B4 - Market Competitions

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

Types of attributes

Search attributes

Easily observable, help consumers make the right choice

Experience attributes:

Only experienced during the use of the product

Credence attributes

Neither observable, nor experienced, consumers should believe that they are there.

Consumption cycle

Cycle for consumers, consuming a food product.

Consists of three sages

1. Acquisition: decide, purchase, gather information

2. Usage: Store the product, open the package, use the product.

3. Disposal: Dispose product, recycle the package.

Post-purchase evaluation: satisfied or not?

Experience < expectations, dissatisfaction

Dissatisfaction, do not buy again

Experience = expectations, satisfaction

Dissatisfaction, do not buy again

Satisfaction → buy

Experience > expectations, satisfaction

Satisfaction → buy (or even repeat purchase)

The profitability of food business

Highly dependent on consumer satisfaction

If consumer is satisfied, they will have more loyal consumers and positive word of mouth.

Additionally, consumer satisfaction leads to:

More sales

less sensitive to price

Less attention to other brands.

Additionally, more sales can also lead to lower costs of production = greater profit.

Competitor identification

Most companies are more internally than externally focussed

They identify competitors based on location, technological features

They overlook competitors that offer comparable benefits in different ways

The average number of competitors that is identified is 7

Many companies focus on increasing market share through price actions and a like for their product.

Competitive rivalry

Talks about whom the company is up against and consists of four different risks:

new entry

Supplier power

Buyer power

Substitution

What is competitive rivalry?

Considers:

Number of competitors

Quality differences

Other differences

Switching costs

Customer loyalty

Costs of leaving market

Threat of new entry (competitive rivalry)

How easy is it for new companies to enter the rivalry?

Time and cost of entry

Specialist knowledge

Economies of scale (larger companies = lower production costs)

Cost advantages

Technology protection

Barriers for entry

Threat of substitution (competitive rivalry)

Definition: The threat of substitution refers to the risk that customers will switch from one product or service to an alternative that serves the same function.

Key Factors:

Substitute Performance: How well alternatives meet customer needs

Switching Costs: The expense and effort required to change products

Price-Performance Trade-off: Value comparison between original and substitute

Supplier power (competitive rivalry)

Number & size of suppliers – Fewer or larger suppliers have more control.

Uniqueness of service – The more unique, the more power they hold.

Ability to substitute – If you can’t easily switch, suppliers have more power.

Cost of switching – High switching costs strengthen supplier influence

Buyer power (competitive rivalry)

Buyer power refers to the influence that customers have over a company's pricing, terms, and market behavior, especially in competitive markets. It's shaped by:

Price Sensitivity

If buyers are very sensitive to price changes, they can demand lower prices or better value.

Number of Customers

Fewer customers means each one has more power, especially if losing one would significantly hurt sales.

Size of Each Order

Larger orders give buyers more leverage, as companies will want to secure their business.

Differences Between Competitors

If competitors offer very similar products, buyers can easily switch, increasing their bargaining power.

Ability to Substitute

When customers can find alternative products or suppliers easily, their power increases.

Buyer power: role of supermarkets

Supermarkets are powerful buyers in the food supply chain, especially in the Netherlands (NLs), where they account for nearly 50% of food spending.

Why food companies struggle with supermarkets:

Market Structure:

There are few large buyers (supermarkets) compared to many sellers (food companies).

Buying power is further concentrated due to centralized buying desks, making negotiations tougher for suppliers.

Price Competition:

Supermarkets aim to cut costs to remain competitive.

This drives down the prices they are willing to pay to suppliers.

Assortment Restrictions:

Supermarkets limit the variety of products on their shelves, reducing opportunities for smaller brands.

Sales Pressure:

Suppliers face strict sales targets per square meter of shelf space, making it hard to maintain product presence.

STP

Market segmentation

Market targeting

Market positioning

Market positioning

Communicating and delivering value to the consumer that is unique

Distinguish the product/brand from competitors

This way a brand can avoid direct competition

Benefits of their product should be clear to consumers

These benefits are often multi-dimensional

Positioning statement

To position a brand in a market you have to ask yourself?

What are the benefits for the customer?

How are these different from competitors?

This way the uniqueness of a product or brand can set them apart from other competitors.

Possible dimension of consumer benefits (positioning statement)

Low price | High price |

Basic quality | High quality |

Low volume | High volume |

Necessity | Luxury |

Light | Heavy |

Simple | Complex |

Unhealthy | Healthy |

Low tech | High-tech |

Marketing mix (4P’s)

Shows how a product can be marketed and is a tool for positioning

Product → customer value

Place → Convenience

Promotion → communication

Price → Cost for the customer

Marketing mix (product, service & brand)

Product | Service | Brand |

Variety - different versions of a product | Variety | Knowledge |

Quality - can vary | Quality | Positioning |

Design - variation in color e.g. | Design | |

Package - bag or box? |

The marketing mix (price & incentives)

Price | Incentives | Distribution |

Retail | Loyalty | Distribution |

Discount | Personal selling | |

Bonuses | Retail location | |

Payment plan | Download | |

Leasing options | Logistics |

The marketing mix (Communication)

Advertising

Sponsorship

Personal selling

Brochures

Sales promotion

Emails

Public relations

Sales call

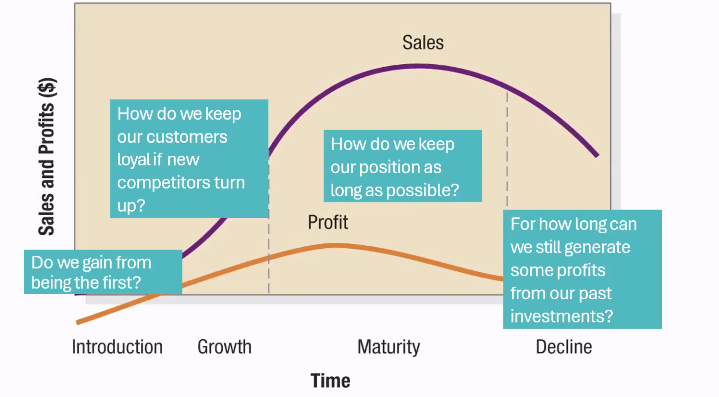

Product life cycle

Marketing channels

Food companies often use multiple channels to sell their brands and products

They should be present at times and places where their consumers are likely to purchase or consume their products

Absence means a loss of market share and a missed opportunity to create associations.

e.g. placing snacks near the counter at shops.