Unit 3 - Year 12 ATAR (WACE) Economics

1/451

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

452 Terms

Define the Terms of Trade

An index measure used to compare export price changes relative to import price changes.

List some things which the Terms of Trade can influence

GDP

National Income

Exchange Rate

Trade Balance

What is a favourable movement in the Terms of Trade

When export prices rise faster / greater than import prices

What does a favourable movement in the TOT entail (regarding purchasing power)

To purchase a given quantity of imports

We need a smaller quantity of exports

A favourable movement (rise) in the TOT can be equated to a _____ Standard of living

Higher / Increased

What is an unfavourable movement in the TOT

When import prices rose faster / more than export prices

How do you calculate the TOT

Terms of Trade = Export Price index / Import Price Index * 100

If import prices fall, ceteris paribus, then the TOT ______

Would rise

If import prices rise, ceteris paribus, then the TOT ______

Would Fall

If export prices rise, ceteris paribus, then the TOT ______

Would rise

If export prices fall, ceteris paribus, then the TOT ______

Would Fall

Does the absolute value of what the TOT really matter?

No.

What matters is how the TOT changes.

What does Australia mainly export

Commodities

Give some examples of commodities

Rural Goods: (Wool, Wheat, Beef)

Bulk Commodities: (Iron ore, Coal)

Other resources: (LNG, Gold, Alumina)

What is the most important determinant of Australia's export price index (XPI). Why?

Commodity prices

Australia's exports (75% of them) are commodities.

A small change in supply or demand for commodities usually leads to ______

A large change in price

Commodity prices are volatile

List a possible sequence if the World economy (or China) were to expand

1. More demand for commodities

2. Prices for commodities increase.

3. Australia's XPI increases

4. Australia's TOT increases

List a possible sequence if the World economy (or China) were to contract

1. Less demand for commodities

2. Prices for commodities decreases

3. Australia's XPI decreases

4. Australia's TOT decreases

The XPI is more / less volatile than the MPI

More

1 multiple choice option

What category of goods mainly make up Australia's imports

Manufactured goods

The prices of Australia's imports are relatively _____

Inelastic

Does Australia have power to influence the prices of its X and M

No

1 multiple choice option

Australia is a price _______ with respect to the prices of traded goods. What does this mean?

Taker

Prices are set in the world market, we have very little direct influence

1 multiple choice option

Why did the MPI increase significantly in 2022

The economy had recovered from covid AND:

The Russia - Ukraine War drove up oil prices, which increased costs across the board for everything

During the 2016 - 2019 period, what was happening in the world economy? What effect, if any, did it have on Australia

Global economies were expanding and growth was high meaning commodity prices were high.

As a result, Australia's XPI rose by over 40% (72 to 103) during this time.

1 multiple choice option

Covid in ______ caused a global ______ and led to AU's XPI falling by ______

2020

Recession

8%

2 multiple choice options

When did the TOT reach its highest recorded level, and why

In June 2022

The global economy recovering from Covid

AND

Energy prices increasing due to war in Europe

List the things that will be effected by changes in the TOT

The business cycle

Output and employment

The BOGS and CAB in the balance of payments.

The exchange rate.

National income.

Government tax revenue

The standard of living.

What sequence of events will occur if the TOT rise due to higher commodity prices

1. Positive shock to the economy / economy expands

2. Resources (Capital/Labour) flow into mining sector

3. Production and employment increase

4. Economic Growth rate increases

What sequence of events will occur if the TOT fall due to lower commodity prices

1. Negative shock to the economy / economy contracts

2. Mining sector contracts

3. Production and employment decreases

4. Growth rate of real GDP is reduced

What is GDP that is adjusted for changes in the TOT called?

Real Gross Domestic Income

2 multiple choice options

During 2020 to 2022 the TOT rose/fell

rose

1 multiple choice option

The rise of the TOT in 2022 led to what?

1. National Income Increased

2. Higher income = higher economic activity

3. Unemployment fell to the lowest it's been in 40 years

'A positive boost to economic growth and living standards' can be seen due to what?

A rise in the TOT

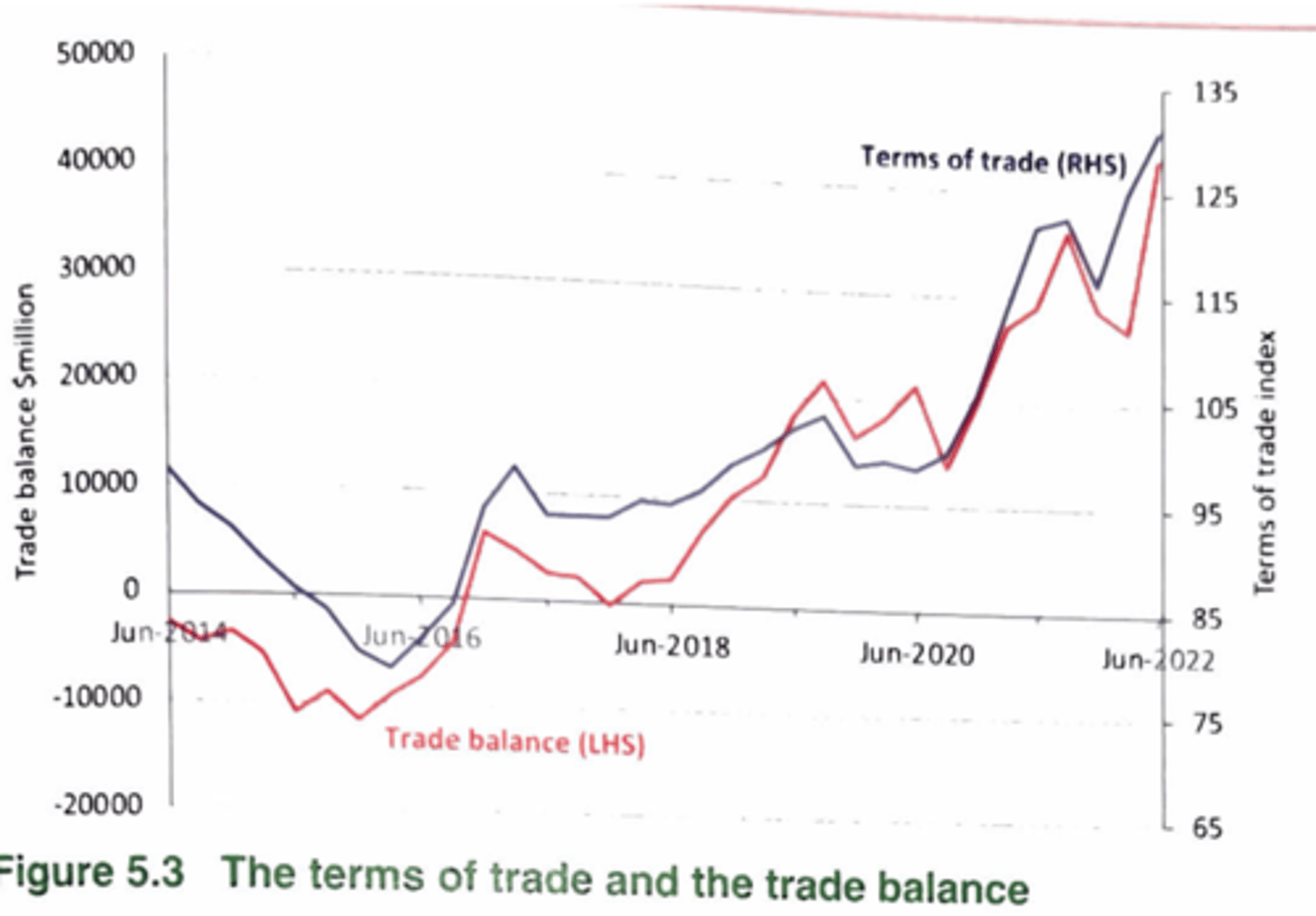

The BOGS and the TOT are closely linked - True/False

True

What is the difference between what the TOT measures and what the BOGS measures

The TOT measures changes in the prices of X and M

The BOGS measures changes in the value of X and M.

The difference is that the BOGS also takes into account the quantities of traded goods.

When was an example of the direct relation between the TOT and the BOGS

2022. Both recorded new peaks.

Explain why the TOT effects the BOGS

Since the TOT is a measure of the change in prices of X and M, and the BOGS is a measure of the value of X and M.

E.g. An increase in export prices, increases the value of exports, which increases the BOGS.

Why is the Australian dollar often referred to as a 'commodity currency'

Because of our dependence on the prices of commodity exports

Why do high export prices cause the AUD to appreciate

Increases the demand for AUD which boosts its value (exchange rate)

How does the TOT effect the exchange rate

High export prices = High TOT = demand for AUD = appreciating AUD

and Vice Versa

Is an appreciating AUD a good thing for consumers? Why

Yes

They can buy more in the foreign market with the same amount of AUD

Is an appreciating AUD a good thing for all domestic producers? Why

No, not for all domestic producers

For producers in the mining sector, they receive more money since the AUD is worth more and people want to buy commodities.

For producers outside the mining sector, a higher AUD means that their products cost more in the foreign market which decreases their competitiveness.

What does 'The Dutch Disease' refer to

Refers to the potential negative effects on the economy caused by an appreciation in the exchange rate which came from high commodity prices

What can a mining boom caused by high commodity prices create?

It creates a Two Speed Economy

The mining sector growing rapidly

Other domestic industries growing much slower, maybe even contracting Due to the increasing exchange rate

When a TOT boom occurs (in Australia), where are resources usually drawn to

Resources like capital and labour are drawn to the mining sector, which puts pressure on the rest of the economy.

Who is a high exchange rate beneficial for? Why?

Consumers

Since a high exchange rate for AU usually means we're receiving more for our exports, our income and thus standard of living and spending increase.

How does the government gain from a TOT boom?

Higher tax revenue

Higher profit tax revenue

Mining royalties

Give a reason why Australia's MPI would increase, reducing the TOT

Increased costs of manufactured goods

Give a reason why Australia's XPI would increase, increasing the TOT

Global increases in demand

Global shortages in supply

In 2022 did Australia's XPI increase due to supply or demand factors, or both? Explain

Both

During 2022, economic growth was high as the global recovery from COVID settled in fully. Countries, especially China, went back to building, so commodities were in high demand meaning high prices

Also, the European War (Russia - Ukraine) caused supply shortages in energy resources (e.g. oil) which increased demand and thus price for them

In 2022 did Australia's MPI increase due to supply or demand factors, or both? Explain

Mainly Supply

Oil prices spiked due to the Russia - Ukraine war causing increased petrol prices. This means that costs rise everywhere since we need petrol for a lot of things.

Do changes in the exchange rate effect the TOT? Why? Why Not?

Not really.

Since a change in exchange rate effects both exports and imports simultaneously it has minimal effect.

E.g. If the AUD depreciates:

The price we pay for imports in AUD increases.

The price of things we export in AUD also increases, since we now receive more of it when we sell it as the currency is worth less.

When did the TOT peak prior to 2022, and why?

in 2013 it peaked at around 120

Due to China emerging as a major resource buyer

AND

Shortages of commodities

What helped the Australian economy recover following COVID

China started building infrastructure again.

This was helped by the fact that other commodity countries (E.g. Brazil) were still suffering and couldn't meet China's demand, leading to supply shortages and again higher prices.

What happened to commodity prices towards the end of 2023, why?

Started to ease off

High inflation caused interest rate rises across the globe

Decreased global demand

If there is a global slow down in 2024, why might Australia be ok?

Because China will just start building crap again and need our resources.

List the general effects of a Favourable TOT movement

1. Trade balance increases

2. National income increases

3. Aggregate demand Increases

4. Government tax revenue increases

5. Living standards increase

6. Investment and employment rises in the resources industry

7. The AUD appreciates

8. Inflation rises

List the general effects of an Unfavourable TOT movement

1. Trade balance decreases

2. National income decreases

3. Aggregate demand decreases

4. Government tax revenue decreases

5. Living standards decrease

6. Investment and employment falls in the resources industry

7. The AUD depreciates

8. Inflation falls

List reasons for the improvement in the TOT since 2018

A rise in commodity prices (both food and energy)

Appreciation of the exchange rate

Growth in East Asian economies = demand for exports & access to cheap manufactured imports

List 3 Effects of an improvement in the TOT

A rise in export receipts

A rise in real incomes

A rise in the spending power of incomes (given amount of X can buy more M)

Injections into the economy due to improved BOGS

Higher growth

Higher employment

Why is the XPI of AU more unstable than its MPI

Our exports are mainly (65%) energy and rural commodities

The prices for these fluctuate heavily depending on supply and demand

Eg. Russian invasion of ukraine caused energy shortage = price hike

Recovery of growth in china = demand for commodities

Our imports are mainly manufactured goods = Prices stable. They're mainly impacted by the exchange rate.

Describe the contemporary trend in the TOT

Unstable between 2019 and 2022, with a rising trend to early 2022 then a fall.

how might a rising terms of trade effect the CAB

Increases the CAB given the price inelasticity of demand for most of our exports.

Encourages foreign investment, which limits the increase in the CAB.

What does an increased TOT mean for companies

Higher profits for mineral and energy producers

Higher tax payments

Higher dividend. payments

Additional employment created

Increase in investment

Why has the import price index generally had a downwards trend

Our imports are mainly manufactured goods

These are getting cheaper due to globalisation and technological developments in transport and production

What 4 specific factors have effected our TOT in the past 10 years

Changes in commodity prices:

Varying demand from East Asian economies

Increased supply of cheap consumer goods:

Globalisation:

Australian producers can now take part in global manufacturing chains (eg. aircraft parts)

Foreign consumers demands changing

Eg. Asian economies have developed and now want more protein rich food, so they buy our beef.

Define Foreign investment

An inflow of money from overseas investors

Define foreign liabilities

When Australian residents borrow money from overseas OR sell assets to foreigners

Define foreign assets

When Australian residents lend money to foreigners OR purchase foreign assets.

Australia has always relied on a net inflow of foreign investment to:

fund and develop its economy and fill in the gap between our domestic savings and the investment our industries need.

Between 2010 and 2022 how has the value of foreign assets changed

1.2 Trillion to 3.6 Trillion

Between 2010 and 2022 how has the value of foreign liabilities changed

2 Trillion to 4.4 Trillion.

The growth rate of foreign _______ is greater than that of foreign _________

The growth rate of foreign assets has been faster than that of foreign liabilities.

What was Australia's overall net foreign liability position in 2023

About $836 billion

the sum of all of Australia's past financial account surpluses / current account deficits equals:

the stock of foreign liabilities

When measured as a percentage of

When measured as a percentage of GDP, net foreign liabilities have increased/decreased over the past decade

Decreased

What two things make up foreign liabilities

Foreign Debt (borrowed money)

Foreign equity (Foreign ownership of Australian assets)

Currently, is foreign equity a liability or asset for Australia

Asset

The value of the foreign assets we own is now greater than the value of our assets foreigners own.

How has net foreign equity changed since 2010, why?

The figure as a percentage of GDP has gone from 4% to -15%.

The reason for this change: The growth in Australia's superannuation funds has enabled Australia to increase its holding of foreign assets.

Why is our reliance on borrowing not really a concern

It fills our S-I gap.

It provides a more flexible approach to investment compared to selling our assets.

In terms of service payments, why is foreign debt better than foreign equity

Although both involve servicing payments (Interest & principle payments, dividends), foreign debt, once paid off, is gone, compared to the continued ownership of equity, which entails dividend and income payments

Historically, Australia consistently recorded a financial account surplus/deficit

surplus

Why did Australia consistently recorded a financial account surplus in the past

Due to the net inflow of capital, mainly debt, that we incur in order to fill our S-I gap and fund our industries

What is the corresponding negative for the credit resulting from foreign investment capital inflow

The income payments associated with this debt make up a large NPY deficit in the current account, which usually led to our CAD.

Why is measuring foreign liabilities as a proportion of GDP misleading

Foreign debt is a stock variable - it accumulates over time

Real GDP is a flow variable - it represents changes year after year

Distinguish between gross and net foreign debt

Gross foreign debt: The total of Australia's overseas borrowing

Net Foreign debt: Our total borrowing minus our total lending

Over the past few decades, most of Australia's foreign liabilities have come to be in the form of ______

Foreign debt

What sector are most of our debts incurred by.

Private sector

In 2022, what proportion of foreign debt was private/public

70% private sector, 30% public sector in 2022.

Since when has the AU government recorded budget deficits

The AU government has recorded budget deficits since the GFC of 2009.

What happens to the governments budget balance when the economy contracts

Whenever the economy contracts, the government's budget balance falls due to decreased tax revenue and increased welfare spending.

When did the government record its largest budget deficit in history

In 2021

The government recorded their largest deficits in history, and had to finance this through domestic and overseas borrowing.

Between 2013 - 2019, the proportion of foreign debt that belonged to the public sector stayed around ____ %

25%

In 2019, the proportion of foreign debt that belonged to the public sector jumped to ____%

29%

In 2021, the proportion of foreign debt that belonged to the public sector jumped to ____%

37%

Is public sector foreign debt bad if it is used for recurrent, immediate expenditure?

If the borrowed money is used for current expenditure, such as welfare payments, that don't help out the economy, this isn't a good thing.

Is public sector foreign debt bad if it is used for government infrastructure and investment in industries

If it used to finance government infrastructure and investment in industries, or some sort of activity that increases productive capacity and will lead to an increase in future income, then it’s a good thing.

Why is private sector foreign debt generally considered better than public

Private foreign debt is incurred with the motive of profit in mind.

It is likely to increase investment, which expands the productive capacity of the economy and provides income streams to service the debt.