IMC Unit 2: Investment Products

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

25 Terms

What are the Regulated Collective Investment Schemes (CISs)

Open ended investment companies (OEICs /ICVCs)

Authorised unit trusts

UCITS schemes

NURS (Non-UCITS Retail Scheme)

What is the role of the manager in Unit Trusts

Market units

Manage assets

Maintain record of units

What is the role of the trustee in Unit Trusts

Protect the interest of unit holders

Take title of the underlying assets

Create/cancel units

What is the pricing in Unit Trusts

Are unit trusts open ended or close ended

Open Ended

What is the role of the AUTHORISED CORPORATE DIRECTOR (ACD) in Open ended investment companies (OEICs/ICVCs)

Market shares

Manage assets

Maintain record of shares

What is the role of the depository in Open ended investment companies (OEICs/ICVCs)

Protect the interest of shareholders

Take title of the underlying assets

Create/cancel shares

What is the pricing in Open ended investment companies (OEICs/ICVCs)

Are Open ended investment companies (OEICs/ICVCs) open ended or close ended

Open Ended

What are CISs investment and borrowing powers governed by

FCA Collective Investment Schemes Sourcebook (COLL), incorporates requirements of UCITS

What are the allowable investments in CISs

Transferable securities

Approved money market instruments

Units in CISs

Derivatives and forward transactions

Deposits

What are the concentration limits in CISs

Not more than 10% of the fund in shares or bonds from a single issuer

Not more than 25% of the fund in a single CIS

Up to 100% of the fund in other CISs

Borrowing not more than 10% of the value of the fund

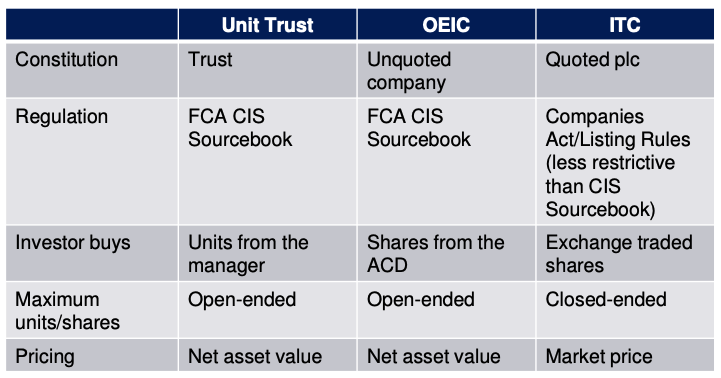

Investment trusts (ITCs)

What are the concentration limits for ITCs

Not more than 15% of the fund in shares of a single issuer

Have the ability to borrow (’gear up’

What are Exchange traded funds (ETFs)

Exchange listed funds that track:

• An index e.g. FTSE100

• A commodity e.g. gold ETC

• OR may simulate the return derivatives

• Open ended

What are the advantages of ETFs

Diversification with a single transaction

Ease of trading: traded like shares

Liquid, with constant market price

What are private client funds

Funds managed by professional stock brokers for individual investor

What are the objectives of private client funds

Diverse, dependent on client circumstance

What are the types of private client funds

Execution only

Advisory dealing services and portfolios

Discretionary portfolios

What are typical perfomance benchmarks for Private client funds

ARC Private Client Indices

What are structured products

Pre-packaged investments linked to underlying assets (e.g. equities, interest rates).

Often include capital protection or conditional returns.

What are wrap accounts

Integrated investment platforms that consolidate multiple products and services.

Provide:

Centralized reporting

Tax wrappers (e.g. ISAs, SIPPs)

Access to a wide range of funds and instruments

What are the featurres of Hedge Funds

Actively managed, complex strategies

Focus on highly geared returns to profit regardless of market direction

Combination of asset and derivative investment

What are the types of Hedge Fund

Market neutral

Event-driven

Long/Short

Tactical

Fund of hedge funds

What is Private Equity

Equity capital that is not quoted on a public exchange