Macroeconomics Chapter 15

1/36

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

37 Terms

The demand-for-money curve illustrates the __________ relationship between the quantity demanded of money and __________.

A.

inverse; the interest rate

B.

direct; GDP.

C.

direct; the interest rate

D.

inverse; GDP

A.

inverse; the interest rate

If the interest rate increases, the opportunity cost of holding money __________, and the quantity demanded of money __________.

A.

does not change; does not change

B.

increases; also increases

C.

decreases; increases

D.

increases; decreases

E.

decreases; also decreases

D.

increases; decreases

As the interest rate falls, the quantity

A.

demanded of money falls.

B.

demanded of money rises.

C.

supplied of money rises.

D.

supplied of money falls.

B.

demanded of money rises.

If the interest rate is below the equilibrium interest rate, then the quantity __________ of money exceeds the quantity __________ of money, and there is a __________ of money.

A.

supplied; demanded; shortage

B.

supplied; demanded; surplus

C.

demanded; supplied; shortage

D.

demanded; supplied; surplus

C.

demanded; supplied; shortage

A general definition of the "transmission mechanism" is: the routes or channels that ripple effects created in the

A.

market for goods and the services travel to affect the money market.

B.

money market travel to affect the market for goods and services.

C.

labor market travel to affect the market for goods and services.

D.

market for goods and services travel to affect the labor market.

E.

none of the above

B.

money market travel to affect the market for goods and services.

Which best describes the Keynesian transmission mechanism when the money supply increases?

A.

The interest rate rises; this in turn reduces investment spending, which in turn raises total expenditures and shifts the AD curve rightward.

B.

The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve leftward.

C.

The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve rightward.

D.

The interest rate falls; this in turn stimulates investment spending, which in turn lowers total expenditures and shifts the AD curve leftward.

C.

The interest rate falls; this in turn stimulates investment spending, which in turn raises total expenditures and shifts the AD curve rightward.

According to the Keynesian transmission mechanism, an increase in the money supply will __________ the interest rate, causing a __________ in investment, which then __________ Real GDP.

A.

raise; fall; raises

B.

raise; rise; lowers

C.

raise; fall; lowers

D.

lower; fall; lowers

E.

lower; rise; raises

E.

lower; rise; raises

The Keynesian transmission mechanism might get blocked if

A.

investment is insensitive to changes in interest rates.

B.

the goods market is not in equilibrium.

C.

the money supply increases too quickly.

D.

interest rates are too high before they fall.

A.

investment is insensitive to changes in interest rates.

Which scenario best explains the Keynesian transmission mechanism when the money supply increases while the money market is in a liquidity trap?

A.

The interest rate and investment are not affected; there is no shift in the AD curve.

B.

The interest rate falls, investment rises, total expenditures rise, and the AD curve shifts rightward.

C.

The interest rate falls, investment falls instead of rising, and the AD curve ends up shifting leftward.

D.

The interest rate falls, but investment does not respond; there is no change in total expenditures and no shift in the AD curve.

A.

The interest rate and investment are not affected; there is no shift in the AD curve.

If the money market is in the liquidity trap, it is operating in the __________ segment of the __________ demand curve.

A.

vertical; investment

B.

vertical; money

C.

horizontal; investment

D.

horizontal; money

D.

horizontal; money

Which scenario best explains the Keynesian transmission mechanism when the investment demand curve is vertical?

A.

The interest rate falls, investment falls even more, the AD curve shifts rightward, but total expenditures do not change.

B.

The interest rate falls, investment rises, total expenditures rise, and the AD curve shifts rightward.

C.

The interest rate falls, investment falls instead of rising, and the AD curve ends up shifting leftward.

D.

The interest rate falls, but investment does not respond; there is no change in total expenditures and no shift in the AD curve.

D.

The interest rate falls, but investment does not respond; there is no change in total expenditures and no shift in the AD curve.

The liquidity trap refers to the

A.

assumption that the money supply curve is vertical as a result of the Fed's control.

B.

problem that occurs when interest rates reach such high levels that no individuals want to hold their wealth in the form of money.

C.

situation that occurs when an excess supply of money results in people holding more money than they desire.

D.

possibility that interest rates drop so low that people willingly hold all the additions to the money supply, rather than use it to buy bonds.

D.

possibility that interest rates drop so low that people willingly hold all the additions to the money supply, rather than use it to buy bonds.

Suppose the money market is in the liquidity trap and the Fed increases the supply of money. We expect that

A.

people will end up willingly holding more money.

B.

the excess money holdings will flow into the loanable funds market and there will be a decrease in interest rates.

C.

interest rates will increase, since the demand curve for money is upward sloping in this case.

D.

eventually, via the transmission mechanism, Real GDP will increase.

A.

people will end up willingly holding more money.

If market interest rates increase, the prices of existing bonds will

A.

decrease.

B.

not change.

C.

increase.

D.

decrease if Real GDP decreases and increase if Real GDP increases.

A.

decrease.

An individual buys a bond for $1,000 and sells it one year later for $1,050. What is the annual interest rate return that this individual has received on this bond?

A.

5.0 percent

B.

50.0 percent

C.

7.5 percent

D.

4.0 percent

E.

0.05 percent

A.

5.0 percent

Suppose that one year ago you purchased a $100 bond with an interest payment of $5 per year and, at the time, the interest rate was 5 percent. One year later the interest rate has increased to 6.5 percent, and you still hold the bond. If you were to sell your bond now, the price that you could sell it for would be

A.

higher than it was when you bought it.

B.

lower than it was when you bought it.

C.

the same as it was when you bought it, that is, $100.

D.

More information is necessary to answer the question.

B.

lower than it was when you bought it.

Suppose the money market is in the liquidity trap and the Fed increases the supply of money. Individuals would rather hold __________ than __________ because they expect that bond prices can go no __________.

A.

bonds; money; higher

B.

bonds; money; lower

C.

money; bonds; higher

D.

money; bonds; lower

C.

money; bonds; higher

If a liquidity trap exists, people are likely to be thinking that

A.

bond prices are so low that they have nowhere to go but up; given this, now is a good time to be holding bonds.

B.

bond prices are so high that they have nowhere to go but down; given this, it is better not to be holding bonds.

C.

bond prices will soon rise so it is better to get out of bonds now.

D.

interest rates will soon fall.

B.

bond prices are so high that they have nowhere to go but down; given this, it is better not to be holding bonds.

If the money market is in the liquidity trap, then people

A.

do not want to hold money because its value is at its lowest.

B.

want to hold bonds because the interest rate is quite high.

C.

do not want to hold bonds because their price is likely to decrease.

D.

want to hold bonds because their price is high.

E.

a, b and d

C.

do not want to hold bonds because their price is likely to decrease.

Compared to the Keynesian transmission mechanism, the monetarist transmission mechanism is

A.

indirect and long.

B.

direct and long.

C.

direct and short.

D.

indirect and short.

C.

direct and short.

According to the monetarist transmission mechanism, a decrease in the supply of money will result in

A.

individuals initially holding excess bonds.

B.

individuals initially holding excess money.

C.

a leftward shift in the aggregate demand curve.

D.

a and c

C.

a leftward shift in the aggregate demand curve.

Monetarists believe that changes in the supply of money

A.

do not affect aggregate demand.

B.

affect aggregate demand through the loanable funds market only.

C.

affect only the investment component of aggregate demand.

D.

affect aggregate demand directly.

D.

affect aggregate demand directly.

Monetary policy refers to

A.

actions taken by banks and other financial institutions regarding their approaches to lending, account management, etc.

B.

changes in the money supply to achieve particular economic goals.

C.

changes in government expenditures and taxation to achieve particular economic goals.

D.

the change in private expenditures that occurs as a consequence of changes in the money supply.

B.

changes in the money supply to achieve particular economic goals.

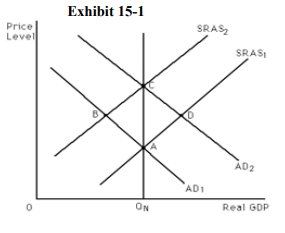

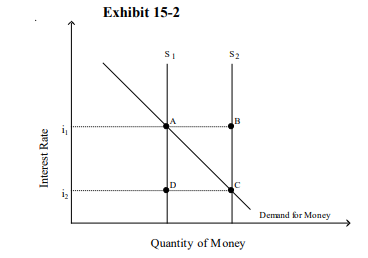

Refer to Exhibit 15-l. A Keynesian monetary policy to eliminate a recessionary gap can be portrayed as a move between points

A.

A and B.

B.

B and C.

C.

C and D.

D.

D and A.

B.

B and C.

Refer to Exhibit 15-l. A monetarist would claim that in a recessionary gap, the economy would move on its own from point

A.

B to point C.

B.

B to point A.

C.

A to point B.

D.

D to point C.

B.

B to point A.

Refer to Exhibit 15-l. A Keynesian monetary policy to eliminate an inflationary gap can be portrayed as a movement between point

A.

A and point B.

B.

B and point C.

C.

C and point D.

D.

D and point A.

D.

D and point A.

Suppose the money market is in the liquidity trap and that the economy is experiencing a recessionary gap. A Keynesian economist would most likely advocate

A.

expansionary monetary policy.

B.

contractionary monetary policy.

C.

expansionary fiscal policy.

D.

contractionary fiscal policy.

C.

expansionary fiscal policy.

A decrease in the money supply will shift the aggregate __________ curve to the __________.

A.

supply; left

B.

supply; right

C.

demand; left

D.

demand; right

C.

demand; left

Activists believe that

A.

monetary policy should not be used to smooth out the business cycle.

B.

fiscal policy should not be used to smooth out the business cycle.

C.

the frequent use of fiscal or monetary policy is called for to smooth out the business cycle.

D.

rules should be established for the conduct of both monetary and fiscal policy.

C.

the frequent use of fiscal or monetary policy is called for to smooth out the business cycle.

A person who opposes the deliberate use of fiscal and monetary policies is called a(n)

A.

Keynesian.

B.

fiscalist.

C.

nonactivist.

D.

activist.

C.

nonactivist.

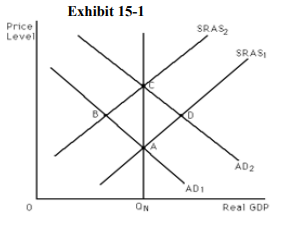

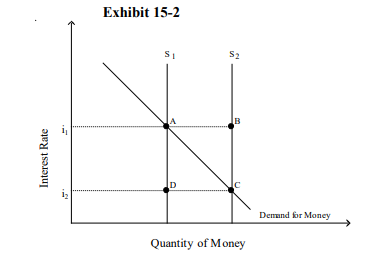

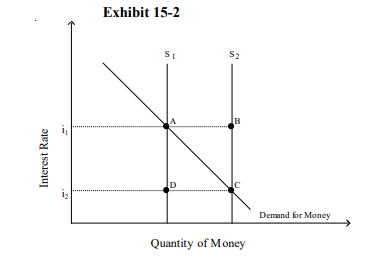

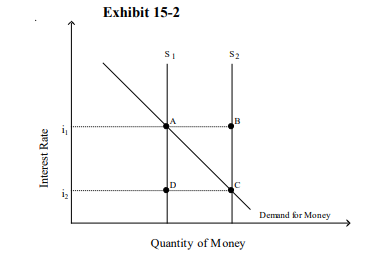

Refer to Exhibit 15-2. A(n)__________ in the money supply from S1 to S2 would have a tendency to __________ the amount of investment, assuming investment is sensitive to changes in the interest rate.

A.

decrease; raise

B.

decrease; lower

C.

increase; raise

D.

increase; lower

C.

increase; raise

Refer to Exhibit 15-2. A(n)__________ in the money supply from S1 to S2 would have a tendency to __________ the opportunity cost of holding money.

A.

increase; raise

B.

increase; lower

C.

decrease; raise

D.

decrease; lower

B.

increase; lower

Refer to Exhibit 15-2. If the interest rate is i1 and the relevant money supply curve is S2, then there is a

A.

shortage of money between points B and A.

B.

surplus of money between points B and A.

C.

surplus of money between points C and D.

D.

shortage of money between points C and D.

B.

surplus of money between points B and A.

Refer to Exhibit 15-2. If the interest rate is i2 and the relevant money supply curve is S1, then there is a

A.

shortage of money between points B and A.

B.

surplus of money between points B and A.

C.

surplus of money between points C and D.

D.

shortage of money between points C and D.

D.

shortage of money between points C and D.

Which of the following may block the Keynesian transmission mechanism?

A.

the loanable funds market

B.

aggregate demand

C.

interest-insensitive investment

D.

the liquidity trap

E.

c and d

E.

c and d

Under a constant growth rate of money rule of 5 percent in an economy in which Real GDP grows at an average rate of 5 percent and velocity is constant, the inflation rate is

A.

5 percent.

B.

-5 percent.

C.

25 percent.

D.

-25 percent.

E.

constant at zero.

E.

constant at zero.

The quantity supplied of money is assumed (in the textbook) to be

A.

inversely related to the interest rate.

B.

directly related to the interest rate.

C.

independent of the interest rate.

D.

determined exclusively by banks.

E.

c and d

C.

independent of the interest rate.