Chapter 23: Government Spending, Taxes, and Fiscal Policy

1/93

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

94 Terms

spends more than state and local governments combined

federal government

government provided insurance against bad outcomes such as unemployment, illness, disability, or outliving your savings

Social insurance programs

spending on programs that does not get determined annually

Mandatory spending

Spending that is set in law

Mandatory spending

Spending for programs like Social Security and Medicare

Mandatory spending

spending that Congress appropriates annually

Discretionary spending

Only accounts for 30% of federal government spending

Discretionary spending

provide employment and income support, education and health care

States

Provide higher education

states

Provide primary and secondary education

local governments

Provide Bus services, water, sewer lines, local parks, trash collection, police, firefighters, etc.

local governments

Total government spending is (BLANK) in the United States than in other rich countries

lower

The federal government primarily collects revenue from (BLANK) and (BLANK)

income taxes, payroll taxes

taxes on earned income

Payroll taxes

Levied as a fixed percentage of your earned income.

Payroll taxes

Funds Medicare and Social Security

Payroll taxes

(BLANK) contributes an additional amount to Medicare and Social Security along with your payroll taxes

Employer

taxes collected on all income regardless of its source

income taxes

Includes income you earned from working AND unearned income such as investment income, pensions, capital gains, and inheritance or gift income

Income taxes

is your stock of savings and assets

wealth

all the money you receive in a year

income

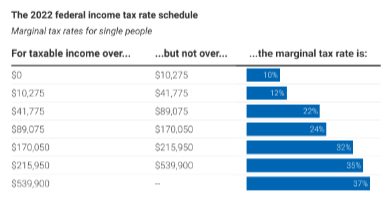

Income taxes are (BLANK)

progressive

The tax rate you pay increases with your income

progressive

the amount of income on that you pay taxes on

taxable income

taxable income =

total income received - deductions

Suppose your job paid you $50,000 in 2022.

Standard deduction: $12,950

Let’s figure out how much you’ll pay in income tax this year.

$4,240.50

As taxes rise, businesses buy (BLANK) capital, which makes workers (BLANK) productive, so employers aren’t willing to pay them as much

less, less

Corporate taxes are paid by

owners of corporations and workers

collect sale, property, and income taxes

States and local governments

A tax on purchases

sales tax

Typically, a percentage of the purchase price

sales tax

a tax on a specific product, such as gas, cigarettes, or alcohol.

Excise tax

Typically, levied base on the quantity you buy, not the price you pay

excise tax

collect sale, property, and income taxes

states and local governments

is a tax on the value of property, usually real estate

property tax

is a tax where those with less income tend to pay a higher share of their income on tax

regressive tax

Sales, excise, and property taxes tend to be

regressive

special deductions, exemptions, or credits that lower your tax obligations, to encourage you to engage in certain kinds of activities

Tax expenditures

Tax expenditures have a lower

political cost

Tax expenditures encourage (BLANK) on certain goods and services

spending

encourage you to purchase health insurance, save for retirement, and buy your own home

Tax expenditures

If you pay $10,000 in interest on your mortgage, that $10,000 is (BLANK) from your taxable income

deducted

Salary $43,000, plus employer-provided health insurance. Ø You’ll have to contribute $3,000 in premium payments. How much is the taxavle income?

$40,000

Salary $45,000, but NO health insurance. How much is the taxable income?

$45,000

The value of tax exclusions and deductions is higher when your income tax rate is (BLANK)

higher

Higher-income people tend to buy (BLANK) tax-preferred goods and services

more

Most tax expenditures don’t provide much help if your income tax bill is (BLANK)

zero

Tax expenditures primarily benefit the (BLANK)

wealthy

often inefficient, poorly targeted, persistent, and rarely evaluated for

effectiveness

Tax expenditures

tries to help by providing benefits even to those who have zero taxable income

refundable tax credit

Make it so that you can get a tax refund even if you don’t pay and taxes

refundable tax credit

The American Opportunity Tax Credit gives you $1,000 to help tuition costs. This is an example of a

refundable tax credit

Government can disguise spending as

tax breaks

allows the government to require spending, while others pay the bill

regulation

Instead of Congress budgeting for this program, now employers pay (and, to some extent, workers pay)

regulation

requiring companies to pay for parental leave might lead some employers to avoid hiring workers they suspect might become parents. Regulation changes (BLANK)

incentives

The Government Sector has (BLANK) over time as the role of the government in providing social insurance and education has expanded

grown

government-provided insurance against bad outcomes such as unemployment, illness, disability, or outliving your savings

Social insurance

Spending on social insurance programs and military

federal spending

Spending on social insurance programs and education

state spending

Spending on education and community services

local spending

What is hidden government spending?

tax expenditures and government regulation

the government’s use of spending and tax policies to attempt to stabilize the economy

fiscal policy

Tries to minimize output fluctuations and keep actual GDP close to potential output

fiscal policy

Fiscal policy is (BLANK) in that it counteracts the effects of the business cycle

countercyclical

If output in the economy is weak, then the government increases spending and lowers taxes in order to boost aggregate demand for output and, thus, raise GDP

Expansionary fiscal policy

If the economy is overheating, then the government decreases spending and raises taxes in order to weaken aggregate demand for output and, thus, lower GDP

Contractionary fiscal policy

Government spending can add to GDP indirectly through

transfer payments

Transfer payments add to GDP indirectly as the boost

aggregate expenditure

describes the possibility that an initial boost in spending will set off ripple effects.

multiplier effect

Discretionary government spending can involve substantial

time lags

Fiscal policy works best when it’s

timely, targeted, and temporary

the decline in private spending—particularly investment—that follows from a rise in government spending

crowding out

Expansionary fiscal policy leads to (BLANK) real interest rates, which (BLANK) private spending

higher, reduces

fiscal policy (i.e., spending and tax programs) that adjusts as the economy expands and contracts without policymakers taking any deliberate action

automatic stabilizers

Automatic stabilizers (BLANK) output during recessions and (BLANK) output during expansions

increase, decrease

The progressive tax system helps counter both booms and busts as you change (BLANK) which changes how much you spend

tax bracket

Dropping into a lower tax bracket during a bust allows consumers to spend (BLANK)

more

Rising into a higher tax bracket during a boom allows consumers to spend (BLANK)

less

Examples of automatic stabilizers

progressive tax system and government support programs

Automatic stabilizers are

timely, targeted, and temporary

Fiscal policy is more

targeted

Fiscal policy is particularly important at the

zero lower bound

The difference between spending and revenue in a year in which spending exceeds revenue.

budget deficit

The difference between spending and revenue in a year in which revenue exceeds spending.

Budget surplus

The federal government typically runs

budget deficits

Budget deficits may reflect

short-run political incentives

Requiring the federal government to balance its budget each year would prevent the use of (BLANK) to counteract business cycles

fiscal policy

Requiring a balanced budget would make business cycles

worse

During the 2007–2009 recession, state governments that faced a balanced budget requirement saw their revenues (BLANK)

decline

helps us think about a country’s debt relative to its capacity to repay it

debt-to-GDP ratio

a commitment to incur expenses in the future without a plan to pay for them

unfunded liability

the total accumulated amount of money the government owes

gross government debt

the debt that the government owes to individuals, businesses, and other governments both here and abroad

Net government debt