SCM Class 10 - Planning Supply Strategies

1/18

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

19 Terms

scm broad activities carried out by organizations

§Analyze sourcing opportunities

§Develop sourcing strategies

§Select suppliers

§Procure goods and services

§Measure and manage suppliers

global sourcing

competing against world class organizations

global competition needs global sourcing

consider where and when goods/ services are needed

information systems

performance impact

affecting way company performs

quality: performance, features, reliability, conformance, durability, serviceability, perceived quality

delivery: right quantity, right time, right place

price

Cost of Goods Sold- COGS

(Financial Performance)

The purchased cost of goods from outside suppliers

Merchandise Inventory

A balance sheet item that shows the amount a company paid for the inventory it has on hand at a particular point in time

Profit Margin

The ratio of earnings (profit) to sales (revenue) for a given time period

Profit Leverage Effect

decreasing the money spent on purchasing functions increases profit FASTER than increasing revenue as a result of marketing and sales

every $1 saved in purchasing, lowers COGS by $1 and contributes directly to bottom line profits

% COGS FORMULA

PERCENT COST OF GOODS SOLD

percent of sales

need to know to calculate profit leverage effect

NEED TO MEMORIZE

(COGS/ SALES REVENUE)X 100

PRETAX PROFIT MARGIN FORMULA

Pretax Profit Margin Percentage

percent of sales

need to know to calculate profit leverage effect

NEED TO MEMORIZE

= (PRETAX PROFIT / SALES REVENUE) x 100

When Purchasing/Procurement reduces COGS by a quantity or percentage the money saved increases Pretax Profit by the same amount

§EXAMPLE: Reducing COGS by $10 increases Pretax Profit by $10

§EXAMPLE: COGS = $100. Reducing COGS by 10%, reduces COGS by:

• $100 x 0.1 = $10, which increases Pretax Profit by $10

Question: When saying if purchasing/procurement reduces COGS by $30 M what are the NEW PRETAX EARNINGS

reducing cogs will go directly increase pretax earnings

NEW PRETAX EARNINGS FORMULA: Original Pretax Earnings + Amount reduced by COGS

Question: When saying if purchasing/procurement reduces COGS by 1%, what are the NEW PRETAX EARNINGS

need to find 1% of Original COGS

COGS Amount (1%)

NEW PRETAX EARNINGS FORMULA= Original Pretax Earnings + Amount reduced by COGS

Strategic Sourcing

Identifying ways to improve long-term business performance by better understanding sourcing needs, developing long-term sourcing strategies, selecting suppliers, and managing the supply base.

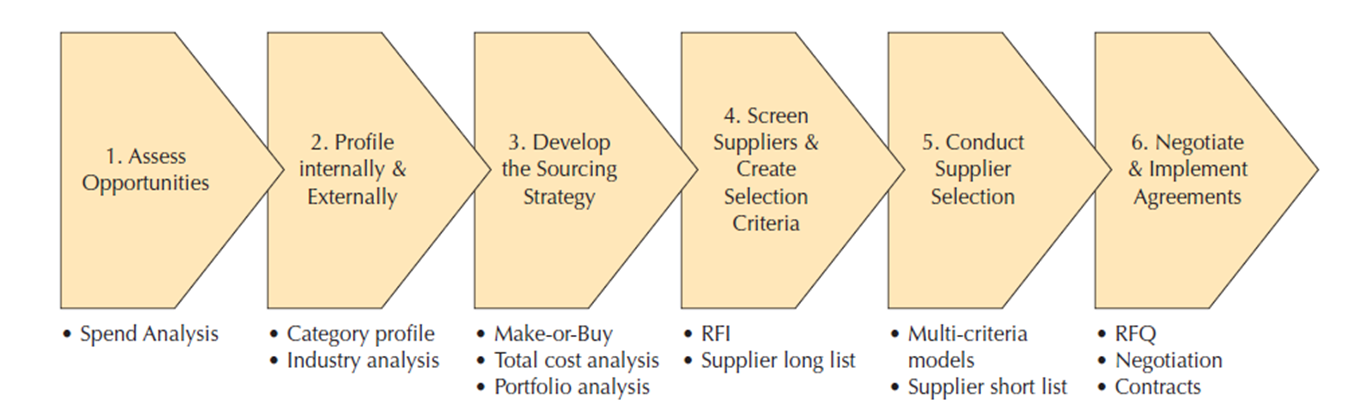

Step 1 in Strategic Sourcing

Assess Opportunities

Spend Analysis

Pareto Chart: Impt categories graphically descending order

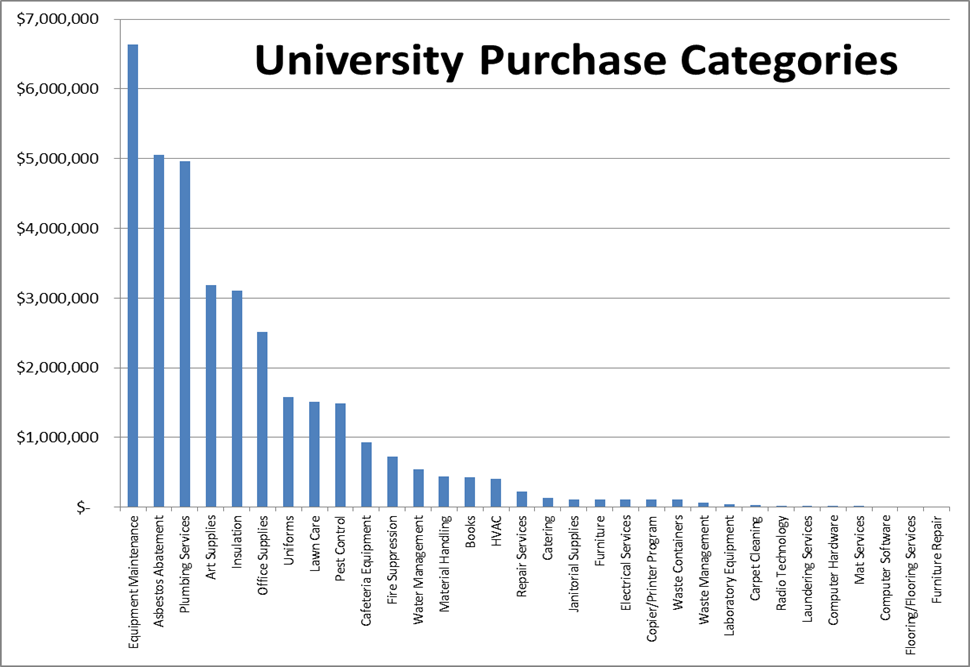

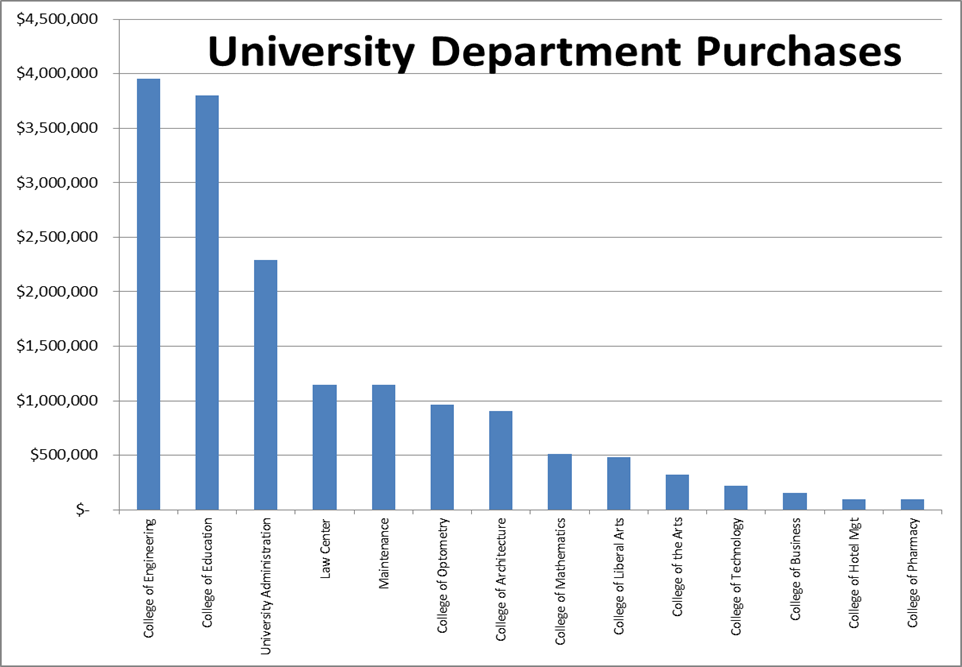

Spend Analysis

Strategic sourcing STEP 1(assess opportunities)

Applying quantitative techniques to purchasing data to BETTER UNDERSTAND SPENDING PATTERNS and IDENTIFY OPPORUTNITIES FOR IMPROVEMENT

Purpose: determine where efforts to change purchasing practices will have most influence

Pareto Chart

step 1 in strategic sourcing (assess opportunities)

visualizing important categories

graphically orders categories of numerical data in DESCENDING ORDER

lets most important categories be more recognized

Step 2 in Strategic Sourcing

Profile Internally and Externally

Category Profile

Industry Analysis

Internal Category Profile

Strategic Sourcing Step 2

understanding all aspects of sourcing category that can have impact on sourcing strategy

break down categories of purchasing into more detail

identify where problems occur internally

MAVERICK SPENDING: unauthorized, off contract purchases (purchases from non qualified spenders/ bypass purchasing procedures)

External Industry Analysis

Strategic Sourcing Step 2

Profiling major forces and trends that are impacting industry (pricing, competition, regulatory forces, substitution, technology changes, supply/demand)

maintain visibility of global political and regulatory policies

tracking trends in commodity and supply pricing

monitoring market, customer, and competitor trends