Looks like no one added any tags here yet for you.

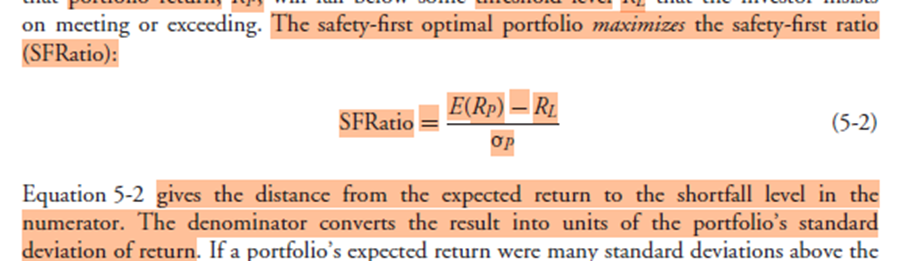

Safety first ratio

Emerging market concerns

•Limitation free float of shares (shares available in the market)

•Limitations on the amount of nondomestic ownership

•The quality of company information

•Pronounced non normality of returns

When investing in international assets, investors should consider the following special issues:

• Currency risk.

• Increased correlations in times of stress. Investors should be aware that correlations across international markets tend to increase in times of market breaks or crashes.

• Emerging market concerns. Among the concerns are limited free float of shares (shares available in the marketplace), limitations on the amount of nondomestic ownership, the quality of company information, and pronounced non-normality of returns (an issue of concern in using a mean–variance approach to choose an asset allocation).

6 types of optimization methods

Mean-variance approach

The resampled efficient frontier

The black litterman approach

Monte Carlo simulation

ALM

Experienced based approach

What’s the advantage of MVO over efficient frontier

The resampled efficient frontier is a technique used in portfolio construction to address the sensitivity of Mean-Variance Optimization (MVO) to input changes. MVO can be highly sensitive to small changes in inputs like expected returns, volatilities, and correlations, which can lead to substantial estimation errors

Portfolios on the resampled efficient frontier tend to be more diversified and stable over time compared to those on a conventional mean-variance efficient frontier

The criticism of resampled efficient frontier

The resampled efficient frontier approach has been questioned on ground such as the lack of a theoretical underpinning for the method and the relevance of historical return frequency data to current asset market values and equilibrium

Steps in the BL model

Define equilibrium market weights and covariance matrix for all asset classes

Back solve equilibrium expected returns

Express views and confidence for each view

Calculate the view adjusted market equilibrium returns

Run mean variance optimization

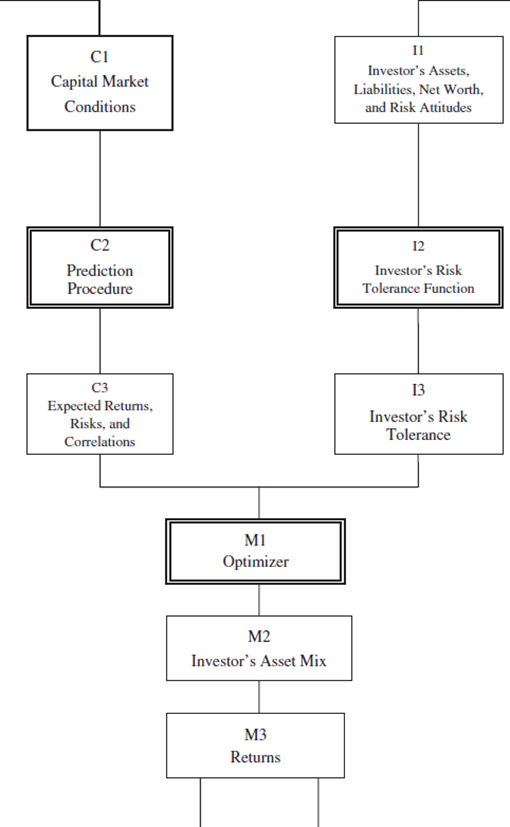

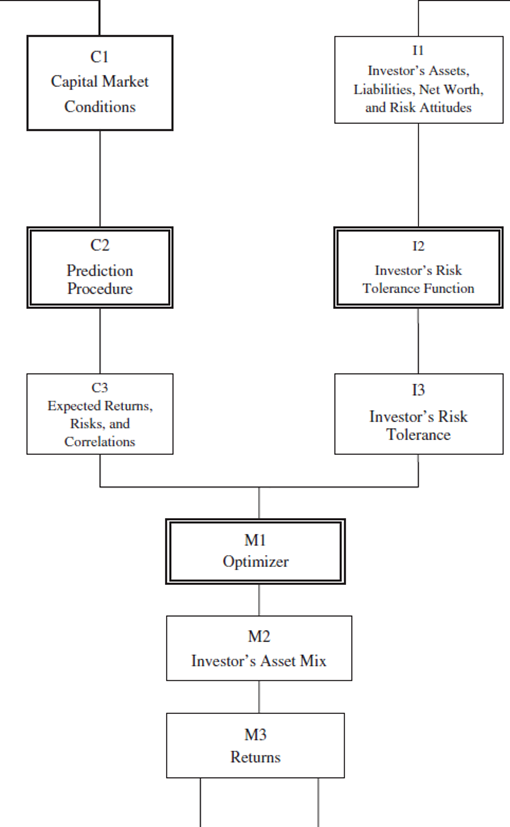

Steps in asset allocation

Those on the left is primarily concerned with the capital market

Those on the right are investor specific

Those in the middle bring together aspects of the capital markets and the investors’ circumstances to determine the investor’s asset mix and its performance

The asset allocation review process begins at the top of the diagram and proceeds downward. Then the outcomes (M3) provide feedback to both the capital market–and investor-related steps at the next asset allocation review.

Optimizer can be used to determine the most appropriate asset allocation and asset mix