IE Unit 4- Balance of payments

1/5

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

6 Terms

What is the Balance of Payments (BoP)

The Balance of Payments (BoP) is a systematic record of all economic transactions between residents of a country and the rest of the world during a year. It includes transactions in goods, services, income flows, financial assets, and reserve movements.

BOP accounts follow a double-entry system and always balances is a fundamental principle of international accounting.

1. The Double-Entry System

The BOP is constructed using the principle of double-entry bookkeeping, similar to corporate accounting. This means every single international transaction gives rise to two entries of equal value: a Credit (+) and a Debit (-).

⚖ Double-Entry Convention in BOP:

The classification of Credit and Debit entries follows this rule:

Credit (+): Any transaction that results in a foreign resident making a payment to a domestic resident. Essentially, any transaction that is a source of foreign exchange for the country.

Examples: Exports of goods/services, receiving income from foreign investments, foreign investment into the domestic country.

Mnemonic: Foreign Money In (FMI)

Debit (-): Any transaction that results in a domestic resident making a payment to a foreign resident. Essentially, any transaction that is a use of foreign exchange by the country.

Examples: Imports of goods/services, paying income to foreign residents, domestic investment in foreign countries.

Mnemonic: Foreign Money Out (FMO)

2. The Explanation: Why It Always Balances (In Accounting Sense)

The BOP always balances by definition because of the double-entry system, which ensures that the sum of all credit entries exactly equals the sum of all debit entries:

\text{Total Credits} = \text{Total Debits}

This zero-sum total is a reflection of the economic reality that every transfer of goods, services, or assets must be accompanied by a financial settlement of equal value.

The balancing mechanism works across the two main accounts:

\text{Current Account} (CA) + \text{Capital Account} (KA) + \text{Financial Account} (FA) + \text{Net Errors \& Omissions} = 0

A surplus in the Current Account (i.e., exports > imports) means the country has provided more goods/services to the world than it received. The surplus money received must, by accounting necessity, be recorded as a debit entry in the Financial Account, usually as an increase in the country's foreign assets (e.g., buying foreign stocks or increasing foreign reserves).

3. Illustration

Consider an example of a single transaction: A U.S. company exports $\$10,000$ worth of software to a German company, and the German company pays by depositing funds into the U.S. company's German bank account.

BOP Account | Entry | Amount ($) | Explanation |

Current Account (Services Export) | Credit (+) | $+10,000$ | The sale of software (an export of a service) is a source of foreign currency. |

Financial Account (Foreign Assets) | Debit (-) | $-10,000$ | The acquisition of a financial asset (the increase in the U.S. company's bank balance in Germany) is a use of funds. |

Net Balance | $\mathbf{0}$ | The transaction is balanced. |

Illustration 2: Financing a Trade Deficit

Suppose a country (Country A) imports $\$1$ Billion more in goods and services than it exports, resulting in a Current Account Deficit of $-\$1$ Billion.

BOP Account | Entry | Amount ($ Billion) | Explanation |

Current Account (Trade Deficit) | Debit (-) | $-1.0$ | More imports (debits) than exports (credits) of goods and services. |

Financial Account (Net Borrowing/Investment) | Credit (+) | $+1.0$ | To pay for the excess imports, the country must have either: 1. Sold domestic assets to foreigners (inflow/credit), or 2. Borrowed from foreigners (increase in foreign liabilities/credit), or 3. Drawn down its official reserves (decrease in assets/credit). |

Net Balance | $\mathbf{0}$ | The deficit in the Current Account is financed by an equal and opposite surplus in the Financial Account, ensuring the overall BOP balances. |

🛑 BOP vs. Accounting Balance (The Practical Reality)

While the BOP always balances in the accounting sense due to the double-entry rule, in practice, there are measurement errors, incomplete data, and unrecorded transactions (like capital flight). To force the actual recorded debits and credits to sum to zero, a balancing item called "Net Errors and Omissions" is included in the statement. This item accounts for the statistical discrepancies, ensuring the equation always holds true.

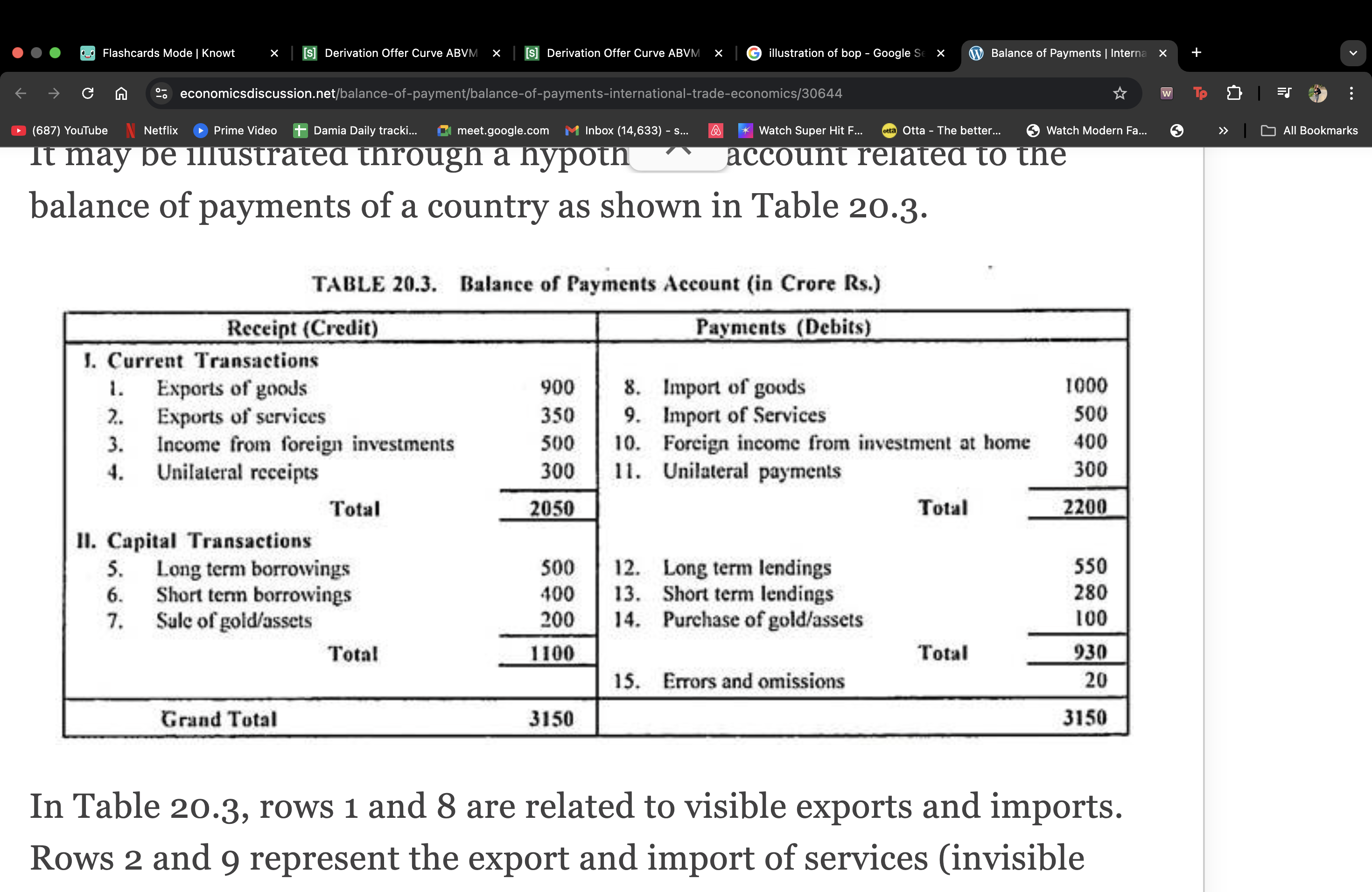

Accounts of BOP

current and capital in tuition book

What is the foreign exchange market, and how are exchange rates determined?

The Foreign Exchange Market (FOREX) is a global marketplace where currencies are bought and sold. According to the PDF, it is the world’s largest and most liquid financial market, operating through spot markets, forward markets, swaps, futures, and options.Key features:

Spot Rate: Price for immediate currency delivery.

Forward Rate: Price fixed today for delivery at a future date.

Foreign Exchange Swaps: Simultaneous spot purchase and forward sale (or vice-versa).

Futures & Options: Standardised contracts traded in organised exchanges.

Exchange Rate Determination (from PDF)

The PDF explains that exchange rates are influenced by:

1. Demand & Supply of Currencies

If demand for USD rises relative to INR, USD appreciates and INR depreciates.

2. Interest Rate Differentials

Higher interest rates attract capital flows into a country → currency appreciates.

3. Expectations

If markets expect future appreciation, investors buy that currency now.

4. Capital Flows

The PDF notes that capital flows dominate trade flows today.

International economics notes

5. Monetary Factors

Money supply growth → inflation → long-run depreciation.

Modern theories emphasise that financial flows dominate trade flows, making exchange rates more sensitive to capital movements.

The monetary approach and the portfolio balance approach explain how money supply, wealth, asset preferences, and expectations influence exchange rates.

CHECK OUT THE BOOK TOO

How are long-run price levels connected to exchange rates?

In the long run, price levels are connected to exchange rates through the theory of purchasing power parity (PPP), which states that exchange rates will adjust to equalize the price of a common basket of goods across countries. This means that if the price level rises faster in one country than another, its currency will depreciate relative to the other country's currency. The exchange rate is also determined by the relative supply of and demand for money in each country.

Purchasing power parity (PPP)

PPP suggests that the exchange rate between two currencies should be equal to the ratio of the two countries' price levels.

What is Purchasing Power Parity (PPP) and how does it relate to exchange rates?

Purchasing power parity (PPP) is an economic theory and a metric that compares the purchasing power of different currencies. It's based on the principle that, in the absence of trade barriers and transport costs, the exchange rate between two currencies should equal the ratio of the two countries' price levels for a fixed basket of goods and services. This allows for more accurate international comparisons of economic productivity, living standards, and currency value.

Identical goods, same price: The core idea is that a standardized basket of goods and services should cost the same in different countries when converted to a common currency.

Example: If a basket of goods costs $400 in India and $5 in the U.S., the PPP exchange rate would be $400 ÷ $5 = ₹80 per U.S. dollar. This means one U.S. dollar has the same purchasing power in both countries for that specific basket.

Beyond market exchange rates: Unlike market exchange rates, which are based on the value of internationally traded goods and can be volatile, PPP includes prices for a wide range of goods and services, both traded and non-traded.

Purchasing Power Parity Theory

This theory is based on the law of one price, which states that under a free and efficient market, equivalent goods must have a uniform price expressed in a common currency without considering the cost of any transaction. Theory about purchasing power parity is employed for comparison of economic productivity as well as living standards across different countries.

How to Calculate Purchasing Power Parity?

To calculate PPP, there are several steps:

Identify a basket of goods and services: This basket is supposed to be a representation of typical consumption within the countries in comparison.

Calculate the prices of the basket in each country: Compile all the costs of the selected items in local currencies.

Converting the prices to the common currency: Using current exchange rate, convert the price from the local currency into a common reference currency, presumably the US dollar.

PPP exchange rate calculation: This is the rate obtained when the two currencies are compared with respect to the total cost of the basket of goods. For instance, if the basket costs $100 in the US and £80 in the UK, then the PPP exchange rate is 1 USD = 0.8 GBP.

The formula for PPP can be represented as:

Eppp= P1/P2

Types of Purchasing Power Parity

The three types of PPP have been explained in brief:

Absolute PPP

Absolute PPP posits that exchange rates between two currencies must be set at the level of the price ratio for a predetermined basket of goods and services between the two countries. That is, this PPP version contends that, in theory, ideally a frictionless world with complete competition, an identical commodity must have an equal value in the two nations when using the same currency.

Relative PPP

Relative PPP takes into account changes in price levels over time due to inflation. It implies that the rate of change in the exchange rate between two currencies during a period should be equal to the difference in inflation rates between the two countries. Therefore, if a country has higher inflation than another, its currency should depreciate relative to the other currency.

Expenditure PPP

Expenditure PPP calculates PPP on the basis of some categories of expenditure like government consumption, private consumption, and capital formation. It offers more refined information on relative prices because it is calculated by comparison of the price of a bigger consumption basket as opposed to that of goods and services alone. This kind of measure enables better and more encompassing comparisons of countries' standards of living and their productivity levels.

Purchasing Power Parity Index

The Purchasing Power Parity Index compares the economic productivity and standards of living between different nations by adjusting for differences in price levels. Organizations, like the World Bank and International Monetary Fund (IMF), make public PPP indices. Of course, the importance of the PPP index should never be underestimated in conducting further economic analysis and policymaking by comparing the benchmark of gross domestic product, poverty rates, income distribution, or people's living standards within two countries.

The World Bank estimated India's GDP per capita in PPP terms to be about $8,477 in 2023. This is in contrast to developed economies such as the United States, whose GDP per capita in PPP terms was estimated to be around $76,398.

Significance of Purchasing Power Parity

PPP has deep economic implications:

Comparative Analysis: PPP enables better comparisons of economic productivity and living standards across nations by removing distortions caused by fluctuating exchange rates.

Economic Policy: Using PPP, policymakers make more rational decisions about monetary policy, fiscal spending, and social welfare programs.

Global Trade: Understanding competitiveness in the global market by accounting for price level differences is possible through PPP.

Investment Decisions: International investors utilize PPP to make relative valuation of investments among countries, after having considered risk due to changes in currency.

Measurement of Living Standards: Agencies such as World Bank and UN have been utilizing PPP to gauge the extent of poverty, inequality of income distribution, and living standards in different nations.

Issues Associated with Purchasing Power Parity

Despite the above-said benefits of PPP, there are many limitations of using it:

Basket of Goods: The choice of goods and services to include in the comparison basket is not going to reflect perfectly the consumption pattern of various countries. Hence, it leads to error.

Non-Traded Goods: PPP does not account for non-traded goods and services, which creates significant differences in the cost of living among countries.

Quality Differences: PPP fails to capture differences in the quality of goods and services. This might lead to an over or underestimation of the purchasing power.

Market Imperfections: Transportation costs, tariffs, and differences in product availability can affect the validity of PPP calculations.

Exchange Rate Volatility: Short-term exchange rate movements do not always reflect basic price level differences, which can mislead the interpretation of PPP.

what is interest rate parity

Interest Rate Parity (IRP) is an economic theory stating that the difference in interest rates between two countries equals the difference between their forward and spot exchange rates, preventing risk-free profit (arbitrage) from currency exchanges. Essentially, it means an investor should earn the same return investing domestically or abroad once currency risk is accounted for, with higher interest rate currencies expected to depreciate to offset gains, ensuring equilibrium in global markets.

Key Concepts

No Arbitrage: IRP ensures no risk-free profits, as any interest rate advantage in one country is cancelled out by expected currency movements.

Covered Interest Parity (CIP): Uses forward contracts to lock in exchange rates, eliminating currency risk and showing a perfect balance.

Uncovered Interest Parity (UIRP): Relates interest rates to expected future spot rates, without hedging currency risk.