasteful duplication of resources.

- Easier to control negative externalities and encourage positive externalities.

- Will prevent monopoly by private firm.

5 - Disadvantages of Nationalisation

- May lack incentive to be efficient.

- May lack competitive pressure, such as pressure to be innovative.

- Decisions could be made for political rather than economic reasons.

- State owned firm could still abuse its monopoly power.

5 - Privatisation

- The transfer of ownership from the public sector to the private sector.

- Gov. may transfer ownership in order to increase firm efficiency.

5 - Benefits of Privatisation

- Greater likelihood of economic efficiency.

- Widens the share ownership in an economy, encouraging people to feel a part of the economic system.

- Higher efficiency would lead to an increase in output and decrease in cost, becoming lower prices.

- Increased revenue would play a key role in government's fiscal policy (use of gov. revenue to influence economy).

- Would raise capital to fund future growth rather than rely on the state to finance expenditure.

5 - Disadvantages of Privatisation

- Public sector monopoly could be replaced by a private sector monopoly.

- May be an increased in wasted resources.

- Greater inefficiency may lead to less employment.

- Income from sale of shares is a "one-off" source of income, not one that will bring in revenue on a regular basis.

- Private sector monopoly may lead to a need to introduce a number of regulations to control it, and ensure consumers aren't being exploited, which could limit the ability of the privatised firm to operate.

5 - Market Failure

- When the free market fails to deliver an efficient allocation of resources, resulting in a loss of economic and social welfare.

- Results in productive inefficiency.

5 - Main Types of Market Failure

1. Market Power (monopoly)

2. Positive/Negative Externalities

3. Imperfect Information

4. Public/Quasi-Public Goods Not Supplied

5. Equity (fairness) Issues

6. Immobility of Factors of Production

5 - Problems of Regulating to Remedy Market Failures

1. What is the right level of regulation?

2. Costs of implementing and regulating?

3. Opportunity Cost?

4. Danger of Evasion?

5. Will it drive producers abroad?

6 - Aggregate Demand

- The total value of demand in the economy.

- Consists of:

1. Consumption (C)

2. Investment (I)

3. Government Expenditure (G)

4. Net Exports (X-M)

- AD = C+I+G+(X-M). Any change in these components will shift the curve.

- Price Level = reference investment

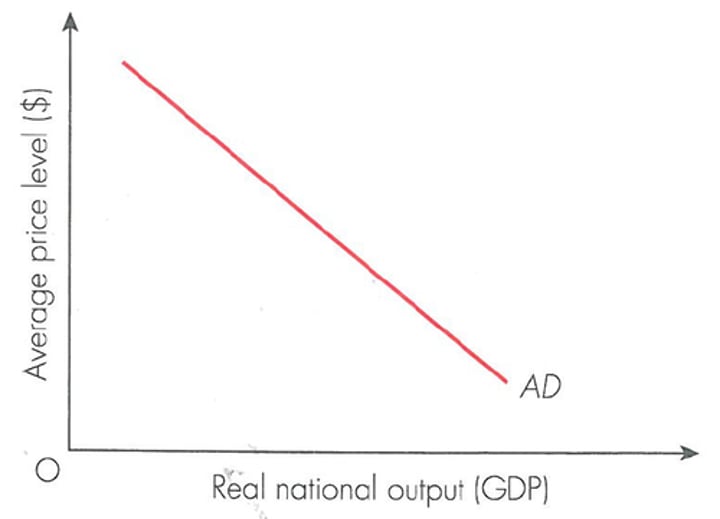

6 - Aggregate Demand Graph

6 - Reasons for Rising Price Levels

1. Nominal Interest Rate = fall in demand for goods and services (decrease in C)

2. Reduction in Cash Purchasing Power (fall in C and I)

3. More Expensive Domestic Goods = fall in exports and increase in imports (fall in X-M)

6 - Aggregate Supply

- The total value of goods and services produced in an economy.

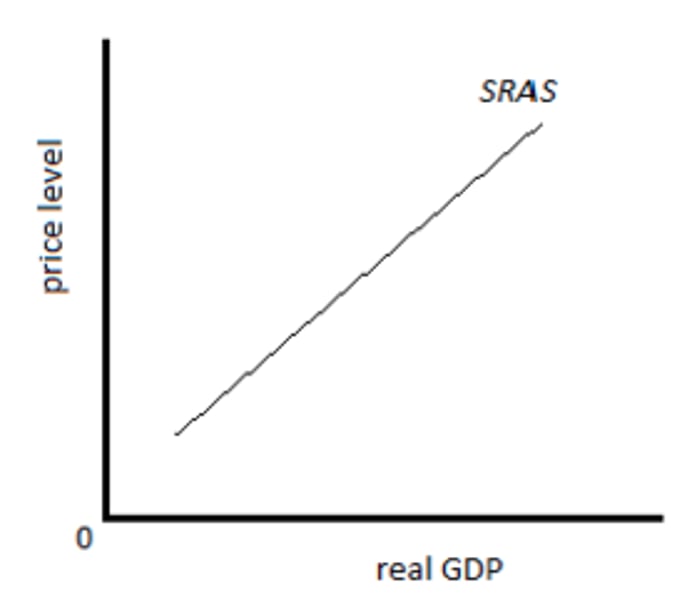

6 - Aggregate Supply Graph

- As prices increase, more will be supplied.

6 - Factors that Affect the SRAS Curve

- Affected by anything that increases a firms cost, including:

1. Wage rates

2. Interest rates

3. Raw material prices

4. Taxes