Equity Valuation in IM Exam 2

1/101

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

102 Terms

Equity Valuation

Process of determining a stock's intrinsic value.

Dividend Discount Model

Valuation method using expected dividends and discount rate.

Price-Earnings Ratio

Valuation ratio comparing a company's share price to earnings.

Free Cash Flow Analysis

Evaluation of cash generated after capital expenditures.

Holding Period Return

Total return from holding an investment over time.

Required Rate of Return

Minimum return expected from an investment.

CAPM

Model to determine required return based on risk.

Intrinsic Value

True value of an asset based on fundamentals.

Market Price

Current trading price of a stock in the market.

Book Value

Net worth of equity calculated from balance sheet.

Liquidation Value

Net amount from selling assets after debts.

Replacement Cost

Cost to replace a firm's assets with new ones.

Earnings Yield

Earnings per share divided by stock price.

Dividend Yield

Annual dividends per share divided by stock price.

Capital Gains Yield

Rate of price appreciation of an investment.

HPR Formula

HPR = (E(P1) - P0 + E(D1)) / P0.

E(D1)

Expected dividends for the next period.

E(P1)

Expected stock price in the next period.

k (Market Capitalization Rate)

Expected return based on risk-free rate and beta.

V0

Present value of expected future cash flows.

Underpriced Stock

When intrinsic value exceeds market price.

Overpriced Stock

When market price exceeds intrinsic value.

Dividend Discount Model (DDM)

Valuation method using future dividend present value.

Intrinsic Value

Present value of expected future cash flows.

Constant-Growth DDM

Assumes dividends grow at a constant rate.

Stable Growth Formula

Dt = D0(1 + g)t for dividends.

Intrinsic Value Equation

V0 = D0(1 + g) / (k - g).

No-Growth Stock

Valued like a perpetuity with D1.

Holding Period Return

Sum of dividend yield and capital gains yield.

Discounted Cash Flow Formula

k = D1/P0 + g for expected return.

Market Capitalization Rate (k)

Required return based on risk and growth.

Beta (β)

Measure of stock's risk relative to market.

Risk-Free Rate (rf)

Return on risk-free investments, e.g., treasury bonds.

Market Risk Premium

Expected return above risk-free rate.

Expected Dividend (D1)

Next period's dividend payment.

Growth Rate (g)

Rate at which dividends are expected to grow.

Price-Earnings Ratio

Valuation ratio comparing company's share price to earnings.

Free Cash Flow Analysis

Evaluates cash generated after capital expenditures.

Multi-Stage DDM

Used when growth rates change over time.

Dividend Yield

Annual dividend payment divided by stock price.

Capital Gains Yield

Rate of price appreciation of the stock.

Expected Rate of Return

Anticipated return on investment based on DCF.

Valuation Implications

Factors affecting stock value based on dividends.

E(r)

Expected return on an investment.

P0

Current price of a stock.

g

Growth rate of dividends or earnings.

k

Required rate of return on investment.

PV

Present value of future cash flows.

DDM

Dividend Discount Model for valuing stocks.

Payout Ratio

Fraction of earnings paid as dividends.

Plowback Ratio

Fraction of earnings retained for reinvestment.

ROE

Return on equity; earnings to book value ratio.

NPV

Net present value; difference between cash inflows and outflows.

PVGO

Present value of growth opportunities for a firm.

Two-stage DDM

Model for valuing firms with temporary high growth.

High-growth period

Initial phase with rapid growth and low payout.

Constant-growth DDM

Model for valuing firms with stable growth.

E1

Earnings per share in the next period.

D1

Dividends per share in the next period.

b

Fraction of earnings retained (plowback ratio).

bnew

New plowback ratio for growth assessment.

k - g

Difference between required return and growth rate.

PNo Growth

Price when no growth occurs; all earnings paid out.

PV(No-Growth Scenario)

Present value when firm does not reinvest earnings.

Example of PVGO

Illustrates calculation of present value of growth opportunities.

PVGO

Present Value of Growth Opportunities.

P0

Current stock price of a firm.

PNo Growth

Price of a firm without growth.

E1

Expected earnings per share next year.

ROE

Return on Equity, profitability measure.

b

Retention ratio, portion of earnings retained.

P/E Ratio

Ratio of stock price to earnings per share.

PEG Ratio

P/E ratio divided by growth rate.

Free Cash Flow Analysis

Assessment of cash generated by operations.

Dividend Discount Model

Valuation method based on expected dividends.

Investment Policy Change

Adjustments made to improve firm value.

Price-Earnings Multiple

Stock price divided by earnings per share.

Growth Opportunities

Potential for future earnings increase.

Riskier Firms

Companies with higher uncertainty in returns.

Perpetuity

Constant cash flow indefinitely.

Market Price

Current trading price of a stock.

P/E Ratio

Price per share divided by earnings per share.

DDM

Model valuing stock based on predicted dividends.

Earnings Management

Manipulating accounting rules to influence profitability.

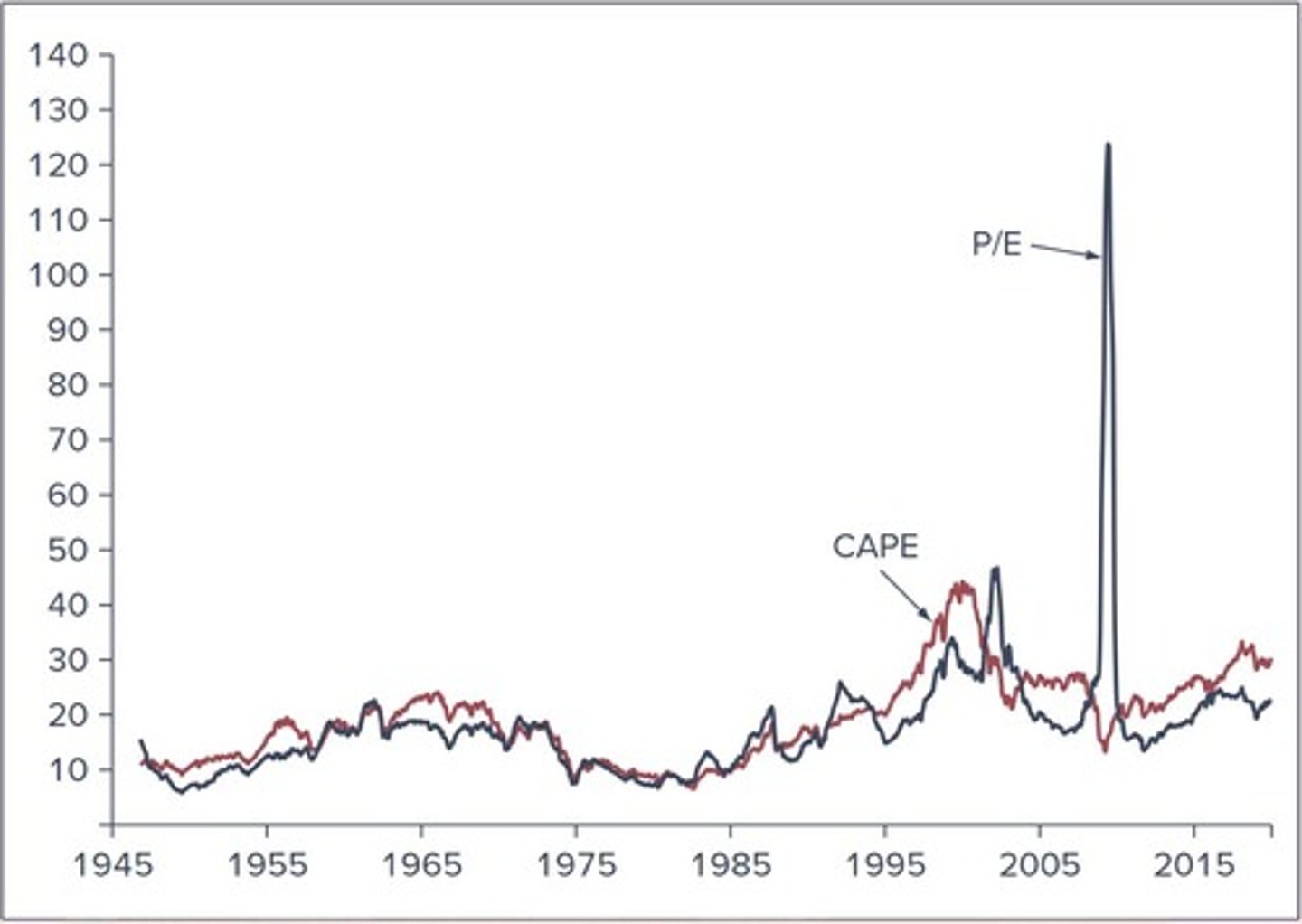

CAPE

Cyclically adjusted P/E ratio for long-term earnings.

Price-to-Book Ratio

Market value compared to firm's book value.

Price-to-Cash Ratio

Valuation based on cash flow, not earnings.

Price-to-Sales Ratio

Valuation for firms without earnings, like startups.

Free Cash Flow

Cash available after capital expenditures.

FCFF

Free cash flow for the firm calculation.

EBIT

Earnings before interest and taxes.

WACC

Weighted average cost of capital for discounting.

Discounted Cash Flow (DCF)

Valuation method using future cash flows.

FCFE

Free cash flow available to equityholders.

Market Cap Rate

Required return on equity investment.

Net Working Capital (NWC)

Current assets minus current liabilities.

Growth Rate (g)

Expected rate of growth in cash flows.

Imprecise Inputs

Sensitivity of DCF models to small changes.

Investment Opportunities

Potential projects with positive net present value.

Profit Margins

Difference between revenue and costs.