Provisions, contingent liabilities and contingent assets- Week 10

1/35

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

36 Terms

What is the definition for a provision?

A liability of uncertain timing or amount.

When can we recognise a provision?

When all 3 of the following conditions are met:

There is a present obligation (legal or constructive) as a result of past events

Probable economic benefits will flow to the entity

A reliable estimate can be made (if not disclose as contingent liab)

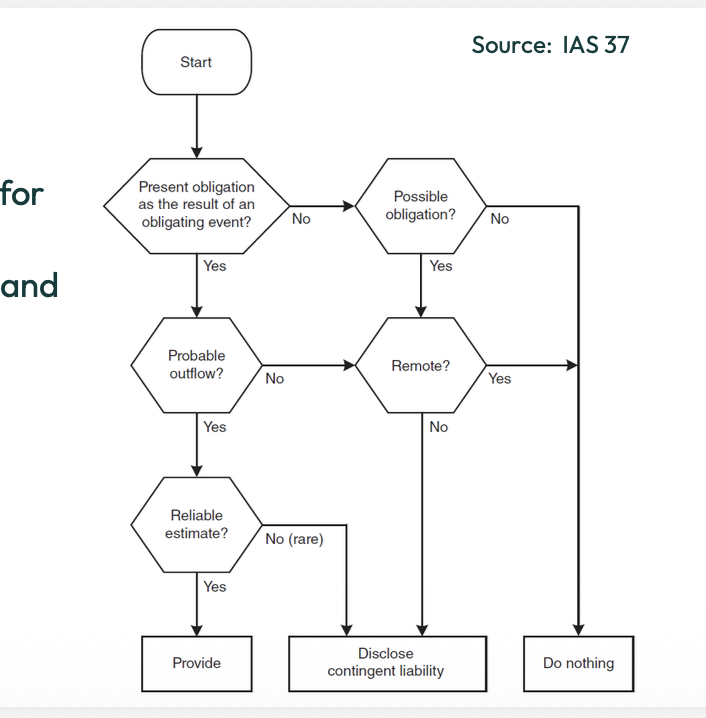

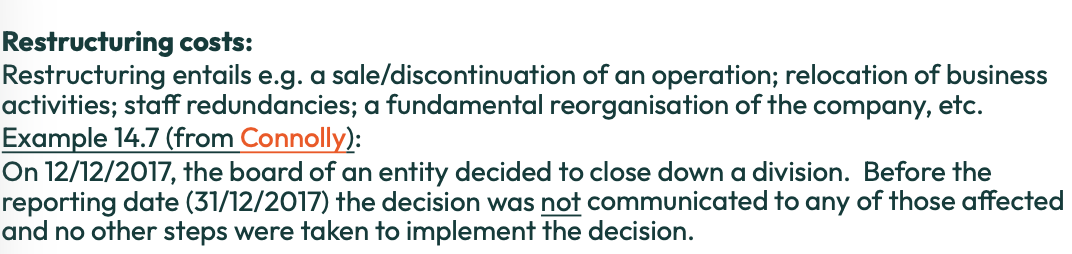

What is the decision tree diagram for provisions, contingent liabilities and non events?

How do we measure a provision?

Use the ‘best estimate’- the amount the entity would rationally pay to settle the obligation or transfer it to a third party

What are the two estimation approaches to measure provisions?

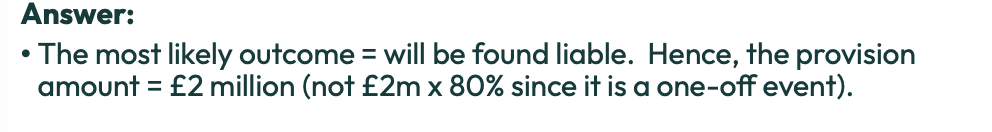

Most likely amount (use on one-off events)

Expected value (use with many similar items)

What are some examples of one off events?

Restructuring

environmental clean up

settlement of a lawsuit

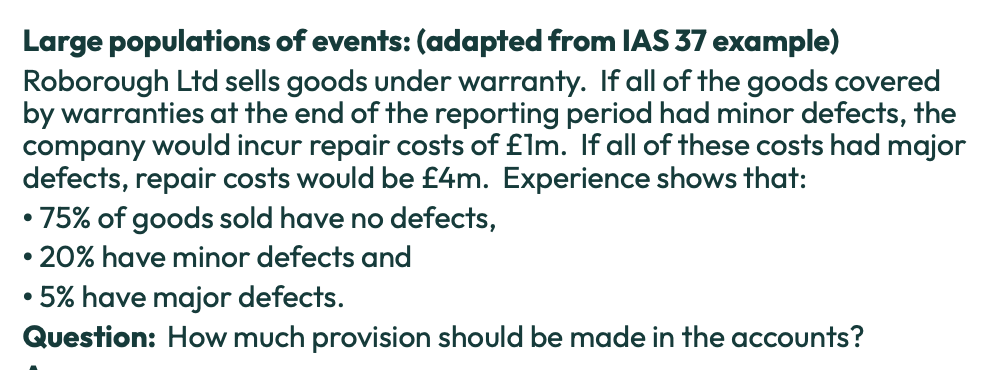

What are some examples of large population events?

Warranties

customer refunds

How often should provisions be reviewed?

every year and adjusted to reflect the current best estimate of the required expenditure.

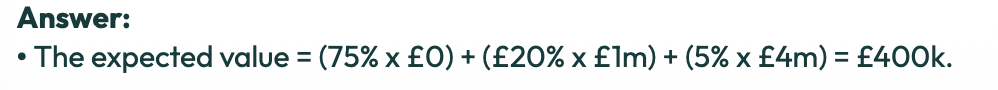

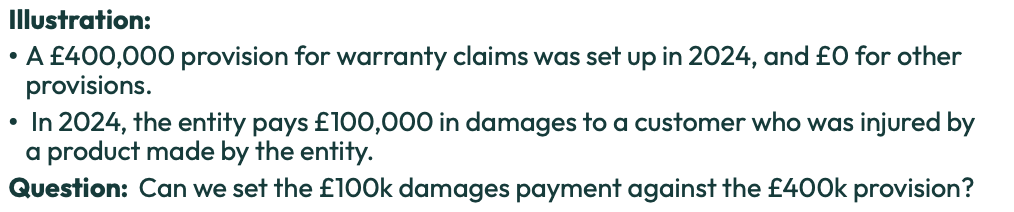

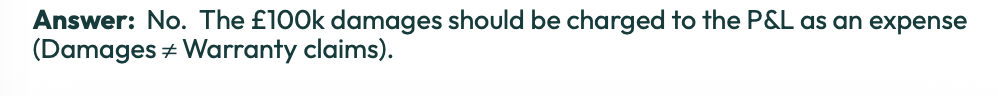

When is a provision only used?

IAS37 states that a provision shall be used only for expenditures for which the provision was originally recognised.

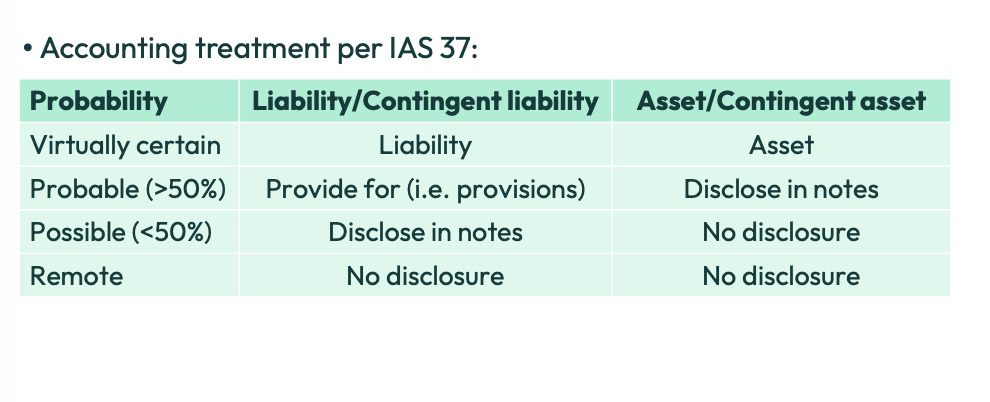

What is a contingent liability?

A possible obligation or present obligation that cannot be recognised because:

Outflow is not probable

Amount cannot be reliably measured

Disclose only in the notes, unless the likelihood of outflow is remote

What is a contingent asset?

A possible asset arising from past events, where the inflow is uncertain

Do not recognise in the balance sheet

disclosed in notes if inflow is probable

Recognised as an asset only when inflow is virtually certain

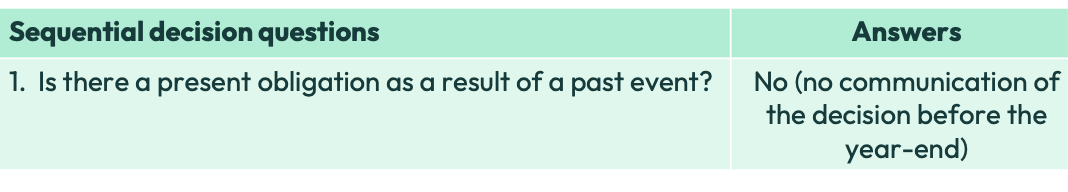

What is the accounting treatment summary for provisions, contingent liabilities and contingent assets?

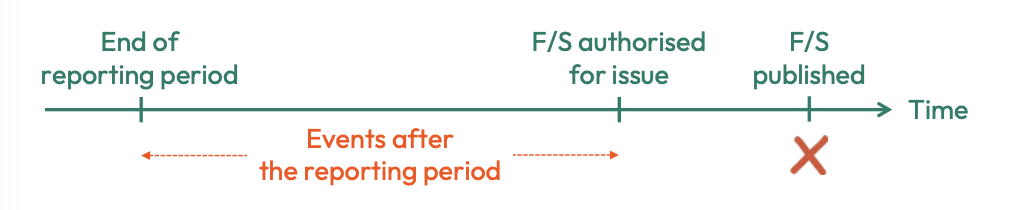

What are events after the reporting period?

Those events, favourable and unfavourable that occur between the end of the reporting period and the date when the financial statements are authorised for issue.

What are adjusting events

Events that provide evidence of conditions that existed at the end of the reporting period.

These require adjustments in the financial statements

What are non adjusting Events

Events that arise after the reporting period, showing conditions that arose after the end of the reporting period.

Do not adjust the financial statements but disclose if material

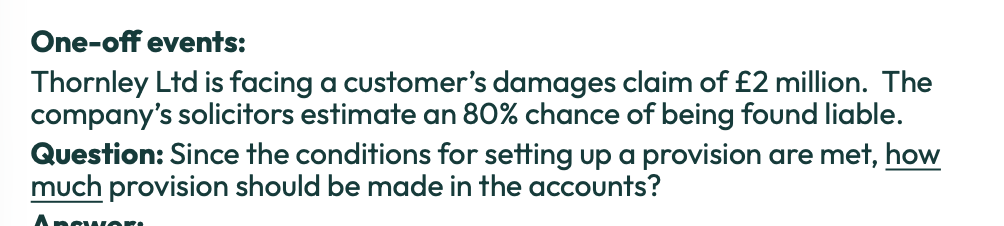

When measuring a provision when do we use the “most likely amount”

When the outcome is a single obligation (one event)

Use this for individual items where there are only two possible outcomes (e.g. win/lose a court case)

When measuring a provision when do we use the “expected value”?

When the obligation involves many similar items

Use this when dealing with a population of similar obligations meaning lots of items with uncertain outcomes.

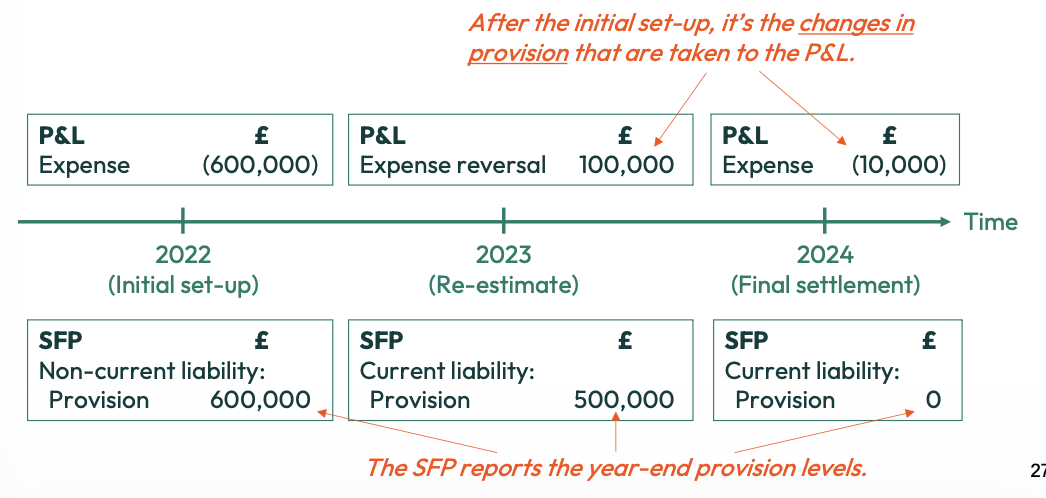

How do we account for provisions?

Provisions are liabilities

Recognised in the SFP as non-current or current liabilities

With provisions what is taken to the P&L?

After the initial set up it is the changes in provision that are taken to the P&L

Kingskerswell PLC proposed a bonus scheme for all employees amounting to £200,000. This scheme was approved by the board of directors and communicated to employees on September 19, 20X5.

Is this an event after the reporting period ??

No, as the event occured after the financial statements were authorised for issue (sep 18th).

No adjustment or disclosure is required in the financial statements for the year ended 30 june 20X5

Another customer of Kingskerswell PLC, whose retail outlet was situated on the Cornwall coast, announced early in September 20X5 that it was closing down after its premises, along with all the fixtures and fittings and its inventory, were destroyed as a result of the August tropical storm. The company was under-insured and was forced to close down. Management of Kingskerswell PLC estimates that it is unlikely that more than £0.30 in £1 will be paid on liquidation. An amount of £150,000 owing from this customer was included in accounts receivable on the draft statement of financial position at 30 June 20X5.

Is this an event after the reporting period?

This is a non-adjusting event after the reporting period, as it is indicative of conditions that arose after the end of the reporting period. The insolvency of this receivable arose solely because of the storm which occurred after the end of the reporting period (30th June)

Disclosure is required of the nature of the event (the storm which destroyed the receivable’s premises) and an estimate of the financial effect (£105,000)

A customer of Kingskerswell PLC was placed into liquidation at the end of July 20X5. The amount of £400,000 owing by this customer was included in accounts receivable on the draft statement of financial position at 30 June 20X5.

Is this an event after the reporting period?

This is an adjusting event after the reporting period as it provides evidence of conditions that existed at the end of the reporting period. The insolvency of a receivable and the inability to pay usually build up over a period of time.

A bad debt expense of £400,000 should be recognised and the amount of the accounts receivable on the SFP should be reduced by £400,000

One of Kingskerswell PLC’s warehouses is situated on the Cornwall coast. A storm struck the area during late August 20X5 and flooded the warehouse, destroying the entire inventory on the ground floor, comprising modems and lightning protector kits. This inventory was included on the draft statement of financial position at 30 June 20X5 at £3,000,000.

Is this an event after the reporting period?

This is a non adjusting event after the reporting period as it is indicative of conditions that arose after the end of the reporting period. The storm occured during late August 20X5 after the end of the reporting period.

Disclosure is required of the nature of the event (the storm) and an estimate of the financial effect (£3m)

A major competitor announced a reduction in the price of its MP3 players during July 20X5. The competitor was able to do this because of its ongoing investment in new technology. Management of Kingskerswell PLC had included the inventory of MP3 players on the draft statement of financial position at its cost of £6,500,000. It is estimated that the net realisable value of this inventory at 30 June 20X5 is £5,000,000 because of the competitor’s price reduction.

Is this an event after the reporting period?

This is an adjusting event after the reporting period, as it provides evidence of conditions that existed at the end of the reporting period.

The closing inventory should therefore be valued at its net realisable value of £5m

Would this be recognized as a provision? A law passed in October 20X2 requires the fitting of new smoke filters for £150,000 by March 20X3. This work has not yet been carried out.

No, as there is no present obligation as a result of past events.

The obligating event when it arises will be the fitting of the filters

Is this recognised as a provision?

A customer has made a claim against Bellrock for defective goods. The claim is nearing settlement, and Bellrock's legal advisers think it is probable that a sum of £300,000 will be paid by Bellrock in settlement, in addition to all legal costs.

Present obligation as a result of a past event- supplying the defected goods

Probable outflow of economic benefits- legal advisers

Reliable estimate - best estimate of £300k + legal costs

Is this recognised as a provision?

Bellrock sells goods with a warranty. If minor defects were to arise in all products sold, repair costs of £2 million would be incurred. If major defects ·arose in all products sold, repair costs of £8 million would arise. Bellrock's experience is that 20% of sales lead to claims for minor defects and 5% to claims for major defects.

Present legal obligation from a past event- warranty

Probable outflow - repair costs

Reliable estimate - (20% x £2000000) + (5% x £8000000)= £800,000

What is a past event?

Something that has already happened and puts the entity in a position where it cannot realistically avoid the resulting duty. E.g.

Selling goods with a warranty- you owe repairs if defects arise

Signing a contract- you now owe the agreed services/costs

Being sued for past actions - legal obligation exists

What do we do once a provision is no longer needed?

It must be reversed. You cannot reuse it for a different unrelated cost.

How do we reverse a provision?

Dr provision

Cr expense (P&L)

With reference to IAS37 Provisions, contingent liabilities and and contingent assets briefly explain the term ‘provision’.

A provision is a liability of an uncertain timing or amount. A provision should be recognised when:

The entity has a present obligation (legal or constructive) as a result of past events

It is probable that an outflow of resources (economic benefits) will be required to settle the obligation

A reliable estimate can be made of the amount of the obligation.

With reference to IAS37 Provisions, Contingent liabilities and contingent assets briefly explain the term ‘contingent liability’

A possible obligation that arises from past events and whose existence will be confirmed only by the occurence or non occurence of one or more uncertain future events not wholly within the control of the entity OR

A present obligation that arises from past events but is not recognized because it is not probable that an outflow of resources embodying economic benefits will be required to settle the obligation

The amount of the obligation cannot be measured with sufficient regularity