tax final

1/75

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

76 Terms

3 methods of cost recovey

depreciation, amortization, or depletion

cost recovery

business must capitalize the cost of assets with a useful life of more than one year on the balance sheet rather than expense the cost immediately

Depreciation

•Deducting the cost of tangible personal and real property (other than land) over a specific period of time.

Amortization

Deducting the cost of intangible property over a specific period of time.

Depletion

deducting the cost of natural resources over time

Basis for cost recovery

asset adjusted tax basis= asset’s initial basis - accumulated deprecation

Asset type: personal property comprised of tangible assets such as automobiles, equipment, and machinery

cost recovery method: depreciation

Asset type: real property comprises building and land

cost recovery method: depreciation

asset type: intangible assets

cost recovery method: amortization

asset type: natural resources

cost recovery method: depletion

•Scrap-Happy Inc., a scrapbooking retail chain, purchased an old office building for $175,000 for use in expanding its current operations. An additional $15,000 was spent painting and remodeling the building in preparation for its opening.

•Two years later, a Scrap-Happy employee discovered that several leaks in the roof were causing serious water damage to the store’s inventory; the company spent $50,000 to reroof the building.

•Every six months, Scrap-Happy pays $500 to have the carpet professionally cleaned.

initial: 190000 (175000+15000)

added: 50000 (reroofing)

no effect for carpet cleaning = maintenance

Tax Depreciation System

MACRS

What to know for MACRS (5 factors)

•Asset’s initial basis.

•Date it was placed in service.

•Applicable depreciation method.

•Asset’s recovery period (or depreciable “life”).

Applicable depreciation convention

Personal Property Depreciation.

•Includes all tangible property such as computers, automobiles, furniture, machinery, and equipment, other than real property.

•Personal property (not real property) and personal-use property (used for personal purposes) are not the same.

3 methods for personal property depreciation

•200 percent (double) declining balance.

•150 percent declining balance.

•Straight-line.

Recovery Period for Cars, light trucks, computers, and peripheral equipment

5 years

recovery period: office furniture, fixtures, and equipment

7 years

recovery period: qualified improvement property

15 years

Depreciation conventions

half-year

half-quarter

half year convention

•One-half of a full year’s depreciation is allowed in first and last year of an asset’s life.

•If an asset is disposed of before it is fully depreciated, only one-half of the table’s applicable depreciation percentage is allowed in the year of disposition.

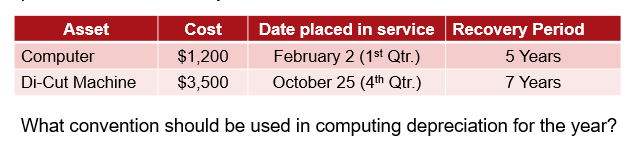

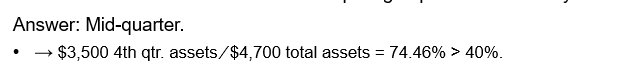

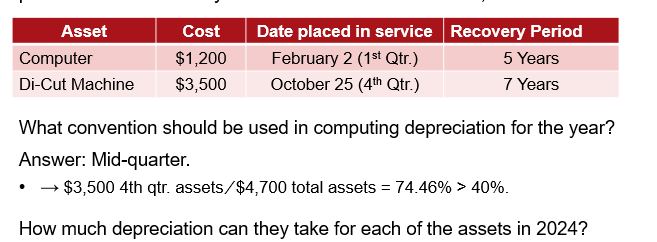

,mid-quarter convention

applicable when more than 40% of the qualified property is placed in service in the last quarter of the year

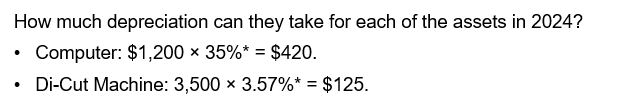

Calculating depreciation for personal property

•Determine the appropriate convention (half-year or mid-quarter).

•Locate the applicable table provided in Rev. Proc. 87-57.

•Select the column that corresponds with the asset’s recovery period.

•Find the row identifying the year of the asset’s recovery period.

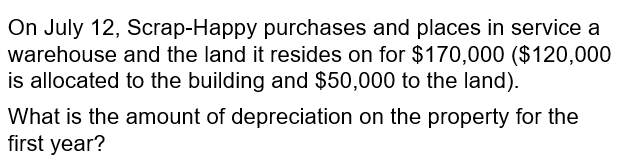

Real Property: Residential

Recovery period 27.5 years

Real Property: Nonresidential property placed after May 13. 1993

Recovery Period: 39 years

Real Property: Nonresidential property placed before May 13 1993

31.5 years

Immediate Expensing is also known as

179 expense

Limits of immediate expensing

Property limitation

taxable income limitation

What can 179 expenses be used for?

qualified property, needs to be acquired by an unrelated person, can be a used property as long as you or unrelated person hasn’t used it befor, regular depreciation life of 20 years or less

Bonus Depreciation

additonal depreciation allowed in the acquisition year for tangible personal property with a recovery period of 20 years or less

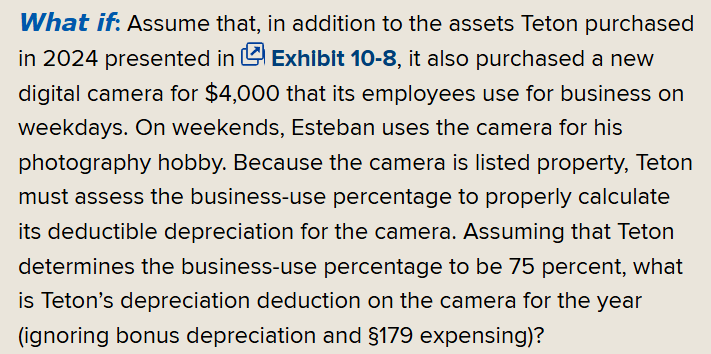

Listed Property

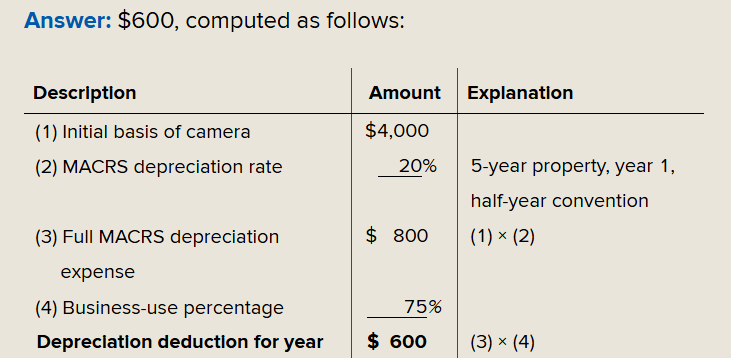

business assets that are often used for personal purposes. Depreciation on listed property is limited to the business-use portion of the asset.

if business use is more than 50%, deduct full annual depreciation*business percentage

Below 50%, depreciation for all previous years is retroactively restated using the MACRS straight line method

MACRS depreciation *business use percentage

Amortization

businesses recover cost of intangible assets through amortization

Examples of intangible assets

-197 intangibles

-start-ups/organization costs

-reserach and experimentation costs

-patents and copyrights

197 intangibles

recovery period of 15 years regardless of their actual life

Patents and Copyrights

if you buy it, amortize it over the remaining life

if you self-created, amortize over 5 years

why would someone choose to apply bonus depreciation

mandatory unless elected out

accelerate tax deductions

Depletion

recover their capital investment in natural resources

cost and percentage depletion —> take the larger of the 2 expenses

can deplete more than you paid

AMT

Alternative minimum tax to make sure people pay tax even if they get certain breaks

If you need to fix one asset write it as a

repair expense

if you replaced all 10 assets

capitalize the cost

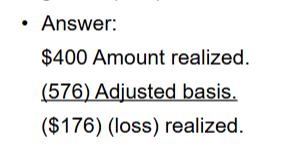

yr 1: 240 yr 2:384 adjusted basis: 576 (1200-240-384)

Netting and Look-Back Rule

§1231 gains and losses from individual asset dispositions are annually netted together. Net §1231 gains may be recharacterized as ordinary income under the §1231 look-back rule.

Like-kind property

Real property All real property used in a trade or business or held for investment is considered “like-kind” with other real property used in a trade or business or held for investment.

Ineligible property Personal property. Domestic property exchanged for property used in a foreign country and all property used in a foreign country. Real property held for sale.

Timing Requirements of a Like-kind exchange

May involve intermediaries

Identify replacement “like-kind” property within 45 days of giving up their property

must be received within 180 days of when the taxpayer transfers property in a “like-kind” exchange

Involuntary Conversions

Gain is deferred when appreciated property is involuntarily converted in an accident or natural disaster

Basis of property directly converted is carried over from the old property to the new one

In an indirect conversion, gain realized is the lessor of gain realized or amount of reimbursement the taxpayer does not reinvest in qualified property

Qualified replacement property must be of a similar or related use to the original property

Installment Sales

Sale of property where the seller receives the sale proceeds in more than one period

Must recognize a portion of gain on each installment payment (gross profit percentage=gross profit/contract price)

Related-Person Loss Disallowance Rules

Treat related persons as though they are the same taxpayer

Losses on sales to related persons are not deductible

Related person may deduct the previously disallowed loss to the extend of the gain on the sale to the unrelated third person

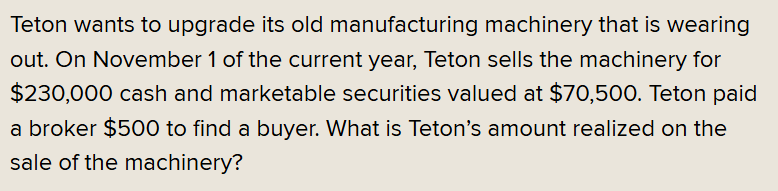

Amount realized =

cash recieved + Fair market value + buyer’s assumptions of liabilities - seller’s expense

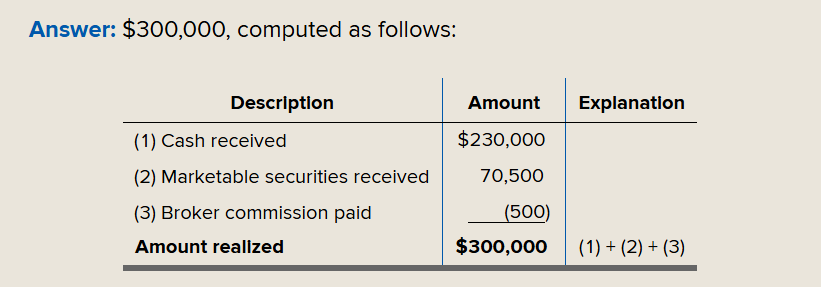

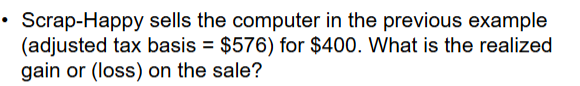

Realized Gain or Loss on disposition =

the amount of gain or loss taxpayers realize on a sale or other dispositions of assets is simply the amount they realize - adjusted basis in the disposed assets

Gain or (loss) realized =

amount realized - adjusted basis

Adjusted basis

initial basis minus depreciation or other types of cost recovery deductions allowed (or allowable) on the property (initial basis - cost recovery allowed)

Adjusted basis for Gifts

AKA carryover

Fair market value > donor’s basis → carryover basis (initial basis is same as donor’s basis)

Fair market value < donor basis → carryover basis if sold at a gain, FMV is sold at a loss

Adjusted basis for Inherited Property

FMV on the date of death, or 6 months after the death if elected by the estate

AKA stepped up

Personal use to business use

Basis depends on whether the property appreciated or declined in value during the time the property was used personally

Appreciated: taxpayer uses the basis

Declined in value: taxpayer uses FMV

Ordinary Assets

Assets created or used in trade or business

Held for less than a year

Ex: inventory, A/R, machinery, equipment

Sold at a gain → gain is taxed at ordinary rates

Sold at a loss→ deduct the loss against other ordinary income

Capital Assets

Assets held for investment, for the production of income, or for personal use

1231 assets

Assets and land used in trade/business held for more than one year

Net gain → long term capital gain

Net loss → ordinary loss

Gains can be recharacterized as ordinary income

3 types of 1231 assets

1231 - Land

1245 - personal property and intangible

1250 - depreciable real property

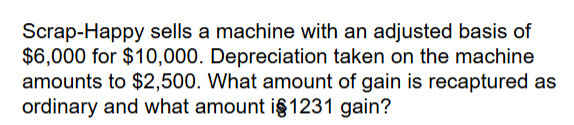

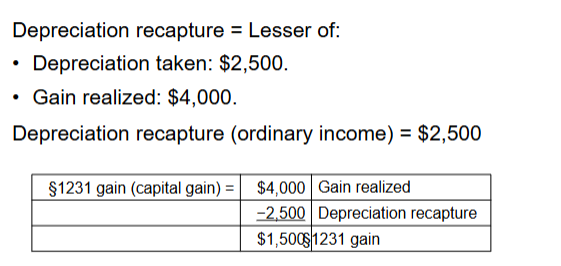

Depreciation Recapture

Conversion of 1231 gain into ordinary income on a sale based on the amount of accumulated depreciation on the property at the time of sale or exchange

Applies to gains ONLY

1245 Assets

Personal property and amortizable intangible assets

The lessor of:

Gain recognized

Total accumulated depreciation

Any remaining gain is a 1231 gain

3 scenarios of depreciation recapture

Gain created through only depreciation deductions

Gain created through both depreciation deductions and actual asset appreciation

Recognize a loss

1250 Depreciation Recapture for Real Property

Depreciable real property sold at a gain is NOT subject to recapture

Unrecaptured 1250 gain for individuals

Depreciable real property sold at a gain is 1250 but is no longer subject to recapture

Involuntary conversions

Lost his asset from something outside of his control

Circumstance most is eminent domain, when the state comes and takes your property, or the state condemns your property

Replacement asset must be of a similar or related use to the original property

Installment Sales

Sale of property where the seller receives the sale proceeds in more than one period

Must recognize a portion of gain on each installment payment received

Gross profit percentage = gross profit/contract price

Inventory, marketable securities, and depreciation recapture cannot be accounted for under installment sale rules

Does not apply to losses

When boot is given as part of a like-kind transaction

The asset received is recorded in two parts: property received in exchange for like-kind property and property received in a sale

Own a different property (the replacement asset)

Based on the basis that you had on your original asset

If i sold the new asset, that gain will come back and be recognized

Calculating 1231 gain or loss if gains>loss

net gain is long-term capital gain

Calculating 1231 gain or loss if gains<loss

net loss is ordinary

when boot is received

creates recognized gain

gain recognized is lessor of gain realized or boot received

Adjusted basis of boot received is the FMV of the boot

Simple Depreciation Recapture thinking

Recapture Potential is limited to the depreciation you claimed before selling. Any additional gain is considered a 1231 gain.