Chapter 1: Introduction to Managerial Accounting

1/79

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

80 Terms

managerial accounting

focuses on providing information for internal decision makers

it helps managers make decisions needed to be successful

financial accounting

focuses on providing information for external decision makers

managers use financial accounting to report monetary transactions and prepare financial statements

Financial Accounting - primary users

external — investors, creditors, and government authorities

financial accounting - Purpose of information

help investors and creditors make investment and credit decisions

financial accounting - focus and time dimension of the information

relevant and faithfully representative information and focus on the past

financial accounting - rules and restrictions

required to follow Generally Accepted Accounting Principles (GAAP); public companies required to be audited by an independent CPA

financial accounting - scope of information

summary reports prepared primarily on the company as a whole, usually on a quarterly or annual basis

financial accounting - behavioral

concern about adequacy of disclosures; behavioral implications are secondary

managerial accounting - primary users

interal — the company’s managers and employees

managerial accounting - purpose of information

helps managers and employees plan, direct, and control operations

managerial accounting - focus and time dimension of the information

relevant information and focus on the future

managerial accounting - rules and restrictions

not required to follow GAAP

managerial accounting - scope of information

detailed reports prepared on parts of the company (products, departments, territories), often on a daily or weekly basis

managerial accounting - behavioral

concern about how reports will affect employee behavior

Most companies structure their organization along ________.

departments or divisions

organizational chart

a company’s (OC) helps show the relationship between departments and divisions and the managers who are responsible for each section

board of directors

elected by the stockholders and is responsible for developing the strategic goals of the corporation

chief executive officer (CEO)

has ultimate responsibility for implementing the company’s short- and long-term plans

Each position in a company can be classified as either a line or staff position.

line positions are directly involved in providing goods or services to customers

staff positions support the line positions

planning

choosing goals and deciding how to achieve them

strategic planning

involves developing long-term strategies to achieve a company’s goals

operational planning

focuses on short-term actions dealing with a company’s day-to-day operations

directing

involves running the day-to-day operations of a business

controlling

the process of monitoring day-to-day operations and keeping the company on track

The Institute of Management Accountants (IMA) have developed standards that managerial accountants are expected to uphold when faced with ethical challenges

maintain their professional competence

preserve the confidentiality of the information they handle

act with integrity and credibility

if policies do not result in a resolution, IMA recommends discussing ethical situations with:

an immediate supervisor

an objective adviser

an attorney

principles of commitment to ethical professional practice

honesty

fairness

objectivity

responsibility

standards of ethical practice:

competence

confidentiality

integrity

credibility

Competence (CICC):

maintain an appropriate level of professional leadership and expertise by enhancing knowledge and skills

perform professional duties in accordance with relevant laws, regulations, and technical standards

provide decision support information and recommendations that are accurate, clear, concise, and timely, Recognize and help manage risk

Confidentiality (CICC):

keep information confidential except when disclosure is authorized or legally required

inform all relevant parties regarding appropriate use of confidential information. Monitor to ensure compliance

refrain from using confidential information for unethical or illegal advantage

Integrity (CICC):

mitigate actual conflicts of interest. Regularly communicate with business associates to avoid apparent conflicts of interest. Advise all parties of any potential conflicts.

Refrain from engaging in any conduct that would prejudice carrying out duties ethically

abstain from engaging in or supporting any activity that might discredit the profession

contribute to a positive ethical culture and place integrity of the profession above personal interests

Credibility (CICC):

communicate information fairly and objectively

provide all relevant information that could reasonably be expected to influence an intended user’s understanding of the reports, analyses, or recommendations

disclose delays or deficiencies in information, timeliness, processing, or internal controls in conformance with organization policy and/or applicable law

communicate professional limitations or other constraints that would preclude responsible judgement or successful performance of an activity

service companies

sell their time, skill, and knowledge

merchandising companies

resell products they previously bought from suppliers

manufacturing companies

use labor, equipment, supplies, and facilities to convert raw materials into finished products

manufacturing companies have three kinds of inventory:

raw materials inventory (RM)

work-in-process inventory (WIP)

finished goods inventory (FG)

Raw Materials Inventory

includes materials used to make a product

work-in-process inventory

includes goods that are in the manufacturing process but are not yet complete

finished goods inventory

includes completed goods that have not yet been sold

direct cost

a cost that can be easily and cost-effectively traced to a cost object

cost object

anything for which managers want a separate measurement of cost

indirect costs

costs that cannot be easily or cost-effectively traced directly to a cost object

Direct materials (DM)

raw materials used in production

direct labor (DL)

labor of employees working on the products

Manufacturing overhead (MOH)

the indirect product costs associated with production, including:

indirect materials

indirect labor

factory costs for rent, utilities, insurance, etc. (other MOH)

prime costs

combine the direct costs of direct materials and direct labor

conversion costs

combine direct labor with manufacturing overhead

product costs

include the costs of purchasing or making a product

direct materials, direct labor, and manufacturing overhead

period costs

non-manufacturing costs

selling and administrative expenses and other expenses such as taxes and interest

balance sheet:

service companies carry no inventories on their balance sheets

merchandising companies record the cost of inventory purchased as an asset, Merchandise Inventory, on their balance sheet

manufacturing companies keep track of costs using three inventory accounts: Raw Materials Inventory, Work-In-Progress Inventory, and FInished Goods Inventory

Income Statement:

service companies only record period costs such as salaries expense and rent expense

merchandising companies and manufacturing companies report Cost of Goods Sold as the major expense

because a manufacturer makes the product it sells, the calculation of cogs is different for manufacturing companies than for merchandising companies

Cost of Goods Manufactured

the manufacturing costs of the goods that finished the production process in a given accounting period

three calculation steps for COGM

calculate direct materials used

calculate total manufacturing costs incurred during the year

calculate cost of goods manufactured

(Manufacturing) Cost of goods sold represents the _____________ inventory that has been sold.

Finished Goods Inventory

amount used, manufactured, or sold =

beginning balance + additions - ending balance

unit product cost =

cost of goods manufactured / total units produced

business trends that are affecting managerial accounting:

shift toward a service economy

global competition

time-based competition

Enterprise Resource planning (ERP) systems integrate companies’ data

e-commerce allows companies to sell products to customers around the world

Just-in-Time (JIT) Management is an inventory management tool

advances in technology

Total Quality Management (TQM)

a philosophy of continuous improvement in products and processes

it creates a value of cooperation

each step adds value to the end product (aka the value chain)

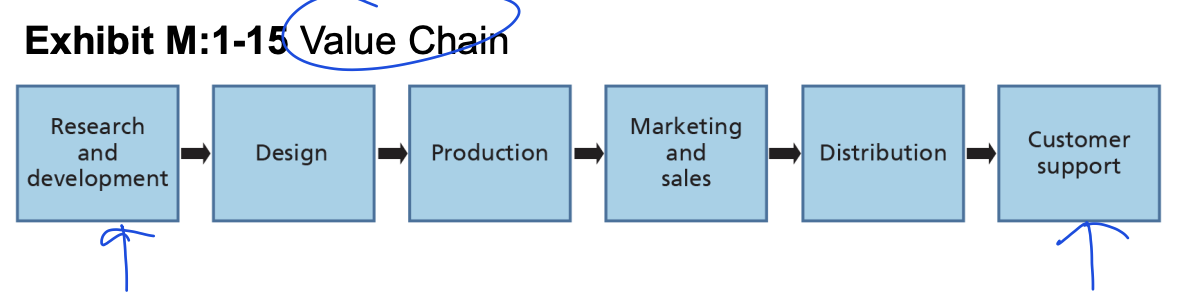

Value Chain

Triple Bottom LIne

the economic, social, and environmental impact of doing business, and includes:

profits

people

planet

customers and stockholders are choosing to support companies based on:

their labor practices, community service, and sustainable environmental practices

how is managerial accounting used in service and merchandising companies?

managers of service and merchandising organizations make decisions on pricing based on cost per service or cost per item

unit cost per service =

total operating costs / total number of services provided

unit cost per item =

total cost of goods sold / total number of items sold