Economic History Lecture 2

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

What does Malthus’ theory explain?

Malthus’ theory explains the relationship between population growth and economic conditions, focusing on how demographic factors (birth and death rates) and economic variables (such as income per capita) are interconnected.

According to Malthus, economic conditions like harvest success or failure impact birth and death rates, influencing overall population growth and income levels.

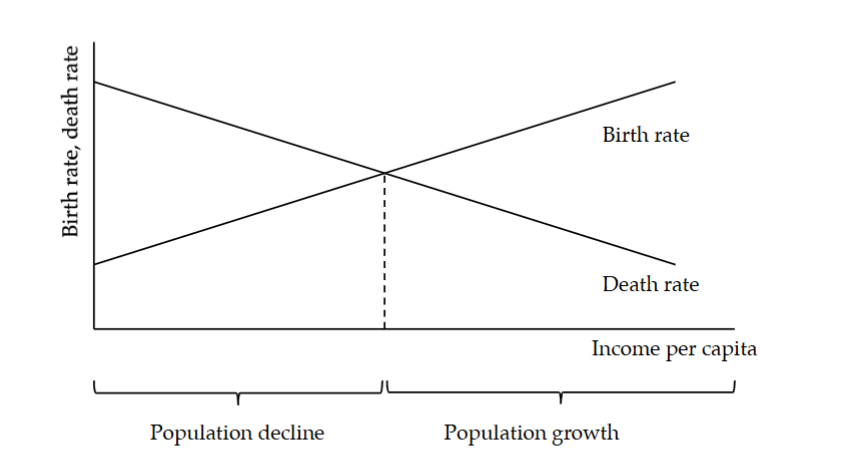

How are birth rates and death rates related to income per capita in Malthusian theory?

Birth rates are positively correlated with income per capita.

When incomes rise due to good harvests, more children are born and are likely to survive. >>> higher incomes allow families to sustain larger families

In contrast, when incomes fall (due to bad harvests), fewer children are born or survive, resulting in a decline in birth rates. >>> lower incomes make it harder to do so.

Death rates are negatively related to income per capita.

A good harvest or higher income means fewer people die from starvation or malnutrition, leading to a decrease in death rates.

Conversely, when income falls due to bad harvests, starvation becomes more common, increasing death rates.

Hence, Malthus argued that economic conditions directly influenced the mortality rate of the population.

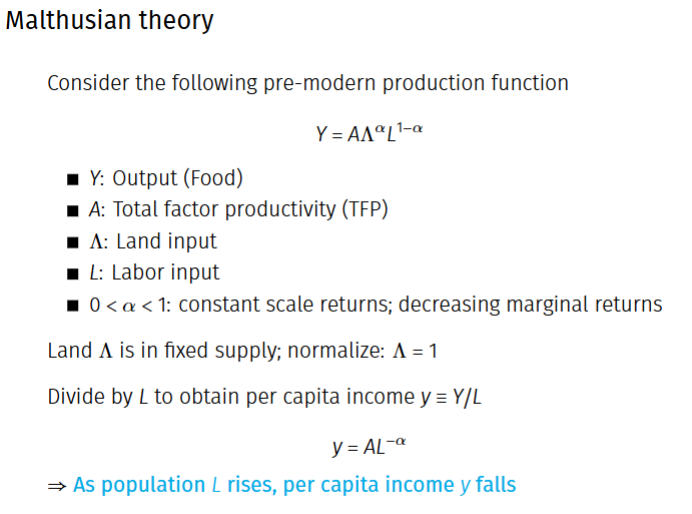

What is the relationship between population and per capita income in the Malthusian Model?

The Malthusian Model highlights an inverse relationship between population size (L) and per capita income (y). As the population grows, income per capita declines.

This occurs because a larger population must share the same limited resources, reducing the share available to each individual.

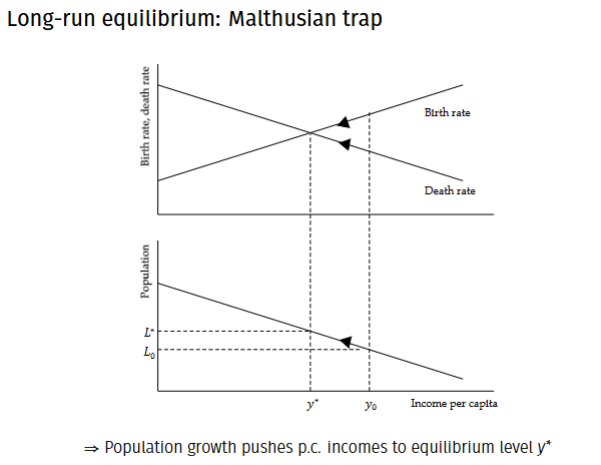

What is the Malthusian Trap?

The Malthusian Trap occurs when population growth pushes the economy to a steady state, where resources are just enough to sustain the population.

At this equilibrium:

Birth and death rates balance out to stabilize the population.

Per capita income remains low, constrained by the limited availability of resources.

Improvements in resources or technology often only result in temporary gains, as population growth eventually absorbs the surplus.

What are the two mechanisms that determine equilibrium income in the Malthusian Model?

Positive Checks: Increase the death rate through factors like famines, wars, and epidemics.

In pre-industrial societies, high death rates increased per capita income by reducing the population as fewer people shared the available resources, enhancing survivors' living standards.

Preventive Checks: Decrease the birth rate through measures like birth control and cultural norms (e.g., later marriage or fewer extramarital births).

Fewer births led to a smaller population, ensuring that available resources were distributed more generously among individuals.

How would technology impact per capita incomes according to Malthusian theory?

Technological advancements only temporarily improve output and per capita income.

Why?: It encourages population growth and these gains are gradually absorbed, returning per capita income to subsistence levels.

What are Pre - Modern efflorescences.

They are essentially Golden Ages: Periods of economic growth and prosperity where per capita incomes rise above subsistence levels for extended periods

Examples: Mediterranean Antiquity, the Islamic Golden Age, Tang/Song China, Mughal India, and the Dutch Golden Age.

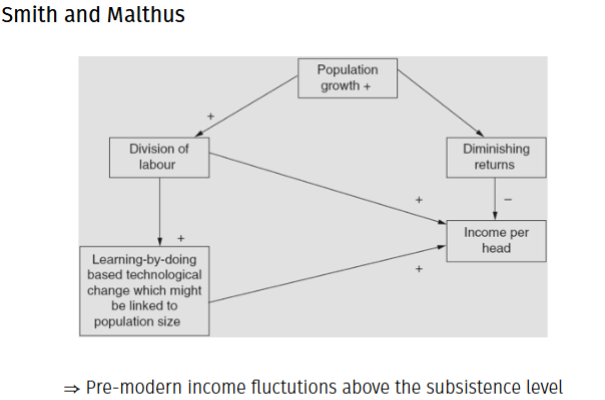

How did Adam Smith and David Ricardo contribute to understanding economic growth in pre-modern economies

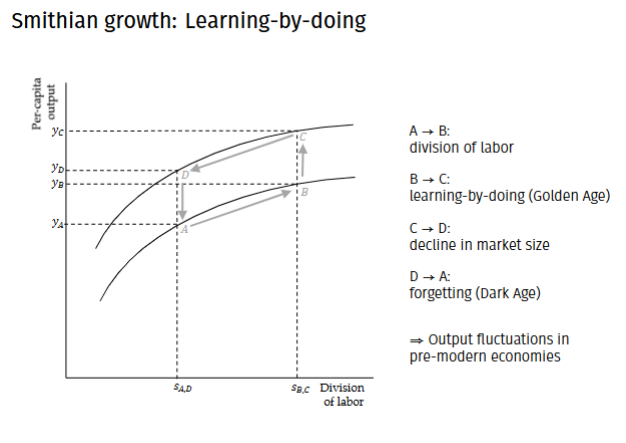

Adam Smith argues that the division of labor drives economic growth, even in the absence of technological progress. A larger population enables more specialization, which increases efficiency. As people specialize, they improve their skills through "learning-by-doing," leading to technological advancements and further economic progress.

Learning by doing: Over time, as workers repeat these tasks, they improve and find better ways to do them, which is learning by doing.

David Ricardo argued that international trade helps countries specialize in producing goods they can make most efficiently, promoting better resource use and driving economic growth.

Smith vs Malthus on Population growth

Smith: Population growth is useful for the division of labor, and learning-by-doing technological advancements which improves per capita incomes

Malthus: Population growth lowers per capita income, since a growing population has to divide the same limited resources, decreasing the amount each person can access.

Why were Golden Ages often correlated with imperial expansion?

Malthusian Mechanism: Imperial expansion can provide more land, but also results in more conflict, which leads to an increased death rate.

Smithian Mechanism: Imperial expansion lowers transaction costs through common currency, enhances market integration, and supports secure trade which can bring about income growth through specialization gains.

What Led to the Decline of Golden Ages in Pre-modern Economies?

Time and place: In pre-modern times, one’s income and well-being depended on when and where they were born.

Specialization and Learning-by-Doing: Increased specialization and learning-by-doing enhanced productivity, driving periods of economic flourishing, known as "Golden Ages."

End of Golden Ages: Economic progress eventually reversed due to wars, invasions, diseases, and Malthusian pressures, where population growth exceeded resource availability

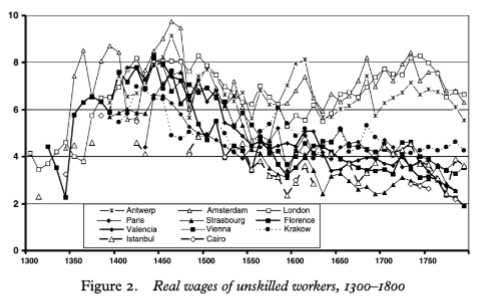

What is the "Little Divergence" in European history?

The "Little Divergence" refers to the period where Northwestern Europe experienced higher wages and better economic conditions compared to Southern and Eastern Europe, particularly after the Black Death.

What were the three key factors contributing to economic changes in early modern Europe/ Little Divergence?

The "Three Horsemen of Riches" included (Horseman effect):

Plague: The Black Death reduced the population, which increased wages due to a limited labor supply, which encouraged people from rural areas to migrate to bigger cities, since cities had more opportunities for work.

Urbanization: Cities grew, but this also increased mortality rates due to overcrowding and which encouraged the spread of disease. Hence, rural mortality was lower. As European cities began to specialize in different manufactures and engaged in long distance trade, diseases could spread more easily. Hence trade flows were taxed

War: the taxes imposed on trade flows were used to finance warfare which further increase mortality rates through battle deaths and the spread of diseases through armies on the move.

What was the link between Urbanization and Tax Revenues?

As cities grew, more people worked in trade and businesses, leading to higher tax revenues. These funds were mainly used to support wars.

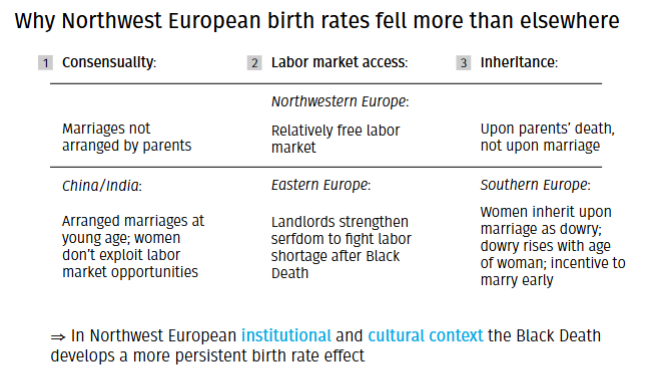

Why did the Little divergence only occur in Europe and not in other parts of Eurasia and Africa?

3 main reasons

Urban Disease Environment: The rapid growth of cities during this period created conditions that promoted the spread of diseases. Poor sanitation and inadequate healthcare systems in urban areas led to higher mortality rates.

Asian cities were often cleaner

Political Fragmentation: Europe's political fragmentation during the Little Divergence meant that different regions had diverse rulers and governance structures. This division influenced how they responded to the Black Death and its long-term economic and social impacts

Eastern empires were more politically integrated, leading to less wars and external threats.

Change in European Marriage patterns (EMP): The Black Death greatly influenced marriage patterns in Europe. With the population decrease, labor became more valuable, leading to higher wages and changes in feudal structures, since workers now had more bargaining power. As a result, many people delayed marriage or, in some cases, decided not to marry at all which reduced fertility

Why did Northwest European birth rates fall more than elsewhere?

See the picture

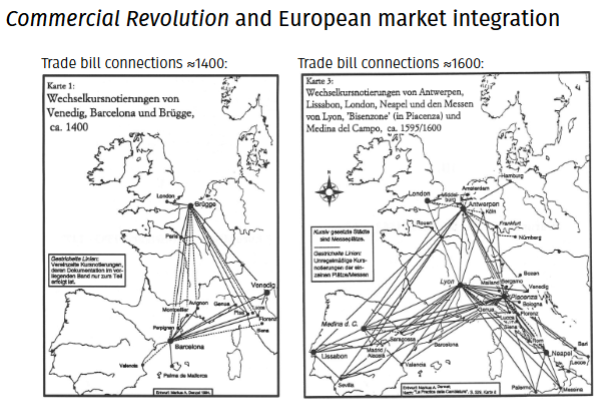

What is the Commercial Revolution and what was its impact on economic growth in Europe?

The Commercial Revolution (16th–18th centuries) transformed European economies through increased intra-European trade, which linked European economies, and institutional innovations.

These institutional innovations included:

Financial Institutions: Banks and credit systems provided capital and facilitated transactions.

Financial Instruments: Bills of exchange reduced risks in long-distance trade.

Business Law: Legal frameworks allowed businesses to operate securely and confidently.

These innovations lowered transaction costs, boosting Smithian Growth by increasing efficiency, specialization, and economic output.

Atlantic economy and the final pre-modern efflorescence

The Colombian voyage to America in 1492 and the circumnavigation of Africa in 1497 significantly boosted the Atlantic’s role as a key economic route. This period marked the beginning of the Age of European naval empires. A new trade pattern emerged, characterized by:

Manufactured goods from Europe, such as textiles and weapons.

Slave labor from Africa to work in plantations and mines.

Primary products from the Americas, like silver, sugar, and cotton.

Luxury goods from Asia, such as spices, tea, textiles, silk, and porcelain.

This global exchange system raised questions about whether imperial expansion led to Smithian growth and Malthusian growth. The economic transformations set the stage for a more interconnected global economy.

What are the different perspectives on whether Europe's early modern growth was grounded in imperialism?

Yes: Dependency Theory

The powerful West exploited resources and labor from other regions.

Williams (1944) argued that slave trade profits eventually financed the Industrial Revolution.

Not Much: Mediterranean View

Until the 18th century, England primarily traded with the Mediterranean.

The boom in intra-European trade, rather than Atlantic trade, was more significant until the 18th century.

No: Cliometricians

The Atlantic trade's impact was too small to significantly affect growth, contributing less than 4% of European GDP.

O'Brien (1982) suggested that the investment financed by Atlantic trade profits accounted for less than 1% of GDP.

Export-led growth: Mercantilist View

Europe's growth was driven by the accumulation of knowledge and experience in manufacturing, spurred by trade.

Allen (2003) argued that 50% of urbanization was due to trade, particularly Intra-European trade.

Amplification: Institutionalist View

Profits from Atlantic trade led to institutional changes, amplifying their effects.

Wealthy Atlantic merchants became politically influential, shaping commerce-friendly institutions.

Indirectly: Money View

The influx of American precious metals stimulated Intra-European trade and investment.

This trade contributed to the European Commercial Revolution, fostering the development of commerce-friendly institutions.

How did colonization affect Malthusian growth in Europe?

Colonization had minimal Malthusian effects in Europe because:

Commodities supplied by America were small until the 18th century.

Emigration to the Americas was limited until the 19th century.

Do note:

The Americas were sparsely populated due to disease which killed Native Americans.

High Incomes in the New World

Demand for Slave Labor: The need for labor to grow cash crops (sugar, tobacco) led to plantation economies, fueling the transatlantic slave trade and the forced migration of millions of Africans.

Did slavery contribute to early modern Europe's economic growth?

Narrow View: Direct profits from the slave trade were small (0.5% of UK GDP, 0.005% of Dutch GDP).

Broader View: Profits from slaveholding and plantations were significant (5% of UK GDP, 5.2% of Dutch GDP).

Slaveholding boosted the UK’s national income by 3.5% in the 1830s, with major cities like London, Bristol, and Liverpool seeing even greater impacts.

Precious metals and Europe’s early modern efflorescence

Influx of Precious Metals: European colonization of the Americas led to a steady influx of gold and silver, especially from Spanish colonies. This continuous flow of wealth significantly impacted the European economy throughout the early modern period.

Sustained Monetary Injections: The constant supply of gold and silver acted as sustained monetary injections into the European economy. This abundance of precious metals helped provide the liquidity needed for economic growth, fueling trade and investments.

Market Integration & Commercial Revolution: These monetary injections facilitated market integration by making transactions smoother across regions. This flow of currency supported the expansion of trade networks and played a key role in the Commercial Revolution.

Money Supply & Rising Income Per Capita: The influx of precious metals led to an increase in the overall money supply. As a result, income per capita rose, stimulating economic activity, raising wages, and improving living standards throughout Europe

Why did countries like the Netherlands and England outperform first-stage receivers like Portugal and Spain?

Dutch Disease: The influx of precious metals caused inflation in Spain and Portugal, which led to a real exchange rate appreciation and made Iberian tradables uncompetitive.

Institutional Resource Curse: Spain and Portugal’s reliance on precious metals from the Americas allowed their governments to become complacent, reducing responsiveness to local economic demands and missing out on the Commercial Revolution because they focused more on mining and not on the manufacturing sector..

The over-reliance on American silver caused a decline in governance and economic flexibility, contributing to the "Little Divergence" where Northern European economies outperformed Southern European ones.