AUDIT

1/236

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

237 Terms

What is a non-issuer and issuer?

Non-issuer = private

AICPA SAS, ASB

Issuer = public

PCAOB AS

Meaning/responsibility for the following terms:

- Must or Is required

- Should

- May, might, could

• “Must” or “is required”: unconditional requirement

• Should: presumptively mandatory requirement

• “May”, “might”, and “could”: a recommendation

Purpose of an audit

To provide financial statement users with an opinion on whether the financial stmts are presented fairly with GAAP (or their framework)

What should an auditor do to obtain reasonable assurance during an audit?

Plan the work and properly supervise any assistants

What order are the sections in for an unmodified opinion for nonissuers?

1. Opinion

2. Basis for Opinion

3. Management’s Responsibility

4. Auditor’s Responsibility

What is the Opinion section for nonissuers?

• States the framework

• Info: fin stmt titles, periods covered, and nature of the engagement

• GAAP

What is the Basis for Opinion section for nonissuers?

• States that the auditor is required to be independent

• States whether the auditor believes that sufficient evidence has been obtained to form an opinion

• GAAS (PCAOB)

What is the Management’s Responsibility section for nonissuers?

States the framework again

GAAP

What is the Auditor’s Responsibility section for nonissuers?

• Where the opinion/judgement is

• Where they evaluate the entity’s ability to continue as a going concern

• GAAS (PCAOB)

What order are the sections in for an unqualified opinion for issuers?

1. Opinion

2. Basis for Opinion

3. Critical Audit Matters (required)

What does the Critical Audit Matters section for an issuer need to make a reference to?

The opinion should make a reference to PCAOB and GAAP

What is a Disclaimer of Opinion?

From Audit Issues

Disclaimer:

Material and pervasive.

Due to:

• Time constraints

• Inability to obtain sufficient appropriate audit evidence (such as):

• Inability to observe or confirm

• Inadequacy of accounting records

• Refusal of client’s attorney to respond to inquiry (this is a SCOPE LIMITATION)

• Refusal of management to provide acknowledgment for their responsibility to present fairly with GAAP

• Not independent

What is a Qualified Opinion (due to Audit Issues)?

Material but not pervasive.

Due to:

• Time constraints

• Inability to obtain sufficient appropriate audit evidence (such as):

• Inability to observe or confirm

• Inadequacy of accounting records

• Refusal of client’s attorney to respond to inquiry (this is a SCOPE LIMITATION)

What is a Qualified Opinion (due to Fin Stmt Issues)?

Material but not pervasive.

Due to:

• Inappropriate accounting principles

• Unreasonable estimates

• Inadequate disclosures

• Including related party transactions

• Incorrect numbers

• No reasonable justification for change in accounting principles

What is an Adverse Opinion?

Financial statement issue.

Material and pervasive.

Due to:

• Inappropriate accounting principles

• Unreasonable estimates

• Inadequate disclosures

• Including related party transactions

• Incorrect numbers

• No reasonable justification for change in accounting principles

What is an “except for” opinion?

“Except for opinion”: a qualified opinion that says the fin stmts are a fair representation of of their financial position, except for a specific issue described in the report

What % would generally be considered material and pervasive?

15%

(This isn’t a hard number but its what they generally use)

What are the contents for a nonissuer for the Emphasis-of-Matter Paragraph?

Contents/Info:

• No specific location

• Material justified change in accounting principle

• Change in audit opinion

• Special Purpose framework

What are the contents for a nonissuer for the Other-Matter Paragraph?

Contents/Info:

• Change in audit opinion

• Prior fin stmts audited by prior auditor and prior auditor’s report is not presented

• Comparative fin stmts where the current year is audited and prior year is not

• Restrict use of report

• Report on compliance in auditor’s report

What are the contents for an issuer for the Explanatory Paragraph?

Contents/info:

• AFTER the Opinion Paragraph

• Material justified change in accounting principle

• Change in audit opinion

• Prior fin stmts audited by prior auditor and prior auditor’s report is not presented

• Comparative fin stmtswhere the current year is audited and prior year is not

• Reference to other info required when issues with info

• Report on supplementary info w/in auditor's report

• Reference to supplementary info required when issues with info

• Special purpose framework

• Restrict use of report

• Going concern when substantial doubt is not alleviated (this is an unqualified opinion)

• Report on compliance in auditor’s report

What are recognized subsequent events?

Events that provide additional info about conditions that existed AT the balance sheet date.

What are nonrecognized subsequent events?

Events that occurred AFTER the balance sheet date and did not exist at the balance sheet date.

They should consider disclosing it though.

What procedures should be performed to evaluate subsequent events?

Procedures done for subsequent events (PRIME)?

• Post balance sheet transactions (changes in stock or LT debt after year end)

• Representation letter (about subsequent events)

• Inquiry (legal counsel and mgmt)

• Minutes

• Examine (prior stmts vs current)

What are the special purpose frameworks?

• Cash

• Tax

• Regulatory basis

• Contractual basis

• Other basis

(aka accrual is the only non-special one?)

What all is in an engagement letter?

Addressee

Objective and scope of audit

Responsibility of the auditor

Resp. of mgmt

Other relevant info

Reporting

Signature

Does the client have to give the new auditor consent to contact the previous auditor?

Yes

What can the new auditor ask the previous auditor about?

Management integrity

Disagreements with management

The reason for the change in auditor

Any fraud, noncompliance, and internal control matters related to communications

Nature of entity’s relationships and transactions with related parties and significant unusual transactions

What are the unacceptable reasons for a change in auditor?

The client refused to allow correspondence with legal counsel

The client refuses to provide a signed representation letter

The auditor should consider withdrawing from the engagement if so ^^

basically the client is refusing correspondence/a letter

Elements of Quality Control: Human Resources

Assign personnel to the engagement

Professional development

Performance eval, compensation, advancement

Elements of Quality Control: Engagement/Client Acceptance and Continuance

Accept or continue relationship?

Policies should give reasonable assurance that the client’s mgmt doesn’t lack integrity and that the firm can be independent

Elements of Quality Control: Leadership Responsibilities

Firm leadership bears ultimate responsibility for the firm’s quality control system

Elements of Quality Control: Performance of the Engagement

Provides means to resolve differences in opinion

Consultation with experts

Proper supervision and work is appropriately reviewed

Keep the info safe

Elements of Quality Control: Monitoring

Ongoing eval of the quality control system

Having a 2nd partner or “wrap up” to review work of other person (only required for issuers)

Peer review

Elements of Quality Control: Ethical Requirements

Maintenance of independence

Helps maintain public confidence in the profession

What are the elements of Quality Control?

Human resources

Engagement/Client acceptance and continuance

Leadership responsibilities

Performance of the engagement

Monitoring

Ethical requirements

HELP ME

What are the differences between the quality control standards and GAAS?

Quality control standards:

Applies to all professional activities of the firm

HELPME

GAAS:

Applies to each individual engagement

Engagement process:

Acceptance

Assess risk and plan response

Perform procedures and obtain evidence

Form conclusions

Reporting

What is the report release date?

Often the date on which the report is delivered to the client. (usually the same date as the audit report)

(Date on which the auditor grants the client permission to use the report)

What is are the document retention requirements?

Nonissuers: documents need to be retained for at least 5 years

Issuers: documents need to be retained for at least 7 years

According to PCAOB standards, the documentation completion date is fourteen days following the report release date (for an issuer)

What goes in the permanent/continuous file and current file?

Permanent/continuous:

Pension plans

Multi-year leases

Minutes of board meetings

Stock options

Articles of incorporation

Current:

Bank recs

Statement of earnings

The audit plan

What goes in the current file?

Typically just for the year under audit

Bank recs

Statement of earnings

The audit plan

At completion of the audit, who has ownership of the working papers?

The CPA firm/auditor!

Client owns the evidence only.

Internal control categories

ORC:

Effectiveness and efficiency of operations

Reliability of financial reporting (most relevant objective for audit)

Compliance with applicable laws and regulations

What are the five components of internal control (COSO)?

Control environment

Risk assessment

Information and communication systems

Monitoring

Existing control activities

CRIME!

COSO: Control Environment

Component: Control environment (is the foundation for the other components)

Description: Sets the tone of the organization (tone at the top)

Key Points:

Integrity

Competence

Participation of those charged with governance

Mgmt philosophy

Org structure

Assignment of responsibility

HR policies

COSO: Risk assessment

Component: Risk assessment

Description: Identification by mgmt of risks relevant to the prep of the fin stmts.

Key Points: Changes or anything new!

COSO: Information and communication systems

Component: Information and communication systems

Description: Methods used to classify and report roles and responsibilities.

Key Points:

Initiating, authorizing, recording, processing, and reporting entity transactions, conditions and events

Communicating roles and responsibilities

COSO: Monitoring

Component: Monitoring

Description: Procedures established to assess the quality of control performance over time.

Key Points:

Internal audit function

Regular mgmt and supervisory activities

Other procedures such as mailing customer statements

COSO: Existing control activities

Component: Existing control activities

Description: Policies and procedures established to ensure that mgmt objectives are carried out.

Key Points:

Authorization

Segregation of duties

Safeguarding of assets

Asset accountability

Technology

Deploying policies and procedures (esp. with IT)

Components and principles of the COSO framework/internal control:

Control Environment

Control environment (EBOCA):

E: commitment to ethics and integrity

B: board independence and oversight

O: organizational structure

C: commitment to competence

A: accountability

Components and principles of the COSO framework/internal control:

Risk Assessment

Risk assessment (SAFR):

S: specify objectives

A: identify and assess change

F: consider potential for fraud

R: identify and analyze risks

Basically anything new is a risk!!

Components and principles of the COSO framework/internal control:

Information and communication

Information and communication (OIE):

O: obtain and use info

I: internally communicate info

E: communicate with external parties

Components and principles of the COSO framework/internal control:

Monitoring Activities

Monitoring activities (SOD):

SO: ongoing and/or separate evaluations

D: communication of deficiencies

1st step is establishing a baseline!

Components and principles of the COSO framework/internal control:

(Existing) Control Activities

(Existing) Control Activities (CATP):

CA: select and develop control activities

T: select and develop technology controls

P: deployment of policies and procedures

What functions should not be combined with a good segregation of duties?

ARC:

Authorization

Record keeping

Custody of related assets

What phase will the auditor discuss timing of audit procedures with management?

Planning phase

What is the audit strategy?

Audit strategy: An outline that sets the scope, timing, and directions of the audit

What are the two categories for audit procedures? DELETE ME

Risk assessment procedures: used to obtain understanding of the entity.

Further audit procedures

Substantive procedures (required): to detect material misstatements

Test of controls (if applicable): to evaluate operating effectiveness of controls

Assertions for Financial Statements (COVERUP) :

Completeness

All account balances, transactions, and disclosures that should’ve been recorded and included in the fin stmts

Assertions for Financial Statements (COVERUP):

Cutoff (O)

Transactions have been recorded in the correct accounting period

Assertions for Financial Statements (COVERUP):

Valuation, allocation, and accuracy

Account balances, transactions, and disclosures are recorded and described fairly and measured at appropriate amounts and any resulting valuation or allocation adjustments are appropriately recorded

Assertions for Financial Statements (COVERUP):

Existence and occurrence

Account balances exist and transactions that have been recorded and disclosed have occurred and pertain to the entity

Assertions for Financial Statements (COVERUP):

Rights and obligations

The entity holds or controls the rights to assets, and liabilities are the obligations of the entity

Assertions for Financial Statements (COVERUP):

Understandability of presentation and classification (UP)

Transactions have been recorded in the proper accounts and appropriately aggregated or disaggregated. Financial information is appropriately presented and described, and disclosures are clearly expressed and understandable in the context of the applicable financial reporting framework

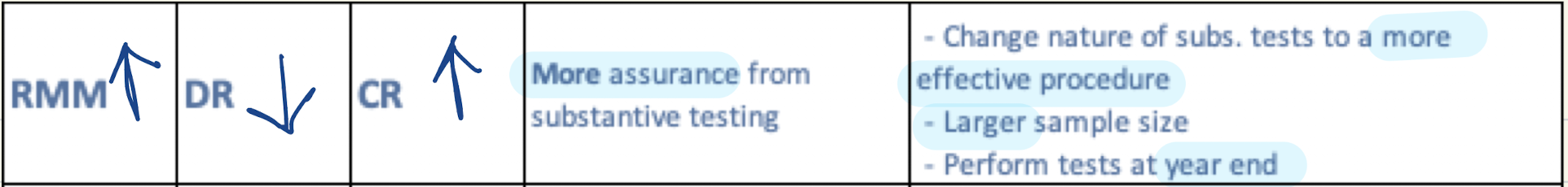

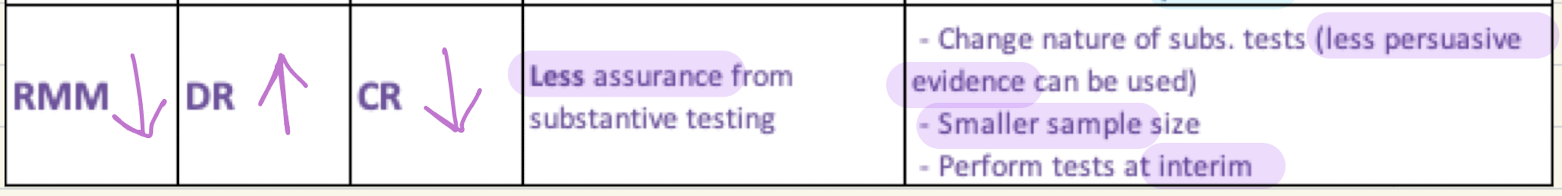

If risk of material misstatement increases, what does detection risk do?

Detection risk decreases, control risk increases

If risk of material misstatement decreases, what does detection risk do?

Detection risk increases, control risk decreases

What is Audit Risk (AR)?

Audit risk: risk that auditor may unknowingly fail to appropriately modify the opinion on fin stmts that are materially misstated

What is Inherent Risk (IR)?

Inherent risk: the susceptibility that an error or omission will occur in a financial statement due to a factor other than a failure of control

What is Control Risk (CR)?

Control risk: risk that a material misstatement will not be prevented or detected (and corrected) on a timely basis by the entity’s system of internal control

What is Detection Risk (DR)?

Detection risk: risk that the auditor will not detect a material misstatement that exists in a relevant assertion

Does sample size have a direct or inverse relationship with control risk (CR)?

Direct relationship (ie, CR decreases, sample size decreases)

What is fraudulent financial reporting?

Involves intentional misstatements or omissions of amounts/disclosures in the fin stmts, usually involves management

What is misappropriation of assets?

Involves theft of an entity’s assets when the theft causes the fin stmts to not be presented in conformity with GAAP, usually involves individuals among mgmgt, employees, or third parties

May involve stealing assets or causing an entity to pay for something that has not been received

Fraud risk factors:

Incentives/pressures

A reason to commit fraud

Examples:

excessive pressure for mgmt to meet aggressive goals

Fraud risk factors:

Opportunity

A lack of effective controls

Examples:

Weak controls over cash, like no locks on cash registers

Fraud risk factors:

Rationalization/Attitude

An attempt to justify the fraudulent behavior

What is the purpose of risk assessment?

To identify and assess the risks of RMM and make informed judgements about other audit matters

What are the risk assessment procedures?

Obtain understanding of the entity and its environment (and their internal control)

Inquire of the audit committee, mgmt, and others about RMM

Perform analytical procedures to find inconsistencies or unusual transactions/events

Perform substantive procedures or tests of controls concurrently with risk assessment procedures

What is the objective of analytical procedures?

To identify unusual transactions, events, etc. that might be significant

What do analytical procedures often involve?

Comparing the current year to the prior year

Comparing current year to budget

Ratios to prior year or industry

What is the sequence of a typical business cycle?

Options: contractionary, expansionary, peak, trough

Expansionary phase

Peak of economic activity

Contractionary phase

Trough of economic activity

What are leading indicators?

They tend to predict economic activity and change before the economy starts to follow a trend.

Examples:

average weekly unemployment insurance claims

interest rate spreads

S&P 500 stock index

What are coincident indicators?

Change at approximately the same time as the whole economy and provide information about the current state of the economy.

Examples:

industrial production

GDP

What are lagging indicators?

Tend to follow economic activity and after a trend has already started, used to confirm or dispute previous forecasts.

Examples:

Average prime rate from banks

Average duration of employment

Inventories to sales ratios

What are detective controls?

Used to provide assurance that errors or irregularities are discovered and corrected on a timely basis (like bank recs)

Documentation that the auditor can use

FIND:

flowchart

internal control questionnaire or checklists

narrative

documentation from the client

How much assurance does a strong system of internal control provide?

Only reasonable assurance (not absolute)

What are financial statement level risks?

Risks that relate pervasively to the fin stmts as a whole and potentially impact many individual assertions

What are assertion level risks?

Risks of RMM that do not relate pervasively to the fin stmts but rather to specific transactions, balances, or disclosures

What may the auditor do in overall response to fin stmt level risk?

communicate to the audit team an increased need to professional skepticism

assign staff with more experience or specialized skills

change the nature, extent, or timing of direction and supervision of the engagement team members

incorporate a greater level of unpredictability into the audit

make changes to the overall audit strategy

What is the substantive approach?

The auditor assesses the RMM but excludes the effects of internal controls.

Control risk is assessed at a maximum (because):

there are no effective controls relative to the specific assertion

the controls aren’t operating effectively

the risk for the assertion may b e addressed by performing only substantive procedures

When are tests of controls required?

Situations in which a significant amount of info is being recorded/handled

When an entity conducts its business using information technology (IT), and it is maintained only through the IT system

What is the combined approach?

Control testing and substantive testing

What are dual purpose tests?

Test of controls and a test of details

When are test of controls performed?

The controls are operating effectively (based on auditor’s assessment) or when the substantive procedures alone are insufficient

What is the Nature of Tests of Controls (NET)? (it is also the most accurate and complete list of walkthrough procedures)

Inquiries, observation, inspection, re-performance

Inquiries: this alone is not sufficient

Observation: generally pertinent only at the time the observation is made, so it is supplemental to other procedures

If the operating effectiveness can’t be evidenced by documentation, what would the auditor rely on?

Inquiry and observation

What procedures test design effectiveness?

inquiries

observation

inspection

What procedures test operating effectiveness?

inquiries

observation

inspection

reperformance (used exclusively for this)

How often does operating effectiveness need to be retested?

Every 3 years if no controls have changed (current period if they have changed)

Are substantive auditing procedures required in either the fin stmt audit or the audit of internal control?

They are only required in the fin stmt audit