AP Macro Econ Test #2

1/77

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

78 Terms

GDP

Gross Domestic Product- the total market value of all final goods and services produced annually in an economy

- measures total income of everyone in econ & total expenditure on econs output of goods

Consumption Approach to Calculating GDP

Y = C + I + G + Nₓ

- Y = GDP

- C = Consumption

- I = Investment

- G = Gov Purchases

- Nₓ = Net Exports

Consumption

- spending by households on goods and services, with the exception of purchases of new housing

Investment

- spending on capital equipment, inventories & structures including household purchases of new housing

Gov. Purchases

- spending on goods and services by local, state, and federal governments

Net Exports

- exports - imports

Income Approach to Calculating GDP

GDP = wages + rent + interest + profit

- Interest: interest income & proprietor's income

Value Added Approach to Calculating GDP

- add up the dollar value added at each stage of the production process

Transfer Payments

- payments made by the gov. without any goods or services being exchanged

- ex: welfare, unemployment compensation, subsidies

Factor Payments

- income people receive for supplying factors of production

- wages for labor, rent for land, interest for capital, profits for entrepreneurship

Real GDP

- GDP expressed in constant, or unchanging, prices

- evaluates current prod. using prices fixed at past lvls to show how econ's overall prod of goods has changed

Nominal GDP

- GDP measured in current prices

- prod. of goods & services valued at current prices

GDP Deflator

- measure of the price lvl

- (Nominal GDP / Real GDP) x 100

Inflation

- continuous rise in the price of goods and services

- rise. of price lvl in econ

Calculating Inflation Rate

[(GDP deflator year 2- GDP deflator year 1)/ GDP deflator year 1 ] X 100

Recession

- periods where GDP declines

- large GDP = better life

Intermediate Goods

- goods purchased for further processing/ manufacturing for sale

- not counted towards GDP

Final Good

- a good sold to final users

- taken into account for GDP

Limitations of GDP

- used & intermediate goods don't count

- nonproduction transactions aren't counted (bonds & stocks)

- illegal/non-market transactions excluded

GNP

- Gross National Product - the sum of all goods and services produced WITHIN a nation in a year

- GNP = GDP - net income from abroad

CPI

- consumer price index

- measure of the overall cost of the goods & services bought by a typical consumer

- computed & reported by BLS

CPI Calculation

(price of basket goods & services in current year/price of basket in base year) x 100

PPI

- Producer Price Index

- measure of the cost of basket goods & services bought by firms

Problems Measuring the Cost of Living

- substitution bias, introduction of new goods, unmeasured quality change

GDP Deflator vs CPI

- GDP reflects the prices of all goods and services, but CPI reflects prices of goods and services bought by the typical consumer.

- CPI compares the prices of a fixed basket of goods and services, BLS rarely changes the basket. GDP always changes.

ex: Volvo raises prices. Volvos are made in Sweden, so NOT PART OF GDP, but bought by US consumers, so it's part of CPI

Indirect Business Tax

- raises prices for consumers to make up for the money paid for taxes

Consumption of Fixed Capital/Depreciation of Capital Goods

- value of capital goods decreases as time goes on

NNP

- Net National Product

- GNP - depreciation

NI

- National Income

- [GDP + Nₓ - (indirect business taxes + consumption of fixed capital)]

- estimates of factors of the cost of production

- NNP - I (Indirect business taxes)

PI

- Personal Income

- NI - (corporate income taxes + undistributed corporate profits + social security taxes + transfer payments + interst paid by persons)

- how much $ a household has before taxes

DPI

- Disposable Personal Income

- PI - personal income taxes

- amount of income households have to dispose of as they wish

Personal Outlays

- consumer purchases of durable goods, nondurable goods, and services- consumer expenditures on goods/services + interest paid by persons

Personal Savings

DPI - Personal Outlays

Business Cycle

- fluctuations in economic activity, such as employment and production

- correspond to changes in business

Model of Aggregate Demand & Supply

- model that most economists use to explain short-run fluctuations in economic activity around its long-run trend

Aggregate Demand Curve

- all goods & services that consumers, the gov, & foreign buyers purchase in an econ.

Aggregate Supply Curve

- shows the quantity of goods and services that firms choose to produce and sell at each price level

Natural Rate of Output

- production of goods and services that an economy achieves in the long run when unemployment is at its normal rate

Determinants of Aggregate Supply

- labor force, productivity, expected future price lvl, workers & firms adjusting to incorrest estimation of price, supply shocks, short-run equilibrium

Short Run Aggregate Supply

- the total amount of goods and services that all firms are willing and able to produce within the economy

- econs total output when at least 1 input price (ex: wages) is fixed

Long Run Aggregate Supply

- wages and resource prices will increase as price levels increase

- max sustainable output at full employment, as input prices are fully flexible

- LRAS = PPF

- vertical

Keynesian Economy

- if stimulated, aggregate demand will stimulate the econ & pull a country out of recession

- total demand consumed for all goods & services prod in a yr

Why Demand Curve Slopes Right

1. Wealth Effect: as price lvl inc, society has less $ to spend

2. Interest Rate Effect: ppl will borrow less $ when interest is high

3. Foreign Purchase Effect: if price lvls inc. Americans will buy less US goods & get cheaper foreign goods

Causes of Shifts in AD

- consumers (wealth & expectations), Interest (purchase of capital goods by businesses), G (gov purchases), Nx (net export spending)

Sticky-Wage Theory

- an unexpectedly low price level raises the real wage, which causes firms to hire fewer workers and produce a smaller quantity of goods and services

SRAS to LRAS

Phase 1: lvls of output are less than full employment (recession)

Phase 2: price lvls rise & real GDP inc. (expansionary phase)

Phase 3: GDP remains constant

- unles tech advances, they get more resources, or econ goes into recession, curve won't shift

Hyperinflation

- rapid rise in inflation

- price lvls constantly rise without AD rising to reach that lvl

Stagflation

- slow economic growth and high unemployment

- quick rise in price lvls & dec in real GDP

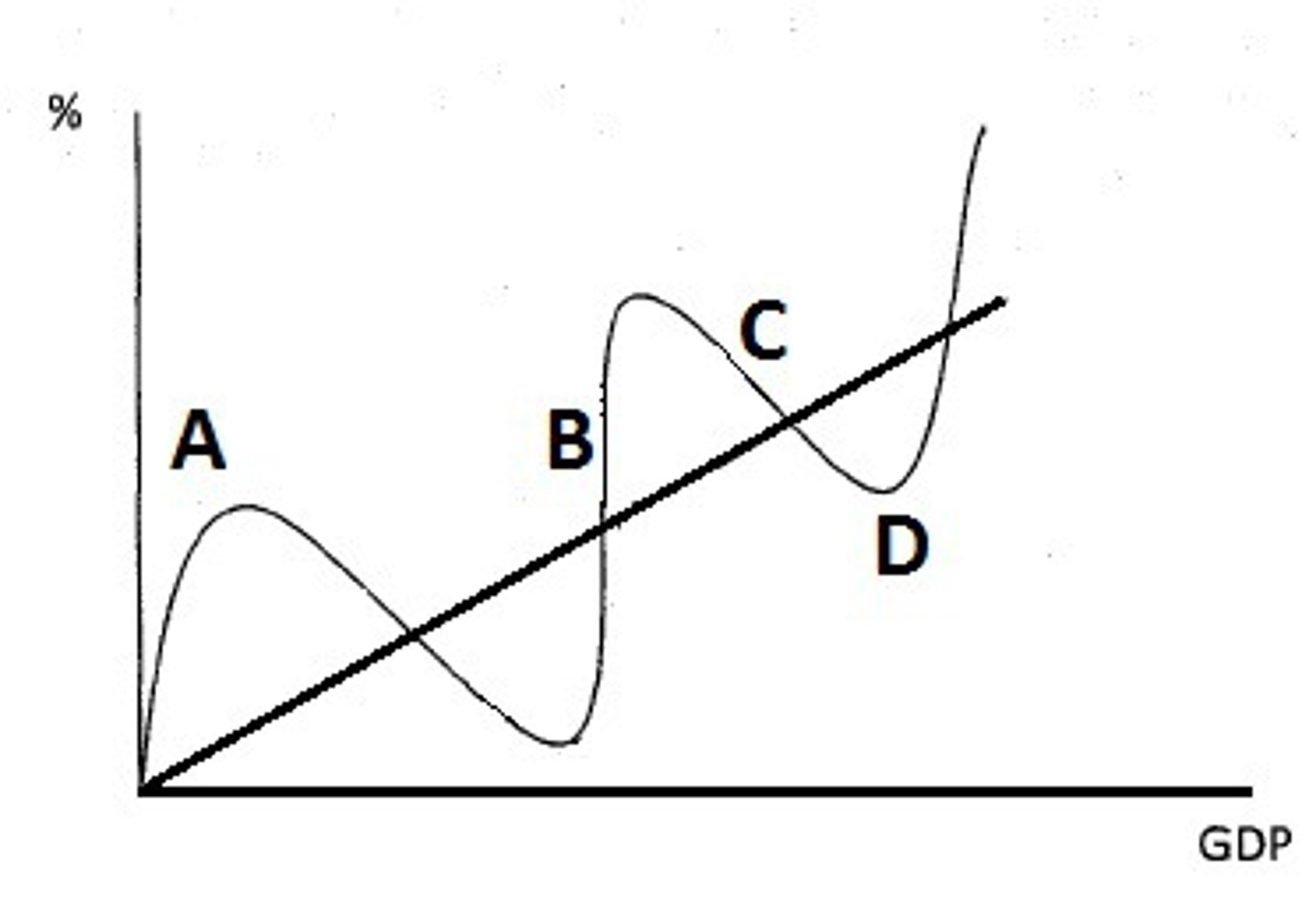

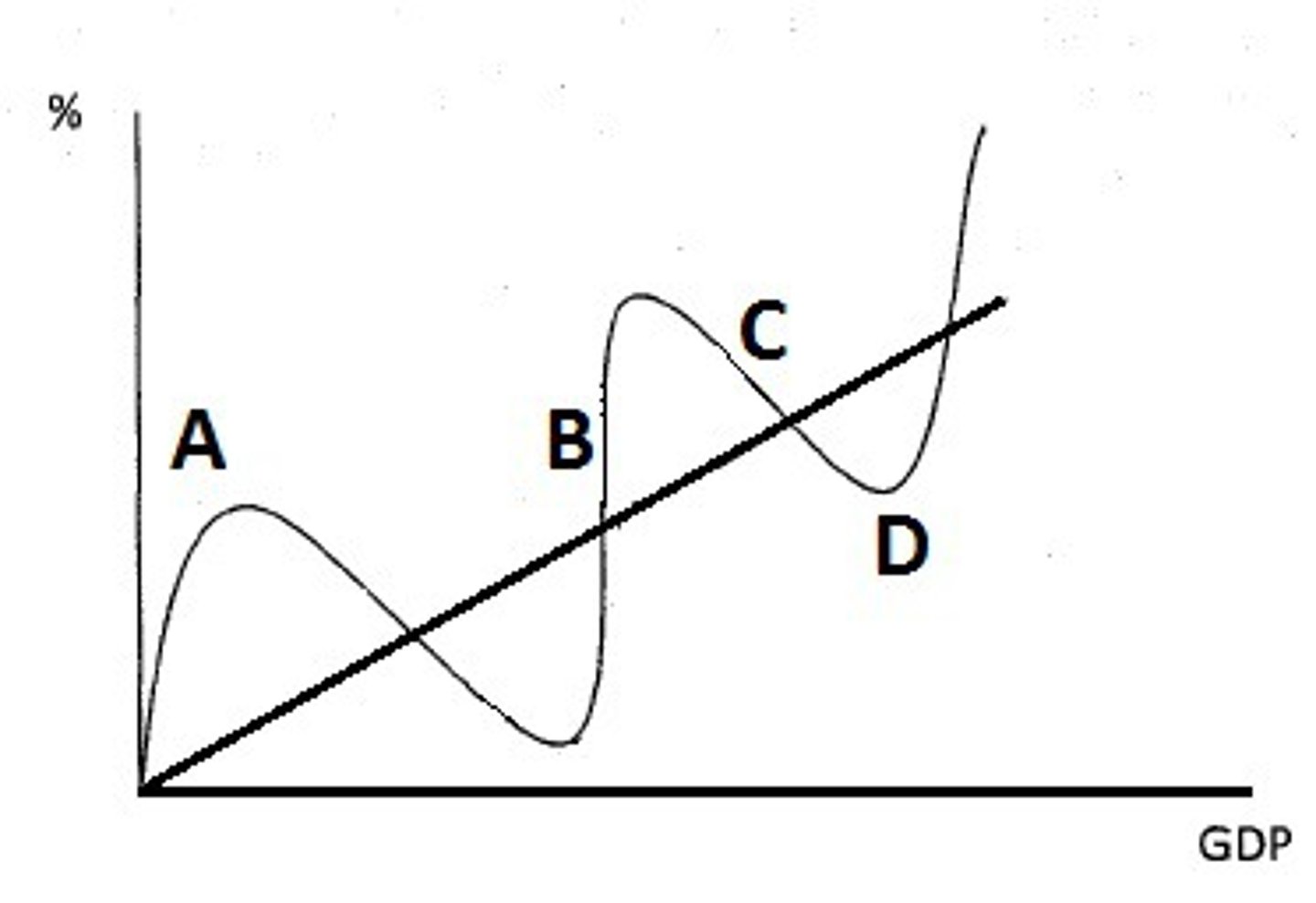

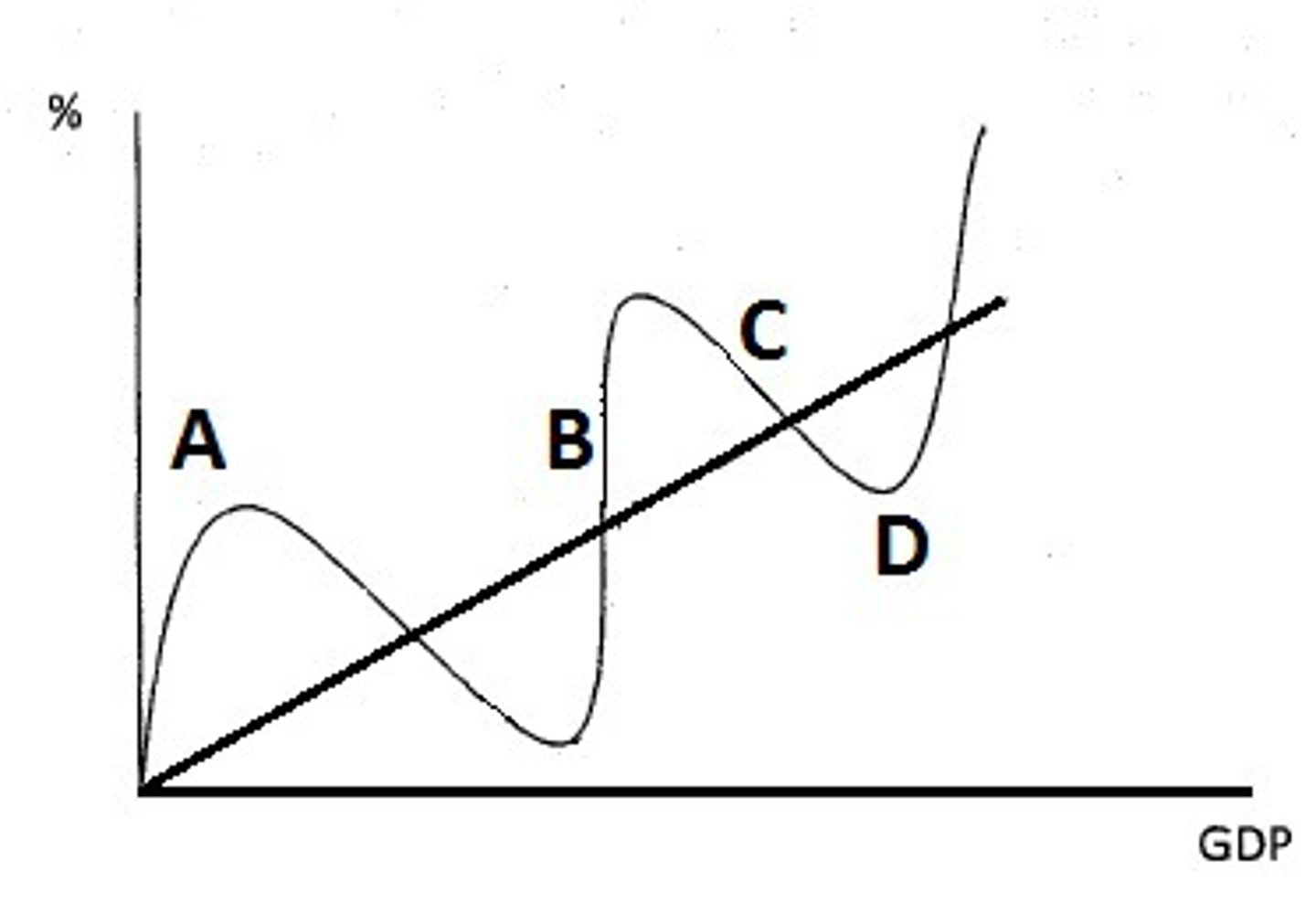

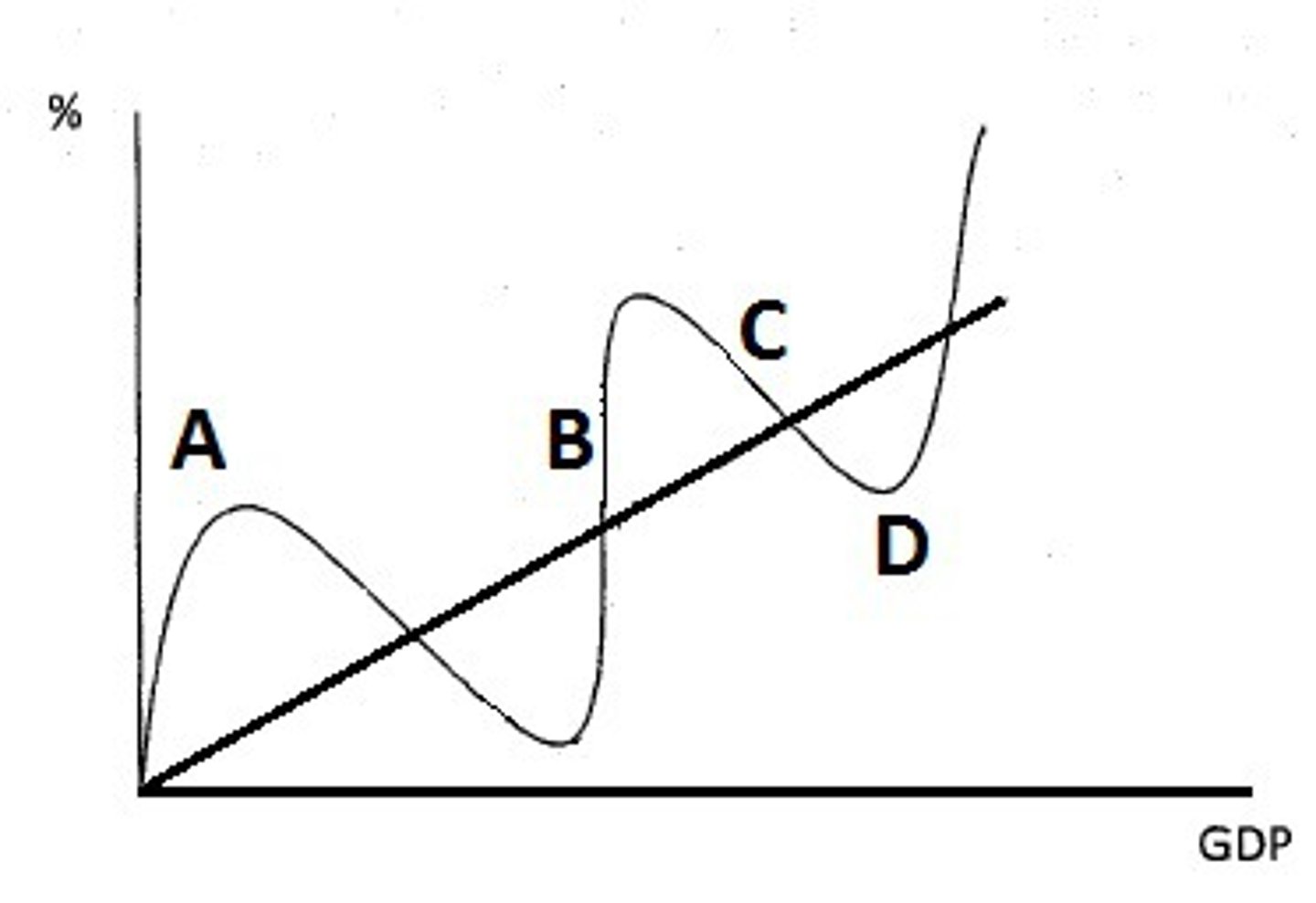

Stages of Business Cycle

- expansionary stage, peak, recession, trough

Expansionary Stage

- rising unemployment

- SRAS curved (phase 2)

- B

Peak

- max output, full employment, domestic output at max

- price lvl inc but not output (GDP stays same)

- LRAS at peak

- Hyperinflation can occur

- A

Recession Stage

- decline in total output, income, employment, price lvls, or trade

- lasts 6+ months

- C

Trough

- lowest lvl of output & employment

- D

Business Cycle Causes

1. Tech innovation

2. Political events

Labor Force

- those 16+ who are either employed or actively seeking employment but are currently unemployed, full-time students, homemakers, or otherwise not seeking work

Labor Force Participation Rate

(# of ppl in labor force/working age pop.) x 100

Unemployment Rate

(# of ppl unemployed seeking a job/# of ppl in labor force) x 100

Discouraged Workers

- ppl who would like to work but have given up looking for a job

Types of Unemployment

frictional, structural, cyclical

Frictional Unemployment

- in between jobs

- have skills & available jobs but haven't found a job yet

Structural Unemployment

- no skills & no jobs available bc structure of labor market changed

- some jobs obsolete bc of new tech

- ex: VCR repair

Cyclical Unemployment

- due to recession

- econ is doing poorly so ppl buy less goods

- businesses need less workers & lay of ppl

Seasonal Unemployment

- unemployment linked to seasonal work

Natural Unemployment

- econ will always have some frictional & structural unemployment

Natural Rate of Unemployment

- lvl of unemployment that exists when the econ is at full employment, including frictional & structural unemployment, but not cyclical unemployment

Shortcomings of Calculating Unemployment

- part-time jobs

- discouraged workers

- illegal jobs

Okun's Law

- 1 percent more unemployment results in 2 percent less output

Rate of Inflation

[(GDP Deflator of year x - GDP deflator of base yr)/GDP deflator of base yr] x 100

Rule of 70

- doubling time of inflation

- 70/inflation rate

Types of Inflation

1. Demand Pull

2. Cost Pull

3. Wage Spiral

Demand Pull

- greater demand results in inadequate supply and raised prices

- too many workers & not enough goods being produced

Cost Pull

- demand outpaces supply

output lvls decline, leading to inc unemployment

- not enough consumers to ppl get laid off

Wage Spiral

- higher prices force workers to request higher wages, forcing producers to raise their prices even more and workers to ask for even higher wages in an upward spiral.

Philips Curve

- inverse relationship between inflation and unemployment.

Causes of Phillips Curve

1. inc in prices of factors of production

2. supply shock

Supply Shock

- event that shifts the short-run aggregate supply curve

- a sudden shortage of a good

Effects of Inflation

1. Income Redistribution

2. Savers have less money over time

3. Debtors & creditors: value of debt inc as inflation inc

4. COLA (cost of living adjustment)

Deflation

- decrease in the general level of prices bc not enough goods being made